Usha

Resources to Acquire Company with High-Grade

Cobalt-Copper

Project and

Launch Financing

Vancouver,

British Columbia, Canada -- August 12, 2021 -- InvestorsHub

NewsWire -- Usha

Resources Ltd. ("Usha" or the "Company") (TSXV:

USHA) (OTCQB:

USHAF) is pleased

to

announce that it has entered into a share exchange agreement dated

August 11, 2021 (the

"Share

Exchange Agreement") with 1236598 B.C.

Ltd. ("1236")

and the

shareholders of 1236 (the "1236

Shareholders").

Pursuant

to the Share Exchange Agreement, it is intended that 1236 will

become a wholly-owned

subsidiary of the

Company (the

"Transaction").

1236 has

an option to acquire

a 100% interest

in a Copper-Cobalt

Property (the "Property")

located in Silver Bow and Madison Counties,

Montana, subject to a

2% net

smelter returns royalty.

The

Property

The Property is

located within Silver Bow and Madison Counties,

32 kilometres

south of

Butte, Montana and is comprised of 65 Federal Unpatented Lode

Claims that total over 1,342

acres.

The

various

claims comprising the Property

have

over

10,000 metres

of

historical

drilling,

including by majors such as BHP, Cominco, Homestake, Phelps

Dodge and Rio Tinto.

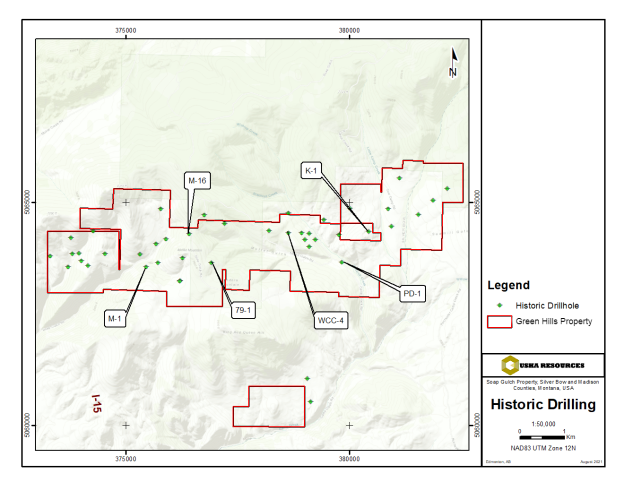

Significant drill and trench results include:

-

1.2%

copper, 0.036% cobalt, and 200 ppb gold over 11.7

metres

of

massive sulfides in DH WCC-4

-

0.15% to

0.3% cobalt and up to 1.14% copper over 96.3

metres

in DH K-1

(note,

only 1 ft

was assayed for every 10 ft)

-

1.8%

copper and 450 ppb gold over 1.25

metres

in DH

PD-1

-

19.0%

zinc over 0.7

metres

in DH

M-1

-

19.8%

zinc over 0.4

metres

in DH

79-1

-

Up

to 4.7% copper,

0.07%

cobalt, and 2.3 g/t gold in

trenches advanced by

BHP-Utah

Figure

1:

Location map showing historical drilling and trenching result

locations.

The land package is

underlain by Proterozoic meta-sedimentary rocks with SEDEX style

mineralization that is interpreted

to be age-equivalent and part

of the same Belt Supergroup that includes the

world-class

past-producing

Sullivan Mine in British Columbia.

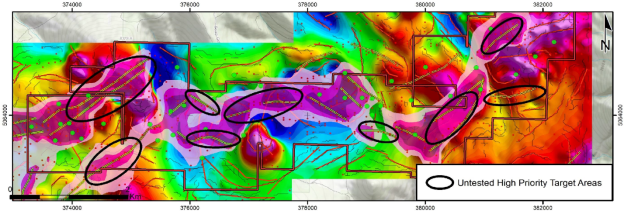

Recent airborne

geophysical survey work (Geotech's Helicopter Borne VTEM) has

delineated a series of

high-priority

electromagnetic anomalies within the Property (often indicative

of sulphide

mineralization),

and numerous major and minor structures, which require

follow-up exploration and

possibly drilling. The

Company's plan over the coming months is to build on the

geophysical work completed through further geophysical mapping and

interpretation, sampling, and other techniques in order to

launch a

comprehensive drill program with the goal of completing a maiden

resource at one or more areas.

Figure

2:

Map overlaying

VTEM and

EM Anomalies

with areas without

historical drilling

highlighted.

"We are thrilled to

have acquired such a significant project at a time when the demand

for cobalt and copper is increasing so

dramatically," stated Deepak

Varshney, CEO of the Company. "This project checks

off all the boxes – a mining-friendly

jurisdiction, easy year-round access, great historic results, and

world-class vendors.

The vendor group

includes Jim Greig,

President

of Benchmark Metals, who

stated

"The cobalt and copper

property has significant anomalous targets with world-class

potential for large new discoveries. We look forward to working

with the USHA team to advance the project in a proven and prolific

region of the USA."

The

Transaction

Under the terms of

the Share Exchange Agreement, the Company proposes

to acquire

all

of the issued and

outstanding shares of

1236

from the

1236 Shareholders in exchange for 5,800,000 common

shares of the Company

(the

"Consideration

Shares"). The

Consideration Shares will be issued to the

1236

Shareholders on a pro rata basis at a deemed price of $0.30 per

Consideration Share. The Consideration

Shares will be subject to "lock-up" provisions

wherein 1,160,000

Consideration

Shares

will be released to the 1236

Shareholders every

4 months

from the closing of the Transaction. Upon completion of

the Transaction, 1236

will

become a wholly-owned

subsidiary of

the

Company.

Closing of the

Transaction is subject

to the TSX Venture Exchange acceptance, as well as other

conditions precedents, including

the closing of the Private Placement. There can be no assurance

that the Transaction will be completed as proposed, or, at

all.

Non-Brokered

Private Placement

The Company is also

pleased to announce that is has launched a

non-brokered private placement for gross proceeds of up to

$3,000,000 through the issuance of up to 10,000,000 units (the

"Units")

at a price of $0.30 per Unit.

Each Unit will

consist of one common share (a "Share")

and one-half of one transferable share purchase warrant (a

"Warrant")

with each whole Warrant exercisable at $0.45 per share for a period

of two (2) years from the date of closing, subject to an

accelerated expiry if the closing trading price of the Company's

shares is greater than $0.75 per Share for a period of 10

consecutive trading days (the "Acceleration

Event").

The

Company will give notice to the holders of the Acceleration Event

and the warrants will expire 30 days thereafter.

Finder's fees may be paid in accordance with applicable securities

laws. The net proceeds from the Private Placement will be used for

exploration on the Company's new

and existing portfolio of properties

and for working capital and general corporate purposes.

Qualified

Person

The technical content

of this news release has been reviewed and approved by Mr.

Dean

Besserer,

P.Geol.,

a qualified person as defined by National Instrument 43-101

Standards of Disclosure for Mineral Projects ("NI

43-101").

About

Usha Resources Ltd.

Usha Resources Ltd.

is a Canadian mineral acquisition and exploration company based in

Vancouver, BC, Canada. Usha is exploring for commercially

exploitable mineral deposits and is currently focused on deposits

located in Northwest Ontario, Canada and the Lost Basin Gold Mining

District in Mohave County, Arizona, U.S.A. Usha increases

shareholder value through the acquisition and exploration of

quality precious and base metal properties and the application of

advanced state-of-the-art exploration methods. Usha's portfolio of

strategic properties provides diversification and mitigates

investment risk.

We seek Safe

Harbor.

USHA RESOURCES LTD.

"Deepak Varshney"

CEO and Director

For more information, please phone

James

Berard,

Investor Relations, at

778-228-2314,

email

jberard@usharesources.com,or

visit

www.usharesources.com.

Neither

TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-looking

statements:

This news release includes "forward-looking information" under

applicable Canadian securities legislation including, but not

limited

to, the anticipated closing of the

Transaction and private placement.

Such forward-looking information reflects management's current

beliefs and are based on

a number of

estimates and assumptions made by and information currently

available to the Company that, while considered reasonable, are

subject to known and unknown risks, uncertainties, and other

factors which may cause the actual results and future events to

differ materially from those expressed or implied by such

forward-looking information. Readers are cautioned that such

forward-looking information are neither promises nor guarantees,

and are subject to known and unknown risks and uncertainties

including, but not limited to, general business, economic,

competitive, political and social uncertainties, uncertain and

volatile equity and capital markets, lack of available capital,

actual results of exploration activities, environmental risks,

future prices of base and other metals, operating risks, accidents,

labor issues, delays in obtaining governmental approvals and

permits, and other risks in the mining industry. There are no

assurances that

the Company will successfully complete the

Transaction and the private placement

on the terms contemplated or at all. All forward-looking

information contained in this news release is qualified by these

cautionary statements and those in our continuous disclosure

filings available on SEDAR at www.sedar.com.

Accordingly, readers should not place undue reliance on

forward-looking information. The Company disclaims any intention or

obligation to update or revise any forward-looking information,

whether

as a result of

new information, future events or otherwise, except as required by

law.

The Company is presently an exploration stage company. Exploration

is highly speculative in nature, involves many risks, requires

substantial expenditures, and may not result in the discovery of

mineral deposits that can be mined profitably. Furthermore, the

Company currently has no reserves on any of its properties. As a

result, there can be no assurance that such forward-looking

statements will prove to be accurate, and actual results and future

events could differ materially from those anticipated in such

statements.

The securities referred to in this news release have not been, nor

will they be, registered under the United States Securities Act of

1933, as amended, and may not be offered or sold within the United

States or to, or for the account or benefit of, U.S. persons absent

U.S. registration or an applicable exemption from the U.S.

registration requirements.

This news release does not constitute an offer for sale of

securities for sale, nor a solicitation for offers to buy any

securities. Any public offering of securities in the United States

must be made by means of a prospectus containing detailed

information about the company and management, as well as financial

statements.

Usha Resources (TSXV:USHA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Usha Resources (TSXV:USHA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024