Verde AgriTech Ltd (TSX: “NPK”)

(“

Verde” or the “

Company”) is

pleased to announce a strategic partnership with WayCarbon to

bolster the development and monetization of its carbon removal

project.

WayCarbon is 80% owned by Banco Santander, one

of Europe's largest banks. It is a leading developer of carbon

removal projects and a pioneer in climate change mitigation and

sustainability solutions. The partnership is based on Verde’s

specialty multi-nutrient potassium fertilizer K Forte® (the

“Product”) and its potential to permanently

capture CO2 through Enhanced Rock Weathering.

“This partnership with WayCarbon marks a new

chapter for Verde. It represents a crucial step towards

monetization of Verde’s own significant carbon removal potential

and allows the Company to collaborate on new projects with Brazil’s

most credible carbon developer. WayCarbon has been active in this

sector since 2006 making it a veteran with a success record to

match. I believe that the combination of our attributes has the

potential to spawn one of the world's largest carbon removal

platforms,” celebrated Cristiano Veloso, Verde’s Founder and

CEO.

WayCarbon has a history of high-quality carbon

projects in Brazil. Within the partnership, WayCarbon will support

Verde with the development, certification, marketing and

monetization of its carbon credits. In addition to leveraging

Verde’s Product, the partnership extends its scope to encompass

Verde's origination and utilization of other minerals capable of

carbon capture through Enhanced Rock Weathering.

"We are thrilled about our partnership with

Verde AgriTech. At WayCarbon, our mission is to drive the

transition to a Net-Zero economy. This transformation is a

multi-sectoral endeavour. The distinctive properties of Verde’s

products, coupled with Verde's extensive proven mineral reserves

and their strategic proximity to key agricultural regions of the

country, present a unique opportunity to advance the

decarbonization of the Brazilian agricultural sector," extolled

Breno Rates, WayCarbon’s Founding Partner and head of Carbon

Projects.

Verde’s Carbon Removal

Potential

Located in São Gotardo within the state of Minas

Gerais, Brazil, Verde's operations are underpinned by one of the

world’s largest potash resources, at 5.9 billion tons as approved

by the Brazilian Mining Agency, of which 3.32 billion tons have

been certified under Canadian National Instrument 43-101.1

Thereupon, Verde has a total capture potential of 0.7

gigatons of CO2 from the atmosphere,2 which would establish it as

one of the world's largest carbon capture projects.

As Brazil's largest potash producer by capacity,

Verde has an annual production capacity of 3 million tons.3 With no

further CAPEX investment, the Company is capable of capturing up to

0.36 million tons of CO2 per year based on its existing production

facilities.4

About WayCarbon and

Santander

WayCarbon is a global company specializing in

solutions aimed at transitioning to a net-zero economy. Founded in

2006, it leverages scientific and business knowledge, enhanced by

technology, to support companies and governments in their climate

change and sustainability strategies.

WayCarbon boasts a portfolio of over 500 private

sector clients, in addition to extensive experience serving

multilateral organizations (UNDP, CAF, World Bank, IADB) in areas

of mitigation, adaptation, and the structuring of emission

reduction and carbon removal projects.

The company's consultancy services, specialized

software, and high-quality carbon projects are designed to support,

in an integrated manner, companies and governments on their

decarbonization journeys. Its technological solutions are utilized

by clients in 40 countries.5

In addition to its comprehensive expertise and

experience acquired over 18 years in the field of climate change

and sustainability, one of WayCarbon's differentiators is its

connection with controlling shareholder, Banco Santander.

Headquartered in Spain, Banco Santander is a global financial

institution with a significant presence in Brazil. Santander plays

an important role in supporting sustainable development and is an

active member of the Net Zero Banking Alliance, demonstrating its

solid commitment to leading innovation and promoting

sustainability.

Santander is already carbon-neutral in its own

operations and aspires to achieve net-zero emissions across the

entire group by 2050, in support of the Paris Agreement's goals

concerning climate change.6 With a large and strategic presence in

the Brazilian agricultural sector, the Bank aligns itself with the

growing demands for responsible and efficient agricultural

practices and brings with it vast financial expertise in the

sector.

Santander’s proactive approach reflects its

commitment to decarbonizing its value chain. This initiative not

only reinforces Santander's position as a leader in sustainability,

but also expands the possibilities for companies to collaborate and

partner with WayCarbon. As an integral part of this banking

ecosystem, WayCarbon is positioned to offer solutions and strategic

partnerships that transcend conventional borders. Together,

WayCarbon and Santander have the potential to promote a significant

transformation of their partners, leading them towards more

sustainable, eco-efficient practices, aligned with global

decarbonization objectives that boost the growth and

competitiveness of their businesses.

Enhanced Rock Weathering

Verde has developed partnerships with leading

British universities in Soil Science7 that have proven Verde’s

Product has the potential to capture carbon dioxide from the

atmosphere through Enhanced Rock Weathering

(“ERW”).

ERW refers to a suite of techniques aimed at

accelerating natural rock weathering, which involves the breakdown

of minerals and the absorption of CO2 from the atmosphere. In

nature, the process takes centuries as the rocks’ surface is

gradually weathered down and reacts with CO2 to form new stable

carbonate minerals or bicarbonate ions, effectively removing CO2

from the atmosphere and storing it for thousands of years.

By crushing and grinding such minerals and

spreading it over large areas, ERW significantly accelerates the

absorption of CO2. The speed of mineral weathering can be

calculated using a ‘shrinking core model’, which assumes that the

reaction occurs at the surface of the mineral so that the unreacted

core gradually shrinks over time.

As detailed by an independent study conducted at

Newcastle University under the leadership of Prof. David Manning,

PhD, a renowned soil scientist, the carbon dioxide capture

properties of the Products are estimated at 120kg per ton. The

potential CO2 removal does not require any change to the Products’

production and farmland application methods, nor does it change the

nutritional benefits to plants. Thus, the Products undergo ERW to

permanently capture atmospheric CO2 while releasing potassium and

other plant nutrients.

In addition, the Product potentially undergoes

mineral dissolution in only a matter of months to a year from its

application to soils, faster than the most rapid reacting silicate

minerals (forsterite), which takes years to decades for a similar

dissolution. Mineral dissolution is directly correlated to the

capture of carbon dioxide from the atmosphere, the faster the

dissolution the faster the absorption of CO2. The conclusion was

reached by a commissioned study conducted by Phil Renforth, Ph.D.,

at Heriot Watt University, based on peer-reviewed publication and

commercial data.

About Verde AgriTech

Verde AgriTech is dedicated to advancing

sustainable agriculture through the innovation of specialty

multi-nutrient potassium fertilizers. Our mission is to increase

agricultural productivity, enhance soil health, and significantly

contribute to environmental sustainability. Utilizing our unique

position in Brazil, we harness proprietary technologies to develop

solutions that not only meet the immediate needs of farmers but

also address global challenges such as food security and climate

change. Our commitment to carbon capture and the production of

eco-friendly fertilizers underscores our vision for a future where

agriculture contributes positively to the health of our planet.

Cautionary Language and Forward-Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

- the estimated amount and grade of Mineral Resources and Mineral

Reserves;

- the estimated amount of CO2 removal per ton of rock;

- the PFS representing a viable development option for the

Project;

- estimates of the capital costs of constructing mine facilities

and bringing a mine into production, of sustaining capital and the

duration of financing payback periods;

- the estimated amount of future production, both produced and

sold;

- timing of disclosure for the PFS and recommendations from the

Special Committee;

- the Company’s competitive position in Brazil and demand for

potash; and,

- estimates of operating costs and total costs, net cash flow,

net present value and economic returns from an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

- the presence of and continuity of resources and reserves at the

Project at estimated grades;

- the estimation of CO2 removal based on the chemical and

mineralogical composition of assumed resources and reserves;

- the geotechnical and metallurgical characteristics of rock

conforming to sampled results; including the quantities of water

and the quality of the water that must be diverted or treated

during mining operations;

- the capacities and durability of various machinery and

equipment;

- the availability of personnel, machinery and equipment at

estimated prices and within the estimated delivery times;

- currency exchange rates;

- Super Greensand® and K Forte® sales prices, market size and

exchange rate assumed;

- appropriate discount rates applied to the cash flows in the

economic analysis;

- tax rates and royalty rates applicable to the proposed mining

operation;

- the availability of acceptable financing under assumed

structure and costs;

- anticipated mining losses and dilution;

- reasonable contingency requirements;

- success in realizing proposed operations;

- receipt of permits and other regulatory approvals on acceptable

terms; and

- the fulfilment of environmental assessment commitments and

arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward-looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:

Cristiano Veloso, Chief

Executive Officer and Founder

Tel: +55 (31) 3245 0205;

Email: investor@verde.ag

www.verde.ag | www.investor.verde.ag

___________________

1 Combined measured and indicated mineral resource of 1.47

billion tons at 9.28% K2O and an inferred mineral resource of 1.85

billion tons at 8.60% K2O (using a 7.5% K2O cut-off grade). As per

the National Instrument 43-101 Standards of Disclosure for Mineral

Projects within Canada (“NI 43 -101”), filed on SEDAR in 2022. For

further information, see the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2022/05/NI-43-101-Pre-Feasibility-Technical-Report-for-the-Cerrado-Verde-Project.pdf

2 The carbon capture potential of Verde's products, through

Enhanced Rock Weathering (ERW), is 120 kg CO2e per ton of K Forte®.

For further information, see “Verde’s Products Remove Carbon

Dioxide From the Air”.3 Verde is currently fully licensed to

produce up to 2.8 million tons per year of its Products and has

submitted mining and environmental applications for an additional

25 million tpy awaiting approval.4 One carbon credit is equivalent

to one metric ton of carbon dioxide captured.5 Learn more

at: https://waycarbon.com/sobre-a-waycarbon/6 Learn more

at: https://www.bancosantander.es/en/santander-sostenible/empresas7

See “Verde’s Products Remove Carbon Dioxide From the Air” and

“Verde’s Products Remove Carbon Dioxide from Air in Mere Months of

Application”.

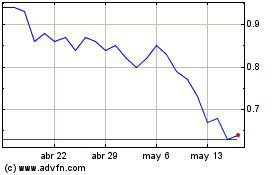

Verde Agritech (TSX:NPK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Verde Agritech (TSX:NPK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024