TIDMCRST

RNS Number : 6186T

Crest Nicholson Holdings PLC

16 November 2023

The information contained in this announcement is deemed by the

Company to constitute inside information for the purposes of

Article 7 of the Market Abuse Regulation (EU) No. 596/2014 which

forms part of domestic law in the United Kingdom pursuant to the

European Union (Withdrawal) Act 2018

Crest Nicholson Holdings plc

(the "Group" or "Crest Nicholson")

STREAMLINING OPERATIONS IN RESPONSE TO MARKET CONDITIONS

STRONG LAND PORTFOLIO TO SUPPORT MEDIUM-TERM GROWTH

AMBITIONS

Crest Nicholson today provides an update on trading for the year

ending 31 October 2023 and a streamlining of Group operations for

FY24.

Financial Summary

-- Previous 10-week private Sales Per Outlet Week (SPOW)

excluding bulk of 0.39, reflecting the continued weakness in the

housing market but on an upward trend

o Previous 10-week private SPOW including bulk of 0.80

-- FY23 Adjusted Profit Before Tax (APBT) expected to be in the range of GBP45.0m to GBP50.0m

o Including a GBP0.5m charge for restructuring activities

o Brightwells Yard, Farnham - a zero margin scheme - has

incurred circa GBP11.0m of incremental build costs in FY23 (a

further GBP7.0m in addition to the GBP4.0m previously

communicated). Construction activities are now in the final stages

as the site approaches its completion

-- Group's year-end net cash position at GBP64.9m

-- Strong strategic relationships with institutional investors

delivering 273 unit completions in FY23

-- Forward sales as at 10 November 2023 of 1,710 units and

GBP408.5m Gross Development Value (GDV) (11 November 2022: 2,038

units and GBP526.2m GDV)

-- Disciplined approach to capital allocation for FY24

o Land activity to reduce significantly given high quality

additions made earlier this year

o Rigorous approach to work-in-progress to align to expected

sales rates

Operational Summary

-- Several high quality sites added to the portfolio in the

first half with planning approvals underway. These sites all

provide excellent prospects to support future growth

-- Build cost inflation is starting to reduce from mid-single

digit percentages and we expect this to continue into FY24

-- On track with our sustainability targets as we actively

collaborate with our supply chain and wider industry to reduce

greenhouse gas emissions and prepare for upcoming regulations

-- Good progress with our fire safety remediation programme

Streamlining of Group Operations

Given the deterioration in trading conditions experienced in the

second half of the year, the Group communicated in its 21 August

2023 Trading Update that it would be reducing overheads for

FY24.

Accordingly, the management team has conducted a thorough and

diligent review of all activities within the Group.

These changes will:

-- Reduce annualised administrative expenses by circa GBP3.0m in FY24

-- Moderate the pace of growth in Yorkshire - now expecting 300-350 units in 2026

-- Incorporate the newly created East Anglia division into the

existing Eastern division with revised boundaries

-- Align headcount and resources in existing divisions to the expected level of output in FY24

-- Require a one-off GBP0.5m cash charge in FY23 APBT to implement

These decisions balance the need to respond to the tougher

operating environment whilst preserving the capability to deliver

future growth as more favourable economic and trading conditions

return.

We will provide further detail and an update on the progress of

these initiatives at our Preliminary results in January 2024.

Peter Truscott, Chief Executive, commented:

'Given the challenging trading backdrop we have experienced this

year, the Group has acted decisively in streamlining its operations

to align our cost base with the operating environment. These are

difficult decisions to take but will ensure the Group is well

positioned to recover strongly as more supportive market conditions

return. I would like to thank all Crest Nicholson colleagues for

their efforts this year and their professionalism in dealing with

the changes we have made.

We expect the housing market will remain challenging as we head

into 2024 with elevated interest rates remaining in place until

inflation comes back down to its target level. In addition, the

absence of any Government support for first time buyers, coupled

with higher borrowing costs continues to impact affordability.

However, there are reasons to be optimistic with year-on-year

inflation now halved and real wage growth starting to be felt in

households across the UK. We have acquired some excellent sites

that are at advanced stages in the planning process, leaving us

well positioned to trade in whatever market conditions emerge.'

For further information, please contact:

Crest Nicholson

Jenny Matthews, Head of Investor Relations +44 (0) 7557 842720

Teneo

James Macey White / Giles Kernick +44 (0) 20 7353 4200

The person responsible for arranging the release of this

announcement on behalf of the Company is Penny Thomas, Group

Company Secretary.

16 November 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGZMMMGKKGFZZ

(END) Dow Jones Newswires

November 16, 2023 02:00 ET (07:00 GMT)

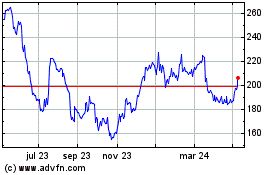

Crest Nicholson (LSE:CRST)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

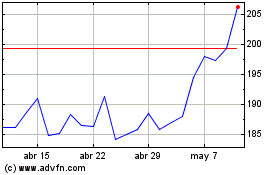

Crest Nicholson (LSE:CRST)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024