MARKET WRAPS

Stocks:

European shares steadied on Thursday on a lack of major news and

data, although sentiment remained fragile as investors continued to

reassess global rate-cut expectations.

"Given how far the Fed doves and the market bulls pushed their

rate cut bets over the past months, there is room for further

downside correction in both stock and bond markets," Swissquote

Bank said.

Share Movers

European semiconductor companies pushed higher after Taiwan's

TSMC posted a net profit ahead of analysts' forecasts for the

fourth quarter.

Stocks to Watch

Barclays is planning to shrink its investment bank as a share of

its overall business and dig deeper into consumer banking, the

lender's CEO told The Wall Street Journal.

CEO, C.S. Venkatakrishnan--under pressure to boost the bank's

share price--said he is working to shift its resources toward

consumer lending in the U.K., as part of a revamp that he will

unveil during Barclays' annual earnings presentation on Feb.

20.

Economic Insight

The U.K. consumer is in decent shape, according the CEO of

Barclays, saying many mortgage adjustments, prompted by rising

interest rates, have already happened, and energy prices have

calmed down.

"I'm very optimistic on the U.K," Venkatakrishnan said, adding

that the country's growth, while not great, is fine, and it has

strong institutional advantages.

U.S. Markets:

Stock futures mostly edged higher, with those tied to Nasdaq

leading the way. Benchmark Treasury yields fell.

The S&P 500 has endured a choppy start to the year, pulling

back from near-record highs as investors have pared expectations of

interest rate cuts in coming months, forcing implied borrowing

costs higher in the process.

Earnings from more regional banks are due, along with housing

starts data for December.

Forex:

EUR/USD is expected to trade in a tight 1.0880-1.0950 range on

Thursday, although ING still expects it to fall to 1.08 by the end

of the first quarter.

"Today sees slightly more settled market conditions, and on the

U.S. calendar are housing starts and initial claims - probably not

market movers."

EUR/USD fell to a five-week low of 1.0845 on Wednesday as data

and central bank comments caused investors to scale back

expectations for interest-rate cuts, though ING said these

developments suggested EUR/USD "should be trading closer to 1.08

than 1.09."

Danske Bank Research said the dollar continued to trade on a

strong footing due to rising yields spurring general risk-off

sentiment in markets. However, the euro was also performing

"decently," keeping EUR/USD only just below 1.09, it added.

UniCredit Research said easing prospects remained strong and

were probably preventing more dollar strength.

Sterling inched higher again after Wednesday's data showed an

unexpected rise in U.K. inflation and caused investors to scale

back expectations for interest-rate cuts, and the currency could be

on course to perform better than many analysts had expected.

ING said it will probably soon have to cut its current forecasts

for EUR/GBP to rise to 0.88 later this quarter and 0.90 later this

year, which now look too aggressive.

The inflation data resulted in a reduction of 20 basis points in

2024 U.K. rate-cut expectations, supporting sterling across the

board, ING added.

Bonds:

The 10-year Treasury yield has scope to rise above the 55-day

exponential moving average, which is currently at 4.163%, UOB

Global Economics & Markets Research said.

Price movements and technical signals suggest the yield could

rise further, but upward momentum appears somewhat tentative, so it

remains to be seen whether there's sufficient momentum for the

yield to clearly breach mid-December high of 4.295%.

On the downside, support is at 3.900% ahead of late-December low

of 3.783%.

Gilt yields continued to rise after Wednesday's

stronger-than-expected U.K. inflation data lowered expectations of

early rate cuts from the Bank of England. Markets are pricing in

fewer rate cuts from the BOE than from the Federal Reserve and the

European Central Bank in 2024, causing gilts to underperform their

U.S. and eurozone peers, XTB.

UniCredit Research said Italian floating-rate notes are

appealing because current investor expectations for ECB

interest-rate cuts are too optimistic.

Markets are pricing in 135 basis points of ECB rate cuts for

2024, according to Refinitiv, more than UniCredit Research's

projection of 75bps of rate cuts.

It sees a risk of an upward correction in short-dated rates,

especially given the prudent rhetoric from ECB officials, and said

the that prospects of rate repricing would favor floating rate

notes.

Energy:

Oil prices edged higher following OPEC's robust growth

expectations for demand this year and next, and as Middle East

tensions and a cold blast in the U.S. raised concerns over supply

disruptions.

"For now, the flat price remains firmly below $80/bbl and with

the balance expected to be fairly comfortable over 1H24,

significant upside is probably limited," ING said.

Metals:

Base metals and gold edged higher on a slightly softer dollar,

but weakening expectations of early interest-rate cuts this year

continued to weigh on market sentiment.

"Concerns about resurging inflationary pressures due to

geopolitical uncertainty in the Middle East, combined with a robust

economy, suggest that the Fed may not need to rush into

implementing monetary policy easing," Sucden Financial said.

ANZ Research said that going forward, gold "is set to benefit

from easing monetary policy, elevated geopolitical risks and strong

central bank buying."

Macquarie said copper prices have already likely bottomed,

having previously seen them cratering deep into 2024.

That revised view reflects recent supply challenges, illustrated

by Anglo American's pared production guidance and a fire at

Udokan's solvent extraction plant.

EMEA HEADLINES

Oil-Demand Growth Slowdown Marks Return to Prepandemic Trends,

IEA Says

Global oil-demand growth slowed significantly at the end of last

year and is expected to weaken further, marking a return to

prepandemic trends, according to the International Energy

Agency.

The Paris-based organization said Thursday in its monthly report

that growth is projected to ease to 1.2 million barrels a day in

2024 from 2.3 million barrels a day last year, taking total demand

to an average of 103 million barrels a day. Demand growth for 2024

was previously estimated at 1.1 million barrels a day.

Richemont's Shares Surge After Sales Show Resilience

Shares in Richemont jumped in early trade after the Swiss

luxury-goods company posted resilient sales growth in its fiscal

third quarter despite a slight slowdown and damped sentiment in the

sector.

At 0835 GMT shares were up 8.2% up at CHF114.05.

Flutter Entertainment U.S. Revenue Misses Guidance

Flutter Entertainment said fourth-quarter U.S. revenue missed

its expectations but the rest of the business's earnings were in

line.

The FTSE 100 gambling and betting group behind the FanDuel,

PokerStars and Paddy Power brands said Thursday that group revenue

for the three months to Dec. 31 rose 11% from a year earlier to

2.67 billion pounds ($3.38 billion).

BHP Reviews Nickel Plans Amid Market Rout

The world is awash in nickel, one of the key ingredients in

batteries for electric vehicles. That's roiling many miners that

produce it.

BHP Group, the world's largest miner by market value, on

Thursday joined several other producers in saying it will rethink

plans for its nickel business to help it ride out the industry

downturn. Prices of nickel have halved since the start of last

year, as demand for the metal, including from EV makers, has failed

to keep pace with new supply coming from countries including

Indonesia.

Pepco Expects Supply Issues if Red Sea Conflict Continues

Discount retailer Pepco Group said conflict in the Red Sea has

had a limited effect on current product availability, but could

hurt supply in the coming months if it continues.

The discount retailer-which houses Poundland in the U.K. and

Dealz and Pepco in continental Europe-said Thursday that attacks on

vessels in the Red Sea by Houthi fighters was leading to higher

spot freight rates and delays to container lead times.

EU New Car Sales Slipped in December After 16 Months of

Growth

Sales of new cars in the European Union fell in December,

marking the first decrease in 16 months as electric-vehicle

purchases slipped and the German market faltered.

The European Automobile Manufacturers' Association said Thursday

that new car registrations-which mirror sales-fell 3.3% in December

compared with a year ago. Registrations finished the month at about

867,000. Sales rose 14% to 10.5 million in 2023.

GLOBAL NEWS

China Goes All In on Green Industry to Jolt Ailing Economy

China is doubling down on manufacturing to reboot its economy

after a turbulent year, a strategy that risks igniting new tensions

over trade as countries step up support for prized industries and

global growth teeters.

The push for new growth drivers comes as figures showed the

world's second-largest economy expanded in 2023 at its weakest rate

in decades, aside from the three years when China was closed to the

outside world during the Covid-19 pandemic. A drawn-out property

crunch means Beijing can no longer rely on debt-fueled real-estate

investment to power the economy, and officials have shown little

appetite to shift activity decisively toward consumer spending.

China's Property Market May Keep Struggling Despite Stimulus

It's becoming clearer that China's stimulus policies for its

beleaguered property sector aren't enough to lift its fortunes

early this year, with disappointing monthly sales data the latest

sign that a recovery is some time away.

"There has been no sign that the sector's fundamentals have

bottomed out, " Nomura analysts Jizhou Dong and Riley Jin said in a

research note following the release of data showing property sales

value fell 17% on year in December.

Pakistan Conducts Strikes in Iran, Retaliating for Earlier Hit

by Tehran

ISLAMABAD, Pakistan-Pakistan carried out airstrikes early

Thursday inside Iranian territory, in retaliation for an Iranian

airstrike in Pakistan on Tuesday that had targeted Iranian

insurgents, Pakistani officials said.

The two nations were careful to say that they had only targeted

their own nationals in the tit-for-tat strikes, an indication that

neither country wants the situation to spiral, experts said. But

risks of a miscalculation remain amid heightened tensions in the

Middle East in the wake of the Israel-Hamas war.

Israel, Under Pressure to Scale Back Intensity of War, Pulls

Thousands of Troops From Gaza

Israel withdrew thousands of troops from Gaza following pressure

from the U.S. to transition to a more surgical phase of its war

against Hamas, a move that has sparked concerns among some Israeli

officials that the pullout could leave the country vulnerable to

another surge in militant activity.

The decision to withdraw one of Israel's four divisions in Gaza

gives Israel with more bandwidth to deploy forces to other

flashpoints, such as unrest in the West Bank, that have emerged

since the start of Israel's invasion of Gaza. In drawing down its

forces in the strip, however, Israel risks undermining its

strategic goal of eradicating Hamas, exposing the country to

renewed attacks.

Write to paul.larkins@dowjones.com

Write to us at newsletters@dowjones.com

We offer an enhanced version of this briefing that is optimized

for viewing on mobile devices and sent directly to your email

inbox. If you would like to sign up, please go to

https://newsplus.wsj.com/subscriptions.

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 18, 2024 05:36 ET (10:36 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

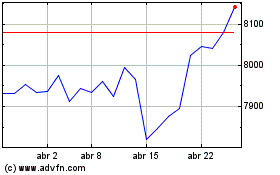

FTSE 100

Gráfica de índice

De Abr 2024 a May 2024

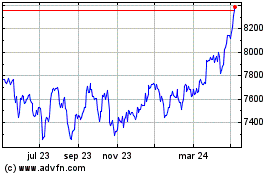

FTSE 100

Gráfica de índice

De May 2023 a May 2024