Pulse Oil Corp. (the “

Company” or

“

Pulse”) (TSXV: PUL) reports the completion of

Pulse’s first new drilling operation since 2019.

Pulse is pleased to announce that the drilling,

and subsequent completion of Pulse’s 100% owned 103/15-04 well,

located in Pulse’s Bigoray Nisku D pool has resulted in production

rates over the last seven days averaging 162 boe/d, consisting of

151 barrels of oil per day and 63 mcf/d of gas. The well was

drilled over 11 days to a depth of 2,639 meters and was done so on

budget. The completion targeted the upper portion of the Nisku D

reef to take advantage of the progress achieved through the

Enhanced Oil Recovery (EOR) program that Pulse initiated in

December 2022. In the EOR process, Pulse is injecting solvent into

the upper portion of the D pool, creating a bank of solvent that

will be pushed through the reef. The injected solvent then becomes

miscible with the oil, thereby decreasing the viscosity of the oil

and allowing oil to be produced that was not moveable in earlier

development within the D pool.

The well was targeted to be ideally located

within the Nisku D pool to improve the efficiency of the EOR

program while also growing oil and gas production immediately.

Pulse is also happy to announce that early

indications are that the EOR solvent flood has started to move

through the D pool and is showing results more efficiently than

originally estimated. After independent lab analysis of the oil and

gas being produced from our new well, Pulse is happy to report that

the results of the testing have shown that the API gravity of the

produced oil has improved from approximately 36 to 42 due to the

miscibility of solvent with the oil within the pool. In addition,

independent analysis of the gas produced has shown that

approximately 10% of the gas is injected solvent from the EOR

program while the remainder is natural gas and other forms of gas

routinely produced. The sweep efficiency of the oil that we are

seeing early on has resulted in a change in the oil-water cut from

approximately 97% water in the Company’s existing production to

approximately 54% in the new well. Pulse is currently evaluating

additional wells within the pool that will be able to take

advantage of the improved efficiency and plans to re-start another

two existing wells to grow production as the solvent sweeps through

the D pool.

As previously announced, the well will assist

the Company in accomplishing certain goals:

- Grow near-term production, which is

currently at 382 BOE/d, (76% oil) and improve cashflow moving

forward.

- Demonstrate the success of Pulse’s

EOR program and assist in moving the program forward by continuing

to find additional efficiencies.

- Materially increase production

rates and ultimate reserve recovery within the Nisku D Pool.

2023 Reserves Summary

Pulse also announces that an independent

qualified reserves evaluator (as defined in National Instrument

51-101 Standards of Disclosure for Oil and Gas Activities

(“NI 51-101”)) with the firm of McDaniel &

Associates Consultants Ltd. (“McDaniel”) has completed a reserves

assessment, effective December 31, 2023, on Pulse’s interests

within the Bigoray and Queenstown core operating areas which was

prepared in accordance with the COGE Handbook (as defined in NI

51-101), resulted in a pre-tax net present value of $76.95 million

for Pulse’s proved plus probable (“2P”) reserves

and $41.73 million for Pulse’s proved (“1P”)

reserves, using a 10% discount rate to Pulse’s net working

interest. This represents an increase in the value of 2P reserves

of 38.1% and an increase in the value of 1P reserves of 71.7% when

compared to December 31, 2022.

The reserves forecast summarizes certain

information contained in McDaniel’s report, which was prepared in

accordance with National Instrument 51-101 Standards of Disclosure

for Oil and Gas Activities (“NI 51-101”) and the definitions,

standards, and procedures contained in the Canadian Oil and Gas

Evaluation Handbook (the “COGE Handbook”). McDaniel evaluated 100%

of the Company’s reserves. The McDaniel Report is based on forecast

prices and costs and applies McDaniel’s forecast escalated

commodity price deck and foreign exchange rate and inflation rate

assumptions as at December 31, 2023. Estimated future net revenue

is stated without any provisions for interest costs, other debt

service charges, or general and administrative expenses, and after

the deduction of royalties, estimated operating costs, estimated

abandonment and reclamation costs, and estimated future development

costs.

Summary of Corporate Reserves

(1)(2)(3)The following table is a summary of the

Company’s estimated reserves as at December 31, 2023, as evaluated

in the McDaniel Report.

|

Reserves Category |

Light Oil |

Natural Gas |

Natural GasLiquids |

Total |

|

|

(Mbbl) |

(MMcf) |

(Mbbl) |

(Mboe) |

|

Proved |

|

|

|

|

|

Developed Producing |

304.80 |

766.20 |

53.30 |

485.90 |

|

Developed Non-Producing |

2,658.70 |

1,050.10 |

106.60 |

2,940.30 |

|

Undeveloped |

398.00 |

105.90 |

10.70 |

426.40 |

|

Total Proved |

3,361.50 |

1,922.20 |

170.60 |

3,852.50 |

|

Probable |

1,425.90 |

943.90 |

70.60 |

1,654.90 |

|

Total Proved plus Probable |

4,787.40 |

2,866.10 |

242.30 |

5,507.40 |

Notes:(1) Reserves are presented on a

“company gross” basis, which is defined as Pulse's working interest

share before deduction of royalties and without including any

royalty interest of the Company.(2) Based on McDaniel’s

December 31, 2023 forecast prices and costs. McDaniels’s commodity

price forecasts as of December 31, 2023, which were used in the

McDaniel Report, can be found at

https://mcdan.com/price-forecasts/.(3) Oil equivalent amounts

have been calculated using a conversion ratio of six thousand cubic

feet of natural gas to one barrel of oil. See “Cautionary

Statements – Barrels of oil equivalent” below.

Net Present Values of Future Net Revenue

Before Income Taxes Discounted at

(%/year) (1)(2)(3)(4)(5)The following table

is a summary of the estimated net present values of future net

revenue (before income taxes) associated with Pulse’s reserves as

at December 31, 2023, discounted at the indicated percentage rates

per year, as evaluated in the McDaniel Report.

|

Reserves Category |

0% |

5% |

10% |

15% |

20% |

|

|

(M$) |

(M$) |

(M$) |

(M$) |

(M$) |

|

Proved |

|

|

|

|

|

|

Developed Producing |

$8,218.40 |

$7,149.20 |

$6,146.90 |

$5,333.10 |

$4,692.30 |

|

Developed Non-Producing |

$83,539.30 |

$48,185.80 |

$30,123.30 |

$19,780.50 |

$13,329.30 |

|

Undeveloped |

$11,166.20 |

$7,509.00 |

$5,457.70 |

$4,195.30 |

$3,353.80 |

|

Total Proved |

$102,923.90 |

$62,844.10 |

$41,727.90 |

$29,308.90 |

$21,375.40 |

|

Probable |

$81,835.70 |

$50,776.00 |

$35,221.60 |

$26,208.00 |

$20,432.00 |

|

Total Proved plus Probable |

$184,759.60 |

$113,620.10 |

$76,949.50 |

$55,516.90 |

$41,807.40 |

Notes:(1) Based on McDaniel’s December 31,

2023 forecast prices and costs. McDaniel’s commodity price

forecasts as of December 31, 2023, which were used in the McDaniel

Report, can be found

at https://mcdan.com/price-forecasts/.(2) Estimated

future net revenues are stated without any provision for interest

costs, other debt service charges or general and administrative

expenses, and after deduction of royalties, estimated operating

costs, estimated abandonment and reclamation costs, and estimated

future development costs.(3) Estimated future net revenue,

whether discounted or not, does not represent fair market

value.(4) Net present values of future net revenue after

income taxes are estimated to approximate the before income tax

values based on the estimated future revenues, available tax pools

and future deductible expenses.(5) Columns may not add due to

rounding of individual items.

Pulse CEO, Garth Johnson, commented, “We are

pleased with the progress we are making. Obviously, we are happy

with the new well adding oil and gas production but even more

importantly, we have independent scientific proof that our EOR

program in the D pool is working and based on the results,

management of Pulse believe that the EOR program is working more

efficiently than first estimated. We look forward to continued

solvent injection sweeping even more oil through the D pool,

reducing water production and increasing oil production. Planning

is also underway to prepare to get our E pool EOR project started

as soon as cash flow permits. Finally, we are also pleased with the

increase in reserves as assessed independently by McDaniel &

Associates Consultants Ltd. We feel with the new production and

proof of concept that the EOR is working in 2024, we will continue

to grow these reserves into the future.”

About Pulse:

Pulse is a Canadian company incorporated under

the Business Corporations Act (Alberta) that is primarily focused

on a 100% Working Interest Enhanced Oil Project Located in West

Central Alberta, Canada. The project includes two established Nisku

pinnacle reef reservoirs that have been producing sweet light crude

oil for over 40 years.

The Company has instituted a proven recovery

methodology (NGL solvent injection) to further enhance the ultimate

oil recovery from these two proven pools. With under 10 million

barrels of oil recovered to date, and representing approximately

30% recovery factor from the pools, Pulse is moving forward to

execute the EOR project and unlock significant value for

shareholders. Pulse’s total reclamation liabilities are just $2.96

million which, when compared to many peers in the industry in

Western Canada, are very low.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information contact:

Pulse Oil Corp.

Garth

JohnsonCEO604-306-4421garth@pulseoilcorp.com

Barrels of oil equivalent (boe) is calculated

using the conversion factor of 6 mcf (thousand cubic feet) of

natural gas being equivalent to one barrel of oil. Boes may be

misleading, particularly if used in isolation. A boe

conversion ratio of 6 mcf:1 bbl (barrel) is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the

wellhead. Given that the value ratio based on the current

price of crude oil as compared to natural gas is significantly

different from the energy equivalency of 6:1, utilizing a

conversion on a 6:1 basis.

Reserves Advisory

This news release includes information

pertaining to the Evaluation of Crude Oil and Natural Gas Reserves

as of December 31, 2022, prepared by independent reserves evaluator

McDaniel & Associates Consultants Ltd. (“McDaniel”). The report

was prepared by qualified reserves evaluators in accordance with

definitions, standards and procedures contained in the Canadian Oil

and Gas Evaluation Handbook and National Instrument 51-101,

Standards of Disclosure for Oil and Gas Activities ("NI 51- 101")

and is based on McDaniel pricing effective December 31, 2022.

Additional reserve information as required under NI 51- 101 is

included in the Company's Annual Information Form filed on SEDAR.

Statements relating to reserves are deemed to be forward looking

statements, as they involve the implied assessment, based on

certain estimates and assumptions, that the reserves described

exist in the quantities predicted or estimated. The reserve

estimates described herein are estimates only. The actual reserves

may be greater or less than those calculated. Estimates with

respect to reserves that may be developed and produced in the

future are often based upon volumetric calculations, probabilistic

methods and analogy to similar types of reserves, rather than upon

actual production history. Estimates based on these methods

generally are less reliable than those based on actual production

history. Subsequent evaluation of the same reserves based upon

production history will result in variations, which may be

material, in the estimated reserves.

Future Net Revenue and Net Present Value

(NPV10), both of which are discounted at 10% are an estimate based

on numerous assumption, do not represent fair market value and are

subject to change without notice. The estimate of reserves and

future net revenue have been made assuming that development of each

property, in which the estimate is made, will occur without regard

to the likely availability to Pulse of the funding required for

that development.

References herein to barrels of oil equivalent

(“boe”) are derived by converting gas to oil in the ratio of six

thousand standard cubic feet (“Mcf”) of gas to one barrel of oil

based on an energy conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. Given the value ratio based on the current price of crude

oil as compared to natural gas is significantly different from the

energy equivalency of 6 Mcf to 1 barrel, utilizing a conversion

ratio at 6 Mcf to 1 barrel may be misleading as an indication of

value, particularly if used in isolation. “Proved” reserves are

those reserves that can be estimated with a high degree of

certainty to be recoverable. It is likely that the actual remaining

quantities recovered will exceed the estimated Proved reserves.

“Probable” reserves are those additional reserves that are less

certain to be recovered than Proved reserves. It is equally likely

that the actual remaining quantities recovered will be greater or

less than the sum of the estimated Proved plus Probable

reserves.

"Proved" reserves are those reserves that can be

estimated with a high degree of certainty to be recoverable. It is

likely that the actual remaining quantities recovered will exceed

the estimated Proved reserves.

"Probable" reserves are those additional

reserves that are less certain to be recovered than Proved

reserves. It is equally likely that the actual remaining quantities

recovered will be greater or less than the sum of the estimated

Proved plus Probable reserves.

Additional reserves information as required

under NI 51-101 will be included in the Company's statement of

reserves data and other oil and gas information on Form 51-101F1,

which is expected to be filed on SEDAR by April 29, 2024.

Abbreviations

The following is a summary of abbreviations used

in this news release:

| M |

Thousands |

| |

|

| MM |

Millions |

| |

|

| Mcf |

Thousands of standard cubic feet |

| |

|

| bbl |

Barrels |

| |

|

| NGL |

Natural gas liquids |

| |

|

Forward-Looking

Statements:

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. All statements, other than statements of historical

fact, included herein are forward-looking information. In this

news release, such statements include but are not limited to the

independent reserves estimates, conditions facing Pulse at the time

of planned expenditure included in the reserve evaluation and in

advancing and optimizing the Bigoray EOR project, conducting

operations on time and on budget and growing reserves, resources,

production, revenue and cash flow anticipated from these

operations. This also applies to Pulse’s latest drilling and

production rates, drilling program, its oil and gas resources and

the Bigoray EOR to continue to make positive progress. There can be

no assurance that such forward-looking information will prove to

be accurate, and actual results and future events could differ

materially from those anticipated in such forward-looking

information.

This forward-looking information reflects

Pulse’s current beliefs and is based on information currently

available to Pulse and on assumptions Pulse believes are

reasonable. These assumptions include, but are not limited to, 5-09

production rates, anticipated drilling results, conditions facing

Pulse at the current time and in advancing and optimizing the

Bigoray EOR project, conducting operations on time and on budget

and growing reserves, resources, production, revenue and cash flow

anticipated from these operations. Forward-looking information is

subject to known and unknown risks, uncertainties and other

factors that may cause the actual results, level of activity,

performance or achievements of Pulse to be materially different

from those expressed or implied by such forward-looking

information. Such risks and other factors may include, but are not

limited to: general business, commodity prices, economic,

competitive, political and social uncertainties; general capital

market conditions and market prices for securities; consistent

production and cash flow from current operations, the actual

results of future operations; competition; changes in legislation,

including environmental legislation, affecting Pulse; the timing

and availability of external financing on acceptable terms; and

loss of key individuals. A description of additional risk factors

that may cause actual results to differ materially from

forward-looking information can be found in Pulse’s disclosure

documents on the SEDAR website at www.sedar.com. Although Pulse

has attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. Readers

are cautioned that the foregoing list of factors is not exhaustive.

Readers are further cautioned not to place undue reliance on

forward-looking information as there can be no assurance that the

plans, intentions or expectations upon which they are placed will

occur. Forward-looking information contained in this news release

is expressly qualified by this cautionary statement. The

forward-looking information contained in this news release

represents the expectations of Pulse as of the date of this news

release and, accordingly, is subject to change after such date.

However, Pulse expressly disclaims any intention or obligation to

update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities law.

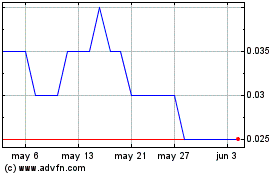

Pulse Oil (TSXV:PUL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

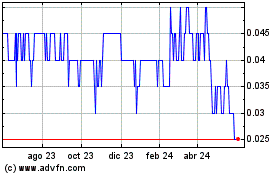

Pulse Oil (TSXV:PUL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024