Mt. Gox Stirs Market with 500 Bitcoin Transfer to Unknown Wallets—What’s Next for BTC?

02 Noviembre 2024 - 3:00AM

NEWSBTC

Mt. Gox, which was once the largest cryptocurrency exchange

globally before its shutdown in 2014, recently transferred 500

Bitcoin (worth roughly over $34 million) to two unidentified

wallets. This transaction, conducted early Friday, marked the first

transfer from the defunct exchange since late September of this

year. Related Reading: Bitcoin Set To Gain If Trump Wins, JPMorgan

Cites ‘Debasement Trade’ As Key Factor Details Of The 500 BTC

Transfer Blockchain analytics firms such as Lookonchain and Arkham

has reported that 31.78 BTC was sent to one address and 468.24 BTC

to another, with both wallets subsequently dispersing portions of

the funds to various other addresses. The #MtGox wallet transferred

500 $BTC($35.04M) out 2 hours ago and currently holds 44,905

$BTC($3.11B).https://t.co/f2q66eQNuk pic.twitter.com/aDGMhSnuML —

Lookonchain (@lookonchain) November 1, 2024 While the recipients of

these funds remain unknown, the transaction has sparked

speculation. However, past transfers from Mt. Gox wallets have

often signaled upcoming repayments to creditors, who have been

awaiting compensation since the platform’s collapse. These prior

distributions were typically facilitated through major crypto

exchange platforms such as Bitstamp and Kraken. Currently, Mt. Gox

retains a substantial holding of 44,905 BTC, valued at more than $3

billion. This recent transfer follows an October announcement by

Mt. Gox that extended its repayment deadline from October 31, 2024,

to October 31, 2025. Bitcoin Price Performance Following The

Transfer Following the recorded transfer from Mt.Gox, Bitcoin’s

price initially surged, reaching a 24-hour high of $71,500 in the

early hours of Friday. However, a correction has followed, with

Bitcoin now trading down by 1.5%, settling at a price of $69,450,

at the time of writing. This dip is seen as a disappointment to

investors, especially as Bitcoin recently experienced an optimistic

rally that nearly pushed it above its all-time high of $73,737 set

in March 2024. Despite the slight downturn, Bitcoin’s market

fundamentals remain resilient. A recent analysis by a CryptoQuant

analyst highlights that significant buying pressure is emerging

from Binance futures whales, who are reportedly driving much of

Bitcoin’s recent gains. Related Reading: Bitcoin’s Active Addresses

Signals Golden Cross—What Next For BTC? According to the analyst,

this futures-led buying momentum marks the strongest pressure

observed in the Binance futures market since September 2023. This

trend is not only visible with Bitcoin but also extends to other

major assets like Ethereum, indicating broader market engagement

from high-value traders. Strong buying momentum has emerged from

Binance futures whales “Recently, the strongest buying pressure

since last September has appeared in Binance futures market… The

same pattern is emerging not only in $BTC but also in $ETH.” – By

@mignoletkr Link 👇… pic.twitter.com/9aXYGMg4HV — CryptoQuant.com

(@cryptoquant_com) November 1, 2024 Interestingly, in spite of the

current decrease in BTC’s price, the asset’s daily trading volume

has seen an opposite trend rising from below $45 billion as of

yesterday to above $52 billion, at the time of writing, Featured

image created with DALL-E, Chart from TradingView

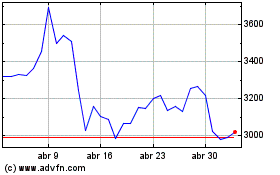

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024