PRO Real Estate Investment Trust (TSX: PRV.UN) ("PROREIT" or the

"REIT") today announced that it has entered into agreements to

acquire a 100% interest in 15 industrial properties located in

Atlantic Canada representing 1,074,269 square feet of gross

leasable area ("GLA") and one industrial property in Winnipeg,

Manitoba representing 106,737 square feet of GLA (collectively, the

“Acquisitions”) for an aggregate purchase price of $163.2 million

(excluding closing costs), representing an implied weighted average

capitalization rate of 5.9% and approximately $138 per square foot.

"The acquisitions of these high-quality

institutional assets represent a strategic transaction for the REIT

and provide AFFO accretion. The assets offer significant growth

potential and substantially increase PROREIT's exposure to the

industrial sector across key markets. The acquisitions also

demonstrate the REIT’s continued success and ability to source and

acquire assets in the highly competitive industrial segment where

we are focused,” said James Beckerleg, CEO.

"We are also very pleased with continued

commitment from an institutional investor of the caliber of the

Bragg Group of Companies through the private placement. We are

excited to continue to grow with this strong partner at our side,"

added James Beckerleg.

Public Offering and Concurrent Private

Placement

The REIT also announced today that it has

entered into an agreement to issue 8,760,000 trust units of the

REIT (“Units”) from treasury on a bought deal basis at a price of

$6.85 per unit (the “Offering Price”) to a syndicate of

underwriters with TD Securities Inc. and Scotiabank acting as

bookrunners and co-led by Canaccord Genuity Corp. (collectively,

the “Underwriters”) for gross proceeds of approximately $60 million

(the “Offering”). The REIT has granted the Underwriters an

over-allotment option to purchase up to an additional 1,314,000

Units on the same terms and conditions, exercisable at any time, in

whole or in part, up to 30 days after the closing of the Offering

(the “Over-Allotment Option”). The Offering is expected to close on

or about October 6, 2021 and is subject to customary conditions,

including regulatory approval. The Units will be offered by way of

a prospectus supplement to the REIT's base shelf prospectus dated

July 13, 2021, to be filed with the securities commissions and

other similar regulatory authorities in each of the provinces and

territories of Canada, pursuant to National Instrument 44-102 –

Shelf Distributions (the "Prospectus Supplement").

PROREIT also entered into a concurrent binding

subscription agreement to issue approximately $14 million of Units

on a non-brokered private placement basis at the Offering Price to

Collingwood Investments Incorporated, a member of the Bragg Group

of Companies, from Nova Scotia (the "Private Placement"). Upon

closing of the Private Placement, Collingwood Investments

Incorporated, will maintain its voting and economic interest of

approximately 19.23% in PROREIT, or approximately 19.5% together

with one of its related parties. Collingwood Investments

Incorporated will be entitled at closing of the Private Placement

to a capital commitment fee equal to 2% of the gross proceeds of

the Private Placement.

The Private Placement is subject to customary

conditions, including regulatory approval. Closing of the Offering

is conditional upon the concurrent closing of the Private

Placement, and closing of the Private Placement is conditional upon

the concurrent closing of the Offering.

The REIT intends to use the net proceeds from

the Offering and the Private Placement (collectively, with the

Acquisitions and the Sale Transaction (as defined below), the

"Transactions") to partially fund the Acquisitions, to repay

certain indebtedness which may be subsequently redrawn, and the

balance if any to fund future acquisitions and for general business

and working capital purposes.

The Acquisitions

Atlantic Canada Acquisition

The assets represent a complementary expansion

of PROREIT’s existing portfolio and include 14 industrial assets

strategically located within Halifax's most sought-after industrial

node, Burnside Industrial Park ("Burnside"), and one asset located

in Moncton, New Brunswick. The 14 assets will increase the REIT's

presence in Burnside to 1.5 million square feet, providing

meaningful operational and leasing synergies. The assets total

1,074,269 square feet of GLA, contain 135 tenants, feature clear

heights of 12 to 24 feet, have efficient bay sizes, ample loading

doors, and are comprised of warehouse, light industrial, and flex

office spaces. Currently the properties are approximately 99%

leased to a diverse mix of tenants with a weighted average lease

term of 3.3 years. Many of the in-place leases benefit from the

inclusion of contracted rent step escalations. Since the beginning

of 2021 the cost to lease industrial space in Burnside has seen

significant increases. Current industrial market rents in Halifax

are $9.791 per square foot, largely above the portfolio's weighted

average in-place rent of $7.05 per square foot, presenting

substantial future rental upside upon turnover.

Halifax's highly sought-after Burnside

Industrial Park is one of Canada's strongest industrial hubs and is

the largest industrial node east of Montréal and north of Boston,

USA. Burnside currently benefits from strong underlying

fundamentals surrounding its industrial markets with vacancy rates

at all-time lows (2.6%) and consistent growth in net rental rates2.

The Atlantic Canadian economy, more specifically Nova Scotia, has

significantly outperformed the rest of the country over the last

few years, including during the COVID-19 pandemic, driven by

investment and strong immigration tailwinds.

Moncton is the largest census metropolitan area

in the province of New Brunswick and the third largest in Atlantic

Canada. Moncton benefits from its central location in Atlantic

Canada, having roughly 1.3 million people living within

approximately a 2.5 hour drive of the city. The city has continued

to benefit from its relatively low-cost of operating for businesses

and has been growing its presence across transportation and

manufacturing sectors in recent years.

Winnipeg Acquisition

In addition, PROREIT has entered into an

agreement to acquire one industrial building in Winnipeg, Manitoba,

totaling 106,737 square feet of GLA, further expanding the REIT's

footprint in the city. Strategically located in an industrial park

at the traffic-intensive intersection of Notre Dame Avenue and

Dublin Avenue and within close proximity to both downtown and the

Trans-Canada Highway, the asset features clear heights of

approximately 16 feet and is currently 100% occupied by a blend of

high-quality commercial tenants with a weighted average lease term

of 2.6 years. With a weighted average in-place industrial rent of

$5.86 per square foot3 the property is well-positioned to generate

rental revenue upside in future years as market industrial rates

are around 44% higher at $8.41 per square foot4 in Winnipeg's West

submarket.

Winnipeg's proximity to the Canada-US border

along with its central location positions the city well as a

distribution hub within North America. The Winnipeg industrial

market has a vacancy rate of 4.1% (West submarket at 3.7%)4 and is

continuing to trend downward. In Q2 2021 alone, there was over

300,000 square feet of absorption across the market, illustrating

the market's continued strength and demand for high-quality

industrial space4. Strong tenant demand and leasing activity in the

city are supported by continued robust immigration and employment

along with its growing popularity as an e-commerce logistic centre,

as evidenced by Amazon's new delivery centre in the city.

Financing of the

Acquisitions

The aggregate purchase price (excluding closing

costs) for the Acquisitions is anticipated to be approximately

$163.2 million. The purchase price of the Acquisitions is expected

to be satisfied by a combination of the following funding sources:

(i) approximately $54.6 million in cash from the Offering and the

Private Placement, (ii) approximately $105.0 million from a bridge

facility which will be replaced with an aggregate principal amount

of new mortgage financing to be determined by closing, and (iii) an

$8 million mortgage assumption. Closing costs for the

Acquisitions, estimated at approximately $4.9 million, will be

funded with cash from the Offering and the Private Placement.

The balance of the proceeds will be used to repay the REIT's credit

facilities.

Sale Transaction

PROREIT has also entered into an agreement to

sell three predominantly retail properties located in New Brunswick

for a total consideration of approximately $8.1 million (the “Sale

Transaction”). The proceeds of the sale are expected to be used to

pay out approximately $5.0 million of mortgages and the balance to

repay certain amounts outstanding under the REIT’s credit

facilities and for general trust purposes. The Sale Transaction is

expected to close in the coming days and is subject to customary

conditions.

Impact of the Transactions on the REIT’s

Overall Portfolio

Upon completion of the Transactions, the REIT’s

portfolio will be comprised of 120 income producing commercial

properties representing approximately 6.6 million square feet of

GLA and $928 million of total assets with a weighted average lease

term of 4.5 years. The addition of the industrial properties will

improve portfolio balance by increasing PROREIT’s portfolio

exposure to the industrial segment to 78% by GLA and 63% by base

rent, pro forma the Transactions.

The Acquisitions are subject to customary

closing conditions, including with respect to regulatory approvals,

and are expected to close in the fourth quarter of 2021.

Portfolio Pro Forma the

Transactions

|

Province |

% By Base Rent |

% By GLA |

|

Asset Class |

% By Base Rent |

% By GLA |

|

Maritime Provinces |

47 |

% |

51 |

% |

|

Industrial |

63 |

% |

78 |

% |

|

Ontario |

27 |

% |

24 |

% |

|

Retail |

26 |

% |

15 |

% |

| Western

Canada |

16 |

% |

14 |

% |

|

Office |

11 |

% |

7 |

% |

|

Quebec |

10 |

% |

12 |

% |

|

|

|

|

|

Total |

100.0 |

% |

100.0 |

% |

|

Total |

100.0 |

% |

100.0 |

% |

Enhanced Liquidity and Repayment of

Debt

In addition to the Acquisitions, PROREIT intends

to use a portion of the net proceeds of the Offering and Private

Placement to repay certain indebtedness, including a significant

pay down of the REIT’s credit facilities, and for general trust

purposes. Following the closing of the Offering and the Private

Placement, PROREIT will have significant available liquidity under

credit facilities to continue to execute on its growth plan.

Additional information related to the

Transactions will be included in the Prospectus Supplement.

* Represents a non-IFRS measure. See “Non-IFRS

and Operational Key Performance Indicators” below.

About PRO Real Estate Investment

Trust

PROREIT is an unincorporated open-ended real

estate investment trust established pursuant to a declaration of

trust under the laws of the Province of Ontario. PROREIT was

established in March 2013 to own a portfolio of diversified

commercial real estate properties in Canada, with a focus on

primary and secondary markets in Québec, Atlantic Canada and

Ontario with selective expansion into Western Canada. PROREIT’s

portfolio is diversified by property type and geography.

The securities offered have not and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any U.S. State securities

laws and may not be offered or sold, directly or indirectly, within

the United States or its territories or possessions or to or for

the account of any U.S. person (as defined in Regulation S under

the U.S. Securities Act) other than pursuant to an available

exemption from the registration requirements of the U.S. Securities

Act. This press release does not constitute an offer to sell or a

solicitation of an offer to buy any such securities within the

United States, or its territories or possessions, or to or for the

account of any U.S. person.

For more information on PROREIT, please visit

the REIT’s website at: https://proreit.com.

Non-IFRS and Operational Key Performance

Indicators

PROREIT’s condensed consolidated financial

statements are prepared in accordance with International Financial

Reporting Standards (“IFRS”). In this press release, as a

complement to results provided in accordance with IFRS, PROREIT

discloses and discusses certain non-IFRS financial measures,

including adjusted funds from operations (“AFFO”) and AFFO payout

ratio as well as other measures discussed elsewhere in this

release. These non-IFRS measures are not defined by IFRS, do not

have a standardized meaning and may not be comparable with similar

measures presented by other issuers. PROREIT has presented such

non-IFRS measures as management believes they are relevant measures

of PROREIT’s underlying operating performance and debt management.

Non-IFRS measures should not be considered as alternatives to net

income, cash generated from (utilized in) operating activities or

comparable metrics determined in accordance with IFRS as indicators

of PROREIT’s performance, liquidity, cash flow, and profitability.

For a full description of these measures and, where applicable, a

reconciliation to the most directly comparable measure calculated

in accordance with IFRS, please refer to the “Non-IFRS and

Operational Key Performance Indicators” section in PROREIT’s

Management’s Discussion and Analysis for the three months ended

June 30, 2021, available on SEDAR at www.sedar.com.

Forward-Looking Information

This news release contains forward-looking

statements within the meaning of applicable securities legislation.

Forward-looking statements are based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond PROREIT’s control, that could cause actual results and

events to differ materially from those that are disclosed in or

implied by such forward-looking statements.

Forward-looking statements contained in this

press release include, without limitation, statements pertaining to

the closing of the Offering, the Private Placement, each of the

Acquisitions and the Sale Transaction, the use of the net proceeds

of the Offering and the Private Placement, the impact of the

Acquisitions on PROREIT’s future financial performance, the impact

of the Transactions on the REIT's AFFO per unit and AFFO Payout

Ratio, and the ability of PROREIT to execute its growth strategies.

PROREIT’s objectives and forward-looking statements are based on

certain assumptions, including that (i) PROREIT will receive

financing on favorable terms; (ii) the future level of indebtedness

of PROREIT and its future growth potential will remain consistent

with REIT’s current expectations; (iii) there will be no changes to

tax laws adversely affecting PROREIT’s financing capacity or

operations; (iv) the impact of the current economic climate and the

current global financial conditions on PROREIT’s operations,

including its financing capacity and asset value, will remain

consistent with PROREIT’s current expectations; (v) the performance

of PROREIT’s investments in Canada will proceed on a basis

consistent with PROREIT’s current expectations; and (vi) capital

markets will provide PROREIT with readily available access to

equity and/or debt.

The forward-looking statements contained in this

news release are expressly qualified in their entirety by this

cautionary statement. All forward-looking statements in this press

release are made as of the date of this press release. PROREIT does

not undertake to update any such forward-looking information

whether as a result of new information, future events or otherwise,

except as required by law.

Additional information about these assumptions

and risks and uncertainties is contained under “Risk Factors” in

PROREIT’s latest annual information form, which is available on

SEDAR at www.sedar.com.

Neither the TSX nor its Regulation Services

Provider (as that term is defined in the policies of the TSX)

accepts responsibility for the adequacy or accuracy of this

release.

For further information, please

contact:

PRO Real Estate Investment TrustJames W.

BeckerlegPresident and Chief Executive Officer514-933-9552

PRO Real Estate Investment TrustGordon G.

Lawlor, CPA, CAExecutive Vice President and Chief Financial

Officer514-933-9552

1 Colliers

Canada National Market Snapshot Q3 2021.2

Colliers Q2 2021

Halifax Industrial Report.3

Based on industrial

space, excludes office portion (~9% of GLA); total property

weighted average in-place rent is $6.08 per square foot.4

Capital Commercial

Real Estate Services Inc. Winnipeg Industrial Market Snapshot Q2

2021.

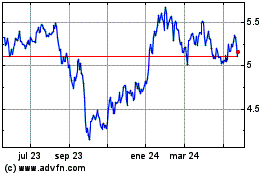

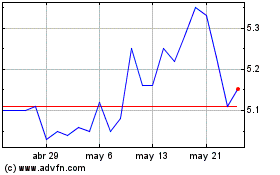

Pro Real Estate Investment (TSX:PRV.UN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Pro Real Estate Investment (TSX:PRV.UN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024