Quipt Home Medical Corp. (the “

Company”) (NASDAQ:

QIPT; TSX: QIPT), a U.S. based home medical equipment provider,

focused on end-to-end respiratory care, today announced its first

quarter fiscal 2024 financial results and operational highlights.

These results pertain to the three months ended December 31,

2023, and are reported in United States dollars ("$", "dollars" and

"US$") and have been rounded to the nearest hundred thousand.

Quipt will host its Earnings Conference Call on

Thursday, February 15, 2024, at 10:00 a.m. (ET). The dial-in number

is 1 (800) 319-4610 or 1 (604) 638-5340. The live audio webcast can

be found on the investor section of the Company’s website through

the following link: www.quipthomemedical.com.

Financial

Highlights:

- Revenue for Q1

2024 was $65.4 million compared to $40.8 million for Q1 2023,

representing a 60% increase. The Company reported 2% sequential

organic growth compared to Q4 2023.

- The Company

expects solid organic growth patterns for the balance of fiscal

2024, with the ongoing objective of achieving 8-10% annualized

organic revenue growth.

- Recurring

Revenue (defined in Non-IFRS Measures below) for Q1 2024 was very

strong and exceeded 83% of total revenue, driven by overall growth

in new equipment set-ups, which is the initial delivery of

equipment to a patient.

- Adjusted EBITDA (defined in

Non-IFRS Measures below) for Q1 2024 was $15.3 million (23.5% of

revenue) compared to $9.0 million (22.0% of revenue) for Q1 2023,

representing a 71% increase.

- Net income

(loss) for Q1 2024 was $(0.6) million, or ($0.01) per diluted

share, as compared to $0.3 million, or $0.01 per diluted share for

Q1 2023.

- Cash flow from

operations was $11.7 million for the three months ended

December 31, 2023, compared to $4.8 million for the three

months ended December 31, 2022.

- For Q1 2024,

bad debt expense as a percentage of revenue improved to 4.3%,

compared to 5.6% for Q1 2023.

- The Company

reported cash on hand of $18.3 million as of December 31, 2023,

compared to $17.2 million as of September 30, 2023. The Company has

total credit availability of $41 million as of December 31, 2023,

with $20 million available on its revolving credit facility and $21

million available pursuant to a delayed-draw term loan

facility.

- The Company maintains a conservative balance sheet with net

debt to Adjusted EBITDA leverage of 1.3x.

Operational

Highlights:

- The Company’s

customer base increased 56% year over year to 155,434 unique

patients served in Q1 2024 from 99,420 unique patients in Q1

2023.

- Compared to

146,350 unique set-ups/deliveries in Q1 2023, the Company completed

215,370 unique set-ups/deliveries in Q1 2024, an increase of 47%.

This includes 123,190 respiratory resupply set-ups/deliveries for

the three months ended December 31, 2023, compared to 69,482 for

the three months ended December 31, 2022, an increase of 77%, which

the Company credits to its continued use of technology and

centralized intake processes.

- The Company’s

resupply program is a major proponent of the Company’s 83%

recurring revenue base as the Company has significantly scaled, now

representing 49% of the recurring revenue mix, driving higher

margin revenue. The program now consists of approximately 172,000

patients as of December 31, 2023, compared to approximately 100,000

patients as of December 31, 2022.

- The Company

continues to experience very strong demand trends for respiratory

equipment, including CPAPs, BiPAPs, oxygen concentrators,

ventilators, as well as the CPAP resupply and other supplies

business.

- The Company has

continued expanding its sales reach, driving organic growth which

spans across 26 U.S. states with the addition of experienced sales

personnel.

- The Company has

287,500 active patients, 34,400 referring physicians and 125

locations.

Management

Commentary:

“We continued experiencing robust demand trends

in the first quarter across our diverse product offering and are

very pleased with the continued record financial and operational

results we have posted. Our commitment to scaling our operations

efficiently is evident in our margin profile, which has shown

remarkable consistency. Moreover, we saw steady sequential organic

growth, reduced our bad debt expense year over year, and

significantly improved our net operating cash flow. To maintain our

positive momentum and competitive edge, we will continue putting a

high priority on strategic investments in both inorganic and

organic growth opportunities, including penetrating our key sales

touch points, with the continued expansion into continuum markets

which has been very successful to date,” said CEO and Chairman

Gregory Crawford.

“We are actively expanding our patient-centric

ecosystem across 26 states, offering specialized clinical

respiratory programs, to provide efficient and tailored home

treatment. Our strategic initiatives are concentrated in regions

with a high COPD prevalence, with a concerted sales effort aimed at

penetrating targeted markets to fuel our organic growth trajectory.

A significant driver of our growth is our proven diversified

business model which has increased our overall performance by

extending a patient’s lifetime relationship with us and generates

higher recurring revenue. Our healthy balance sheet, well-timed

organic growth initiatives, and strategic acquisition and

integration strategy provide us with ample opportunity to

capitalize on the expanding market for at-home clinical respiratory

care.”

“We take great pride in our continued cost

discipline and capital allocation prudency which are the

cornerstones of our consistent financial and operating results. Our

Fiscal Q1 results underscore this with an Adjusted EBITDA margin of

23.5% of revenue, and net cash flow from operations which came in

at 18% of revenue,” said Hardik Mehta, Quipt’s Chief Financial

Officer. “We are thrilled to surpass the milestones of $261 million

in Run-Rate Revenue and $61 million of Run-Rate Adjusted EBITDA

(both defined in Non-IFRS Measures below). Our strategic capital

management approach has endowed us with a conservative balance

sheet characterized by a low Leverage Ratio of 1.3x net debt to

Adjusted EBITDA, bolstered by over $59 million in available credit

and cash on hand. Despite the challenges posed by higher interest

rates, our strong financial foundation ensures we are well equipped

to pursue our strategic objectives. With our flexible capital

structure, we continue to explore diverse avenues to enhance

shareholder value. The structure of our operations, coupled with

our solid financial position, which includes the ability to

increase the size of our senior credit facility, equips us with all

the necessary tools to successfully drive our growth strategy

forward.”

From time to time, the Company is involved in

various legal proceedings arising from the ordinary course of

business. The Company received a civil investigative demand from

the U.S. Attorney’s Office for the Northern District of Georgia

pursuant to the False Claims Act regarding an investigation

concerning whether the Company may have caused the submission of

false claims to government healthcare programs for CPAP

equipment. The Company is cooperating with the investigation

and the DOJ has not indicated to the Company whether it

believes the Company engaged in any wrongdoing. No assurance

can be given as to the timing or outcome of the DOJ’s

investigation.

ABOUT QUIPT HOME MEDICAL

CORP.

The Company provides in-home monitoring and

disease management services including end-to-end respiratory

solutions for patients in the United States healthcare market. It

seeks to continue to expand its offerings to include the management

of several chronic disease states focusing on patients with heart

or pulmonary disease, sleep disorders, reduced mobility, and other

chronic health conditions. The primary business objective of the

Company is to create shareholder value by offering a broader range

of services to patients in need of in-home monitoring and chronic

disease management. The Company’s organic growth strategy is to

increase annual revenue per patient by offering multiple services

to the same patient, consolidating the patient’s services, and

making life easier for the patient.

Forward-Looking Statements

Certain statements contained in this press

release constitute "forward-looking information" as such term is

defined in applicable Canadian securities legislation. The

words "may", "would", "could", "should", "potential", "will",

"seek", "intend", "plan", "anticipate", "believe", "estimate",

"expect", "outlook", and similar expressions as they relate to

the Company, including: the Company anticipating solid and robust

organic growth, with the goal of achieving 8-10% revenue growth on

an annualized basis; are intended to identify forward-looking

information. All statements other than statements of historical

fact may be forward-looking information. Such statements reflect

the Company's current views and intentions with respect to

future events, and current information available to the Company,

and are subject to certain risks, uncertainties and

assumptions, including: the Company successfully identified,

negotiating and completing additional acquisitions; and

operating and other financial metrics maintaining their current

trajectories. Many factors could cause the actual results,

performance or achievements that may be expressed or implied by

such forward-looking information to vary from those described

herein should one or more of these risks or uncertainties

materialize. Examples of such risk factors include, without

limitation: risks related to credit, market (including equity,

commodity, foreign exchange and interest rate), liquidity,

operational (including technology and infrastructure),

reputational, insurance, strategic, regulatory, legal,

environmental, and capital adequacy; the general business and

economic conditions in the regions in which the Company operates;

the ability of the Company to execute on key priorities,

including the successful completion of acquisitions, business

retention, and strategic plans and to attract, develop and retain

key executives; difficulty integrating newly acquired

businesses; the ability to implement business strategies and

pursue business opportunities; low profit market segments;

disruptions in or attacks (including cyber-attacks) on the

Company's information technology, internet, network access or

other voice or data communications systems or services; the

evolution of various types of fraud or other criminal behavior

to which the Company is exposed; the failure of third parties to

comply with their obligations to the Company or its affiliates;

the impact of new and changes to, or application of, current

laws and regulations; decline of reimbursement rates; dependence

on few payors; possible new drug discoveries; a novel business

model; dependence on key suppliers; granting of permits and

licenses in a highly regulated business; the overall difficult

litigation environment, including in the U.S.; increased

competition; changes in foreign currency rates; increased

funding costs and market volatility due to market illiquidity and

competition for funding; the availability of funds and

resources to pursue operations; critical accounting estimates and

changes to accounting standards, policies, and methods used by

the Company; the occurrence of natural and unnatural

catastrophic events and claims resulting from such events; and

risks related to COVID-19 including various recommendations,

orders and measures of governmental authorities to try to limit

the pandemic, including travel restrictions, border closures,

non-essential business closures, quarantines, self-isolations,

shelters-in-place and social distancing, disruptions to

markets, economic activity, financing, supply chains and sales

channels, and a deterioration of general economic conditions

including a possible national or global recession; as well as

those risk factors discussed or referred to in the Company’s

disclosure documents filed with United States Securities and

Exchange Commission and available at www.sec.gov, and with the

securities regulatory authorities in certain provinces of Canada

and available at www.sedar.com. Should any factor affect the

Company in an unexpected manner, or should assumptions

underlying the forward-looking information prove incorrect, the

actual results or events may differ materially from the results

or events predicted. Any such forward-looking information is

expressly qualified in its entirety by this cautionary

statement. Moreover, the Company does not assume responsibility

for the accuracy or completeness of such forward-looking

information. The forward-looking information included in this

press release is made as of the date of this press release and

the Company undertakes no obligation to publicly update or revise

any forward-looking information, other than as required by

applicable law.

Non-IFRS Measures

This press release refers to “Recurring

Revenue”, “Adjusted EBITDA”, “Run-Rate Revenue”, “Run-Rate Adjusted

EBITDA”, and “Leverage Ratio”, which are non-IFRS financial

measures that do not have standardized meanings prescribed by IFRS.

The Company’s presentation of these financial measures may not be

comparable to similarly titled measures used by other companies.

These financial measures are intended to provide additional

information to investors concerning the Company’s

performance.

Recurring Revenue for Q1 is calculated as

rentals of medical equipment of $27.4 million plus sales of

respiratory resupplies of $26.8 million for a total of $54.2

million, divided by total revenues of $65.4 million, or 83%.

Adjusted EBITDA is calculated as net income

(loss), and adding back depreciation and amortization, interest

expense, net, provision for income taxes, stock-based compensation,

professional fees related to civil investigative demand,

acquisition-related costs, share of loss of equity method

investment, and loss (gain) on foreign currency transactions. The

following table shows our non-IFRS measure, Adjusted EBITDA,

reconciled to our net income (loss) for the following indicated

periods (in $millions):

| |

|

|

|

|

|

|

| |

Three |

|

Three |

|

| |

months |

|

months |

|

| |

ended December |

|

ended December |

|

| |

31, 2023 |

|

31, 2022 |

|

|

Net income (loss) |

$ |

(0.6 |

) |

|

$ |

0.3 |

|

| Add back: |

|

|

|

|

|

|

| Depreciation and

amortization |

|

12.3 |

|

|

|

6.8 |

|

| Interest expense, net |

|

2.0 |

|

|

|

0.7 |

|

| Provision for income

taxes |

|

0.2 |

|

|

|

0.3 |

|

| Stock-based compensation |

|

1.0 |

|

|

|

0.6 |

|

| Professional fees related to

civil investigative demand |

|

0.4 |

|

|

|

— |

|

| Acquisition-related costs |

|

0.2 |

|

|

|

0.3 |

|

| Share of loss in equity method

investment |

|

0.1 |

|

|

|

— |

|

| Loss (gain) on foreign

currency transactions |

|

(0.3 |

) |

|

|

0.0 |

|

| Adjusted EBITDA |

$ |

15.3 |

|

|

$ |

9.0 |

|

Run-Rate Revenue is calculated as revenue for Q1

2023 of $65.4 million times four quarters equals $261.6

million.

Run-Rate Adjusted EBITDA is calculated as

Adjusted EBITDA for Q1 of $15.3 million times four quarters equals

$61.2 million.

Leverage Ratio is calculated as long-term debt

less cash, divided by Run-Rate Adjusted EBITDA, and is reconciled

as follows (in $millions):

| |

As of and for |

| |

the three months |

| |

ended December |

| |

31, 2023 |

|

|

Senior credit facility, principal |

$ |

65.5 |

|

| Equipment loans |

|

13.3 |

|

| Lease liabilities |

|

18.8 |

|

| Cash |

|

(18.3 |

) |

| Long-term debt less cash |

|

79.3 |

|

| Run-Rate Adjusted EBITDA |

|

61.2 |

|

| Leverage Ratio |

|

1.3x |

|

For further information please visit our website

at www.Quipthomemedical.com, or contact:

Cole StevensVP of Corporate DevelopmentQuipt Home Medical

Corp.859-300-6455cole.stevens@myquipt.com

Gregory CrawfordChief Executive OfficerQuipt Home Medical

Corp.859-300-6455investorinfo@myquipt.com

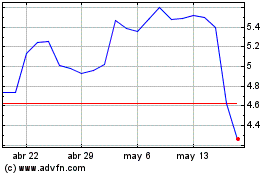

Quipt Home Medical (TSX:QIPT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Quipt Home Medical (TSX:QIPT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024