District Metals Corp. (TSX-V: DMX; "District" or the

“Company”) is pleased to announce the Company has executed

a definitive purchase agreement dated February 27, 2020 (the

"

Purchase Agreement") with a wholly-owned

subsidiary of EMX Royalty Corp. (TSX-V:EMX)

("

EMX") to acquire 100% ownership of the Tomtebo

and Trollberget properties (together, the

"

Properties") (Figure 1) in the prolific

Bergslagen District of Sweden, which hosts Lundin’s Zinkgruvan Mine

and Boliden’s Garpenberg Mine. Upon completion of the

proposed transaction, the Company's primary focus will be on the

advanced exploration stage Tomtebo Property.

The proposed transaction constitutes a

"Fundamental Acquisition" as such term is defined in Policy 5.3 of

the TSX Venture Exchange (the "Exchange" or the

"TSXV"). As a result, completion of the

proposed transaction is subject to, among other things, the

completion of an updated technical report prepared in accordance

with National Instrument 43-101 – Standards of Disclosure for

Mineral Projects ("NI 43-101") on the Tomtebo

Property, and obtaining all necessary regulatory approvals,

including Exchange acceptance. The common shares of the Company

will remain halted until the Exchange has reviewed the proposed

transaction in accordance with Exchange Policy 5.3.

Garrett Ainsworth, President & CEO of

District, commented: “These Swedish properties provide District

with significant opportunities in the prolific Bergslagen District,

which is known for its large tonnage and high grade Volcanogenic

Massive Sulphide (VMS) and Sedimentary Exhalative (SedEx) deposit

types. Tomtebo, in particular, underwent a rigorous due diligence

process, which revealed immense potential. The

Bergslagen District has substantial polymetallic production and

endowment that is evidenced by the numerous historical and active

mines, which has seen little modern systematic exploration compared

to peer districts. Access and infrastructure on the

properties and in the region are highly accommodative. Sweden

is a stable and supportive jurisdiction for mining that is ranked

highly by the Fraser Institute. We are also excited to

partner with EMX Royalty Corp. to advance these

properties.”

Tomtebo Property Highlights

- Tomtebo covers an area of 5,144 ha, and is located 175 km

northwest from the capital city of Stockholm in Sweden (Figure

1).

- Boliden’s Garpenberg Mine is located 25 km to the southeast,

and the historic Falun Mine is located 25 km to the northwest.

Lundin’s Zinkgruvan Mine is located 175 km to the

southwest.

- Tomtebo contains similar host rocks, structure, alteration, and

mineralization styles as the Garpenberg, Falun, and Zinkgruvan

Mines.

- Two historic mines, and numerous mineralized prospects are

situated along a 17 km trend on the property. Mineralization

at the historic Tomtebo and Lovas Mines appears to be open in all

directions.

- Historic production at the Tomtebo Mine comprised 120,000

tonnes at 4.4% Cu1. Historic production at the Lovas Mine

comprised 330,000 tonnes at 3.5% Zn, 2.5% Pb, and 30g/t Ag2.

- Drilling from the 1960’s and 1970’s resulted in a historic

mineral resource on the Tomtebo Mine from surface to 200 m depth

that comprises 385,000 tonnes grading 0.67% Cu, 1.84% Pb, 3.72% Zn,

0.66 g/t gold, and 55 g/t Ag3. This is a historic

resource for the purposes of NI 43-101, and a Qualified Person has

not done sufficient work to classify the historic resource above as

current mineral resources or mineral reserves, and District is not

treating the historical estimate as current mineral resources or

mineral reserves. District considers these results as

indications of the presence of mineralization on the property, and

will use the information to guide future exploration.

- Development work and mining at the historical Tomtebo and Lovas

Mines reached depths of 200 m and 190 m, respectively. Mining

operations at Boliden’s Garpenberg Mine and Lundin Mining’s

Zinkgruvan Mine are currently at depths of 1400 m and 1200 m,

respectively.

- Modern systematic exploration has never been carried out on the

Tomtebo Property.

Trollberget Property

Highlights

- The Trollberget property covers an area of 333 ha, and is

located 15 km northeast from Tomtebo and 17 km east of the historic

Falun Mine (Figure 1).

- Trollberget is an early stage property that strategically

covers the same host rocks, structure, alteration, and

mineralization as the Garpenberg, Falun and Zinkgruvan

Mines.

- Several polymetallic mineralized prospects on the property

warrant detailed follow up.

- Two historic channel samples4 located approximately 25 m apart

returned:

- 1.5 m at 21.4% Zn, 1.8% Pb, 1.3% Cu, 131 g/t Ag and 2.3 g/ t

Au.

- 2.0 m at 9.9% Zn, 1.2% Pb, 0.7% Cu, 85 g/t Ag and 0.2 g/ t

Au.

The Purchase Agreement

Pursuant to the Purchase Agreement, District

will acquire a 100% interest in the Properties upon the following

principal terms:

- At closing of the proposed transaction DMX will:(i) make a cash

payment of $35,000 to EMX; and (ii) issue EMX approximately

3,688,965 common shares of DMX, representing a 9.9% equity

ownership in DMX (on a non-diluted basis).

- To retain the Properties, DMX must:

(i) incur $1,000,000 of eligible expenditures on the Properties

within two years of the closing of the proposed transaction; and

(ii) complete a minimum of 2,000 m of drilling within three years

of completion of the proposed transaction and an aggregate of 5,000

m within five years of completion of the proposed transaction.

- Upon announcement of each of a

mineral resource estimate and preliminary economic assessment, DMX

will pay to EMX a fee of $275,000 and, in the absence of either or

both a mineral resource estimate and/or preliminary economic

assessment, an aggregate of $550,000 upon a development decision,

in each case, in either cash or common shares of DMX (based on the

20 day volume weighted average trading price of DMX's common

shares).

- Until the first to occur of the

five-year anniversary of the closing of the transaction and DMX

completing a financing raising gross proceeds of at least $3

million, EMX is entitled to maintain its shareholding in DMX for no

additional consideration.

- DMX will grant EMX a 2.5% NSR

royalty on each of the Properties subject to an option to

repurchase up to 0.5% of the royalty for $2,000,000 at any time

within six years of the closing of the proposed transaction and in

respect of which DMX will make annual advance royalty payments of

$25,000 commencing on the third anniversary of the closing of the

proposed transaction, with each payment increasing by $10,000 per

year subject to maximum of $75,000 per year.

In addition, upon closing of the proposed

transaction EMX and DMX will enter into a shareholder rights

agreement pursuant to which:

|

(i) |

for so long as it holds at least 9.9% of the issued and outstanding

shares of the Company (on a non-diluted basis), EMX will be

entitled to nominate one director to the Company's board of

directors; |

|

|

|

|

(ii) |

for so long as it holds at least 5.0% of the issued and outstanding

shares of the Company (on a non-diluted basis), EMX will have a

pre-emptive right in respect of future financings by the

Company; |

|

|

|

|

(iii) |

for so long as it holds at least 9.9% of the issued and outstanding

shares of the Company (on a non-diluted basis), EMX will be subject

to a standstill provision; and |

|

|

|

|

(iv) |

for so long as it holds at least 9.9% of the issued and outstanding

shares of the Company (on a non-diluted basis), EMX may not sell or

transfer common shares of the Company representing 1% or more of

the outstanding common shares of the Company in any 30 day period

without advance notice to the Company and if the Company fails to

identify a purchaser for such shares, only sell such shares by way

of a broad distribution, through the facilities of an exchange or

trading system. |

As consideration for identifying the Tomtebo and

Trollberget properties and facilitating completion of the proposed

transaction, Vector Geological Solutions, a "non-arm's length

party" to the Company will be issued 500,000 common shares in the

capital of the Company as a finder’s fee (the "Finder's Fee

Shares"). The issue of the Finder's Fee Shares is

subject to Exchange acceptance and, if so accepted, will be subject

to a hold period of four months and one day.

District Metals Corp. is pleased to announce

that our corporate website has been updated at

www.districtmetals.com where our new corporate presentation is now

available.

A figure accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/38fa95d1-437e-4e51-9554-c2b15253d57e

Note: The nearby mines provide

geologic context for Tomtebo and Trollberget, but this is not

necessarily indicative that the Properties host similar grades or

tonnages of mineralization.

References

1 Ed. Eilu, Pasi, 2012, Geological Survey of

Finland, Special Paper 53, Metallogenic areas in Sweden, p.

154.

2 Geological Survey of Sweden report grb_097,

1997.

3 Technical Report on Tomtebo Mine, Birger

Hellegren, 1983.

4 Tumi Resources Ltd. News Release, September 4,

2007. True widths of the channel samples are unknown.

5 Allen, R.L., Lundström, I., Ripa, M., and

Christofferson, H., 1996, Facies analysis of a 1.9 Ga, continental

margin, back-arc, felsic caldera province with diverse

Zn-Pb-Ag-(Cu-Au) sulfide and Fe oxide deposits, Bergslagen region,

Sweden: Economic Geology, v. 91, p. 979–1008.

6

https://www.boliden.com/globalassets/operations/exploration/mineral-resources-and-mineral-reserves-pdf/2019/resources_and_reserves_garpenberg_2019-12-31.pdf

Technical Information

All scientific and technical information in this

news release has been prepared by, or approved by Garrett

Ainsworth, PGeo, President and CEO of the Company. Mr.

Ainsworth is a qualified person for the purposes of National

Instrument 43-101 - Standards of Disclosure for Mineral

Projects.

Mr. Ainsworth has not verified any of the

information regarding any of the properties or projects referred to

herein other than the Tomtebo and Trollberget Properties.

Mineralization on any other properties referred to herein is not

necessarily indicative of mineralization on the Tomtebo and

Trollberget Properties.

On Behalf of the Board of Directors

“Garrett Ainsworth”

President and Chief Executive Officer

604-628-2669

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking”

Information.

This news release contains certain statements

that may be considered “forward-looking statements” with respect to

District Metals Corp. (“District Metals” or the “Company”) within

the meaning of applicable securities laws. In some cases, but not

necessarily in all cases, forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “targets”, “expects” or “does not expect”, “is expected”,

“an opportunity exists”, “is positioned”, “estimates”, “intends”,

“assumes”, “anticipates” or “does not anticipate” or “believes”, or

variations of such words and phrases or state that certain actions,

events or results “may”, “could”, “would”, “might”, “will” or “will

be taken”, “occur” or “be achieved”. In addition, any statements

that refer to expectations, predictions, indications, projections

or other characterizations of future events or circumstances

contain forward-looking information. Statements containing

forward-looking information are not historical facts but instead

represent management’s expectations, estimates and projections

regarding future events.

Forward-looking statements relating to District

Metals include, among other things, statements relating to:

timing of the closing of the proposed acquisition of the Tomtebo

Project including receipt of all regulatory approvals and

satisfaction of all other conditions precedent; completion of the

expenditure requirements thereunder, future commodity prices;

District Metals’ planned exploration activities including costs,

timing and results thereof; the adequacy of the Company’s financial

resources and ability to raise additional funds as and when

required and on reasonable terms; and timing, receipt and

maintenance of all required approvals, consents and permits under

applicable legislation.

These statements and other forward-looking

information are based on opinions, assumptions and estimates made

by District Metals in light of its experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors that the Company believes

are appropriate and reasonable in the circumstances, as of the date

of this news release, including, without limitation, assumptions

about the receipt of all regulatory approvals to the completion of

the proposed transaction; satisfaction of all conditions precedent

to completion of the acquisition of the Properties; the Company’s

ability to raise sufficient capital to fund planned exploration

activities, maintain corporate capacity and satisfy the

exploration expenditure requirements required by the Purchase

Agreement by the times specified therein (failing which the

Properties will be forfeited without any repayment to the Company);

and stability in financial and capital markets.

Forward-looking information is necessarily based

on a number of opinions, assumptions and estimates that,

while considered reasonable by District Metals as of the date such

statements are made, are subject to known and unknown risks,

uncertainties, assumptions and other factors that may cause the

actual results, level of activity, performance or achievements to

be materially different from those expressed or implied by such

forward-looking information, including but not limited to the

following factors: a number of conditions precedent must be

satisfied for the acquisition of the Properties to be completed

(including regulatory approval); the risk that the Company will be

unable to raise sufficient capital to maintain its mineral tenures

and concessions in good standing, finance planned exploration

(including incurring prescribed exploration expenditures required

by the Purchase Agreement) and for general corporate purposes, the

risk that the Company will not be able to explore and develop the

Properties; the risk that if the required exploration expenditures

are not incurred by the time specified therefor the Properties will

be forfeited without any repayment of the purchase price;

management and conflicts of interest; fluctuations in demand for,

and prices of gold, silver and copper; inherent risks of

exploration for mineral deposits, including that commercial

quantities or grades of minerals may not be discovered; risks

associated with the uncertainty of estimates of mineral resources

governmental regulations, particularly those applicable to the

mineral exploration and development industry; environmental laws

and regulations and associated risks, including climate change

legislation; land reclamation requirements; the ability to obtain

and maintain necessary rights, concessions and permits; risks of

operating in a foreign jurisdiction and through foreign

subsidiaries; a dependence on ability to attract and retain

qualified management; limitations of insurance and uninsured risks;

public social activism against companies undertaking natural

resource development; risks associated with First Nations

relations; competition; legal proceedings and the enforceability of

judgments; anti-corruption and bribery regulations;; market events

and general economic conditions globally; currency exchange rate

risks; These factors and assumptions are not intended to represent

a complete list of the factors and assumptions that could affect

District Metals. These factors and assumptions, however, should be

considered carefully.

Although the Company has attempted to identify

factors that would cause actual actions, events or results to

differ materially from those disclosed in the forward-looking

statements or information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. Also, many of such factors are beyond the control of the

Company. Accordingly, readers should not place undue reliance on

forward-looking statements or information. The forward-looking

information is made as of the date of this news release, and the

Company assumes no obligation to publicly update or revise such

forward-looking information

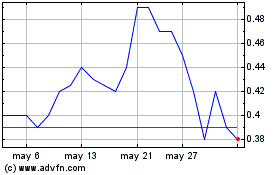

District Metals (TSXV:DMX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

District Metals (TSXV:DMX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024