TSX: TWC

The unprecedented COVID-19 global

event has demonstrated our strength

and resilience as an organization. By activating our

Crisis Management Team and allocating appropriate

resources, we have coordinated efforts

across our Clubs and taken definitive action to

ensure the health and well-being of everyone around us,” said Rai

Sahi, Chairman and Chief Executive Officer. “At this unique time,

we celebrate our customers for their patience and

loyalty, and thank our employees who continue to maintain our

assets under difficult circumstances.”

Consolidated Financial

Highlights (unaudited)

|

(in thousands of dollars except per

share amounts) |

Three months ended |

|

March 31,2020 |

March 31,2019 |

|

Net loss |

(32,420 |

) |

(3,986 |

) |

|

Basic and diluted loss per share |

(1.22 |

) |

(0.15 |

) |

Operating Data

|

|

Three months ended |

|

|

March 31,2020 |

March 31,2019 |

|

ClubLink |

|

Canadian Full Privilege Golf Members |

13,656 |

|

14,350 |

|

|

Championship rounds – Canada |

- |

|

1,000 |

|

|

18-hole equivalent championship golf courses – Canada |

40.5 |

|

41.5 |

|

|

18-hole equivalent managed championship golf courses – Canada |

1.0 |

|

1.0 |

|

|

Championship rounds – U.S. |

112,000 |

|

136,000 |

|

|

18-hole equivalent championship golf courses – U.S. |

11.0 |

|

11.0 |

|

The following is a breakdown of net operating

income (loss) by segment:

| |

For the three months ended |

|

(thousands of Canadian dollars) |

March 31, 2020 |

March 31, 2019 |

|

Net operating income (loss) by segment |

|

|

|

Canadian golf club operations |

$ |

1,157 |

|

$ |

1,998 |

|

|

US golf club operations |

|

|

|

(2020 - US $918,000 ; 2019 - US $1,832,000) |

|

1,234 |

|

|

2,435 |

|

|

Corporate operations |

|

(771 |

) |

|

(856 |

) |

|

Net operating income (1) |

$ |

1,620 |

|

$ |

3,577 |

|

The following is an analysis of net loss:

| |

For the three months ended |

|

(thousands of Canadian dollars) |

March 31, 2020 |

March 31, 2019 |

|

Operating revenue |

$ |

20,070 |

|

$ |

23,034 |

|

|

Direct operating expenses (1) |

|

18,450 |

|

|

19,457 |

|

|

Net operating income (1) |

|

1,620 |

|

|

3,577 |

|

|

Amortization of membership fees |

|

1,004 |

|

|

1,247 |

|

|

Depreciation and amortization |

|

(4,953 |

) |

|

(5,099 |

) |

|

Interest, net and investment income |

|

(590 |

) |

|

(1,374 |

) |

|

Other items |

|

(34,498 |

) |

|

(4,265 |

) |

|

Income taxes |

|

4,997 |

|

|

1,928 |

|

|

Net loss |

$ |

(32,420 |

) |

$ |

(3,986 |

) |

(1) Please see Non-IFRS Measures

First Quarter 2020 Consolidated

Operating Highlights

The outbreak of the novel strain of coronavirus,

specifically identified as “COVID-19”, has resulted in governments

worldwide enacting emergency measures to contain the spread of the

virus which may lead to prolonged voluntary or mandatory building

closures, business closures, government restrictions on travel and

gatherings, quarantines, self-isolation and physical distancing. As

a result, the Company closed all golf clubs in order to adhere to

these restrictions and ensure the health and wellbeing of members

and staff alike. This has and will continue to impact revenue

streams such as corporate events, banquets, meetings, resort and

greens fee revenue. The Company will continue to adhere to guidance

provided by governments and regulatory authorities. As required by

IFRS, ClubLink recognizes its annual dues revenue on a

straight-line basis throughout the year based on when its

properties are open.

Consolidated operating revenue decreased 12.9%

to $20,070,000 for the three month period ended March 31, 2020 from

$23,034,000 in 2019 due to the decline in revenue from when the

golf properties were closed.

Direct operating expenses decreased 5.2% to

$18,450,000 for the three month period ended March 31, 2020 from

$19,457,000 in 2019 due to the fact that our golf clubs were closed

for a portion of the first quarter.

Net operating income for the Canadian golf club

operations segment decreased to $1,157,000 for the three month

period ended March 31, 2020 from income of $1,998,000 in 2019 due

to the impact of COVID-19 resulting in the temporary closure of

Canadian golf clubs.

Amortization of membership fees decreased 19.5%

to $1,004,000 from $1,247,000 in 2019.

Interest, net and investment income decreased

57.1% to $590,000 interest expense for the three month period ended

March 31, 2020 from $1,374,000 in 2019 due to interest income

earned on funds from the sale of White Pass and a decrease in

borrowings.

Other items consist of the following income

(loss) items:

|

(thousands of Canadian dollars) |

March 31, 2020 |

March 31, 2019 |

|

Foreign exchange gain (loss) |

$ |

7,731 |

|

$ |

(4,407 |

) |

|

Unrealized loss on investment in Automotive Properties REIT |

|

(25,871 |

) |

|

- |

|

|

Loss on sale of common shares in Carnival plc |

|

(16,240 |

) |

|

- |

|

|

Equity loss |

|

(193 |

) |

|

- |

|

|

Other |

|

75 |

|

|

142 |

|

|

Other items |

$ |

(34,498 |

) |

$ |

(4,265 |

) |

The exchange rate used for translating US

denominated assets has changed from 1.2988 at December 31, 2019 to

1.4187 at March 31, 2020 due to the declining Canadian dollar as a

result of economic impacts of COVID-19. This has resulted in a

foreign exchange gain of $7,731,000 for the three month period

ended March 31, 2020 on the translation of the Company’s US

denominated financial instruments.

For the three month period ended March 31, 2020,

there was a fair value loss of $25,871,000 on the Company’s

investment in Automotive Properties REIT. The outbreak of COVID-19

has had a material adverse effect on debt and capital markets, and

as a result has negatively affected the trading price of Automotive

Properties REIT units.

On March 17, 2020, TWC sold its interest in

Carnival plc for $5,825,000. This sale resulted in a loss of

$16,240,000 reflected in other items.

Net loss is $32,420,000 for the three month

period ended March 31, 2020 from $3,986,000 in 2019 due to the

large increase in other items. Basic and diluted loss per share

increased to $1.22 per share in 2020, compared to 15 cents in

2019.

Operating Update - COVID-19

Pandemic

During March 2020, the outbreak of the novel

strain of coronavirus (“COVID-19”), has resulted in governments

enacting emergency measures to combat the spread of the virus.

These measures, which include the implementation of travel bans,

self-imposed quarantine periods and physical distancing, have

caused an economic slowdown and material disruption to business.

Government has reacted with interventions intended to stabilize

economic conditions. The duration and impact of the COVID-19

outbreak is unknown at this time. It is not possible to reliably

estimate the length and severity of these developments and the

impact on the financial performance and financial position of the

Company in future periods.

The Company recognizes the impact COVID-19 has

on its properties along with its operations. All of our properties

were closed on March 20th and they all remain closed as of this

report with the exception of Renaissance and Scepter re-opening on

April 15th. All other properties are subject to government

closures.

In March, ClubLink activated its Crisis

Management Team which was mandated to maintain a safe environment

for our members, customers and employees, coordinating efforts

across our portfolio, standardizing communications and responding

as circumstances demand. These are unprecedented times. Everyone

has been impacted by the global efforts to reduce the spread of

COVID-19.

With the guidance of public health authorities,

and at the direction of various levels of government, ClubLink has

implemented measures to help reduce the spread of COVID-19

including:

- temporarily eliminating services

deemed to be risky;

- intensified cleaning, focusing

staff efforts on cleaning high-touch point areas at all our

properties using approved cleaning products;

- management offices are staffed but

doors are locked;

- non critical maintenance work has

been deferred;

- added additional hand sanitizers to

help customers and employees maintain recommended practices for

hand washing; and

- posted health and safety best

practice reminders to increase awareness of the most current

guidelines.

The company is actively monitoring the ongoing

developments with regards to COVID-19 and are committed in ensuring

a healthy and safe environment, adjusting our service model as

necessary.

2020 Golf Season

ClubLink has been working with customers and

clients to move their weddings, events and functions to dates later

in the year and next year. In some cases, the customer has chosen

to cancel. It is expected that there will be declines in these

revenue streams in 2020.

It is also expected that there will be

restrictions on food and beverage services for at least a portion

of 2020, this will result in anticipated declines in this revenue

stream.

In order to mitigate the impact of these

expected revenue shortfalls, ClubLink will be applying for the wage

subsidy program as offered by the Canadian Federal Government.

ClubLink is also taking advantage of other deferrals such as

property, sales and payroll taxes as well as eliminating or

deferring discretionary spending as appropriate – without

compromising our assets.

As of this report, all of the Company’s Canadian

golf courses are closed due to governmental orders. These expire in

early May. ClubLink is hopeful that golf courses will be allowed to

open after this date.

In response to COVID-19, ClubLink has

established amended standard operating procedures which are

intended to ensure the safety of our employees and

members/customers. These include:

- Restrictions on customers and

members coming onto the property beyond what is needed for their

tee time

- Physical distancing measures

- Temporary suspension of certain

privileges such as dining

- Ball washers, bunker rakes have

been removed

- Increasing frequency and depth of

cleaning procedures

The Company is prepared to open its golf courses

immediately when the governmental orders are lifted.

Eligible Dividend

Today, TWC Enterprises Limited announced an

eligible cash dividend of 2 cents per common share to be paid on

June 14, 2020 to shareholders of record as at May 31, 2020.

Non-IFRS

Measures

TWC uses non-IFRS measures as a benchmark

measurement of our own operating results and as a benchmark

relative to our competitors. We consider these non-IFRS measures to

be a meaningful supplement to net earnings. We also believe these

non-IFRS measures are commonly used by securities analysts,

investors and other interested parties to evaluate our financial

performance. These measures, which included direct operating

expenses and net operating income do not have standardized meaning

under IFRS. While these non-IFRS measures have been disclosed

herein to permit a more complete comparative analysis of the

Company’s operating performance and debt servicing ability relative

to other companies, readers are cautioned that these non-IFRS

measures as reported by TWC may not be comparable in all instances

to non-IFRS measures as reported by other companies.

The glossary of financial terms is as

follows:

Direct operating expenses =

expenses that are directly attributable to company’s business units

and are used by management in the assessment of their performance.

These exclude expenses which are attributable to major corporate

decisions such as impairment.

Net operating

income = operating revenue – direct operating expenses

Net operating income is an important metric used

by management in evaluating the Company’s operating performance as

it represents the revenue and expense items that can be directly

attributable to the specific business unit’s ongoing operations. It

is not a measure of financial performance under IFRS and should not

be considered as an alternative to measures of performance under

IFRS. The most directly comparable measure specified under IFRS is

net earnings.

Corporate Profile

TWC is engaged in golf club operations under the

trademark, “ClubLink One Membership More Golf.” TWC is Canada’s

largest owner, operator and manager of golf clubs with 52.5 18-hole

equivalent championship and 3.5 18-hole equivalent academy courses

(including one managed property) at 40 locations in Ontario, Quebec

and Florida.

For further information please contact:

Andrew TamlinChief Financial Officer15675

Dufferin StreetKing City, Ontario L7B 1K5Tel: 905-841-5372 Fax:

905-841-8488atamlin@clublink.ca

Management’s discussion and analysis, financial

statements and other disclosure information relating to the Company

is available through SEDAR and at www.sedar.com and on the Company

website at www.twcenterprises.ca.

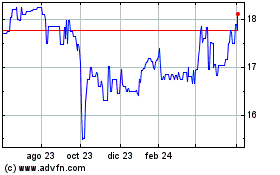

TWC Enterprises (TSX:TWC)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

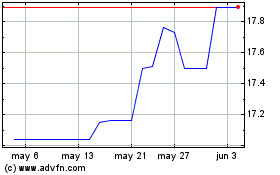

TWC Enterprises (TSX:TWC)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025