UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-41404

Woodside Energy Group Ltd

(ABN 55 004 898 962)

(Registrant’s name)

Woodside

Energy Group Ltd

Mia Yellagonga, 11 Mount Street

Perth, Western Australia 6000

Australia

(Address of

principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Dated: November 7, 2024

|

|

|

| WOODSIDE ENERGY GROUP LTD |

|

|

| By: |

|

/s/ Damien Gare |

|

|

Damien Gare Corporate

Secretary |

Exhibit 99.1

Woodside Energy Group Ltd

ACN 004 898 962

Mia Yellagonga

11 Mount Street

Perth WA 6000

Australia

T +61 8 9348 4000

www.woodside.com

ASX: WDS

NYSE: WDS

LSE: WDS

Announcement

Thursday, 7 November 2024

2024 INVESTOR SITE VISIT - AUSTRALIA

Woodside is hosting

an investor site visit at Pluto LNG which will include a tour of Pluto Train 2. A copy of the presentation slides to be used during the site visit is attached.

Woodside CEO Meg O’Neill said the site visit provided an opportunity for investors and analysts to see first-hand Woodside’s world-class Pluto LNG

facility, as well as the excellent progress that has been made on the Scarborough Energy Project.

“Now almost three quarters complete and on track

for first LNG cargo in 2026, our Scarborough Energy Project is set to help meet demand for the lower carbon and reliable energy the world needs today and into the future.”

|

|

|

| Contacts: |

|

|

| INVESTORS |

|

MEDIA |

| Marcela Louzada |

|

Christine Forster |

| M: +61 456 994 243 |

|

M: +61 484 112 469 |

| E: investor@woodside.com |

|

E: christine.forster@woodside.com |

This announcement was approved and authorised for release by Woodside’s Disclosure Committee.

Page 1 of 1

7 November 2024 www.woodside.com

investor@woodside.com Pluto LNG site visit Q&A

Disclaimer, important notes and

assumptions Information This presentation has been prepared by Woodside Energy Group Ltd (“Woodside”). All information included in this presentation, including any forward-looking statements, reflects Woodside’s views held as at

the date of this presentation and, except as required by applicable law, neither Woodside, its related bodies corporate, nor any of their respective officers, directors, employees, advisers or representatives (“Beneficiaries”) intends

to, undertakes to, or assumes any obligation to, provide any additional information or update or revise any information or forward-looking statements in this presentation after the date of this presentation, either to make them conform to actual

results or as a result of new information, future events, changes in Woodside’s expectations or otherwise. This presentation may contain industry, market and competitive position data that is based on industry publications and studies

conducted by third parties as well as Woodside’s internal estimates and research. While Woodside believes that each of these publications and third party studies is reliable and has been prepared by a reputable source, Woodside has not

independently verified the market and industry data obtained from these third party sources and cannot guarantee the accuracy or completeness of such data. Accordingly, undue reliance should not be placed on any of the industry, market and

competitive position data contained in this presentation. To the maximum extent permitted by law, neither Woodside, its related bodies corporate, nor any of their respective Beneficiaries, assume any liability (including liability for equitable,

statutory or other damages) in connection with, any responsibility for, or make any representation or warranty (express or implied) as to, the fairness, currency, accuracy, adequacy, reliability or completeness of the information or any opinions

expressed in this presentation or the reasonableness of any underlying assumptions. No offer or advice This presentation is not intended to and does not constitute, form part of, or contain an offer or invitation to sell to Woodside shareholders (or

any other person), or a solicitation of an offer from Woodside shareholders (or any other person), or a solicitation of any vote or approval from Woodside shareholders (or any other person) in any jurisdiction. This presentation has been prepared

without reference to the investment objectives, financial and taxation situation or particular needs of any Woodside shareholder or any other person. The information contained in this presentation does not constitute, and should not be taken as,

financial product or investment advice. Woodside encourages you to seek independent legal, financial, taxation and other professional advice before making any investment decision. This presentation shall not be distributed, transmitted, published,

reproduced or otherwise made available to any other person, in whole or in part, directly or indirectly, for any purposes whatsoever. In particular, this presentation and the information contained herein may not be taken or transmitted, in, into or

from and may not be copied, forwarded, distributed or transmitted in or into any jurisdiction in which such release, publication or distribution would be unlawful. The release, presentation, publication or distribution of this presentation, in whole

or in part, in certain jurisdictions may be restricted by law or regulation, and persons into whose possession this presentation comes should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions

may constitute a violation of the laws of the relevant jurisdiction. Woodside does not accept liability to any person in relation to the distribution or possession of this document in or from any such jurisdiction. Forward-looking statements This

presentation contains forward-looking statements with respect to Woodside’s business and operations, market conditions, results of operations and financial condition, including, for example, but not limited to, statements regarding long-term

demand for Woodside’s products, development, completion and execution of Woodside’s projects, expectations regarding future capital expenditures, the payment of future dividends and the amount thereof, future results of projects,

operating activities, procurement or marketing activities, new energy products, expectations and plans for renewables production capacity and investments in, and development of, renewables projects, expectations and guidance with respect to

production, facility performance, capital and exploration expenditure, and expectations regarding the achievement of Woodside’s net equity Scope 1 and 2 greenhouse gas emissions reduction and new energy investment targets and other climate and

sustainability goals. All statements, other than statements of historical or present facts, are forward-looking statements and generally may be identified by the use of forward-looking words such as ‘guidance’, ‘foresee’,

‘likely’, ‘potential’, ‘anticipate’, ‘believe’, ‘aim’, ‘aspire’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘target’,

‘plan’, ‘strategy’, ‘forecast’, ‘outlook’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or expressions. Similarly,

statements that describe the objectives, plans, goals or expectations of Woodside are forward-looking statements. Forward-looking statements in this presentation are not guidance, forecasts, guarantees or predictions of future events or performance,

but are in the nature of future expectations that are based on management’s current expectations and assumptions. Those statements and any assumptions on which they are based are subject to change without notice and are subject to inherent

known and unknown risks, uncertainties, assumptions and other factors, many of which are beyond the control of Woodside, its related bodies corporate and their respective Beneficiaries. If any of the assumptions on which a forward-looking statement

is based were to change or be found to be incorrect, this would likely cause outcomes to differ from the statements made in this presentation. Important factors that could cause actual results to differ materially from those in the forward-looking

statements include, but are not limited to, fluctuations in commodity prices, actual demand for Woodside products, currency fluctuations, geotechnical factors, drilling and production results, gas commercialisation, development progress, operating

results, engineering estimates, reserve and resource estimates, loss of market, industry competition, environmental risks, climate related risks, physical risks, legislative, fiscal and regulatory developments, changes in accounting standards,

economic and financial markets conditions in various countries and regions, political risks, the actions of third parties, project delay or advancement, regulatory approvals, the impact of armed conflict and political instability (such as the

ongoing conflict in Ukraine) on economic activity and oil and gas supply and demand, cost estimates, the effect of future regulatory or legislative actions on Woodside or the industries in which it operates, including potential changes to tax laws,

the impact of general economic conditions, inflationary conditions, prevailing exchange rates and interest rates and conditions in financial markets, and risks associated with acquisitions, mergers and joint ventures, including difficulties

integrating businesses, uncertainty associated with financial projections, restructuring, increased costs and adverse tax consequences, and uncertainties and liabilities associated with acquired and divested properties and businesses. A more

detailed summary of the key risks relating to Woodside and its business can be found in the “Risk” section of Woodside’s most recent Annual Report released to the Australian Securities Exchange and the London Stock Exchange and in

Woodside’s most recent Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (SEC) and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings. You should review

and have regard to these risks when considering the information contained in this presentation. Investors are strongly cautioned not to place undue reliance on any forward-looking statements. Actual results or performance may vary materially from

those expressed in, or implied by, any forward-looking statements. Climate strategy and emissions data All greenhouse gas emissions data in this presentation are estimates, due to the inherent uncertainty and limitations in measuring or quantifying

greenhouse gas emissions, and our methodologies for measuring or quantifying greenhouse gas emissions may evolve as best practices continue to develop and data quality and quantity continue to improve.

Disclaimer, important notes and

assumptions (continued) Climate strategy and emissions data Woodside “greenhouse gas” or “emissions” information reported are net equity Scope 1 greenhouse gas emissions, Scope 2 greenhouse gas emissions, and/or Scope 3

greenhouse gas emissions, unless otherwise stated. For more information on Woodside’s climate strategy and performance, including further details regarding Woodside’s targets, aspirations and goals and the underlying methodology,

judgements, assumptions and contingencies, refer to Woodside’s Climate Transition Action Plan 2023 (CTAP) available on the Woodside website at https://www.woodside.com/sustainability/climate-change. The glossary and footnotes to this

presentation provide clarification regarding the use of terms such as "lower carbon" under Woodside's climate strategy. A full glossary of terms used in connection with Woodside's climate strategy is contained in the CTAP. Notes to petroleum

resource estimates Unless otherwise stated, all petroleum resource estimates are quoted as at the effective date (i.e. 31 December 2023) of the Reserves and Resources Statement included in Woodside’s most recent Annual Report released to the

Australian Securities Exchange and the London Stock Exchange and in Woodside’s most recent Annual Report on Form 20-F filed with the SEC and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings,

net Woodside share at standard oilfield conditions of 14.696 psi (101.325 kPa) and 60 degrees Fahrenheit (15.56 degrees Celsius). Woodside estimates and reports its Proved (1P) Reserves in accordance with the SEC regulations, which are also

compliant with SPE-PRMS guidelines. SEC-compliant Proved (1P) Reserves estimates use a more restrictive, rules-based approach and are generally lower than estimates prepared solely in accordance with SPE-PRMS guidelines due to, among other things,

the requirement to use commodity prices based on the average of first of month prices during the 12-month period in the reporting company’s fiscal year. Woodside estimates and reports its Proved plus Probable (2P) Reserves and Best Estimate

(2C) Contingent Resources in accordance with SPE-PRMS guidelines. Woodside is not aware of any new information or data that materially affects the information included in the Reserves and Resources Statement. All the material assumptions and

technical parameters underpinning the estimates in the Reserves and Resources Statement continue to apply and have not materially changed. Woodside reports its petroleum resource estimates inclusive of all fuel consumed in operations. For offshore

oil projects, the reference point is defined as the outlet of the floating production storage and offloading facility (FPSO) or platform, while for the onshore gas projects the reference point is defined as the outlet of the downstream (onshore) gas

processing facility. Woodside uses both deterministic and probabilistic methods for the estimation of Reserves and Contingent Resources at the field and project levels. All Proved (1P) Reserves estimates have been estimated using deterministic

methodology and reported on a net interest basis in accordance with the SEC regulations and have been determined in accordance with SEC Rule 4-10(a) of Regulation S-X. Unless otherwise stated, all petroleum estimates reported at the company or

region level are aggregated by arithmetic summation by category. The aggregated Proved (1P) Reserves may be a conservative estimate due to the portfolio effects of arithmetic summation. ‘MMboe’ means millions (106) of barrels of oil

equivalent. Natural gas volumes are converted to oil equivalent volumes via a constant conversion factor, which for Woodside is 5.7 Bcf of dry gas per 1 MMboe. Volumes of natural gas liquids, oil and condensate are converted from MMbbl to MMboe on a

1:1 ratio. Disclosure of reserve information and cautionary note to US investors Woodside is an Australian company listed on the Australian Securities Exchange, the New York Stock Exchange and the London Stock Exchange. As noted above, Woodside

estimates and reports its Proved (1P) Reserves in accordance with the SEC regulations, which are also compliant with SPE-PRMS guidelines, and estimates and reports its Proved plus Probable (2P) Reserves and Best Estimate (2C) Contingent Resources in

accordance with SPE-PRMS guidelines. Woodside reports all of its petroleum resource estimates using definitions consistent with the 2018 Society of Petroleum Engineers (SPE)/World Petroleum Council (WPC)/American Association of Petroleum Geologists

(AAPG)/Society of Petroleum Evaluation Engineers (SPEE) Petroleum Resources Management System (PRMS). The SEC permits oil and gas companies, in their filings with the SEC, to disclose only Proved, Probable and Possible Reserves, and only when such

Reserves have been determined in accordance with the SEC guidelines. In this presentation, Woodside includes estimates of quantities of oil and gas using certain terms, such as “Proved plus Probable (2P) Reserves”, “Best Estimate

(2C) Contingent Resources”, “Reserves and Contingent Resources”, “Proved plus Probable”, “Developed and Undeveloped”, “Probable Developed”, “Probable Undeveloped”, “Contingent

Resources” or other descriptions of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of proved, probable and possible reserves, and which the SEC’s guidelines strictly

prohibit Woodside from including in filings with the SEC. These types of estimates do not represent, and are not intended to represent, any category of reserves based on SEC definitions, and may differ from and may not be comparable to the same or

similarly-named measures used by other companies. These estimates are by their nature more speculative than estimates of proved reserves and would require substantial capital spending over a significant number of years to implement recovery, and

accordingly are subject to substantially greater risk of not being recovered by Woodside. In addition, actual locations drilled and quantities that may be ultimately recovered from Woodside’s properties may differ substantially. Woodside has

made no commitment to drill, and likely will not drill, all drilling locations that have been attributable to these quantities. US investors are urged to consider closely the disclosures in Woodside’s most recent Annual Report on Form 20-F

filed with the SEC and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings and its other filings with the SEC, which are available from Woodside at https://www.woodside.com. These reports can also be

obtained from the SEC at www.sec.gov. Assumptions Unless otherwise indicated, the targets set out in this presentation have been estimated on the basis of a variety of economic assumptions including: (1) US$70/bbl Brent long-term oil price (2022

real terms, inflated at 2.0%); (2) currently sanctioned projects being delivered in accordance with their current project schedules; and (3) applicable growth opportunities being sanctioned and delivered in accordance with the target schedules

provided in this presentation. These growth opportunities are subject to relevant joint venture participant approvals, commercial arrangements with third parties and regulatory approvals being obtained in the timeframe contemplated or at all.

Woodside expresses no view as to whether its joint venture participants will agree with and support Woodside’s current position in relation to these opportunities, or such commercial arrangements and regulatory approvals will be obtained.

Additional assumptions relevant to particular targets or other statements in this presentation may be set out in the relevant slides. Any such additional assumptions are in addition to the assumptions and qualifications applicable to the

presentation as a whole. Other important information All references to dollars, cents or $ in this presentation are to US currency, unless otherwise stated. References to “Woodside” may be references to Woodside Energy Group Ltd and/or

its applicable subsidiaries (as the context requires). This presentation does not include any express or implied prices at which Woodside will buy or sell financial products. A securities rating is not a recommendation to buy, sell or hold

securities and may be subject to revision or withdrawal at any time.

Close Q&A Opening remarks 1 2 3

Agenda

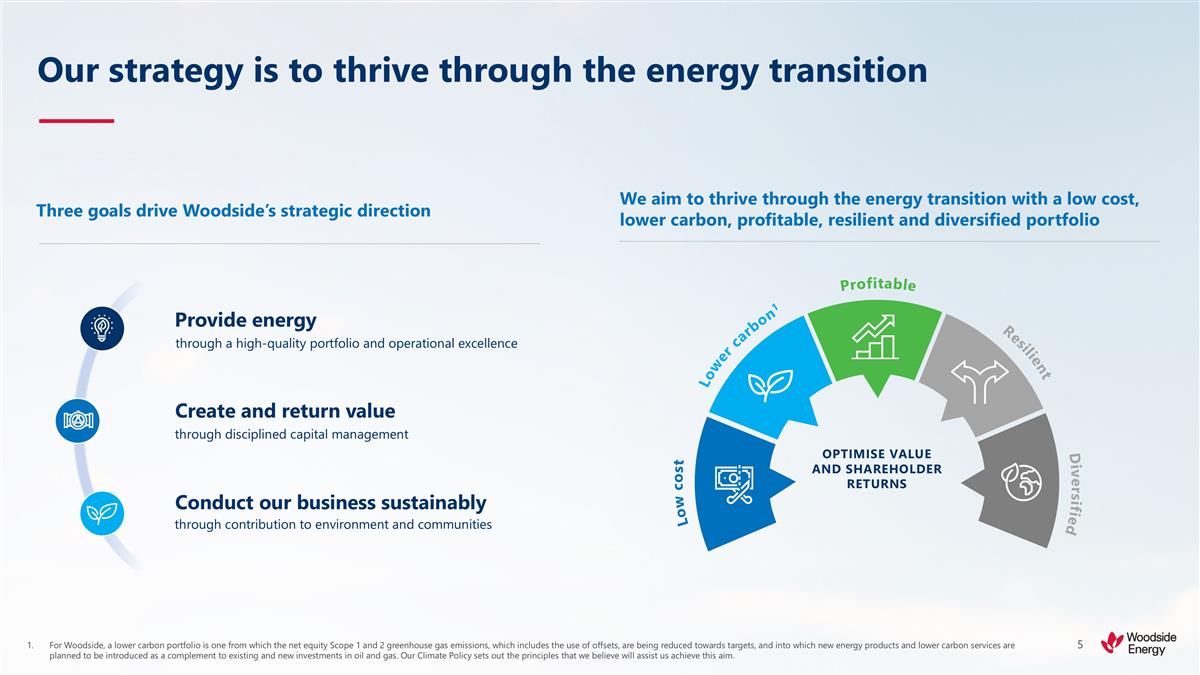

For Woodside, a lower carbon portfolio

is one from which the net equity Scope 1 and 2 greenhouse gas emissions, which includes the use of offsets, are being reduced towards targets, and into which new energy products and lower carbon services are planned to be introduced as a complement

to existing and new investments in oil and gas. Our Climate Policy sets out the principles that we believe will assist us achieve this aim. Our strategy is to thrive through the energy transition OPTIMISE VALUE AND SHAREHOLDER RETURNS Lower carbon1

Resilient Diversified Low cost Profitable Provide energy through a high-quality portfolio and operational excellence Create and return value Conduct our business sustainably through disciplined capital management through contribution to environment

and communities Three goals drive Woodside’s strategic direction We aim to thrive through the energy transition with a low cost, lower carbon, profitable, resilient and diversified portfolio

Targets and aspiration are for net

equity Scope 1 and 2 greenhouse gas emissions relative to a starting base of 6.32 Mt CO2-e which is representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and which may be adjusted (up or down) for

potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. Compelling investment thesis High quality portfolio Positioned for

the energy transition Geographically advantaged to meet growing LNG demand Tier-one operating assets and healthy growth pipeline Disciplined capital management and clear capital allocation framework Strong balance sheet and commitment to shareholder

returns Delivering on emissions reduction targets1 Progressing customer-led and scalable ammonia, hydrogen and CCS opportunities 35 years of operating experience in LNG with world class operated reliability Resilient, low cost, high margin operating

assets Shareholder value and returns Operational excellence

Project track record Demonstrated

capability in LNG plant development Long-term relationships with key contractors Strong project management capabilities Operational excellence Marketing capability 35 years of LNG operations ~98% reliability across operated LNG facilities1 Proven

ability to increase plant capacity through de-bottlenecking Strong reputation as a reliable energy supplier Long-term relationships with customers Experienced marketing and trading teams with global relationships 2024 Half-Year Results.

Woodside’s LNG expertise

Competitively advantaged marketing

portfolio Advantaged global supply Long shipping position Seven LNG carriers on long-term charter and incoming new builds Positioned to capture upside cargoes Diversion capability through DES sales Commercial operations excellence Deep customer

relationships Portfolio marketing strategy Dedicated global marketing teams Long-term relationships provide market insights Collaborating with customers on new energy solutions Portfolio seller enables flexibility and optimisation Layered contracts

to manage market cycles Price marker diversity for stability with upside exposure Risk management frameworks Proximity to demand hubs Competitive cost of supply Geographic arbitrage opportunities Lower transport related emissions

All products. Includes 31 MMboe of

fuel for North West Shelf Project, 20 MMboe of fuel for Pluto LNG and 165 MMboe of fuel for Scarborough Energy Project. NWS and Pluto are as of 31 December 2023 and Scarborough is as of 31 October 2024. Assumes 74.9% participating interest. As a

result of the completion of the sale of a 15.1% non-operating participating interest in the Scarborough Joint Venture to JERA, Woodside’s Scarborough field proved plus probable (2P) reserves was updated to 1,506 MMboe (Woodside share). Refer

to the announcement titled ‘Woodside completes sale to JERA of 15.1% interest in Scarborough’, released 31 October 2024. World-class LNG operations Scarborough Energy Project North West Shelf Project Pluto LNG 90% 2012 ~87% (HY 2024) 4.9

Mtpa 97.7% (Q2 2024) 46 MMboe (2023; Woodside share) 279 MMboe (Woodside share) 25-33.33% 1989 ~83% (HY 2024) 16.9 Mtpa 99.7% (Q2 2024) 33 MMboe (2023; Woodside share) 232 MMboe (Woodside share) 74.9% (upstream), 51% (downstream) Targeting 2026 n/a

5.0 Mtpa + 3.0 Mtpa (Pluto Train 1) n/a n/a 1,506 MMboe (Woodside share)2 Woodside equity First LNG cargo EBITDA margin Gross capacity Reliability Annual LNG production Proved plus probable (2P) reserves1

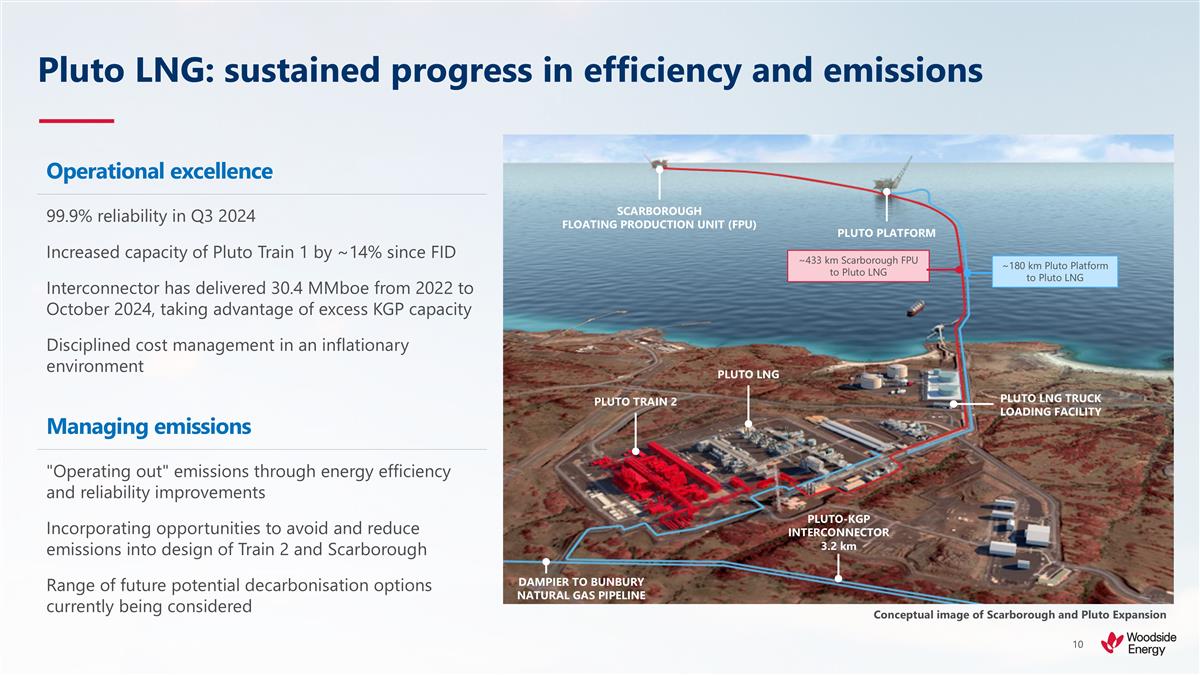

Pluto LNG: sustained progress in

efficiency and emissions Conceptual image of Scarborough and Pluto Expansion Operational excellence 99.9% reliability in Q3 2024 Increased capacity of Pluto Train 1 by ~14% since FID Interconnector has delivered 30.4 MMboe from 2022 to October

2024, taking advantage of excess KGP capacity Disciplined cost management in an inflationary environment Managing emissions "Operating out" emissions through energy efficiency and reliability improvements Incorporating opportunities to avoid and

reduce emissions into design of Train 2 and Scarborough Range of future potential decarbonisation options currently being considered SCARBOROUGH FLOATING PRODUCTION UNIT (FPU) PLUTO PLATFORM PLUTO LNG PLUTO TRAIN 2 PLUTO LNG TRUCK LOADING FACILITY

PLUTO-KGP INTERCONNECTOR 3.2 km DAMPIER TO BUNBURY NATURAL GAS PIPELINE ~433 km Scarborough FPU to Pluto LNG ~180 km Pluto Platform to Pluto LNG

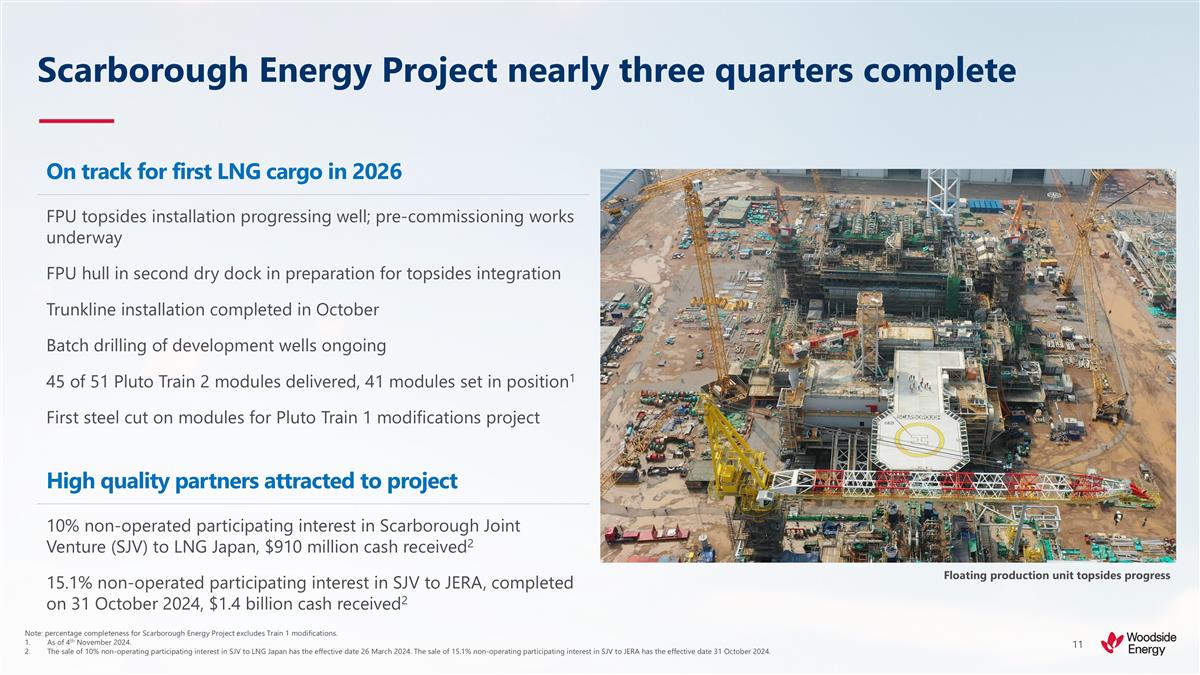

Scarborough Energy Project nearly

three quarters complete Floating production unit topsides progress Note: percentage completeness for Scarborough Energy Project excludes Train 1 modifications. As of 4th November 2024. The sale of 10% non-operating participating interest in SJV to

LNG Japan has the effective date 26 March 2024. The sale of 15.1% non-operating participating interest in SJV to JERA has the effective date 31 October 2024. On track for first LNG cargo in 2026 FPU topsides installation progressing well;

pre-commissioning works underway FPU hull in second dry dock in preparation for topsides integration Trunkline installation completed in October Batch drilling of development wells ongoing 45 of 51 Pluto Train 2 modules delivered, 41 modules set in

position1 First steel cut on modules for Pluto Train 1 modifications project High quality partners attracted to project 10% non-operated participating interest in Scarborough Joint Venture (SJV) to LNG Japan, $910 million cash received2 15.1%

non-operated participating interest in SJV to JERA, completed on 31 October 2024, $1.4 billion cash received2

Q&A

BACKUP

Deploying technology across our

portfolio SAFE LOW COST LOWER CARBON MAXIMISE VALUE Autonomous inspections, crewless deployment reduces high-risk exposure Integrity management enabling older facilities to operate at lower cost for longer Protects base business and supports

customer requirements Digital strategies driving increased production, optimised maintenance, and energy efficiency

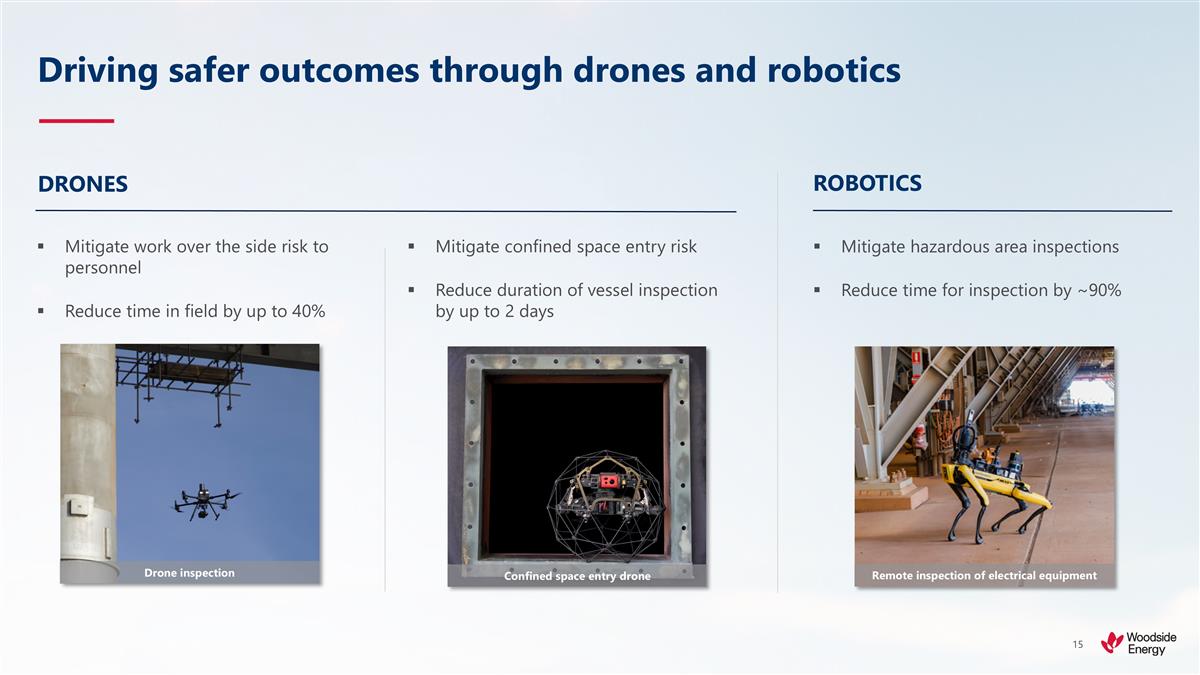

Driving safer outcomes through

drones and robotics DRONES Mitigate work over the side risk to personnel Reduce time in field by up to 40% Mitigate confined space entry risk Reduce duration of vessel inspection by up to 2 days ROBOTICS Mitigate hazardous area inspections

Reduce time for inspection by ~90% Remote inspection of electrical equipment Confined space entry drone Drone inspection

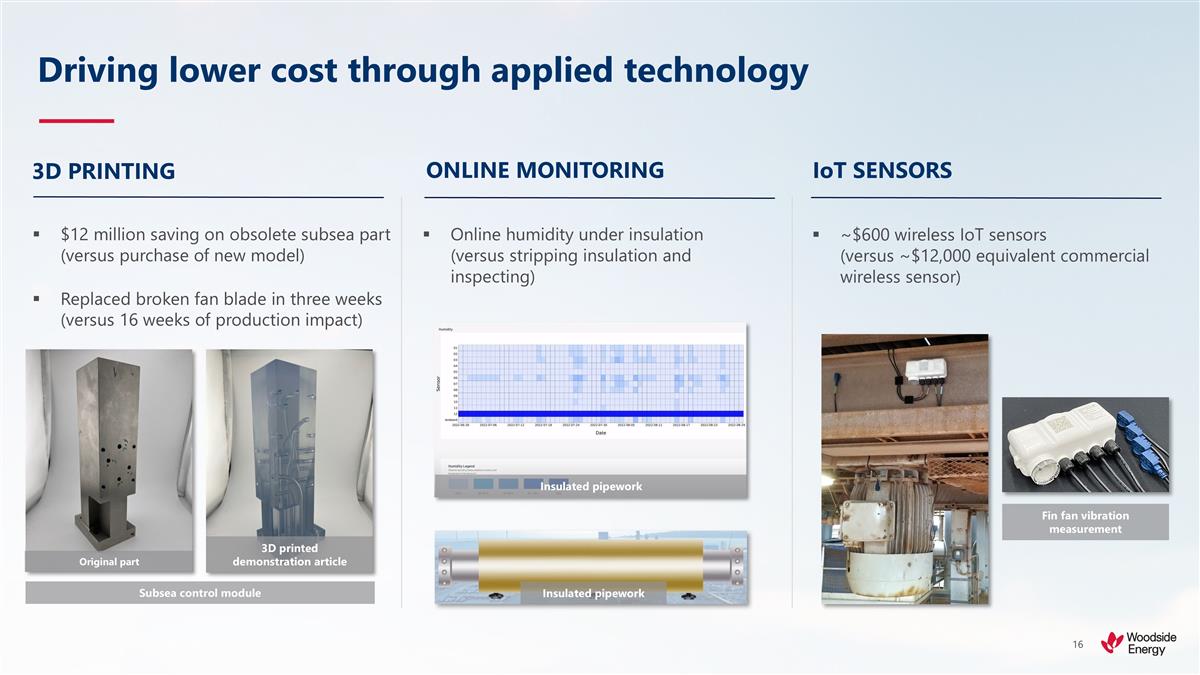

Driving lower cost through applied

technology 3D PRINTING IoT SENSORS ~$600 wireless IoT sensors (versus ~$12,000 equivalent commercial wireless sensor) $12 million saving on obsolete subsea part (versus purchase of new model) Replaced broken fan blade in three weeks (versus 16 weeks

of production impact) Online humidity under insulation (versus stripping insulation and inspecting) ONLINE MONITORING Insulated pipework Insulated pipework Fin fan vibration measurement Subsea control module 3D printed demonstration article Original

part

Pluto decarbonisation

www.woodside.com investor@woodside.com 6 November 2024

Disclaimer, important notes and

assumptions Information This presentation has been prepared by Woodside Energy Group Ltd (“Woodside”). All information included in this presentation, including any forward-looking statements, reflects Woodside’s views held as at

the date of this presentation and, except as required by applicable law, neither Woodside, its related bodies corporate, nor any of their respective officers, directors, employees, advisers or representatives (“Beneficiaries”) intends

to, undertakes to, or assumes any obligation to, provide any additional information or update or revise any information or forward-looking statements in this presentation after the date of this presentation, either to make them conform to actual

results or as a result of new information, future events, changes in Woodside’s expectations or otherwise. This presentation may contain industry, market and competitive position data that is based on industry publications and studies

conducted by third parties as well as Woodside’s internal estimates and research. While Woodside believes that each of these publications and third party studies is reliable and has been prepared by a reputable source, Woodside has not

independently verified the market and industry data obtained from these third party sources and cannot guarantee the accuracy or completeness of such data. Accordingly, undue reliance should not be placed on any of the industry, market and

competitive position data contained in this presentation. To the maximum extent permitted by law, neither Woodside, its related bodies corporate, nor any of their respective Beneficiaries, assume any liability (including liability for equitable,

statutory or other damages) in connection with, any responsibility for, or make any representation or warranty (express or implied) as to, the fairness, currency, accuracy, adequacy, reliability or completeness of the information or any opinions

expressed in this presentation or the reasonableness of any underlying assumptions. No offer or advice This presentation is not intended to and does not constitute, form part of, or contain an offer or invitation to sell to Woodside shareholders (or

any other person), or a solicitation of an offer from Woodside shareholders (or any other person), or a solicitation of any vote or approval from Woodside shareholders (or any other person) in any jurisdiction. This presentation has been prepared

without reference to the investment objectives, financial and taxation situation or particular needs of any Woodside shareholder or any other person. The information contained in this presentation does not constitute, and should not be taken as,

financial product or investment advice. Woodside encourages you to seek independent legal, financial, taxation and other professional advice before making any investment decision. This presentation shall not be distributed, transmitted, published,

reproduced or otherwise made available to any other person, in whole or in part, directly or indirectly, for any purposes whatsoever. In particular, this presentation and the information contained herein may not be taken or transmitted, in, into or

from and may not be copied, forwarded, distributed or transmitted in or into any jurisdiction in which such release, publication or distribution would be unlawful. The release, presentation, publication or distribution of this presentation, in whole

or in part, in certain jurisdictions may be restricted by law or regulation, and persons into whose possession this presentation comes should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions

may constitute a violation of the laws of the relevant jurisdiction. Woodside does not accept liability to any person in relation to the distribution or possession of this document in or from any such jurisdiction. Forward-looking statements This

presentation contains forward-looking statements with respect to Woodside’s business and operations, market conditions, results of operations and financial condition, including, for example, but not limited to, statements regarding long-term

demand for Woodside’s products, development, completion and execution of Woodside’s projects, expectations regarding future capital expenditures, the payment of future dividends and the amount thereof, future results of projects,

operating activities, procurement or marketing activities, new energy products, expectations and plans for renewables production capacity and investments in, and development of, renewables projects, expectations and guidance with respect to

production, facility performance, capital and exploration expenditure, and expectations regarding the achievement of Woodside’s net equity Scope 1 and 2 greenhouse gas emissions reduction and new energy investment targets and other climate and

sustainability goals. All statements, other than statements of historical or present facts, are forward-looking statements and generally may be identified by the use of forward-looking words such as ‘guidance’, ‘foresee’,

‘likely’, ‘potential’, ‘anticipate’, ‘believe’, ‘aim’, ‘aspire’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘target’,

‘plan’, ‘strategy’, ‘forecast’, ‘outlook’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or expressions. Similarly,

statements that describe the objectives, plans, goals or expectations of Woodside are forward-looking statements. Forward-looking statements in this presentation are not guidance, forecasts, guarantees or predictions of future events or performance,

but are in the nature of future expectations that are based on management’s current expectations and assumptions. Those statements and any assumptions on which they are based are subject to change without notice and are subject to inherent

known and unknown risks, uncertainties, assumptions and other factors, many of which are beyond the control of Woodside, its related bodies corporate and their respective Beneficiaries. If any of the assumptions on which a forward-looking statement

is based were to change or be found to be incorrect, this would likely cause outcomes to differ from the statements made in this presentation. Important factors that could cause actual results to differ materially from those in the forward-looking

statements include, but are not limited to, fluctuations in commodity prices, actual demand for Woodside products, currency fluctuations, geotechnical factors, drilling and production results, gas commercialisation, development progress, operating

results, engineering estimates, reserve and resource estimates, loss of market, industry competition, environmental risks, climate related risks, physical risks, legislative, fiscal and regulatory developments, changes in accounting standards,

economic and financial markets conditions in various countries and regions, political risks, the actions of third parties, project delay or advancement, regulatory approvals, the impact of armed conflict and political instability (such as the

ongoing conflict in Ukraine) on economic activity and oil and gas supply and demand, cost estimates, the effect of future regulatory or legislative actions on Woodside or the industries in which it operates, including potential changes to tax laws,

the impact of general economic conditions, inflationary conditions, prevailing exchange rates and interest rates and conditions in financial markets, and risks associated with acquisitions, mergers and joint ventures, including difficulties

integrating businesses, uncertainty associated with financial projections, restructuring, increased costs and adverse tax consequences, and uncertainties and liabilities associated with acquired and divested properties and businesses. A more

detailed summary of the key risks relating to Woodside and its business can be found in the “Risk” section of Woodside’s most recent Annual Report released to the Australian Securities Exchange and the London Stock Exchange and in

Woodside’s most recent Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (SEC) and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings. You should review

and have regard to these risks when considering the information contained in this presentation. Investors are strongly cautioned not to place undue reliance on any forward-looking statements. Actual results or performance may vary materially from

those expressed in, or implied by, any forward-looking statements. Climate strategy and emissions data All greenhouse gas emissions data in this presentation are estimates, due to the inherent uncertainty and limitations in measuring or quantifying

greenhouse gas emissions, and our methodologies for measuring or quantifying greenhouse gas emissions may evolve as best practices continue to develop and data quality and quantity continue to improve.

Disclaimer, important notes and

assumptions (continued) Climate strategy and emissions data Woodside “greenhouse gas” or “emissions” information reported are net equity Scope 1 greenhouse gas emissions, Scope 2 greenhouse gas emissions, and/or Scope 3

greenhouse gas emissions, unless otherwise stated. For more information on Woodside’s climate strategy and performance, including further details regarding Woodside’s targets, aspirations and goals and the underlying methodology,

judgements, assumptions and contingencies, refer to Woodside’s Climate Transition Action Plan 2023 (CTAP) available on the Woodside website at https://www.woodside.com/sustainability/climate-change. The glossary and footnotes to this

presentation provide clarification regarding the use of terms such as "lower carbon" under Woodside's climate strategy. A full glossary of terms used in connection with Woodside's climate strategy is contained in the CTAP. Notes to petroleum

resource estimates Unless otherwise stated, all petroleum resource estimates are quoted as at the effective date (i.e. 31 December 2023) of the Reserves and Resources Statement included in Woodside’s most recent Annual Report released to the

Australian Securities Exchange and the London Stock Exchange and in Woodside’s most recent Annual Report on Form 20-F filed with the SEC and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings,

net Woodside share at standard oilfield conditions of 14.696 psi (101.325 kPa) and 60 degrees Fahrenheit (15.56 degrees Celsius). Woodside estimates and reports its Proved (1P) Reserves in accordance with the SEC regulations, which are also

compliant with SPE-PRMS guidelines. SEC-compliant Proved (1P) Reserves estimates use a more restrictive, rules-based approach and are generally lower than estimates prepared solely in accordance with SPE-PRMS guidelines due to, among other things,

the requirement to use commodity prices based on the average of first of month prices during the 12-month period in the reporting company’s fiscal year. Woodside estimates and reports its Proved plus Probable (2P) Reserves and Best Estimate

(2C) Contingent Resources in accordance with SPE-PRMS guidelines. Woodside is not aware of any new information or data that materially affects the information included in the Reserves and Resources Statement. All the material assumptions and

technical parameters underpinning the estimates in the Reserves and Resources Statement continue to apply and have not materially changed. Woodside reports its petroleum resource estimates inclusive of all fuel consumed in operations. For offshore

oil projects, the reference point is defined as the outlet of the floating production storage and offloading facility (FPSO) or platform, while for the onshore gas projects the reference point is defined as the outlet of the downstream (onshore) gas

processing facility. Woodside uses both deterministic and probabilistic methods for the estimation of Reserves and Contingent Resources at the field and project levels. All Proved (1P) Reserves estimates have been estimated using deterministic

methodology and reported on a net interest basis in accordance with the SEC regulations and have been determined in accordance with SEC Rule 4-10(a) of Regulation S-X. Unless otherwise stated, all petroleum estimates reported at the company or

region level are aggregated by arithmetic summation by category. The aggregated Proved (1P) Reserves may be a conservative estimate due to the portfolio effects of arithmetic summation. ‘MMboe’ means millions (106) of barrels of oil

equivalent. Natural gas volumes are converted to oil equivalent volumes via a constant conversion factor, which for Woodside is 5.7 Bcf of dry gas per 1 MMboe. Volumes of natural gas liquids, oil and condensate are converted from MMbbl to MMboe on a

1:1 ratio. Disclosure of reserve information and cautionary note to US investors Woodside is an Australian company listed on the Australian Securities Exchange, the New York Stock Exchange and the London Stock Exchange. As noted above, Woodside

estimates and reports its Proved (1P) Reserves in accordance with the SEC regulations, which are also compliant with SPE-PRMS guidelines, and estimates and reports its Proved plus Probable (2P) Reserves and Best Estimate (2C) Contingent Resources in

accordance with SPE-PRMS guidelines. Woodside reports all of its petroleum resource estimates using definitions consistent with the 2018 Society of Petroleum Engineers (SPE)/World Petroleum Council (WPC)/American Association of Petroleum Geologists

(AAPG)/Society of Petroleum Evaluation Engineers (SPEE) Petroleum Resources Management System (PRMS). The SEC permits oil and gas companies, in their filings with the SEC, to disclose only Proved, Probable and Possible Reserves, and only when such

Reserves have been determined in accordance with the SEC guidelines. In this presentation, Woodside includes estimates of quantities of oil and gas using certain terms, such as “Proved plus Probable (2P) Reserves”, “Best Estimate

(2C) Contingent Resources”, “Reserves and Contingent Resources”, “Proved plus Probable”, “Developed and Undeveloped”, “Probable Developed”, “Probable Undeveloped”, “Contingent

Resources” or other descriptions of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of proved, probable and possible reserves, and which the SEC’s guidelines strictly

prohibit Woodside from including in filings with the SEC. These types of estimates do not represent, and are not intended to represent, any category of reserves based on SEC definitions, and may differ from and may not be comparable to the same or

similarly-named measures used by other companies. These estimates are by their nature more speculative than estimates of proved reserves and would require substantial capital spending over a significant number of years to implement recovery, and

accordingly are subject to substantially greater risk of not being recovered by Woodside. In addition, actual locations drilled and quantities that may be ultimately recovered from Woodside’s properties may differ substantially. Woodside has

made no commitment to drill, and likely will not drill, all drilling locations that have been attributable to these quantities. US investors are urged to consider closely the disclosures in Woodside’s most recent Annual Report on Form 20-F

filed with the SEC and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings and its other filings with the SEC, which are available from Woodside at https://www.woodside.com. These reports can also be

obtained from the SEC at www.sec.gov. Assumptions Unless otherwise indicated, the targets set out in this presentation have been estimated on the basis of a variety of economic assumptions including: (1) US$70/bbl Brent long-term oil price (2022

real terms, inflated at 2.0%); (2) currently sanctioned projects being delivered in accordance with their current project schedules; and (3) applicable growth opportunities being sanctioned and delivered in accordance with the target schedules

provided in this presentation. These growth opportunities are subject to relevant joint venture participant approvals, commercial arrangements with third parties and regulatory approvals being obtained in the timeframe contemplated or at all.

Woodside expresses no view as to whether its joint venture participants will agree with and support Woodside’s current position in relation to these opportunities, or such commercial arrangements and regulatory approvals will be obtained.

Additional assumptions relevant to particular targets or other statements in this presentation may be set out in the relevant slides. Any such additional assumptions are in addition to the assumptions and qualifications applicable to the

presentation as a whole. Other important information All references to dollars, cents or $ in this presentation are to US currency, unless otherwise stated. References to “Woodside” may be references to Woodside Energy Group Ltd and/or

its applicable subsidiaries (as the context requires). This presentation does not include any express or implied prices at which Woodside will buy or sell financial products. A securities rating is not a recommendation to buy, sell or hold

securities and may be subject to revision or withdrawal at any time.

Examples of Operate Out Example of

Design Out Pluto Train 2 design inherently more efficient Focus on operating facilities ‘design out’ Design-out (operating): Pluto Solar Process efficiency improvement Methane emissions reduction Flaring reduction High reliability

operations Start-up optimisation Efficiency: Train 1 fin fans upgrade Methane: GTG nozzles replacement Progressing Pluto decarbonisation plan

Compressor drives and power

turbines are key contributors to the facility’s emissions Primary emissions sources at Pluto LNG

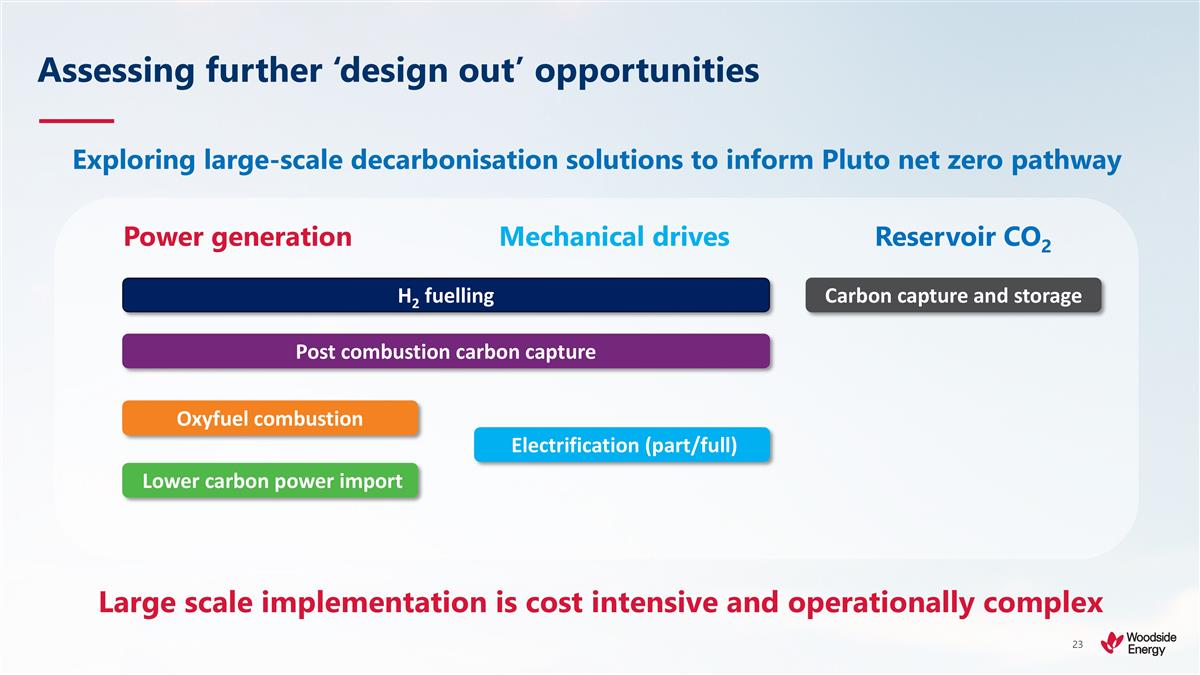

Large scale implementation is cost

intensive and operationally complex Exploring large-scale decarbonisation solutions to inform Pluto net zero pathway Power generation Mechanical drives Reservoir CO2 H2 fuelling Post combustion carbon capture Oxyfuel combustion Lower carbon power

import Electrification (part/full) Carbon capture and storage Assessing further ‘design out’ opportunities

Woodside Energy (PK) (USOTC:WOPEF)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Woodside Energy (PK) (USOTC:WOPEF)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024