Lumina Gold Corp. (TSXV: LUM) (OTCQX:

LMGDF) (the “Company” or “Lumina”) is pleased to announce

that it has entered into an agreement with a syndicate of agents,

led by Haywood Securities Inc. and Raymond James Ltd.

(collectively, the “Agents”), that have agreed to sell, on a

commercially reasonable efforts private placement basis, up to

26,670,000 common shares (“Shares”) at a price of C$0.60 per Share

(the “Offering Price”), for aggregate gross proceeds of up to C$16

million (the “Brokered Offering”). In addition, the Company intends

to complete a concurrent non-brokered private placement of up to

C$10 million worth of Shares (the “Non-Brokered Offering”, and

together with the Brokered Offering, the “Offering"), on the same

terms as the Brokered Offering with certain insiders and strategic

investors.

The Company has granted the Agents an option

(the “Over-Allotment Option”), exercisable in whole or in part by

the Agents, to sell an additional C$2,400,300 of Shares at the

Offering Price.

The Company has upsized its existing credit

facility (the “Facility”) with Ross Beaty from C$5 million to C$6

million (the “Facility Upsize”). The term of the Facility has been

extended from September 30, 2021 to December 31, 2021. Ross Beaty

will convert his entire outstanding principal and interest

associated with the Facility into Shares at the Offering Price (the

“Debt Settlement”) concurrent with the closing of the Offering.

The Company plans to use the net proceeds from

the Offering for infill drilling, step-out drilling and

Pre-Feasibility work at its Cangrejos project and for general

corporate purposes. The Offering and the Debt Settlement are

scheduled to close on or about October 4, 2021 the (“Closing

Date”), and are subject to certain conditions customary for

transactions of this nature, including, but not limited to, the

receipt of all necessary approvals, including the approval of the

TSX Venture Exchange. The Company has agreed to pay the Agents a

cash commission of up to 6.0% of the gross proceeds raised under

the Brokered Offering.

The Shares issued in the Offering and the Debt

Settlement will be subject to a statutory hold period of four

months and one day following the Closing Date.

The securities to be offered pursuant to the

Offering and the Debt Settlement have not been, and will not be,

registered under the U.S. Securities Act of 1933, as amended (the

"U.S. Securities Act") or any U.S. state securities laws, and may

not be offered or sold in the United States or to, or for the

account or benefit of, United States persons absent registration or

any applicable exemption from the registration requirements of the

U.S. Securities Act and applicable U.S. state securities laws. This

news release shall not constitute an offer to sell or the

solicitation of an offer to buy securities in the United States,

nor shall there be any sale of these securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful.

The Company expects certain related parties as

defined in Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions ("MI 61-101") to

participate in the Offering and Mr. Beaty, a related party of the

Company, to participate in the Debt Settlement and the Facility

Upsize. Any such resulting related party transaction will be exempt

from the formal valuation requirement and shareholder approval

requirement of MI 61-101 as the fair market value of any Shares

issued to such persons will not exceed 25% of the Company’s market

capitalization.

To the knowledge of the Company or any director

or senior officer of the Company, after reasonable inquiry, no

"prior valuations" (as defined in MI 61-101) in respect of the

Company that relate to the Offering, the Debt Settlement or the

Facility Upsize, or are relevant to the Offering, the Debt

Settlement or the Facility Upsize, have been prepared within 24

months preceding the date hereof. All of the terms and conditions

of the Offering, the Debt Settlement and the Facility Upsize were

reviewed and unanimously approved by the board of directors of the

Company.

About Lumina Gold

Lumina Gold Corp. (TSXV: LUM) is a Vancouver,

Canada based precious and base metals exploration and development

company focused on the Cangrejos Gold-Copper Project, Ecuador’s

largest primary gold deposit located in El Oro Province, southwest

Ecuador. Lumina has an experienced management team with a

successful track record of advancing and monetizing exploration

projects.

Further details are available on the Company’s

website at https://luminagold.com/

Please click here and subscribe to receive

future news releases: https://luminagold.com/contact

| LUMINA GOLD

CORP. |

|

| |

For further information contact: |

| Signed: “Marshall

Koval” |

Scott Hicks |

| |

shicks@luminagold.com |

| Marshall Koval,

President & CEO, Director |

T: +1 604 646 1890 |

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release

Cautionary Note Regarding

Forward-Looking Information

Certain statements and information herein,

including all statements that are not historical facts, contain

forward-looking statements and forward-looking information within

the meaning of applicable securities laws. Such forward-looking

statements or information include but are not limited to statements

or information with respect to: the size of the Offering and the

Debt Settlement, the use of proceeds from the Offering, the

expected participation of insiders in the Offering, the anticipated

Closing Date and the receipt of regulatory approvals for the

Offering and the Debt Settlement. Often, but not always,

forward-looking statements or information can be identified by the

use of words such as “will” or variations of that word and phrases

or statements that certain actions, events or results “will”,

“could” or are “intended to” be taken, occur or be achieved.

With respect to forward-looking statements and

information contained herein, the Company has made numerous

assumptions including among other things, assumptions about general

business and economic conditions, the prices of gold and copper,

and anticipated costs and expenditures. The foregoing list of

assumptions is not exhaustive.

Although management of the Company believes that

the assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that a forward-looking statement or information herein will prove

to be accurate. Forward-looking statements and information by their

nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause the

Company’s actual results, performance or achievements, or industry

results, to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements or information. These factors include,

but are not limited to: risks associated with the business of the

Company; business and economic conditions in the mining industry

generally; the supply and demand for labour and other project

inputs; changes in commodity prices; changes in interest and

currency exchange rates; risks relating to inaccurate geological

and engineering assumptions (including with respect to the tonnage,

grade and recoverability of reserves and resources); risks relating

to unanticipated operational difficulties (including failure of

equipment or processes to operate in accordance with specifications

or expectations, cost escalation, unavailability of materials and

equipment, government action or delays in the receipt of government

approvals, industrial disturbances or other job action, and

unanticipated events related to health, safety and environmental

matters); risks relating to adverse weather conditions; political

risk and social unrest; changes in general economic conditions or

conditions in the financial markets; and other risk factors as

detailed from time to time in the Company’s continuous disclosure

documents filed with Canadian securities administrators. The

Company does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

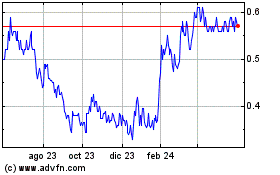

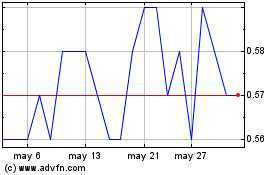

Lumina Gold (TSXV:LUM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Lumina Gold (TSXV:LUM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024