In alignment with its Purpose to provide trusted energy that

enhances people’s lives while caring for each other and the earth,

Suncor today will share its updated strategy focused on increasing

shareholder returns and accelerating its progress in reducing GHG

emissions with an objective to be net-zero by 2050.

The strategy is underpinned by Suncor’s principles of

operational excellence and capital discipline. Suncor will focus

its planned $5 billion annual capital spend through 2025 on

optimizing its integrated value chain and sustaining the base

business, while improving its cost and carbon competitiveness, and

growing low-carbon businesses, which is expected to deliver an

annual $2 billion of incremental free funds flow to the business by

2025. This planned free funds flow growth will be focused on

returning significant value to shareholders through increased

dividends, ongoing share buybacks and fortifying the balance sheet

through continued debt reduction. In addition, the strategy

includes a goal to be a net-zero GHG emissions company by 2050 and

substantially contribute to society’s net-zero goals; and a plan to

sustain our world-class ESG (Environmental, Social and Governance)

performance and disclosure while being recognized as a leader in

sustainability.

“For decades, Suncor has been evolving and growing its business

– transforming a budding oil sands resource into one of the world’s

most reliable and ESG-leading oil basins in the world,” said Mark

Little, Suncor president and chief executive officer. “We will

continue to produce oilsands for many decades to come, driving

significant shareholder returns and value, and delivering further

emissions reductions on our journey to net-zero by 2050.”

By 2030, Suncor expects to reduce greenhouse gas emissions by 10

megatonnes (MT) per year across its energy value chain. The

company’s emissions were approximately 29 MT per year in 2019.

Suncor plans to accomplish this by reducing emissions in its base

business – expanding in areas where the company has existing

expertise and where it can continue to lower the cost and carbon

profile of the existing base business and assets – and at the same

time growing its renewable fuels, electricity, and hydrogen

businesses. This includes Suncor helping its customers contribute

to a net-zero world by providing them with cleaner energy choices

such as renewable fuels and the Petro-Canada™ Electric Highway.

Suncor continues its evolution to create a stronger, more

resilient and competitive company and is confident it can

significantly increase returns to investors while progressing to

net-zero and meet growing energy needs. The updated strategy builds

on the company’s unique advantages: unparalleled energy expertise;

long-life, low-decline resource; integrated business; connection to

customers; long history of embracing technological change and

innovation; decades-long sustainability journey; and strong

relationships with stakeholders.

More details on the strategy will be shared at Suncor’s Investor

Day, which begins today at 8:00 a.m. MT (10:00 a.m. ET). Investor

Day materials will be available at 6:00 a.m. MT (8:00 a.m. ET) by

visiting

https://www.suncor.com/en-ca/investor-centre/investor-day-2021.

Legal Advisory – Forward-Looking Information and

Non-GAAP Measures

This news release contains certain forward-looking information

and forward-looking statements (collectively referred to herein as

“forward-looking statements”) within the meaning of applicable

Canadian and U.S. securities laws. Forward-looking statements in

this news release include references to: Suncor’s Purpose and

updated strategy which is focused on increasing shareholder returns

and accelerating its progress in reducing GHG emissions with an

objective to be net-zero by 2050; Suncor's expectation that it will

focus its planned $5 billion annual capital spend through 2025 on

optimizing its integrated value chain and sustaining the base

business, while improving its cost and carbon competitiveness, and

growing low carbon businesses, and its expectation that this will

deliver an annual $2 billion of incremental free funds flow to the

business by 2025; Suncor's belief that its planned free funds flow

growth will be focused on returning significant value to

shareholders through increased dividends, ongoing share buybacks

and fortifying the balance sheet through continued debt reduction;

statements about Suncor's goal to be a net-zero GHG emissions

company by 2050 and substantially contribute to society's net-zero

goals and its plan to sustain its ESG performance and disclosure

while being recognized as a leader in sustainability; Suncor's

belief that it will continue to produce oilsands for many decades

to come, driving significant shareholder returns and value, and

delivering further emissions reductions on our journey to net-zero

by 2050 and the basis for such belief; Suncor's expectation that,

by 2030, it will reduce greenhouse gas emissions by 10 MT per year

across its energy value chain, from approximately 29 MT per year in

2019 and its plans on how it will achieve this; and Suncor's belief

that it can significantly increase returns to investors while

progressing to net-zero and meet growing energy needs and the

reasons for this belief. In addition, all other statements and

information about Suncor’s strategy for growth, expected and future

expenditures or investment decisions, commodity prices, costs,

schedules, production volumes, operating and financial results and

the expected impact of future commitments are forward-looking

statements. Some of the forward-looking statements and information

may be identified by words like “expects”, “anticipates”, “will”,

“estimates”, “plans”, “scheduled”, “intends”, “believes”,

“projects”, “indicates”, “could”, “focus”, “vision”, “goal”,

“outlook”, “proposed”, “target”, “objective”, “continue”, “should”,

“may” and similar expressions.

Forward-looking statements are based on Suncor’s current

expectations, estimates, projections and assumptions that were made

by the company in light of its information available at the time

the statement was made and consider Suncor’s experience and its

perception of historical trends, including expectations and

assumptions concerning: the accuracy of reserves estimates; the

current and potential adverse impacts of the COVID-19 pandemic,

including the status of the pandemic and future waves and any

associated policies around current business restrictions,

shelter-in-place orders or gatherings of individuals; commodity

prices and interest and foreign exchange rates; the performance of

assets and equipment; capital efficiencies and cost savings;

applicable laws and government policies; future production rates;

the sufficiency of budgeted capital expenditures in carrying out

planned activities; the availability and cost of labour, services

and infrastructure; the satisfaction by third parties of their

obligations to Suncor; the development and execution of projects;

and the receipt, in a timely manner, of regulatory and third-party

approvals. All dividends are at the discretion of Suncor's Board of

Directors.

Forward-looking statements and information are not guarantees of

future performance and involve a number of risks and uncertainties,

some that are similar to other oil and gas companies and some that

are unique to Suncor. Suncor’s actual results may differ materially

from those expressed or implied by its forward-looking statements,

so readers are cautioned not to place undue reliance on them.

Suncor’s most recently filed Management’s Discussion &

Analysis (MD&A), its Annual Information Form and Annual Report

to Shareholders, each dated February 24, 2021, Form 40-F dated

February 25, 2021 and other documents it files from time to time

with securities regulatory authorities describe the risks,

uncertainties, material assumptions and other factors that could

influence actual results and such factors are incorporated herein

by reference. Copies of these documents are available without

charge from Suncor at 150 6th Avenue S.W., Calgary, Alberta T2P

3E3; by email request to invest@suncor.com; by calling

1-800-558-9071; or by referring to suncor.com/FinancialReports or

to the company’s profile on SEDAR at sedar.com or EDGAR at sec.gov.

Except as required by applicable securities laws, Suncor disclaims

any intention or obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Free funds flow is not prescribed by GAAP and does not have a

standardized meaning and therefore is unlikely to be comparable to

similar measures presented by other companies. Free funds flow

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with GAAP. Free

funds flow is included because management uses the information to

analyze business performance, leverage and liquidity and therefore

may be considered useful information by investors. See the

“Non-GAAP Financial Measures Advisory” section of the most recently

filed MD&A.

Suncor Energy is Canada's leading integrated energy company,

with a global team of over 30,000 people. Suncor's operations

include oil sands development, production and upgrading, offshore

oil and gas, petroleum refining in Canada and the US, and our

national Petro-Canada retail distribution network (now including

our Electric Highway network of fast-charging EV stations). A

member of Dow Jones Sustainability indexes, FTSE4Good and CDP,

Suncor is responsibly developing petroleum resources, while

profitably growing a renewable energy portfolio and advancing the

transition to a low-emissions future. Suncor is listed on the UN

Global Compact 100 stock index. Suncor's common shares (symbol: SU)

are listed on the Toronto and New York stock exchanges.

For more information about Suncor, visit our web site at

suncor.com, follow us on Twitter @Suncor or Living our Purpose.

Media inquiries: 1-833-296-4570 media@suncor.com

Investor inquiries: 800-558-9071 invest@suncor.com

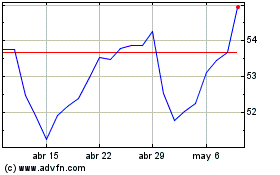

Suncor Energy (TSX:SU)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Suncor Energy (TSX:SU)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024