Clear Blue Technologies International Inc. (TSXV: CBLU) (the

"

Company") is pleased to announce that it has

successfully closed the second (and final) tranche of its private

placement offering (the "

Offering") previously

announced on August 6, 2024 and September 4, 2024, in the aggregate

principal amount of up to $2,500,000 of unsecured convertible

debentures (each, a "

Debenture") at a price of

$1,000 per Debenture. The second tranche of the Offering consisted

of gross subscriptions of $800,578 in principal debentures, and

$2,206,990 collectively across both tranches of the Offering.

The Debentures, issued in the second tranche

carry the same terms as the first tranche. The Debentures bear

interest from the applicable issuance date at 14% per annum until

the date that is 36 months following the closing date (the

"Maturity Date"). The principal amount of the

Debentures will be convertible into units of the Company (the

"Units") at the option of the holder at any time

prior to the close of business on the last business day immediately

preceding the Maturity Date, at a conversion price of $0.10 per

Unit (the "Conversion Price"), subject to

adjustment in certain events.

Each Unit will be comprised of: (i) one common

share of the Company (each, a "Common Share"); and

(ii) one half of one Common Share purchase warrant (each whole

warrant, a "Warrant"). Each Warrant will be

exercisable to acquire one Common Share at an exercise price of

$0.15 per Common Share, subject to adjustment in certain events,

until the Maturity Date; provided however, the Company will have

the right to accelerate the expiry date of the Warrants to a date

which is not less than 21 days after the date on which a written

notice is provided to the holders of Warrants if the daily volume

weighted average trading price of the Common Shares is greater than

$0.25 (subject to adjustment in certain events) for any 10

consecutive trading days on the TSX Venture Exchange (the

"TSXV").

Beginning on the date that is one year following

the closing date, but subject to receipt of any required approvals,

the Company may force the conversion of all of the principal amount

of the then outstanding Debentures at the Conversion Price on not

less than 21 days' notice should the daily volume weighted average

trading price of the Common Shares be greater than $0.25 (subject

to adjustment in certain events) for any 10 consecutive trading

days on the TSXV.

Certain directors and officers of the Company

(collectively, the "Insiders") participated in the

Offering, and, as such, the Offering constitutes a related party

transaction under Multilateral Instrument 61-101 – Protection of

Minority Security Holders in Special Transactions ("MI

61-101"), but is otherwise exempt from the formal

valuation and minority approval requirements of MI 61-101 by virtue

Sections 5.5(a) and 5.7(1)(a) of MI 61-101 in respect of such

Insider participation. No special committee was established in

connection with the Offering or the participation of the Insiders,

and no materially contrary view or abstention was expressed or made

by any director of the Company in relation thereto. Further details

will be included in a material change report that will be filed by

the Company in connection with the completion of the second closing

of the Offering. Closing of the participation of Insiders in the

Offering remains subject to the approval of the TSXV.

Fees of $5,740 and 22,400 broker warrants at a

price of $0.10 were paid as finders fees in the first tranche of

the Offering.

The net proceeds received by the Company will be

used for working capital purposes. The closing of the Offering is

subject to the satisfaction of customary conditions, including the

approval of the TSXV. All securities issued under the Offering

remain subject to a statutory four month hold period.

Additionally, the Company is correcting the

disclosure of Clear Blue entering into debt settlement agreements

with a consultant of the Company to settle indebtedness from

$132,200 to $167,223 in exchange for the issuance of 3,040,418

warrants from 2,203,333 warrants of the Company, convertible to

equal number of common shares at a price per share of $0.055 from

$0.06, thereby allowing the Company to preserve additional cash and

improve its balance sheet. This amendment is subject to the

approval of the TSXV.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this news release. Such securities have not been, and

will not be, registered under the U.S. Securities Act, or any state

securities laws, and, accordingly, may not be offered or sold

within the United States, or to or for the account or benefit of

persons in the United States or “U.S. Persons”, as such term is

defined in Regulation S promulgated under the U.S. Securities Act,

unless registered under the U.S. Securities Act and applicable

state securities laws or pursuant to an exemption from such

registration requirements.

About Clear Blue Technologies International

Clear Blue Technologies International, the Smart

Off-Grid™ company, was founded on a vision of delivering clean,

managed, “wireless power” to meet the global need for reliable,

low-cost, solar and hybrid power for lighting, telecom, security,

Internet of Things devices, and other mission-critical systems.

Today, Clear Blue has thousands of systems under management across

37 countries, including the U.S. and Canada. (TSXV: CBLU) (FRA:

0YA) (OTCQB: CBUTF).

For more information, contact:

Miriam Tuerk, Co-Founder and CEO+1 416 433

3952investors@clearbluetechnologies.comwww.clearbluetechnologies.com/en/investors

Nikhil Thadani, Sophic Capital+1 437 836

9669Nik@SophicCapital.com

Legal Disclaimer

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statement

This press release contains certain

"forward-looking information" and/or "forward-looking statements"

within the meaning of applicable securities laws. Such

forward-looking information and forward-looking statements are not

representative of historical facts or information or current

condition, but instead represent only Clear Blue’s beliefs

regarding future events, plans or objectives, many of which, by

their nature, are inherently uncertain and outside of Clear Blue's

control. Generally, such forward-looking information or

forward-looking statements can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or may contain

statements that certain actions, events or results "may", "could",

"would", "might" or "will be taken", "will continue", "will occur"

or "will be achieved". The forward-looking information contained

herein may include, but is not limited to, information concerning

the completion of future tranches of the Offering and the use of

proceeds of the Offering.

By identifying such information and statements

in this manner, Clear Blue is alerting the reader that such

information and statements are subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Clear Blue to be

materially different from those expressed or implied by such

information and statements.

An investment in securities of Clear Blue is

speculative and subject to several risks including, without

limitation, the risks discussed under the heading "Risk Factors" in

Clear Blue's listing application dated July 12, 2018. Although

Clear Blue has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information and forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended.

In connection with the forward-looking

information and forward-looking statements contained in this press

release, Clear Blue has made certain assumptions. Although Clear

Blue believes that the assumptions and factors used in preparing,

and the expectations contained in, the forward-looking information

and statements are reasonable, undue reliance should not be placed

on such information and statements, and no assurance or guarantee

can be given that such forward-looking information and statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information

and statements. The forward-looking information and forward-looking

statements contained in this press release are made as of the date

of this press release. All subsequent written and oral forward-

looking information and statements attributable to Clear Blue or

persons acting on its behalf is expressly qualified in its entirety

by this notice.

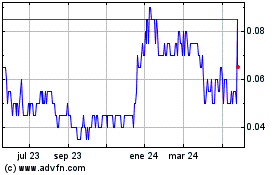

Clear Blue Technologies (TSXV:CBLU)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

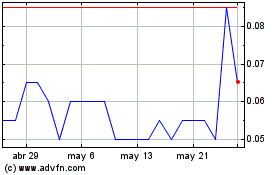

Clear Blue Technologies (TSXV:CBLU)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024