TIDMINHC

RNS Number : 5646S

Induction Healthcare Group PLC

07 November 2023

Induction Healthcare Group PLC

("Induction", the "Company", or the "Group")

Unaudited Interim Results

for the six months ended 30 September 2023

Induction (AIM: INHC), a leading digital health platform driving

transformation of healthcare systems, announces its unaudited

interim results for the six months ended 30 September 2023.

Financial Highlights

-- Revenues of GBP6.1m (H1 2022: GBP7.1m). New NHS patient

portal contracts (revenue to be recognized in second half of this

financial year) compensates for decline in NHS video conferencing

usage.

-- Gross margin improvement to 75% (H1 2022: 66.1%). Improved

management of direct cost base including cloud infrastructure.

-- Adjusted EBITDA of GBP0.01m (H1 2022: Loss GBP1.0m) Breakeven after non-cash adjustments.

-- Operating loss reduced to GBP2.4m (H1 2022: (GBP4.5m)).

Ongoing cost containment programme continues to yield results.

-- Cash position GBP3.1m (FY23 YE: GBP4.3m). We remain on track

towards our objective of self-sustaining growth and cash flow

breakeven in FY24.

Operational Highlights

-- Awarded five new patient portal development contracts

totaling GBP1.9m with several large Trusts/ICS and ICBs for the

Zesty patient portal. In addition to the GBP1.4m announced in

October, a further GBP538,000 is announced today:

o Whittington Health NHS Trust worth GBP267,000 covering several

patient portal projects including the use of Induction's Form

Builder module for wait list validation, enhancing appointment

management functionality, and integrating with Whittington's

pre-surgical assessment tool.

o Milton Keynes University Hospital worth GBP271,000 covering

several patient portal projects related to reducing wait lists and

launching an Induction video consultation from the patient

portal.

-- Induction to be the first NHS-accredited portal to digitize

maternity records for expectant mothers ensuring patient records

are accessible within Zesty.

-- Completed roll out of NHS App integration with 6 new

customers. 2.5 million patients can now access Zesty via the NHS

App, up from 1 million patients at the beginning of April 2023.

-- One of only two patient portal providers to launch new

functionality into the NHS App related to notifications, messages,

and forms. This functionality is vital to supporting waitlist

validation.

-- In final stages of engineering work which will enable

patients to launch video consultation from within the patient

portal, as well as enable clinicians to access a video consultation

from their Electronic Medical Record (EMR) - integration of Zesty

and Attend Anywhere platforms.

-- Non-core asset (Switch) sold for material consideration.

Paul Tambeau, CEO of Induction Healthcare, said: "With reports

that over 8m patients will be on a waiting list by next year,

Induction has a vital role to play in helping NHS Trusts manage

their backlog and giving patients more choice in how they access

care. We're well positioned to do this because of the work we've

done on integrating our platforms and enhancing the features

available through the NHS App. Improvement in both gross margin and

operating losses also demonstrates the outcome of our cost

containment work completed in the last 9 months which remains on

track to achieve our goal of being breakeven this year."

Enquiries

Induction

Christopher Samler, Chair +44 (0)7712 194092

Paul Tambeau, Chief Executive Officer +44 (0)7983 104443

Singer Capital Markets (Nominated

Adviser and Broker) +44 (0)20 7496 3000

Philip Davies

Alaina Wong

Jalini Kalaravy

About Induction - www.inductionhealthcare.com

Induction (AIM: INHC) Induction delivers a suite of software

solutions that transforms care delivery and the patient journey

through hospital. Our system-wide applications help healthcare

providers and administrators to deliver care at any stage remotely

as well as face-to-face - giving the communities they serve greater

flexibility, control and ease of access. Purpose-built for

integration with leading Electronic Medical Record (EMR) platforms,

our products offer immediate stand-alone value that becomes even

greater when integrated with pre-existing systems.

Used at scale by national and regional healthcare systems, as

well non-health government services, our applications are relied

upon by hundreds of thousands of clinicians and millions of

patients across almost every hospital in the British Isles.

CEO Review

Overview

Over the last six months, we have been focused on implementing

our FY24 plan that was based on four goals:

1. To be a profitable and sustainable growing business to

deliver our commitments to shareholders.

2. To successfully develop our Integrated Product.

3. To be customer centric and commercial in everything we do.

4. To implement and continuously develop an inclusive,

performance driven and rewarding employee experience.

I am pleased to say that we are making strong progress on all

four of these goals.

Through greater cost management, we are on track towards our

objective of self-sustaining growth and cash flow breakeven in

2024. In addition to completing the cost containment measures

started in Q4 FY23, an important driver has been better management

of our cloud infrastructure. Our cloud costs are down c.50%

compared to this time last year. In July 2023 we completed a major

overhaul of our database infrastructure and are currently

completing a significant change to our call screen which will

generate further savings as well as improve user experience. There

are additional projects we're evaluating to drive further savings

in our cloud infrastructure.

In terms of sales growth, we have capitalised on the funding

provided by the NHS to support Trusts to adopt or enhance their

patient portal. We've been successful in securing GBP1.9m in new

contracts which will fund key items on our integrated product

roadmap, such as:

-- Digitizing maternity records for expectant mothers, as well

as making diagnostic appointment details available from within the

patient portal.

-- Enabling a patient to launch a video consultation from within

the patient portal - integrating Attend Anywhere and Zesty.

-- Enhancing our appointment management functionality so that it

can be used to support Patient Initiated Follow Up / and Clinician

Initiated Follow Up initiatives.

-- Using our Form Builder module to support waitlist validation.

-- Deeping our integration with EMR partners such as Oracle

Cerner, as well as other third-party systems.

Whilst the large majority of these new contracts are one time

revenue, the enhanced platform will result in new features and case

studies to support future sales.

We have made tangible progress in integrating our product,

notably being able to launch a video consultation from within the

patient portal. We expect this work to be completed in early Q4

FY24 and already have 3 customers contracted to adopt this

functionality. We're also near completion of work to enable a

clinician or staff member to launch a video consultation within

their EMR.

We also continue to work closely with the NHS Wayfinder team in

integrating new features into the NHS App. We are one of only two

patient portal providers to launch new functionality into the NHS

App related to notifications, messages, and forms. This

functionality is vital to supporting waitlist validation. We've

also completed roll out of NHS App integration with 6 new

customers; 2.5 million patients can now access Zesty via the NHS

App, up from 1 million patients at the beginning of April.

Consistent with our previously announced focus on our key

strategic assets, we sold the Switch platform for a material

consideration. We continue to look for a strategic buyer for the

Guidance platform.

Financial Overview

We ended the first half of this year with GBP6.1m in recognised

revenue, down from GBP7.1m over the same period last year. This

decrease primarily reflects some Attend Anywhere contracts churning

in England as well as lower than expected utilisation in Wales.

This is offset by a 20% increase in Zesty revenue over the previous

corresponding period. As we look to the full year, we note that

most of the new NHS contracts will be recognised in the second half

of the fiscal year, meaning a higher overall contribution from

Zesty to revenue.

Gross margin in H1 improved to 75% compared to 66.1% in the same

period last year. This demonstrates the improved management of

direct cost base including cloud infrastructure.

Our operating loss was reduced in H1 to -GBP2.4m, an improvement

from -GBP4.5m compared with the same period last year. This

reflects that the ongoing cost containment programme continues to

yield results. On an adjusted EBITDA position, we ended H1 at

GBP0.01m compared to a loss of GBP1m over the same period last

year.

From a cash perspective, we ended H1 with GBP3.1m, down from

GBP4.3m at the end of FY23. The timing difference of the impact of

post year end termination costs and delay in receipt of invoiced

revenue accounts for this drop at the half year.

Outlook

With reports that over 8m patients will be on a waiting list by

next year, we have a vital role to play in helping NHS Trusts

manage their backlog and give patients more choice in how they

access care. We're well positioned to do this because of the work

we've completed on integrating our platforms and enhancing the

features available through the NHS App. The NHS continues to

prioritize further developments within the NHS App, enabling

Induction to become more embedded in the health ecosystem. We're

already seeing early evidence of the effectiveness of Induction's

digital tools in supporting waitlist validation which positions us

well for future growth.

We continue to see headwinds with Attend Anywhere renewals due

to downward pressure on pricing, Trusts returning to more in-person

appointments, and a post-Covid decline in the perceived advantages

of video appointments.

We're also seeing increasing demand for integrating the

capabilities of both our Zesty and Attend Anywhere platforms,

creating a better experience for clinicians and patients.

Given the rightsizing changes we have already implemented, and

the growth opportunities in front of us, we are increasingly

confident about Induction's future as a leading player in the

interface between the patient and their secondary care clinical

teams.

Paul Tambeau

CEO

7 November 2023

Condensed Consolidated Statement of Comprehensive Income

(Unaudited)

For the six months ended 30 September 2023

30 September 2023 30 September 2022

Unaudited Unaudited

Note GBP'000 GBP'000

---------------------------------------------------------- ----------------------------- ------------------

Revenue from contracts with customers 2 6,057 7,118

Cost of sales (1,514) (2,414)

---------------------------------------------------------- ----------------------------- ------------------

Gross Profit 4,543 4,704

Sales and marketing expenses 3 (578) (821)

Development expenses 3 (4,652) (4,159)

Administrative expenses 3 (1,731) (4,237)

Operating loss (2,418) (4,513)

---------------------------------------------------------- ----------------------------- ------------------

Finance Costs (2) (4)

Finance Income 2 -

---------------------------------------------------------- ----------------------------- ------------------

Loss before tax (2,418) (4,517)

---------------------------------------------------------- ----------------------------- ------------------

Taxation - (311)

---------------------------------------------------------- ----------------------------- ------------------

Loss for the period from continuing operations (2,418) (4,828)

---------------------------------------------------------- ----------------------------- ------------------

Profit / (Loss) from discontinued operations, net of tax 5 755 -

---------------------------------------------------------- ----------------------------- ------------------

Loss for the period (1,663) (4,828)

---------------------------------------------------------- ----------------------------- ------------------

Attributable to:

Equity holders of the parent (1,663) (4,828)

---------------------------------------------------------- ------------------

(1,663) (4,828)

---------------------------------------------------------- ----------------------------- ------------------

Loss per share from operations

---------------------------------------------------------- ----------------------------- ------------------

- Basic 4 (0.03) (0.06)

- Diluted 4 (0.03) (0.06)

---------------------------------------------------------- ----------------------------- ------------------

Condensed Consolidated Statement of Comprehensive Income

(Unaudited)

For the six months ended 30 September 2023

30 September 30 September

2023 2022

Unaudited Unaudited

Note GBP'000 GBP'000

-------------------- --------------------

Loss for the period (1,663) (4,828)

-------------------------------- -------------------- --------------------

Other comprehensive income

Items that may be reclassified

to profit or loss

Foreign currency translation

differences (394) 457

Reclassified to profit and

loss during the period 162 (801)

Other comprehensive income

for the financial period (233) (344)

-------------------------------- -------------------- --------------------

Total comprehensive loss

for the financial period (1,896) (5,172)

-------------------------------- -------------------- --------------------

Attributable to:

Equity holders of the parent (1,896) (5,172)

(1,896) (5,172)

-------------------------------- -------------------- --------------------

Loss per share:

Basic loss per share (GBP) 4 (0.03) (0.06)

Diluted loss per share (GBP) 4 (0.03) (0.06)

Condensed Consolidated Statement of Financial Position

As at 30 September 2023

30 September 2023 31 March 2023

Unaudited Audited

Note GBP'000 GBP'000

------------------ --------------

Non-current assets

Goodwill 10,685 10,685

Intangible Assets 13,005 15,251

Property, Plant and Equipment 7 9

Deferred tax assets 552 556

-----------------------------------------------------

Total non-current assets 24,249 26,501

----------------------------------------------------- ------------------ --------------

Current assets

Trade and other receivables 6 2,165 2,672

Contract Assets 1,589 1,228

Current tax receivable 810 1,175

Cash and cash equivalents 3,055 4,287

Assets held for sale 2,474 2,474

-----------------------------------------------------

Total current assets 10,093 11,836

----------------------------------------------------- ------------------ --------------

Total assets 34,342 38,337

----------------------------------------------------- ------------------ --------------

Non-current liabilities

Contract liabilities - (3,588)

Deferred tax liabilities (3,789) (3,870)

Other financial liabilities - (56)

-----------------------------------------------------

Total non-current liabilities (3,789) (1,235)

----------------------------------------------------- ------------------ --------------

Current liabilities

Trade and other payables 7 (1,922) (2,713)

Provisions (25) (528)

Contract liabilities (4,846) (2,198)

Liabilities associated with assets held for sale (1,016) (1,016)

Other financial liabilities (91) (72)

Total current liabilities (7,900) (6,527)

----------------------------------------------------- ------------------ --------------

Total liabilities (11,689) (14,041)

-----------------------------------------------------

Net assets/(liabilities) 22,653 24,296

----------------------------------------------------- ------------------ --------------

Equity attributable to equity holders of the parent

Share capital 462 462

Share premium 41,665 41,665

Merger reserve 20,205 20,205

Translation reserve (405) (162)

Other reserves 1,776 1,578

Accumulated deficit (41,050) (39,452)

-----------------------------------------------------

Total equity 22,653 24,296

----------------------------------------------------- ------------------ --------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 September 2023

Share Share Translation Other Merger Accumulated Total

Capital Premium reserve reserve reserve deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----------------- -------------- -------------------- -------------------- --------------- ------------------- -----------

Balance at 1

April 2023 462 41,665 (162) 1,578 20,205 (39,452) 24,296

Total

comprehensive

loss for the

period

Loss for the

period - - - - - (1,663) (1,663)

Other

comprehensive

loss for the

period - - (243) - - - (243)

Total

comprehensive

loss for the

period - - (243) - - (1,663) (1,906)

----------------- ----------------- -------------- -------------------- -------------------- --------------- ------------------- -----------

Transactions

with owners, in

their

capacity as

owners

Equity-settled

share-based

payments - - - 199 - - 199

Total

contributions

by and

distributions

to owners - - - 199 - - 199

----------------- ----------------- -------------- -------------------- -------------------- --------------- ------------------- -----------

Balance at 30

September 2023 462 41,665 (405) 1,776 20,205 (41,050) 22,653

----------------- ----------------- -------------- -------------------- -------------------- --------------- ------------------- -----------

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 September 2021

For the period ended For the period ended

Note 30 September 2023 30 September 2022

GBP'000 GBP'000

-------------------------------------------------------------- --------------------- ---------------------

Cash flows from operating activities

Loss for the financial period (1,663) (4,828)

Adjustments for:

Depreciation of property, plant and equipment 1 39

Amortisation and impairment of intangible assets 2,150 2,363

Finance costs 2 4

Finance income (2) -

Share-based payment expense 199 246

Taxation 311

Gain on sale of discontinued operations, net of tax (750) -

1,600 (2,963)

--------------------- ---------------------

Decrease / (Increase) in trade and other receivables and contract

assets 146 (1,500)

(Decrease) / Increase in trade and other payables and contract

liabilities (1,731) 7,303

(Decrease) / Increase in provisions (503) -

Interest received 2 -

Interest paid (2) (4)

Income taxes paid - (288)

Income taxes received 365 44

Net cash generated from / (used in) operating activities (1,786) (3,690)

---------------------------------------------------------------------- --------------------- ---------------------

Cash flows from investing activities

Payment of software development costs - (1,615)

Acquisitions of property, plant and equipment - (5)

Disposal of discontinued operations, net of cash 750 -

Net cash from investing activities 750 (1,620)

---------------------------------------------------------------------- --------------------- ---------------------

Cash flow from financial activities

Share issue proceeds - (194)

Payment of lease liabilities (33) -

Net cash from financing activities (33) (194)

---------------------------------------------------------------------- --------------------- ---------------------

Net increase in cash equivalents (1,069) 1,876

Cash and cash equivalents at the beginning of the financial period 4,287 7,495

Effects of exchange rate changes on cash and cash equivalents (163) (393)

Cash and cash equivalents at the end of the financial period 3,055 8,978

====================================================================== ===================== =====================

Notes to the Condensed Consolidated Interim Financial

Statements

1. Accounting Policies

1.1. Reporting entity

Induction Healthcare Group PLC ("Induction", the "Group" or the

"Company") is publicly listed on the AIM market of the London Stock

Exchange ("LSE"), and incorporated, domiciled and registered in the

United Kingdom. The registered number is 11852026 and the

registered address is 30 Crown Place, London, EC2A 4ES.

1.2. Basis of preparation

These interim financial statements have been prepared and

approved by the directors in accordance with International

Financial Reporting Standards ("Adopted IFRSs"). They do not

include all the information required for a complete set of IFRS

financial statements. However, selected explanatory notes are

included to explain events and transactions that are significant to

an understanding of the changes in the Group's financial position

and performance since the most recent annual consolidated financial

information included in the annual report and accounts as of and

for the year ended 31 March 2023.

The accounting policies applied are consistent with those

applied in the most recent consolidated annual report and accounts

for the year ended 31 March 2023, which are available on the

Company's website at www.inductionhealthcare.com under "Investors -

Financial reports & publications"

Subsidiaries are fully consolidated from the date of

acquisition, being the date on which the Group obtained control and

continue to be consolidated until the date when such control

ceases. The financial information of the subsidiaries is prepared

for the same reporting period as the Group, using consistent

accounting policies. All intra-group balances, transactions,

unrealised gains and losses resulting from intra-group transactions

are eliminated in full.

Changes in the Group's interest in a subsidiary that do not

result in a loss of control are accounted for as equity

transactions.

When the Group loses control over a subsidiary, the assets and

liabilities are derecognised along with any related non-controlling

interest and other components of equity. Any resulting gain or loss

is recognised in profit or loss. Any interest retained in the

former subsidiary is measured at fair value when control is

lost.

These interim condensed consolidated financial statements are

unaudited and were approved by the Board of Directors and

authorised for issue on 6 November 2023 and are available on the

Company's website at www.inductionhealthcare.com under "Investors -

Financial reports & publications".

2. Revenue

2.1 Revenue by performance obligations

Period to 30 September 2023 Period to 30 September 2022

GBP'000 GBP'000

--------------------------------------------- ---------------------------- ----------------------------

Provision of software 5,221 6,294

Post-contract support and maintenance 165 103

Set-up services 169 30

Professional services 225 492

Text message revenue 277 199

----------------------------------------------

Total revenue from contracts with customers 6,057 7,118

---------------------------------------------- ---------------------------- ----------------------------

3. Expenses by nature

Period to 31 September 2023 Period to 30 September 2022

GBP'000 GBP'000

--------------------------- ---------------------------

Employee benefit expense 3,686 4,809

Contractors 814 1,858

Amortisation of intangible assets 2,150 2,363

Depreciation of property, plant and equipment 1 39

Professional and legal fees 48 251

Research and development expense capitalised - (1,615)

4. Earnings per share

Basic EPS is calculated by dividing the profit for the year

attributable to ordinary equity holders of the parent by the

weighted average number of ordinary shares outstanding during the

year.

Diluted EPS is calculated by dividing the profit attributable to

ordinary equity holders of the parent (after adjusting for interest

on the convertible preference shares) by the weighted average

number of ordinary shares outstanding during the year plus the

weighted average number of ordinary shares that would be issued on

conversion of all the dilutive potential ordinary shares into

ordinary shares.

The following table reflects the income and share data used in

the basic and diluted EPS calculations:

Loss attributable to ordinary shares (basic and diluted)

30 September 30 September

2023 2022

GBP'000 GBP'000

------------------------------------------------------------------------------------- ------------ ------------

Loss attributable to ordinary shares used in calculating basic loss per share and

diluted

loss per share

From continuing operations (2,418) (4,828)

From discontinued operations 755 -

-------------------------------------------------------------------------------------- ------------ ------------

(1,663) (4,828)

------------ ------------

Weighted average number of ordinary shares (basic and

diluted)

Period to 30 September 2023 Period to 30 September 2022

----------------------------------------------------- ---------------------------- ----------------------------

Shares in issue on 1 April 92,380,300 92,050,727

Issue of ordinary shares on exercise of equity

settled share-based payments - 329,573

Issued ordinary shares as at the end of the period 92,380,300 92,380,300

------------------------------------------------------ ---------------------------- ----------------------------

Weighted-average number of ordinary shares (basic and

diluted) 92,380,300 92,206,033

------------------------------------------------------ ---------------------------- ----------------------------

Basic loss per share from continuing operations (0.03) (0.06)

Total basic loss per share (0.03) (0.06)

Diluted loss per share from continuing operations (0.03) (0.06)

Total diluted loss per share (0.03) (0.06)

5. Discontinued operations

During June 2023, the Group completed the sale of the Induction

Switch disposal Group for an undisclosed sum. This disposal Group

was classified as held for sale in accordance with IFRS 5

"Non-current assets held for sale and discontinued operations" at

31 March 2023. The sale was completed in line with the Group's

strategy to focus on sustainable growth.

6. Trade and other receivables

30 September 2023 31 March 2023

GBP'000 GBP'000

Receivables from third-party customers 1,568 2,069

Other receivables 320 351

Prepayments 230 125

Social security and other taxes receivable 47 127

------------------ --------------

Total trade and other receivables 2,165 2,672

------------------ --------------

Trade receivables are non-interest bearing and are generally on

terms of 30 days. Included within trade and other receivables is

GBPnil expected to be recovered in more than 12 months.

7. Trade and other payables

30 September 2023 31 March 2023

GBP'000 GBP'000

------------------ --------------

Trade payables 509 849

Accruals 886 1,096

Social security and other taxes 469 703

Other payables 58 65

1,922 2,713

------------------ --------------

Included within trade and other payables is GBPnil expected to

be settled in more than 12 months

All trade and other payables are non-interest bearing and are

normally settled on 30-day terms.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DDBDBCUGDGXL

(END) Dow Jones Newswires

November 07, 2023 02:00 ET (07:00 GMT)

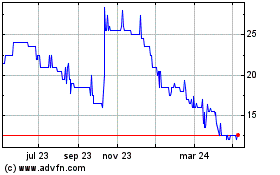

Induction Healthcare (LSE:INHC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

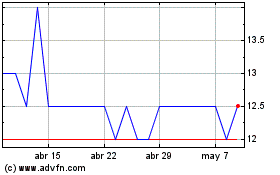

Induction Healthcare (LSE:INHC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024