Verde AgriTech Ltd (TSX: “

NPK”)

("OTCMKTS: "

VNPKF") (the

“

Company”) is pleased to announce the appointment

of Luciana de Oliveira Cezar Coelho and Fernando Prezzotto (the

“

Directors”) to its Board of Directors (the

“

Board”).

“As we start a carefully planned renewal of the

Board, we welcome Mrs. Oliveira Cezar Coelho and Mr. Prezzotto,

whose agricultural sector experience and deep understanding of

Brazil will further strengthen Verde's Board”, declared Verde’s

Director, Renato Gomes.

“As someone with a career devoted to Brazilian

agriculture and relevant technology, I am pleased to join Verde

AgriTech because its mission of supplying a superior local source

of potash and micronutrients to farmers is something I strongly

believe in and know that I can add value to”, commented Fernando

Prezzotto.

“I am pleased to be the first woman to join the

Board of Verde. As a board member at Raízen, Brazil’s largest

agricultural producer by land coverage, I know very well the

importance of fertilizers to agriculture’s supply chain. Verde is

ideally positioned to be Brazil’s leader in its segment of that

market and I will do my best to ensure that happens”, proclaimed

Luciana Oliveira Cezar Coelho.

“At Verde, we know that there is strength in

diversity, a principle that we adopt across all levels of the

Company, from our mine pits to our executives. Mrs. Oliveira Cezar

Coelho is the first female director of the Board, representing an

important step toward gender equality. Today, approximately 60% of

the administrative staff, including corporate, marketing, finance

and human resources, are women. The percentage of women in

leadership positions, such as managers and coordinators, is 41%.

Overall, including more physically demanding mine and plant

laborers, women comprise 31% of all Verde’s employees, compared to

a global industry average of 8% to 17%1”, celebrated Verde’s

Founder, President & CEO, Cristiano Veloso.

The Board is now composed of four independent

directors, Alysson Paolinelli, Fernando Prezzotto, Luciana de

Oliveira Cezar Coelho and Renato Gomes, with Mr. Veloso as sole

executive director.

The Board will soon update the composition of

the Audit, Compensation, Corporate Governance and Nominating

committees.

About Luciana de Oliveira Cezar

Coelho

Mrs. Oliveira Cezar Coelho is the founding and

managing partner of STS GAEA Capital and board member in multiple

companies with billion-plus market valuation. She has over 20 years

of experience in mergers and acquisitions, corporate restructuring,

debt and equity capital markets, financial restructuring and

private equity investment.

Before founding STS GAEA in 2013, Mrs. Oliveira

Cezar Coelho was a founding partner of STK Capital, an asset

management company focused on public equities, and of Virtus BR

Partners, a financial advisory boutique. Prior to Virtus, Mrs.

Oliveira Cezar Coelho’s experiences include: Managing Director

responsible for the coverage of clients in the industrial segment

at Banco Santander; Managing Director of the industrials and

conglomerates advisory group at ABN Amro; Vice President in the

investment banking division of Merrill Lynch in São Paulo and in

the merger and acquisitions group of Merrill Lynch in New York;

Associate in the merger and acquisitions group of Lehman Brothers

in New York.

Currently, Mrs. Oliveira Cezar Coelho is also a

member of the Board of Directors and of the Audit Committee of

Raízen S.A., an energy company that produces sugarcane and ethanol,

also acting in fuel distribution, renewable energy generation, and

lubricants sectors, being the second largest fuel distribution

company in Brazil2; member of the Board of Directors and of the

Audit & Risk Committee of Energisa S.A., a publicly traded

holding company, that operates in the generation and

commercialization of electricity in Brazil, in addition to being

the fifth largest energy distribution group in the country in

number of clients3; member of the Board of Directors of Restoque

S.A., a Brazilian retail company focused on the sale of high-end

clothing, accessories, and cosmetics, with stores divided into six

brands4; member of the Board of Directors of LPS Brasil S.A.

(Lopes), Brazilian company that provides services in the real

estates sector, such as brokerage and consultancy for projects and

finance5; and member of the Harvard Global Advisory Council.

She is also co-founder of the Instituto

República.org, co-founder and vice president of the Instituto

Vassouras Cultural, member of the Center for Debate of Public

Policy (CDPP), member of the Executive Committee of Prep - Program

- Lemann Foundation, member of the Women Corporate Directors (WCD)

and certified for membership of Fiscal Committee by the Brazilian

Institute of Corporate Governance (IBGC). Previously, she served as

a member of the Board of Directors of Norte Energia S.A. (Belo

Monte Hydroelectric Complex), Entalpia Participações S.A. (Unicoba)

and Instituto República.org.

Mrs. Oliveira Cezar Coelho has a Bachelor’s

degree in Economics from the Federal University of Rio de Janeiro

(UFRJ), a Master’s degree in Economics from the Catholic University

of Rio de Janeiro (PUC-RJ), and a Ph.D. in Economics in the fields

of Finance, Game Theory and Contract Theory from Harvard

University.

About Fernando Prezzotto

Fernando João Prezzotto is a serial entrepreneur

focused on innovative solutions for agribusiness. In 2021 he was

elected by Ernst & Young the entrepreneur of the year in

Brazil. He is the founder and CEO of SEMPRE AgTech, focused on the

genetic improvement of plants, on the research of transgenic events

and on the creation of eco-friendly biopesticides with RNAi

technology and other gene editing techniques. It operates mainly in

Brazil and in some South American countries, having a significant

share in the corn hybrids market.6 He is also the founder and CEO

of Produce, a company that provides agricultural inputs and

technical services to producers of all crops, with over 3,800 sales

consultants throughout Brazil.7 Mr. Prezzotto acts as a mentor and

entrepreneur of Endeavor,8 an acceleration network for companies,

present in over 40 markets around the world. He is an angel

investor in multiple startups, with a focus on emerging markets. In

addition to his corporate activities, Mr. Prezzotto is also a

farmer with ongoing agricultural production.

Mr. Prezzotto holds a degree in Business

Administration, with specializations from Harvard Business School,

University of California and Tel Aviv University.

About Verde AgriTech

Verde is an agricultural technology company that

produces potash fertilizers. Our purpose is to improve the health

of all people and the planet. Rooting our solutions in nature, we

make agriculture healthier, more productive, and profitable.

Verde is a fully integrated Company: it mines

and processes its main feedstock from its 100% owned mineral

properties, then sells and distributes the Product.

Verde’s focus on research and development has

resulted in one patent and eight patents pending. Among its

proprietary technologies are Cambridge Tech, 3D Alliance, MicroS

Technology, N Keeper, and Bio Revolution.9 Currently, the Company

is fully licensed to produce up to 2.8 million tonnes per year of

its multinutrient potassium fertilizers K Forte® and BAKS®, sold

internationally as Super Greensand®.10 By the end of 2022, it plans

to become Brazil's largest potash producer by capacity.11 Verde has

a combined measured and indicated mineral resource of 1.47 billion

tonnes at 9.28% K2O and an inferred mineral resource of 1.85

billion tonnes at 8.60% K2O (using a 7.5% K2O cut-off grade).12

This amounts to 295.70 million tonnes of potash in K2O. For

context, in 2021 Brazil’s total consumption of potash in K2O was

7.92 million13.

Brazil ranks second in global potash demand and

is its single largest importer, currently depending on external

sources for over 96% of its potash needs. In 2021, potash accounted

for approximately 2% of all Brazilian imports by dollar value.

Corporate Presentation

For further information on the Company, please view

shareholders’ deck:

https://verde.docsend.com/view/k425izamysda5q6s

Investors Newsletter

Subscribe to receive the Company’s updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

https://bit.ly/InvestorsNL-August2022

Cautionary Language and Forward-Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

(i) the estimated amount and grade of Mineral

Resources and Mineral Reserves;

(ii) the PFS representing a viable development

option for the Project;

(iii) estimates of the capital costs of

constructing mine facilities and bringing a mine into production,

of sustaining capital and the duration of financing payback

periods;

(iv) the estimated amount of future production,

both produced and sold;

(v) timing of disclosure for the PFS and

recommendations from the Special Committee;

(vi) the Company’s competitive position in

Brazil and demand for potash; and,

(vii) estimates of operating costs and total

costs, net cash flow, net present value and economic returns from

an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

(i) the presence of and continuity of resources and

reserves at the Project at estimated grades;

(ii) the geotechnical and metallurgical

characteristics of rock conforming to sampled results; including

the quantities of water and the quality of the water that must be

diverted or treated during mining operations;

(iii) the capacities and durability of various

machinery and equipment;

(iv) the availability of personnel, machinery and

equipment at estimated prices and within the estimated delivery

times;

(v) currency exchange rates;

(vi) Super Greensand® and K Forte® sales prices,

market size and exchange rate assumed;

(vii) appropriate discount rates applied to the

cash flows in the economic analysis;

(viii) tax rates and royalty rates applicable to

the proposed mining operation;

(ix) the availability of acceptable financing under

assumed structure and costs;

(x) anticipated mining losses and dilution;

(xi) reasonable contingency requirements;

(xii) success in realizing proposed operations;

(xiii) receipt of permits and other regulatory

approvals on acceptable terms; and

(xiv) the fulfilment of environmental assessment

commitments and arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:

Cristiano Veloso, Founder,

Chairman & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.investor.verde.ag | www.supergreensand.com |

www.verde.ag

________________________________

1 See McKinsey & Company, Why women are leaving the

mining industry and what mining companies can do about it,

September 2021, available at:

https://www.mckinsey.com/industries/metals-and-mining/our-insights/why-women-are-leaving-the-mining-industry-and-what-mining-companies-can-do-about-it.

2 See:

https://www.raizen.com.br/sobre-a-raizen/quem-somos/meus-numeros 3

See: http://grupoenergisa.com.br/Paginas/home.aspx 4 See:

https://www.restoque.com.br/a-companhia/marcas/ 5 See:

https://ri.lopes.com.br/show.aspx?idCanal=CzBbfspg5ckMYH7ffHwDTg== 6

See: https://catalogo.sempre.agr.br/ 7 See:

https://www.produce.agr.br/#/sobre-nos 8 See:

https://endeavor.org.br/quem-somos/ 9 Learn more about our

technologies:

https://verde.docsend.com/view/yvthnpuv8jx6g4r9 10 See

the release at:

https://investor.verde.ag/2-5-million-tonnes-per-year-potash-mining-concession-granted-to-verde/

11 See the release at:

https://investor.verde.ag/verde-to-reach-3-million-tonnes-potash-production-capacity-in-2022/

12 As per the National Instrument 43-101 Standards of Disclosure

for Mineral Projects within Canada (“NI 43 -101”), filed on SEDAR

in 2017. See the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2021/01/NI-43-101-Pre-Feasibility-Technical-Report-Cerrado-Verde-Project.pdf

13 Union of the Agricultural Fertilizers and Correctives Industry,

in the State of São Paulo (“SIACESP”, from Sindicato da Indústria

de Fertilizantes e Corretivos Agropecuários, no Estado de São

Paulo).

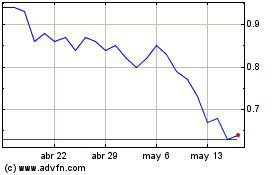

Verde Agritech (TSX:NPK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Verde Agritech (TSX:NPK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024