Euro Drops As Eurozone Business Activity Slows Sharply

23 Junio 2022 - 2:56AM

RTTF2

The euro declined against its major counterparts in the European

session on Thursday, as Eurozone business growth slowed sharply to

a 16-month low in June as demand stalled and price pressures

remained elevated.

The latest survey from S&P Global showed that the flash

composite output index fell to a 16-month low of 51.9 in June from

54.8 in May. Economists had expected a score of 54.

The services purchasing managers' index dropped to a 5-month low

of 52.8 in June from 56.1 in May. The score was forecast to ease to

55.5.

The manufacturing PMI fell to a 22-month low of 52.0 in June

from 54.6 in May. Economists had expected the reading to drop to

53.9.

Separate surveys showed that business activity in Germany and

France eased in June, fuelling worries about the bloc's growth

outlook.

German bond yields fell, with the yield on the 10-year bund

reaching 1.466 percent.

The weak data prompted money markets to lower expectations on

rate hikes from the European Central Bank.

The euro edged down to 1.0483 against the greenback and 1.3607

against the loonie, following its early highs of 1.0581 and 1.3710,

respectively. If the euro falls further, it may challenge support

around 1.03 against the greenback and 1.34 against the loonie.

The euro retreated to 1.5231 against the aussie and 1.6749

against the kiwi, after hitting near a 4-month high of 1.5345 and a

new 4-month high of 1.6891, respectively in the previous session.

The euro is likely to find support around 1.49 against the aussie

and 1.62 against the kiwi.

The euro touched a 2-day low of 141.88 against the yen, falling

from a high of 143.99 seen at 8:50 pm ET. On the downside, 137.00

is possibly seen as its next support level.

The euro pulled back from an 8-day high of 0.8641 against the

pound and slipped to 0.8595 after the data. Against the franc, it

remained lower at 1.0144. The euro is seen finding support around

0.84 against the pound and 1.00 against the franc.

Looking ahead, Canada manufacturing and wholesale sales for May,

U.S. weekly jobless claims for the week ended June 18 and S&P

Global's services PMI for June will be released in the New York

session.

At 10 am ET, Federal Reserve Chair Jerome Powell will testify on

the semi-annual monetary policy report before the House Financial

Services Committee in Washington DC.

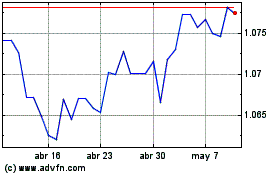

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024