Prospera Energy Inc. (“PEI”) (TSX.V: PEI, OTC: GXRFF, FRA: OF6B)

The 2024 Prospera corporate update outlines the

company’s restructuring efforts since 2021, highlighting key

milestones achieved, challenges faced, and the strategic path

forward to achieve production stability and profitability.

Preamble:By the end of 2020

Prospera faced a litany of financial challenges, including low

production, high operating costs, and the global impacts of the

Covid pandemic. The company’s liability was in excess of $24MM

($12MM ARO, $11MM AP arrears, & $1.5MM in Credit Facilities)

mainly towards secured mezzanine capital, CRA, mineral royalties,

municipality property tax, landowners lease payments, numerous

local service providers, and high asset retirement obligations.

Adding to the problems, Prospera had in excess of 400+

non-compliance infractions with spills, dysfunctional monitoring

devices, and facilities that had been neglected and orphaned.

Consequently, Prospera Energy Inc. was in a terminal position. In

Q1 2021, the municipality and secured debt holder exercised their

rights, taking control of payments from the limited revenue and

production that remained. The then-CEO and directors were fleeing

from the company’s obligations, especially to the CRA.

Towards the end of 2020, PEI’s continuing

operations had become difficult due to high and long-term

liabilities, a situation further amplified by the pandemic and

drastic reduction in produced volumes (less than 200 bpd

Gross).

At the time, Mr. Samuel David was leading a

private company developing medium-light oil around the Brooks area

and as a result of his association with the late Burkhart Franz,

founder of Prospera Energy Inc. (formerly Georox Resources), Mr.

David accepted a role as an advisor to help rescue the company from

entering into CCA.

Prospera Energy

Restructure:Prospera Energy Inc’s restructuring commenced

in Q1, 2021, with the appointment of Mr. David as President, CEO

& Director. Mr. David observed legacy heavy (13-17API) oil

fields were developed with numerous vertical wells on reduced

spacing. These wells were in primary depletion without any

patterned pressure support. Produced water was randomly disposed

resulting in water recycling. Reserves were estimated on the

decline of the small number of low producing wells and their

economies were burdened by high surface lease costs and their high

number of standing wells. Unprocessed 3-D seismic coverage was

available over the entire reservoir of each asset, each of which

has a facility processing capacity to handle large volumes of

produced fluid, and the wells were tied into these central

facilities. Clean oils were trucked out to a nearby terminal.

Produced water was reinjected by central pumps at the facility to

injectors throughout the field. These infrastructures had

previously been neglected and not maintained.

Mr. David recognized the recovery to

date was low with respect to volumetric estimation of oil in place,

and a significant amount of oil remains within adequate

infrastructure. The recovery has been from an under

pressured solution gas drive reservoir with low active edge water

and exploited by vertical well technology only. However, high AP

arrears, ARO and neglected infrastructure were significant

obstacles. Overcoming poor technical conduct and neglect required

sufficient capital to exploit the remaining reserves effectively

and profitably. To rectify these issues, Samuel devised a

development plan in phases to capture the significant remaining

reserves.

The Prospera development plan is comprised of

three phases:

- Phase one was to

bring operations to safe operating conditions and optimize low

hanging opportunities to increase production.

- Phase two was to

transition to horizontal wells and abandon depleted vertical wells

along the path. This reduces the environmental footprint and the

corresponding fixed operating cost. It would also diversify product

mix by adding higher API oil assets.

- The third and

final phase is to implement improved and enhanced recovery methods

tailored to the reservoir conditions, aiming to reduce decline for

sustained long-term production. This approach, combined with a

reduced footprint and lower operating costs, is designed to yield

higher margins.

At the time, the minimum allowed for a private

placement was five cents, while PEI stock was trading at one cent

and at risk of being halted. Fortunately, a one-time, two-cents

private placement offering opportunity, that was only offered

during extraordinary circumstances such as the pandemic, was

permitted. Utilizing this opportunity and the proposed engineering

solutions, capital was raised with the assistance of Kurt Soost,

who played a key role in connecting credible investors such as

Peter Lacey, Dave Richardson, and others to the seed capital

provided by the management group, which included Mr. David and Jaz

Dhaliwal. They participated in the initial and subsequent private

placement offerings, helping Prospera secure a financial

lifeline.

This realigned the PEI board, which requested

Mr. David amalgamate his private company assets into Prospera at an

equal interest, to avoid any perception of bias towards his assets

and to ensure focus on Prospera’s asset development going forward.

As a result, Prospera acquired a 50% working interest in a

medium-light oil property with operatorship from Mr. David on

favorable terms, with no upfront cash consideration and delayed

consideration on a success basis. These terms were released on

December 7th, 2022, and the transaction consideration was based on

third-party evaluations, TSX approval, and independent scrutiny and

approval resolution by the directors.

Restructuring Efforts Resulted

In:Oil in Place Validated - Prospera Oil in place and

remaining reserves were authenticated by geological delineation,

well control & production performance, 3D seismic confirmation,

and by 3rd party evaluation

- Total OOIP = 396.7 MMbbl

- Produced = 34.2 MMbbl

- Recovered = 8.6%

NPV Appreciation - Net Present value of the

reserves was steadily substantiated by PEI’s optimization and

development. As a result:

- Before Tax PDP reserves increased

508% from $4.4MM$ to $27.1MM$ in 2023 at a 10% discount rate

- Before tax 2P reserves increased by

$60.8m from $72.5m to $133.3MM$ in 2023 at a 10% discount rate

- Total proved and probable reserves

increased by 25% from 4,306 to 5,403 Mboe

- Reserve life index increased by 6% from 28.4 to 30.0 years

Increased Ownership - In the three core heavy

oil properties from an average of 35% to 95% by settling out joint

venture receivables.

Regulator License Liability Rating - Asset to

liability ratio was elevated by PEI restructured efforts

- The Saskatchewan regulator assessed the company’s asset value

18MM$ higher due to the changes implemented

- The asset to liability ratio has increased from 0.47 to 1.44 in

Saskatchewan

- The asset to liability ratio has increased from 0.90 to 2.60 in

Alberta

Diversify Production Mix – Acquired a 50%

interest in Medium-oil development play and successfully perforated

two existing wells with favorable results. In 2023, the first well

was drilled, with initial production (IP) rates exceeding

expectations. This led to attractive investment returns, with a

payout achieved in just seven months.

In 2024, four development wells were drilled,

encountering pay, structure, and oil shows as anticipated. The

first medium-oil horizontal well encountered 800 meters of porous

reservoirs with oil shown in the lateral section. The well test

demonstrated strong inflow, producing over 50 m³/d of fluid at 50%

oil cuts. The oil quality is 26–30-degrees API. This well is now

online and delivering consistent rates as it is stabilizing.

Financial Position Appreciation - Netbook value

(Total assets) has increased from $5.5 million in 2020 to

approximately $59.0 million by the end of Q3 2024. This growth was

driven by capital raised ($35MM) and cash flow from operations

($7MM), both of which were deployed for optimization and

development. Additional value appreciation resulted from an

impairment reversal, supported by the substantiation of remaining

reserve value ($8 million) and the capitalization of a working

interest acquisition ($3 million). Since 2021, the total asset

value has been appreciated by $53+ million.

Due to capital deployed for optimization,

non-compliance elimination, infrastructure upgrades and development

aimed at increasing production and recoveries, the company is

beginning to see operational profitability. 2022 saw production

increased and, if not for the lower commodity prices in 2023, the

company would have been profitable in 2022. Nonetheless, 2022 was a

rebound year, generating $2.3 million in operating income compared

to a substantial loss the previous year. With ongoing production

optimization and development, Prospera has achieved approximately

$2.6 million in cash operating income as of Q3, 2024.

The restructuring efforts have transformed the

company into cash-flow-positive operation. Prospera’s bare bones

break-even operating expenses are $1.1 million per month (500 boe/d

@ $75/boe CAD). Any cash flow above this break-even amount is

allocated to servicing debt, addressing legacy arrears and further

funding, optimization and development initiatives.

With current production levels around 900 boe/d,

the company has generated $2.6 million year to date Q3, 2024.

Production Appreciation & Challenges – PEI’s

restructuring efforts successfully optimized production from 80

boepd to 800 boepd during the phase one execution. By the end of

2023, peak production rates reach 1,800 boepd driven by horizontal

development and medium oil development.

While the restructuring yielded positive

results, Prospera production progress and forecast were impacted by

operational set-back and by severe cold weather conditions. These

issues hindered expected production rates, preventing the company

from achieving its short-term production and financial targets.

PEI has continually implemented measures to

address operational constraints, and restore and maintain peak

production rates. These include failure analysis, calibrated

equipment, revised operational procedures, and accountability for

accurate and timely data to maximize run time with experienced

personnel. As a result, Cuthbert operations are starting to

stabilize while challenges are being addressed. Approximately 70+

m3/d of production is currently behind pipe at Cuthbert, and PEI is

focused on capturing this additional volume.

Revised 2024 Prospera

ForecastFollowing a challenging recalibration, Prospera

has expressed optimism going forward, however, PEI has faced a

series of challenges including cold weather conditions,

infrastructure breakdown, water recycling issues, legacy arrears,

non-participating JV partners, and lower commodity prices. These

factors have unexpectedly delayed the company’s timeline for

attaining the initially projected targets.

The legacy reservoirs are now in the final

stages of primary pressure depletion and require additional energy

in-situ to increase the mobility of the viscous oil. Enhanced

recovery methods suited to the specific reservoir conditions must

be applied gradually and methodically to maximize oil recovery,

which will take time. PEI has initiated horizontal transformation

while testing the recovery methods to be applied to the future

horizontal wells while modifying necessary infrastructure

adjustments. With the benefit of new information, extensive data,

and a revised plan, Prospera has reassessed and incorporated the

challenges and setback into the company’s updated forecast moving

forward.

Prospera has achieved many technical and

financial successes, these accomplishments have been overshadowed

by production shortfalls set out by optimistic early targets.

Moving forward, PEI’s primary focus is on efficient operations to

ensure sustained, stable production and production

growth.

ConclusionProspera Energy Inc.

has come a long way since the brink of bankruptcy in Q1, 2021.

Through a successful restructuring, PEI has eliminated the risk of

insolvency, addressed critical regulatory non-compliances, and

raised regulator license liability ratings by increasing production

through optimization and development. The company has also

substantiated the large amount of remaining reserves and

substantially increased the proven asset value of the company. By

improving cash flow from operations well above break-even, PEI has

remained operational while deploying capital to address legacy

accounts payable arrears and implement proven technical

applications. Additionally, the acquisition of medium-oil assets

has reduced dependency on heavy-oil differentials.

In short, Prospera have made significant

progress in positioning the company for future growth. However, PEI

achievements have been overshadowed by production short fall set

out by optimistic targets by optimization and drilling success.

Prospera acknowledges these challenges encountered and has

incorporated them into the revised 2024 forecast, to allocate

sufficient time and resources to improve operational efficiencies,

optimize well run times, and implement reservoir management

applications while adhering to safety & regulatory guidelines.

These proactive measures are being implemented in Q4 2024 and Q1

2025 to stabilize and support robust, sustained growth throughout

Q2 and Q3 of 2025.

While the company is revising the year-end

production target down to 1,250 barrels, it is important to

emphasize that the fundamentals of Prospera Energy’s assets remain

strong. The significant recovery potential remains within reach,

and PEI continues to execute on our long-term development plan to

capitalize on these opportunities. The reduction in short-term

targets does not diminish the company’s confidence in the strategic

path forward. Prospera remains focused on optimizing production,

improving efficiency, and unlocking the full value of PEI’s

resources. As Prospera moves ahead, the company is committed to

increasing production through optimization, horizontal

transformation, and enhanced oil recovery.

About Prospera Prospera is a

publicly traded energy company based in Western Canada,

specializing in the exploration, development, and production of

crude oil and natural gas. Prospera is primarily focused on

optimizing hydrocarbon recovery from legacy fields through

environmentally safe and efficient reservoir development methods

and production practices. Prospera was restructured in the first

quarter of 2021 to become profitable and in compliance with

regulatory, environmental, municipal, landowner, and service

stakeholders.

The company is in the midst of a three-stage

restructuring process aimed at prioritizing cost effective

operations while appreciating production capacity and reducing

liabilities. Prospera has completed the first phase by optimizing

low hanging opportunities, attaining free cash flow, while bringing

operation to safe operating condition, all while remaining

compliant. Currently, Prospera is executing phase II of the

restructuring process, the horizontal transformation intended to

accelerate growth and capture the significant oil in place (400

million bbls). These horizontal wells allow PEI to reduce its

environmental and surface footprint by eliminating the numerous

vertical well leases along the lateral path. Phase III of

Prospera’s corporate redevelopment strategy is to optimize recovery

through EOR applications. Furthermore, Prospera will pursue its

acquisition strategy to diversify its product mix and expand its

core area. Its goal is to attain 50% light oil, 40% heavy oil and

10% gas.

The Corporation continues to apply efforts to

minimize its environmental footprint. Also, efforts to reduce and

eventually eliminate emissions, alongside pursuing innovative ESG

methods to enhance API quality, thereby achieving higher margins

and eliminating the need for diluents.

For Further Information: Shawn Mehler, PR

Email: investors@prosperaenergy.comWebsite:

www.prosperaenergy.com

FORWARD-LOOKING STATEMENTSThis

news release contains forward-looking statements relating to the

future operations of the Corporation and other statements that are

not historical facts. Forward-looking statements are often

identified by terms such as “will,” “may,” “should,” “anticipate,”

“expects” and similar expressions. All statements other than

statements of historical fact included in this release, including,

without limitation, statements regarding future plans and

objectives of the Corporation, are forward-looking statements that

involve risks and uncertainties. There can be no assurance that

such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in

such statements.

Although Prospera believes that the expectations

and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements because Prospera can give no assurance

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, risks associated with the oil and gas industry in

general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses, and health, safety and

environmental risks), commodity price and exchange rate

fluctuations and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures.

The reader is cautioned that assumptions used in

the preparation of any forward-looking information may prove to be

incorrect. Events or circumstances may cause actual results to

differ materially from those predicted, as a result of numerous

known and unknown risks, uncertainties, and other factors, many of

which are beyond the control of Prospera. As a result, Prospera

cannot guarantee that any forward-looking statement will

materialize, and the reader is cautioned not to place undue

reliance on any forward- looking information. Such information,

although considered reasonable by management at the time of

preparation, may prove to be incorrect and actual results may

differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement. The forward-looking statements

contained in this news release are made as of the date of this news

release, and Prospera does not undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as expressly required by Canadian securities

law.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Photos accompanying this announcement are

available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/0b193b58-7798-4139-b69d-1f8aec58a8f7https://www.globenewswire.com/NewsRoom/AttachmentNg/46e266dc-9f3f-43b1-a3f7-1f71bb526ccehttps://www.globenewswire.com/NewsRoom/AttachmentNg/2d404ae6-c38e-40c3-910a-403f9376549fhttps://www.globenewswire.com/NewsRoom/AttachmentNg/506b134d-3ce3-4639-9a61-f0caa42b633ehttps://www.globenewswire.com/NewsRoom/AttachmentNg/b0ac6d1d-5ea5-4c86-b5b4-d49a72936f7bhttps://www.globenewswire.com/NewsRoom/AttachmentNg/e14fb81b-462a-456d-99fa-e4a54a549e7dhttps://www.globenewswire.com/NewsRoom/AttachmentNg/100176cb-60ba-45e8-9311-e94604dcd117https://www.globenewswire.com/NewsRoom/AttachmentNg/8fc83e60-6686-4b8f-93e8-84598ec586a0https://www.globenewswire.com/NewsRoom/AttachmentNg/6c20cd2d-ef07-41b7-9149-5d80f7288b16https://www.globenewswire.com/NewsRoom/AttachmentNg/fb37dc99-2c7f-4db1-bcab-a3807af55016

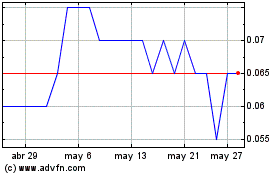

Prospera Energy (TSXV:PEI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Prospera Energy (TSXV:PEI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024