Dear Nova Leap Shareholders:

As Nova Leap Health Corp. (“Nova Leap” or the

“Company”) is midway through its 8th year of operations, and in

advance of tomorrow’s annual general meeting, this is an

appropriate time for me to provide some commentary as well as a

corporate update.

Leadership, Process Improvement and Expected

Impact

From Q2 2022 through to the end of Q1 2023, we

made several leadership and structural changes to the Company. I

have commented on these changes in the past. These changes were

strategic and reflect the resources and leadership qualities

necessary to move the Company through to its next phase of growth.

The ensuing benefits of these changes often take time to show up in

the financial results as new leaders evaluate specific

opportunities and challenges at the agency level. I fully expect

that these changes will lead to our intended long-term results and

will begin to be reflected in future quarterly financial

reporting.

During this quarter, I had the pleasure of

traveling to meet with several of our leaders across the U.S. These

travels took me to visit our home care agency teams in Texas,

Oklahoma, Arkansas, Ohio, Kentucky and western Massachusetts. These

travels built upon previous visits to our offices throughout

Massachusetts, Vermont, New Hampshire and Rhode Island several

weeks earlier. I came away extremely impressed with the quality of

leadership and talent that we have in place. Our leaders and teams

instill a confidence in the exceptional service we provide to our

clients, leading with safety in mind, and continuing to move the

business forward in a positive manner. These meetings also

facilitated an increase in inter-agency cooperation and sharing of

best practices, the implementation of new agency revenue sources

and the removal of certain barriers, all of which I anticipate will

lead to improved financial results over

time.

Prudent Fiscal Management

In an environment of rapidly increasing interest

rates and economic uncertainty, companies that learn to operate in

a fiscally prudent manner with a view to continuous improvement

generally are well positioned for growth. I believe Nova Leap is

such a company.

I have referenced our favorable debt position in

past commentary many times and believe it provides us with a great

deal of financial flexibility as we continue to navigate the

current economic and capital markets environment. With the full

collection of the ERC receivable, referenced separately below, our

bank debt at the end of 2023 is projected to be less than $300,000.

This is a major accomplishment, particularly for a company that has

borrowed several million dollars to support funding of its

acquisition program.

Further, with the litigation settlement in

place, also referenced separately below, our cash flow profile has

improved because of the settlement cash received, the reduction in

ongoing legal fees, and the entire elimination of both promissory

notes and potential earnout payments.

The strength of our balance sheet positions Nova

Leap well for future growth opportunities.

Government Tax Credit Receivable

The Government Tax Credit (“ERC”) receivable on

our balance sheet at the end of Q1 in the amount of $452,306 has

now been fully collected. The funds were used to repay the

remaining balance of $430,000 in demand loans. As a result, the Q1

demand loans in the amount of $995,366 has been reduced by 43% (not

including regular monthly principal and interest payments). Both

the ERC receivable collection and the demand loan repayment will be

reflected in the Q2 financial statements.

Litigation Settlement

The litigation initiated by Nova Leap and

previously referenced as part of Q2 2022 results has been settled.

The settlement consists of the following:

- Cash payments to Nova Leap in the

amount of $95,000 received in Q2;

- Forgiveness of the remaining

promissory notes related to this agency, plus accrued interest, in

the amount to $258,000; and

- No future earnout payments, if

earnout thresholds have been reached.

As a result, the Q1 promissory notes in the

amount of $897,706 has been reduced by 28.7% (not including

regularly scheduled payments) and significant future legal costs to

pursue this litigation will be eliminated both improving future

cash flow. The results of the settlement will be reflected in the

Q2 financial statements.

Insider ownership

During the past six weeks, insiders have

purchased just over three quarters of a million shares in the open

market as part of their long -term investment strategy showing

confidence in the Company’s future prospects. As a result, insider

ownership has increased to 39.97%.

Thank you for your ongoing support.

Yours truly,

Chris Dobbin, CPA, ICD.DPresident & CEO

FORWARD LOOKING

INFORMATION:

Certain information in this press release may

contain forward-looking statements, such as statements regarding

future expansions and cost savings, and plans regarding future

acquisitions and business growth, including anticipated annualized

revenue or annualized recurring revenue run rate growth and

anticipated consolidated Adjusted EBITDA margins. This information

is based on current expectations and assumptions, including

assumptions described elsewhere in this release and those

concerning general economic and market conditions, availability of

working capital necessary for conducting Nova Leap’s operations,

availability of desirable acquisition targets and financing to fund

such acquisitions, and Nova Leap’s ability to integrate its

acquired businesses and maintain previously achieved service hour

and revenue levels, that are subject to significant risks and

uncertainties that are difficult to predict. Actual results might

differ materially from results suggested in any forward-looking

statements. Risks that could cause results to differ from those

stated in the forward-looking statements in this release include

the impact of the COVID-19 pandemic or any recurrence, including

staff and supply shortages, regulatory changes affecting the home

care industry or government programs utilized by the Company (such

as ERC), other unexpected increases in operating costs and

competition from other service providers. All forward-looking

statements, including any financial outlook or future-oriented

financial information, contained in this press release are made as

of the date of this release and included for the purpose of

providing information about management's current expectations and

plans relating to the future, and these statements may not be

appropriate for other purposes. The Company assumes no obligation

to update the forward-looking statements, or to update the reasons

why actual results could differ from those reflected in the

forward-looking statements unless and until required by securities

laws applicable to the Company. Additional information identifying

risks and uncertainties is contained in the Company's filings with

the Canadian securities regulators, which filings are available at

www.sedar.com.

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information:

Chris Dobbin, CPA, ICD.D

Director, President and CEO

T: 902 401 9480

E:cdobbin@novaleaphealth.com

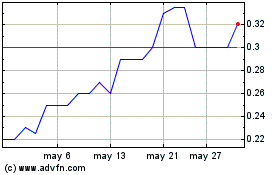

Nova Leap Health (TSXV:NLH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

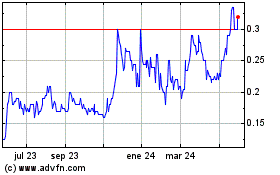

Nova Leap Health (TSXV:NLH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024