AbraPlata Resource

Corp. (TSX.V:ABRA) (OTC:ABBRF) (Frankfurt:1AH)

("AbraPlata" or the "Company") is pleased to announce the

completion of an independent Preliminary Economic Assessment

("PEA") on the Company's 100% owned Diablillos silver-gold project,

located in Salta Province, Argentina. The results of the PEA

demonstrate the potential technical and economic viability of

establishing an open pit silver-gold mine with mill complex on the

Diablillos property. Highlights of the PEA are provided in Table 1

and the forecast annual silver-equivalent (“AgEq”) production and

head grades are shown in Figure 1.

| |

|

Table 1 - Summary of Diablillos Project PEA (all dollar

amounts in US$) |

|

Pre-Tax Net Present Value (“NPV”)7.5% |

$342 Million |

|

Pre-Tax Internal Rate of Return (“IRR”) and Payback |

40.7% and 2.9 years |

|

After-Tax NPV7.5% |

$197 Million |

|

After-Tax IRR and Payback |

30.2% and 3.1 years |

|

Average Head Grade |

125.1 g/t Ag and 0.72 g/t Au |

|

Average Annual Production |

9.8 Moz AgEq or 136,000 oz AuEq |

|

Mine Life |

8 years |

|

Average All-in Sustaining Cost per Ounce Produced |

$7.52/AgEq oz or $542/AuEq oz |

|

Initial Capital |

$293 Million |

|

Metal Price Assumptions |

Ag: $20.00/oz and Au: $1,300/oz |

|

Calculated Metal Net Smelter Return (“NSR”) Values |

Ag: $15.20/oz and Au: $1,097/oz |

| |

|

The PEA is preliminary in nature and

includes inferred mineral resources that are too speculative

geologically to have economic considerations applied to them that

would enable them to be categorized as mineral reserves. There is

no certainty that PEA results will be realized. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability.

Commenting on the results, Hernan Zaballa,

Chairman of AbraPlata, stated, “We are very pleased with the robust

results of the Diablillos PEA. The PEA demonstrates that

Diablillos has the potential to produce almost 10 million AgEq

ounces per year at a low all-in sustaining cost per ounce. While

the main Oculto deposit does require pre-stripping, the average

grades are relatively high for an open pit mine. On the basis

of historical drill results, our geological team believes that

there is strong potential to expand the high grade gold zones in

the eastern portion of the Oculto deposit, which are not included

in the PEA pit shell. The gold-rich mineralization at Oculto

and additional near-surface mineralization at satellite deposits

sets up the potential to extend the mine life and potentially

strengthen the economics even more in future economic studies.”

The PEA was prepared under the guidance of lead consultant RPA

Inc. of Toronto ("RPA") with input from GR Engineering Services Ltd

of Perth, Western Australia (“GRES”), and Saxum Engineered

Solutions of Argentina (“Saxum”).

A cash flow valuation model for the Diablillos

project was developed as part of the PEA. From metal prices

of US$20.00 per ounce silver and US$1,300 per ounce gold, Table 2

shows the sensitivity of estimated NPV of the project's cash flows

at various silver prices. Figure 2 shows the undiscounted

annual and cumulative after-tax cash flows.

| |

|

Table 2 - PEA Sensitivity to Silver Price |

|

Silver Price (US$/oz Ag) |

After-Tax NPV7.5% (US$) |

After-Tax IRR |

After-Tax Pay Back |

|

$16/oz Ag |

$108 Million |

20.3 |

% |

3.7 Years |

|

$18/oz Ag |

$153 Million |

25.3 |

% |

3.4 Years |

|

$20/oz Ag |

$197 Million |

30.2 |

% |

3.1 Years |

|

$22/oz Ag |

$241 Million |

34.9 |

% |

3.0 Years |

|

$24/oz Ag |

$285 Million |

39.5 |

% |

2.8 Years |

| |

|

|

|

|

Project Description and Mineral Resource

Estimate

The Diablillos property is located in the Puna

of Argentina, in the Province of Salta, approximately 150 km

southwest of the city of Salta. The property comprises nine

mineral leases acquired by AbraPlata in 2016 from SSR Mining Inc.

(formerly Silver Standard Resources Inc.), with several known

occurrences of epithermal gold-silver mineralization.

Exploration work, conducted by a number of operators over the

history of the project, includes 87,711 m of diamond and reverse

circulation drilling in 476 holes. This drilling has

delineated the Oculto and Fantasma deposits, which are weathered

high-sulphidation epithermal gold-silver deposits hosted primarily

in Tertiary volcanic and sedimentary rocks. The current

Mineral Resource estimates for the Oculto and Fantasma deposits are

shown in Table 3.

| |

|

Table 3 - Diablillos Mineral Resource Estimates – Effective

August 31, 2017 |

| Deposit |

Category |

Tonnage |

Ag |

Au |

Contained Ag |

Contained Au |

|

(000 t) |

(g/t) |

(g/t) |

(000 oz Ag) |

(000 oz Au) |

|

Oculto |

Indicated |

26,850 |

93.0 |

0.85 |

80,300 |

732 |

|

Fantasma |

Indicated |

200 |

98.3 |

- |

650 |

- |

|

|

Total Indicated |

27,100 |

93.1 |

0.84 |

80,940 |

732 |

|

Oculto |

Inferred |

1,000 |

46.8 |

0.89 |

1,510 |

29 |

|

Fantasma |

Inferred |

80 |

75.3 |

- |

190 |

- |

|

|

Total Inferred |

1,100 |

48.8 |

0.83 |

1,690 |

29 |

Notes:

- CIM definitions were followed for Mineral Resources.

- Mineral Resources are estimated at a cut off grade of 40 g/t

AgEq for Oculto and 40 g/t Ag for Fantasma.

- Mineral Resources are estimated using long-term metal prices of

US$1,500/oz Au and US$23/oz Ag.

- Average bulk density is 2.22 t/m3 for the Indicated category

and 2.29 t/m3 for Inferred for Oculto and 2.00 t/m3 for both

Indicated and Inferred categories for Fantasma.

- The estimate is constrained by pit shells for both Oculto and

Fantasma.

- Numbers may not add due to rounding.

Production Summary The

PEA envisions conventional open pit mining methods utilizing

contractor-operated truck and shovel operations. Oculto will

require approximately 18 months of pre-stripping of unmineralized

overburden. The Oculto pit will have a mine life of eight

years (excluding pre-stripping) and be supplemented by a small

amount of material from the nearby Fantasma deposit. The life

of mine (“LOM”) strip ratio will be 3.2:1, or 4.6:1 including

pre-stripping. The final pit shells and waste dump are shown

in Figure 3.

Process PlantThe processing

facility has been selected as a conventional silver processing

plant that incorporates crushing, grinding, agitated leaching,

counter current decantation (“CCD”), cyanide recovery,

Merrill-Crowe zinc precipitation, refining and tailings disposal.

The design basis for the process plant is 6,000 tonnes of

mineralized material per calendar day (“tpd”), or 2.19 million

tonnes of mineralized material per annum. The equipment has

been sized to achieve this throughput with an operating

availability of 70% in the crushing circuit and 91.3% in the

grinding and cyanidation sections.

The three-stage crushing circuit delivers

crushed material to a fine ore storage bin. The crushed

material is withdrawn from the bin to feed a 6.0 MW ball mill that

has a centrifugal gravity recovery circuit included in the

design. Ground material is fed into six leach tanks where the

silver and gold will be dissolved. The leached slurry is then

sent to the CCD circuit where the silver and gold solution is

washed away from the solids before being sent to the Merrill-Crowe

zinc precipitation circuit to recover the silver and gold. The

precious metals are then refined and poured into Dore bars in the

refinery. The washed solids from the CCD circuit are sent to

the cyanide recovery circuit to maximize the amount of cyanide that

can be recirculated and the resulting slurry is sent to cyanide

detoxification before being pumped to the final tailings storage

facility (“TSF”).

A number of trade-off studies looked at the

treatment options for the project’s high and low grade mineralized

material. A range of throughput options were investigated for

high grade milling at 4,000 tpd, 6,000 tpd and 8,000 tpd. The

optimum throughput for high grade mineralized material was

determined to be 6,000 tpd.

For the lower grade mineralized material, two

different treatment options were considered, being either heap

leaching (“HL”) or operating the process plant at a higher

throughput (“HTP”) than the nominated 6,000 tpd. This was

achieved by allowing the grind size of the material exiting the

grinding section to increase from a P80 of 75 micron to a P80 of

100 micron, increasing the nominal throughput rate to 7,500

tpd.

RecoveriesThe recovery of

silver and gold was calculated as a function of the head grade of

the mineralized material treated. For both the standard

milling circuit and the HTP option, the same regression equations

were used, with an additional lowering of the recovery with the

coarser particle size in the HTP option. The gold recovery

for HTP was lowered by an additional 4% from the regression

calculation, whilst the silver recovery was lowered by 8%.

Life of mine average silver and gold recovery for the standard

milling option are 82% and 86%, respectively, and the HTP milling

option achieves 55% and 81%, respectively.

Project Capital CostsThe

capital costs ("CAPEX") for the contemplated open pit mine, process

plant and supporting infrastructure for the Diablillos project are

estimated at US$311 million. Initial capital costs are

estimated at US$293 million, including US$91 million in

pre-stripping costs at the Fantasma and Oculto deposits and

contingencies of US$32 million. The capital costs for the

process plant were based on input from GRES, which specializes in

fixed price engineering design and construction services to the

resources and mineral processing industry. Other capital

costs were estimated from a variety of sources including

comparative analysis of other operations, derivation from first

principles, equipment quotes and factoring from other costs

contained within the PEA. The project CAPEX is summarized in

Table 4.

| |

|

| Table 4 -

Summary of Capital Cost Estimates |

|

|

Description |

Cost US$000s |

|

Surface Mining |

93,308 |

|

Processing |

69,192 |

|

Site Infrastructure |

35,195 |

|

Owner Costs |

17,336 |

|

Indirect Costs |

45,645 |

|

Contingency & Other Provisions |

32,282 |

|

Initial Capital Cost |

292,959 |

|

Sustaining Capital |

4,998 |

|

Closure |

13,000 |

|

Total Capital Costs |

310,957 |

| |

|

Operating CostsThe operating

cost estimate ("OPEX") is based on a contractor-operated truck and

shovel mining operation, conventional processing facility, and

TSF. Mine operating cost estimates are provided in Table 5

and unit OPEX per ounce produced is shown in Table 6. The PEA

estimates that the OPEX will average US$6.52 per ounce of AgEq (or

US$470 per ounce of AuEq).

|

|

|

|

|

Table 5 – Mine Operating Cost Estimates |

|

|

|

Operating Costs |

US$ per tonne mined |

US$ per tonne milled |

|

Mining – waste |

3.00 |

8.75* |

|

Mining - mineralized material |

3.60 |

3.23 |

|

Standard Milling |

|

14.63 |

|

Standard Milling G&A |

|

2.92 |

|

HTP Milling |

|

12.68 |

|

HTP Milling G&A |

|

2.33 |

* Note: excludes capitalized stripping

costs.

| |

|

Table 6 - Operating Costs per Ounce Produced |

|

Operating Costs |

US$ per AgEq oz Produced |

US$ per AuEq oz Produced |

|

Surface Mining |

2.57 |

186 |

|

Salta Province Royalty |

0.34 |

24 |

|

Processing |

3.02 |

218 |

|

G & A |

0.59 |

43 |

|

Total Operating Cost |

6.52 |

470 |

| |

|

|

Opportunities to Enhance

ValueThe PEA pit shell focuses on the most profitable

portion of the Mineral Resources, accounting for approximately 60%

of the tonnage contained within the Mineral Resource pit

shell. The PEA does not contemplate mining the eastern

portion of the Oculto deposit due to the depth of mineralization,

which would result in an increased stripping ratio.

Historical drilling in the eastern portion of the Oculto deposit

has encountered high grade gold mineralization in metamorphic

basement rocks (e.g. DDH-87-007A intersected 16.7 g/t Au and 39.2

g/t Ag over 10.6 metres starting at 210 metres down hole). A

recent comprehensive review of drilling results by the Company and

its consulting geologist suggests the existence of a high grade

gold zone that coincides with the recently identified structure

that controls both geometry and the overall NE-SW trend of the

Oculto deposit. Additional drilling is recommended to test

the extent of the high grade gold zone as additional high grade

gold in the eastern portion of the Oculto deposit could result in

an increased mine life.

Satellite deposits to Oculto - namely Fantasma,

Laderas, and Cerro Viejo - are known to contain silver and/or gold

mineralization near surface. Additional drilling of these

deposits may provide additional mill feed to increase the mine life

envisioned in the PEA.

Technical DisclosureThe

scientific and technical information in this news release with

respect to the PEA has been reviewed and approved by Scott Ladd,

P.Eng. and David Rennie, P.Eng. of RPA, and Gerry Neeling, FAusIMM

of GRES, each of whom is an independent "qualified person" under

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects ("NI-43-101"). All other scientific and technical

information in this news release has been approved by Willem

Fuchter, PhD P.Geo., President & CEO of AbraPlata Resource Corp

and a qualified person as defined by National Instrument

43-101.

A new technical report summarizing the PEA will

be filed on SEDAR (www.sedar.com) within 45 days of this news

release.

About AbraPlataAbraPlata is a

junior mining exploration company focused on delivering shareholder

returns by unlocking mineral value in Argentina. The

Company's experienced management team has assembled an outstanding

portfolio of gold, silver and copper exploration assets, and is

focused on advancing its flagship Diablillos silver-gold property,

with an Indicated Mineral Resource containing 80.9M oz Ag and 732k

oz Au, through the various stages of feasibility. In

addition, AbraPlata owns the highly prospective Cerro Amarillo

property with its cluster of five mineralized Cu-(Mo-Au) porphyry

intrusions located in a mining camp hosting the behemoth El

Teniente, Los Bronces, and Los Pelambres porphyry Cu-Mo deposits.

Further exploration work is also planned for the Company’s Samenta

porphyry Cu-Mo property south of First Quantum’s TacaTaca project

as well as its Aguas Perdidas Au-Ag epithermal property.

About RPARPA is a global mining

consultant with offices in Canada, the United States, and the

United Kingdom. The company provides services to the mining

industry at all stages of project development from exploration and

resource evaluation through scoping, prefeasibility and feasibility

studies, financing, permitting, construction, operation, closure

and rehabilitation. RPA advises major mining companies, mid-cap

producers, junior mining and exploration companies, financial

institutions, governments, law firms, and individual investors on

the technical and commercial aspects of mineral property

development.

About GRESGR Engineering

Services Limited is a medium-sized, ASX-listed (ASX: GNG) process

design and engineering contractor specializing in providing

engineering design and construction services to the mineral

processing industry. Headquartered in Perth, Western Australia,

GRES has successfully delivered EPC fixed price projects and EPCM

services into a large number of projects which have been located in

many different countries and regions. GRES has teams of highly

experienced technical and engineering professionals and broad

experience in the compilation of feasibility studies.

ON BEHALF OF THE BOARD ABRAPLATA RESOURCE

CORP."Willem Fuchter"Willem Fuchter President & Chief

Executive Officer

For further information concerning this news

release, please contact:Willem Fuchter - President & CEO

Rob Bruggeman - Investor RelationsTel:

+54.11.5258.0920

Tel:

+1.416.884.3556E-mail: willem@abraplata.com

Email: rob@abraplata.com

This news release includes certain

"forward-looking statements" under applicable Canadian securities

legislation. Forward-looking statements are necessarily based upon

a number of estimates and assumptions that, while considered

reasonable, are subject to known and unknown risks, uncertainties,

and other factors which may cause the actual results and future

events to differ materially from those expressed or implied by such

forward-looking statements. All statements that address future

plans, activities, events or developments that the Company

believes, expects or anticipates will or may occur are

forward-looking information. There can be no assurance that such

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements. The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information about AbraPlata and its

projects, please visit the Company’s website at

www.abraplata.com.

Photos accompanying this announcement are available

at: http://www.globenewswire.com/NewsRoom/AttachmentNg/218dc95f-806a-428e-a298-f71d6419d57ahttp://www.globenewswire.com/NewsRoom/AttachmentNg/7ed8d2cf-b910-43d6-83ac-d8d628fbb428http://www.globenewswire.com/NewsRoom/AttachmentNg/d527339a-f91a-419c-9c26-16714cf080c6

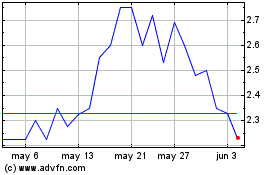

Abra Silver Resource (TSXV:ABRA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Abra Silver Resource (TSXV:ABRA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024