TIDMFRP

RNS Number : 4065W

FRP Advisory Group PLC

12 December 2023

12 December 2023

FRP ADVISORY GROUP PLC

("FRP", the "Group" or the "Company")

Half Year Results

For the six months ended 31 October 2023

FRP Advisory Group plc, a leading national specialist business

advisory firm, announces its half year results for the six months

ended 31 October 2023 ("H1 2024").

FRP seeks to deliver solutions that create, preserve and recover

value, enabling businesses to navigate a broad range of complex

situations. Specialising in Restructuring, Corporate Finance, Debt,

Forensics and Financial Advisory, we develop effective strategies

tailored to the needs of businesses of all kinds. Our five service

pillars complement each other to support clients throughout their

entire business lifecycle. We draw on experts within each of our

service areas to put the best team forward for each situation.

Financial H1 2024 H1 2023 Growth

Revenue GBP58.7m GBP49.4m 19%

--------- --------- -------

Underlying adjusted EBITDA(1) GBP15.5m GBP11.6m 34%

--------- --------- -------

Reported profit before tax GBP11.5m GBP5.6m 105%

--------- --------- -------

Adjusted profit before tax(3) GBP13.8m GBP10.2m 35%

--------- --------- -------

Reported basic EPS 3.76p 2.68p 41%

--------- --------- -------

Adjusted total EPS(4) 4.20p 3.35p 25%

--------- --------- -------

Cash collection (inclusive of

VAT where applicable) GBP56.3m GBP52.0m 8%

--------- --------- -------

H1 dividend 1.8p 1.7p 6%

--------- --------- -------

Net cash(2) GBP11.7m GBP21.0m (56%)

--------- --------- -------

Revenue per Partner for 6 months GBP0.7m GBP0.6m 17%

--------- --------- -------

Non-Financial

--------- --------- -------

Number of administration appointments 169 78 117%

--------- --------- -------

Number of fee earners, including

Partners 484 422 15%

--------- --------- -------

Number of colleagues, excluding

Consultants 622 536 16%

--------- --------- -------

Colleague utilisation rate 65% 63% 3%

--------- --------- -------

Financial highlights

-- Strong profitable growth

o Revenue increased by 16% on an organic basis and by 3% on an

inorganic basis (APP and Wilson Field Group acquisitions)

o Growth was driven by an uptick in restructuring activity

levels

o Underlying adjusted EBITDA grew by 34% to GBP15.5m

-- Balance sheet strength maintained

o Net cash at 31 October 2023 of GBP11.7 million(2)

o Continued undrawn committed revolving credit facility ("RCF")

of GBP10 million, along with an accordion acquisition facility of

GBP15 million.

-- Increased interim dividend

o H1 2024 dividend of 1.8p (Q1 0.9p and Q2 0.9p), up 6% on prior

year

Operational highlights

-- Continued progress across five specialist service pillars:

o Restructuring

-- Administration appointments more than doubled in H1 2024 to

169 (H1 2023: 78) as market activity increased

-- Administration appointment market share grew to 20% by volume

which includes some group appointments. Underlying was circa. 15%

(H1 2023: 13%)

o FRP Corporate Finance (including Debt Advisory)

-- Continued to remain active in the mid market, completing 25

transactions in H1 2024 with a combined deal value of GBP537

million and GBP209 million of debt raised

-- Signs of an increase in debt refinancing and restructuring

related M&A activity

o Forensic Services

-- High level of activity across both investigations and

disputes

o Financial Advisory

-- Actively engaged in a range of assignments including option

reviews and transaction due diligence, supported by our valuations

and pensions advisory specialists

-- Seventh acquisition since IPO in March 2020

o Sheffield-based Wilson Field Group acquired in September 2023

for GBP4.8 million

o Wilson Field provides restructuring advisory and debt advisory

services to clients both locally and nationwide, supported by the

Wilson Field website and operational platform

o On an annual basis it is expected that Wilson Field's

underlying incremental contribution to FRP will be revenue of

GBP5.6 million and adjusted EBITDA of GBP1.1 million

o Two of the firm's Directors joined as Partners along with

their team of 63

-- Further investment in operational infrastructure

o Formal certification of International Standard ISO/IEC

27001:2013 issued in November 2023 c onfirming that FRP have put in

place a system to manage risks related to the security of data

owned or handled by the Group

-- Investment in colleagues

o FRP have launched a new leadership programme for 100

colleagues nationwide

o Continued investment in learning and development, including

the launch of a learning management system ("LMS")

o Consistent high level of staff retention within FRP compared

to the wider professional services industry (FRP voluntary

attrition this half 10%, H1 2023: 10%)

Outlook and current trading

-- The FRP team is experiencing increased demand for their

advice and we have leading positions in our core markets

-- The Restructuring Team are considerably more active this half

compared to the same period a year ago, with administration market

share gains

-- Trading to date has been positive and the Board expects to

exceed current consensus market expectations for FY 2024. If

current activity levels continue the Board expects the Company to

deliver revenue of GBP123m and adjusted EBITDA of GBP32m for FY

2024.

Key Performance Indicators ("KPIs")

Financial H1 2024 H1 2023

Revenue GBP58.7m GBP49.4m

--------- ---------

Underlying adjusted EBITDA(1) GBP15.5m GBP11.6m

--------- ---------

Cash collection (inclusive of GBP56.3m GBP52.0m

VAT where applicable)

--------- ---------

Adjusted profit before tax(3) GBP13.8m GBP10.2m

--------- ---------

Revenue per Partner for 6 months GBP0.7m GBP0.6m

--------- ---------

Non-Financial H1 2024 H1 2023

--------- ---------

Number of administration appointments 169 78

--------- ---------

Number of fee earners, including

Partners 484 422

--------- ---------

C olleague utilisation rate 65% 63%

--------- ---------

1) Underlying adjusted EBITDA removes exceptional costs and

non-cash costs including share-based payments relating to deemed

remuneration arising on acquisitions that is subject to continuing

employment and the Employee Incentive Plan established on IPO and

funded by Partners, resulting in no dilution to existing

shareholders. This is illustrated in the underlying adjusted EBITDA

table below.

2) GBP15.7m gross cash less GBP4.0m of structured debt (H1 2023:

GBP26.6m less GBP5.6m), repayable over two and a half remaining

years.

3) Adjusted profit before tax is reported profit before tax of

GBP13.8m (H1 2023: GBP10.2m) adjusted for share-based payments of

GBP2.3m (H1 2023: GBP4.5m) and exceptional items of GBPnil (H1

2023: GBP0.1m).

4) See note 4

Geoff Rowley, Chief Executive Officer of FRP Advisory Group plc,

said:

" I am proud of the team's achievements to date and FRP has

performed well in the first half. Our strategy is to ensure our

five service pillars and 28 locations are connected and work

together to provide solutions that achieve the best possible

outcomes, which supports our delivery of sustainable profitable

growth. Our total first half revenue growth was 19%, of which

organic revenue growth accounted for 16%, while underlying adjusted

EBITDA grew by of 34%.

Our Restructuring Team are considerably more active compared to

the same period last year and have increased their administration

market share. The Forensic Services team is expanding, and are

seeing an increase in demand for support on disputes and

investigations, often driven by fraud related matters or the need

for independent investigations. Financial Advisory and FRP

Corporate Finance (including Debt Advisory) remain active in the

mid-market and have a healthy H2 pipeline, although increased

caution among investors and lenders in the current environment is

also driving an increase in due diligence which means deals are

taking longer to complete. There is also an increase in debt

refinancing and restructuring related M&A activity.

As demand for our services continues to increase, we remain

committed to retaining our healthy collegiate culture where we

promote the development, health and well-being of our colleagues

and believe that we can best serve clients by ensuring colleagues

collaborate and help each other. FRP always aims to put forward the

right team, from the right services pillars and locations for each

project.

Trading to date has been positive and the Board expects to

exceed current consensus market expectations for FY 2024. FRP is

well positioned in our core markets, to support corporates through

their business cycle and the Board is confident of continued

progress."

Enquiries:

FRP Advisory Group plc

Geoff Rowley, CEO

Jeremy French, COO

Gavin Jones, CFO

Enquiries via MHP

Cavendish Capital Markets Limited (Nominated Adviser and Joint

Broker)

Katy Birkin/Stephen Keys/George Lawson (Corporate Finance)

Tel: +44 (0) 207 220 0500

Investec Bank plc (Joint Broker)

Carlton Nelson/James Rudd (Corporate Broking)

Tel: +44 (0) 207 597 4000

MHP (Financial Public Relations)

Oliver Hughes

Charlie Barker

Catherine Chapman

Tel: +44 (0) 783 462 3818

FRP@mhpgroup.com

Notes to Editors

FRP is a leading national specialist business advisory firm

established in 2010. It offers a range of advisory services to

companies, lenders, investors and other stakeholders, as well as

individuals. These services include:

-- Restructuring Advisory: corporate financial advisory, formal

insolvency appointments, informal restructuring advisory, personal

insolvency and general advice to all stakeholders.

-- Corporate Finance: mergers & acquisitions (M&A),

strategic advisory and valuations, financial due diligence, capital

raising, special situations M&A and partial exits.

-- Debt Advisory: raising and refinancing debt, debt amendments

and extensions, restructuring debt, asset based lending and

corporate and leveraged debt advisory.

-- Forensic Services: forensic investigations, compliance and

risk advisory, dispute services and forensic technology.

-- Financial Advisory: transaction services including financial

due diligence, lender services, financial modelling, valuations,

pensions and company-side advisory services.

Management statement

The Group delivered another strong performance during H1 2024,

continuing to grow its revenues, profits and team. Revenue grew by

19% (GBP9.3m) which was primarily organic. This in turn led to an

increase in underlying adjusted EBITDA of 34% (GBP3.9m). The total

number of colleagues increased by 13% over H1 2024, due to

demand-led lateral hiring, and by 16% year-on-year, including

colleagues that joined the Group following the Wilson Field Group

acquisition in September 2023.

Operational review

The Group's multidisciplinary nature, with experts across

Restructuring Advisory, Corporate Finance, Debt Advisory, Forensic

Services and Financial Advisory, ensures that the business is

versatile, resilient and can offer tailored solutions to support

and advise clients throughout their entire lifecycle.

Restructuring

FRP continues to be one of the most active Restructuring

Advisory businesses in the UK, supporting clients on both stress

and distress situations where we create commercial solutions to

achieve the best possible outcome.

During the 2023 calendar year, the restructuring market has seen

an increase in activity levels, including administrations

approaching pre-pandemic levels. Companies with significant

borrowings who have rolled off lower interest rate arrangements are

now subject to much higher debt service costs, with interest rates

now considerably higher than the 2009-2021 period. Businesses are

also exposed to much higher levels of cost inflation. Certain

sectors such as construction, property, casual dining and food

service, retail, administrative and support services are finding

current trading conditions particularly challenging.

The Restructuring team serves the full range of UK clients

across all sectors, with a focus on the core mid-market, their

assignments range from personal clients and SMEs through to

higher-profile appointments.

Within the UK, the number of administrations in the first half

increased by 37% to 846 (H1 2023: 616). FRP's administration

appointments doubled year on year to 169 (H1 2023: 78). FRP's

administration appointment market share grew to 20%, although this

is slightly higher than our underlying share, circa 15%, due to

reported group appointments where FRP may be listed as the

administrator for many different entities in an overall group (H1

2023: 13%). Growth in the higher volume liquidations market, which

are typically lower value and less complex, has continued,

including Creditors Voluntary Liquidations ("CVLs") and Compulsory

Liquidations. There were 12,914 formal company insolvencies

(excluding Member Voluntary Liquidations) in England and Wales in

the six months to 31 October 2023. This was 8% higher than in the

six months to October 2022.

The source for all insolvency statistics are London and Regional

Gazettes.

Corporate Finance (including Debt Advisory)

FRP Corporate Finance continued to invest in external and

internal talent and recently announced six promotions within the

team, including two Partner promotions. In addition, Tim Spooner

joined as a Partner in the Bristol office, and Victoria Kisseleva

joined in London, with particular expertise in the beauty and

wellness sector.

Whilst deal volumes in the UK are down compared to the prior

year - reflecting the challenging conditions seen across the

broader economy - the team remained an active player in the

mid-market, and closed 25 transactions in H1 2024, with a combined

value of GBP537m and raising GBP209m of debt (H1 2023: 40 deals

with a combined value of GBP1.2bn and raising GBP552m of debt).

Notable deals in H1 2024 included:

-- The sale of CLC Group to HIG Group

-- The sale of The Vegner Group to Odevo

-- The refinancing of Bridge Farm Group

-- A GBP33 million committed debt facility for Slater & Gordon

Going into H2 2024, our pipeline of new opportunities remains

robust and we are continuing to see good levels of activity across

the national Corporate Finance practice. Whilst the mid-market in

which we operate is appearing to remain resilient - aided by the

availability of capital and an eagerness to deploy - there is a

clear flight to quality. Investors are understandably cautious and

requiring additional diligence, meaning deals are taking longer to

complete but there are signs that confidence is returning, and we

continue to work closely with the PE community having closed

transactions with 11 mid-market firms in H1 2024. As predicted, we

are seeing signs of an increase in debt refinancing and

restructuring related M&A activity.

Forensic Services

Forensic Services have seen a high level of activity across both

investigations and disputes. We have seen more assignments

requiring forensic accounting support and have hired more staff

across multiple locations to meet the increase in demand for our

services.

Financial Advisory

The team is actively engaged in a range of assignments including

option reviews and transaction due diligence, where stakeholders

are seeking more assurance on the viability of new investments and

refinancing, given the greater cost of capital and a higher risk

environment.

Our valuation specialists have been active with both mainstream

projects and preparing valuations which underpin restructuring

plans and schemes of arrangement.

Our pensions advisory specialists continue to work with trustees

and corporates, increasingly those moving towards buying-out

schemes with insurers to secure member benefits after the recent

changes in market conditions, as well as those navigating the

changing regulatory environment and its impact on corporate

transactions and scheme funding.

People and operations

At FRP we focus on the basics; delivering clear, honest advice

and always doing the right thing. Our reputation is built on our

colleagues helping stakeholders to achieve the best possible

outcome.

As a professional services business, we understand that our

people are central to our success and our most valuable asset. As

well as offering competitive financial rewards, we offer

opportunities for our team members to grow within the business and

reach their full potential. We believe highly engaged colleagues

deliver excellent client service and results, and in turn,

strengthen our reputation in the market.

We work hard to attract and retain highly skilled professionals

by creating a rewarding, high-performing environment. An Employee

Incentive Plan (EIP) was established on IPO in order to incentivise

employees under which options over ordinary shares were granted to

staff, vesting three years from IPO. The trust holding these

options is not eligible for dividends as rights were waived. On

vesting, the ordinary shares will gain rights to dividends.

In an increasingly competitive environment, we have continued to

recruit talented individuals to join FRP and help us grow in

targeted areas. Our team grew to 622 as at 31 October 2023,

representing 16% growth year-on-year, set out in the table

below.

31-Oct-23 30-Apr-23 31-Oct-22

Partners 88 78 80

---------- ---------- ---------

Other Fee earners 396 361 342

---------- ---------- ---------

Subtotal - Fee earners 484 439 422

---------- ---------- ---------

Support 138 112 114

---------- ---------- ---------

Total colleagues (ex Consultants) 622 551 536

---------- ---------- ---------

In May 2023 the Group promoted a record 12 colleagues to

Partner, part of a total 72 promotions across locations and our

five service pillars. Combined with our ongoing investments in

learning and development, this demonstrates the Group's long-term

commitment to developing talent and providing attractive career

paths. FRP have launched a new leadership programme for 100

colleagues nationwide, which complements an existing programme,

First in Leadership and Management ("FILM").

In November 2023, we announced a further 33 promotions across

our five service pillars and within the Central Services teams,

which included three new Partners and six new Directors.

Four lateral hire Partners were appointed to our Bristol, London

and Manchester offices between September and November 2023.

In June 2023, we opened an additional office in Salisbury, to

support continued team and business growth from our Southampton

office and the Wilson Field acquisition brought a second new

office, in Sheffield. Adding offices in selective new locations is

part of our growth strategy and as at October 2023, we have 27

locations (H1 2023: 26) in the UK and 1 in Cyprus. All offices

continue to work well together, drawing on specialists from our

five complementary service pillars as necessary, in order to

deliver the best possible service and outcome.

In September 2023, Glasgow Restructuring Partner, Michelle

Elliot won 'Corporate Leader of the Year' at the Scottish Women's

Awards.

The health, safety and wellbeing of all of our colleagues

remains a key priority. We feel that colleague interactions within

an office environment are important for learning and development,

team building and mental wellbeing. FRP has consistent high level

of staff retention compared to the wider professional services

industry (FRP voluntary attrition this half 10%, H1 2023: 10%).

The Group has been progressing projects to improve operational

efficiencies and risk management, enhancing internal controls which

include:

-- Together with enhancements to the Group's Information

Security Management System ("ISMS"), we were formally awarded ISO

27001 accreditation in October 2023. This confirms that FRP has put

in place a system to manage risks related to the security of data

owned or handled by the Group and that this system respects all of

the best practices and principles enshrined in this International

Standard.

-- The rollout of a new learning management system ("LMS"), and

continued planning around the launch of a document management

System ("DMS").

-- Updated finance system allows for improved efficiencies and internal controls.

Environmental, Social and Governance ("ESG")

As we navigate the complexities of the present and look to the

future, we remain committed to improving our sustainability and

climate resilience efforts. Our alignment with the Task Force on

Climate-related Financial Disclosures ("TCFD") guidelines serves as

evidence of our dedication to understanding and effectively

managing climate-related risks and opportunities.

We recognise that improvements have to be made and after the

appointment of a specialist Sustainability Manager, Alexis

Ioannidis in June 2023 our EcoVardis rating was upgraded to Silver,

putting FRP in the 87(th) percentile of companies. During H1 2024,

we have seen a 22% reduction in our Scope 1 emissions compared to

the prior year (sourced from the use of a company car fleet) and a

corresponding 7% reduction in our Scope 2 emissions (sourced from

the generation of purchased electricity, heat and steam). We have

also improved our emissions estimate calculations to account for

all Scope 3 categories and we are on track to publish a full

emissions inventory, along with our updated carbon reduction plan

in 2024. Finally, we are launching a waste reduction initiative in

H2 2024 to reduce our office printing numbers.

In addition, Alexis works within our Financial Advisory pillar

as a sustainability consultant and is currently advising an

investment conglomerate.

The ESG Committee ensures the Group has focus on relevant and

proportionate value creative ESG initiatives. We have committed the

Group to being Carbon Neutral by 2030. For further details please

see our website:

https://www.frpadvisory.com/about/approach/corporate-social-responsibility/environmental-social-and-governance/

FRP is a member of the UN Global Compact, whose aim is to

strengthen corporate sustainability worldwide. Over 23,500

companies across 167 countries participate and membership will

assist FRP to commit to, assess, define, implement, measure and

communicate our sustainability strategy.

FRP has committed to support charities or similar organisations

that provide aid for those who are homeless, in poverty, for

children's education, well-being and health and for environmental

issues. During H1 2024, we donated GBP23,600 to our professional

network's charity programmes, with colleagues raising an additional

GBP22,400. Notable colleague activities included Manchester's Josh

Richmond swimming the English Channel in a 6-person relay team,

collectively raising over GBP12,000 for the Children's Air

Ambulance and our London City office taking part in the Lord

Mayor's Appeal Charity's 'City Giving Day', raising GBP6,400, which

included a matched donation from FRP. A percentage of this total

was distributed to the Appeal, with the remainder to The Connection

at St Martin's in the Fields.

Selective acquisitions

FRP's strategy is to generate sustainable profitable growth by

combining a focus on organic growth with acquisitions that meet the

Group's selective criteria. The three acquisition criteria we focus

on are: cultural fit, strategic fit (within our five pillars/growth

region) and economic fit (acceptable transaction economics).

The Wilson Field Group was acquired in September 2023 for

GBP4.8m and this team serve clients both locally in Sheffield and

nationally through a digital platform. Integration of the business

continues as planned and their results and contribution for the

seven weeks post-acquisition are in line with the Board's

expectations.

Following an acquisition we treat the first 12 months'

contribution to the Group as inorganic, with contribution from

month 13 onwards becoming organic.

A strong financial performance and continued discipline

The Group delivered another strong performance during H1 2024,

continuing to grow revenue and underlying adjusted EBITDA. The

Group generated GBP58.7m in revenue in H1 2024, up by 19% or

GBP9.3m on the same period last year (H1 2023: GBP49.4m),

comprising organic growth of 16% and inorganic growth of 3%.

Underlying adjusted EBITDA was GBP15.5m, up 34% or GBP3.9m(H1 2023:

GBP11.6m).

Reported profit before tax for the period increased by 105% to

GBP11.5m (H1 2023: GBP5.6m) and was in line with the Board's

expectations. This was driven by both revenue increases and a

stable cost base. Converting unbilled revenue (also known as work

in progress or "WIP") to cash remains a top priority, however our

success in winning larger, more complex assignments can extend the

working capital cycle. As our activity levels have increased, there

has been an expected growth in our unbilled revenue although we

have consistently maintained our discipline around appropriate

valuation. The increase has arisen as FRP has been appointed on

new, large and/or complex administration assignments that have

assets other than cash (i.e. property) and/or a longer creditor

approval process before fees can be drawn. FRP continues to have a

strong track record of converting WIP into cash.

Dividend

Due to our continued profitability and cash position, in line

with our stated dividend policy, the Board declares an interim

dividend for Q2 2024 of 0.9p per eligible ordinary share. This

dividend will be paid on 22 March 2024 to shareholders on the

Company's register on 23 February 2024, with an ex-dividend date of

22 February 2024. This dividend takes the total for H1 2024 to 1.8p

per eligible share (H1 2023: 1.7p).

Going concern

During H1 2024, FRP has continued to grow profitably. The Group

had net cash of GBP11.7m (H1 2023: GBP21.0m) and an undrawn RCF of

GBP10m as at 31 October 2023. Net cash is calculated based on

GBP15.7m gross cash less GBP4.0m of structured debt (repayable over

approximately two and a half years). The Group also has an

accordion acquisition facility of GBP15m.

The Directors have made appropriate enquiries and consider that

the Group has adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the Directors

continue to adopt the going concern basis in preparing the

financial statement. Further detail on the assessment of going

concern can be found within note 2.3 of this interim financial

report.

Current trading and outlook

FRP is a resilient business, with a track record of growth

throughout the economic cycle. We have a robust business model and

our five complementary service pillars are available to support

clients throughout their entire lifecycle. This breadth of services

enables us to help clients review their operating models and adapt

or evolve as needed, in a fast-changing environment subject to many

disruptive and economic pressures.

The Restructuring Team are considerably more active this half

compared to the same period a year ago and have increased

administration market share. Companies with significant borrowings

who have rolled off lower interest rate arrangements are now

subject to much higher debt service costs, with interest rates now

considerably higher than the 2009-2021 period. Businesses are also

exposed to much higher levels of cost inflation . FRP continues to

be one of the most active Restructuring Advisory businesses in the

UK, supporting clients on both stress and distress situations where

we create commercial solutions to achieve the best possible

outcome. Certain sectors such as construction, property, casual

dining and food service, retail, administrative and support

services are finding current trading conditions particularly

challenging.

The Forensic services team is expanding, and are seeing an

increase in demand for support on disputes and investigations,

often driven by fraud related matters or the need for independent

investigations.

Financial Advisory are supporting on range of assignments

including option reviews and transaction due diligence, where

stakeholders are seeking more assurance on the viability of new

investments and re-financing given the greater cost of capital and

a higher risk environment. Our valuation specialists have been

active with both mainstream projects and preparing valuations which

underpin restructuring plans and schemes of arrangements.

FRP Corporate Finance (including Debt Advisory) remains active

in the mid-market and have a healthy H2 pipeline, although

increased caution among investors and lenders in the current

environment is also driving an increase in due diligence which

means deals are taking longer to complete. There is also an

increase in debt refinancing and restructuring related M&A

activity.

The group has a strong balance sheet and available facilities to

support continued growth.

Trading to date has been positive and the Board expects to

exceed current consensus market expectations for FY 2024. If

current activity levels continue the Board expects the Company to

deliver revenue of GBP123m and adjusted EBITDA of GBP32m for FY

2024.

Geoff Rowley Nigel Guy

Chief Executive Officer Non-Executive Chairman

Underlying adjusted results

For the six months ended 31 October 2023

Calculation of underlying adjusted EBITDA

(Earnings Before Interest Tax Depreciation and Amortisation)

(restated)

GBPm H1 2024 H1 2023 FY 2023

------------------------------------------------------- ---------------- --------------- ---------------

Reported profit before tax (PBT) 11.5 5.6 15.6

Add interest, depreciation, amortisation 1.7 1.4 2.9

Reported EBITDA 13.2 7.0 18.5

------------------------------------------------------- ---------------- --------------- ---------------

Add exceptional items - 0.1 0.1

Add share-based payment expense relating to the

Employee Incentive Plan 1.6 3.3 6.3

Add share-based payment expense - deemed remuneration 0.7 1.2 2.1

Underlying adjusted EBITDA 15.5 11.6 27.0

------------------------------------------------------- ---------------- --------------- ---------------

At present the Company has expensed in H1 2024 but not

underlying adjusted EBITDA for:

Ø Employers National Insurance due to the EIP awards when the

options vest, GBP0.4m (H1 2023: GBP0.9m) accrued in the period.

Consolidated statement of comprehensive income

For the six months ended 31 October 2023

Restated

Unaudited Unaudited Audited

6 months 6 months

ended ended Year Ended

30 Apr

31 Oct 23 31 Oct 22 23

Notes GBP million GBP million GBP million

--------------- ------ ----------------------------------- -------------------------------- ---------------------------

Revenue 58.7 49.4 104.0

Personnel

costs (33.0) (32.3) (64.3)

Depreciation

and

amortisation (1.3) (1.2) (2.5)

Other

operating

expenses (12.5) (10.0) (21.1)

Exceptional

costs 3 - (0.1) (0.1)

Operating

profit 11.9 5.8 16.0

--------------- ------ ----------------------------------- -------------------------------- ---------------------------

Finance income 0.2 0.1 0.2

Finance costs (0.6) (0.3) (0.6)

--------------- ------ ----------------------------------- -------------------------------- ---------------------------

Net finance

costs (0.4) (0.2) (0.4)

Profit before

tax 11.5 5.6 15.6

Taxation (2.7) 0.3 (2.9)

--------------- ------ ----------------------------------- -------------------------------- ---------------------------

Profit for the

period 8.8 5.9 12.7

--------------- ------ ----------------------------------- -------------------------------- ---------------------------

Total

comprehensive

income

for the

period 8.8 5.9 12.7

--------------- ------ ----------------------------------- -------------------------------- ---------------------------

Earnings per

share (in

pence)

Total 4 3.53 2.38 5.13

Basic 4 3.76 2.68 5.58

Diluted 4 3.64 2.50 5.33

--------------- ------ ----------------------------------- -------------------------------- ---------------------------

Adjusted

earnings per

share

(in pence)

Total 4 4.20 3.35 7.83

Basic 4 4.49 3.76 8.52

Diluted 4 4.34 3.51 8.14

--------------- ------ ----------------------------------- -------------------------------- ---------------------------

All results derive from continuing operations.

Consolidated statement of financial position

For the six months ended 31 October 2023

Restated

Unaudited Unaudited Audited

6 months 6 months

ended ended Year Ended

31 Oct 23 31 Oct 22 30 Apr 23

Notes GBP million GBP million GBP million

-------------- ------ ---------------------------------- ---------------------------------- ----------------------------------

Non-current

assets

Goodwill 12.7 10.2 10.8

Other

intangible

assets 2.3 0.7 0.6

Property,

plant and

equipment 2.5 2.7 2.5

Right of use

asset 6.0 5.6 6.5

Deferred tax

asset 1.6 4.7 2.5

Total

non-current

assets 25.1 23.9 22.9

-------------- ------ ---------------------------------- ---------------------------------- ----------------------------------

Current

assets

Trade and

other

receivables 6 68.5 48.5 58.3

Cash and cash

equivalents 15.7 26.6 27.7

Total current

assets 84.2 75.1 86.0

-------------- ------ ---------------------------------- ---------------------------------- ----------------------------------

Total assets 109.3 99.0 108.9

-------------- ------ ---------------------------------- ---------------------------------- ----------------------------------

Current

liabilities

Trade and

other

payables 7 26.6 26.1 29.7

Loans and

borrowings 1.6 1.6 1.6

Lease

liabilities 1.6 1.7 1.2

Total current

liabilities 29.8 29.4 32.5

-------------- ------ ---------------------------------- ---------------------------------- ----------------------------------

Non-current

liabilities

Trade and

other

payables 7 5.1 5.4 4.8

Loans and

borrowings 2.4 4.0 3.2

Lease

liabilities 4.5 4.0 5.3

Total

non-current

liabilities 12.0 13.4 13.3

-------------- ------ ---------------------------------- ---------------------------------- ----------------------------------

Total

liabilities 41.8 42.8 45.8

-------------- ------ ---------------------------------- ---------------------------------- ----------------------------------

Net assets 67.5 56.2 63.1

-------------- ------ ---------------------------------- ---------------------------------- ----------------------------------

Equity

Share capital 0.2 0.2 0.2

Share premium 33.7 31.5 32.0

Treasury

shares

reserve (0.0) (0.0) (0.0)

Share-based

payment

reserve 1.9 2.9 1.3

Merger

reserve 1.3 1.3 1.3

Retained

earnings 30.4 20.3 28.3

Shareholders

equity 67.5 56.2 63.1

-------------- ------ ---------------------------------- ---------------------------------- ----------------------------------

Approved by the Board and authorised for issue on 11 December

2023.

Jeremy French Gavin Jones

Director, COO Director, CFO

Company Registration No. 12315862

Consolidated statement of changes in equity

For the six months ended 31 October 2023

Called Share Treasury Share-based Merger Retained Total

up share premium share payment reserve earnings equity

capital account reserve reserve

GBP GBP GBP GBP GBP GBP GBP

million million million million million million million

-------------- ------------------ ------------------ ------------------ ------------------ ------------------ ------------------ ------------------

Balance at 31

October

2022

(unaudited)

(restated) 0.2 31.5 (0.0) 2.9 1.3 20.3 56.2

Profit for

the half

year - - - - - 6.8 6.8

Other

movements - - 0.0 - - (0.0) -

Dividends - - - - - (3.8) (3.8)

Issue of

share

capital 0.0 0.5 - - - - 0.5

Share-based

payment

expense - - - 3.0 - - 3.0

Deemed

remuneration

additions - - - (1.0) - - (1.0)

Deemed

remuneration

charge - - - 1.4 - - 1.4

Transfer to

retained

earnings - - - (5.0) - 5.0 -

Balance at 30

April

2023

(audited) 0.2 32.0 (0.0) 1.3 1.3 28.3 63.1

-------------- ------------------ ------------------ ------------------ ------------------ ------------------ ------------------ ------------------

Profit for

the half

year - - - - - 8.8 8.8

Dividends - - - - - (6.7) (6.7)

Issue of

share

capital 0.0 1.7 - - - - 1.7

Other

movements - - 0.0 - - (0.0) -

Share-based

payment

expense - - - 1.6 - - 1.6

Deemed

remuneration

additions - - - (1.7) - - (1.7)

Deemed

remuneration

charge - - - 0.7 - - 0.7

Balance at 31

October

2023

(unaudited) 0.2 33.7 (0.0) 1.9 1.3 30.4 67.5

-------------- ------------------ ------------------ ------------------ ------------------ ------------------ ------------------ ------------------

Consolidated statement of cash flows

For the six months ended 31 October 2023

Restated

Unaudited Unaudited Audited

6 months 6 months

ended ended Year Ended

31 Oct 23 31 Oct 22 30 Apr 23

GBP million GBP million GBP million

--------------------- ----------------------------------- ---------------------------------- ----------------------------------

Cash flows from

operating activities

Profit before

taxation 11.5 5.6 15.6

Depreciation,

amortisation and

impairment (non

cash) 1.3 1.2 2.5

Share-based

payments: employee

options (non cash) 1.6 3.3 6.3

Share-based

payments: deemed

remuneration

(non cash) 0.7 0.7 2.1

Net finance expenses 0.4 0.2 0.4

Increase in trade

and other

receivables (7.5) (2.6) (11.6)

Decrease in trade

and other payables (1.5) (5.1) (2.2)

Tax paid (5.4) (0.2) (2.0)

Net cash from

operating

activities 1.1 3.1 11.1

--------------------- ----------------------------------- ---------------------------------- ----------------------------------

Cash flows from

investing activities

Purchase of tangible

assets (0.2) (0.3) (0.6)

Acquisition of

subsidiaries less

cash acquired (4.1) (0.4) (1.6)

Interest received 0.2 0.0 0.2

Net cash used in

investing

activities (4.1) (0.7) (2.0)

--------------------- ----------------------------------- ---------------------------------- ----------------------------------

Cash flows from

financing activities

Gross Proceeds from

share sales - 7.5 7.5

Dividends (6.8) (6.0) (9.8)

Principal elements

of lease payments (1.0) (0.7) (1.4)

Repayment of loans

and borrowings (0.8) (1.2) (2.0)

Interest paid (0.4) (0.3) (0.6)

Net cash used in

financing

activities (9.0) (0.7) (6.3)

--------------------- ----------------------------------- ---------------------------------- ----------------------------------

Net

(decrease)/increase

in cash

and cash

equivalents (12.0) 1.7 2.8

Cash and cash

equivalents at the

beginning of the

period 27.7 24.9 24.9

Cash and cash

equivalents at

the end of the

period 15.7 26.6 27.7

--------------------- ----------------------------------- ---------------------------------- ----------------------------------

Notes to the Financial Statements

For the six months ended 31 October 2023

1. General information

FRP Advisory Group plc (the "Company") and its subsidiaries'

(together "the Group") principal activities include the provision

of specialist business advisory services for a broad range of

clients, including restructuring and insolvency services, corporate

nance, debt advisory, forensic services and financial advisory.

The Company is a public company limited by shares registered in

England and Wales and domiciled in the UK. The address of the

registered of ce is 110 Cannon Street, London, EC4N 6EU and the

company number is 12315862.

2. Basis of preparation and accounting policies

The condensed consolidated financial information is prepared in

sterling, which is the presentational currency of the Company.

Amounts in this nancial information are rounded to the nearest

GBP0.1 million.

The condensed consolidated financial information has been

prepared on the basis of Company accounting policies and should be

read in conjunction with the Group's last annual consolidated

financial statements.

This financial information does not include all of the

information required for a complete set of IFRS financial

statements.

This condensed consolidated H1 2024 financial information does

not comprise statutory accounts within the meaning of Section 434

of the Companies Act 2006. Statutory accounts for the year ended 30

April 2023 were approved by the Board of Directors on 25 July 2023

and delivered to the Registrar of Companies. The report of the

auditor on those accounts was unqualified, did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying their report and did not contain

statements under section 498 (2) or (3) of the Companies Act

2006.

2.1 Basis of consolidation

The nancial statements incorporate the results of FRP Advisory

Group plc and all of its subsidiary undertakings as at 31 October

2023.

FRP Advisory Group plc is the 100% shareholder of FRP Advisory

Trading Limited. FRP Advisory Trading Limited has twelve wholly

owned subsidiaries, FRP Advisory Cyprus, APP Audit Co Limited, FRP

Debt Advisory Limited, FRP Corporate Finance Limited, FRP Corporate

Advisory Limited, Litmus Advisory Limited, Abbott Fielding Limited,

JDC Accountants & Business Advisors Limited, JDC Holdings

Limited, Spectrum Corporate Finance Limited, BridgeShield Asset

Management Limited and Wilson Field Group Limited. FRP Advisory

Trading Limited is also a member of FRP Advisory Services LLP and

Apex Debt Solutions LLP. JDC Holdings Limited has two subsidiaries,

Jon Dodge & Co Limited and Walton Dodge Forensic Limited.

Wilson Field Group limited has two subsidiaries, Wilson Field

Limited and WF Financial Solutions. FRP has 100% of the economic

interest in JDC Accountants & Business Advisors Ltd and APP

Audit Co Limited.

2.2 Significant accounting policies

Accounting policies adopted in preparation of the H1 2024

condensed consolidated financial statements are consistent with

those followed in the preparation of the Group's annual financial

statements for the year ended 30 April 2023.

2.3 Going concern

The business has been, and is currently, both pro table and cash

generative. It has consistently grown year on year and has proven

to be resilient, growing in both periods of economic growth and

recession.

At period end the Group had net cash of GBP11.7m. The Group also

has available an undrawn GBP10m committed revolving credit

facility. Ongoing operational cash generation and this cash balance

mean we have suf cient resources to both operate and move swiftly

should acquisition opportunities arise.

The quality of client service, strong referral network and

barriers to enter the market, together with the strong cash

position, make the Board con dent that the Company will continue to

grow. In terms of diversi cation, of ces can adapt quickly to

supporting each other and work on both higher value assignments or

higher volume lower value jobs. Financial Advisory, Forensic

Services, Corporate Finance and Debt Advisory can equally support

the Restructuring Advisory offering and also earn fees

autonomously.

In the unlikely event that the business has a signi cant

slowdown in cash collections, the business has a number of further

options available to preserve cash.

Having due consideration of the nancial projections, the level

of structured debt and the available facilities, it is the opinion

of the Directors that the Group has adequate resources to continue

in operation for a period of at least 12 months from signing these

financial statements and therefore consider it appropriate to

prepare the Financial Statements on the going concern basis.

2.4 Restatement of prior period results

The restatement of prior period results is the reclassification

of GBP0.2m of costs relating to the issue of share capital from

exceptional costs to offsetting with share premium.

3. Exceptional costs

Exceptional costs in the prior period relate to the placing in

June 2022, which included an extension of the lock-in for

Partners.

4. Earnings per share ("EPS")

The EPS has been calculated using the pro t for the year and the

weighted average number of ordinary shares outstanding during the

year, as follows:

Adjusted

EPS EPS EPS Adjusted EPS

GBPm H1 2024 H1 2024 H1 2023 H1 2023

-------------------------- ------------------------- ------------------------------ -----------------------

Reported

Profit

after tax 8.8 8.8 5.9 5.9

Add

Exceptional

items - - - 0.1

Add

Share-based

payments - 2.3 - 4.5

Less

deferred

tax - (0.6) - (2.2)

Adjusted

Profit

after tax 8.8 10.5 5.9 8.3

Total

average

shares in

issue 249,813,394 249,813,394 247,448,913 247,448,913

Total share

EPS (pence) 3.53 4.20 2.38 3.35

------------- -------------------------- ------------------------- ------------------------------ -----------------------

Weighted

average

shares in

issue

excluding

EBT 234,015,204 234,015,204 220,504,872 220,504,872

Basic EPS

(pence) 3.76 4.49 2.68 3.76

------------- -------------------------- ------------------------- ------------------------------ -----------------------

Dilutive

potential

ordinary

shares

under share

option

schemes 7,827,995 7,827,995 15,213,834 15,213,834

Weighted

diluted

shares in

issue 241,843,199 241,843,199 235,718,706 235,718,706

Diluted EPS

(pence) 3.64 4.34 2.50 3.51

------------- -------------------------- ------------------------- ------------------------------ -----------------------

The Employee Bene t Trust does not have an entitlement to

dividends, holding 15,798,190 (H1 2023: 26,944,041) shares of the

above 249,813,394 (H1 2023: 247,448,913) ordinary shares.

5. Dividend

The Board declared an interim dividend for Q2 2024, the period

to 31 October 2023 of 0.9p per eligible* share. This dividend will

be paid on 22 March 2024 to shareholders on the Company's register

on 23 February 2024, with an ex-dividend date of 22 February

2024.

*An Employee Incentive Plan (EIP) established on IPO was used to

grant options to staff. The trust holding these shares is not

eligible for dividends, rights were waived. The options vested from

March 2023 onwards, and gain rights to dividends.

6. Trade and other receivables

Unaudited Unaudited Audited

6 months 6 months

ended ended Year Ended

31 Oct 23 31 Oct 22 30 Apr 23

Trade and

other

receivables GBP million GBP million GBP million

---------------------------------- ---------------------------------- ----------------------------------

Trade

receivables 7.6 6.0 7.9

Other

receivables 4.5 2.4 4.6

Unbilled

revenue 56.4 40.1 45.8

68.5 48.5 58.3

---------------------------------- ---------------------------------- ----------------------------------

The ageing profile of non-related party trade

receivables is as follows:

As at As at As at

31 Oct 23 31 Oct 22 30 Apr 23

Due in GBP million GBP million GBP million

---------------------------------- ---------------------------------- ----------------------------------

<30 Days 5.0 3.0 4.1

30-60 Days 0.3 1.0 1.6

60-90 Days 0.3 0.3 0.8

>90 Days 2.0 1.7 1.4

Total 7.6 6.0 7.9

---------------------------------- ---------------------------------- ----------------------------------

7. Trade and other payables

Unaudited Unaudited Audited

6 months 6 months

ended ended Year Ended

31 Oct 23 31 Oct 22 30 Apr 23

Current

liabilities GBP million GBP million GBP million

---------------------------------- ---------------------------------- ----------------------------------

Trade

payables 3.0 0.7 1.9

Other taxes

and social

security

costs 4.0 5.7 8.4

Liabilities

to Partners

go forward 11.4 10.9 10.3

Other

payables

and

accruals 8.2 8.8 9.1

26.6 26.1 29.7

---------------------------------- ---------------------------------- ----------------------------------

Unaudited Unaudited Audited

6 months 6 months

ended ended Year Ended

31 Oct 23 31 Oct 22 30 Apr 23

Non-current

liabilities GBP million GBP million GBP million

---------------------------------- ---------------------------------- ----------------------------------

Other

payables

and

accruals 0.6 1.1 0.7

Partner

capital 4.5 4.3 4.1

5.1 5.4 4.8

---------------------------------- ---------------------------------- ----------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DGBDDBGBDGXB

(END) Dow Jones Newswires

December 12, 2023 02:00 ET (07:00 GMT)

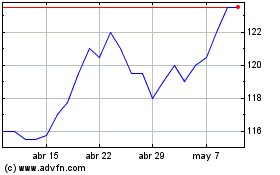

Frp Advisory (LSE:FRP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Frp Advisory (LSE:FRP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024