First-Half 2023 Results

FIRST-HALF

2023 RESULTS

Paris, 28/07/2023

- Backlog in the construction

businesses up 9% year-on-year

- Group sales up 41%

year-on-year

- Group current operating

profit from activities up

€214 million

year-on-year

- Net profit attributable to

the Group up €78 million

year-on-year

- All 2023 guidance for the

Group and business segments

confirmed

The Board of Directors, chaired by Martin

Bouygues, met on 27 July 2023 to close off the financial statements

for first-half 2023.

KEY FIGURES

With regard to the financial information

presented in this press release, the income statement includes the

financial statements of Equans only for first-half 2023. Equans was

acquired on 4 October 2022 and Equans’ quarterly proforma financial

statements are not available for 2022.

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Sales |

26,136 |

|

18,531 |

|

+41% |

a |

|

Current operating profit/(loss) from

activities |

727 |

|

513 |

|

+214 |

|

|

Margin from activities |

2.8% |

|

2.8% |

|

= |

|

|

Current operating profit/(loss) ᵇ |

681 |

|

492 |

|

+189 |

|

|

Operating profit/(loss) ᶜ |

601 |

|

448 |

|

+153 |

|

|

Financial result |

(201) |

|

(106) |

|

-95 |

|

|

Net profit/(loss) attributable to the Group |

225 |

|

147 |

|

+78 |

|

(a) Up 3% like-for-like and at constant exchange

rates.(b) Includes PPA amortisation of €46m in first-half 2023 and

of €21m in first-half 2022.(c) Includes net non-current charges of

€80m in first-half 2023 and of €44m in first-half 2022.

|

(€ million) |

End-June 2023 |

|

End-Dec 2022 |

|

End-June 2022 |

|

|

|

|

|

|

|

|

|

|

Net surplus cash (+)/net debt (-) |

(10,573) |

|

(7,440) |

|

(3,705) |

|

- Sales in

first-half 2023 were €26.1 billion, up 41% versus first-half

2022. Sales growth was driven mainly by Equans’ contribution, as

well as by commercial performance in most of the business segments.

Like-for-like and at constant exchange rates, sales growth was

3%.

- Current operating profit

from activities (COPA) was €727 million, an increase

of €214 million compared with first-half 2022. Margin from

activities was stable year-on-year at 2.8%. As a reminder,

first-half results – especially those of Colas – are not indicative

of full-year results, due to the seasonality of activities.

- Net profit attributable to

the Group was €225 million. This includes mainly:

- amortisation and impairment of

intangible assets recognised in acquisitions (PPA) of

€46 million (including €26 million at Bouygues SA

related to the acquisition of Equans), compared with

€21 million for first-half 2022;

- net non-current charges1 of

€80 million, which are not indicative of business. As a

reminder, net non-current charges in first-half 2022 were

€44 million;

- financial result of

-€201 million, versus -€106 million in first-half 2022,

the change being mainly related to the acquisition of Equans. In

particular, the cost of net debt was -€149 million compared

with -€73 million in first-half 2022;

- income tax expense of

€155 million;

- a share of net profits of joint

ventures amounting to €46 million versus a €8 million

loss in first-half 2022, driven by Tipco’s contribution and the end

of losses from Salto.

- Net debt was

€10.6 billion at 30 June 2023, versus

€7.4 billion at end-December 2022, a change of around

€3.1 billion due to the usual seasonal effect. Net gearing2

was 78% (versus 53% at end-2022).

OUTLOOK FOR 2023

The outlook below is based on information known

to date.

Outlook for the Group

In an unstable environment marked by inflation,

rising interest rates and currency volatility, Bouygues confirms

that it is aiming for 2023 sales close to those of 2022, as well as

an increase in its current operating profit from activities

(COPA).This outlook is based on 2022 proforma financial information

that assumes the Equans acquisition was completed on 1 January

2022, namely sales of €54.4 billion and current operating

profit from activities of €2,164 million.

Outlook for Colas

In an unstable environment marked by inflation,

rising interest rates and currency volatility, the Colas group has

strong fundamentals and will continue to benefit from the positive

impacts of the transformation plans that it has undertaken.Colas

confirms that its current operating profit from activities (COPA)

is expected to increase in 2023 compared with 2022.

Outlook for

Equans

In 2023, Equans is aiming for:

- a slight increase in sales, as a

result of its selective approach strategy;

- a current operating margin from

activities (COPA margin) between 2.5% and 3%;

- a cash conversion rate

(COPA-to-cash flow3) before working capital requirements (WCR) of

between 80% and 100%.

Outlook for Bouygues

Telecom

As it continues to grow its customer base,

particularly in the fixed segment, and maintains its investments to

boost its mobile network capacity, Bouygues Telecom confirms its

2023 guidance as follows:

- an increase in sales billed to

customers;

- EBITDA after Leases of around

€1.9 billion;

- gross capital expenditure at around

€1.5 billion (excluding frequencies).

TF1 group outlook

The TF1 group maintains its outlook, with

different dynamics within its segments:

- in a market that

could gradually return to 2022 levels in the second half of 2023,

advertising revenue in the Media operating segment will notably be

driven by the broadcast of the Rugby World Cup in France, which

will be hosted in France;

- the recently

announced reboot by Newen Studios of the iconic soap opera Plus

belle la vie which will be broadcasted on TF1 channel and streamed

on MYTF1, is part of the TF1 group’s digital acceleration strategy

and reflects the synergies within the TF1 group.

TF1 group will further cement its leadership

position and maintain a broadly stable current operating margin of

activities in 2023. The TF1 group will continue to generate cash

flow in order to aim for a growing or stable dividend policy over

the coming years.

DETAILED ANALYSIS BY SECTOR OF

ACTIVITY

CONSTRUCTION BUSINESSES

As a reminder, Bouygues Energies & Services

has been consolidated within Equans since the start of 2023. For

easier comparison, the first-half 2022 data for the construction

businesses presented below have been restated for Bouygues Energies

& Services, as it contributed to Bouygues Construction’s

figures.

At end-June 2023, the backlog in the

construction businesses (Bouygues Construction

excluding Bouygues Energies & Services, Bouygues Immobilier and

Colas) rose 9% to €30.8 billion (up 10% at constant exchange

rates and excluding principal disposals and acquisitions).

In first-half 2023, Bouygues

Construction saw an 68% increase in order intake relative

to first-half 2022, lifted by the gain of major contracts. In the

second quarter, this chiefly consisted of the extension of the

metro line MTRC 1201 in Hong Kong (for around €470 million),

two data centres in Australia (for a total of around

€350 million) and the Riviera Tower in Greece (for around

€200 million). Order intake from the normal course of business

also held up well. Bouygues Construction’s backlog (excluding

Bouygues Energies & Services) stood at €15.4 billion, up

12%, providing good visibility on future activity. This growth was

driven by both Building and Civil Works. Within the Building

activity, the international backlog rose sharply (up 29%) following

the gain of several significant contracts in the past year, and the

backlog in France was up by around 2%. The Civil Works backlog was

up 7%.

In line with the previous quarters,

Bouygues Immobilier has to

contend with a challenging market environment, mainly related to

the sharply higher interest rates. As such, residential property

reservations were down 26% year-on-year, with the sharp drop in

unit sales nonetheless mitigated by block sales in the second

quarter. Commercial property sales were again weak as investors

remained in wait-and-see mode. In this context, Bouygues Immobilier

is therefore cautious about launching new projects. The backlog at

Bouygues Immobilier was 21% lower than at end-June 2022.

Last, Colas benefited from a

12% increase in order intake versus first-half 2022. Major

contracts were booked during the first six months, such as the

Interstate 26 road rehabilitation contract in the United States

(for around €110 million) and the contract for the

modification of existing lines for the Old Oak Common station in

Greater London (for around €215 million). The backlog at Colas

was €14.1 billion, up 9% year-on-year (up 11% at constant

exchange rates and excluding principal disposals and acquisitions),

driven by Rail (up 21%) and, to a lesser extent, by Roads (up

5%).

The construction businesses reported sales of

€12.2 billion in first-half 2023, up 3% year-on-year, driven

by Colas and Bouygues Construction. Like-for-like and at constant

exchange rates, sales increased by 4%. Bouygues Construction’s

sales rose by 5%, lifted mainly by a strong performance from

International Building. Bouygues Immobilier’s sales declined 14%4

versus first-half 2022, reflecting market conditions (including the

share of co-promotions, sales would have decreased 12%). Sales at

Colas were up 4%, driven both by Rail (up 5%) and by Roads (up 4%)

notably in EMEA, Canada and the United States.

The current operating loss from activities in

the construction businesses was €7 million in first-half 2023,

improving by €7 million year-on-year, and the COPA margin

in the construction businesses was stable over the period at -0.1%.

As a reminder, the first-half COPA and COPA margin of the

construction businesses are not indicative of the full-year

performance, due to the seasonality of Colas’ activities.

In first-half 2023, Bouygues Construction’s COPA

declined by €6 million year-on-year to €120 million. The

margin from activities was 2.5%, notably related to the non-linear

progress of worksites. Against a backdrop of a sharp decline in

sales, Bouygues Immobilier limited the decrease in its COPA5, which

amounted to €0.1 million (including the share of

co-promotions, this figure would have been €15 million). The

current operating loss from activities at Colas, which benefited

from the ongoing positive effects of action plans implemented, was

€127 million, improving €29 million versus first-half

2022.

EQUANS

Equans’ figures include

Bouygues Energies & Services with effect from

January 2023. Figures for first-half 2022 comprise only Bouygues

Energies & Services, as it contributed to Bouygues

Construction. As a reminder, Equans’ proforma first-half 2022

figures are not available.

The integration of Bouygues

Energies & Services within Equans is going according

to expectations, with an organisational structure now in place in

the main countries. The Perform plan has been launched in most

business units.

In line with the strategy outlined at the

Capital Markets Day in February 2023, Equans is prioritising

margins over volume growth, resulting in a continued selective

approach to contracts. The backlog at Equans, including Bouygues

Energies & Services, at end-June 2023 was €26.4 billion,

up 2% on end-December 2022, offering good visibility on future

activity. Order intake was a strong €9.5 billion, in a buoyant

environment that included several contracts for data centres in

Germany and the United Kingdom.

First-half 2023 sales were €9.1 billion,

lifted by strong overall momentum, with €3.1 billion from

France and €6 billion from international markets. Current

operating profit from activities was €243 million,

representing a margin from activities (COPA margin) of 2.7%. The

second-quarter 2023 margin from activities improved versus

first-quarter 2023, highlighting the seasonality of business and

the first positive impacts of the Perform plan.

TF1

The TF1 group reported sales of € 1 billion

in first-half 2023, decreasing as expected (down 13% year-on-year

and down 9% like-for-like and at constant exchange rates):

- media sales fell by 12% (and by 6%

like-for-like and at constant exchange rates). Advertising revenue

continued to reflect lower ad spend in an inflationary

macroeconomic context, decreasing by 5% like-for-like and at

constant exchange rates in second-quarter 2023, although the

decline was lower than in first-quarter 2023. Like-for-like and at

constant exchange rates, advertising revenue was down 6% overall in

the first-half 2023;

- sales at Newen Studios declined by

16% year-on-year. The decline was due especially to an unfavourable

base effect linked to the delivery of a large-scale production in

Germany during first-half 2022 and the closure of Salto.

Like-for-like and at constant exchange rates, the decline is 28% in

first-half 2023.

The margin from activities in the first six

months was 14.7%, making up some of the ground lost in the first

quarter, helped by the solid performance from the Media segment,

for which the COPA margin was 21.6% in second quarter, up 0.4

points relative to second-quarter 2022. This was indicative of

TF1’s very tight control over programme costs, which amounted to

€404 million (down €37 million year-on-year), largely

offsetting the decline in advertising revenue while confirming its

leadership amongst commercial targets6. Current operating profit

from activities (COPA) was €152 million, down €40 million

year-on-year.Current operating profit from activities at Newen

Studios was €6.0 million, resulting in a 4.5% margin from

activities in first-half 2023, while the margin from

activities was 10.4% in second-quarter 2023. In first-half 2023,

TF1 generated free cash flow after WCR of €155 million,

equating to an increase of €34 million relative to first-half

2022.

BOUYGUES TELECOM

The results of nPerf’s fixed and WiFi surveys,

released in July 2023, testify to the very high quality of

Bouygues Telecom’s fixed network and the efficiency of its devices.

It was rated the No. 1 operator for WiFi for the fourth time

in a row and became the No. 1 operator in the fixed segment across

all technologies.

Bouygues Telecom continued expanding in both

mobile and fixed segments during first-half 2023. At

end-June 2023, mobile plan customers excluding MtoM totalled

15.3 million, thanks to the gain of 109,000 new customers in

the first half, of which 82,000 in the second quarter. In fixed,

FTTH customers were 3.3 million at end-June 2023, thanks to

270,000 new adds in the first six months, of which 122,000 in the

second quarter. The proportion of fixed customers subscribing to a

FTTH plan continued to increase, reaching 69% versus 58% one year

earlier. The fixed customer base was 4.8 million, which was

86,000 more than at end-December 2022 and of which 40,000 were

added in the second quarter.

This performance is explained in particular by

the ramp-up of FTTH roll-out. Bouygues Telecom now has over

32 million FTTH premises marketed and is on course to reach

the target of 35 million FTTH premises by end-2026.

Sales billed to customers reflected this

commercial momentum and reached €2.9 billion, up 6% versus

first-half 2022, lifted by the strength of the mobile and fixed

customer bases and solid ABPU7 (year-on-year, mobile ABPU has grown

€0.3 to €19.7 per customer per month, while fixed ABPU has

increased €1.8 to €30.5 per customer per month).

Sales from services rose 4% year-on-year, still

held back by the decrease in sales from incoming traffic. Other

sales increased 6% year-on-year, driven mainly by growth in

built-to-suit sales. In total, the operator’s sales increased 5%

versus first-half 2022.

EBITDA after Leases rose €98 million

year-on-year to €928 million, driven by sales growth and tight

control on costs. The EBITDA after Leases margin continued

increasing, up to 31.5% (up 2.1 points versus end-June

2022).Current operating profit from activities (COPA) was

€366 million, up €57 million year-on-year.Gross capital

expenditure excluding frequencies was €857 million at end-June

2023, which was a similar level to first-half 2022.

FINANCIAL SITUATION

- at €10.5 billion, the Group

maintained a high level of available cash compared

with €14.7 billion at end-2022. Available cash comprised

€1.9 billion in cash and equivalents, supplemented by

€8.6 billion in undrawn medium- and long-term credit

facilities;

- net debt at end-June 2023 was

€10.6 billion versus €7.4 billion at end-December 2022

and €3.7 billion at end-June 2022. The change versus

31 December 2022 is mainly impacted by the usual seasonal

effects and the change between end-June 2022 and end-June 2023

reflected mainly:

- the acquisition of Equans;

- the payment of €310 million8

to Free Mobile, on 16 May 2023, in respect of which Bouygues

Telecom is disputing the ruling and validity of its immediate

execution9;

- and, to a lesser extent, Bouygues

share buybacks.

- the change in WCR related to

operating activities & other, impacted by usual seasonal

effects, was -€2.1 billion, marking an improvement of

€291 million versus end-June 2022, reflecting the efforts made

by all the business segments;

- net

gearing10 was 78% (versus 53% at end-2022).

In the first half of the year, Bouygues:

- renewed its medium- and long-term

credit facilities as they expired, without financial covenants or

rating clauses;

- redeemed a €700-million bond

issue;

- completed a €1-billion, eight-year

bond issue (maturing 17 July 2031), with a coupon of 3.875%. The

economic cost for the Group, after factoring in pre-hedging, comes

to slightly below 1.95%.

At end-June 2023, the average maturity of the

Group’s bonds was 9.0 years, and the average coupon was 3.10%

(average effective rate of 2.16%). The debt maturity schedule is

evenly spread.

The long-term credit ratings assigned to the

Group by Moody’s and Standard & Poor’s are: A3, stable outlook,

and A-, negative outlook, respectively.

CAPITAL INCREASE RESERVED FOR

EMPLOYEES

In June 2023, Bouygues carried out a capital

increase of €150 million, inclusive of share premium, as part

of the Bouygues Confiance no. 12 employee share ownership plan,

which was reserved for the employees of the Group’s French

companies, including for the first time those at Equans. It was

2.25x oversubscribed, demonstrating the high level of employee

loyalty and confidence in the Group. This transaction led to the

creation of 6,845,564 Bouygues shares. The dilutive impact was

offset by the prior buyback and cancellation of shares in 2022.

At 30 June 2023, Bouygues’ capital comprised

381,336,141 shares with a nominal value of €1 each (versus

374,486,777 shares at 31 December 2022).

FURTHER PROGRESS IN SUSTAINABLE AND

RESPONSIBLE INITIATIVES

In first-half 2023, the Group and all its

business segments continued to work towards a more sustainable and

responsible society:

- in January, the

Bouygues group signed a joint undertaking in Paris in support of

#StOpE (Stop Casual Sexism in the Workplace) that covers all its

subsidiaries. This inter-company initiative, created in 2021 by the

AFMD (French Association of Diversity Managers), has 199

signatories who are committed to pooling their resources in the

daily fight against this type of sexism. Bouygues has committed to

implementing specific initiatives in its subsidiaries and has set

up a committee of internal liaison officers to share best practices

and broaden the range of initiatives in place across the

Group;

- in February, the

Group also organised the “Hello Handicap” event with all its

business segments. This digital job fair, aimed at recruiting

people with disabilities, offered candidates over 1,000 permanent,

fixed-term and apprenticeship positions. Out of the 2,000

applications received, all the selected candidates were offered an

interview with one of the Group’s recruitment officers.

The Group’s business segments also showcased

innovations at the forefront of the digital, environmental and

energy transition, at the seventh Viva Technology event in

Paris:

- Colas

demonstrated a system that analyses the condition of road surfaces

by harvesting and processing data to optimise the use of materials

during renovation;

- Bouygues

Construction, amongst other innovations:

- presented

batteries that connect at night to store green energy and

electricity when it is more available;

- announced the

launch, in the second half, a platform dedicated to the re-use of

interior building materials (false ceilings, floors, doors, etc.)

to promote more sustainable construction.

- Equans showcased

a solution for storing thermal energy in aquifers (ATES or Aquifer

Thermal Energy Storage) for more eco-friendly air conditioning, as

well as smart charging software for more efficient and sustainable

battery use in electric buses (adjusting battery charging to what

is strictly necessary);

- Bouygues Telecom

presented:

- a solution from

its subsidiary Apizee (which develops real-time video communication

solutions) that enables patients to undergo fully independent

rehabilitation at home under the remote supervision of a healthcare

professional;

- a self-driving

delivery vehicle, manufactured by TwinswHeel, that can deliver

parcels to homes and businesses or carry out remote surveillance

and which can be controlled remotely in the event of an incident,

using Bouygues Telecom’s 5G network. Other trials are currently in

progress as part of the 5G Open Road programme;

- its latest

eco-designed routers (WiFi 6 Box, 5G Box, TV Bbox 4K decoder). This

eco-design approach aims to rethink products and use more

responsible materials that are easier to recycle while minimising

the weight of products and making them easier to repair or

refurbish.

FINANCIAL CALENDAR:

- 31 October 2023: Nine-month 2023

results (7.30am CET)

The financial statements have been subject

to a limited review by the statutory auditors and the corresponding

report has been issued.

You can find the full financial statements and

notes to the financial statements on www.bouygues.com/results.

The results presentation webcast will start at

9am (CET) on 28 July 2023.Details on how to connect are available

on www.bouygues.com.

The results presentation will be available before

the webcast startson www.bouygues.com/results.

ABOUT

BOUYGUESBouygues is a diversified services group

operating in over 80 countries with 200,000 employees all working

to make life better every day. Its business activities in

construction (Bouygues Construction, Bouygues

Immobilier, Colas); energies

& services (Equans);

media (TF1) and telecoms

(Bouygues Telecom) are able to drive growth since they all satisfy

constantly changing and essential needs.

INVESTORS AND ANALYSTS

CONTACT:investors@bouygues.com • Tel.: +33 (0)1 44

20 12 29

PRESS

CONTACT:presse@bouygues.com • Tel.: +33 (0)1 44 20

12 01

BOUYGUES SA • 32 avenue Hoche •

75378 Paris Cedex 08 • bouygues.com

FIRST-HALF 2023 BUSINESS

ACTIVITY

BACKLOG IN THE CONSTRUCTION

BUSINESSES

In order to facilitate analysis, Bouygues

Construction’s backlog at end-June 2023 and end-June 2022 only

includes the Building & Civil Works backlog.

|

(€ million) |

End-June 2023 |

End-June 2022 |

Change |

|

|

|

|

|

|

|

|

Bouygues Construction |

15,398 |

13,752 |

+12% |

a |

|

Bouygues Immobilier |

1,353 |

1,713 |

-21% |

b |

|

Colas |

14,071 |

12,936 |

+9% |

c |

|

Total |

30,822 |

28,401 |

+9% |

d |

(a) Up 13% at constant exchange rates and

excluding principal disposals and acquisitions.

(b) Down 21% at constant exchange rates and

excluding principal disposals and acquisitions.

(c) Up 11% at constant exchange rates and

excluding principal disposals and acquisitions.

(d) Up 10% at constant exchange rates and

excluding principal disposals and acquisitions.

BOUYGUES CONSTRUCTION ORDER

INTAKE

Bouygues Construction’s order intake in H1 2023

and H1 2022 only includes the Building & Civil Works order

intake.

|

(€ million) |

H1 2023 |

H1 2022 |

Change |

|

|

|

|

|

|

France |

2,066 |

1,566 |

+32% |

|

International |

3,890 |

1,977 |

+97% |

|

Total |

5,956 |

3,543 |

+68% |

BOUYGUES IMMOBILIER

RESERVATIONS

|

(€ million) |

H1 2023 |

H1 2022 |

Change |

|

|

|

|

|

|

Residential property |

641 |

868 |

-26% |

|

Commercial property |

22 |

25 |

-12% |

|

Total |

663 |

893 |

-26% |

COLAS BACKLOG

|

(€ million) |

End-June 2023 |

End-June 2022 |

Change |

|

|

|

|

|

|

Mainland France |

3,573 |

3,385 |

+6% |

|

International and French overseas territories |

10,498 |

9,551 |

+10% |

|

Total |

14,071 |

12,936 |

+9% |

EQUANS BACKLOG

In order to facilitate analysis, Equans’ backlog

at end-June 2023 and end-December 2022 includes Bouygues Energies

& Services’ backlog.

|

(€ million) |

End-June 2023 |

End-Dec 2022 |

Change |

|

|

|

|

|

|

Total |

26,397 |

25,927 |

+2% |

TF1 AUDIENCE

SHARE a

|

(%) |

End-June 2023 |

End-June 2022 |

Change |

|

|

|

|

|

|

Total |

33.6% |

33.5% |

+0.1 pts |

(a) Source Médiamétrie – Women under 50 who are

purchasing decision-makers.

BOUYGUES TELECOM CUSTOMER BASE

|

(‘000) |

End-June 2023 |

End-Dec 2022 |

Change |

|

|

|

|

|

|

Mobile customer base excl. MtoM |

15,600 |

15,499 |

+101 |

|

Mobile plan base excl. MtoM |

15,331 |

15,222 |

+109 |

|

Total mobile customers |

22,892 |

22,455 |

+437 |

|

FTTH customers |

3,263 |

2,993 |

+270 |

|

Total fixed customers |

4,756 |

4,670 |

+86 |

FIRST-HALF 2023 FINANCIAL

PERFORMANCE

As a reminder, Bouygues Energies & Services

is consolidated by Equans with effect from the start of 2023. For

easier comparison, 2022 data for Bouygues Energies & Services,

as it contributed to Bouygues Construction’s figures, have been

re-classified from Bouygues Construction to Equans.

GROUP CONDENSED CONSOLIDATED INCOME

STATEMENT

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Sales |

26,136 |

|

18,531 |

|

+41% |

a |

|

Current operating profit/(loss) from

activities |

727 |

|

513 |

|

+214 |

|

|

Amortisation and impairment of intangible assets recognised in

acquisitions (PPA) ᵇ |

(46) |

|

(21) |

|

-25 |

|

|

Current operating profit/(loss) |

681 |

|

492 |

|

+189 |

|

|

Other operating income and expenses |

(80) |

c |

(44) |

d |

-36 |

|

|

Operating profit/(loss) |

601 |

|

448 |

|

+153 |

|

|

Cost of net debt |

(149) |

|

(73) |

|

-76 |

|

|

Interest expense on lease obligations |

(37) |

|

(29) |

|

-8 |

|

|

Other financial income and expenses |

(15) |

|

(4) |

|

-11 |

|

|

Income tax |

(155) |

|

(103) |

|

-52 |

|

|

Share of net profits of joint ventures and associates |

46 |

|

(8) |

|

+54 |

|

|

Net profit from continuing operations |

291 |

|

231 |

|

+60 |

|

|

Net profit attributable to non-controlling interests |

(66) |

|

(84) |

|

+18 |

|

|

Net profit/(loss) attributable to the Group |

225 |

|

147 |

|

+78 |

|

(a) Up 3% like-for-like and at constant exchange

rates.

(b) Purchase Price Allocation.

(c) Includes non-current charges of €46m at

Bouygues Construction, of €8m at Colas, of €19m at Equans and of

€19m at TF1; and non-current income of €11m at Bouygues Telecom and

of €1m at Bouygues SA.

(d) Includes non-current charges of €6m at

Bouygues Construction (Building & Civil Works), of €7m at

Equans (Bouygues Energies & Services), of €7m at TF1 and of

€34m at Bouygues SA; and non-current income of €10m at Bouygues

Telecom.

GROUP SALES BY SECTOR OF

ACTIVITY

|

(€ million) |

H1 2023 |

H1 2022 |

Change |

Forex effect |

Scope effect |

Lfl & constant

fx ᶜ |

|

|

|

|

|

|

|

|

|

Construction

businessesa |

12,194 |

11,865 |

+3% |

+1% |

+0% |

+4% |

|

o/w Bouygues Construction |

4,746 |

4,540 |

+5% |

+1% |

+0% |

+5% |

|

o/w Bouygues Immobilier |

743 |

869 |

-14% |

+0% |

+0% |

-14% |

|

o/w Colas |

6,788 |

6,517 |

+4% |

+1% |

+0% |

+6% |

|

Equans |

9,138 |

1,873 |

nm |

nm |

nm |

nm |

|

TF1 |

1,038 |

1,187 |

-13% |

+0% |

+3% |

-9% |

|

Bouygues Telecom |

3,806 |

3,636 |

+5% |

+0% |

+0% |

+5% |

|

Bouygues SA and other |

118 |

99 |

nm |

- |

- |

nm |

|

Intra-Group eliminations ᵇ |

(241) |

(190) |

nm |

- |

- |

nm |

|

Group sales |

26,136 |

18,531 |

+41% |

+0% |

-39% |

+3% |

|

o/w France |

13,339 |

11,121 |

+20% |

+0% |

-22% |

-2% |

|

o/w international |

12,797 |

7,410 |

+73% |

+1% |

-64% |

+9% |

(a) Total of the sales contributions (after

eliminations within the construction businesses).

(b) Including intra-Group eliminations of the

construction businesses.

(c) Like-for-like and at constant exchange

rates.

CALCULATION OF GROUP EBITDA AFTER

LEASES a

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Group current operating profit/(loss) from

activities |

727 |

|

513 |

|

+214 |

|

|

Amortisation and impairment of intangible assets recognised in

acquisitions (PPA) |

(46) |

|

(21) |

|

-25 |

|

|

Interest expense on lease obligations |

(37) |

|

(29) |

|

-8 |

|

|

Net charges for depreciation, amortisation and impairment losses on

property, plant and equipment and intangible assets |

1,075 |

|

977 |

|

+98 |

|

|

Charges to provisions and other impairment losses, net of reversals

due to utilisation |

(20) |

|

(59) |

|

+39 |

|

|

Reversals of unutilised provisions and impairment losses and

other |

(127) |

|

(149) |

|

+22 |

|

|

Group EBITDA after Leases |

1,572 |

|

1,232 |

|

+340 |

|

(a) See glossary for definitions.

CONTRIBUTION TO GROUP EBITDA AFTER

LEASES a BY SECTOR OF

ACTIVITY

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

99 |

|

70 |

|

+29 |

|

|

o/w Bouygues Construction |

131 |

|

115 |

|

+16 |

|

|

o/w Bouygues Immobilier |

(11) |

|

22 |

|

-33 |

|

|

o/w Colas |

(21) |

|

(67) |

|

+46 |

|

|

Equans |

286 |

|

27 |

|

+259 |

|

|

TF1 |

277 |

|

326 |

|

-49 |

|

|

Bouygues Telecom |

928 |

|

830 |

|

+98 |

|

|

Bouygues SA and other |

(18) |

|

(21) |

|

+3 |

|

|

Group EBITDA after Leases |

1,572 |

|

1,232 |

|

+340 |

|

(a) See glossary for definitions.

CONTRIBUTION TO GROUP CURRENT OPERATING

PROFIT FROM ACTIVITIES (COPA)a BY

SECTOR OF ACTIVITY

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

(7) |

|

(14) |

|

+7 |

|

|

o/w Bouygues Construction |

120 |

|

126 |

|

-6 |

|

|

o/w Bouygues Immobilier |

0 |

|

16 |

|

-16 |

|

|

o/w Colas |

(127) |

|

(156) |

|

+29 |

|

|

Equans |

243 |

|

59 |

|

+184 |

|

|

TF1 |

152 |

|

192 |

|

-40 |

|

|

Bouygues Telecom |

366 |

|

309 |

|

+57 |

|

|

Bouygues SA and other |

(27) |

|

(33) |

|

+6 |

|

|

Group current operating profit/(loss) from

activities |

727 |

|

513 |

|

+214 |

|

(a) See glossary for definitions.

RECONCILIATION OF CURRENT OPERATING PROFIT

FROM ACTIVITIES (COPA) TO CURRENT OPERATING PROFIT (COP) FOR

FIRST-HALF 2023

|

(€ million) |

COPA |

|

PPA amortisation ᵃ |

|

COP |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

(7) |

|

-4 |

|

(11) |

|

|

o/w Bouygues Construction |

120 |

|

0 |

|

120 |

|

|

o/w Bouygues Immobilier |

0 |

|

0 |

|

0 |

|

|

o/w Colas |

(127) |

|

-4 |

|

(131) |

|

|

Equans |

243 |

|

0 |

|

243 |

|

|

TF1 |

152 |

|

-2 |

|

150 |

|

|

Bouygues Telecom |

366 |

|

-14 |

|

352 |

|

|

Bouygues SA and other |

(27) |

|

-26 |

|

(53) |

|

|

Total |

727 |

|

-46 |

|

681 |

|

(a) Amortisation and impairment of intangible

assets recognised in acquisitions.

RECONCILIATION OF CURRENT OPERATING PROFIT

FROM ACTIVITIES (COPA) TO CURRENT OPERATING PROFIT (COP) FOR

FIRST-HALF 2022

|

(€ million) |

COPA |

|

PPA amortisation ᵃ |

|

COP |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

(14) |

|

-4 |

|

(18) |

|

|

o/w Bouygues Construction |

126 |

|

0 |

|

126 |

|

|

o/w Bouygues Immobilier |

16 |

|

0 |

|

16 |

|

|

o/w Colas |

(156) |

|

-4 |

|

(160) |

|

|

Equans |

59 |

|

0 |

|

59 |

|

|

TF1 |

192 |

|

-3 |

|

189 |

|

|

Bouygues Telecom |

309 |

|

-14 |

|

295 |

|

|

Bouygues SA and other |

(33) |

|

0 |

|

(33) |

|

|

Total |

513 |

|

-21 |

|

492 |

|

(a) Amortisation and impairment of intangible

assets recognised in acquisitions.

CONTRIBUTION TO GROUP CURRENT OPERATING

PROFIT (COP) BY SECTOR OF ACTIVITY

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

(11) |

|

(18) |

|

+7 |

|

|

o/w Bouygues Construction |

120 |

|

126 |

|

-6 |

|

|

o/w Bouygues Immobilier |

0 |

|

16 |

|

-16 |

|

|

o/w Colas |

(131) |

|

(160) |

|

+29 |

|

|

Equans |

243 |

|

59 |

|

+184 |

|

|

TF1 |

150 |

|

189 |

|

-39 |

|

|

Bouygues Telecom |

352 |

|

295 |

|

+57 |

|

|

Bouygues SA and other |

(53) |

|

(33) |

|

-20 |

|

|

Group current operating profit/(loss) |

681 |

|

492 |

|

+189 |

|

CONTRIBUTION TO GROUP OPERATING PROFIT BY

SECTOR OF ACTIVITY

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

(65) |

|

(24) |

|

-41 |

|

|

o/w Bouygues Construction |

74 |

|

120 |

|

-46 |

|

|

o/w Bouygues Immobilier |

0 |

|

16 |

|

-16 |

|

|

o/w Colas |

(139) |

|

(160) |

|

+21 |

|

|

Equans |

224 |

|

52 |

|

+172 |

|

|

TF1 |

131 |

|

182 |

|

-51 |

|

|

Bouygues Telecom |

363 |

|

305 |

|

+58 |

|

|

Bouygues SA and other |

(52) |

|

(67) |

|

+15 |

|

|

Group operating profit/(loss) |

601 |

a |

448 |

b |

+153 |

|

(a) Includes non-current charges of €46m at

Bouygues Construction, of €8m at Colas, of €19m at Equans and of

€19m at TF1; and non-current income of €11m at Bouygues Telecom and

of €1m at Bouygues SA.

(b) Includes non-current charges of €6m at

Bouygues Construction (Building & Civil Works), of €7m at

Equans (Bouygues Energies & Services), of €7m at TF1 and of

€34m at Bouygues SA; and non-current income of €10m at Bouygues

Telecom.

CONTRIBUTION TO NET PROFIT ATTRIBUTABLE TO

THE GROUP BY SECTOR OF ACTIVITY

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

(53) |

|

(27) |

|

-26 |

|

|

o/w Bouygues Construction |

79 |

|

92 |

|

-13 |

|

|

o/w Bouygues Immobilier |

0 |

|

9 |

|

-9 |

|

|

o/w Colas |

(132) |

|

(128) |

|

-4 |

|

|

Equans |

148 |

|

43 |

|

+105 |

|

|

TF1 |

46 |

|

56 |

|

-10 |

|

|

Bouygues Telecom |

192 |

|

174 |

|

+18 |

|

|

Bouygues SA and other |

(108) |

|

(99) |

|

-9 |

|

|

Net profit/(loss) attributable to the Group |

225 |

|

147 |

|

+78 |

|

NET SURPLUS CASH (+)/NET DEBT (-) BY

BUSINESS SEGMENT

|

(€ million) |

End-June 2023 |

|

End-Dec 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Bouygues Construction |

2,731 |

|

3,612 |

|

-881 |

|

|

Bouygues Immobilier |

(329) |

|

(156) |

|

-173 |

|

|

Colas |

(1,349) |

|

(292) |

|

-1,057 |

|

|

Equans |

(127) |

|

181 |

|

-308 |

|

|

TF1 |

365 |

|

326 |

|

+39 |

|

|

Bouygues Telecom |

(3,112) |

|

(2,303) |

|

-809 |

|

|

Bouygues SA and other |

(8,752) |

|

(8,808) |

|

+56 |

|

|

Net surplus cash (+)/net debt (-) |

(10,573) |

|

(7,440) |

|

-3,133 |

|

|

Current and non-current lease obligations |

(2,639) |

|

(2,605) |

|

-34 |

|

CONTRIBUTION TO GROUP NET CAPITAL

EXPENDITURE BY SECTOR OF ACTIVITY, EXCLUDING

FREQUENCIES

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

79 |

|

65 |

|

+14 |

|

|

o/w Bouygues Construction |

7 |

|

17 |

|

-10 |

|

|

o/w Bouygues Immobilier |

1 |

|

1 |

|

0 |

|

|

o/w Colas |

71 |

|

47 |

|

+24 |

|

|

Equans |

110 |

|

6 |

|

+104 |

|

|

TF1 |

112 |

|

139 |

|

-27 |

|

|

Bouygues Telecom |

855 |

|

837 |

|

+18 |

|

|

Bouygues SA and other |

(25) |

|

17 |

|

-42 |

|

|

Group net capital expenditure |

1,131 |

|

1,064 |

|

+67 |

|

CONTRIBUTION TO GROUP FREE CASH FLOW BY

SECTOR OF ACTIVITY

|

(€ million) |

H1 2023 |

|

H1 2022 |

|

Change |

|

|

|

|

|

|

|

|

|

|

Construction businesses |

(91) |

|

(59) |

|

-32 |

|

|

o/w Bouygues Construction |

112 |

|

127 |

|

-15 |

|

|

o/w Bouygues Immobilier |

(9) |

|

17 |

|

-26 |

|

|

o/w Colas |

(194) |

|

(203) |

|

+9 |

|

|

Equans |

158 |

|

42 |

|

+116 |

|

|

TF1 |

100 |

|

137 |

|

-37 |

|

|

Bouygues Telecom |

(37) |

|

(82) |

|

+45 |

|

|

Bouygues SA and other |

(119) |

|

(82) |

|

-37 |

|

|

Group free cash flow ᵃ |

11 |

|

(44) |

|

+55 |

|

(a) See glossary for definitions.

GLOSSARY

ABPU (Average Billing Per

User):

- in the mobile segment, it is equal

to the total of mobile sales billed to customers (BtoC and BtoB)

divided by the average number of customers over the period. It

excludes MtoM SIM cards and free SIM cards;

- in the fixed segment, it is equal

to the total of fixed sales billed to customers (excluding BtoB)

divided by the average number of customers over the period.

BtoB (business to

business): when one business makes a commercial

transaction with another.

Backlog (Bouygues Construction,

Colas,

Equans): the amount of work still

to be done on projects for which a firm order has been taken, i.e.

the contract has been signed and has taken effect (after notice to

proceed has been issued and suspensory clauses have been

lifted).

Backlog (Bouygues

Immobilier): sales outstanding

from notarised sales plus total sales from signed reservations that

have still to be notarised.Under IFRS 11, Bouygues Immobilier’s

backlog does not include sales from reservations taken via

companies accounted for by the equity method (co-promotion

companies where there is joint control).

Construction businesses:

Bouygues Construction, Bouygues Immobilier and Colas.

Current operating profit/(loss) from

activities: current operating profit from

activities (COPA) equates to current operating profit before

amortisation and impairment of intangible assets recognised in

acquisitions (PPA).

EBITDA after Leases: current

operating profit after taking account of the interest expense on

lease obligations, before (i) net charges for depreciation,

amortisation and impairment losses on property, plant and equipment

and intangible assets, (ii) net charges to provisions and other

impairment losses and (iii) effects of losses of control. Those

effects relate to the impact of remeasuring retained interests.

EBITDA margin after Leases (Bouygues

Telecom): EBITDA after Leases as a proportion of sales

from services.

Energies & services:

Equans.

Free cash flow: net cash flow

(determined after (i) cost of net debt, (ii) interest expense on

lease obligations and (iii) income taxes paid), minus net capital

expenditure and repayments of lease obligations. It is calculated

before changes in working capital requirements (WCR) related to

operating activities and excluding frequencies.

FTTH (Fibre

to the Home): optical fibre from the central

office (where the operator’s transmission equipment is installed)

all the way to homes or business premises (Arcep definition).

FTTH premises secured: premises

for which the horizontal is deployed, being deployed or ordered up

to the concentration point.

FTTH premises marketed: the

connectable sockets, i.e. the horizontal and vertical deployed and

connected via the concentration point.

Growth in sales like-for-like and at

constant exchange rates:

- at constant

exchange rates: change after translating foreign-currency sales for

the current period at the exchange rates for the comparative

period;

- on a

like-for-like basis: change in sales for the periods compared,

adjusted as follows:

- for acquisitions, by deducting from

the current period those sales of the acquired entity that have no

equivalent during the comparative period;

- for divestments, by deducting from

the comparative period those sales of the divested entity that have

no equivalent during the current period.

MtoM: machine

to machine communication. This refers to direct communication

between machines or smart devices or between smart devices and

people via an information system using mobile communications

networks, generally without human intervention.

Net surplus

cash/(net debt): the

aggregate of cash and cash equivalents, overdrafts and short-term

bank borrowings, non-current and current debt, and financial

instruments. Net surplus cash/(net debt) does not include

non-current and current lease obligations. A positive figure

represents net surplus cash and a negative figure represents net

debt. The main components of change in net debt are presented in

Note 7 to the consolidated financial statements at

30 June 2023, available at bouygues.com.

Order intake (Bouygues Construction,

Colas): a project is included under order intake when the

contract has been signed and has taken effect (the notice to

proceed has been issued and all suspensory clauses have been

lifted) and the financing has been arranged. The amount recorded

corresponds to the sales the project will generate.

Reservations by value (Bouygues

Immobilier): the € amount of the

value of properties reserved over a given period.

- residential properties: the sum of the

value of unit and block reservation contracts signed by customers

and approved by Bouygues Immobilier, minus registered

cancellations;

- commercial properties: these are

registered as reservations on notarised sale;

For co-promotion companies:

- if Bouygues Immobilier has

exclusive control over the co-promotion company (full

consolidation), 100% of amounts are included in reservations;

- if joint control is exercised (the

company is accounted for by the equity method), commercial activity

is recorded according to the amount of the equity interest in the

co-promotion company.

Sales from services (Bouygues

Telecom) comprise:

- sales billed to customers, which

include:

In Mobile:

- for BtoC customers: sales from

outgoing call charges (voice, texts and data), connection fees, and

value-added services;

- for BtoB customers: sales from

outgoing call charges (voice, texts and data), connection fees, and

value-added services, plus sales from business services;

- machine-To-Machine (MtoM)

sales;

- visitor roaming sales;

- sales generated with Mobile Virtual

Network Operators (MVNOs).

In Fixed:

- for BtoC customers: sales from

outgoing call charges, fixed broadband services, TV services

(including Video on Demand and catch-up TV), and connection fees

and equipment hire;

- for BtoB customers: sales from

outgoing call charges, fixed broadband services, TV services

(including Video on Demand and catch-up TV), and connection fees

and equipment hire, plus sales from business services;

- sales from bulk sales to other

fixed line operators.

- sales from incoming

Voice and Texts;

- spreading of handset subsidies over

the projected life of the customer account, required to comply with

IFRS 15;

- capitalisation of connection fee

sales, which is then spread over the projected life of the customer

account.

Other sales (Bouygues Telecom):

difference between Bouygues Telecom’s total sales and sales from

services.It comprises:- sales from handsets, accessories and

other;

- roaming sales;- non-telecom services

(construction of sites or installation of FTTH lines);

- co-financing of advertising.

Wholesale: wholesale market for

telecoms operators.

1 Includes non-current charges of €46m at

Bouygues Construction, of €8m at Colas, of €19m at Equans, of €19m

at TF1; and non-current income of €11m at Bouygues Telecom and of

€1m at Bouygues SA.2 Net debt/shareholders’ equity.3 Free cash flow

before cost of net debt, interest expense on lease obligations and

income taxes paid.4 Excluding the share of co-promotions.5

Excluding the share of co-promotions.6 33.6% among women under 50

who are purchasing-decision makers (+0.1 points year-on-year) and

30.2% among the 25-49 age group (+0.1 points year-on-year).7 Q2

2023 ABPU – Mobile ABPU is no longer restated for the roaming

impact.8 €308m plus statutory interest in relation to the legal

dispute regarding smartphone plus mobile plan bundled offers.9 See

Bouygues Telecom’s press release of 16 May 202310 Net

debt/shareholders’ equity.

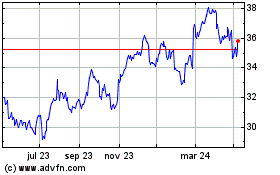

Bouygues (EU:EN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

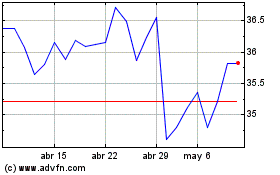

Bouygues (EU:EN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024