false

0001593549

0001593549

2022-01-01

2022-12-31

0001593549

2022-12-31

0001593549

2021-12-31

0001593549

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001593549

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001593549

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001593549

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001593549

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001593549

us-gaap:SeriesDPreferredStockMember

2021-12-31

0001593549

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001593549

2021-01-01

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2020-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2020-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2020-12-31

0001593549

us-gaap:CommonStockMember

2020-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001593549

us-gaap:RetainedEarningsMember

2020-12-31

0001593549

2020-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2021-12-31

0001593549

us-gaap:CommonStockMember

2021-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001593549

us-gaap:RetainedEarningsMember

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2021-01-01

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2021-01-01

2021-12-31

0001593549

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001593549

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-01-01

2022-12-31

0001593549

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001593549

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001593549

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001593549

us-gaap:CommonStockMember

2022-12-31

0001593549

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001593549

us-gaap:RetainedEarningsMember

2022-12-31

0001593549

NUGN:SeriesAAndCertainSeriesCPreferredStockMember

NUGN:MsHoffmanMember

2022-03-14

2022-03-14

0001593549

us-gaap:PreferredClassAMember

NUGN:MrStybrMember

2022-03-14

0001593549

srt:ScenarioPreviouslyReportedMember

2022-01-01

2022-12-31

0001593549

srt:RestatementAdjustmentMember

2022-01-01

2022-12-31

0001593549

srt:ScenarioPreviouslyReportedMember

2021-01-01

2021-12-31

0001593549

srt:RestatementAdjustmentMember

2021-01-01

2021-12-31

0001593549

srt:ScenarioPreviouslyReportedMember

2021-12-31

0001593549

srt:RestatementAdjustmentMember

2021-12-31

0001593549

srt:ScenarioPreviouslyReportedMember

2020-12-31

0001593549

srt:RestatementAdjustmentMember

2020-12-31

0001593549

srt:ScenarioPreviouslyReportedMember

2022-12-31

0001593549

srt:RestatementAdjustmentMember

2022-12-31

0001593549

2022-09-06

0001593549

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0001593549

NUGN:PromissoryNoteMember

2020-01-26

2020-01-26

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:RevenuesMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:RevenuesMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:RevenuesMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:SalesDiscountsMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:SalesDiscountsMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:SalesDiscountsMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:MerchandiseAccountFeesMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:MerchandiseAccountFeesMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:MerchandiseAccountFeesMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:ProfessionalFeesRTSMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:ProfessionalFeesRTSMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:ProfessionalFeesRTSMember

2020-01-01

2020-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:AmortizationRTSMember

2022-01-01

2022-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:AmortizationRTSMember

2021-01-01

2021-12-31

0001593549

NUGN:LiventoGroupIncAndLiventoGroupLLCMember

NUGN:AmortizationRTSMember

2020-01-01

2020-12-31

0001593549

NUGN:MoviesMember

2022-12-31

0001593549

NUGN:ManagedRealEstateProjectsMember

2022-01-01

2022-12-31

0001593549

NUGN:ManagedRealEstateProjectsMember

2022-12-31

0001593549

NUGN:DevelopmentProjectsMember

2022-01-01

2022-12-31

0001593549

us-gaap:RealEstateMember

2022-01-01

2022-12-31

0001593549

NUGN:DevelopmentProjectMember

2022-01-01

2022-12-31

0001593549

us-gaap:RealEstateInvestmentMember

2020-03-10

0001593549

us-gaap:RealEstateInvestmentMember

2021-10-07

0001593549

us-gaap:RealEstateInvestmentMember

2022-09-06

0001593549

us-gaap:RealEstateInvestmentMember

2022-12-31

0001593549

NUGN:DevlopmentProjectResiDukeMember

2020-07-09

0001593549

NUGN:DevelopmentProjectResiDukeMember

2021-03-09

0001593549

us-gaap:RealEstateMember

2021-09-09

0001593549

NUGN:DevlopmentProjectsMember

2022-12-31

0001593549

NUGN:MovieProjectMember

2022-01-01

2022-12-31

0001593549

NUGN:MovieProjectMember

srt:MinimumMember

2022-01-01

2022-12-31

0001593549

NUGN:MovieProjectMember

srt:MaximumMember

2022-01-01

2022-12-31

0001593549

NUGN:MovieProjectMember

2022-12-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-01-01

2022-12-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

NUGN:TwoThousandAndTwentyThreeMember

2022-01-01

2022-12-31

0001593549

NUGN:ScriptCarnivalKillersMember

2020-08-25

0001593549

NUGN:ScriptWritersCarnivalMember

2020-09-10

0001593549

NUGN:ScriptWritersCarnivalMember

2021-08-24

0001593549

NUGN:ProducerFeesMember

2021-11-11

0001593549

NUGN:RunningWildWorksMember

2022-03-05

0001593549

NUGN:RunningWildWorksMember

2022-05-04

0001593549

NUGN:RunningWildWorksOneMember

2022-05-04

0001593549

NUGN:RunningWildWorksTwoMember

2022-05-04

0001593549

NUGN:CarnivalKillersWorksMember

2022-07-18

0001593549

NUGN:KidsMovie1Member

2022-07-18

0001593549

NUGN:KidsMovie1ScriptMember

2022-09-14

0001593549

NUGN:MovieXScriptMember

2022-09-14

0001593549

NUGN:ProducersWorksMovieBRMember

2022-09-14

0001593549

NUGN:MovieXScriptWritersMember

2022-09-14

0001593549

NUGN:TVSeriesMember

2022-09-25

0001593549

NUGN:ProducerWorksScriptMember

2022-10-13

0001593549

NUGN:MovieXScriptWritersMember

2022-10-19

0001593549

NUGN:ProducerWorkMovieBRMember

2022-10-11

0001593549

NUGN:R.U.ROBOTS.R.O.SavageMember

2022-11-28

0001593549

NUGN:DirectorWorkMovieBRMember

2022-12-09

0001593549

NUGN:DirectorWorkMovieBRMember

2022-12-23

0001593549

NUGN:KidsMovie1ScriptMember

2022-12-29

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-01-10

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-03-25

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-06-30

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-09-30

0001593549

NUGN:EliseeSystemDevelopmentMember

2020-12-31

0001593549

NUGN:DatabaseOfStockForAnalysis2QMember

2021-06-30

0001593549

NUGN:DEBITPAYMENTTOICONICLABSPLCRef1368435Member

2021-06-30

0001593549

NUGN:DatabaseOfStockForAnalysis3QMember

2021-11-25

0001593549

NUGN:EliseeSystemDevelopmentMember

2021-12-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2021-06-30

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2021-09-30

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2021-12-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-03-31

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-06-30

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-09-30

0001593549

NUGN:AAndImachineLearningprogramEliseeMember

2022-12-31

0001593549

NUGN:AIMachineLearningProgramMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LIVENTO

Group, Inc.

(Exact

Name of Registrant as Specified in Its Charter)

| Nevada |

|

7372 |

|

46-3999052 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification Number) |

17

State Street, Suite 4000, New York, NY 10004

Registrant’s

telephone number, including area code: (980)432-8241

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive office)

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| |

Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Commission, acting pursuant to such Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS

SUBJECT TO COMPLETION, DATED FEBRUARY 16, 2024

LIVENTO

GROUP, INC.

55,555,556

Shares of common stock

27,777,778

Shares of common stock Issuable Upon Exercise of Warrants

The

selling stockholders named in this prospectus may offer and sell, from time to time, in one or more offerings, up to an aggregate of

83,333,333 shares of our common stock, par value $0.001 per share consisting of (i) 55,555,556 shares issuable under the Equity

Line Purchase Agreement (defined below and described in the section entitled “Recent

Developments – Equity Line of Credit Financing”)

using an adjusted price of $0.009 for the per share purchase price, (ii) 27,777,778 shares issuable upon exercise of warrants issued

to Alumni Capital LP at an exercise price per warrant share calculated by dividing $15,000,000 by the total number of outstanding

shares of common stock as of the exercise date. We may receive proceeds from the exercise of warrants, however, there is no guarantee

that warrants will be exercised. The shares of our common stock may be sold publicly or through private transactions by the selling

stockholders at prevailing market prices or at negotiated prices at the times of sale. The shares of common stock may be offered

by the selling stockholders to or through underwriters, dealers or other agents, directly to investors or through any other manner permitted

by law, on a continued or delayed basis. We provide more information about how the selling stockholders may sell or otherwise dispose

of the shares of common stock in the section entitled “Plan

of Distribution”

beginning on page 23 of this prospectus.

We

are not selling any shares of common stock in this offering, and we will not receive any proceeds from the sale of shares by the

selling stockholders. The registration of the securities covered by this prospectus does not necessarily mean that any of these securities

will be offered or sold by the selling stockholders. The timing and amount of any sale is within the respective selling stockholders’

sole discretion, subject to certain restrictions. To the extent that any selling stockholder resells any securities, the selling stockholder

may be required to provide you with this prospectus identifying and containing specific information about the selling stockholder and

the terms of the securities being offered.

Shares

of our common stock are listed on the OTCMarkets (“OTC”) under the symbol “NUGN”. On February 12,

2024, the last sale price per share of our common stock as reported on OTCMarkets .com was $0.009.

Investing

in our common stock involves risks that are described in the “Risk Factors” section in any other annual, periodic

or current report incorporated by reference into this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is [February 11, 2024].

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”), using

a “shelf” registration process. Under this shelf registration process, the selling stockholders may, from time to time, offer

and sell shares of common stock offered under this prospectus. We will not receive any proceeds from the sale by the selling stockholders

of the common stock offered by them described in this prospectus.

We

and the selling stockholders have not authorized anyone to provide any information or make any representations other than those contained

in this prospectus. We and the selling stockholders take no responsibility for, and can provide no assurance as to the reliability of,

any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under

circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information

or to represent anything not contained in this prospectus. This prospectus is not an offer to sell securities, and it is not soliciting

an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is current

only as of its date. Our business, financial condition, results of operations and prospects may have changed since its date.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described in the section entitled “Where

You Can Find More Information.”

The

selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers

and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus regardless of

the time of delivery of this prospectus or of any sale of common stock. Neither the delivery of this prospectus, nor any sale

made hereunder, will under any circumstances create any implication that there has been no change in our affairs since the date hereof

or that the information contained herein is correct as of any time subsequent to the date of such information.

For

investors outside the United States: Neither we nor the selling stockholders, have done anything that would permit this offering or possession

or distribution of this prospectus in connection with this offering in any jurisdiction, other than the United States, where action for

that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about,

and observe any restrictions relating to, the offering of our common stock and the distribution of this prospectus outside the

United States and in their jurisdiction.

Unless

otherwise indicated or the context otherwise requires, all references in this prospectus to “LIVENTO” or the “Company,”

“we,” “our,” “ours,” “us” or similar terms refer to LIVENTO GROUP, Inc., together with

its consolidated subsidiaries.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this prospectus

can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,”

“should,” “plan,” “intend,” “may,” “predict,” “continue,” “estimate,”

and “potential,” or the negative of these terms or other similar expressions.

Forward-looking

statements appear in a number of places in this prospectus and include, but are not limited to, statements regarding our intent, beliefs

or current expectations. These forward-looking statements include information about possible or assumed future results of our business,

financial condition, results of operations, liquidity, plans and objectives. Forward-looking statements are based on our management’s

beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including,

but not limited to, those identified described in the section “Risk Factors” in any other annual, periodic or current report

incorporated by reference into this prospectus. The statements we make regarding the following matters are forward-looking by their nature:

| ● |

our

growth prospects and strategies; |

| ● |

launching

new movies and distribution of existing movies that are commercially successful; |

| ● |

our

expectations regarding significant drivers of our future growth; |

| ● |

our

ability to retain and increase movie library and develop new movie titles; |

| ● |

competition

from companies including other movie production companies and studios and both large and small, public and private media companies; |

| ● |

our

ability to attract and retain a qualified management team and other team members while controlling our labor costs; |

| ● |

our

ability to successfully enter new markets and manage our international expansion; |

| ● |

protecting

and developing our brand and intellectual property portfolio; |

| ● |

costs

associated with defending intellectual property infringement and other claims; |

| ● |

our

future business development, results of operations and financial condition; |

| ● |

the

effects of the COVID-19 pandemic and the ongoing international conflicts, on our business and the global economy generally, including

inflation and interest rates; |

| ● |

our

plans to pursue and successfully integrate strategic acquisitions; |

| ● |

other

risks and uncertainties described in this prospectus, including those described in the section entitled “Risk Factors”

in any other annual, periodic or current report incorporated by reference into this prospectus; and |

| ● |

assumptions

underlying any of the foregoing. |

Further

information on risks, uncertainties and other factors that could affect our financial results are included in our filings with the Securities

and Exchange Commission (the “SEC”) from time to time, including in the section entitled “Risk Factors” in any

other annual, periodic or current report incorporated by reference into this prospectus. You should not rely on these forward-looking

statements, as actual outcomes and results may differ materially from those expressed or implied in the forward-looking statements as

a result of such risks and uncertainties. All forward-looking statements in this prospectus are based on management’s beliefs and

assumptions and on information currently available to us, and we do not assume any obligation to update the forward-looking statements

provided to reflect events that occur or circumstances that exist after the date on which they were made.

PROSPECTUS

SUMMARY

This

summary highlights certain information contained elsewhere in this prospectus. This summary is not complete and does not contain all

the information that may be important to you. We urge you to read this entire prospectus carefully, including the sections entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our

consolidated financial statements and notes thereto included in our Annual Report on Form 10-K, Quarterly Report on Form 10-Q filed on

May 15, 2023, and Quarterly Report on Form 10-Q filed on November 14, 2023, which are published on SEC.GOV, before making an investment

decision. Some of the statements made in this prospectus discuss future events and developments,

including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks

and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements.

See “Cautionary Statement Regarding Forward-Looking Statements”.

Company

Overview

Our

Company has two distinct operations, namely; BOXO a film development operation, Robotics primarily consisting of ELISE a propriety

Artificial Intelligence Software product (“ELISE” or “AI Software”).

Present

Operations - BOXO

The

Company formed BOXO Productions, Inc., a Delaware corporation (“BOXO”), on June 17, 2022 as a wholly owned subsidiary. BOXO

previously operated as a division of Livento that operated since 2020, where we meet with top film and movie producers. BOXO’s

business model is strongly oriented toward the growing demand for content to fill cinemas after COVID19 and the expansion of online content

distributors. BOXO Productions will hold all assets related to Company’s business in movies in the future and currently doesn’t

employ any personnel. In most of its projects, BOXO is not primarily dependent on the movie’s success, as a distributor pays it

before the film is finalized and receives a share of the revenue from cinemas’ box office and home sales. BOXO plans to produce

up to 6 movies and 12 television productions during 2024 and increase this number based on the success of this prospectus in raising

capital investment. BOXO also intends to participate in other films based on management’s assessment of their potential success

in cinemas already in the post-production phase. BOXO will focus on negotiating distribution agreements that provide for its sharing

in the box office sales of these movies. Scripts are chosen by BOXO’s production team, which regularly receives offers from authors

commonly involved in the film industry. BOXO may acquire movie or television rights in various stages of development. Less frequently,

BOXO receives offers for participating in a project’s post-production phase. BOXO finances movies via internal resources, loans,

and investors depending on the project’s state of development and the Company’s cash position.

During

2022 BOXO started production of three movies, Carnival of Killers, Wash Me in the River and Running Wild. These projects received an

initial investment from Livento of USD 400,000 each. Two of these projects, Carnival of Killers and Running Wild are expected to enter

the development stage of production competed in the summer of 2023 and filming and postproduction should end during 4Q 2024. The movie

Wash Me in the River was released in Q4 of 2022.

We

are in early stages of producing other movies that will be announced during the end of 2023 and early 2024 once all the relevant agreements

are finalized.

The

team has been involved either as producers, executive producers, or agents over the years on the following movies, which have been aired

both in theaters and streaming services such as Netflix, Prime Video, Paramount, and Disney Plus:

| ● |

The

Misfits; a 2021 Action/Thriller featuring Pierce Brosnan |

| ● |

Packaging

of Ironman movie |

| ● |

Black

Swan; a 2010 Drama/Thriller featuring Natalie Portman, Mila Kunis, Winona Ryder, and Vincent Cassel |

| ● |

Extremely

Wicked, Shockingly Evil and Vile; a 2019 Crime/Drama featuring John Malkovich and Zac Efron |

| ● |

Marley

& Me; a 2008 Comedy/Drama featuring Jennifer Aniston and Owen Wilson |

| ● |

The

Last Full Measure; a 2019 War/Drama featuring Samuel L. Jackson and Ed Harris |

| ● |

Worth;

a 2020 Drama featuring Michael Keaton and Stanley Tucci Jr. |

| ● |

American

Traitor: The Trial of Axis Sally; a 2021 Drama that features Al Pacino |

| ● |

Best

Sellers; a 2021 Drama/Comedy featuring Michael Caine and Cary Elwes |

Currently,

the Company’s primary focus is the activities of BOXO Productions. As previously mentioned, new movies and television productions

are started monthly, with the target being six movies this year. The Company will use the proceeds of the condominium sales to fund the

activity and operations of BOXO.

The

BOXO team is comprised of three consultants that have been in the production business for last 20 – 30 years and has experience

with large productions as the above-mentioned examples. They have together worked on approximately 300 movie projects over the years.

While the terms of our financings vary from movie to movie, we generally form a limited liability company and serve as its managing member.

Our cash investment, in addition to performing the tasks typical of a producer, is generally from $300,000 to $700,000. The rest of the

costs of the movie are provided by investors. We typically retain a 20 % interest in cash flow, although each movie will be done on differing

terms reflecting market conditions and investors’ assessments of the risk involved.

Trends

in the Our Markets - BOXO

Management

believes that the entertainment industry is experiencing structural changes. COVID19 changed the movie distribution business and offered

new business models and potential growth to participants who provide apps and streaming content directly to consumers through the Internet.

Based on management’s analysis of recent market statistics and trends, we believe these models have become dominant trends in this

market segment.

Management

also believes that these trends will continue and that there is a large market for BOXO’s films and television productions. The

movie production market has expanded significantly in the last two years and is likely to continue growing significantly in the coming

years. Management has observed that online streaming platforms continually require new content, and an increased number of connected

devices will likely result in more customers using these services. In the next few years, many developed and emerging nations will add

new customers to the network.

Present

Operations - ROBOTICS : AI Software - ELISE

The

Company has internally developed software called “ELISEE” that can capture large amounts of data and create predictive behavior

based on client inputs that assist the client in establishing its investment portfolio. Successfully building an equity portfolio is

not simple since one must consider the future of particular industries and the companies within them. Retail investors and Family Offices

lack complex historical data, and this is where ELISEE excels. This data has been acquired from Dow Jones and other public sources and

dissected and analyzed. We believe in diversification but place more emphasis on those industries and companies with a more promising

outlook based on guidance from ELISEE. Management believes each potential customer’s financial situation and investment needs are

unique. We see the constant shift of the world’s financial markets, real estate prices, CPI data, and effective portfolio management

as the key to success.

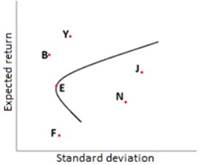

ELISE,

our software product, uses algorithms that read market data and neurological network abilities to determine the best path forward and

make ongoing corrections over time. The main idea is based on reducing risk by investing in several assets. Investors should approach

assets individually and carefully assemble them into their portfolios. When creating an optimal portfolio, ELISEE constantly measures

two factors. The first factor is a parameter expressing potential profitability, and the second parameter represents risk. It is necessary

to consider the riskiness of the individual assets in the portfolio, their mutual covariance, or their mutual correlation to calculate

the risk of the entire portfolio. Covariance expresses the extent to which two investment instruments move in the same direction at a

specific time.

Our

competitors are other A.I. database and algorithm programming companies delivering services to clients like banks and asset managers.

ELISEE is diversification tool.

The

investor could create his portfolio from all the points in the picture. But only points E, N, and J form an admissible set suitable for

the investor. This set is also bounded by the efficient frontier, characterized by the rational investor choosing only those portfolios

that offer the maximum expected return for the specified amount of risk. And at the same time, he chooses a portfolio that provides him

the minimum risk for the given amount of expected return. If the investor chooses point E, he can no longer create a better mix of stocks

in his portfolio. If an investor establishes a portfolio from any combination lying on the efficient frontier, it will be the best possible

portfolio combination in the given situation.

We

identified this as a unique opportunity to support several companies with different needs and to aid them in their asset selection process.

We developed our system that can read large amounts of data and run portfolio analyses on these assets, providing improved portfolio

management and performance.

The

system’s development commenced in early 2018, and the first version took one year of development and testing with various basic

data sets. Currently, Livento has a team of three analysts who focus on the maintenance and further development of the system. We are

continually developing and improving our software, making it more robust, stable, and capable of supporting an increased number of asset

classes.

Key

summary of points for ELISE:

| |

● |

ELISE

was developed and tested over four years. |

| |

● |

ELISEE

has had a successful and profitable track record for three years. |

| |

● |

ELISEE

can process 1 TB (terabyte) of data per hour. |

| |

● |

ELISEE

uses neurological network algorithms to determine and analyze large data portions. |

Marketing

Strategy

Our

marketing strategy comprises the following components; social media (Twitter, LinkedIn, FB, etc.), PR and video communications, and a

personal approach. The strategy differs based on the product offered. They may be described as follows:

Social

media:

We

can rapidly, quickly, and reliantly inform all stakeholders about necessary and relevant news. We use promotional posts to gain company

followers.

PR

and video communications:

A

professional IR agency was hired to write our PR communications, arrange interviews with Management, write articles, and introduce them

via different channels to the media. Video interviews and conference attendance are also planned for more prominent investors’

involvement.

Personal

approach:

Our

software uses a direct and personal approach via different marketing channels, including social networks, industry liaisons, and articles

in specialized magazines.

Recent

Developments

Equity

Line of Credit Financing

On

January 25, 2024, the Company entered into a securities purchase agreement (the “Equity Line Purchase Agreement”)

with an accredited investor (the “Equity Line Investor”). The Equity Line Purchase Agreement allows the Company to

sell up to $500,000 of shares of the Company’s common stock (the “common stock”),

upon the terms and subject to the conditions and limitations set forth therein, until

December 31, 2025.

Pursuant

to the terms of the Equity Line Purchase Agreement, the Company has the right, but not the obligation, at any time until December 31,

2025, to require the Equity Line Investor to purchase the number of shares of common stock (the “Purchase Notice Shares”)

set forth on a written notice from the Company (the “Purchase Notice”). The Company will deliver the Purchase Notice Shares

concurrently with the Purchase Notice, which will be deemed delivered on the same business day if the Equity Line Investor receives the

Purchase Notice Shares and the Purchase Notice (the “Purchase Notice Date”). The purchase price at which the Company may

sell the Purchase Notice Shares will be the volume-weighted average price (“VWAP”) of the common stock on the Nasdaq Stock

Market for the five business days prior to a date on which a closing occurs, multiplied by 90%.

The

Company is issuing to the Equity Line Investor a five year warrant (the

“Equity Line Warrant”) entitling the Investor to

purchase up to $250,000 of shares of common stock at an exercise price per warrant share calculated by dividing $15,000,000 (the

“Valuation”) by the total number of outstanding shares of common stock as of the Exercise Date (the “Equity Line Warrant

Exercise Price”) and expires five years from the date of issuance. The Equity Line Warrant Exercise Price is subject to customary

adjustments for stock dividends, stock splits, recapitalizations and the like.

Pursuant

to the Equity Line Purchase

Agreement, the Company agreed to file a resale registration statement covering the resale of the Securities with the SEC and to use best

efforts to cause such resale registration statement to be declared effective by the SEC within certain time frames. Effectiveness

of the registration statement is a condition to the Company’s ability to issue a Purchase Notice.

The

Purchase Agreement provides customary representations, warranties and covenants of the Company and the Equity Line Investor.

The

Equity Line Investor is an underwriter within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities

Act”). The registration of the shares hereunder does not mean that the Equity Line Investor will actually purchase or that the

Company will actually issue and sell all or any of the $500,000 in shares of our common stock being registered pursuant to this registration

statement.

All

capitalized terms not defined herein shall have their respective meanings as set forth in the Equity Line Purchase Agreement and

Equity Line Warrant. The foregoing descriptions of the Equity Line Purchase Agreement and Equity Line Warrant do not purport to be complete

and each is qualified in its entirety by reference to the full text of the Equity Line Purchase Agreement and Equity Line Warrant, the

forms of which are filed as Exhibits 4.1 and 10.1, respectively, to this Current Report on Form 8-K and are incorporated herein by

reference.

Entry

into the Equity Line of Credit Financing described herein was approved by the Company’s board of directors on January 22, 2024.

All

capitalized terms not defined in this Recent Developments section shall have their respective meanings as set forth in the Equity Line

Purchase Agreement and Equity

Line Warrant. The foregoing descriptions of the Equity Line Purchase Agreement and Equity Line Warrant do not purport to be complete

and each is qualified in its entirety by reference to the full text of the Equity Line Purchase Agreement and Equity Line Warrant, the

forms of which are filed as exhibits to this registration statement.

The

shares

of common stock issuable pursuant to the Equity Line Purchase Agreement, the Equity Line Warrant, and the shares of common stock

issuable upon exercise of the Equity Line Warrants were, and will be, offered pursuant to an exemption from the registration

requirements under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder, or in the event of

an issuance of shares of common stock underlying the Equity Line Warrants on a cashless basis, pursuant to the exemption provided

in Section 3(a)(9) under the Securities Act.

Corporate

Information

Livento

Group is company specializing in the development and growth of disruptive business models. Our main area of business is production of

premium film and television content for international audiences across multiple genres under new brand BOXO Productions. We develop as

well proprietary artificial intelligence (AI) & machine learning products that incorporate risk analysis, predictive maintenance

and operational forecasting into our decision making process.

Corporate

History

We

were incorporated in the State of Nevada on October 30, 2013, under the name “Bling Marketing, Inc.”. Until December 29,

2014, we were a wholesaler of jewelry, principally earrings, rings, and pendants (“BMI Business”). We recognized a minimal

amount of sales from operations before the three months ending June 30, 2014, and were accordingly classified as a shell company. During

the three-month ended June 30, 2014, we began working with several distributors to sell our jewelry products to retail outlets and, as

a result, recognized sales revenue of $22,025 during the said period. On September 11, 2014, we filed a Current Report on Form 8-K indicating

that we were no longer a shell company as defined by Rule12b-2 of the Exchange Act in light of our operations through the quarter that

ended June 30, 2014.

On

December 26, 2014, we entered into an Agreement and Plan of Merger (“Nugene Merger Agreement”) with NuGene Inc., a California

corporation (“NuGene”). On December 29, 2014 (the “Closing Date”), we filed a certificate of merger in the State

of California whereby our subsidiary, NG Acquisition Inc. (“Acquisition Sub”), merged with NuGene. As a result, NuGene, the

surviving entity, became our wholly owned subsidiary. The transaction under the Nugene Merger Agreement was deemed to be a reverse merger,

whereby the Company (the legal acquirer) is considered the accounting acquiree and NuGene is considered the accounting acquirer, and

NuGene (the legal acquiree) is considered the accounting acquirer. The assets, liabilities, and operations of the acquired entity, NuGene,

were brought forward at their book value, and no goodwill was recognized.

In

2021, Livento Group LLC moved more forward as well in movie projects and started to shift its position from real estate towards movies.

We continued to developELISE platform for new clients in USA and our real estate projects started to being realized and developed. The

Company name was changed to Livento Group, Inc. in February 2015.

We

have proprietary rights to trademarks, trade names and service marks appearing in this prospectus that are important to our business.

Solely for convenience, the trademarks, trade names and service marks may appear in this prospectus without the ® and ™ symbols,

but any such references are not intended to indicate, in any way, that we forgo or will not assert, to the fullest extent under applicable

law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names

and service marks appearing in this prospectus are the property of their respective owners.

DESCRIPTION

OF PROPERTY

We

currently occupy space within serviced office suites in New York City and Prague in the Czech Republic. Since our employees and consultants

work virtually, we believe this arrangement is adequate for us and allows us to operate at a very low cost. In the future, if we require

more office space, we will acquire appropriate quarters within which to operate.

Our

principal offices are located at 17 State Street, Suite 4000, New York, NY 1004 We do not currently lease or own any other real property.

We do not currently lease or own any other real property in the US. Depending upon the success of this offering, if we require more office

space, we will acquire office space suitable for specific business within which to operate.

The

Offering

This

prospectus relates to the offer and sale from time to time of up to an aggregate of 55,555,556

shares of the Company’s common stock by the selling stockholders.

Under

the terms of the Equity Line Purchase Agreement entered into with the selling stockholders, we agreed to register with the shares

of common stock issuable pursuant to the Equity Line Purchase Agreement and upon the exercise of the Equity Line Warrant.

The number of shares ultimately offered for resale by the selling stockholders depends upon how

many shares are issuable in connection with purchase notices pursuant to the Equity Line Purchase Agreement and exercise of the Equity

Line Warrant, and the liquidity and market price of shares of our common stock. We have used a price per share

of common stock of $0.009 solely for the purposes of making a good faith estimate as to a reasonable number of shares issuable

pursuant to the Equity Line Purchase Agreement

and exercise of the Equity Line Warrant to be registered.

| Issuer |

|

LIVENTO

Group, INC. |

| |

|

|

| common

stock to be offered by the selling stockholders |

|

The

selling stockholders are offering up to 55,555,556 shares of the Company’s common stock, par value $0.0001 per share. |

| |

|

|

| common

stock outstanding prior to this offering

(1) |

|

815,903,962

shares of common stock. |

| |

|

|

| common

stock to be outstanding after the offering

(1) |

|

899,237,295

shares of common stock if all the Warrants are exercised in full and the Notes are converted in full. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of common stock by the selling stockholders. All of the net proceeds from the

sale of shares of our common stock will go to the selling stockholders as described below in the sections entitled “Selling

Stockholders” and “Plan of Distribution”. We have agreed to bear the expenses relating to the registration of the

shares of common stock for the selling stockholders. |

| |

|

|

| Risk

factors |

|

Investing

in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth

in the “Risk Factors” section beginning on page 9 before deciding to invest in our securities. |

| (1) |

The

number of shares of our common stock outstanding prior to and to be outstanding immediately after this offering, as set forth in

the table above, is based on 815,903,962 shares outstanding as of February 12, 2024. |

Item

3. Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges.

Consolidated

Financial Information

LIVENTO

GROUP, INC., AND SUBSIDIARIES

Condensed

Consolidated Balance Sheet

(Unaudited)

| | |

AS OF SEP 30, 2023 | | |

AS OF DEC 31, 2022 | |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalent | |

| 189,578 | | |

| 24,159 | |

| Accounts Receivable | |

| 367,204 | | |

| 489,910 | |

| Other Current Assets | |

| | | |

| | |

| Other Accounts Receivable | |

| 329,666 | | |

| 121,460 | |

| Total Other Current Assets | |

| 329,666 | | |

| 121,460 | |

| Total Current Assets | |

| 886,448 | | |

| 635,529 | |

| | |

| | | |

| | |

| Long Term Assets | |

| | | |

| | |

| Long Term Investments | |

| 341,470 | | |

| 9,952,880 | |

| Property & Equipment | |

| 51,637 | | |

| - | |

| Intangible Assets | |

| 49,266,263 | | |

| 15,118,847 | |

| Accumulated Amortization & Depreciation | |

| (3,809,061 | ) | |

| (2,391,999 | ) |

| Total Fixed Assets | |

| 45,850,309 | | |

| 22,679,728 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

| 46,736,757 | | |

| 23,315,257 | |

| | |

| | | |

| | |

| LIABILITIES & EQUITY | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts Payable | |

| 657,870 | | |

| 139,530 | |

| Other Current Liabilities | |

| | | |

| | |

| Other Payables | |

| 54,293 | | |

| 62,549 | |

| Total Other Current Liabilities | |

| 54,293 | | |

| 62,549 | |

| Total Current Liabilities | |

| 712,164 | | |

| 202,079 | |

| | |

| | | |

| | |

| Long-Term Liabilities | |

| | | |

| | |

| Co-Investments | |

| 3,315,970 | | |

| 3,046,017 | |

| Long-Term Busines Loans | |

| 26,383 | | |

| - | |

| Total Long-Term Liabilities | |

| 3,342,353 | | |

| 3,046,017 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 4,054,517 | | |

| 3,248,096 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Common Stock | |

| 36,734 | | |

| 22,700 | |

| Common Stock to Issue after AGM | |

| 39,159 | | |

| - | |

| Preferred Stock | |

| 9,523, | | |

| 2,234 | |

| Additional Paid in Capital | |

| 61,221,669 | | |

| 32,493,023 | |

| Retained Earnings | |

| (18,635,864 | ) | |

| (12,450,797 | ) |

| Non-Controling Interest | |

| 11,020 | | |

| - | |

| Total Equity | |

| 42,682,240 | | |

| 20,067,160 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES & EQUITY | |

| 46,736,757 | | |

| 23,315,257 | |

The

accompanying notes are an integral part of these condensed financial statement.

LIVENTO

GROUP, INC., AND SUBSIDIARIES

Condensed

Statements of Operations

(Unaudited)

| | |

Three

Months ended

September

30, | | |

Nine

months ended

September

30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| ORDINARY ICOME/EXPENSE | |

| | | |

| | | |

| | | |

| | |

| Income | |

| | | |

| | | |

| | | |

| | |

| Revenues | |

| 586,643 | | |

| 350,000 | | |

| 1,509,294 | | |

| 1,030,202 | |

| Total Income | |

| 586,643 | | |

$ | 350,000 | | |

$ | 1,509,294 | | |

$ | 1,030,202 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of Goods Sold | |

| | | |

| | | |

| | | |

| | |

| Merchant Account Fees | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Professional fees RTS | |

| 91,249 | | |

| 183,134 | | |

| 697,966 | | |

| 226,879 | |

| Amortization RTS | |

| 736,170 | | |

| 419,353 | | |

| 1,579,263 | | |

| 1,258,058 | |

| Total COGS | |

$ | 827,419 | | |

$ | 602,487 | | |

$ | 2,277,229 | | |

$ | 1,484,937 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

$ | (240,776 | ) | |

$ | (252,487 | ) | |

$ | (767,935 | ) | |

$ | (454,734 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Expense | |

| | | |

| | | |

| | | |

| | |

| Advertising & marketing | |

| 283,907 | | |

| 17,399 | | |

| 315,372 | | |

| 52,226 | |

| Bank Charges | |

| 3,421 | | |

| 314 | | |

| 6,629 | | |

| 573 | |

| Commissions & fees | |

| 6,565 | | |

| 3,937 | | |

| 62,695 | | |

| 3,937 | |

| Contract labor | |

| 184,787 | | |

| 37,510 | | |

| 445,162 | | |

| 38,476 | |

| Contractors | |

| 2,105 | | |

| 0 | | |

| 2,602 | | |

| 0 | |

| General business expenses | |

| 7,341 | | |

| 12,857 | | |

| 20,711 | | |

| 21,183 | |

| Insurance | |

| 20 | | |

| 0 | | |

| 1,040 | | |

| 0 | |

| Legal & accounting services | |

| 45,703 | | |

| 11,235 | | |

| 80,400 | | |

| 26,264 | |

| Professional Fees | |

| 26,591 | | |

| 43,500 | | |

| 209,563 | | |

| 88,500 | |

| Office expenses | |

| 2,526 | | |

| 1,602 | | |

| 4,850 | | |

| 1,766 | |

| Payroll expenses | |

| 46,368 | | |

| 0 | | |

| 144,632 | | |

| 0 | |

| Rent | |

| 701 | | |

| 1,301 | | |

| 4,435 | | |

| 1,484 | |

| Travel | |

| 2,502 | | |

| 840 | | |

| 19,238 | | |

| 840 | |

| Uncategorized Expense | |

| 8 | | |

| 0 | | |

| 131 | | |

| 0 | |

| Stock based compensation | |

| 327,340 | | |

| 0 | | |

| 4,053,961 | | |

| 0 | |

| Taxes paid | |

| 175 | | |

| 0 | | |

| 1,415 | | |

| 0 | |

| Total Expense | |

$ | 940,059 | | |

$ | 130,496 | | |

$ | 5,372,836 | | |

$ | 235,249 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Ordinary Income | |

$ | (1,180,835 | ) | |

$ | (382,983 | ) | |

$ | (6,140,771 | ) | |

$ | (689,983 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income/Expense | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income | |

| 298 | | |

| 100,000 | | |

| 287 | | |

| 100,000 | |

| Other Expense | |

| 0 | | |

| 0 | | |

| | | |

| 0 | |

| Net Other Income | |

$ | 298 | | |

$ | 100,000 | | |

$ | 287 | | |

$ | 100,000 | |

| | |

| | | |

| | | |

| | | |

| | |

Net

loss | |

$ | (1,180,537 | ) | |

$ | (282,983 | ) | |

$ | (6,140,484 | ) | |

$ | (589,983 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Net

loss per share - basic and diluted | |

| (0 | ) | |

| (0 | ) | |

| (0 | ) | |

| (0 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding, basic and diluted | |

| 367,335,929 | | |

| 209,001,268 | | |

| 294,896,185 | | |

| 209,001,268 | |

The

accompanying notes are an integral part of these condensed financial statements.

RISK

FACTORS

Investing

in our Shares involves risk. In evaluating the Company and an investment in the Shares, careful consideration should be given to the

following risk factors, in addition to the other information included in this Offering circular. Each of these risk factors could materially

adversely affect The Company’s business, operating results or financial condition, as well as adversely affect the value of an

investment in our Shares. The following is a summary of the most significant factors that make this offering speculative or substantially

risky. The company is still subject to all the same risks that all companies in its industry, and all companies in the economy, are exposed

to. These include risks relating to economic downturns, political and economic events and technological developments (such as cyber-security).

Additionally, smaller companies like ours are inherently more risky than more developed companies. You should consider general risks

as well as specific risks when deciding whether to invest.

COVID-19

Risks Related to the Company

The

COVID-19 pandemic has posed specific risks related to our Company and continues to do so. Specifically it makes it difficult for us to

evaluate specific projects visit certain areas easily, meet with potential investors and joint venture partners. Some finance companies

may also determine that because we are a smaller company, that we will delayed unreasonably in our ability to acquire and develop a film

property in a timely manner. This may influence them in a negative manner and make decisions based on those estimates of our potential

future performance.

Where

the existing properties are scheduled, there may be unforeseen delays and late payments due to COVID-19. This may reduce our ability

to obtain financing for those projects if delayed. This will require the Company to purchase the film property without financing, be

asked to agree to unreasonable terms or abandon those projects altogether. This will increase our cost and create delays in acquiring

projects.

There

is, however, a potential upside to the COVID-19 disruption. If we can obtain the confidence of investors, we may be able to target projects

where other competitors have been delayed or disrupted. We would typically have to make a fast, all-cash, offer on such projects in order

to negotiate a purchase. We would expect to obtain such projects at a discount relative to the normal market.

In

either case the COVID-19 pandemic will cause continued disruption in the film industry for an unknown time period. This may result in

the delayed expansion of the Company’s operations.

Risks

Related to the Company

As

of September 30, 2023, we have generated revenue of $586,643 and generated a loss of $240,776. As a consequence, it is difficult, if

not impossible, to forecast our future results based upon our historical data. Because of the related uncertainties, we may be hindered

in our ability to anticipate and timely adapt to increases or decreases in revenues and increases in expenses. If we make poor budgetary

decisions as a result of unreliable data, we may never become profitable or incur losses, which may result in a decline in our stock

price.

The

company has realized significant operating losses to date and expects to incur losses in the future

The

company has operated at a loss since inception, and these losses are likely to continue. The Company’s net loss for the period

ending September 30, 2023, was $240,776. Until the company achieves profitability, it will have to seek other sources of capital in order

to continue operations.

The

Company has limited capitalization and a lack of working capital and as a result is dependent on raising funds to grow and expand its

business.

The

Company lacks sufficient working capital in order to execute its business plan. The ability of the Company to move forward with its objective

is therefore highly dependent upon the success of the offering described herein. Should we fail to obtain sufficient working capital

through this offering we may be forced to abandon our business plan.

Because

we have a limited history of operations we may not be able to successfully implement our business plan.

We

have less than 5 years of full operational history in our industry. Although the Company is working with many experienced individuals

and companies with decades of film industry experience, our Company has a much shorter time frame working with these entities. Accordingly,

our operations are subject to the risks inherent in the establishment of a young business enterprise, including access to capital, successful

implementation of our business plan and limited revenue from operations. We cannot assure you that our intended activities or plan of

operation will be successful or result in revenue or profit to us and any failure to implement our business plan may have a material

adverse effect on the business of the Company.

We

are a recently reorganized corporation with a limited operating history, and we may not be able to successfully operate our business

or generate sufficient operating cash flows to make or sustain distributions to our stockholders.

The

Company formed BOXO Productions, Inc., a Delaware corporation (“BOXO”), on June 17, 2022 as a wholly owned subsidiary of

the Company and we have a limited operating history as a standalone business. Our financial condition, results of operations and ability

to make or sustain distributions to our stockholders will depend on many factors, including:

| |

● |

our

ability to identify attractive projects and other investment opportunities that are consistent with our investment strategy; |

| |

|

|

| |

● |

our

ability to consummate financing on favorable terms; |

| |

|

|

| |

● |

our

ability to contain production and other operating costs; |

| |

|

|

| |

● |

our

ability to absorb costs that are beyond our control, such as actors and writers strikes, insurance premiums, litigation costs and

compliance costs; and |

| |

|

|

| |

● |

economic

conditions in our markets, as well as the condition of the financial film industry and the economy generally. |

We

are dependent on the sale of our securities to fund our operations.

We

are dependent on the sale of our securities to fund our operations, and will remain so until we generate sufficient revenues to pay for

our operating costs. Our Officers and Directors have not made any written commitments with respect to providing a source of liquidity

in the form of cash advances, loans and/or financial guarantees. There can be no guarantee that we will be able to successfully sell

our equity securities. Such liquidity and solvency problems may force the Company to cease operations if additional financing is not

available. No known alternative resources of funds are available in the event we do not generate sufficient funds from operations.

The

Company is dependent on the hiring and maintaining key personnel and loss of the services of any of these individuals could adversely

affect the conduct of the Company’s business.

Our

business plan is significantly dependent upon the ability to hire and retain qualified individuals and key personal, who may be appointed

as officers and directors, and their continued participation in our Company. It may be difficult to replace any of them at the expansion

stage of development of the Company. The loss by or unavailability to the Company of their services would have an adverse effect on our

business, operations and prospects, in that our inability to replace them could result in the loss of one investment. There can be no

assurance that we would be able to locate or employ personnel to replace any of our officers, should their services be discontinued.

In the event that we are unable to locate or employ personnel to replace our officers we would be required to cease pursuing our business

opportunity, which would result in a loss of your investment.

Our

Certificate of Incorporation and Bylaws limit the liability of, and provide indemnification for, our officers and directors.

Our

Certificate of Incorporation, including controlling state statute permits us to indemnify our officers and directors to the fullest extent

authorized or permitted by law in connection with any proceeding arising by reason of the fact any person is or was an officer or director

of the Company. Furthermore, our Certificate of Incorporation provides that no director of the Company shall be personally liable to

it or its shareholders for monetary damages for any breach of fiduciary duty by such director acting as a director. Notwithstanding this

indemnity, a director shall be liable to the extent provided by law for any breach of the director’s duty of loyalty to the Company

or its shareholders, for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law,

pursuant to section 174 of the General Corporation Law of Nevada and Delaware (BOXO Productions) for (unlawful payment of a Stock dividend

or unlawful redemption of Stock), or for any transaction from which a director derived an improper personal benefit. Our Certificate

of Incorporation permits us to purchase and maintain insurance on behalf of directors, officers, employees or agents of the Company or

to create a trust fund, grant a security interest and/or use other means to provide indemnification.

Our

Bylaws permit us to indemnify our officers and directors to the full extent authorized or permitted by law.

We

have been advised that in the opinion of the SEC indemnification for liabilities arising under the Securities Act is against public policy

as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless

in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification

is against public policy to court of appropriate jurisdiction. We will then be governed by the court’s decision.

The

Company may not be able to attain profitability without additional funding, which may be unavailable.

The

Company has limited capital resources. Unless the Company begins to generate sufficient revenues to finance operations as a going concern,

the Company may experience liquidity and solvency problems. Such liquidity and solvency problems may force the Company to cease its expansion

plans if additional financing is not available. No known alternative resources of funds are available in the event we do not generate

sufficient funds from operations.

Risks

Relating to Our Business

The

profitability of attempted project acquisitions and media development is uncertain.

We

intend to acquire and develop film projects selectively. The acquisitions and development of film projects entails risks that investments

may fail to perform in accordance with expectations. In undertaking these projects, we will incur certain risks, including the expenditure

of funds on, and the devotion of management’s time to, transactions that may not come to fruition. Additional risks inherent in

the projects include risks that the films will not achieve anticipated sales or revenue levels. Production Costs and Expenses may be

greater than anticipated.

Film

investments are illiquid.

Because

Film investments are relatively illiquid, our ability to vary our portfolio promptly in response to economic or other conditions will

be limited. The foregoing and any other factor or event that would impede our ability to respond to adverse changes in the performance

of our investments could have an adverse effect on our financial condition and results of operations.

We

may not make a profit if we finance a film project.

There

is a risk that we will not realize any significant appreciation on our investment in a particular film project. This may result in a

loss of confidence in our share price and limit our ability to raise capital through the sale of Shares. Accordingly, your ability to

recover all or any portion of your investment under such circumstances will depend on the amount of funds so realized and claims to be

satisfied therefrom.

Our

film projects may not be sufficiently diversified.

Our

potential profitability and our ability to diversify our film investments may be limited, both geographically and by type of film projects.

We will be able to purchase or develop additional projects only as additional funds are raised, Additionally the owners of film projects

are willing to accept our stock in exchange for an interest in the target property or title to the property. Our projects may not be

well diversified and their economic performance could be affected by changes in local economic conditions.

Our

performance is therefore linked to economic conditions in the regions in which we will acquire and develop projects and in the market

for film projects generally. Therefore, to the extent that there are adverse economic conditions in the regions in which our projects

are developed, such conditions could result in a reduction of our income and cash to return capital and thus affect the amount of distributions

we can make to you.

Competition

with third parties for film projects and other media investments may result in our paying higher prices for projects which could reduce

our profitability and the return on your investment.

We

compete with many other entities engaged in the film industry, including individuals, corporations, limited partnerships, many of which

have greater resources than we do. Some of these have significant competitive advantages that result from, among other things, a lower

cost of capital and enhanced operating efficiencies. In addition, the number of entities and the amount of funds competing for suitable

film investments may increase. Any such increase would result in increased demand for these assets and increased costs. If competitive

pressures cause us to pay higher prices for film projects, our profitability may be reduced. This may cause you to experience a lower

return on your investment.

The

Company has identified several film projects to acquire with the net proceeds of this offering. You will not be unable to evaluate the

economic merits of the companys investments made with such net proceeds before making an investment decision to purchase the Company’s

securities.

The

Company will have broad authority to invest a portion of the net proceeds of this offering in any media opportunities the Company may

identify in the future, and the Company may use those proceeds to make investments with which you may not agree. You will be unable to

evaluate the economic merits of the Company’s projects before the Company invests in them and the Company will be relying on its

ability to select attractive investments. In addition, the Company’s investment policies may be amended from time to time at the

discretion of the Company’s Management, without notice to the Company’s Shareholders. These factors will increase the uncertainty

and the risk of investing in the Company’s securities.

Although

the Company intends to use substantial portion of the net proceeds of this offering to acquire and develop film projects, including working

capital, the Company cannot assure you that it will be able to do so. The Company’s failure to apply the proper portion of the

net proceeds of this offering effectively or find suitable projects to acquire and develop in a timely manner or on acceptable terms

could result in losses or returns that are substantially below expectations.

Risks

Related to Our Securities

There

is a limited established trading market for our common stock and if a trading market does not develop, purchasers of our securities

may have difficulty selling their securities.

The

Company recently (on November 1st 2023) became an SEC reporting company within the meaning of the 1934 securities exchange

act. As a result, there is a limited public trading market for our common stock since this change and an active trading market

in our securities may not develop or, if developed, may not be sustained. While we intend to seek a quotation on a major national exchange

or a listed exchange in the future, there can be no assurance that any such trading market will develop, and purchasers of the common

stock may have difficulty selling their common stock. No underwrites have committed to sponsoring the Company’s common

stock to list on any exchange, and none may do so.

We

may, in the future, issue additional Shares of common stock, which would reduce investors percent of ownership and may dilute

our share value.

Our

Articles of Incorporation authorize the issuance of multiple classes of stock, including 500, 000,000 Shares of common stock.

Additionally the Company authorized the following additional classes of shares; up to 100 Shares of Preferred Stock Class A, 10,000,000

Shares of Preferred Stock Class C, 4,000,000 Shares of Preferred Stock Class D, 40,000 of Preferred Stock Class E and 75,000 of Preferred

Stock Class F. The rights of each Class of Securities is described in detail in the Notes section of the Financial Reports. The Financial

Reports also shows the issuances for each Class of Securities at the date of this filing.

The

future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our existing

shareholders. We may issue further any common stock issued in the future on an arbitrary basis. The issuance of common stock

for future services or acquisitions or other corporate actions may have the effect of diluting the value of the Shares held by our

investors, and might have an adverse effect on any trading market for our common stock.

We

are a Film Project company and we may finance our business through loans.

As

with many other Film Project companies, we will from time to time finance our business through loans collateralized by the underlying