AbraPlata Resource

Corp. (TSX.V:ABRA) (OTCPK:ABBRF) (Frankfurt:1AH)

("AbraPlata" or the "Company") is pleased to announce the filing on

SEDAR (www.sedar.com) of the Preliminary Economic Assessment

(“PEA”) Technical Report (the "Report") for its 100%-owned

Diablillos silver-gold project (the “Project”) located in Salta

Province, Argentina.

The Report is entitled "Technical Report on the

Diablillos Project, Salta Province" and is dated April 16,

2018. The Report was authored by independent Qualified

Persons at Roscoe Postle Associates Inc (“RPA”) and prepared in

accordance with National Instrument 43-101.

The PEA results were previously disclosed in the

Company's news release dated March 2, 2018. Given the

positive economic results presented in the report, RPA recommends

that the Project be advanced to the next stage of engineering study

and permitting.

The Report proposes that open pit mining be

carried out by contractor as a conventional truck and shovel

operation on two pits at Diablillos, the larger Oculto pit and the

smaller Fantasma open cut. A conventional silver processing plant,

incorporating crushing, grinding, agitated vat leaching, and

precipitation of the precious metals by Merrill-Crowe, has a design

throughput of 6000t/d. The Project achieves an undiscounted

pre-tax cash flow of US$639

million (after-tax cash flow of US$391 million) over mine

life, and an after-tax Net Present Value (“NPV”)

at a 7.5% discount rate of US$212 million assuming

US$20/oz silver and US$1,300/oz gold. The after-tax Internal

Rate of Return (“IRR”) is 30.2%,

and the Project achieves a simple Payback after

3.1 years of production. The Project is expected

to have a mine life of 8 years

after a preproduction period of 18

months, and is estimated to produce 9.8 million

silver-equivalent1 ounces per year (Figure 1) at an

average All-in Sustaining Cost of US$7.52 per silver-equivalent

ounce. Initial Capital has been estimated at

US$293 million. For further details please refer

to the Report on SEDAR or the Company’s press release of March 2,

2018.

Figure 1 - Diablillos Project Annual

Silver Equivalent Production and Grade Profile

Figure 1 is available at

http://resource.globenewswire.com/Resource/Download/db0c1da0-3167-457e-a963-bb20ab90f646.

“With the PEA Report now complete, we are

planning to move forward with the Pre-Feasibility Study ("PFS")”

commented Hernan Zaballa, Chairman of AbraPlata, “Our objective is

to deliver a fully permitted, construction-ready Project by the end

of 2019. This means that we need to complete the PFS by the

end of 2018 which will require additional engineering work, some

drilling at Oculto and its satellite deposits, as well as

continuing with the baseline environmental work.”

Table 1 - Diablillos Project Mineral

Resource Estimate at August 31, 2017

Table 1 is available at

http://resource.globenewswire.com/Resource/Download/5446dfa7-5ddf-41e3-b5ff-e673d7492df9.

Figure 2 - Location of the Oculto Deposit

and Associated Mineral Occurrences on the Diablillos

Property

Figure 2 is available at

http://resource.globenewswire.com/Resource/Download/43f4eacd-1128-4171-9ecc-cebbf3d26610.

While the Diablillos project already has a

substantial mineral resource due to 87,711 metres of historical

drilling, the Report acknowledges that additional exploration

potential exists in many localities at Diablillos. AbraPlata is

currently evaluating drilling campaigns at the following locations

(Figures 2 and 3):

- In-pit drilling of resources within the Oculto pit, as some

areas are categorized as waste due to insufficient drill

density;

- Definition drilling of near-surface silver and gold

mineralization at the Fantasma, Laderos, and Alpaca satellite

deposits to the main Oculto deposits;

- Drilling of the high grade gold zone ("High Grade Gold Zone")

beneath the current pit shell at Oculto (Figure 4); and

- Further definition of the high grade silver zone (“Enriched

Silver Zone”) by increasing the resolution of existing wire frame

models through relogging of existing holes and augmenting the

drilling where necessary.

Figure 3 - Resource Expansion Program for

the Oculto Deposit and its Satellite Occurrences

Figure 3 is available at

http://resource.globenewswire.com/Resource/Download/78e23f10-3f37-467b-a081-f58218e9d65b.

The High Grade Gold Zone and the Enriched Silver

Zone (Figure 4) are of particular interest as they have the

possibility of significantly impacting the growth potential of the

resources that will be considered for the PFS. In particular,

the Enriched Silver Zone lies approximately 100m below the surface

and has an altitude that mimics the surface topography. Given

that ground water levels in most drill holes are generally

encountered at depths of about 100m, the Enriched Silver Zone,

which is defined by the >300g/t Ag grade shell, is being

interpreted as a supergene zone with obvious implication for

ongoing exploration. Furthermore, the Enriched Silver Zone

significantly impacts the production profile (Figure 1) because

this zone is mined in Years 2 and 4.

Figure 4 - Oculto Deposit Long Section

Showing the Enriched Silver Zone and the High Grade Gold

Zone

Figure 4 is available at

http://resource.globenewswire.com/Resource/Download/b2858b1d-d86c-40ad-bcc5-30af670e81f2.

With respect to the High Grade Gold Zone, it is

located in the lower part of the Oculto deposit, largely in the

basement (Figure 4), and centered on drill hole DDH-97-007A which

intersected 2.7g/t Au & 15.6g/t Ag over 108m including 16.7g/t

Au & 39.2g/t Ag over 10.6m. The High Grade Gold Zone comprises

at least two, sub parallel, gold-rich zones measuring over 600m in

length and, in places, over 50m in width (Figure 3), and is

coincident with the recently identified structures that controls

both the geometry and overall NE-SW trend of the Oculto deposit as

a whole. Because mineralization at Diablillos is of a high

sulphidation epithermal nature, the high grade gold rich zone can

be expected to persist to considerable depths.

Qualified PersonAll scientific

and technical information in this news release has been approved by

Willem Fuchter, PhD PGeo, President & CEO of AbraPlata Resource

Corp and a qualified person as defined by National Instrument

43-101.

About AbraPlataAbraPlata is a

junior mining exploration company focused on delivering shareholder

returns by unlocking mineral value in Argentina. The

Company's experienced management team has assembled an outstanding

portfolio of gold, silver and copper exploration assets, and is

focused on advancing its flagship Diablillos silver-gold property,

with an Indicated Mineral Resource containing 80.9M oz Ag and 732k

oz Au, through the various stages of feasibility. In

addition, AbraPlata owns the highly prospective Cerro Amarillo

property with its cluster of five mineralized Cu-(Mo-Au) porphyry

intrusions located in a mining camp hosting the behemoth El

Teniente, Los Bronces, and Los Pelambres porphyry Cu-Mo deposits.

Further exploration work is also planned for the Company’s Samenta

porphyry Cu-Mo property south of First Quantum’s TacaTaca project

as well as its Aguas Perdidas Au-Ag epithermal property.

ON BEHALF OF THE BOARD ABRAPLATA RESOURCE

CORP."Willem Fuchter"Willem Fuchter President & Chief

Executive Officer

| For further

information concerning this news release, please contact: |

| Willem Fuchter -

President & CEOTel: +54.11.5258.0920E-mail:

willem@abraplata.com |

Rob Bruggeman -

Investor RelationsTel: +1.416.884.3556Email: rob@abraplata.com |

| |

|

This news release includes certain

"forward-looking statements" under applicable Canadian securities

legislation. Forward-looking statements are necessarily based upon

a number of estimates and assumptions that, while considered

reasonable, are subject to known and unknown risks, uncertainties,

and other factors which may cause the actual results and future

events to differ materially from those expressed or implied by such

forward-looking statements. All statements that address future

plans, activities, events or developments that the Company

believes, expects or anticipates will or may occur are

forward-looking information. There can be no assurance that such

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements. The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.For further information

about AbraPlata and its projects, please visit the Company’s

website at www.abraplata.com.

1 Silver equivalent calculation based on relative NSR

contribution from silver and gold (AgEq = Ag + 72.15*Au).

Please also refer to the Mineral Resource Estimate for the

Diablillos project (Table 1).

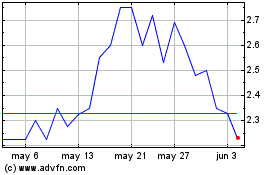

Abra Silver Resource (TSXV:ABRA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Abra Silver Resource (TSXV:ABRA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024