TIDMZPHR

RNS Number : 4563N

Zephyr Energy PLC

30 September 2021

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

30 September 2021

Zephyr Energy plc

("Zephyr", the "Company" or the "Group")

Interim Results for the six months ended 30 June 2021

Zephyr Energy plc (AIM: ZPHR) (OTCQB: ZPHRF), the Rocky Mountain

oil and gas company focused on responsible resource development

from carbon-neutral operations, is pleased to announce its

unaudited interim results for the six months ended 30 June

2021.

Overview

The first six months of the 2021 financial year, and the period

since, were a time of tremendous progress and intense activity

during which Zephyr transformed from a single project exploration

company into a self-sustaining, cash-generating, carbon-neutral oil

and natural gas producer. During this period, significant

additional operational and technical milestones were met on our

Paradox Project. In addition, the Company completed five separate

acquisitions which resulted in a growing portfolio of operated and

non-operated assets located in two established U.S. oil producing

basins. The Company also delivered on its ambitious goal to

commence 100% carbon-neutral Scope 1 operations by 30 September

2021.

Highlights

Paradox Project, Utah, U.S. (operated asset)

-- The State 16-2LN-CC horizontal well was safely drilled to a

total depth of 14,370 feet ("ft") with 4,555 ft of horizontal

landed successfully in the Cane Creek reservoir target.

o Significant data from an extensive suite of wireline logs,

cores and pressure data was acquired from drilling operations and

from the subsequent diagnostic fracture injection test

("DFIT").

o Premier Oilfield Group, a leading consulting specialist with

expertise in well completions, was engaged to assist the Company's

multi-month evaluation of optimal completion designs.

o Multiple positive factors from the data analysed led Zephyr's

Board of Directors (the "Board") to approve the running of

production casing and to elect to complete the State 16-2LN-CC by

way of hydraulic stimulation.

o Completion operations will take place in the coming weeks,

followed shortly thereafter by a production test of the well.

-- If development of the overall project through the utilisation

of hydraulic stimulation proves successful, the Company estimates

the potential for a wider development with up to 200 potential well

locations across the project, with a range of risked net

recoverable contingent resources of up to 143 million barrels of

oil equivalent ("mmboe") from both the Cane Creek reservoir and

eight overlying reservoirs.

-- An additional 12,260 acres of Paradox Basin acreage was

acquired during the period (with potential resources not yet

included in Zephyr's internal estimates).

Williston Basin, U.S. (non-operated assets)

-- Zephyr completed four acquisitions which provide the Company

with working interests in 22 wells across multiple pads and

operators:

o 7 wells are currently producing, and 15 wells are drilled and

currently awaiting completion.

o Q2 2021 production averaged 148 barrels of oil equivalent per

day ("boe/d") net to Zephyr, with an average realised sales price

of US$52.90 per barrels of oil equivalent ("boe").

o August 2021 production averaged 506 boe/d net to Zephyr.

o Monthly production is expected to climb further as existing

wells hit peak production and additional wells are brought

online.

-- Cashflow from the non-operated portfolio will be reinvested

into the development of the Paradox project or used to acquire

further non-operated assets that meet the Company's strict

criteria.

-- In August 2021, the Company executed a Joint Venture

agreement with Purified Resource Partners, LLC, a highly

experienced Williston Basin team, focused on the generation of

additional non-operated deal flow.

Corporate

-- Achieved its ambitious Environmental, Social and Governance

target to commence 100% carbon neutral operations by 30 September

2021.

-- Completed a GBP10 million fundraise in April 2021 which

funded drilling operations on the Paradox project and the

acquisition of non-operated assets.

-- Commenced cross trading on the OTCQB Venture Market which is

expected to facilitate future investor outreach in the U.S.

Colin Harrington, Zephyr's Chief Executive said: " I am

delighted by the tremendous growth and progress delivered during

the period under review. Zephyr is now ideally positioned as a cash

generating platform from which to deliver significant future growth

for our Shareholders.

"We've worked tirelessly to meet or exceed the goals and

timelines we publicly set for ourselves, while doing so on budget

and in a low-cost manner - and I'm particularly proud that we

successfully executed our strategy in line with our twin core

values of being responsible stewards of investors' capital and

responsible stewards of the environment in which we work.

"The next few months will continue to see a flurry of corporate

and operational activity as we target production from the Paradox

project, increase non-operated production and accumulate cash flows

from our assets in the Williston Basin.

"These are exciting times, and we look forward to keeping all

our stakeholders updated on our progress."

A copy of the interim results report will be available on the

Company's website later today at http://www.zephyrplc.com .

Contacts:

Zephyr Energy plc Tel: +44 (0)20 7225 4590

Colin Harrington (CEO)

Chris Eadie (CFO)

Allenby Capital Limited - AIM Nominated Tel: +44 (0)20 3328 5656

Adviser

Jeremy Porter / Liz Kirchner

Turner Pope Investments - Broker Tel: +44 (0)20 3657 0050

James Pope / Andy Thacker

Flagstaff Strategic and Investor Communications

- PR Tel: +44 (0) 20 7129

Tim Thompson / Mark Edwards / Fergus 1474

Mellon

ZEPHYR ENERGY PLC

INTERIM REPORT FOR THE SIX MONTHS TO 30 JUNE 2021

The Board is pleased to present Zephyr's unaudited interim

report for the six-month period to 30 June 2021.

CHIEF EXECUTIVE'S STATEMENT

OVERVIEW AND OUTLOOK

During the first six months of the 2021 financial year and in

the period since, Zephyr transformed from a single project

exploration company into a self-sustaining, cash generating, oil

producing company. The Company now has a growing and balanced

portfolio of both operated and non-operated assets located in two

established oil producing basins in the U.S.

During the period under review, we made substantial progress on

our operated flagship project in the Paradox Basin, Utah (the

"Paradox project") where we are targeting first production in the

coming weeks. We also established a thriving non-operated business

through the acquisition of four producing, near-term production and

future drilling packages in the Williston Basin one of the most

prolific oil producing basins in the U.S. Over the last several

months, the Company received its first monthly production revenues

from the non-operated portfolio, and we expect to generate further

substantial cash flows from these assets over the next twelve

months and beyond. These revenues will be reinvested into the wider

development of the Paradox project or will be used to secure and /

or fund the acquisition of additional non-operated assets that meet

our stringent criteria.

In late 2020, we completed the rebranding of the Group, which

included the Board approving the two core values under which Zephyr

will operate. These values are simple yet fundamental to our

mission: Zephyr's team will always strive 1) to be responsible

stewards of investors' capital and 2) to be responsible stewards of

the environment in which we work. We believe that good

environmental practices, together with good governance and

oversight, will translate into good business performance. We are

one hundred per cent focused on delivering strong economic returns

in the most environmentally responsible manner possible.

On this front, I was delighted when, in June 2021 we announced

our intention to achieve Scope 1 carbon-neutrality across our

operational footprint by the end of September 2021, and I'm equally

delighted to report that we have now delivered on that pledge

within our ambitious timeline. This industry-leading initiative,

unanimously supported by our Board, marks a major step in the

Company's commitment to social and environmental best

practices.

In all, I am proud of the growth and progress delivered during

the period under review. We've worked hard to meet or exceed the

goals and timelines we publicly set ourselves, while doing so on

budget, in a low-cost manner and in line with our twin core values.

The next few months will continue to see a flurry of corporate and

operational activity as we target production from the Paradox

project, increase non-operated production and accumulate cash flows

from our assets in the Williston Basin. These are exciting times,

and we look forward to keeping all our stakeholders updated on our

progress.

BACKGROUND

Twelve months ago, following the comprehensive restructuring of

the Company, Zephyr was positioned as a clean and unlevered vehicle

with a single asset and a clearly defined strategy designed to

deliver responsible growth, both through acquisitions and through

the measured development of our existing asset.

During the period under review, we made substantial progress

delivering on that stated strategy. Zephyr is now a

cash-generating, oil producing Group with significant organic

growth prospects on the brink of delivering first potential

production from the Paradox project. As importantly, we made

tremendous progress regarding our understanding of the geology and

optimal development path of our Paradox asset, with a series of

incremental steps and positive indications related to the upside

potential of that project.

We believe the successful execution of our strategy occurred not

simply by sheer hard work, but by being bold and opportunistic

while the larger marketplace experienced turmoil and disruption due

to the impacts of the global pandemic.

PARADOX PROJECT

Overview and next steps

During the period under review and in the subsequent months, the

Company made significant headway on its operated Paradox project in

which Zephyr currently has operatorship and a minimum 75 per cent

working interest across 37,613 gross leased acres. The Company will

be targeting initial production from the Paradox project over the

coming weeks.

Recent work on the project, in particular the safe and

successful completion of the State 16-2LN-CC drilling operations in

August 2021, provided Zephyr with a far greater understanding of

not only the Company's prime target, the Cane Creek reservoir, but

also of the potential of the reservoirs that overlie the Cane Creek

(the "overlying reservoirs").

The evaluation of the significant data acquired from two

discrete drilling operations, and the results from the subsequent

DFIT, enabled the Company's technical team and consultants to

complete a thorough analysis of the optimal way in which to develop

the project.

Highlights from the DFIT included the following:

-- High formation pressure: After perforation of the State

16-2LN-CC wellbore and stimulation of the reservoir, pressure

measurements from the wellbore suggested high formation pressure -

a strong positive indicator of reservoir drive.

-- Permeability: DFIT results also suggested evidence of matrix

permeability consistent with other prolific U.S. resource

plays.

-- Hydrocarbon flow: During the DFIT operation, there was

demonstrable evidence of hydrocarbons flowing into the well after

stimulation.

-- Geomechanical interpretations: Further rock mechanical data

(including lithostatic gradient, effective stress and fracture

propagation data) has been interpreted and has provided valuable

insight to assist with completion design.

Based on the positive results from the DFIT, and in conjunction

with the log and core data acquired, Zephyr has elected to complete

the State 16-2LN-CC using hydraulic stimulation. The well will

serve as the initial "proof of concept" for wider potential

development of the Paradox asset base as a hydraulically stimulated

resource play (an "HSRP"), although natural fracture completions

may also be utilised in the future where optimal.

The Board continues to believe that that the Paradox project has

the potential to be a project of significant scale as evidenced by

the Zephyr's internal resource estimates for the project based on

HSRP development. In summary:

-- In the Cane Creek reservoir alone, up to 30 potential well

locations with a range of risked net recoverable contingent

resources of up to 18 mmboe.

-- In the overlying reservoirs high-graded by Zephyr as

potential exploration zones, an estimated P50 total of 1 billion

barrels of oil equivalent hydrocarbons in place across the

Company's acreage.

-- In total, up to 200 potential well locations with a range of

risked net recoverable contingent resources of up to 143 mmboe.

Following the decision to proceed down the HSRP completion route

for the State 16-2LN-CC well, final completion design work is

underway with plans for a completion crew to be on-site during the

second week of October. Completion operations are expected to take

less than a week and production testing is envisioned to commence

shortly thereafter, with initial flow tests and results expected

two to four weeks later.

Background

Having completed a restructuring of the Paradox project in 2020,

which primarily involved overhauling the joint venture partnership

and securing additional tenure for the most attractive project

acreage, our next task was to commence operations on the ground and

begin the process of unlocking the considerable potential value of

the project.

In September 2020, Zephyr secured US$2 million of U.S.

Government grant funding which enabled us to proceed with the

drilling of the State 16-2 well and which was the catalyst for the

considerable progress on the project in the period under

review.

After a period of intense activity to complete all drill

planning activities (including site preparation, road work, permit

approvals and vendor selection) the State 16-2 wells was spud in

December 2020 and was completed in January 2021 having been

successfully drilled to a measured depth of 9,745 ft total depth

("TD"). Drilling operations were safe and effective, conducted in

accordance with Covid-19 related guidance and restrictions, and

were completed well within the Group's forecast timeframe. This was

a fantastic achievement by everybody involved.

The primary objective was to drill and set casing at 6,450 ft

measured depth ("MD") in order to provide a host wellbore for a

future horizontal side track. This goal was achieved within

thirteen days from spud. As mentioned above, we subsequently

reached TD within nineteen days of spud, a marked improvement over

historical drilling efforts in this part of the Paradox Basin. The

reduction in drilling time represented a major operational success

and demonstrated that the cost of future development wells could be

significantly reduced from our earlier estimates, thereby improving

the overall potential value of the Paradox project for

Shareholders.

Our secondary objective was to acquire a significant amount of

new data to improve our understanding of our Paradox acreage. We

were pleased to report that Zephyr's data acquisition programme

secured the following:

-- approximately 113 ft of continuous whole core across the

historically productive Cane Creek reservoir interval - the first

whole Cane Creek core ever to be retrieved in the northern part of

the Paradox Basin;

-- rotary side wall cores in eleven shallower exploration targets; and

-- gamma ray, neutron density, resistivity, formation litho

scanner and sonic wireline log data across the bulk of the Paradox

Formation, which secured significant additional petrophysical

data.

Following the completion of drilling and data acquisition

operations, the State 16-2 well was temporarily plugged at 6,450 ft

TD, stable and for future re-use as a lateral wellbore host.

Decision to proceed with State 16-2LN-CC lateral well

The core and log data acquired from the State 16-2 Cane Creek

reservoir both corroborated and supported the Board's long-held

view that the Paradox has the potential to be a project of

considerable scale.

On 15 March 2021, we announced a detailed update on the Paradox

project, which included confirmation of evidence of hydrocarbon

saturation across the entirety of the continuous core acquired from

the Cane Creek reservoir. When integrated with the recently

acquired log data, existing 3D seismic data, geologic and regional

analogue analysis, the resulting analysis gave the Board strong

justification for advancement to the next phase of the project. The

Board therefore elected to proceed with detailed planning for the

near-term drilling of the lateral, and following the successful

completion of the fundraise in April 2021, the Company was fully

funded to commence the drilling of the lateral portion of the

well.

Drilling of the State 16-2LN-CC lateral well

Drilling operations commenced in July 2021, ahead of its

forecast timeline, and the Company was delighted to announce in

August that the well was successfully drilled to a TD of 14,370 ft,

at which point a full suite of wireline logs was run and production

casing was set.

Drilling operations achieved their main objective of hitting the

Cane Creek reservoir target and staying within that reservoir

across the entire lateral portion of the well. In addition, there

was evidence of hydrocarbon charge across the entirety of the Cane

Creek lateral, as well as in multiple overlying reservoirs.

With the setting of production casing, we now have an excellent

well bore from which to complete the well and test production from

the Cane Creek reservoir.

Results from the State 16-2LN-CC data evaluation and DFIT

Following the completion of the lateral well, the Company was

pleased to report the initial results from the interpretation of

the data acquired during drilling operations.

We were particularly pleased that wireline data suggested that

85 per cent of the lateral has the potential to be completed for

well testing and production, with additional positive data

suggesting porosity and permeability estimates equivalent to other

producing basins with prolific HSRP development, as well as mud gas

mass spectrometry evidence suggesting the presence of oil, gas and

condensate with corresponding apparent low water saturations.

Based on the preponderance of positive data received, we

therefore elected to initiate a DFIT to provide additional insight

into the potential for successful hydraulic stimulation on our

acreage position. As the State 16-2LN-CC is the first horizontal

well in this part of the Paradox Basin, the ability to develop a

strong understanding of reservoir mechanical properties was

crucially important to help assess the series of options for wider

potential development.

In early September the Company announced the results from the

DFIT, during which a 3 ft interval at the toe of the lateral was

perforated and hydraulically stimulated.

The results from the DFIT were highly encouraging and suggested

high formation pressure (a strong positive indicator of reservoir

drive), permeability consistent with other prolific resource plays,

and demonstrable evidence of hydrocarbons flowing into the well

after stimulation. In addition, the DFIT provided rock mechanical

data (including lithostatic gradient, effective stress and fracture

propagation data) which was subsequently interpreted and provided

valuable insight to assist with completion design.

In all, the results of the DFIT, combined with the significant

amount of data previously gathered from the well, all indicate that

the State 16-2LN-CC has the potential to be an excellent "proof of

concept" location for an HSRP test.

On that basis, the Board unanimously approved proceeding with a

HSRP completion at the State 16-2LN-CC.

The completion is scheduled for October 2021 and, if successful,

would result in a substantial reduction in development risk across

our acreage, as well as allow for a wider systematic development

with predictable well distribution.

Production results from the well are expected to be available in

November and will be the first test of the viability of this

strategy, but given what we have learned to date, the Board feels

confident that we will continue to hone drilling and completion

techniques on this acreage well into the future.

We believe that our Paradox acreage holds multiple opportunities

within both the Cane Creek and the shallower clastic reservoirs to

support the drilling of additional wells to delineate the acreage.

This first completion will add further data to help us understand

the reservoirs and our ability to optimise well length, well

spacing and completion design.

I would like to conclude by noting that in pursuing the HSRP

development route, Zephyr's goal is to maximise resource efficiency

and project economics while minimising environmental and surface

disruption. Zephyr's core mission is to be responsible stewards of

investors' capital while also being responsible stewards of the

environment. With any future development, we will continue to

strive to mitigate the environmental impact by reducing surface

footprint, minimising disturbance and offsetting our emissions.

NON-OPERATED PORTFOLIO

Overview

As we outlined to Shareholders in January 2021, Zephyr's key

goal for 2021 was to establish production and positive cash flow

either through our existing portfolio, via acquisition, or through

a combination of both. In the period under review and since, we

have significantly exceeded my expectations.

We have now closed four separate non-operated asset acquisitions

to date this year, deals which created a balanced asset base of

working interests in 22 producing or near-term production wells and

which also provide exposure to additional non-operated drilling

expected in 2022. I am particularly pleased that the current blend

of strong commodity prices and highly economic production has the

potential to generate enough cash flow to fund additional Paradox

Basin development.

The acquisitions completed to date are in prime locations, and

the majority of the wells are operated by Whiting Petroleum

Corporation ("Whiting"), a leading Williston Basin producer.

Sourcing and structuring compelling acquisitions requires

detailed basin knowledge and deep local experience, which is why

I'm delighted to have entered into a joint-venture ("JV") with

Purified Resource Partners LLC ("Purified") related to ongoing

non-operated business development efforts . I have known the

Purified principals for over two decades, and have watched as they

successfully assembled a top-notch portfolio of Williston Basin

non-operated interests for their former sponsor.

Over the last few months, we've worked very closely with

Purified to close our initial Williston Basin acquisitions, the

details of which are outlined below, and I look forward to

continued collaboration and co-investment from their team.

Whiting wells

In March 2021, following a successful fundraise to fund the

acquisition, the Group completed the purchase of the initial

Whiting wells, which were expected to provide the Group with

low-risk oil production from five already drilled wells and to

generate substantial cash flows that could be utilised across the

Group.

The initial cost of the acquisition was US$350,000. In addition,

the Company made a payment of approximately US $3.7 million to the

project operator for historical capital expenditure ("CAPEX")

obligations on the project.

The key details of the project were as follows:

-- acquisition of non-operated working interests in five wells

(one producing well and four drilled but uncompleted wells (a "DUC"

or "DUCs") in Mountrail County, North Dakota, U.S.;

-- the working interests on the five wells ranged from 16.8% to 37.2%;

-- the wells are operated by Whiting, an active and highly

experienced operator in the Williston Basin;

-- the Group agreed headline terms with the vendor when the oil

price was at US$45 per barrel of oil ("bo");

-- the producing well had been on production since March 2020

and first revenue payments were received by Zephyr in April

2021;

-- the completions on the four DUCs commenced in April and

production revenues will be received on all four wells by the end

of October 2021;

-- 2P Reserves acquired were estimated at 449,434 boe to the Group; and

-- the five wells are spread across three separate drilling pads, creating attractive production diversification.

The key benefits of the Whiting well acquisition are as

follows:

-- a low-risk acquisition with substantial near-term cash flow expected;

-- no remaining drilling risk - all five wells were already

drilled successfully to target depth;

-- excellent complement to (and funding source for future

development on) the Paradox project; and

-- no federal tax payments payable in the short-term as profits

can be offset against the Group's historic tax losses.

The Group forecasts that the acquisition will provide:

-- up to US$8 million of undiscounted cash flow over the next 12

months, and a total of US$15 million of undiscounted cash flow over

the lifetime of the project, for Zephyr to deploy into the Paradox

development or into additional projects (assuming an oil price of

US$60/bo);

-- 2P net present value at NPV-10 of US$4.3 million;

-- a cash flow breakeven oil price of US$36.69/bo (inclusive of all CAPEX expended);

-- a one-year cash payback; and

-- the opportunity to shelter U.S. federal tax payments by

utilising the Group's historical tax losses of more than US$16

million.

Continental acreage

In May 2021, Zephyr announced the acquisition of the Continental

acreage, which gave the Group a working interest in a drilling

spacing unit ("DSU") operated by Continental Resources Inc ("

Continental "), the largest operator in the Williston Basin. The

Continental acreage is located approximately ten miles from the

Company's Whiting wells, in a highly attractive part of the Basin.

The cost of the acreage acquired by Zephyr was approximately

US$170,000 and was paid for from the Company's existing cash

resources.

Continental has drilled two initial wells on the DSU ("Initial

wells"), with up to an additional 22 future wells ("Future wells")

forecast to be drilled by 2023.

-- Zephyr's forecast net CAPEX for the initial wells was

approximately US$135,000 which was funded from existing cash

resources.

-- Zephyr's net CAPEX for the proposed 22 Future wells is

forecast to be approximately US$710,000, which could also be funded

from the Group's existing cash resources.

-- CAPEX on the Future wells is discretionary, and Zephyr's

Board of Directors will elect whether to participate in those wells

on a case-by-case basis.

The Continental acreage has, net to Zephyr, Company estimated 2P

reserves (from all 24 wells) of circa 60,000 boe which were

acquired at a price of approximately US$2.83/boe. The 1P reserves

on the Continental acreage are, net to Zephyr, estimated at circa

41,000 boe and the 3P reserves at circa 72,000 boe.

This opportunistic acquisition has strong forecasted economics

and has provided the Company with additional exposure to low risk,

near-term production. Initial revenues from the acquisition are

expected to be received in the second half of this year.

The acquisition of the Continental acreage, in a DSU operated by

a first-class Williston Basin participant, is a strong example of

what can be achieved in the current market. The acreage is in an

excellent location and provides both near-term drilling exposure

and future drilling optionality. While the initial scale of the

acquisition is small, for a minimal upfront cost Zephyr now has

potential to participate in up to twenty-four highly economic wells

over the next two years. Given the continued improvement in

drilling costs and robust oil price environment, we believe this

acreage will provide attractive near-term cash flow returns and is

an excellent addition to our asset portfolio.

Production

During Q2 2021, the Company's net production from the Whiting

and Continental wells averaged 148 boe/d with an average realised

sales price of US$52.90 per boe.

In September 2021, the Company provided a further update to the

market on the progress on the Whiting and Continental wells. In

summary:

-- The Company reported that production from the wells was, net

to Zephyr, 506 boe/d during August 2021.

-- Four of the wells continue to be brought into full

production, with oil production still rising, water cuts reducing

and stable gas oil ratios.

-- Four of the wells were initially brought on at reduced

production rates in order to minimise any gas flaring and CO2

emission impact while gas export infrastructure constraints were

addressed, a CO2 mitigation effort very much welcomed by the Board.

Now that those infrastructure constraints have been resolved, the

Company expects overall production to continue to rise during the

next quarter and further updates will be announced as production

data matures.

Further non-operated acquisitions

In September 2021, Zephyr announced the completion of two

additional non-operated portfolio acquisitions in the Williston

Basin.

Details of the acquisitions were as follows:

-- The first acquisition purchased 72.5 net acres, resulting in

an average 5.6% working interest in four drilled but uncompleted

("DUC") wells operated by Prima Exploration Inc. ("Prima") which

target production from the Middle Bakken reservoir in Richland

County, Montana, U.S.

-- The second acquisition purchased an average 3.1% WI in 11

wells (one currently being drilled and 10 DUC wells) operated by

Whiting, all of which target the Middle Bakken reservoir in

Mountrail County, North Dakota, U.S.

-- All newly acquired wells are estimated by Zephyr to have

rapid paybacks, high internal rates of return and a combined total

2P estimated ultimate recoveries (EURs), net to Zephyr, of 194,000

boe.

-- Once initial payback has been achieved, Zephyr can utilise

its historical tax losses of more than US$16 million to reduce the

federal tax payable on the revenues received from these new

acquisitions.

-- Total consideration for the new acquisitions was US$968,000,

which has been paid for from the Company's existing cash

resources.

-- In addition to the acquisition price paid, Zephyr plans to

fund the discretionary CAPEX related to the drilling and completion

of the 15 wells acquired. This CAPEX total is forecast to be circa

US$3.9 million. CAPEX will be due in late 2021 and early 2022, and

the Board expects to be able to fund this CAPEX out of its current

cash resources and with additional revenues from its current

production.

-- The Company expects all 15 newly acquired wells to be in

production by 31 March 2022, resulting in a forecasted additional

200-300 net boe/d. Additional updates will be provided as wells

come online and adequate production history is gathered.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

As previously mentioned, the Board is unanimously committed to

ensuring that every action and investment decision the Company

makes is in line with our core values. This includes the following

points of focus:

-- we will continue to protect the Group, safeguard its existing

asset base and position it for attractive growth opportunities;

-- we will continue to seek creative and beneficial funding

opportunities in an effort to unlock value from our existing asset

portfolio, as evidenced by the U.S. Government funding we received

for our recent drilling programme on the Paradox project;

-- we will continue to adopt a disciplined focus on growth via

the acquisition of producing or near-term development opportunities

in the Rocky Mountain region. Even in this unusual economic

environment, we believe that attractive, value-additive

acquisitions are available and may be acquired using

non-traditional funding structures;

-- we will continue with our programme of tight financial

controls and cash preservation which will enable the Group to

continue trading effectively; and

-- we will continue to ensure management and the Board are

aligned with our Shareholders through significant ownership of

shares.

I am proud of how we have conducted our operations in the period

under review and we will continue to adhere to our core values of

being responsible stewards of investors' capital and being

responsible stewards of the environment in which we work.

Furthermore, I was delighted that Zephyr was able to recently

announce that it has achieved carbon-neutrality across its

operational footprint prior to its published goal of 30 September

2021.

As an integral part of this undertaking, Zephyr is collaborating

with the Prax Group, a British multinational independent oil

refining, trading, storage, distribution and retail conglomerate

dealing in crude oil, petroleum products and bio-fuels,

headquartered in London, United Kingdom. The Prax Group, which has

trading offices in London, Singapore and the U.S., worked with

Zephyr to measure, reduce and mitigate greenhouse gas ("GHG")

emissions across Zephyr's businesses, with mitigation efforts

primarily focused on the purchase of sustainability/decarbonisation

offsets (called Verified Emission Reductions or "VER") from

reputable pre-vetted developers of sustainable projects. This

exercise includes Zephyr's current corporate activity, its

non-operated production assets in the Williston Basin, North

Dakota, U.S., and its upcoming appraisal drilling project in the

Paradox Basin, Utah, U.S.

In addition to the environmental benefits that will result from

Zephyr's efforts to reach carbon-neutrality, the Company

anticipates that this approach will also yield economic benefits

including expanded access to a wider group of potential

institutional investors, as total ESG-focused assets under

management are currently estimated to be over US$30 trillion

globally. Moreover, the average cost of capital for companies with

committed ESG and decarbonisation initiatives has been shown to be

demonstrably less than that of traditional resource companies. The

Board believes that incremental regulatory benefits may also

materialise from Zephyr's actions.

JV with Purified

In September I was excited to announce the formation of a JV

with Purified for the identification and execution of additional

non-operated acquisitions. Purified's principals have substantial

experience in the Williston Basin, a basin in which they previously

helped assemble and close over US$70 million of non-operated asset

acquisitions and associated CAPEX for a private equity-backed

vehicle.

Purified has assisted and/or co-invested with Zephyr in all four

Williston acquisitions that it has closed this year, and their team

will have the right to continue to co-invest up to 20 per cent in

future transactions. The newly formed JV provides Zephyr with

significant land and business development expertise directly in

Zephyr's geographic region of focus.

Commencement of trading on OTCQB Venture Market

In July 2021, Zephyr announced that its Ordinary Shares had been

approved to trade on the OTCQB Venture Market ("OTCQB") in the

U.S.

We believe that c ross-trading on the OTCQB will increase

liquidity and significantly enhance the ability of U.S. based

investors to access and trade Zephyr shares during a period in

which we are actively expanding our U.S. asset base. Over the

coming months, Zephyr's management team will place specific

additional emphasis on increasing our outreach efforts to U.S.

based institutions and investors.

FINANCIAL REVIEW

The financial information is reported in United States Dollars

("US$").

Income Statement

The Group reports revenues from its newly acquired Whiting wells

for the six months ended 30 June 2021 of US$0.9 million (30 June

2020: nil). Revenues relate to the Company's share of production

from the corresponding wells from 1 March 2021. Revenues for the

second half of the financial year will be considerably higher as it

will not only include revenues for a full six-month period but will

also include revenue from all five of the Whiting wells, some of

which came online until after 30 June.

Administrative expenses for the six months ended 30 June 2021

were US$1.2 million (30 June 2020: US$0.6 million). The increase in

administrative expenses mirrors the Company's growth over the last

twelve months as it emerged from a significant corporate

retrenchment in response to the global pandemic, in addition to the

increase in its asset portfolio and significantly enhanced

corporate and operational footprint. Costs continue to be closely

controlled and monitored regularly by executive management and also

at Board level, with this being a continuing priority of the Board.

It is recognised by the Board, however, that additional technical,

legal and other costs were justified to help deliver the various

acquisitions which the Company has secured over the past nine

months.

Net loss after tax from continuing operations was US$1.0 million

or a loss of 0.1 US cents per share for the six months ended 30

June 2021 (30 June 2020: net profit after tax from continuing

operations of US$0.9 million or a profit of 0.32 US cents per

share).

The profit for the comparative six-month period to 30 June 2020

was primarily the result of unrealised foreign exchange differences

that arose on the restatement of the Company's loans to its

subsidiaries. These foreign exchange differences resulted in an

unrealised loss of US$0.4 million for the six months ended 30 June

2021 (30 June 2020: unrealised gain of US$1.6 million). The

unrealised loss in this period is the result of the strengthening

of sterling against the US dollar.

Balance Sheet

Intangible assets at 30 June 2021 were US$16.0 million (30 June

2020: US$13.6 million) which reflects the Company's ongoing

investment into the Paradox project.

Tangible assets at 30 June 2021 were US$6.4 million (30 June

2020: US$44,000) which reflects the Company's ongoing investment in

the Whiting wells and the Continental acreage.

Cash and cash equivalents at 30 June 2021 were US$9.2 million

(30 June 2020: US$0.4 million), primarily due to the Company's

US$13.9 million (GBP10 million) fundraise that completed in April

2021. Cash conservation and tight cash management remain key

priorities of the Board. Cash and cash equivalents at 1 September

2021 were US$4 million.

CONCLUSION

The period under review was one of substantial progress for the

Group, and I am confident that over the next few months we will

continue to see a flurry of corporate and operational activity as

we target production from the Paradox project and accumulate

significant cash flows from our non-operated assets in the

Williston Basin. Over the next period there is also the possibility

of the expansion of the Group's asset portfolio through additional

acquisitions or partnerships.

These are exciting times, and we look forward to keeping all our

stakeholders updated on our progress.

Finally, I would like to extend my heartfelt gratitude to the

Company's Shareholders and advisers for their ongoing support. We

are delighted to be invested alongside you, and we look forward to

keeping you updated as we progress through these exciting

times.

Colin Harrington

Chief Executive Officer

30 September 2021

ZEPHYR ENERGY PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

For the six months ended 30 June 21

Unaudited Unaudited Audited

six months six months year ended

ended 30 June ended 30 31 December

June

2021 2020 2020

Notes US$'000 US$'000 US$'000

Continuing operations

Revenue 917 - -

Cost of Sales (270) - -

Gross profit 647 - -

Administrative expenses (1,194) (613) (1,517)

Development expenses (43) (104) (135)

Foreign exchange (losses)/gains (377) 1,623 (705)

Operating (loss)/profit (967) 906 (2,357)

Other income - - 13

Finance costs (1) - -

(Loss)/profit before taxation (968) 906 (2,344)

Taxation charge (7) - -

(Loss)/profit for the period attributable

to owners of the parent company (975) 906 (2,344)

(Loss)/profit per Ordinary Share

Basic and diluted, cents per share 3 (0.10) 0.32 (0.66)

ZEPHYR ENERGY PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2021

Unaudited Unaudited Audited

six months six months year ended

ended 30 ended 30 31 December

June June

2021 2020 2020

US$'000 US$'000 US$'000

(Loss)/profit for the period attributable

to owners of the parent company (975) 906 (2,344)

Other comprehensive income

Items that may be subsequently reclassified

to profit or loss, net of tax

Foreign currency translation differences

on foreign operations (619) 3,223 (1,277)

Total comprehensive (loss)/profit

for the period attributable to owners

of the parent company (1,594) 4,129 (3,621)

ZEPHYR ENERGY PLC

CONDENSED CONSOLIDATED BALANCE SHEET

As at 30 June 2021

Unaudited Unaudited Audited

as at as at as at

30 June 30 June 31 December

2021 2020 2020

Notes US$'000 US$'000 US$'000

Non-current assets

Intangible assets 4 15,962 13,586 13,914

Property, plant and equipment 5 6,462 44 28

22,424 13,630 13,942

Current assets

Trade and other receivables 861 88 135

Cash and cash equivalents 9,216 350 3,940

10,077 438 4,075

Total assets 32,501 14,068 18,017

Current liabilities

Trade and other payables (3,163) (411) (2,464)

Lease liabilities - (23) (8)

(3,163) ( (434) (2,472)

Non-current liabilities

Provisions (67) (57) (7)

Total liabilities (3,230) (491) (2,479)

Net assets 29,271 13,577 15,538

Equity

Share capital 6 42,045 40,688 41,221

Share premium account 51,787 37,975 39,638

Warrant reserve 136 227 227

Share-based payment reserve 4,581 3,341 3,762

Cumulative translation reserves (8,892) (11,612) (9,225)

Retained deficit (60,386) (57,042) (60,085)

Equity attributable to owners

of the parent company 29,271 13,577 15,538

ZEPHYR ENERGY PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2021 (Unaudited)

Share-based

Share payment Cumulative

Share premium Warrant reserve translation Retained

capital account reserve reserve deficit Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

As at 1 January

2021 41,221 39,638 227 3,762 (9,225) (60,085) 15,538

Transactions with

owners in their

capacity as owners:

Issue of equity

shares 824 14,332 - - - - 15,156

Expenses of issue

of equity shares - (2,183) - 1,357 - - (826)

Transfer to retained

deficit in respect

of exercised warrants - - (91) (583) - 674 -

Share-based payments - - - 45 - - 45

Total transactions

with owners in

their capacity

as owners 824 12,149 (91) 819 - 674 14,375

Loss for the period - - - - - (975) (975)

Other comprehensive

income:

Currency translation

differences - - - - (619) - (619)

Total other

comprehensive

income for the

period - - - - (619) - (619)

Total comprehensive

income for the

period - - - - (619) (975) (1,594)

Currency translation

differences on

equity at historical

rates - - - - 952 - 952

As at 30 June 2021 42,045 51,787 136 4,581 (8,892) (60,386) 29,271

ZEPHYR ENERGY PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2020 (Audited)

Share-based

Share payment Cumulative

Share premium Warrant reserve translation Retained

capital account reserve reserve deficit Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

As at 1 January

2020 40,688 37,975 568 3,748 (9,972) (58,737) 14,270

Transactions with

owners in their

capacity as owners:

Issue of equity

shares 533 2,401 - - - - 2,934

Expenses of issue

of equity shares - (738) - 594 - - (144)

Transfer in respect

of lapsed warrants - - (341) (251) - 592 -

Share-based payments - - - 79 - - 79

Transfer in respect

of lapsed options - - - (404) - 404 -

Effect of foreign

exchange rates - - - (4) - - (4)

Total transactions

with owners in

their capacity

as owners 533 1,663 (341) 14 - 996 2,865

Loss for the year - - - - - (2,344) (2,344)

Other comprehensive

income:

Currency translation

differences - - - - (1,277) - (1,277)

Total other

comprehensive

income for the

period - - - - (1,277) - (1,277)

Total comprehensive

income for the

year - - - - (1,277) (2,344) (3,621)

Currency translation

differences on

equity at historical

rates - - - - 2,024 - 2,024

As at 31 December

2020 41,221 39,638 227 3,762 (9,225) (60,085) 15,538

ZEPHYR ENERGY PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2020 (Unaudited)

Share-based

Share payment Cumulative

Share premium Warrant reserve translation Retained

capital account reserve reserve deficit Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

As at 1 January

2020 40,688 37,975 568 3,748 (9,972) (58,737) 14,270

Transactions with

owners in their

capacity as owners:

Transfer to retained

deficit in respect

of lapsed

warrants/options - - (341) (448) - 789 -

Share-based payments - - - 42 - - 42

Effect of foreign

exchange rates - - - (1) - - (1)

Total transactions

with owners in

their capacity

as owners - - (341) (407) - 789 41

Profit for the

period - - - - - 906 906

Other comprehensive

income:

Currency translation

differences - - - - 3,223 - 3,223

Total other

comprehensive

income for the

period - - - - 3,223 - 3,223

Total comprehensive

income for the

period - - - - 3,223 906 4,129

Currency translation

differences on

equity at historical

rates - - - - (4,863) - (4,863)

As at 30 June 2020 40,688 37,975 227 3,341 (11,612) (57,042) 13,577

ZEPHYR ENERGY PLC

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 30 June 2021

Unaudited Unaudited Audited

six months six months year ended

ended 30 ended 30 31 December

June June

2021 2020 2020

Appendices US$'000 US$'000 US$'000

Net cash from/(used) in operating

activities a 777 (661) (1,350)

Net cash (used in)/from investing

activities b (9,843) (38) 1,445

Net cash from/(used in) financing

activities c 14,322 (26) 2,745

Net increase/(decrease) in cash

and cash equivalents 5,256 (725) 2,840

Cash and cash equivalents at

beginning of period 3,940 1,084 1,084

Effect of foreign exchange rate

changes 20 (9) 16

Cash and cash equivalents at

end of period 9,216 350 3,940

ZEPHYR ENERGY PLC

APPICES TO THE CONDENSED CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 30 June 2021

Unaudited Unaudited Audited

six months six months year ended

ended 30 ended 30 31 December

June June

2021 2020 2020

US$'000 US$'000 US$'000

a Operating activities

(Loss)/profit before taxation from

continuing operations (968) 906 (2,344)

Finance costs 1 - -

Adjustments for:

Depreciation of property, plant

and equipment 96 29 49

Share-based payments 45 5 79

Unrealised foreign exchange gain 308 (1,631) 739

Operating outflow before movements

in working capital (518) (691) (1,477)

(Increase)/decrease in trade and

other receivables (616) 24 (20)

Increase in trade and other payables 1,913 6 147

779 (661) (1,350)

Income tax paid (2) - -

Net cash from/(used) in operating

activities 777 (661) (1,350)

b Investing activities

Purchase of intangible exploration

and evaluation

assets (4,116) (38) (355)

Grant funds received 200 - 1,800

Purchase of development and production (5,927) - -

assets

Net cash (used in)/from investing

activities (9,843) (38) 1,445

c Financing activities

Proceeds from issue of shares 15,156 - 2,934

Expenses of issue of shares (826) - (144)

Repayment of lease liabilities (8) (26) (45)

Net cash from/(used in) financing

activities 14,322 (26) 2,745

ZEPHYR ENERGY PLC

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

For the six months ended 30 June 2021

1. ACCOUNTING POLICIES

Basis of preparation

This report was approved by the Directors on 30 September

2021.

The condensed consolidated interim financial statements have

been prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards as

adopted by the EU ('Adopted IFRSs')

The condensed consolidated interim financial statements are

presented in United States Dollar ('US$') as the Group's trading

operations, and the majority of its assets are primarily

represented in US$.

The Company is domiciled in the United Kingdom. The Company's

shares are admitted to trading on the AIM market in the UK and the

OTCQB Venture Market ("OTCQB") in the U.S.

The current and comparative periods to June have been prepared

using the accounting policies and practices consistent with those

adopted in the annual financial statements for the year ended 31

December 2020, and with those expected to be adopted in the Group's

financial statements for the year ending 31 December 2021.

Comparative figures for the year ended 31 December 2020 have

been extracted from the statutory financial statements for that

period which carried an unqualified audit report, did not contain a

statement under section 498(2) or (3) of the Companies Act 2006 and

have been delivered to the Registrar of Companies.

The financial information contained in this report does not

constitute statutory financial statements as defined by section 434

of the Companies Act 2006, and should be read in conjunction with

the Group's financial statements for the year ended 31 December

2020. This report has not been audited or reviewed by the Group's

auditors.

During the first six months of the current financial year there

have been no related party transactions that materially affect the

financial position or performance of the Group and there have been

no changes in the related party transactions described in the last

annual financial report.

Having considered the Group's current cash forecast and

projections, and following detailed conversations with the

Company's brokers and major shareholders, the Directors have a

reasonable expectation that the Company and the Group have, or have

access to, sufficient resources to continue operating for at least

the next 12 months. Accordingly, the Directors continue to adopt

the going concern basis in preparing the financial statements.

The principal risks and uncertainties of the Group have not

changed since the publication of the last annual financial report

where a detailed explanation of such risks and uncertainties can be

found.

2. DIVIDS

The Directors do not recommend the payment of a dividend for the

period.

3. (LOSS)/PROFIT PER ORDINARY SHARE

Basic (loss)/profit per Ordinary Share is calculated by dividing

the net (loss)/profit for the period attributable to owners of the

parent company by the weighted average number of Ordinary Shares

outstanding during the period. The calculation of the basic and

diluted (loss)/profit per Ordinary Share is based on the following

data:

Continuing Continuing Continuing

operations operations operations

unaudited unaudited audited

six months six months year ended

ended 30 ended 30 31 December

June June 2020

2021 2020 US$'000

US$'000 US$'000

(Losses)/profits

(Losses)/profits)

for the purpose of

basic (loss)/profit

per Ordinary Share

being net (loss)/profit

attributable to owners

of the parent company (975) 906 (2,344)

Number Number Number

'000 '000 '000

Number of shares

Weighted average

number of shares

for the purpose of

basic (loss)/profit

per Ordinary Share 939,631 287,111 357,951

(Loss)/profit per

Ordinary Share

Basic and diluted,

cents per share (0.10) 0.32 (0.66)

Due to the losses incurred, there is no dilutive effect from the

existing share options, share based compensation plan or

warrants.

4. INTANGIBLE ASSETS

Exploration

and evaluation

assets US$'000

Cost

At 1 January 2020 13,549

Additions 37

At 30 June 2020 13,586

Additions 2,128

Grant funds (1,800)

At 31 December 2020 13,914

Additions 2,338

Grant funds (290)

At 30 June 2021 15,962

Carrying amount

At 30 June 2021 15,962

At 30 June 2020 13,586

At 31 December 2020 13,914

5. PROPERTY, PLANT AND EQUIPMENT

Development

Plant and Right-of-use and production

machinery assets assets Total

'000 '000 '000 '000

Cost

At 1 January 2020 159 90 - 249

Exchange differences (1) (4) - (5)

At 30 June 2020 158 86 - 244

Disposal (39) (34) - (73)

Exchange differences 10 5 - 15

At 31 December 2020 129 57 - 186

Additions - - 6,530 6,530

Exchange differences 2 1 - 3

At 30 June 2021 131 58 6,530 6,719

Accumulated depreciation,

depletion and amortisation

At 1 January 2020 142 30 - 172

Charge for the period 3 26 - 29

Exchange differences - (1) - (1)

At 30 June 2020 145 55 - 200

Charge for the period 2 18 - 20

Disposal (39) (34) - (73)

Exchange differences 9 2 - 11

At 31 December 2020 117 41 - 158

Charge for the period 3 16 77 96

Exchange differences 2 1 - 3

At 30 June 2021 122 58 77 257

Carrying amount

At 30 June 2021 6,462

At 30 June 2020 44

At 31 December 2020 28

6. SHARE CAPITAL

Unaudited Unaudited Audited

as at as at as at

30 June 30 June 31 December

2021 2020 2020

Number Number Number

'000 '000 '000

Authorised

Ordinary Shares of 0.1p each 7,779,297 7,779,297 7,779,297

Deferred Shares of 9.9p each 227,753 227,753 227,753

8,007,050 8,007,050 8,007,050

Unaudited Unaudited Audited

as at as at as at

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Allotted, issued and fully paid

1,290,314,182 Ordinary Shares of 0.1p

each (30 June 2020: 287,111,606: 31

December 2020 696,202,515) 1,740 383 916

227,752,817 Deferred Shares of 9.9p

each 40,305 40,305 40,305

42,045 40,688 41,221

The Deferred Shares are not listed on AIM, do not give the

holders any right to receive notice of, or to attend or vote at,

any general meetings, have no entitlement to receive a dividend or

other distribution or any entitlement to receive a repayment of

nominal amount paid up on a return of assets on winding up nor to

receive or participate in any property or assets of the Company.

The Company may, at its option, at any time redeem all of the

Deferred Shares then in issue at a price not exceeding GBP0.01 from

all shareholders upon giving not less than 28 days' notice in

writing.

As outlined in the Company's 2020 Annual Report it is the

Company's intention to issue nil-cost options to certain Directors

and employees to compensate them for salaries sacrificed during

2020. This will be done when the Board is permitted to do so and in

line with its regulatory responsibilities.

ISSUED ORDINARY SHARE CAPITAL

In January 2021, the Company issued 1,308,227 Ordinary Shares of

0.1p each at a price of 0.55p per share, raising gross proceeds of

US$0.012 million (GBP0.01 million).

In February 2021, the Company issued 5,124,000 Ordinary Shares

of 0.1p each at a price of 0.55p per share, raising gross proceeds

of US$0.048 million (GBP0.035 million).

In February 2021, the Company issued 8,236,363 Ordinary Shares

of 0.1p each at a price of 2p per share, raising gross proceeds of

US$0.22 million (GBP0.16 million).

In March 2021, the Company issued 200,000,000 Ordinary Shares of

0.1p each at a price of 2p per share, raising gross proceeds of

US$5.5 million (GBP4.0 million).

In March 2021, the Company issued 8,468,182 Ordinary Shares of

0.1p each at a price of 2p per share, raising gross proceeds of

US$0.23 million (GBP0.17 million).

In April 2021, the Company issued 300,000,000 Ordinary Shares of

0.1p each at a price of 2p per share, raising gross proceeds of

US$8.4 million (GBP6.0 million).

In April 2021, the Company issued 2,428,885 Ordinary Shares of

0.1p each at a price of 0.08p per share, raising gross proceeds of

US$0.03 million (GBP0.02 million).

In May 2021, the Company issued 2,727,273 Ordinary Shares of

0.1p each at a price of 2p per share, raising gross proceeds of

US$0.08million (GBP0.05 million).

In June 2021, the Company issued 62,409,646 Ordinary Shares of

0.1p each at a price of 0.55p per share, raising gross proceeds of

US$0.55 million (GBP0.4 million).

In June 2021, the Company issued 3,409,091 Ordinary Shares of

0.1p each at a price of 2p per share, raising gross proceeds of

US$0.09 million (GBP0.07 million).

Ordinary Deferred

Shares Shares

Number Number

'000 '000

At 1 January 2020 and 30 June 2020 287,112 227,753

Allotment of shares 409,090 -

At 31 December 2020 696,202 227,753

Allotment of shares 594,112 -

At 30 June 2021 1,290,314 227,753

7. POST BALANCE SHEET EVENTS

All matters relating to events occurring since the period end

are reported in the Chief Executive's Statement.

Dr Gregor Maxwell, BSc Hons. Geology and Petroleum Geology, PhD,

Technical Adviser to the Board of Zephyr Energy plc, who meets the

criteria of a qualified person under the AIM Note for Mining and

Oil & Gas Companies - June 2009, has reviewed and approved the

technical information contained within this announcement.

Estimates of resources and reserves contained within this

announcement have been prepared according to the standards of the

Society of Petroleum Engineers. All estimates are internally

generated and subject to third party review and verification.

Glossary of Terms

Reserves are those quantities of petroleum anticipated to be

commercially recoverable by application of development projects to

known accumulations from a given date forward under defined

conditions. Reserves must satisfy four criteria: discovered,

recoverable, commercial, and remaining (as of the evaluation's

effective date) based on the development project(s) applied. When

the range of uncertainty is represented by a probability

distribution, a low, best, and high estimate shall be provided such

that:

Proved Reserves are those quantities of Petroleum that, by

analysis of geoscience and engineering data, can be estimated with

reasonable certainty to be commercially recoverable from known

reservoirs and under defined technical and commercial conditions.

If deterministic methods are used, the term "reasonable certainty"

is intended to express a high degree of confidence that the

quantities will be recovered. If probabilistic methods are used,

there should be at least a 90% probability that the quantities

actually recovered will equal or exceed the estimate.

Probable Reserves are those additional Reserves which analysis

of geoscience and engineering data indicate are less likely to be

recovered than Proved Reserves but more certain to be recovered

than Possible Reserves. It is equally likely that actual remaining

quantities recovered will be greater than or less than the sum of

the estimated Proved plus Probable Reserves (2P). In this context,

when probabilistic methods are used, there should be at least a 50%

probability that the actual quantities recovered will equal or

exceed the 2P estimate.

Possible Reserves are those additional Reserves that analysis of

geoscience and engineering data suggest are less likely to be

recoverable than Probable Reserves. The total quantities ultimately

recovered from the project have a low probability to exceed the sum

of Proved plus Probable plus Possible (3P) Reserves, which is

equivalent to the high-estimate scenario. When probabilistic

methods are used, there should be at least a 10% probability that

the actual quantities recovered will equal or exceed the 3P

estimate.

*Production summaries and estimates are given as two phase well

head fluids (oil and unprocessed gas) summaries or estimates. A 6

mcf (thousand cubic feet) of gas to one BOE is used in the

conversion of gas to barrel of oil equivalents.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEDFAUEFSESU

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

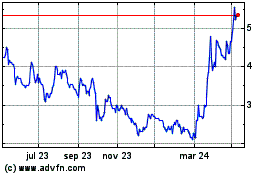

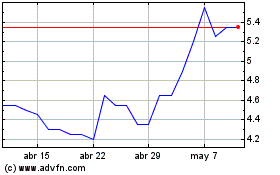

Zephyr Energy (LSE:ZPHR)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Zephyr Energy (LSE:ZPHR)

Gráfica de Acción Histórica

De May 2023 a May 2024