American Hotel Income Properties REIT LP (“

AHIP”)

(TSX: HOT.UN, TSX: HOT.U, TSX: HOT.DB. V), today announced the

extension of the maturity date for its revolving credit facility

(the “RCF”) and certain term loans to June 2025 in accordance with

the terms of the agreement governing such credit facilities (the

“Sixth Amendment”) and provided an update on previously announced

property dispositions.

All amounts presented in this news release are

in United States dollars (“U.S. dollars”) unless otherwise

indicated.

AHIP has satisfied the conditions in the Sixth

Amendment for the extension of the maturity date for the RCF and

term loans, which primary conditions include: (i) reduction of the

aggregate maximum facility size to $148.2 million from and after

December 3, 2024; (ii) obtaining updated appraisals for the

Borrowing Base Properties (defined below) in order to determine the

value of such properties for purposes of setting the maximum

borrowing availability under the Sixth Amendment, which is set

based on a maximum loan to value ratio of 67.5%; and (iii)

compliance with the terms of the Sixth Amendment at the time of the

extension, which includes among other things compliance with

financial covenants including payout ratio and fixed charge

coverage ratio. For further details, see a copy of the Sixth

Amendment, which has been filed under AHIP’s profile on SEDAR+ at

www.sedarplus.com.

As of the date of the news release, the balance

of the RCF and term loans under the Sixth Amendment has been

reduced to $133.2 million. The total appraised value of the 16

hotel properties (the "Borrowing Base Properties") is $249.2

million, which results in a loan-to-value ratio of 53.4%. The

current maximum borrowing availability under the RCF and term loans

is $148.2 million. The appraised value of $249.2 million for the 16

Borrowing Base Properties (1,678 keys) is equivalent to $149

thousand per key, which is significantly higher than AHIP’s

enterprise value per key(1) of $95 thousand, based on the U.S.

dollar closing price of US$0.36 per unit on the TSX on December 2,

2024.

In November and December 2024, AHIP completed

the previously announced dispositions of three hotel properties, in

Kingsland, Georgia, Ocala, Florida, and Corpus Christi, Texas, for

gross proceeds of $5.2 million, $7.7 million, and $10.3 million,

respectively. A portion of the total net proceeds from these

dispositions, $18.0 million, was used to partially repay the term

loans governed by the Sixth Amendment in the same period.

As of the date of the news release, AHIP had two

hotel properties under purchase and sales agreements in Dallas,

Texas, and Amarillo, Texas for gross proceeds of $27.0 million and

$2.6 million, respectively, with expected closing dates in December

2024.

As previously announced, AHIP signed a

non-binding term sheet with a major US Bank to refinance certain

Borrowing Base Properties. As a result of the completed RCF

extension and the additional time available to maturity, management

is currently evaluating a number of refinancing options for the

credit facilities governed by the Sixth Amendment, which include

closing this refinancing in the near term. This refinancing, if

completed, is expected to reduce the aggregate facility balance

under the Sixth Amendment by approximately $60.0 million.

ABOUT AMERICAN HOTEL INCOME PROPERTIES REIT

LP

American Hotel Income Properties REIT LP (TSX:

HOT.UN, TSX: HOT.U, TSX: HOT.DB.V), or AHIP, is a limited

partnership formed to invest in hotel real estate properties across

the United States. AHIP’s portfolio of premium branded,

select-service hotels are located in secondary metropolitan markets

that benefit from diverse and stable demand. AHIP hotels operate

under brands affiliated with Marriott, Hilton, IHG and Choice

Hotels through license agreements. AHIP’s long-term objectives are

to build on its proven track record of successful investment,

deliver monthly U.S. dollar denominated distributions to

unitholders, and generate value through the continued growth of its

diversified hotel portfolio. More information is available at

www.ahipreit.com.

NON-IFRS AND OTHER FINANCIAL

MEASURES

Management believes the following supplementary

financial measures are relevant measures to monitor and evaluate

AHIP’s financial and operating performance. These measures do not

have any standardized meaning prescribed by IFRS and are therefore

unlikely to be comparable to similar measures presented by other

issuers. These measures are included to provide investors and

management additional information and alternative methods for

assessing AHIP’s financial and operating results and should not be

considered in isolation or as a substitute for performance measures

prepared in accordance with IFRS.

Enterprise value: is a

supplementary financial measure and is calculated as (i) the sum of

total debt obligations as reflected on the September 30, 2024

balance sheet, AHIP’s market capitalization (which is calculated as

the U.S. dollar closing price of the units on the TSX as of

December 2, 2024, multiplied by the total number of units issued

and outstanding), and face value of series C preferred shares, less

(ii) the amount of cash and cash equivalents reflected on the

September 30, 2024 balance sheet.

Enterprise value per key: is a

supplementary financial measure and is calculated as enterprise

value divided by the total number of hotel keys/rooms in the

portfolio.

NON-IFRS RECONCILIATION

The following calculation is for the AHIP portfolio of 63 hotel

properties:

|

(thousands of dollars except unit price and number of

keys) |

September 30, 2024 |

|

|

|

|

Number of units outstanding – (a) |

79,234 |

|

Unit price at December 2, 2024 – (b) |

0.36 |

|

Market capitalization – (A) = (a) * (b) |

28,524 |

|

|

|

|

Term loans and revolving credit facility |

534,705 |

|

Liabilities related to assets held for sale |

37,044 |

|

Face value of convertible debenture |

49,730 |

|

Total debt – (B) |

621,479 |

|

|

|

|

Face value of Series C preferred shares – (C) |

50,000 |

|

|

|

|

Unrestricted cash – (D) |

25,811 |

|

Total Enterprise Value – (E) = (A) + (B) + (C) –

(D) |

674,192 |

|

|

|

|

Number of keys – (F) |

7,075 |

|

Enterprise value per key = (E)/(F) |

95 |

FORWARD-LOOKING INFORMATION

Certain statements in this news release may

constitute “forward-looking information” and “financial outlook”

within the meaning of applicable securities laws. Forward-looking

information and financial outlook generally can be identified by

words such as “anticipate”, “believe”, “continue”, “expect”,

“estimates”, “intend”, “may”, “outlook”, “objective”, “plans”,

“should”, “will” and similar expressions suggesting future outcomes

or events. Forward-looking information and financial outlook

include, but are not limited to, statements made or implied

relating to the objectives of AHIP, AHIP’s strategies to achieve

those objectives and AHIP’s beliefs, plans, estimates, projections

and intentions and similar statements concerning anticipated future

events, results, circumstances, performance, or expectations that

are not historical facts. Forward-looking information and financial

outlook in this news release include, but is not limited to,

statements with respect to: AHIP’s planned disposition of hotels in

Dallas, Texas and Amarillo, Texas and the expected proceeds

therefrom and timing thereof; AHIP management contemplating a

number of refinancing options for the credit facilities governed by

the Sixth Amendment, including completion of the refinancing for

certain of the Borrowing Base Properties contemplated by the

non-binding term sheet signed with a major US Bank in the near term

and the estimated reduction in the loan facilities governed by the

Sixth Amendment to result therefrom; and AHIP’s stated long-term

objectives.

Although the forward-looking information and

financial outlook contained in this news release is based on what

AHIP’s management believes to be reasonable assumptions, AHIP

cannot assure investors that actual results will be consistent with

such information. Forward-looking information and financial outlook

is based on a number of key expectations and assumptions made by

AHIP, including, without limitation: AHIP will complete its planned

disposition of hotels in Dallas, Texas and Amarillo, Texas in

accordance with the terms and timing currently contemplated; AHIP

will complete the refinancing for certain of the Borrowing Base

Properties contemplated by the non-binding term sheet signed with a

major US Bank in accordance with the terms and timing currently

contemplated; AHIP will be successful in refinancing the credit

facilities governed by the Sixth Amendment prior to their revised

maturity date; inflation, labor shortages, and supply chain

disruptions will negatively impact the U.S. economy, U.S. hotel

industry and AHIP’s business; AHIP will continue to have sufficient

funds to meet its financial obligations; AHIP’s strategies with

respect to completion of capital projects, liquidity, addressing

near-term debt maturities, and divestiture of assets will be

successful and achieve their intended effects; AHIP will continue

to have good relationships with its hotel brand partners; capital

markets will provide AHIP with readily available access to equity

and/or debt financing on terms acceptable to AHIP, including the

ability to refinance maturing debt as it becomes due on terms

acceptable to AHIP; AHIP’s future level of indebtedness and its

future growth potential will remain consistent with AHIP’s current

expectations; and AHIP will achieve its long term objectives.

Forward-looking information and financial

outlook involve significant risks and uncertainties and should not

be read as a guarantee of future performance or results as actual

results may differ materially from those expressed or implied in

such forward-looking information and financial outlook, accordingly

undue reliance should not be placed on such forward-looking

information and financial outlook. Those risks and uncertainties

include, among other things, risks related to: AHIP may not

complete its planned disposition of hotels in Dallas, Texas and

Amarillo, Texas in accordance with the terms and timing currently

contemplated, or at all; AHIP may not complete the loan refinancing

for certain of the Borrowing Base Properties contemplated by the

non-binding term sheet signed with a major US Bank in accordance

with the timing or on the terms currently contemplated or at all;

AHIP may not be successful in refinancing the credit facilities

governed by the Sixth Amendment prior to their revised maturity

date; AHIP may not achieve its expected performance levels in 2024

and beyond; inflation, labor shortages, supply chain disruptions;

AHIP’s brand partners may impose revised service standards and

capital requirements which are adverse to AHIP; AHIP’s strategic

initiatives with respect to liquidity, addressing near-term debt

maturities and providing AHIP with financial stability may not be

successful and may not achieve their intended outcomes; AHIP’s

strategies for divesting assets to reduce debt may not be

successful; AHIP may not be successful in reducing its leverage;

AHIP may not be able to refinance debt obligations as they become

due or may do so on terms less favorable to AHIP than under AHIP’s

existing loan agreements; general economic conditions and consumer

confidence; the growth in the U.S. hotel and lodging industry;

prices for AHIP’s units and its debentures; liquidity; tax risks;

ability to access debt and capital markets; financing risks;

changes in interest rates; the financial condition of, and AHIP’s

relationships with, its external hotel manager and franchisors;

real property risks, including environmental risks; the degree and

nature of competition; ability to acquire accretive hotel

investments; ability to integrate new hotels; environmental

matters; increased geopolitical instability; and changes in

legislation and AHIP may not achieve its long term objectives.

Management believes that the expectations reflected in the

forward-looking information and financial outlook are based upon

reasonable assumptions and information currently available;

however, management can give no assurance that actual results will

be consistent with the forward-looking information and financial

outlook contained herein. Additional information about risks and

uncertainties is contained in AHIP’s management’s discussion and

analysis for the three and nine months ended September 30, 2024 and

2023, and AHIP’s annual information form for the year ended

December 31, 2023, copies of which are available on SEDAR+ at

www.sedarplus.com.

To the extent any forward-looking information

constitutes a “financial outlook” within the meaning of applicable

securities laws, such information is being provided to investors to

assist in their understanding of: estimated proceeds from the

planned disposition of certain hotel properties and the expected

impact of the potential refinancing with a US Bank on the credit

facilities governed by the Sixth Amendment.

The forward-looking information and financial

outlook contained herein is expressly qualified in its entirety by

this cautionary statement. Forward-looking information and

financial outlook reflect management's current beliefs and are

based on information currently available to AHIP. The

forward-looking information and financial outlook are made as of

the date of this news release and AHIP assumes no obligation to

update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

For additional information, please

contact:

Investor Relationsir@ahipreit.com

(1) Non-IFRS and other financial measures. See

“NON-IFRS AND OTHER FINANCIAL MEASURES” section of this news

release.

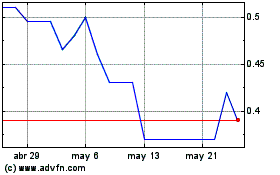

American Hotel Income Pr... (TSX:HOT.U)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

American Hotel Income Pr... (TSX:HOT.U)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024