TIDMBERI

BLACKROCK ENERGY AND RESOURCES INCOME TRUST PLC (LEI:54930040ALEAVPMMDC31)

INVESTMENT OBJECTIVE

The Company's objectives are to achieve an annual dividend target and, over the

long term, capital growth by investing primarily in securities of companies

operating in the mining and energy sectors.

PERFORMANCE RECORD

31 May 30

2020 November Change

(unaudited) 2019 %

(audited)

Net asset value per ordinary share (pence) 65.71 75.28 -12.7

- with dividends reinvested1 -10.0

Net assets (GBP'000)2 74,558 85,945 -13.2

Ordinary share price (mid-market) (pence) 55.20 66.00 -16.4

- with dividends reinvested1 -13.3

Discount to net asset value1 16.0% 12.3%

======== ======== ========

For the six For the six

months months

ended ended

31 May 31 May

2020 2019 Change

(unaudited) (unaudited) %

Revenue

Net profit on ordinary activities after taxation (GBP'000) 2,113 2,282 -7.4

Revenue earnings per ordinary share (pence) 1.86 1.97 -5.6

-------------- -------------- --------------

Interim dividends (pence)

1st interim 1.00 1.00 -

2nd interim3 1.00 1.00 -

======== ======== ========

1 Alternative Performance Measures, see Glossary included within the

interim report (which can be found on the Company's website at

www.blackrock.com/uk/beri).

2 The change in net assets reflects market movements, the buyback of shares

and dividends paid during the period.

3 Paid on 17 July 2020.

PERFORMANCE TO 31 MAY 2020

Six months One year Three years Five years

Net Asset Value (with dividends reinvested)1 -10.0% -9.3% 4.0% 4.8%

-------------- -------------- -------------- --------------

Share price (with dividends reinvested)1 -13.3% -16.0% -10.0% -13.9%

======== ======== ======== ========

1 Alternative Performance Measure. Further details of the calculation of

performance with dividends reinvested are given in the Glossary included within

the interim report (which can be found on the Company's website at

www.blackrock.com/uk/beri).

Source: BlackRock.

CHAIRMAN'S STATEMENT FOR THE SIX MONTHS TO 31 MAY 2020

MARKET OVERVIEW

The past six months have been challenging for investors across the globe, with

the COVID-19 pandemic creating deep uncertainty about the prospects for

economies and triggering extreme volatility in markets. The early weeks of the

period under review began promisingly for the mining and energy sectors but

this was swept away in mid-February when the extent of the global health crisis

became apparent and markets slumped. Shares in oil companies were particularly

badly affected as the crisis emerged at the same time as heightened political

tensions between the major oil producing nations, which conspired to drive

crude oil prices sharply lower. Stock markets have subsequently rallied and oil

prices have partially recovered, aided by the eventual implementation of OPEC1

production cuts. Mined commodity prices have also risen as positive economic

data from China indicated some recovery in industrial activity. However,

despite these recent promising indications, significant market volatility is

expected to remain until there is greater clarity on the likely duration of the

COVID-19 outbreak and its effects on the global economy.

PERFORMANCE

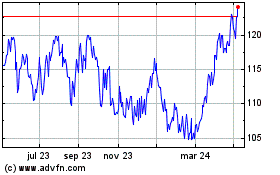

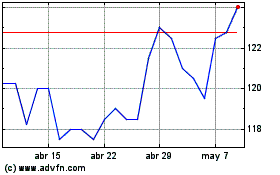

During the six months ended 31 May 2020 the Company's net asset value ('NAV')

per share fell by 10.0% and its share price fell by 13.3% (both percentages in

sterling terms with dividends reinvested). Although the Company does not have a

formal benchmark, to set this in the context of the market backdrop, the EMIX

Global Mining Index rose by 6.3% and the MSCI World Energy Index fell by 28.3%

over the same period (both percentages in sterling terms with dividends

reinvested). Further information on investment performance is given in the

Investment Manager's Report.

Since the period end and up until close of business on 28 July 2020 the

Company's NAV has increased by 11.8% and the share price has risen by 17.4%

(with dividends reinvested).

FOCUS ON ENERGY TRANSITION

The Board announced on 17 March that, within the parameters of the Company's

existing investment policy, it intended to increase exposure to stocks

benefitting from the transition in the energy sector, away from carbon-based

energy supplies towards alternative and renewable sources. The Board views the

global transition to a low-carbon economy as a secular trend and an investment

opportunity that demands inclusion in the portfolio in a significant way. The

Company has adopted a balanced approach, and will continue to incorporate

traditional energy and mining equity investments in the portfolio, as these

continue to have a key role to play in the energy transition theme alongside

those in the vanguard of sustainable energy production. As at 28 July 2020,

27.4% of the portfolio is now invested in these transitional energy stocks,

with 18.6% invested in traditional energy holdings and 54.0% invested in the

mining sector.

The Board does not formally benchmark the Company's performance against mining

and energy sector indices because meeting a specific dividend target is not

within the scope of these indices but also because no index that appropriately

reflects the Company's blended exposure to the energy and mining sectors. For

internal purposes, however, the Board compares the performance of the portfolio

against a bespoke internal mining and energy composite index and this will

evolve in line with the portfolio changes described above. The neutral sector

weightings of 50% mining and 50% traditional energy in this current bespoke

index will evolve to 40% mining, 30% traditional energy and 30% energy

transition sector weightings.

REVENUE RETURN AND DIVIDS

While dividends have come under pressure in the wider equity markets as a

result of the COVID-19 crisis, the income from the investments held by your

Company has remained relatively robust. Revenue return per share for the

six-month period was 1.86 pence (six months to 31 May 2019: 1.97 pence). The

Board's current target is to declare quarterly dividends of at least 1.00 pence

per share in the year to 30 November 2020, making a total of at least 4.00

pence for the year as a whole. This target represents a yield of 7.2% based on

the share price of 55.20 pence per share as at 31 May 2020.

The first quarterly dividend of 1.00 pence per share was paid on 18 April 2020

and the second quarterly dividend of 1.00 pence per share was paid on 17 July

2020 (four quarterly interim dividends each of 1.00 pence per share were paid

in the twelve months ended 30 November 2019).

We do not expect the shift in focus away from carbon-based energy supplies

towards alternative and renewable sources described above to impair the

Company's ability to meet its target dividend, which will be delivered

primarily from a mix of dividend income from the portfolio and dividend

reserves, supported by the payment of income out of capital if required. The

Company may also write options to generate revenue return, although the

portfolio managers' focus is on investing the portfolio to generate an optimal

level of total return without striving to meet an annual income target and they

will only enter into option transactions to the extent that the overall

contribution is beneficial to total return.

FRANKED INVESTMENT INCOME (FII) GROUP LITIGATION ORDER (GLO) V HMRC

In 2003 The Prudential Assurance Company Limited filed a case against HM

Revenue & Customs (HMRC) on the treatment of foreign sourced dividends. The

litigation concerned the tax treatment of UK-resident companies (including

investment funds) that received dividends from portfolio shareholdings in

non-UK companies. It had previously been settled that the UK dividend tax

regime that applied to portfolio dividends prior to 2009 was contrary to EU

law, as UK dividends were not subject to tax whereas non-UK dividends were

taxable.

On 25 July 2018 the UK Supreme Court handed down its judgement in the

Prudential case, ruling (inter alia) that non-UK dividends remained taxable but

that credit should be given for the underlying foreign tax at the foreign

nominal corporate income tax rate of the source country. In June 2020, the

Company received correspondence from HMRC accepting the entitlement of the

Company to claim for double tax relief in the relevant accounting periods in

relation to underlying tax suffered on dividends from non-UK companies. While

the amount of the repayment has not been formally agreed with HMRC, and as such

a degree of uncertainty remains, the Board has been advised that the receipt of

a repayment in respect of these amounts had become sufficiently probable to

merit recognition in the Company's NAV, and it announced on 26 June 2020 that

an asset of GBP945,614 had been reflected in the NAV in respect of these claims.

As the original tax expense was debited to the revenue column of the income

statement, the benefit of this recovery has been credited to the revenue column

of the income statement and will result in an uplift of 0.83 pence per share to

the Company's revenue earnings per share for the year to 30 November 2020. More

information is given in note 15.

CHANGES TO PORTFOLIO MANAGEMENT AND FEES

Given the Company's increased focus on energy transition stocks, we announced

on 17 March 2020 that BlackRock's energy specialist Mark Hume would be

replacing Olivia Markham as portfolio manager to work alongside Tom Holl. Mark

has 10 years of experience directly managing energy stocks and is co-manager of

BlackRock's all-cap Energy strategy. The Board would like to take the

opportunity to thank Olivia for her contribution in managing the Company's

portfolio over the last six years.

The Board is very mindful of the need to ensure that shareholders receive good

value from the operations of the Company and regularly review all of its costs.

To that end, as also announced on 17 March, we agreed a reduction in the

management fee payable by the Company to BlackRock Fund Managers Ltd (the

"Manager") to 0.80% on gross assets per annum (previously 0.95% per annum on

the first GBP250 million of gross assets and 0.90% per annum thereafter). In

addition, it was agreed that the Company's Ongoing Charges, as set out and

defined in its annual report (and for avoidance of doubt including the

management fee), would be capped at 1.25% per annum of average daily net

assets. More information is set out in note 4.

GEARING

The Company operates a flexible gearing policy which depends on prevailing

market conditions. It is not intended that gearing will exceed 20% of the gross

assets of the Company. The maximum gearing used during the period was 8.5%, and

the level of gearing at 31 May 2020 was 3.0%. For calculations, see the

Glossary included within the interim report (which can be found on the

Company's website at www.blackrock.com/uk/beri).

SHARE CAPITAL AND DISCOUNT CONTROL

The Directors recognise the importance to investors that the Company's share

price should not trade at a significant premium or discount to NAV, and

therefore, in normal market conditions, may use the Company's share buyback,

sale of shares from treasury and share issue powers to ensure that the share

price is broadly in line with the underlying NAV. The Company currently has

authority to buy back up to 14.99% of the Company's issued share capital

(excluding treasury shares) and to allot ordinary shares representing up to 10%

of the Company's issued ordinary share capital.

Over the six months to 31 May 2020, the Company's shares have traded at an

average discount of 13.5%, and within a range of a 3.6% discount to a 24.6%

discount. The Company bought back a total of 700,000 ordinary shares between 1

December 2019 and 20 February 2020 at an average price of 66.06 pence per

share, for a total consideration of GBP462,000 and at an average discount of

12.3%. These shares were placed in treasury for potential reissue, thereby

saving the associated costs of an issue of new shares if demand arises.

However, as the COVID-19 pandemic took hold and global markets plummeted in

March and April 2020, the extreme market volatility created challenges for many

investment companies in determining appropriate intraday pricing levels for buy

back transactions. Consequently the Board has been less active in buying back

shares over the second half of the period under review and into June 2020, but

continues to monitor the market and, in conjunction with the Company's broker,

gives consideration to the possibility of buying back shares on a daily basis.

MARKET OUTLOOK AND PORTFOLIO POSITIONING

Recent signs of economic recovery in many of the world's major nations have

boosted oil and mined commodity prices and in turn share prices in our sectors.

Deferred infrastructure spending and continued recovery in demand as lockdowns

ease create the prospect of a structural upcycle for oil and commodity prices.

However, the investment environment remains extremely uncertain. Significant

market volatility is expected to remain until there is greater clarity on how

long it will take for more accustomed levels of economic activity to resume,

which in turn will depend on the extent to which the spread of COVID-19 can be

contained.

The Company's portfolio is focussed on larger market capitalisation,

established companies. In addition, the Manager is seeking to enhance the

growth element of the portfolio through selective investments in companies that

are exposed to energy transition and the decarbonisation of the energy supply

chain, where the Manager believes that the long term prospects are compelling.

ED WARNER

30 July 2020

1 Organization of the Petroleum Exporting Countries.

INVESTMENT MANAGER'S REPORT

MARKET OVERVIEW

The first half of 2020 will be viewed as one of the most extraordinary six

months for financial markets and for many aspects of life for all of us. The

year started out with economic activity buoyant, and growing modestly in most

major economies, and most market debate focused on what might trigger a

recession and/or the end of the decade long bull market for equities. The

mining companies were generating strong cashflow with a bias to returning it to

shareholders. We saw the lack of recent investment in conventional oil projects

as being likely to tighten markets towards the end of 2020 and the energy

transition accelerating and creating exciting new investment opportunities.

The emergence of COVID-19 and subsequent rapid spread across the world of the

virus caused an unprecedented impact on economic activity. This sent shockwaves

through the commodity markets as demand collapsed across almost every sector.

The hardest hit areas were those where the demand has been "lost" - such as

oil; the cancelled flights and missed car journeys will not be caught up,

however fast the recovery is. Other commodities that are more exposed to

capital expenditure, such as iron ore and steel, fared better as lost time on

construction projects can be made up.

Although China was the first country to suffer the effects of the virus, it has

also been the first to emerge out the other side. The Chinese Government

unleashed economic stimulus that quickly led to a rebound in underlying

activity. This can be seen in many data points and the chart on page 8 of the

half yearly annual report shows inventories across the metals space in China

and shows the effects of lockdown (rising inventories) followed by the swift

recovery through April and May.

Although the financial markets in Europe and North America have followed a

similar trajectory of sharp decline and rapid rebound, it remains to be seen

whether underlying economic activity will follow the same V-shaped recovery.

The ability of China to stimulate commodity-intensive activity is significantly

higher than that of governments in the West and this is one of the key reasons

we have maintained a larger weight in mining (versus energy) during the first

half as China accounts for a significantly greater proportion of mined

commodity demand than oil (or gas) demand.

The sections on mining, energy and the energy transition describe the first

half impacts in greater detail, the response of the companies to the dramatic

changes and how we have positioned the portfolio going into the second half of

the year.

2020 on 2019

Average Price

%

Change

(Average of

30 November 31 May % 31/05/18-31/05/

Commodity 2019 2020 Change 19

to 31/05/19-

31/05/20)

Base Metals (US$/tonne)

Aluminium 1,792 1,526 -14.8 -13.5

Copper 5,843 5,352 -8.4 -8.9

Lead 1,923 1,655 -13.9 -6.3

Nickel 13,618 12,260 -10.0 10.6

Tin 16,504 15,503 -6.1 -16.4

Zinc 2,300 1,993 -13.3 -16.4

-------------- -------------- -------------- --------------

Precious Metals (US$/oz)

Gold 1,461.5 1,731.6 18.5 21.8

Silver 17.0 17.8 4.7 10.2

Platinum 894.0 825.0 -7.7 4.5

Palladium 1,832.0 1,920.0 4.8 55.4

-------------- -------------- -------------- --------------

Energy

Oil (WTI) (US$/Bbl) 55.2 33.7 -38.9 -22.1

Oil (Brent) (US$/Bbl) 64.5 34.2 -47.0 -23.2

Natural Gas (US$/MMBTU) 2.5 1.7 -32.0 -30.1

Uranium (US$/lb) 26.0 34.0 30.8 -2.0

-------------- -------------- -------------- --------------

Bulk Commodities (US$/tonne)

Iron ore 87.0 101.5 16.7 21.0

Coking coal* 141.3 133.3 -5.7 -23.2

Thermal coal 69.4 52.0 -25.1 -35.6

-------------- -------------- -------------- --------------

Equity Indices

EMIX Global Mining Index (US$) 787.9 800.4 1.6 n/a

EMIX Global Mining Index (GBP) 609.2 647.4 6.3 n/a

MSCI World Energy Index (US$) 303.6 208.0 -31.5 n/a

MSCI World Energy Index (GBP) 234.7 168.2 -28.3 n/a

======== ======== ======== ========

* Source: Bloomberg.

Source: Datastream.

PORTFOLIO ACTIVITY AND INVESTMENT PERFORMANCE

The chart on page 10 of the half-yearly report sets out in detail the monthly

changes in the Company's portfolio composition between February 2017 and May

2020.

Throughout the first half of 2020 the portfolio had a greater weighting in

mining stocks than energy ones given our views on relative commodity price

outlook and, importantly, what commodity prices were being priced into the

market valuation of the companies. In our view, the market has consistently

underestimated the iron price and therefore the major mining companies have

appeared relatively attractive.

Gearing in the Company has been used quite sparingly in the first half of the

year compared to much of 2018 and 2019. In March we reduced gearing to just

over 5% due to the market volatility, but we will look to increase this back to

at least match the portfolio's fixed interest holdings as and when we think

appropriate. The energy transition companies that are being integrated into the

portfolio typically have lower volatility than the commodity-driven mining and

energy companies and this could allow gearing to be used to a modestly higher

degree in time too.

Within mining the biggest change in commodity positioning has been in the gold

sector where we started the period at around 14.5% and ended at 16.1%. There

are two main reasons why we increased the gold exposure. First was the speed

and magnitude of the response of Central Banks, most notably the US Federal

Reserve (the Fed), to the COVID-19 driven economic shock. The asset purchase

programme announced by the Fed and the guidance they have given on interest

rates remaining exceptionally low is, we believe, very supportive for gold.

Secondly the gold companies have shown a new willingness to act with more

capital discipline. Many of the larger, and even mid-size, gold companies have

announced dividend increases in the last six months. The gold companies still

have lower yields than the diversified mining companies, but it is an important

signal to investors that the misallocation of capital that occurred in the last

gold cycle is less likely to occur this time around.

Notwithstanding the enormous volatility experienced in global markets in

general and energy markets in particular, many of the structural trends in

traditional energy markets remain in place. We continue to believe that demand

for oil will peak some time in the next ten to fifteen years as society

continues to drive towards a lower carbon world. Combined with almost unchecked

growth from US shale for the last decade, this has led to increasingly volatile

oil prices. This has placed greater value on strong balance sheets, diversified

portfolios and stable sources of cash flow - a characteristic more often than

not of the larger Integrated Oil Companies (IOCs) and Midstream (Pipelines)

businesses. With the outlook for interest rates now looking 'lower-for-longer',

this should bode well for high quality dividend streams such as those within

the Midstream space. This has resulted in a deliberate shift in energy

sub-sector allocation over the period with, for instance, Midstream companies

making up 8% of the Company's NAV from less than 3% at the start of the period.

Other key changes include reducing the exposure to Exploration and Production

companies from almost 14% of NAV to just under 10% by the end of the period.

Whilst some of this shift has been driven by underlying market movements a

large proportion of the reduction reflects increasing risks around a Democratic

Presidential victory in November this year, which may result in less favourable

treatment of domestic producers. Finally, the Company has increased its

exposure to selected Oilfield Services stocks from zero to just under 2% in the

period. Whilst a smaller component of the Company's NAV, it marks the first

foray into the sector since September 2018.

The Company delivered a NAV total return of -10.0% over the six month period to

31 May 2020. This compares to a return of -11.0% over the same time period for

the reference index (used for internal monitoring purposes), which is a 50/50

split of the EMIX Global Mining Index and the MSCI World Energy Index. Although

the Company performed moderately better than UK equity markets (the FTSE All

Share returning -16.0% for the six month period), it lagged global equity

markets with the MSCI World Index (in GBP) down just 0.5%.

INCOME

During the first half of 2020, the Company generated GBP2.6 million in gross

income. This funded a dividend payment of 1.00p per share for the first and

second quarters, for a total of 2.00p per share for the first half of the year.

Although the high level of market volatility was attractive for option writing,

we were selective in our option writing, to target the best total return,

rather than overwrite the same proportion of the portfolio and generate excess

income from options.

The mining companies continued their now-established track record of returning

surplus cash to shareholders with companies such as Rio Tinto declaring final

year dividends at the upper end of targeted pay out ranges. The gold companies

have also shown a notable change in attitude towards dividends - for example

Newmont hiked its dividend by almost 80% and guided that it would return around

half of its free cashflow to shareholders through time.

The energy companies provided a less positive dividend story during the first

half of the year. Whilst some companies opted to use their balance sheet

strength to maintain payments despite the very challenging oil price

environment, many others took the chance to reset dividends lower. This

happened in areas of structural challenge, such as the oil services sector

where Schlumberger cut its dividend by 75%. Elsewhere, Royal Dutch Shell cut

its dividend by two-thirds, which was the first time it has cut its dividend

since World War II.

The energy transition companies under consideration for the portfolio did not

experience anything like the financial squeeze the oil companies faced from the

collapse in the oil price. Their dividends therefore look more likely to be

maintained over the medium term. However some, especially in Europe, may be

under political pressure to limit dividend payments in favour of reinvesting as

Governments are keen to see a green bias to any economic recovery. Overall for

the energy transition companies, their dividend yields are often lower than

those in mining and conventional energy as they typically have greater growth

opportunities. Thus, the flexibility to pay dividends from capital should allow

the portfolio to have an appropriate exposure to Energy Transition stocks

without diluting the importance of income within the Company's Objectives.

ENERGY

The International Energy Agency (IEA) estimates that average oil demand in 2020

will fall by over 8 million barrels per day, equivalent to 8% of total

consumption - making it the largest annual contraction in history (the chart on

page 13 of the Company's interim report shows the growth in global demand year

on year from the first quarter of 2019 and projected forward to the end of

2021).

The timing of this unprecedented collapse in demand came just as the world's

major oil producers (OPEC and Russia) had failed to reach an agreement on

supply at the group's meeting on 6 March 2020. This mismatch between supply and

demand caused crude inventories to rise at record rates, in turn, driving Brent

oil prices from an early January high of $69/barrel to a low of $19/barrel in

late-April. Prompt action by OPEC and Russia (OPEC+) saw the group agree a

reduction of almost 10 million barrels per day effective from the start of May.

Elsewhere, US shale producers implemented one of the sharpest reductions in

activity in history with the horizontal rig count falling from 701 to 271 over

the period. This has translated into budget cuts from producers in the order of

50% on an annualised basis through the balance of the year. As a result, US

shale output is forecast to contract by as much as 2 million barrels per day

through the second half of 2020 (a chart showing the supply and growth activity

for US Natural Gas Liquids and the horizontal rig count since January 2015 is

included on page 14 of the half-yearly financial report).

Taken together, these actions helped to drive crude prices back towards $35/

barrel by the end of the period and assuming OPEC+ remains focused on managing

supply we would expect inventories, and therefore prices, to normalise in the

first half of next year.

Turning to equities, the global energy sector fell 30% in the period with the

larger companies faring better (-27%) than smaller companies (-50%). From a

sub-sector perspective the Midstream (Pipelines) and Downstream (Refining &

Marketing) companies held up relatively better - falling by less than 20%. In

contrast, Oilfield Services stocks fell by more than one-third over the period.

Energy equities touched their lows in mid-March and have since rallied more

than 50%. As at the end of May, the sector is still trading at more than 30%

below where we started the period with global oil markets continuing to

rebalance.

ENERGY TRANSITION

Mitigating climate change is unquestionably the greatest challenge currently

facing humanity. In the decades ahead, the entire global energy system needs to

decarbonise if we are to limit emissions to tolerable levels. The

decarbonisation of the energy system not only covers the power sector, it also

touches transportation, buildings materials and petrochemicals all of which

have, up until now, been great enablers of a better quality of life. Continuing

to deliver affordable, clean and safe energy, whilst reducing carbon emissions

presents an immense challenge. A shift away from hydrocarbons is already

underway with coal's share of primary energy consumption, for instance, now at

its lowest level in 16 years. Closer to home, policy makers are also stepping

up their efforts. For example, in December 2019, the European Commission rolled

out its "roadmap for making the EU's economy sustainable by turning climate

change and environmental challenges into opportunities across all policy

areas". The EU plans to hit "Net Zero" emissions by 2050 with the aid of a EUR7

trillion investment plan. Within this plan as much as 45% could be allocated

towards the Utilities sector and will see a massive renovation wave of our

buildings and infrastructure, the roll-out of renewable energy projects and

cleaner transport. More detail is given in the chart on page 15 of the

half-yearly report.

Although the direction of travel is clear for decarbonisation, the pace is not.

Nevertheless, in recognition of the momentum building in the Energy Transition,

the board announced at the 2020 AGM in March, that the Company would be

shifting its investments to reflect this transition. This shift was undertaken

more formally on 1 June 2020 with a target neutral portfolio weighting for

Energy Transition stocks of 30%.

MINING

The mining sector mirrored similar trends as with the broader equity market,

largely recovering its losses following a sharp selloff in March; by the end of

the period it had recovered its losses. Within this though there was a wide

differential between the performance of the mined commodities, with the safe

haven metal gold once again showing its value as a hedge against volatility and

iron ore again benefitting from a favourable market structure.

Looking at the industrial mined commodities first, most of the base metals saw

price declines in the first half and this contrasted against iron ore, which

saw a price rise of over 15%. The chart on page 16 of the Company's interim

report for the six months ended 31 May 2020 shows China's demand (as a share of

total global demand) for a sample of mined commodities and the price change

from the start of 2020 to early June. China, whilst clearly impacted earlier by

the virus, has looked to reverse some of the negative economic impacts by

injecting stimulus. Whilst not of the scale seen at the start of 2016 and not

entirely focused in resource-intensive areas, it has provided a material boost

to steel demand (and hence iron ore demand).

The demand side is just one half of the story - it is important to look at the

role of supply in the various mined commodities too. On the supply side, the

highly concentrated nature of iron ore supply (both in terms of country of

supply and number of companies responsible for it) has caused supply to be more

vulnerable to disruption. The biggest source of supply shortfall relative to

expectations has come from Brazil where the struggles of Vale (the country's

biggest iron ore producer) to recover from the tailings dam disaster last year

have been compounded by the country's slow response to bring the virus under

control. These supply disruptions have coincided with China's strong

stimulus-driven demand and have resulted in a tight iron ore market, hence the

robust pricing. Also the supply disruptions from Brazil (relative to

expectations at the start of the year) are expected to continue through 2020,

maintaining a relatively tight balance between supply and demand in the global

iron ore market.

There has also been supply disruption in other commodities, but it has either

not been as impactful on overall supply as seen for iron ore, and/or the fall

in apparent demand has been even greater than the supply declines. In copper,

there were quite a few temporary mine closures in countries such as Peru and

Chile but following a number of weeks of suspension, production appears to have

ramped back up.

The strong performance of iron ore is a material positive for the major mining

companies, which are the core of the mining part of the portfolio. Unlike many

other sectors in the market, cashflows for the major miners have remained

strong in the first half of 2020 and look set to remain robust for the balance

of the year. When combined with the strong balance sheets that the sector had

at the start of the year, the stage is set for dividend payments to continue.

This is reassuring for the portfolio and there is a possibility that as other

sectors see dividend cuts or cancellations, the mining sector re-rates as the

dividend yield attracts new investors.

MARKET OUTLOOK & PORTFOLIO POSITIONING

From a conventional energy perspective the recent collapse in oil prices has

finally forced a dramatic downturn in US shale growth. The energy industry was

already driving towards much needed capital discipline and this downturn has

merely accelerated and reinforced this fiscal constraint. We believe that 2020

will mark the end of what has been a multi-year non-OPEC supply-driven bear

market. As a result, OPEC's role will change from needing to cut output to

balance the market, to adding barrels back - this will completely change the

financial market's perception that the world is awash with oil. Put another

way, despite the near-term challenges for oil markets, we are actually becoming

more bullish on the sector on a 2+ year time frame and reaffirm our view that

normalised oil prices will return to the $60-70/bbl range - a view we have held

since 2017. Our constructive outlook on the sector remains focused on higher

quality, globally diversified energy companies that can not only benefit from

rising commodity prices but can do so within the framework of the Energy

Transition.

Following the formal introduction of Energy Transition stocks into the

portfolio on 1 June 2020, these stocks now comprise more than a quarter of the

total NAV with Utility companies (e.g. Enel, RWE, NextEra Energy and EDP

Renovaveis) and Wind Manufacturers (e.g. Vestas) complementing our more

traditional energy holdings.

On the mining side, the key determinants of second half performance will be the

duration of the steel / commodity intensive stimulus in China and the pace of

recovery in economic activity in the rest of the world. The mining holdings

remain tilted towards iron ore, through a combination of the majors such as BHP

and specialists such as Fortescue, given the ongoing risks to iron ore supply.

The outlook for gold remains attractive given the vast quantitative easing and

the likely investor demand for risk hedges given how quickly equity markets

have rebounded following the March lows and the ongoing risks to the real

economy.

MARK HUME AND THOMAS HOLL

BLACKROCK INVESTMENT MANAGEMENT (UK) LIMITED

30 July 2020

TEN LARGEST INVESTMENTS AS AT 31 MAY 2020

BHP: 8.4% (2019: 7.8%) is the world's largest diversified natural resources

company. The company is a major producer of aluminium, iron ore, copper,

thermal and metallurgical coal, manganese, uranium, nickel, silver, titanium

minerals and diamonds. The company also has significant interests in oil, gas

and liquefied natural gas. (MSCI ESG Rating: BBB)

First Quantum Minerals: 6.5%1 (2019: 7.4%) is an established and rapidly

growing mining company operating seven mines and developing five projects

worldwide. The company is a significant copper producer and also produces

nickel, gold, zinc and platinum group elements. (MSCI ESG Rating: BB)

Barrick Gold: 5.7% (2019: 5.0%) is the world's second largest gold company by

market capitalisation following the merger with Randgold Resources in 2018.

Barrick Gold has operations and projects in 15 countries across the world. In

2019 the company successfully established a joint venture with Newmont Mining

across both companies' Nevada assets to maximize the synergies across both sets

of assets. (MSCI ESG Rating: BBB)

Chevron: 4.9% (2019: 4.7%) is an integrated oil and gas producer engaged in all

aspects of the oil and gas industry. The company has both upstream and

downstream operations, as well as alternative energy operations including

solar, wind and biofuels. (MSCI ESG Rating: BBB)

Total: 4.6% (2019: 3.6%) is a French multinational and is one of the largest

oil companies in the world. This integrated oil and gas company covers the

entire oil and gas chain from exploration and production to power generation,

transportation, refining and marketing and energy trading. (MSCI ESG Rating: A)

Rio Tinto: 4.5% (2019: 3.5%) is one of the world's leading mining companies.

The company's primary production is iron ore, but it also produces aluminium,

copper, diamonds, gold, industrial minerals and energy products. (MSCI ESG

Rating: A)

Newmont Mining: 4.3% (2019: 2.5%) is the only gold producer listed in the S&P

500 Index. The company has operations in Australia, Canada, Ghana, Peru,

Suriname, Mexico, Argentina, Dominican Republic and the United States. The

company has a commitment to sustainable and responsible mining and has been

named the mining industry leader in overall sustainability by the Dow Jones

Sustainability World Index in 2015, 2016, 2017 and 2018. (MSCI ESG Rating: A)

Royal Dutch Shell: 4.1% (2019: 6.0%) is one of the world's leading energy

companies. The Anglo-Dutch company is active in every area of the oil and gas

industry within exploration and production, refining and marketing, power

generation and energy trading. The company also has renewable energy interests

in biofuels. (MSCI ESG Rating: A)

Vale: 3.7%2 (2019: 3.0%) is one of the largest mining companies in the world,

with operations in 30 countries. Vale is the world's largest producer of iron

ore and iron ore pellets, and the world's largest producer of nickel. The

company also produces manganese ore, ferroalloys, metallurgical and thermal

coal, copper, platinum group metals, gold, silver, cobalt, potash, phosphates

and other fertiliser nutrients. (MSCI ESG Rating: CCC)

Williams Companies: 3.5% (2019: 0.8%) is an American energy company based in

Tulsa, Oklahoma. Its core business is natural gas processing and

transportation, with additional petroleum and electricity generation assets.

(MSCI ESG Rating: BB)

1 5.2% relates to fixed interest holdings in First Quantum Minerals.

2 0.1% relates to fixed interest holdings in Vale.

All percentages reflect the value of the holding as a percentage of total

investments. For this purpose where more than one class of securities is held,

these have been aggregated. The percentages in brackets represent the value of

the holding as at 30 November 2019. Together, the ten largest investments

represent 50.2% of total investments (ten largest investments as at 30 November

2019: 50.6%).

MSCI ESG ratings look to identify environmental, social and governance risks

and opportunities for individual stocks. Companies are rated on a scale from

AAA to CCC according to their exposure to certain risks and their ability to

manage them relative to the industry peers. A stock rated as AAA signifies a

company which is leading in terms of ESG factors relative to its industry. On

the other hand, a stock with a CCC score is considered a laggard, due to the

presence of one or more ESG risks that MSCI perceives to be material. The

rating scale is as follows: AAA, AA, A, BBB, BB, B, CCC. From AAA to AA a

company is considered to be an ESG leader in its respective industry, A to BB

is deemed to be an average score, whilst B and CCC represents a below average

score.

DISTRIBUTION OF INVESTMENTS AS AT 31 MAY 2020

ASSET ALLOCATION - GEOGRAPHY

Global 62.4%

USA 15.0%

Canada 7.7%

Australia 6.6%

Latin America 4.8%

Asia 2.4%

South Africa 0.8%

Africa 0.3%

Source: BlackRock.

ASSET ALLOCATION - COMMODITY

Mining 53.9%

Energy 46.1%

Integrated Oil, Gas and Energy 37.0%

Transition

Distribution 5.2%

Exploration & Production 3.9%

Diversified Mining 20.6%

Gold 16.1%

Copper 8.6%

Silver 3.0%

Diamonds 1.5%

Iron Ore 1.5%

Steel 1.3%

Platinum Group Metals 0.8%

Nickel 0.5%

Source: BlackRock.

INVESTMENTS AS AT 31 MAY 2020

Main Market

geographic value % of

exposure GBP'000 investments

Integrated Oil and Energy Transition

Chevron Global 3,795 4.9

Total Global 3,498 4.6

Royal Dutch Shell 'B' Global 3,140 4.1

BP Group Global 2,642 3.4

ConocoPhillips USA 2,433 3.2

Enel Global 1,965 2.6

Suncor Energy Canada 1,813 2.4

Pilgangoora 12% 21/06/22 Australia 1,654 2.2

Pioneer Natural Resources USA 1,514 2.0

Albemarle Global 1,371 1.8

Marathon Petroleum USA 1,359 1.8

Schlumberger USA 1,177 1.5

Petrobras Latin 850 1.1

America

Umicore Global 631 0.8

Santos Australia 478 0.6

-------------- --------------

28,320 37.0

-------------- --------------

Diversified Mining

BHP Global 6,437 8.4

Rio Tinto Global 3,493 4.5

Vale Latin 2,735 3.6

America

Vale Debentures* Latin 105 0.1

America

Anglo American Global 1,785 2.3

KAZ Minerals Asia 1,140 1.5

Teck Resources Canada 150 0.2

-------------- --------------

15,845 20.6

-------------- --------------

Gold

Barrick Gold Global 4,346 5.7

Barrick Gold Call Option 19/06/20 $27 Global (12) -

Newmont Mining Global 3,317 4.3

Agnico Eagle Mines Canada 1,328 1.7

Franco-Nevada Global 1,269 1.7

Newcrest Mining Australia 985 1.3

AngloGold Ashanti Global 722 0.9

Osisko Gold Royalties Convertible Bond 4% 31/12/22 Canada 414 0.5

Kirkland Lake Gold Put Option 19/06/20 $35 Canada (14) -

-------------- --------------

12,355 16.1

-------------- --------------

Copper

First Quantum Minerals 7.25% 15/05/22 Global 2,535 3.3

First Quantum Minerals Global 990 1.3

First Quantum Minerals 6.875% 01/03/26 Global 833 1.1

First Quantum Minerals 7.5% 01/04/25 Global 338 0.4

First Quantum Minerals 7.25% 01/04/23 Global 332 0.4

Freeport-McMoRan Copper & Gold Global 1,100 1.4

OZ Minerals Australia 361 0.5

Lundin Mining Global 185 0.2

-------------- --------------

6,674 8.6

-------------- --------------

Distribution

Williams Companies USA 2,707 3.5

TC Energy Corporation Canada 1,305 1.7

-------------- --------------

4,012 5.2

-------------- --------------

Exploration & Production

Hess USA 1,151 1.5

EOG Resources USA 717 0.9

CNOOC Asia 660 0.9

Kosmos Energy USA 438 0.6

-------------- --------------

2,966 3.9

-------------- --------------

Silver

Wheaton Precious Metals Global 2,308 3.0

Fresnillo Latin 36 -

America

-------------- --------------

2,344 3.0

-------------- --------------

Diamonds

Mountain Province Diamonds 8% 15/12/22 Canada 898 1.2

Petra Diamonds 7.25% 01/05/22 Africa 231 0.3

-------------- --------------

1,129 1.5

-------------- --------------

Iron Ore

Fortescue Metals Australia 1,119 1.5

-------------- --------------

1,119 1.5

-------------- --------------

Steel

ArcelorMittal Global 1,014 1.3

-------------- --------------

1,014 1.3

-------------- --------------

Platinum Group Metals

Impala Platinum South 617 0.8

Africa

-------------- --------------

617 0.8

-------------- --------------

Nickel

Nickel Mines Australia 391 0.5

-------------- --------------

391 0.5

-------------- --------------

Portfolio 76,786 100.0

-------------- --------------

Comprising

Equity and fixed income investments 76,812 100.0

Derivative financial instruments - written options (26) -

-------------- --------------

76,786 100.0

======== ========

* Includes investments held at Directors' valuation.

All investments are ordinary shares unless otherwise stated. The total number

of holdings (including options) at 31 May 2020 was 53 (30 November 2019: 49).

The total number of open options as at 31 May 2020 was 2 (30 November 2019: 2).

The negative valuations of GBP26,000 (30 November 2019: GBP30,000) in respect of

options held represent the notional cost of repurchasing the contracts at

market prices as at 31 May 2020.

As at 31 May 2020, the Company did not hold any equity interests comprising

more than 3% of any company's share capital.

INTERIM MANAGEMENT REPORT AND RESPONSIBILITY STATEMENT

The Chairman's Statement and the Investment Manager's Report give details of

the important events which have occurred during the period and their impact on

the financial statements.

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks faced by the Company can be divided into various areas as

follows:

* Investment performance;

* Income/dividend;

* Gearing;

* Legal and regulatory compliance;

* Operational;

* Market; and

* Financial

The Board reported on the principal risks and uncertainties faced by the

Company in the Annual Report and Financial Statements for the year ended 30

November 2019. A detailed explanation can be found in the Strategic Report on

pages 36 to 39 and in note 16 on pages 88 to 99 of the Annual Report and

Financial Statements which are available on the website at blackrock.com/uk/

beri.

In the view of the Board, the outbreak of the COVID-19 pandemic has

fundamentally altered the nature of the risks reported in the Annual Report and

Financial Statements. COVID-19 has resulted in travel restrictions, closed

international borders, enhanced health screenings at ports of entry and

elsewhere, disruption of and delays in healthcare service preparation and

delivery, prolonged quarantines, cancellations, supply chain disruptions and

lower consumer demand, as well as general concern and uncertainty. The impact

of COVID-19 has adversely affected the global economy, individual issuers and

capital markets, and could continue with a degree of severity and duration

which cannot be predicted. In addition, the impact of infectious illnesses in

emerging market countries may be greater due to generally less established

healthcare systems. Public health crises caused by the COVID-19 outbreak may

exacerbate other pre-existing political, social and economic risks in certain

countries or globally.

GOING CONCERN

The Board is mindful of the uncertainty surrounding the potential duration of

the COVID-19 pandemic and its impact on the global economy, the Company's

assets and the potential for the level of revenue derived from the portfolio to

reduce versus the prior year. The Directors, having considered the nature and

liquidity of the portfolio, the Company's investment objective, the Company's

projected income and expenditure and the Company's substantial distributable

reserves, are satisfied that the Company has adequate resources to continue in

operational existence for the foreseeable future and is financially sound. The

Board believes that the Company and its key third party service providers have

in place appropriate business continuity plans and will be able to maintain

service levels through the COVID-19 pandemic.

The Company has a portfolio of investments which are considered to be readily

realisable and is able to meet all of its liabilities from its assets and

income generated from these assets. Ongoing charges (excluding finance costs,

direct transaction costs, custody transaction charges, nonrecurring charges and

taxation) have been capped by the Manager at 1.25% of net asset value with

effect from 17 March 2020, and were approximately 1.48% of net assets for the

year ended 30 November 2019. Based on the above, the Board is satisfied that it

is appropriate to continue to adopt the going concern basis in preparing the

financial statements.

RELATED PARTY DISCLOSURE AND TRANSACTIONS WITH THE INVESTMENT MANAGER

BlackRock Fund Managers Limited (BFM) is the Company's Alternative Investment

Fund Manager (AIFM) and has, with the Company's consent, delegated certain

portfolio and risk management services, and other ancillary services, to

BlackRock Investment Management (UK) Limited (BIM (UK)). Both BFM and BIM (UK)

are regarded as related parties under the Listing Rules. Details of the

management fee payable are set out in note 4 and note 13. The related party

transactions with the Directors are set out in note 12.

DIRECTORS' RESPONSIBILITY STATEMENT

The Disclosure Guidance and Transparency Rules (DTR) of the UK Listing

Authority require the Directors to confirm their responsibilities in relation

to the preparation and publication of the Interim Management Report and

Financial Statements.

The Directors confirm to the best of their knowledge that:

* the condensed set of financial statements contained within the half yearly

financial report has been prepared in accordance with International

Accounting Standard 34 "Interim Financial Reporting"; and

* the Interim Management Report together with the Chairman's Statement and

Investment Manager's Report include a fair review of the information

required by 4.2.7R and 4.2.8R of the FCA's Disclosure Guidance and

Transparency Rules.

This half yearly report has not been audited or reviewed by the Company's

Auditor. The half yearly financial report was approved by the Board on 30 July

2020 and the above responsibility statement was signed on its behalf by the

Chairman.

ED WARNER

For and on behalf of the Board

30 July 2020

FINANCIAL STATEMENTS

Consolidated statement of comprehensive income for the six months ended 31 May

2020

Revenue GBP'000 Capital GBP'000 Total GBP'000

Notes

Six months ended Six months ended Six months ended

Year ended Year ended Year ended

31.05.20 31.05.19 30.11.19 31.05.20 31.05.19 30.11.19 31.05.20 31.05.19 30.11.19

(unaudited) (unaudited) (audited) (unaudited) (unaudited) (audited) (unaudited) (unaudited) (audited)

Income from investments 3 1,975 2,154 4,336 - - 658 1,975 2,154 4,994

held at fair value through

profit or loss

Other income 3 620 671 1,308 - - - 620 671 1,308

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Total income 2,595 2,825 5,644 - - 658 2,595 2,825 6,302

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Net (loss)/profit on - - - (10,475) 1,215 (585) (10,475) 1,215 (585)

investments and options

held at fair value through

profit or loss

Net (loss)/profit on - - - (98) 36 25 (98) 36 25

foreign exchange

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Total 2,595 2,825 5,644 (10,573) 1,251 98 (7,978) 4,076 5,742

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Expenses

Investment management fee 4 (74) (116) (237) (209) (348) (711) (283) (464) (948)

Other operating expenses 5 (173) (199) (404) (1) (1) (5) (174) (200) (409)

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Total operating expenses (247) (315) (641) (210) (349) (716) (457) (664) (1,357)

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Net profit/(loss) on 2,348 2,510 5,003 (10,783) 902 (618) (8,435) 3,412 4,385

ordinary activities before

finance costs and taxation

Finance costs 6 (5) (23) (49) (15) (67) (148) (20) (90) (197)

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Net profit/(loss) on 2,343 2,487 4,954 (10,798) 835 (766) (8,455) 3,322 4,188

ordinary activities before

taxation

Taxation (230) (205) (376) 38 27 42 (192) (178) (334)

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Net profit/(loss) on 8 2,113 2,282 4,578 (10,760) 862 (724) (8,647) 3,144 3,854

ordinary activities after

taxation

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Earnings/(loss) per 8 1.86 1.97 3.97 (9.47) 0.74 (0.63) (7.61) 2.71 3.34

ordinary share (pence)

========= ========= ========= ========= ========= ========= ========= ========= =========

The total column of this statement represents the Group's Consolidated

Statement of Comprehensive Income, prepared in accordance with International

Financial Reporting Standards (IFRS) as adopted by the European Union (EU). The

supplementary revenue and capital columns are both prepared under guidance

published by the Association of Investment Companies (AIC). All items in the

above statement derive from continuing operations. No operations were acquired

or discontinued during the period. All income is attributable to the equity

holders of the Group.

The Group does not have any other comprehensive income/(loss). The net profit/

(loss) for the period disclosed above represents the Group's total

comprehensive income/(loss).

Consolidated statement of changes in equity for the six months ended 31 May

2020

Share

Called up premium Special Capital Revenue

share capital account reserve reserve reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

For the six months ended 31 May 2020

(unaudited)

At 30 November 2019 1,190 46,977 67,241 (33,604) 4,141 85,945

Total comprehensive income/(loss):

Net (loss)/profit for the period - - - (10,760) 2,113 (8,647)

Transactions with owners, recorded directly

to equity:

Ordinary shares purchased into treasury 9 - - (462) - - (462)

Share purchase costs - - (4) - - (4)

Dividends paid1 7 - - - - (2,274) (2,274)

------------ ------------ ------------ ------------ ------------ ------------

At 31 May 2020 1,190 46,977 66,775 (44,364) 3,980 74,558

------------ ------------ ------------ ------------ ------------ ------------

For the six months ended 31 May 2019

(unaudited)

At 30 November 2018 1,190 46,977 68,873 (32,880) 3,949 88,109

Total comprehensive income:

Net profit for the period - - - 862 2,282 3,144

Transactions with owners, recorded directly

to equity:

Ordinary shares purchased into treasury 9 - - (389) - - (389)

Share purchase costs - - (3) - - (3)

Dividends paid2 7 - - (232) - (2,090) (2,322)

------------ ------------ ------------ ------------ ------------ ------------

At 31 May 2019 1,190 46,977 68,249 (32,018) 4,141 88,539

------------ ------------ ------------ ------------ ------------ ------------

For the year ended 30 November 2019

(audited)

At 30 November 2018 1,190 46,977 68,873 (32,880) 3,949 88,109

Total comprehensive income/(loss):

Net (loss)/profit for the year - - - (724) 4,578 3,854

Transactions with owners, recorded directly

to equity:

Ordinary shares purchased into treasury 9 - - (1,390) - - (1,390)

Share purchase costs - - (10) - - (10)

Dividends paid3 7 - - (232) - (4,386) (4,618)

------------ ------------ ------------ ------------ ------------ ------------

At 30 November 2019 1,190 46,977 67,241 (33,604) 4,141 85,945

========= ========= ========= ========= ========= =========

1 4th interim dividend of 1.00p per share for the year ended 30 November

2019, declared on 10 December 2019 and paid on 20 January 2020 and 1st interim

dividend of 1.00p per share for the year ended 30 November 2020, declared on 17

March 2020 and paid on 23 April 2020.

2 4th interim dividend of 1.00p per share for the year ended 30 November

2018, declared on 11 December 2018 and paid on 18 January 2019 and 1st interim

dividend of 1.00p per share for the year ended 30 November 2019, declared on 12

March 2019 and paid on 18 April 2019.

3 4th interim dividend of 1.00p per share for the year ended 30 November

2018, declared on 11 December 2018 and paid on 18 January 2019; 1st interim

dividend of 1.00p per share for the year ended 30 November 2019, declared on 12

March 2019 and paid on 18 April 2019, 2nd interim dividend of 1.00p per share

for the year ending 30 November 2019, declared on 11 June 2019 and paid on 19

July 2019 and 3rd interim dividend of 1.00p per share for the year ended 30

November 2019, declared on 17 September 2019 and paid on 22 October 2019.

The transaction costs relating to the acquisition and disposal of investments

amounted to GBP57,000 and GBP15,000 respectively for the six months ended 31 May

2020 (six months ended 31 May 2019: GBP23,000 and GBP8,000; year ended 30 November

2019: GBP67,000 and GBP9,000). All transaction costs have been included within the

capital reserve.

The share premium account is not distributable profit under the Companies Act

2006. The special reserve may be used as distributable profits for all purposes

and, in particular, for the repurchase by the Company of its ordinary shares

and for payment as dividends. In accordance with the Company's articles, net

capital reserves may be distributed by way of the repurchase by the Company of

its ordinary shares and for payment as dividends.

Consolidated statement of financial position as at 31 May 2020

31 May 31 May 30 November

2020 2019 2019

GBP'000 GBP'000 GBP'000

Notes (unaudited) (unaudited) (audited)

Non current assets

Investments held at fair value through profit or 10 76,812 94,423 98,554

loss

------------ ------------ ------------

Current assets

Other receivables 763 5,017 519

Cash collateral held with brokers 249 634 218

Cash and cash equivalents 104 - -

------------ ------------ ------------

1,116 5,651 737

------------ ------------ ------------

Total assets 77,928 100,074 99,291

------------ ------------ ------------

Current liabilities

Other payables (1,052) (742) (727)

Derivative financial liabilities held at fair value 10 (26) (203) (30)

through profit or loss

Bank overdraft (2,292) (10,590) (12,589)

------------ ------------ ------------

(3,370) (11,535) (13,346)

------------ ------------ ------------

Net assets 74,558 88,539 85,945

========= ========= =========

Equity attributable to equity holders

Called up share capital 9 1,190 1,190 1,190

Share premium account 46,977 46,977 46,977

Special reserve 66,775 68,249 67,241

Capital reserve (44,364) (32,018) (33,604)

Revenue reserve 3,980 4,141 4,141

------------ ------------ ------------

Total equity 74,558 88,539 85,945

========= ========= =========

Net asset value per ordinary share (pence) 8 65.71 76.60 75.28

========= ========= =========

Consolidated cash flow statement for the six months ended 31 May 2020

Six months Six months Year

ended ended ended

31 May 31 May 30 November

2020 2019 2019

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

Operating activities:

Net (loss)/profit on ordinary activities before taxation (8,455) 3,322 4,188

Add back finance costs 20 90 197

Net loss/(profit) on investments and options held at fair 10,475 (1,215) 585

value through profit or loss (including transaction costs)

Net loss/(profit) on foreign exchange 98 (36) (25)

Sales of investments held at fair value through profit or 37,875 25,933 34,855

loss

Purchases of investments held at fair value through profit or (26,613) (24,804) (39,831)

loss

Decrease/(increase) in other receivables 10 (36) (43)

(Decrease)/increase in other payables (242) 35 23

Increase in amounts due from brokers (258) (4,507) -

Increase in amounts due to brokers 502 - -

Net movement in cash collateral held with brokers (31) 1,379 1,795

------------ ------------ ------------

Net cash inflow from operating activities before taxation 13,381 161 1,744

------------ ------------ ------------

Taxation paid (45) (191) (245)

Taxation on investment income included within gross income (77) (103) (209)

------------ ------------ ------------

Net cash inflow/(outflow) from operating activities 13,259 (133) 1,290

------------ ------------ ------------

Financing activities

Interest paid (20) (90) (197)

Payments for share purchases (462) (389) (1,390)

Share purchase costs paid (4) (3) (10)

Dividends paid (2,274) (2,322) (4,618)

------------ ------------ ------------

Net cash outflow from financing activities (2,760) (2,804) (6,215)

------------ ------------ ------------

Increase/(decrease) in cash and cash equivalents 10,499 (2,937) (4,925)

Effect of foreign exchange rate changes (98) 36 25

------------ ------------ ------------

Change in cash and cash equivalents 10,401 (2,901) (4,900)

Cash and cash equivalents at start of period (12,589) (7,689) (7,689)

------------ ------------ ------------

Cash and cash equivalents at end of period (2,188) (10,590) (12,589)

------------ ------------ ------------

Comprised of:

Cash at bank 104 - -

Bank overdraft (2,292) (10,590) (12,589)

------------ ------------ ------------

(2,188) (10,590) (12,589)

========= ========= =========

NOTES TO THE FINANCIAL STATEMENTS FOR THE SIX MONTHSED 31 MAY 2020

1. PRINCIPAL ACTIVITY

The principal activity of the Company is that of an investment trust company

within the meaning of section 1158 of the Corporation Tax Act 2010.

The principal activity of the subsidiary, BlackRock Energy and Resources

Securities Income Company Limited, is investment dealing and options writing.

2. BASIS OF PREPARATION

The half yearly financial statements for the period ended 31 May 2020 have been

prepared in accordance with the Disclosure Guidance and Transparency Rules

sourcebook of the Financial Conduct Authority and with International Accounting

Standard 34 (IAS 34), 'Interim Financial Reporting', as adopted by the European

Union (EU). The half yearly financial statements should be read in conjunction

with the Company's Annual Report and Financial Statements for the year ended 30

November 2019, which have been prepared in accordance with International

Financial Reporting Standards (IFRS) as adopted by the EU and as applied in

accordance with the provisions of the Companies Act 2006 and in accordance with

IAS 34 Interim Financial Reporting.

Insofar as the Statement of Recommended Practice (SORP) for investment trust

companies and venture capital trusts issued by the Association of Investment

Companies (AIC) in October 2019 is compatible with IFRS, the financial

statements have been prepared in accordance with guidance set out in the SORP.

The revised SORP issued in October 2019 is applicable for accounting periods

beginning on or after 1 January 2019, therefore the Company has adopted the new

SORP for the accounting year beginning 1 December 2019. As a result, there will

be an amended presentation of movements in investments held at fair value

through profit or loss in the notes to the financial statements, which will be

included as part of the 2020 Annual Report and Financial Statements. As this

note is not included as part of the Interim Report and Financial Statements,

there is no impact on the Interim Report and Financial Statements as a result

of the adoption of the revised SORP.

The taxation charge has been calculated by applying an estimate of the annual

effective tax rate to any profit for the period.

Adoption of new and amended standards and interpretations

IFRS 16 Leases

The Group adopted IFRS 16 as of the date of initial application of 1 December

2019. IFRS 16 specifies accounting for leases and removes the distinction

between operating and finance leases. This standard is not applicable to the

Group as it has no leases.

IFRS standards that have yet to be adopted

Amendments to IFRS 3 - Definition of a business (effective 1 January 2020).

This amendment revises the definition of a business. According to feedback

received by the International Accounting Standards Board, application of the

current guidance is commonly thought to be too complex and it results in too

many transactions qualifying as business combinations. The standard has been

endorsed by the EU. This standard is unlikely to have any impact on the Group.

Amendments to IAS 1 and IAS 8 - Definition of material (effective 1 January

2020). The amendments to IAS 1, 'Presentation of Financial Statements', and IAS

8, 'Accounting Policies, Changes in Accounting Estimates and Errors', and

consequential amendments to other IFRSs require companies to:

(i) use a consistent definition of materiality throughout IFRSs and the

Conceptual Framework for Financial Reporting;

(ii) clarify the explanation of the definition of material; and

(iii) incorporate some of the guidance of IAS 1 about immaterial information.

This standard has been endorsed by the EU. This standard is unlikely to have

any impact on the Group.

Amendments to IFRS 9, IAS 39 and IFRS 7 - Interest rate benchmark reform

(effective 1 January 2020). These amendments provide certain reliefs in

connection with the interest rate benchmark reform. The reliefs relate to hedge

accounting and have the effect that the Inter Bank Offer Rate (IBOR) reform

should not generally cause hedge accounting to terminate. However, any hedge

ineffectiveness should continue to be recorded in the income statement. Given

the pervasive nature of hedges involving IBOR based contracts, the reliefs will

affect companies in all industries.

This standard has been endorsed by the EU. This standard is unlikely to have

any significant impact on the Group.

IFRS 17 - Insurance contracts (effective 1 January 2021). This standard

replaces IFRS 4, which currently permits a wide variety of practices in

accounting for insurance contracts. IFRS 17 will fundamentally change the

accounting by all entities that issue insurance contracts and investment

contracts with discretionary participation features. The standard has not been

endorsed by the EU. This standard is unlikely to have any impact on the Group

as it has no insurance contracts.

3. INCOME

Six months Six months Year

ended ended ended

31 May 31 May 30 November

2020 2019 2019

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

Investment income:

UK dividends 709 716 1,485

UK special dividends - - 57

Overseas dividends 827 778 1,707

Overseas special dividends - 179 178

Fixed interest 439 481 909

-------------- -------------- --------------

1,975 2,154 4,336

-------------- -------------- --------------

Other income:

Deposit interest 10 1 14

Option premium income 610 670 1,294

-------------- -------------- --------------

620 671 1,308

-------------- -------------- --------------

Total income 2,595 2,825 5,644

======== ======== ========

During the period, the Group received option premium income in cash totalling GBP

644,000 (six months ended 31 May 2019: GBP604,000; year ended 30 November 2019: GBP

1,156,000) for writing put and covered call options for the purposes of revenue

generation.

Option premium income is amortised evenly over the life of the option contract

and accordingly, during the period option premiums of GBP610,000 (six months

ended 31 May 2019: GBP670,000; year ended 30 November 2019: GBP1,294,000) were

amortised to revenue.

At 31 May 2020, there were 2 (31 May 2019: 3; 30 November 2019: 2) open

positions with an associated liability of GBP26,000 (31 May 2019: GBP203,000; 30

November 2019: GBP30,000).

Dividends and interest received in cash in the period amounted to GBP1,473,000

and GBP380,000 (six months ended 31 May 2019: GBP1,533,000 and GBP427,000; year ended

30 November 2019: GBP3,167,000 and GBP836,000) respectively.

No special dividends have been recognised in capital during the period (six

months ended 31 May 2019: GBP658,000; year ended 30 November 2019 GBP658,000).

4. INVESTMENT MANAGEMENT FEE

Six months ended Six months ended Year ended

31 May 2020 31 May 2019 30 November 2019

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment management fee 78 234 312 116 348 464 237 711 948

Expense rebate due from Manager (4) (25) (29) - - - - - -

-------------- -------------- -------------- -------------- -------------- -------------- -------------- -------------- --------------

Total 74 209 283 116 348 464 237 711 948

======== ======== ======== ======== ======== ======== ======== ======== ========

Up to 16 March 2020, the investment management fee was levied at the rate of

0.95% of gross assets per annum on the first GBP250 million of the Company's

gross assets reducing to 0.90% thereafter. With effect from 17 March 2020, the

investment management fee is levied at 0.80% of gross assets per annum.

Gross assets are calculated based on net assets before the deduction of the

bank overdraft.

The fee is allocated 25% to the revenue column and 75% to the capital column of

the Consolidated Statement of Comprehensive Income.

In addition, effective from 17 March 2020 the Company is entitled to a rebate

from the investment management fee charged by the Manager in the event the

Company's Ongoing Charges exceeds the cap of 1.25% per annum of average daily

net assets. The amount of rebate accrued as at 31 May 2020 amounted to GBP29,000

and has been adjusted in the investment management fee charged by the Manager.

5. OTHER OPERATING EXPENSES

Six months Six months Year

ended ended ended

31 May 31 May 30 November

2020 2019 2019

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

Allocated to revenue:

Custody fee 2 2 4

Auditor's remuneration - audit services 13 13 27

Registrar's fee 16 13 30

Directors' emoluments 69 62 124

Broker fees 11 12 23

Depositary fees 4 5 9

Marketing fees 11 12 29

Printing and postage fees 13 17 31

Legal and professional fees 1 13 21

Directors search fees - - 26

Bank charges 3 11 15

Stock exchange listings fees 4 4 7

Other administration costs 26 35 58

-------------- -------------- --------------

173 199 404

-------------- -------------- --------------

Allocated to capital:

Custody transaction charges 1 1 5

-------------- -------------- --------------

174 200 409

======== ======== ========

Effective 17 March 2020 the Company's Ongoing Charges, as defined in the

Glossary included within the interim report (which can be found on the

Company's website at www.blackrock.com/uk/beri) (including the investment

management fee), will be capped at 1.25% per annum of average daily net assets.

The Company is entitled to a rebate from the investment management fee charged

by the Manager in the event the Company's Ongoing Charges exceeds the cap. The

rebate will apply to Ongoing Charges incurred by the Company from 17 March

2020. No cap was in place for Ongoing Charges incurred up to 16 March 2020.

The overall cap on Ongoing Charges and any applicable rebate is calculated and

accrued on a daily basis and will be adjusted in the investment management fees

charged up to 30 November every year.

6. FINANCE COSTS

Six months ended Six months ended Year ended

31 May 2020 31 May 2019 30 November 2019

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Interest payable - bank 5 15 20 23 67 90 49 148 197

overdraft

-------------- -------------- -------------- -------------- -------------- -------------- -------------- -------------- --------------

Total 5 15 20 23 67 90 49 148 197

======== ======== ======== ======== ======== ======== ======== ======== ========

Finance costs for the Company are charged 25% to the revenue column and 75% to

the capital column of the Consolidated Statement of Comprehensive Income.

Subsidiary finance costs are charged 100% to the revenue column of the

Consolidated Statement of Comprehensive Income.

At 31 May 2020, 31 May 2019 and 30 November 2019, the Group had an overdraft

facility of the lower of GBP17.5 million or 20% of the Group's net assets.

7. DIVIDS

The Board's current dividend target is to declare quarterly dividends of 1.00

pence per share in the year to 30 November 2020, making a total of at least

4.00 pence for the year as a whole.

A first interim dividend for the period ending 29 February 2020 of GBP1,139,000

(1.00p per share) was paid on 23 April 2020 to shareholders on the register on

27 March 2020.

The Directors have declared a second interim dividend for the year ended 30

November 2020 of 1.00p per ordinary share. The total cost of the dividend was GBP

1,350,000 and was paid on 17 July 2020 to shareholders on the Company's

register on 19 June 2020. This dividend has not been accrued in the financial

statements for the six months ended 31 May 2020, as under IFRS, interim

dividends are not recognised until paid. Dividends are debited directly to

reserves.

The third and fourth interim dividends will be declared in September 2020 and

December 2020 respectively.

Dividends on equity shares paid during the period were:

Six months Six months Year

ended ended ended

31 May 31 May 30 November

2020 2019 2019

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

Second interim dividend for the year ended 30 November 2019 - - 1,151

of 1.00p (2018: 1.00p)

Third interim dividend for the year ended 30 November 2019 of - - 1,145

1.00p (2018: 1.00p)

Fourth interim dividend for the year ended 30 November 2019 1,139 1,161 1,161

of 1.00p (2018: 1.00p)

First interim dividend for the year ending 30 November 2020

of 1.00p (2019: 1.00p);

- Distributed from Revenue 1,135 929 929

- Distributed from Special Reserve - 232 232

-------------- -------------- --------------

2,274 2,322 4,618

======== ======== ========

8. CONSOLIDATED EARNINGS AND NET ASSET VALUE PER ORDINARY SHARE

Total revenue and capital returns per share and net asset value per share are

shown below and have been calculated using the following:

Six months Six months Year

ended ended ended