Teck Receives Regulatory Approval to Renew Normal Course Issuer Bid

18 Noviembre 2024 - 4:06PM

Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK)

(“Teck”) has been informed that the Toronto Stock Exchange (“TSX”)

has accepted Teck’s notice of intention to make a normal course

issuer bid to purchase its Class B subordinate voting shares

(“Class B Shares”).

Under the normal course issuer bid, Teck may purchase up to 40

million Class B Shares during the period starting November 22,

2024, and ending November 21, 2025, representing approximately 7.9%

of the outstanding Class B Shares, or 8.0% of the public float, as

at November 8, 2024. 503,097,912 Class B Shares were issued and

outstanding as at that date.

Teck will make any purchases through the facilities of the TSX,

the New York Stock Exchange or other alternative trading systems in

Canada and the United States, if eligible, or by such other means

as may be permitted under applicable securities laws, including

private agreements under an issuer bid exemption order or block

purchases in accordance with applicable regulations. Purchases will

generally be made at the prevailing market price, although any

purchases made by way of private agreement under an applicable

exemption order issued by a securities regulatory authority may be

at a discount to the prevailing market price, as provided for in

such exemption order.

Under the TSX rules, except pursuant to permitted exceptions,

the number of Class B Shares purchased on the TSX on any given day

will not exceed 296,920 Class B Shares, which is 25% of the average

daily trading volume for the Class B Shares on the TSX during the

six-month period ended October 31, 2024, of 1,187,683, calculated

in accordance with the TSX rules. The actual number of Class B

Shares to be purchased and the timing of any such purchases will

generally be determined by Teck from time to time as market

conditions warrant. In addition, Teck may from time to time

repurchase Class B Shares under an automatic securities repurchase

plan, which will enable purchases during times when Teck would

typically not be permitted to purchase its shares due to regulatory

or other reasons.

Consistent with its approach in previous years, Teck is making

the normal course issuer bid because it believes that the market

price of its Class B Shares may, from time to time, not reflect

their underlying value and that the share buy-back program may

provide value by reducing the number of shares outstanding at

attractive prices. All repurchased shares will be cancelled.

As at November 8, 2024, during the previous normal course issuer

bid, which commenced on November 22, 2023, and will end on November

21, 2024, Teck has purchased 18,062,775 Class B Shares at a

weighted average purchase price of $62.75 through the facilities of

the TSX, the New York Stock Exchange and alternative trading

systems in both Canada and the United States. Teck sought and

received approval to purchase up to 40 million Class B Shares under

the previous normal course issuer bid.

Forward-Looking Statements This press release

contains certain forward-looking statements within the meaning of

the Unites States Private Securities Litigation Reform Act of 1995

and forward-looking information as defined in the Securities Act

(Ontario). Forward-looking statements and information can be

identified by statements that certain actions, events or results

“may”, “could”, “should”, “would”, “might” or “will” be taken,

occur or achieved. Forward-looking statements include statements

regarding Teck’s expectations regarding the number of Class B

Shares that might be purchased under the normal course issuer

bid.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors, which may cause the actual

results, performance or achievements of Teck to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

Factors that may cause actual results to vary include, but are

not limited to, the ability to acquire Class B Shares in the market

through the normal course issuer bid and in compliance with

regulatory requirements, share price volatility, availability of

funds to purchase shares and other risk factors impacting Teck’s

business as detailed in Teck’s annual information form and in its

public filings with Canadian securities administrators and the U.S.

Securities and Exchange Commission. Teck does not assume the

obligation to revise or update these forward-looking statements

after the date of this document, except as may be required under

applicable securities laws.

About TeckTeck is a leading Canadian resource

company focused on responsibly providing metals essential to

economic development and the energy transition. Teck has a

portfolio of world-class copper and zinc operations across North

and South America and an industry-leading copper growth pipeline.

We are focused on creating value by advancing responsible growth

and ensuring resilience built on a foundation of stakeholder trust.

Headquartered in Vancouver, Canada, Teck’s shares are listed on the

Toronto Stock Exchange under the symbols TECK.A and TECK.B and the

New York Stock Exchange under the symbol TECK. Learn more about

Teck at www.teck.com or follow @TeckResources.

Investor Contact:Fraser PhillipsSenior Vice

President, Investor Relations & Strategic

Analysis604.699.4621fraser.phillips@teck.com

Media Contact:Dale SteevesDirector, External

Communications236.987.7405dale.steeves@teck.com

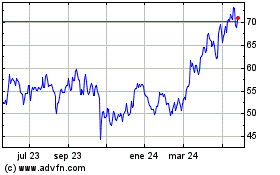

Teck Resources (TSX:TECK.A)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

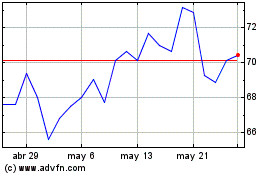

Teck Resources (TSX:TECK.A)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025