Magna International Inc. (TSX: MG, NYSE: MGA), a mobility

technology company and global leader in the automotive industry,

will hold a virtual investor event today. Magna’s Chief Executive

Officer, Swamy Kotagiri and Chief Financial Officer, Pat McCann

will present on the company’s unique position in the market,

systems-level capabilities and Go-Forward Strategy to power

profitable growth.

“We are excited to update investors on our

strategic progress and the tremendous opportunities we see in the

transforming industry where our addressable markets continue to

grow,” said Swamy Kotagiri, Magna CEO.

The presentation and question and answer session

will run from 9:00 a.m. to 10:30 a.m. ET. To view the webcast,

participants can register by clicking here. The live stream will

begin at 9:00 a.m. ET.

To ask a question during the question &

answer session, please dial:

|

RESERVATION # 22027877 |

|

Toll-Free France: 0-800-913-554 |

Toll-Free Germany: 0-800-180-0036 |

|

Toll Switzerland: 0-800-836-320 |

Toll-Free United Kingdom: 0-800-528-2796 |

|

Toll-Free North America: 1-800-768-8804 |

Toll International: 1-303-223-0118 |

|

REBROADCAST INFORMATIONReplay available 2 hours after event until

September 21, 2023 |

|

North America: 1-800-558-5253 |

International: 1-416-626-4100 |

2025 OUTLOOK

Our 2025 Outlook below has been updated solely

to reflect the acquisition of Veoneer Active Safety. All other 2025

assumptions and financial information are unchanged from our 2025

Outlook previously provided in our press release dated February 10,

2023.

2025 Outlook Assumptions

|

|

|

|

Current |

|

Previous |

| Light Vehicle

Production (millions of units) |

|

|

|

|

North America |

16.5 |

|

16.5 |

|

Europe |

17.5 |

|

17.5 |

|

China |

29.0 |

|

29.0 |

| |

|

|

|

|

|

| Average Foreign exchange

rates: |

|

|

|

|

|

| 1 Canadian dollar equals |

|

|

US$0.750 |

|

US$0.750 |

| 1 euro equals |

|

|

US$1.070 |

|

US$1.070 |

| |

|

|

|

|

|

2025 Updated Outlook

|

|

|

|

Current |

|

Previous |

| Segment

Sales |

|

|

|

|

|

|

Body Exteriors & Structures |

|

|

$20.0 - $21.0 billion |

|

$20.0 - $21.0 billion |

|

Power & Vision |

|

|

$16.8 - $17.4 billion |

|

$14.8 - $15.4 billion |

|

Seating Systems |

|

|

$6.2 - $6.6 billion |

|

$6.2 - $6.6 billion |

|

Complete Vehicles |

|

|

$4.0 - $4.5 billion |

|

$4.0 - $4.5 billion |

| Total

Sales |

|

|

$46.7 - $49.2 billion |

|

$44.7 - $47.2 billion |

|

|

|

|

|

|

|

|

Adjusted EBIT Margin(1) |

|

|

6.7% - 7.8% |

|

6.7% - 7.8% |

|

|

|

|

|

|

|

| Notes:(1)

Adjusted EBIT Margin is the ratio of Adjusted EBIT to Total

Sales |

| |

Our Outlook is intended to provide information

about management's current expectations and plans and may not be

appropriate for other purposes. Although considered reasonable by

Magna as of the date of this document, the 2025 Outlook above and

the underlying assumptions may prove to be inaccurate. Accordingly,

our actual results could differ materially from our expectations as

set forth herein. The risks identified in the “Forward-Looking

Statements” section below represent the primary factors which we

believe could cause actual results to differ materially from our

expectations.

Certain of the forward-looking financial measures above are

provided on a Non-GAAP basis. We do not provide a reconciliation of

such forward-looking measures to the most directly comparable

financial measures calculated and presented in accordance with U.S.

GAAP. To do so would be potentially misleading and not practical

given the difficulty of projecting items that are not reflective of

on-going operations in any future period. The magnitude of these

items, however, may be significant.

This press release together with our

Management’s Discussion and Analysis of Results of Operations and

Financial Position and our Interim Financial Statements are

available in the Investor Relations section of our website at

www.magna.com/company/investors and filed electronically through

the System for Electronic Document Analysis and Retrieval (SEDAR)

which can be accessed at www.sedar.com as well as on the United

States Securities and Exchange Commission’s Electronic Data

Gathering, Analysis and Retrieval System (EDGAR), which can be

accessed at www.sec.gov.

INVESTOR CONTACTLouis Tonelli, Vice-President,

Investor Relations louis.tonelli@magna.com, 905-726-7035

MEDIA CONTACT Tracy Fuerst, Vice-President,

Corporate Communications & PR tracy.fuerst@magna.com,

248-761-7004

WEBCAST CONTACTNancy Hansford, Executive Assistant, Investor

Relations nancy.hansford@magna.com, 905-726-7108

OUR BUSINESS (2)Magna is more than one of the

world’s largest suppliers in the automotive space. We are a

mobility technology company built to innovate, with a global,

entrepreneurial-minded team of over 174,000(3) employees across 351

manufacturing operations and 103 product development, engineering

and sales centres spanning 30 countries. With 65+ years of

expertise, our ecosystem of interconnected products combined with

our complete vehicle expertise uniquely positions us to advance

mobility in an expanded transportation landscape.

For further information about Magna (NYSE:MGA;

TSX:MG), please visit www.magna.com or follow us on social.

(2) Manufacturing operations, product

development, engineering and sales centres include certain

operations accounted for under the equity

method.(3) Number of employees includes approximately

162,000 employees at our wholly owned or controlled entities and

over 12,000 employees at certain operations accounted for under the

equity method.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release

constitute "forward-looking information" or "forward-looking

statements" (collectively, "forward-looking statements"). Any such

forward-looking statements are intended to provide information

about management's current expectations and plans and may not be

appropriate for other purposes. Forward-looking statements may

include financial and other projections, as well as statements

regarding our future plans, strategic objectives or economic

performance, or the assumptions underlying any of the foregoing,

and other statements that are not recitations of historical fact.

We use words such as "may", "would", "could", "should", "will",

"likely", "expect", "anticipate", "believe", "intend", "plan",

"aim", "forecast", "outlook", "project", "estimate", "target" and

similar expressions suggesting future outcomes or events to

identify forward-looking statements. The following table identifies

the material forward-looking statements contained in this document,

together with the material potential risks that we currently

believe could cause actual results to differ materially from such

forward-looking statements. Readers should also consider all of the

risk factors which follow below the table:

|

Material Forward-Looking Statement |

Material Potential Risks Related to Applicable

Forward-Looking Statement |

|

Light Vehicle Production |

- Light vehicle sales levels

- Supply disruptions

- Production disruptions, including

as a result of lower vehicle sales, and/or labour or other

disruptions to vehicle production

- Production allocation decisions by

OEMs

|

|

Total SalesSegment Sales |

- Lower than expected light vehicle

production volumes

- Potential supply disruptions

- Concentration of sales with six

customers

- Shifts in market shares among

vehicles or vehicle segments

- Shifts in consumer “take rates” for

products we sell

- Relative foreign exchange

rates

|

|

Adjusted EBIT Margin |

- Same risks as for Total Sales and

Segment Sales above

- Operational underperformance,

product launch and/or product warranty/recall risks

- Successful execution of critical

program launches, including complete vehicle manufacturing of the

Fisker Ocean SUV

- Elevated levels of inflation

- Higher costs incurred to mitigate

the risk of supply disruptions, including: materials price

increases; higher-priced substitute supplies; premium freight costs

to expedite shipments; production inefficiencies due to production

lines being stopped/restarted unexpectedly based on customers’

production schedules; and price increases from sub-suppliers that

have been negatively impacted by production inefficiencies

- Our ability to secure cost

recoveries from customers and/or otherwise offset higher input

costs

- Price concessions

- Commodity cost volatility

- Scrap steel price volatility

- Higher labour costs

- Tax risks

|

Forward-looking statements are based on

information currently available to us and are based on assumptions

and analyses made by us in light of our experience and our

perception of historical trends, current conditions and expected

future developments, as well as other factors we believe are

appropriate in the circumstances. While we believe we have a

reasonable basis for making any such forward-looking statements,

they are not a guarantee of future performance or outcomes. In

addition to the factors in the table above, whether actual results

and developments conform to our expectations and predictions is

subject to a number of risks, assumptions and uncertainties, many

of which are beyond our control, and the effects of which can be

difficult to predict, including, without limitation:

Risks Related to the Automotive Industry

- economic cyclicality;

- regional production volume declines, including as a result of

deteriorating vehicle affordability;

- intense competition;

- potential restrictions on free trade;

- trade disputes/tariffs;

Customer and Supplier Related Risks

- concentration of sales with six customers;

- risks related to conducting business with newer OEMs with

limited operating history, product maturity and warranty

experience;

- OEM consolidation and cooperation;

- shifts in market shares among vehicles or vehicle

segments;

- shifts in consumer "take rates" for products we sell;

- dependence on outsourcing;

- quarterly sales fluctuations;

- potential loss of any material purchase orders;

- a deterioration in the financial condition of our supply

base;

Manufacturing / Operational Risks

- product and new facility launch risks, including the successful

launch of critical programs such as the Fisker Ocean SUV;

- operational underperformance;

- supply disruptions, including with respect to semiconductor

chips;

- impact of volatile OEM vehicle production allocation decisions

on the efficiency of our operations;

- restructuring costs;

- impairment charges;

- labour disruptions;

- climate change risks;

- attraction/retention of skilled labour;

IT Security/Cybersecurity Risk

- IT/Cybersecurity breach;

- Product Cybersecurity breach;

|

Pricing Risks

- inflationary pressures;

- our ability to secure cost recoveries from customers and/or

otherwise offset higher input costs;

- pricing risks between time of quote and start of

production;

- price concessions;

- commodity cost volatility;

- declines in scrap steel/aluminum prices;

Warranty / Recall Risks

- costs related to repair or replacement of defective products,

including due to a recall;

- warranty or recall costs that exceed warranty provision or

insurance coverage limits;

- product liability claims;

Acquisition Risks

- competition for strategic acquisition targets;

- inherent merger and acquisition risks;

- acquisition integration risks;

Other Business Risks

- risks related to conducting business through joint

ventures;

- our ability to consistently develop and commercialize

innovative products or processes;

- our changing business risk profile as a result of increased

investment in electrification and active safety, including: higher

R&D and engineering costs, and challenges in quoting for

profitable returns on products for which we may not have

significant quoting experience;

- risks of conducting business in foreign markets;

- fluctuations in relative currency values;

- tax risks;

- reduced financial flexibility as a result of an economic

shock;

- changes in credit ratings assigned to us;

Legal, Regulatory and Other Risks

- antitrust risk;

- legal claims and/or regulatory actions against us; and

- changes in laws and regulations, including those related to

vehicle emissions.

|

In evaluating forward-looking statements

or forward-looking information, we caution readers not to place

undue reliance on any forward-looking statement. Additionally,

readers should specifically consider the various factors which

could cause actual events or results to differ materially from

those indicated by such forward-looking statements, including the

risks, assumptions and uncertainties above which are:

- discussed under the “Industry Trends and Risks” heading

of our Management’s Discussion and Analysis; and

- set out in our Annual Information Form filed with

securities commissions in Canada, our annual report on Form 40-F

filed with the United States Securities and Exchange Commission,

and subsequent filings.

Readers should also consider discussion of our risk

mitigation activities with respect to certain risk factors, which

can be also found in our Annual Information Form.

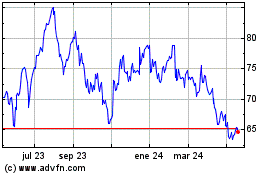

Magna (TSX:MG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

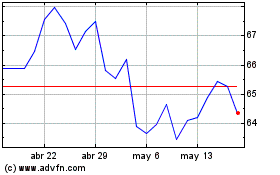

Magna (TSX:MG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025