Source -

Ahead of the Herd newsletter

Graphite

prices heading higher on market tightness

As expected, the electrification

of the global transportation system is creating strong tailwinds

for the EV market.

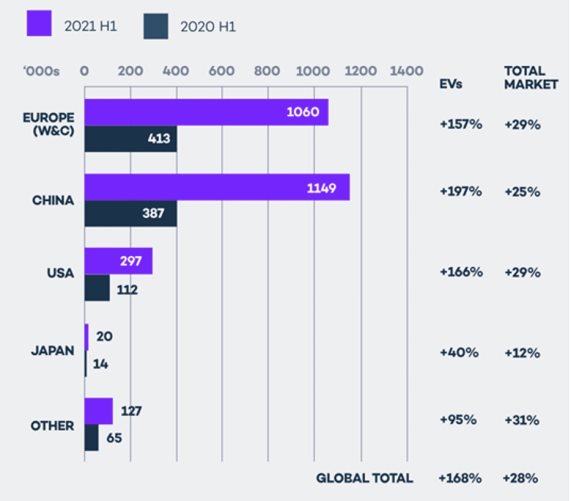

Power Technology, known for its

research on the energy sector, reports that EV sales more than

doubled in the first half of 2021, increasing by 160% compared to

H1 2020. The 2.6 million units sold, 1.1 million of which were in

China, represent 26% of total new car and truck sales

globally.

An analysis from IDTechEx quoted

by the publication forecasts EV sales in 2021 are on track to

surpass 5 million passenger cars. "If they do, it will mean an astonishing

growth rate of ~86% CAGR since 2011," the report reads.

Virta, which claims to be the

fastest-growing electric vehicle charging platform in Europe,

operating in over 30 countries, is more aggressive in its 2021 EV

sales forecast.

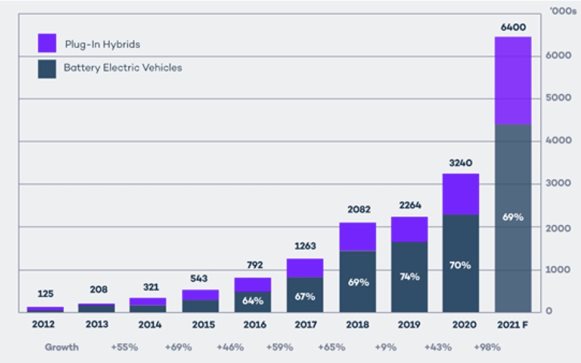

Global plug-in

vehicle sales. Source: Virta

BEV + PHEV sales

and % growth. Source: Virta

"Carried by a decarbonization

challenge most leading nations now take seriously, 2021 is a game

changer in the history of EV sales and it is expected that 6.4

million vehicles (EVs and PHEVs combined) will be sold globally by

the end of the year. It would then represent a 98% year over year

increase," the company states in a report titled 'The Global

Electric Vehicle Overview in 2022: Statistics and

Forecasts'.

Projecting further out, Virta

cites the International Energy Agency's (IEA) Global EV Outlook 2021, whose Stated Policies

Scenario suggests that by 2030, the global EV stock (excluding two-

and three-wheelers) could reach nearly 145 million and account for

7% of the total vehicle fleet.

The more ambitious EV30@30

campaign envisions, plainly, 30% of all vehicles becoming electric

by 2030, putting global sales at 43 million, or almost double that

of the Stated Policies Scenario.

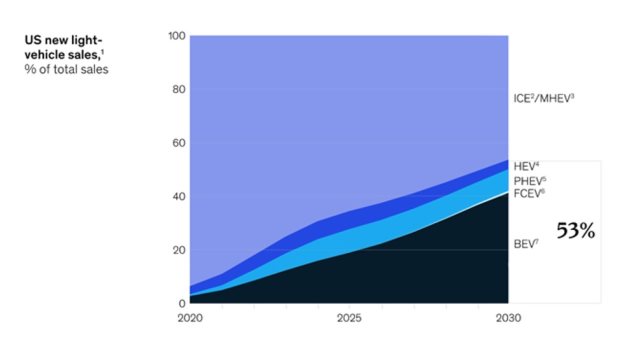

Consulting firm McKinsey &

Company believes EV sales will continue increasing, fueled by

government policies including the Biden administration's stated

goal that half of all new vehicle sales by 2030 be zero-emission;

state-level adoption of credit programs; tougher emissions

standards; and increasing electrification commitments from

OEMs.

Second-quarter EV sales in the US

increased by nearly 200% compared to Q2 2020, contributing to a

domestic penetration rate of 3.6% during the pandemic. The next

report should deliver similar or even better growth

figures.

EVs are likely

to account for more than half of all US passenger car sales by

2030, according to McKinsey. Source: McKinsey &

Company

Li-ion

battery demand

A lithium-ion (Li-ion) battery is

a type of rechargeable battery technology common to portable

electronics, electric vehicles and large grid-scale storage systems

for renewable energy.

These batteries consist of an

anode, cathode, separator, electrolyte and two current collectors

(positive and negative).

The cathode contains lithium,

either in the form of lithium carbonate or lithium hydroxide, while

the anode is made up of graphite. There are no substitutes for

either in a Li-ion battery.

While there are several obstacles

to increasing the penetration rate of EVs to regular vehicles,

including charging station infrastructure and lowering their

sticker prices, recent research suggests the battery storage market

is growing in leaps and bounds.

According to an analysis by

Adamas Intelligence, in 2020 a total of 134.5 gigawatt hours (GWh)

of battery capacity was deployed globally into newly sold passenger

BEVs, PHEVs and HEVs, an increase of 39.6% compared to

2019.

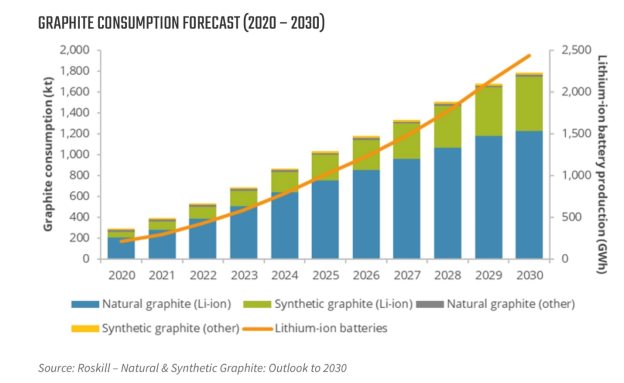

The added capacity is on trend

with a report last year from Roskill, which found that lithium-ion

battery demand is expected to increase more than

10-fold.

"The pipeline capacity of battery

Gigafactories is reported by Roskill to exceed

2,000GWh in

2029, at over 145

facilities globally," the report reads. "Driven by demand from the

automotive and energy storage markets, NCM/NCA type cathode

materials are expected to remain dominant, though other cathode

types will take market share in niche environments or

applications."

In March of this year, Benchmark

Mineral Intelligence said it is tracking 200 "super-sized"

lithium-ion battery cell plants in the pipeline to 2030, bringing

total global capacity to 3.4 terawatt-hours, a massive increase

from the 755 gigawatt-hours in 2020. (1TWh = 1,000 GWh)

The bulk of these sprawling new

battery-making facilities are likely to be in China, which

currently produces around three-quarters of the world's lithium-ion

batteries.

Of the 200 plants that BMI is

tracking, 148 are in China, compared to 21 in Europe and 11 in the

United States.

However, new energy storage

systems in the US are sprouting up. According to

a 2020

report by commodities consultancy Wood Mackenzie,

and the US Energy Storage Association, over 2,000 megawatt-hours

(MWh) were brought online in the fourth quarter of last

year.

And there's more to come. The

firm's head of energy storage, Dan Finn-Foley, predicts the US

energy storage market will add five times more megawatts of storage

in 2025 than was added in 2020, with front of the meter (FTM)

storage continuing to contribute between 75-85% of new MW each

year.

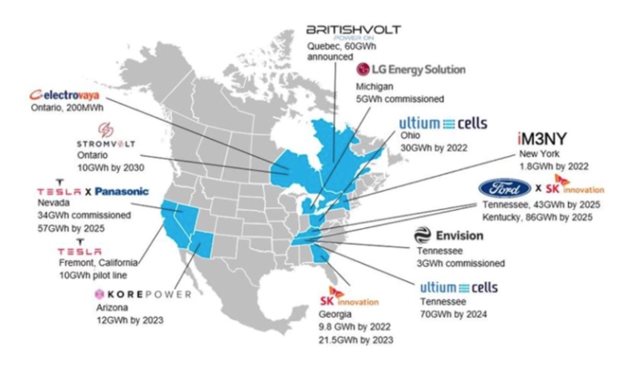

There are a number of battery

plants in the works to join Tesla, whose first gigafactory in

Nevada started production of battery cells in 2017. The company has

a plant in Buffalo, New York, and plans to open a third (US plant)

in Texas by the end of this year. Tesla also has a "pilot line" at

its facility in Fremont, California, for R&D

technologies.

In 2020 General

Motors announced

plans to install its first battery cell factory in

Ohio, a project called Ultium Cells launched with its Korean

partner LG Chem. The latter opened a plant in Holland, Michigan in

2013.

Another South Korean company, SK

Innovation, is planning on opening the first of two battery plants

in Georgia early next year; the company is a supplier to Volkswagen

and Ford.

The latter along with American

auto icon GM have big plans to electrify their fleets. Ford

announced plans to boost spending on electrification by more than a

third, and aims

to have 40% of its global volume electric by

2030, which translates to

more than 1.5 million EVs based on last year's sales.

GM reportedly aspires to halt all

sales of gas-powered vehicles by 2035, with plans to invest $27

billion in electric and autonomous vehicles over the next five

years.

In October Toyota

said it will invest about $3.4 billion on American battery development and

production through 2030.

North

American battery cell manufacturing landscape. Source:

BloombergNEF,

North

American battery cell manufacturing landscape. Source:

BloombergNEF,

company

announcements

There are

currently 11

EV start-ups racing to catch up with market leader

Tesla, fueled by money

from Wall Street. They include Rivian out of Irvine, California,

Lucid Motors based in Newark, CA, Lordstown Motors from Ohio,

Nikola Corp (Phoenix), Fisker (Los Angeles), Faraday & Future

(Los Angeles), Canoo (Torrance), NIO, Li Auto and XPing from China,

and Arrival, based in London.

The latest car company to commit

to EVs is Nissan,

which plans to spend 2 trillion yen (US$17.6 billion) over the next

five years. The Japanese

automaker is hoping to launch 23 electrified models including 15

EVs, aiming for 50% electrification by 2030 through its Ambition 30

strategy.

This gives you a sense of the

extent to which the EV lithium battery market in the US is

growing.

Need for

graphite

For all the talk of

electrification and battery plant growth, nothing can be achieved

without ensuring there is enough supply of the metals used to power

these vehicles.

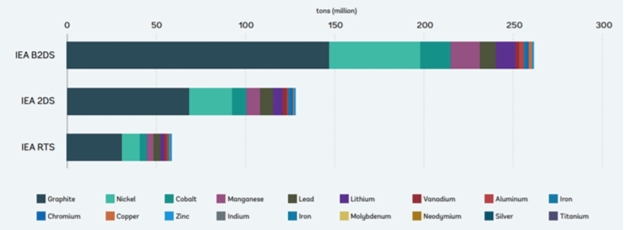

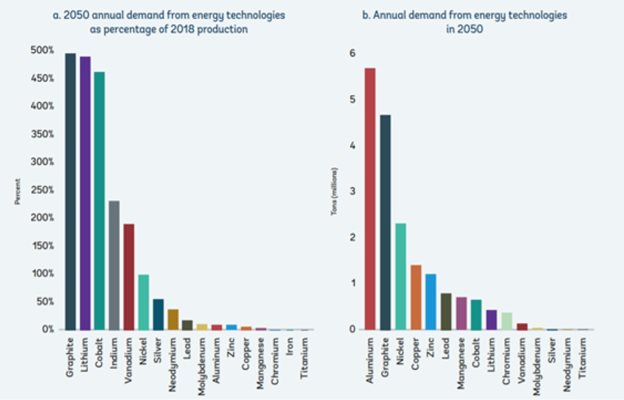

A 2020 World Bank report

entitled 'The Mineral Intensity of the Clean Energy

Transition', estimated that production of minerals underpinning the

clean energy shift would have to increase by nearly 500% by 2050 to

meet global demand for renewable energy.

Cumulative

demand for minerals needed for energy storage through 2050. Source:

World Bank

Cumulative

demand for minerals needed for energy storage through 2050. Source:

World Bank

Projected

annual mineral demand under the 2-Degree Scenario. Source: World

Bank

Projected

annual mineral demand under the 2-Degree Scenario. Source: World

Bank

Lithium, obviously a key

ingredient for making EV batteries, is set to endure an

unprecedented shortage of supply in the coming years. Global miner

Rio Tinto has said even if they had another 60 lithium mines, that

wouldn't fill the supply-demand gap. Bloomberg NEF research shows

that over five times more lithium is needed in 2030 compared to

current levels.

Another battery metal less in the

spotlight but also facing severe supply concerns is graphite.

Graphite is the only material that can be used in the lithium-ion

battery anode, there are no substitutes. This is due to the fact

that, with high natural strength and stiffness, graphite is an

excellent conductor of heat and electricity. The only other natural

form of carbon besides diamonds is also stable over a wide range of

temperatures.

According to the World Bank,

graphite accounts for nearly 53.8% of the mineral demand in

batteries, the most of any. Lithium, despite being a staple across

all Li-ion batteries, accounts for only 4% of total

demand.

An electric car contains more

than 200 pounds (>90 kg) of coated spherical graphite (CSPG),

meaning it takes 10 to 15 times more graphite than lithium to make

a Li-ion battery.

For every million electric

vehicles, which is only about 1% of the new car market, we need in

the order of 75,000 tonnes of natural graphite, representing a 10%

increase in flake graphite demand.

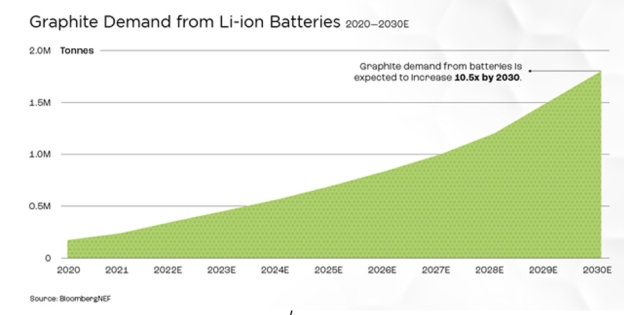

The EV battery market alone is

projected to consume well over 1.6 million tonnes of flake graphite

per year, resulting in a 10-fold increase in demand by 2030. This

is worrisome considering that total graphite mined in 2020

for all uses, including lump graphite for pencils

and graphite used in nuclear reactors, was only 1.1 million

tonnes.

It is estimated that the natural

flake graphite market could reach a deficit as soon as 2023, with

few new sources being developed around the world.

Image

by Visual Capitalist

Image

by Visual Capitalist

Critical

graphite

At the moment, nearly all

graphite processing takes place in China because of the ready

availability of graphite there, weak environmental standards and

low costs. Nearly 60% of the world's mined production last year

came from China, making it a dominant player in every stage of the

supply chain.

Data

source: USGS. Image by Visual Capitalist

Data

source: USGS. Image by Visual Capitalist

After China, the next leading

graphite producers are Mozambique, Brazil, Madagascar, Canada and

India. The United States does not produce any natural graphite and

therefore must rely solely on imports to satisfy domestic

demand.

The level of foreign dependence

has increased over the years. The US imported 38,900 tonnes of

graphite in 2016 and 70,700t in 2018.

According to the USGS, in 2020

the US imported 42,000 tons, of which 71% was high-purity flake

graphite, 28% was amorphous, and 1% was lump and chip graphite. The

top importers were China (33%), Mexico (23%), Canada (17%) and

India (9%). But remember, the US is not 33% dependent on China for

its battery-grade graphite, but 100%, since China controls all

spherical graphite processing.

It's thought that the increased

use of lithium-ion batteries could gobble up well over 1.6 million

tonnes of flake graphite per year (out of a total 2020 market, all

uses, of 1.1Mt) — only flake graphite, upgraded to 99.9% purity,

and synthetic graphite (made from petroleum coke, a very expensive

process) can be used in lithium-ion batteries.

The USGS believes that

large-scale fuel cell applications are being developed that could

consume as much graphite as all other uses combined.

Can the mining industry crank out

more graphite every year to match this demand? Call me skeptical.

Between 2018 and 2019, world mine production actually declined by

20,000 tonnes, or 1.8%. Global production in 2019 and 2020 was

exactly the same, 1.1 million tonnes.

China's

limitations

Currently there are no producing

graphite mines in the United States, and only 10,000 tonnes a year

is being mined from two facilities in Canada. The fact is, for the

United States to develop a "mine to battery" supply chain at home,

it currently has no choice but to import its raw materials from

foreign countries.

For battery-grade graphite, that

means China, which is growing increasingly adversarial, in terms of

trade, foreign policy and militarily.

Even if the US wants to keep

importing its graphite, doubts have been raised over whether China

could keep up with surging global demand. The top producer has

already taken steps to retain its graphite resources by restricting

its export quota and imposed a 20% export duty.

Metal Bulletin reported

in October that Chinese

graphite prices are likely heading higher in the last quarter of

this year due to rising electricity costs

and reduced power supply, as well as insufficient inventories and

inadequate availability of feedstock for spherical graphite

processing.

High

power costs and limits on energy consumption in China may make it

increasingly difficult for graphite producers to stockpile material

to serve customers during the winter months. Graphite producers

typically halt production from mid-November/December until

March.

Prohibitively

cold temperatures in northern China's Heilongjiang province, where

the majority of natural flake graphite production is centered,

typically prompt extended graphite production stoppages, with

producers supplying customers from inventory during the outage

period.

If

natural graphite producers in Heilongjiang are unable to produce

sufficient volumes of material for their stockpiles, given power

shortages and elevated electricity costs, we may see natural

graphite shortages emerge in the coming months, lending upward

support to prices.

In short, the days of affordable,

abundant graphite from China are numbered, adding further urgency

for the US to develop its own supply.

The demand for graphite is only

headed in one direction. A White House report on critical supply

chains showed that graphite demand for clean energy applications

will require 25 times more graphite by 2040 than was produced

worldwide in 2020.

We have clearly reached a point

when much more graphite needs to be discovered and

mined.

This is why the US is looking to

develop its own "mine to battery" supply chain, which would include

a cost-competitive and environmentally sustainable source of

graphite.

Political

support

In February of this year,

President Joe Biden signed an executive order (EO) aimed at

strengthening critical US supply chains. Graphite was specifically

identified as one of four minerals considered essential to the

nation's "national security, foreign policy and

economy."

Fortunately there are a growing

number of US politicians who like the idea of developing domestic

critical metal mines, and are working with the mining industry to

achieve results.

Among the most vocal is Alaska

Republican Senator Lisa Murkowsi. Murkowski helped draft the bipartisan

infrastructure bill recently passed by Congress. The $1.2 trillion package includes money

for research and demonstration projects and other efforts aimed at

lessening the reliance on China for the supply of critical minerals

like lithium and graphite.

In discussing America's

dependence on foreign nations such as Russia and China to meet its

resource needs, Murkoswski said:

"We need a rational,

clear-headed, eyes-wide-open approach to energy and mineral

development. We don't want to go back on energy, and we can't be

caught flat-footed on minerals. We have the resources, and we have

the highest labor standards in the world, the highest environmental

standards in the world. Our energy workers, our miners, they hold

themselves to that standard. So instead of importing more from

places like Russia and China, we need to free ourselves from them

to the extent that we can and establish ourselves as this global

alternative."

Fortunately, there is plenty of

North American graphite for local consumption, if industry and

government can find the collective will to make it

happen.

The Kigluaik Mountains on

Alaska's Seward Peninsula hosts a deposit with the size and grade

to meet the nation's growing need for graphite in Li-ion

batteries.

Graphite

One

Earlier this year, the Federal

Permitting Improvement Steering Committee (FPISC) granted

High-Priority Infrastructure Project (HPIP) status

to Graphite One Inc.

(TSXV:GPH, OTCQX:GPHOF),

which is aiming to develop America's first high-grade producer of

coated spherical graphite (CSG) integrated with a domestic graphite

resource at Graphite Creek, Alaska.

The HPIP designation allows

Graphite One to list on the US government's Federal Permitting

Dashboard, which ensures that the various federal permitting

agencies coordinate their reviews of projects as a means of

streamlining the approval process.

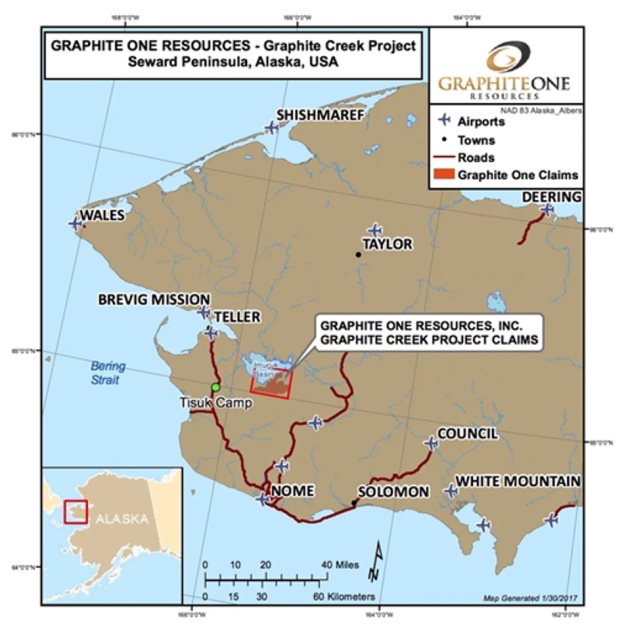

Graphite Creek is the

highest-grade and largest known flake graphite deposit in North

America, spanning a distance of 18 km.

The Graphite

Creek property is located 55 km north of Nome, Alaska

The project is envisioned as a

vertically integrated enterprise to mine, process and manufacture

high-quality CSPG for the lithium-ion electric vehicle battery

market. Graphite One aims to become the first US vertically

integrated domestic producer to do so.

The latest resource estimate

(March 2019) for Graphite Creek showed 10.95 million tonnes of

measured and indicated resources at a graphite grade of 7.8% Cg

(graphitic carbon), for some 850,000 tonnes of contained graphite.

Another 91.9 million tonnes were tagged as inferred resources, with

an average grade of 8.0% Cg containing 7.3 million

tonnes.

A Preliminary Economic Assessment

(PEA) supports a 40-year operation with a mineral processing plant

capable of producing 60,000 tonnes of graphite concentrate (at 95%

purity) per year. On a pre-tax basis, the project has a net

present value of $1.03 billion using a 10% discount rate, with an

internal rate of return (IRR) of 27%.

Once in full production, Graphite

One's proposed graphite products manufacturing plant — the second

link in its proposed supply chain strategy — is expected to turn

graphite concentrates into 41,850 tonnes of battery-grade coated

spherical graphite and 13,500 tonnes of graphite powders per

year. A location in the Pacific Northwest is being

considered.

Conclusion

There are no substitutes for

lithium and graphite; these critical metals are expected to remain

the foundation of all lithium-ion EV battery chemistries for the

foreseeable future.

Lithium is in the battery cathode

and graphite, or more precisely, coated spherical graphite, is in

the anode.

Graphite has long been used in

the aviation, automotive, sports, steel and plastic industries, as

well as in the manufacture of bearings and lubricants. Graphite is

an excellent conductor of heat and electricity, corrosion- and

heat-resistant, as well as strong and light.

Lithium-ion batteries contain 10

to 15 times more graphite than lithium. The need for lithium

batteries not only for EVs, but energy storage, handheld tools like

drills, and an array of consumer electronics like cell phones and

laptops, is almost certain to outstrip supply.

In fact, the lithium-ion battery

manufacturing capacity currently under construction would require

flake graphite production to more than double.

(BMI estimates the major

automakers have committed over $300 billion to developing EVs, and

more than 2 terawatts of lithium battery production capacity,

equating to 800,000 tonnes of new annual graphite demand by 2023

and 1.4Mt by 2028.)

To meet this demand, 12 battery

factories are being built in the United States, including Tesla's

Texas "Terafactory", which would have an annual battery production

capacity of 1 terawatt-hour, or 1,000 gigawatt-hours

(GWh).

According to BMI, just one 30 GWh

per year lithium-ion battery factory needs roughly 33,000 tonnes of

graphite anode material per year. The Texas Terafactory would

demand more than 1 million tonnes of graphite per year, about one

year's worth of current mined graphite output for all uses.

If all 12 factories are built,

they will require about 396,000 tonnes of graphite, every year.

This is nearly two-thirds the amount of graphite produced by China,

by far the largest graphite producer in the world, in 2020.

Remember, the US currently produces NO natural graphite, yet it is

consumed by roughly 90 American companies.

According to MINING.com's

EV Metal Index, graphite

prices have held steady above $700 a tonne in 2021. But the more

important number is the dramatically higher amount of graphite

being used for EV batteries. MINING.com states:

In April 2021,

just over 14,000 tonnes of synthetic and natural graphite were

deployed globally in batteries of all newly-sold passenger EVs

combined, a 233% jump over the same month last year.

The evidence piling up here leads

to only one conclusion: if we continue to rely on China and other

foreign source for graphite, the price of this indispensable EV

battery ingredient is going to go through the roof.

Explosive EV demand + tight

supply especially from China, which dominates the production of

coated spherical graphite needed for Li-ion batteries = supply

insecurity and higher prices.

There is however a happier ending

to this story, and that is taking steps to secure a domestic supply

of graphite with enough tonnage for America to reduce and even

eliminate its dependence on foreign suppliers.

In my opinion, we

can

build a North American "mine to

battery to EV" supply chain, using graphite mined and processed

from Graphite One's Graphite Creek deposit.

If we're going to spend hundreds

of billions trying to electrify and decarbonize, it just makes

sense to us at AOTH that the mining is done in-country. Leaving it

up to foreigners only weakens the supply chain, leaving it

vulnerable to breakage.

US critical minerals have been

ignored for decades but they are finally getting the attention they

deserve. Graphite One is a company on the move with the largest and

highest-grade flake graphite deposit in the United

States.

Graphite One

Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$2.18, 2021.11.30

Shares Outstanding

83.3m

Market cap Cdn$181.7m

GPH website

Richard (Rick)

Mills

aheadoftheherd.com

subscribe

to my free newsletter

Legal Notice

/ Disclaimer

Ahead of the Herd

newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the

entire Disclaimer carefully before you use this website or read the

newsletter. If you do not agree to all the AOTH/Richard Mills

Disclaimer, do not access/read this website/newsletter/article, or

any of its pages. By reading/using this AOTH/Richard Mills

website/newsletter/article, and whether you actually read this

Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard

Mills document is not, and should not be, construed as an offer to

sell or the solicitation of an offer to purchase or subscribe for

any investment.

AOTH/Richard Mills

has based this document on information obtained from sources he

believes to be reliable, but which has not been independently

verified.

AOTH/Richard Mills

makes no guarantee, representation or warranty and accepts no

responsibility or liability as to its accuracy or

completeness.

Expressions of

opinion are those of AOTH/Richard Mills only and are subject to

change without notice.

AOTH/Richard Mills

assumes no warranty, liability or guarantee for the current

relevance, correctness or completeness of any information provided

within this Report and will not be held liable for the consequence

of reliance upon any opinion or statement contained herein or any

omission.

Furthermore,

AOTH/Richard Mills assumes no liability for any direct or indirect

loss or damage for lost profit, which you may incur as a result of

the use and existence of the information provided within this

AOTH/Richard Mills Report.

You agree that by

reading AOTH/Richard Mills articles, you are acting at your OWN

RISK. In no event should AOTH/Richard Mills liable for any direct

or indirect trading losses caused by any information contained in

AOTH/Richard Mills articles. Information in AOTH/Richard Mills

articles is not an offer to sell or a solicitation of an offer to

buy any security. AOTH/Richard Mills is not suggesting the

transacting of any financial instruments.

Our publications

are not a recommendation to buy or sell a security – no information

posted on this site is to be considered investment advice or a

recommendation to do anything involving finance or money aside from

performing your own due diligence and consulting with your personal

registered broker/financial advisor.

AOTH/Richard Mills

recommends that before investing in any securities, you consult

with a professional financial planner or advisor, and that you

should conduct a complete and independent investigation before

investing in any security after prudent consideration of all

pertinent risks.

Ahead of the Herd

is not a registered broker, dealer, analyst, or advisor. We hold no

investment licenses and may not sell, offer to sell, or offer to

buy any security.

Richard owns shares of Graphite

One Inc. (TSX.V:GPH). GPH is a paid advertiser on his site

aheadoftheherd.com