Adventus Mining Corporation (“Adventus” or the

“Company”)

(TSX-V: ADZN) announces it has

completed its bought deal prospectus offering announced on July 28,

2020 (the “Offering”). Raymond James Ltd., Haywood Securities Inc.,

and National Bank Financial Inc. acted as co-lead underwriters of

the Offering, with participation by Cormark Securities Inc., BMO

Capital Markets Inc., Eight Capital, and Laurentian Bank Securities

Inc. (collectively, the “Underwriters”). Pursuant to the Offering,

the Company issued a total of 27,559,100 common shares of the

Company (the "Shares") at a price of C$1.27 per Share (the

"Offering Price"), representing aggregate gross proceeds of

C$35,000,057.

Adventus has granted the agents an overallotment

option, exercisable in whole or in part, at the sole discretion of

the Underwriters, at any time and from time to time, for a period

of 30 days following the closing of the Offering, to purchase up

to an additional 4,133,865 million common shares from Adventus at

the Offering Price for additional gross proceeds to the Company of

C$5,250,009 if the overallotment option is exercised in full.

The net proceeds of the Offering will be used by

the Company to fund exploration and development activities at the

Curipamba project, including the completion of a feasibility study

for the El Domo copper-gold deposit, exploration activities at the

Pijili and Santiago projects, and general administration and

corporate purposes.

The Shares were offered by way of short form

prospectus in British Columbia, Alberta, Ontario, New Brunswick and

Newfoundland and Labrador pursuant to National Instrument 44-101 –

Short Form Prospectus Distributions. The Shares were not offered or

sold in the United States except under Rule 144A, Rule 506(b) of

Regulation D or in such other manner as to not require registration

under the United States Securities Act of 1933, as amended. The

Underwriters received a cash commission equal to 5.5% of the gross

proceeds from the sale of the Shares pursuant to the Offering,

which commission was reduced to 2.75% or 1.0% in respect of certain

president’s list purchasers.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the Shares in any state in which such offer,

solicitation or sale would be unlawful. The Shares have not been

registered under the United States Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements.

About AdventusAdventus Mining

Corporation (ADZN.TSXV) is a unique copper-gold exploration and

development company, focused primarily in Ecuador. Its strategic

shareholders include Altius Minerals Corporation, Greenstone

Resources LP, Resource Capital Funds, Wheaton Precious Metals

Corp., and the Nobis Group of Ecuador. Adventus is leading the

exploration and engineering advancement of the Curipamba

copper-gold project in Ecuador as part of an earn-in agreement to

obtain a 75% ownership interest. In addition, Adventus is engaged

in a country-wide exploration alliance with its partners in

Ecuador, which has incorporated the Pijili and Santiago copper-gold

projects to date. Adventus also controls an exploration project

portfolio in Ireland with South32 as funding partner as well as an

investment portfolio of equities in several junior exploration

companies. Adventus is based in Toronto, Canada, and is listed on

the TSX Venture Exchange under the symbol ADZN.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This press release contains "forward -looking

information" within the meaning of applicable Canadian securities

laws. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions or future events or performance (often, but

not always, identified by words or phrases such as "believes",

"anticipates", "expects", "is expected", "scheduled", "estimates",

"pending", "intends", "plans", "forecasts", "targets", or "hopes",

or variations of such words and phrases or statements that certain

actions, events or results "may", "could", "would", "will",

"should" "might", "will be taken", or "occur" and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

Forward-looking information herein includes, but

is not limited to, statements that address activities, events or

developments that Adventus expects or anticipates will or may occur

in the future, including the use of proceeds from the Offering.

Although Adventus has attempted to identify important factors that

could cause actual actions, events or results to differ materially

from those described in forward-looking information, there may be

other factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. Adventus undertakes to

update any forward-looking information except in accordance with

applicable securities laws.

For further information from Adventus, please

contact Christian Kargl-Simard, President and Chief Executive

Officer, at +1-416-230-3440 or christian@adventusmining.com. Please

also visit the Company website at www.adventusmining.com.

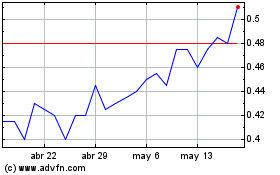

Adventus Mining (TSXV:ADZN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Adventus Mining (TSXV:ADZN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024