TIDMPHI

RNS Number : 7363R

Pacific Horizon Investment Tst PLC

03 March 2023

RNS Announcement

Pacific Horizon Investment Trust PLC ('PHI')

Legal Entity Identifier: VLGEI9B8R0REWKB0LN95

Regulated Information Classification: Half Yearly Financial

Report

Results for the six months to 31 January 2023

The following is the unaudited Interim Financial Report for the

six months to 31 January 2023 which was approved by the Board on 2

March 2023.

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of Financial Statements has been prepared

in accordance with FRS 104 'Interim Financial Reporting';

b) the Interim Management Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.7R (indication of important events during the first six months,

their impact on the Financial Statements and a description of the

principal risks and uncertainties for the remaining six months of

the year); and

c) the Interim Financial Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.8R (disclosure of related party transactions and changes

therein).

On behalf of the Board

Angus Macpherson

Chairman

2 March 2023

Summary of Unaudited Results*

31 July

31 January 2022

2023 (audited) % change

===================================== ========== ========== =========

Total assets GBP604.7m GBP610.6m

Borrowings Nil Nil

Shareholders' funds GBP604.7m GBP610.6m

Net asset value per ordinary share 663.08p 664.65p (0.2%)

Share price 670.00p 647.00p 3.6%

MSCI All Country Asia ex Japan Index

(in sterling terms) # 544.2 527.8 3.1%

Premium/(discount) ++ 1.0% (2.7%)

Active share ++ 82% 83%

Six months Six months

to 31 to 31

January January

2023 2022

==================================== ========== ==========

Revenue earnings per ordinary share 0.25p (0.44p)

Six months

to 31 Year to

January 31 July

2023 2022

================================================== ========== ========

Total return # ++

Net asset value per ordinary share 0.3% (14.5%)

Share price 4.1% (19.3%)

MSCI All Country Asia ex Japan Index (in sterling

terms) # 4.0% (8.2%)

Six months to Year to 31 July

31 January 2023 2022

=================================== ================== =================

Period's high and low High Low High Low

Net asset value per ordinary share 699.18p 579.02p 871.11p 656.64p

Share price 684.00p 523.00p 948.00p 602.00p

Premium/(discount) ++ 2.7% (11.7%) 11.4% (10.9%)

* For a definition of terms see Glossary of Terms and

Alternative Performance Measures at the end of this

announcement.

The MSCI All Country Asia ex Japan Index (in sterling terms) is

the principal index against which performance is measured.

# Source: Baillie Gifford/Refinitiv and relevant underlying

index providers. See disclaimer at the end of this

announcement.

++ Alternative performance measure. See Glossary of Terms and

Alternative Performance Measures at the end of this

announcement.

Key Performance Indicator.

Past performance is not a guide to future performance.

Interim Management Report

Overview

What defines us is growth. We believe Asia ex Japan will be one

of the fastest growing regions over the coming decades and we

strive to be invested in its fastest growing companies. It is

growth multiplied by growth or, as we like to call it,

'Growth(2)'.

Such an investment style has been rewarded over the longer term,

with the Company's NAV outperforming the comparative index, the

MSCI All Country Asia ex Japan Index (in sterling terms) by 76

percentage points over the past five years, and the share price

returning 99%. Over the reporting period (31 July 2022 to 31

January 2023) the Company's NAV increased by 0.3%, while the share

price increased by 4.1%, compared to the comparative index which

rose 4.0% in sterling terms, all figures total return.

The period was noticeable for its volatility, with markets in

the region falling in aggregate nearly 20%, reaching their nadir as

President Xi cemented his grip on power during the 20th Chinese

Communist Party Congress in October, before rallying as China

abandoned its zero Covid policy, to end the period in positive

territory.

Markets will likely remain volatile. However, we are hopeful

that Asian markets have bottomed and we are very optimistic about

the future. In the near term, China's re-opening will spur

significant growth across the region. Longer term, the region's

structural advantages including demographics and a rising middle

class, combined with the superior financial position of most Asian

economies compared to the west, are likely to result in Asian

growth significantly outperforming over the coming years. In such

an environment we believe our focus on growth companies will

generate substantial returns for investors.

By sector, in absolute terms, our largest exposure remains

focused on the rising middle class, technology and innovation.

However, we continue to have significant exposure to growth

companies in more cyclical industries including materials,

industrials and energy.

The most notable change to the portfolio over the period was

significant additions to China, predominantly in the internet

sector, which we had also been adding to in the prior period.

Funding was from further reductions in India, and selling a number

of smaller positions in South Korea.

Review

For some time, Asia has faced a series of challenges as markets

have grappled with the implications of soaring inflation, interest

rate rises and tapering in the West, armed conflict in Eastern

Europe, a housing collapse in China and a soaring US Dollar to name

a few. Despite all these issues, there has been no Asian crisis,

quite the opposite, Asian economies have remained remarkably

resilient and are generally growing far faster than the majority of

western economies.

This is extremely encouraging and suggests Asian economies are

far better positioned than in the past, especially when compared to

developed markets. There are three key reasons. Firstly, Asian

balance sheets are in superior shape having lacked the profligate

monetary and fiscal stimulus of the west. For example, China's

Covid stimulus has equated to c.10% of GDP compared to c.70% for

many major European countries.

Secondly, while Western markets have, for years, operated with

ultra-low or even negative interest rates, most of Asia has

maintained positive rates for many years. Arguably, it is Asian

countries that have behaved like orthodox developed countries while

much of the developed world has behaved like the emerging markets

of old, (perhaps we are seeing the beginning of the 'converging

markets').

Thirdly, capital flows into Asia have been negative for a decade

and the region therefore far less vulnerable to money outflows than

in the past.

The result is that today, Asia's financial position is superior

to much of the developed world. Combine this with Asia's

structurally faster growth rates and valuations at multi-year lows

relative to developed markets, and the long-term outlook for Asian

investors looks very encouraging.

Why has this positive position not been reflected in the

performance of Asian equities more recently? China has been the key

issue.

Regulatory clampdowns on the private sector, increasing

geopolitical tensions, Covid induced lockdowns and problems in the

property market have led to a collapse in investor sentiment about

the country: the MSCI China Index is down nearly 50% since its 2021

peak, while many Chinese companies listed in the United States have

fallen significantly more. Sentiment reached its nadir at the 20th

Communist Party Congress this October, the results of which

confirmed Xi's iron grip on the government with all the most senior

positions in the country going to Xi loyalists, combined with the

very public removal of the former Chinese leader, Hu Jintao, from

the closing ceremony.

Sentiment, however, turned more positive towards the end of the

year as China suddenly abandoned its zero Covid policies,

effectively ending all forms of lockdowns which were seriously

hurting the economy. With pent up consumer demand, a huge build up

in personal savings (retail deposits at banks have increased by

roughly 60% in the past 18 months) and a government clearly keen to

see a stronger economy, growth in China is likely to accelerate

rapidly and provide a strong backdrop for many domestic

companies.

Over the past year, we have increasingly been finding compelling

investment opportunities in China. This is especially true in the

technology space, where valuations have been extreme. For example,

during the period Dada Nexus' (Chinese e-commerce logistics) market

capitalisation fell to almost the level of cash on its balance

sheet, while Alibaba Group's core e-commerce business (stripping

out cash and subsidiaries) was trading on a low single digit PE

multiple. (We added to both of these holdings over the period).

At the same time, many of the regulatory headwinds that have

affected the sector have subsided. This is in part due to the

geopolitical tensions with the United States, whose recent actions

to stymie China's innovation, including drastic measures to cut

China off from certain semiconductor chips, means China needs its

own technological giants to thrive and innovate and is thus

becoming more supportive of the sector.

With the economy now open and set to grow strongly, we have

further increased our exposure to China by adding c.600bp to

Chinese companies. In addition to the aforementioned Dada Nexus and

Alibaba Group, most of the additions were made to internet firms,

including JD.com (e-commerce), KE Holdings (online property portal)

and Baidu.com (online search engine). We also added to two

financial companies, Ping An Insurance, China's leading private

insurance company, and one of its subsidiaries, Ping An Bank. This

takes the portfolio's exposure to China to 38% (+30bp relative to

the comparative index) compared to 19% of the portfolio (-ve 1240bp

relative) a year ago.

Outside China, additions were made to Nickel Mines, an

Indonesian nickel processing company. Until now, Nickel Mines has

focused solely on processing nickel for use in stainless steel

production, however, the company is now taking a stake in one of

Indonesia's new High Pressure Acid Leach (HPAL) facilities that can

convert Indonesia's low-grade nickel into high-grade nickel

required for electric vehicle batteries.

Such a development is significant news for Indonesia. The

country is already the world's largest nickel producer and, if it

can successfully convert its lower-grade nickel into battery-grade

material, it can greatly enhance the country's prospect of becoming

a key link in the electric vehicle supply chain. Companies

including CATL (the world's largest electric vehicle battery maker)

and LG Energy (Korea's largest battery manufacturer) have already

invested some $25bn in the country's commodity complex, with Tesla

considering a $5bn investment. Versus the comparative index,

Indonesia is the portfolio's largest country overweight

position.

Finally, a new purchase was made in Silergy, a leading designer

of analogue chips in China (listed in Taiwan). The company has the

largest market share among domestic designers and is likely to be a

key beneficiary of Chinese attempts to become self reliant in

semiconductor chips.

Funding for the purchases came from two main sources. The most

significant was a reduction to a number of smaller (<60bps)

holdings in South Korea. These were across a range of sectors

including green energy businesses (LG Energy Solutions, SK IE

Technology and S-Fuelcell), cloud computing (Douzone Bizon) and

speech recognition software (Flitto). Over the period our Korean

weighting reduced from 17.4% of the portfolio to 14.6%.

We also continued to reduce our exposure to India, selling

Zomato, the online food delivery businesses, as the company's unit

economics are not as favourable as we would have hoped, and made a

small reduction to Star Health & Allied Insurance Co (health

insurance). Although India remains our second largest absolute

(19.3%) and relative (+470bp) country position, it is noteworthy

that this has come down significantly from 32.1% (absolute) and

+1720bp (relative) since this time last year. Vietnam is now the

second largest overweight country in the portfolio (+530bp).

By sector, there have been limited changes, with the portfolio

continuing to look different to many of our growth focused peer

funds. In absolute terms, our largest exposures remain focused on

the key themes of the rising middle class, technology and

innovation. However, we have significant exposures to more cyclical

industries including materials, industrials and energy that, after

consumer discretionary, make up the three largest relative

positions within the portfolio.

Overall, the number of names in the portfolio reduced to 77 from

85. Private companies, of which there are 5 in the portfolio,

currently make up 5.4% of the portfolio, and invested gearing is

currently nil.

Performance

We are long-term investors, running a high conviction growth

portfolio that is index agnostic. Performance will be volatile and

there will be short term periods when we underperform. It is

pleasing that over the past 5 years, the timescale on which we

believe our performance should be judged, the portfolio has

generated significant value for shareholders.

Over the six months to 31 January 2023 the Company's NAV

increased by 0.3%, while the share price increased by 4.1%,

compared to the comparative index which rose 4.0% in sterling

terms, all figures total return.

The weakest performing companies over the period were internet

related. The most significant was Delhivery in India (India's

largest private logistics company, with a core focus on e-commerce

logistics). Delhivery was previously held as a private company

until listing in May 2022. Thanks to strong share price performance

the company was a 5.5% holding at the start of the period.

Unfortunately, Delhivery's latest quarterly results were weak.

M&A integration challenges and a slowdown in broader e-commerce

growth in India led the share price down 52% and took 310bp off our

performance. We are hopeful these issues are short term, and with

key private players finding funding far more difficult, e-commerce

a multi decade growth opportunity and Delhivery the clear number

one player, we continue to have faith in the company.

Other detractors in the internet space came from the large

internet platforms in China which appreciated in value. Our

underweight positions in some of the largest platforms, including

Tencent and Alibaba Group, detracted c.110bp.

More positively, the portfolio's significant exposure to more

cyclical sectors, which has been increased significantly over the

past few years, helped offset some of the weakness. Materials were

the largest positive contributor, led by several of our copper

companies including Zijin Mining Group and Merdeka Copper Gold,

that performed strongly on China's reopening. The longer-term

driver remains copper's role in the green transition.

Consumer discretionary was the second largest contributor,

mainly due to the strong performance of our China holdings as the

reopening theme took hold. Dada Nexus (e-commerce logistics) was

the standout performer adding +110bp and was the single largest

stock contributor.

Our increased exposure to China over the period resulted in

China and Hong Kong being the most significant contributors to

performance. This was followed by Indonesia, driven by our

commodity holdings. India was the weakest market in the portfolio

due to the performance of Delhivery and Dailyhunt (Social

media).

The Company's shares ended the period at a 1% premium to the NAV

per share, having been at a 2.7% discount six months earlier. Over

the six months to 31 January 2023, the Company issued 25,000 shares

from treasury and bought back in total 686,593 shares for treasury.

At the end of January 2023 the Company was promoted to the FTSE 250

Index and since period end the Company has issued a further 175,000

shares from treasury at a premium to NAV.

Conclusion

While short term markets may remain volatile, we remain

extremely positive on the long-term outlook for the region. Asia

has already taken up the baton of global demand growth, with China

alone having contributed more to global growth in US dollar terms

than the US over the past decade, while India is overtaking Japan.

Asia is now better positioned financially than much of the

developed world and, with a renewed investment cycle unfolding,

Asian growth is likely to significantly outperform over the coming

years.

We firmly believe the best way to invest in the Asia growth

story is to invest in the region's fastest growing companies.

The principal risks and uncertainties facing the Company are set

out in note 13.

Bailie Gifford & Co Limited

Managers & Secretaries

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Total return information is sourced from Baillie

Gifford/Refinitiv and relevant underlying index providers. See

disclaimer at the end of this announcement.

Valuing Private Companies

We aim to hold our private company investments at 'fair value',

i.e. the price that would be paid in an open-market transaction.

Valuations are adjusted both during regular valuation cycles and on

an ad hoc basis in response to 'trigger events'. Our valuation

process ensures that private companies are valued in both a fair

and timely manner.

The valuation process is overseen by a valuations committee at

Baillie Gifford, which takes advice from an independent third party

(S&P Global). The valuations committee is independent from the

portfolio managers, as well as Baillie Gifford's Private Companies

Specialist team, with all voting members being from different

operational areas of the firm, and the portfolio managers only

receive final valuation notifications once they have been

applied.

We revalue the private holdings on a three-month rolling cycle,

with one-third of the holdings reassessed each month. The prices

are also reviewed twice per year by the Pacific Horizon Board and

are subject to the scrutiny of external auditors in the annual

audit process.

Recent market volatility has meant that recent pricing has moved

much more frequently than would have been the case with the

quarterly valuations cycle.

Beyond the regular cycle, the valuations committee also monitors

the portfolio for certain 'trigger events'. These may include

changes in fundamentals, a takeover approach, an intention to carry

out an Initial Public Offering ('IPO'), company news which is

identified by the valuation team or by the portfolio managers or

changes to the valuation of comparable public companies.

The valuations committee also monitors relevant market indices

on a weekly basis and update valuations in a manner consistent with

our external valuer's (S&P Global) most recent valuation report

where appropriate. When market volatility is particularly

pronounced the team does these checks daily. Any ad hoc change to

the fair valuation of any holding is implemented swiftly and

reflected in the next published net asset value. There is no

delay.

Pacific Horizon Investment

Trust PLC *

=============================

Instruments valued 6

Revaluations performed 14

Percentage of portfolio

revalued 2 times 83%

Percentage of portfolio

revalued 4 times 17%

======================== ===

* Data reflecting period 1 August 2022 to 31 January 2023 to

align with the Company's reporting period end.

For the six months to 31 January 2023, most revaluations have

been decreases. The average movement in both valuation and share

price for those which have decreased in value is shown below.

Average Average

movement movement

in investee in investee

company share

valuation price

============ ============ ============

Instruments

valued * (6%) (14%)

============ ============ ============

* Data reflecting period 1 August 2022 to 31 January 2023 to

align with the Company's reporting period end.

Share prices have decreased more than headline valuations

because Pacific Horizon typically holds preference stock, which

provides downside protection.

The share price movement reflects a probability-weighted average

of both the regular valuation, which would be realised in an IPO,

and the downside protected valuation, which would normally be

triggered in the event of a corporate sale or liquidation.

Baillie Gifford Statement on Stewardship

Baillie Gifford's over-arching ethos is that we are 'actual'

investors. We have a responsibility to behave as supportive and

constructively engaged long-term investors. We invest in companies

at different stages in their evolution, across vastly different

industries and geographies and we celebrate their uniqueness.

Consequently, we are wary of prescriptive policies and rules,

believing that these often run counter to thoughtful and beneficial

corporate stewardship. Our approach favours a small number of

simple principles which help shape our interactions with

companies.

Our Stewardship Principles

Prioritisation of Long-term Value Creation

We encourage our holdings to be ambitious and focus their

investments on long-term value creation. We understand that it is

easy to be influenced by short-sighted demands for profit

maximisation but believe these often lead to sub-optimal long-term

outcomes. We regard it as our responsibility to steer holdings away

from destructive financial engineering towards activities that

create genuine economic and stakeholder value over the long run. We

are happy that our value will often be in supporting management

when others don't.

A Constructive and Purposeful Board

We believe that boards play a key role in supporting corporate

success and representing the interests of all capital providers.

There is no fixed formula, but it is our expectation that boards

have the resources, information, cognitive and experiential

diversity they need to fulfil these responsibilities. We believe

that good governance works best when there are diverse skillsets

and perspectives, paired with an inclusive culture and strong

independent representation able to assist, advise and

constructively challenge the thinking of management.

Long-term Focused Remuneration with Stretching Targets

We look for remuneration policies that are simple, transparent

and reward superior strategic and operational endeavour. We believe

incentive schemes can be important in driving behaviour, and we

encourage policies which create genuine long-term alignment with

external capital providers. We are accepting of significant payouts

to executives if these are commensurate with outstanding long-run

value creation, but plans should not reward mediocre outcomes. We

think that performance hurdles should be skewed towards long-term

results and that remuneration plans should be subject to

shareholder approval.

Fair Treatment of Stakeholders

We believe it is in the long-term interests of all enterprises

to maintain strong relationships with all stakeholders - employees,

customers, suppliers, regulators and the communities they exist

within. We do not believe in one-size-fits-all policies and

recognise that operating policies, governance and ownership

structures may need to vary according to circumstance. Nonetheless,

we believe the principles of fairness, transparency and respect

should be prioritised at all times.

Sustainable Business Practices

We believe an entity's long-term success is dependent on

maintaining its social licence to operate and look for holdings to

work within the spirit and not just the letter of the laws and

regulations that govern them. We expect all holdings to consider

how their actions impact society, both directly and indirectly, and

encourage the development of thoughtful environmental practices and

'net-zero' aligned climate strategies as a matter of priority.

Climate change, environmental impact, social inclusion, tax and

fair treatment of employees should be addressed at board level,

with appropriately stretching policies and targets focused on the

relevant material dimensions. Boards and senior management should

understand, regularly review and disclose information relevant to

such targets publicly, alongside plans for ongoing improvement.

Thirty Largest Holdings at 31 January 2023 (unaudited)

% of

total

Value assets

Name Geography Business GBP'000 *

Memory, phones and electronic components

Samsung Electronics Korea manufacturer 34,910 5.8

Ping An Insurance H Shares HK/China Life insurance provider 24,034 4.0

JD.com HK/China Online mobile commerce 23,814 3.9

Li Ning HK/China Sportswear apparel supplier 19,668 3.3

Dailyhunt (VerSe Innovation)

Series I Preferred (U) India Indian news aggregator application 14,465 2.4

Dailyhunt (VerSe Innovation)

Series Equity (U) India Indian news aggregator application 2,755 0.4

Dailyhunt (VerSe Innovation)

Series J Preferred (U) India Indian news aggregator application 2,181 0.4

======== =======

19,401 3.2

Jadestone Energy Singapore Oil and gas explorer and producer 18,238 3.0

Alibaba Group HK/China Online and mobile commerce 17,343 2.9

Zijin Mining Group Co H Shares HK/China Gold and copper miner 16,694 2.8

Delhivery (P) India Logistics and courier services provider 15,329 2.5

Samsung SDI Korea Electrical equipment manufacturer 14,975 2.5

Chinese ecommerce distributor of

Dada Nexus ADR HK/China online consumer products 14,868 2.5

Merdeka Copper Gold Indonesia Indonesian miner 14,390 2.4

MMG HK/China Chinese copper miner 13,135 2.2

ByteDance Series E-1 Preferred

(U) HK/China Social media 13,040 2.2

Tata Motors India Indian automobile manufacturer 12,630 2.1

Samsung Engineering Korea Korean construction 12,322 2.0

Reliance Industries India Indian petrochemical company 12,010 2.0

Bank Rakyat Indonesia Consumer bank 11,663 1.9

Sea Limited ADR Singapore Internet gaming and ecommerce 11,559 1.9

Meituan HK/China Local services aggregator 10,533 1.7

Ramkrishna Forgings India Auto parts manufacturer 10,275 1.7

HDBank Vietnam Consumer bank 9,398 1.6

Owner and operator of a chain of

Lemon Tree Hotels India Indian hotels and resorts 9,334 1.5

Nickel Mines Indonesia Base metals miner 9,145 1.5

China Oilfield Services H Shares HK/China Oilfield services 8,970 1.5

LONGi Green Energy A Shares HK/China Chinese semiconductor manufacturer 8,658 1.4

KE Holdings HK/China Chinese real-estate platform 7,825 1.3

KE Holdings ADR HK/China Chinese real-estate platform 721 0.1

======== =======

8,546 1.4

Phoenix Mills India Commercial property manager 8,412 1.4

Midea A Shares HK/China Household appliance manufacturer 8,169 1.4

PT Astra International Indonesia Automobile distributor 8,054 1.3

================================= ========== ========================================= ======== =======

419,517 69.5

====================================================================================== ======== =======

HK/China denotes Hong Kong and China.

* For a definition of terms see Glossary of Terms and

Alternative Performance Measures at the end of this

announcement.

U Denotes private company (unlisted) security.

P Denotes listed security previously held in the portfolio as a

private company (unlisted) security.

Private

company Net liquid

Listed (unlisted) assets Total

equities securities % assets

% % %

================= =========== ============ ============= =========

31 January 2023 93.6 5.4 1.0 100.0

----------- ------------ ------------- ---------

31 July 2022 93.6 6.1 0.3 100.0

----------------- ----------- ------------ ------------- ---------

Figures represent percentage of total assets.

Includes holdings in ordinary shares and preference shares.

Distribution of Total Assets* (Unaudited)

Geographical Analysis

At At

31 January 31 July

2023 2022

% %

====================================================== ================= ==============

Investments: Hong Kong and China 40.9 32.4

Including 6.8% (2022: 7.1%)

'A' Shares *

India 19.3 24.2

Korea 14.6 17.4

Indonesia 7.9 8.9

Singapore 5.5 6.5

Vietnam 5.3 5.4

Taiwan 4.5 4.5

Other 1.0 0.4

Total investments 99.0 99.7

Net liquid assets* 1.0 0.3

====================================================== ================= ==============

Total assets 100.0 100.0

====================================================== ================= ==============

Sectoral Analysis

At At

31 January 31 July

2023 2022

% %

======================================== ================= ==============

Investments: Communication Services 8.6 9.6

Consumer Discretionary 23.1 20.2

Consumer Staples 0.3 0.3

Energy 6.5 6.9

Financials 13.5 9.9

Healthcare Nil 0.6

Industrials 9.5 13.5

Information Technology 18.9 19.5

Materials 13.1 14.6

Real Estate 5.5 4.6

======================================= ================= ==============

Total investments 99.0 99.7

Net liquid assets* 1.0 0.3

======================================== ================= ==============

Total assets 100.0 100.0

======================================== ================= ==============

* For a definition of terms see Glossary of Terms and

Alternative Performance Measures at the end of this

announcement.

Income Statement (Unaudited)

For the six months ended For the six months ended For the year ended 31

31 January 2023 31 January 2022 July 2022 (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================= ========= ======== ======== ========= ======== ======== ========= ========= =========

Losses on investments - (545) (545) - (32,632) (32,632) - (118,594) (118,594)

Currency (losses)/gains - (575) (575) - 652 652 - 1,292 1,292

Income from investments

and interest

receivable 2,821 - 2,821 2,720 - 2,720 11,067 - 11,067

Investment management

fee

(note 3) (1,712) - (1,712) (2,121) - (2,121) (4,036) - (4,036)

Other administrative

expenses (405) - (405) (589) - (589) (1,093) - (1,093)

======================= ========= ======== ======== ========= ======== ======== ========= ========= =========

Net return before

finance

costs and taxation 704 (1,120) (416) 10 (31,980) (31,970) 5,938 (117,302) (111,364)

======================= ========= ======== ======== ========= ======== ======== ========= ========= =========

Finance costs of

borrowings (201) - (201) (281) - (281) (756) - (756)

======================= ========= ======== ======== ========= ======== ======== ========= ========= =========

Net return before

taxation 503 (1,120) (617) (271) (31,980) (32,251) 5,182 (117,302) (112,120)

======================= ========= ======== ======== ========= ======== ======== ========= ========= =========

Tax (note 4) (274) 1,578 1,304 (123) 1,153 1,030 (1,352) 5,288 3,936

======================= ========= ======== ======== ========= ======== ======== ========= ========= =========

Net return after

taxation 229 458 687 (394) (30,827) (31,221) 3,830 (112,014) (108,184)

======================= ========= ======== ======== ========= ======== ======== ========= ========= =========

Net return per ordinary

share (note 5) 0.25p 0.50p 0.75p (0.44p) (34.15p) (34.59p) 4.21p (123.01p) (118.80p)

======================= ========= ======== ======== ========= ======== ======== ========= ========= =========

The total column of this statement represents the profit and

loss account of the Company. The supplementary revenue and capital

columns are prepared under guidance issued by the Association of

Investment Companies.

All revenue and capital items in this statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as the

Company does not have any other comprehensive income and the net

return on ordinary activities after taxation is both the profit and

total comprehensive income for the period.

Balance Sheet (Unaudited)

At 31

July

At 31

January 2022

2023 (audited)

GBP'000 GBP'000

=========================================== ========== ==========

Fixed assets

Investments held at fair value through

profit or loss (note 7) 598,943 608,539

=========================================== ========== ==========

Current assets

Debtors 4,951 1,248

Cash and cash equivalents 3,383 5,399

=========================================== ========== ==========

8,334 6,647

=========================================== ========== ==========

Creditors

Amounts falling due within one year (1,115) (1,620)

=========================================== ========== ==========

Net current assets 7,219 5,027

=========================================== ========== ==========

Total assets less current liabilities 606,162 613,566

=========================================== ========== ==========

Creditors

Amounts falling due after more than one

year:

Provision for tax liability (note 9) (1,438) (3,016)

=========================================== ========== ==========

Net assets 604,724 610,550

=========================================== ========== ==========

Capital and reserves

Share capital (note 10) 9,208 9,208

Share premium account 253,967 253,946

Capital redemption reserve 20,367 20,367

Capital reserve 316,242 319,573

Revenue reserve 4,940 7,456

=========================================== ========== ==========

Shareholders' funds 604,724 610,550

=========================================== ========== ==========

Net asset value per ordinary share *

(after deducting borrowings at book cost) 663.08p 664.65p

=========================================== ========== ==========

Ordinary shares in issue (note 10) 91,199,368 91,860,961

=========================================== ========== ==========

* See Glossary of Terms and Alternative Performance Measures at the end of this announcement.

Statement of Changes in Equity

For the year ended 31 January 2023

Capital Capital

Share Share premium redemption reserve Revenue Shareholders'

capital account reserve * reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Shareholders' funds at 1 August

2022 9,208 253,946 20,367 319,573 7,456 610,550

Net return after taxation - - - 458 229 687

Ordinary shares issued (note - -

10) - - - -

Ordinary shares bought back

into treasury (note 10) - - - (3,940) - (3,940)

Ordinary shares sold from treasury

(note 10) - 21 - 151 - 172

Dividends paid during the period

(note 6) - - - - (2,745) (2,745)

=================================== ======== ============= =========== ======== ======== =============

Shareholders' funds at 31 January

2023 9,208 253,967 20,367 316,242 4,940 604,724

=================================== ======== ============= =========== ======== ======== =============

For the year ended 31 January 2022

Capital Capital

Share Share premium redemption reserve Revenue Shareholders'

capital account reserve * reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Shareholders' funds at 1 August

2021 8,843 221,354 20,367 433,041 3,626 687,231

Net return after taxation - - - (30,827) (394) (31,221)

Ordinary shares issued 365 32,592 - - - 32,957

Ordinary shares bought back

into treasury - - - (1,203) - (1,203)

Ordinary shares sold from treasury - - - - - -

Dividends paid during the period - -

(note 6) - - - -

=================================== ======== ============= =========== ======== ======== =============

Shareholders' funds at 31 January

2022 9,208 253,946 20,367 401,011 3,232 687,764

=================================== ======== ============= =========== ======== ======== =============

* The Capital Reserve balance at 31 January 2023 includes

investment holding gains on investments of GBP103,733,000 (31

January 2022- gains of GBP239,779,000).

Condensed Cash Flow Statement (Unaudited)

Six months Six months

to to

31 January 31 January

2023 2022

GBP'000 GBP'000

========================================== =========== ===========

Cash flows from operating activities

Net return before taxation (617) (32,251)

Net losses on investments 545 32,632

Currency losses/(gains) 575 (652)

Finance costs of borrowings 201 281

Overseas withholding tax (269) (100)

Indian CGT paid on transactions - (1)

Changes in debtors and creditors 98 12

========================================== =========== ===========

Cash from operations * 533 (79)

Interest paid (201) (229)

========================================== =========== ===========

Net cash inflow/(outflow) from operating

activities 332 (308)

========================================== =========== ===========

Cash flows from investing activities

Acquisitions of investments (58,477) (39,234)

Disposals of investments 63,217 39,799

========================================== =========== ===========

Net cash inflow from investing activities 4,740 565

========================================== =========== ===========

Cash flows from financing activities

Ordinary shares bought back into treasury (3,940) (1,203)

Ordinary shares sold from treasury 172 -

Ordinary shares issued - 32,880

Borrowings brought down - 119,372

Borrowings repaid - (122,598)

Equity dividends paid (2,745) -

========================================== =========== ===========

Net cash (outflow)/inflow from financing

activities (6,513) 28,451

========================================== =========== ===========

(Decrease)/increase in cash and cash

equivalents (1,441) 28,708

Exchange movements (575) 2,462

Cash and cash equivalents at start

of period 5,399 31,766

========================================== =========== ===========

Cash and cash equivalents at end

of period 3,383 62,936

========================================== =========== ===========

* Cash from operations includes dividends received of

GBP2,862,000 (31 January 2022 - GBP2,682,000) and interest received

of GBP118,000 (31 January 2022 - nil).

Notes to the Financial Statements

1. Basis of Accounting

The condensed Financial Statements for the six months to 31

January 2023 comprise the statements set out above together with

the related notes below. They have been prepared in accordance with

FRS 104 'Interim Financial Reporting' and the AIC's Statement of

Recommended Practice issued in issued in November 2014 and updated

in October 2019, April 2021 and July 2022 with consequential

amendments. They have not been audited or reviewed by the Auditor

pursuant to the Auditing Practices Board Guidance on 'Review of

Interim Financial Information'. The Financial Statements for the

six months to 31 January 2023 have been prepared on the basis of

the same accounting policies as set out in the Company's Annual

Report and Financial Statements at 31 July 2022.

Going Concern

The Directors have considered the Company's principal risks and

uncertainties, as set out on the inside cover of this report,

together with the Company's current position, investment objective

and policy, the level of demand for the Company's shares, the

nature of its assets, its liabilities and projected income and

expenditure. The Board has, in particular, considered the impact of

heightened market volatility since the Covid-19 pandemic and over

recent months due to macroeconomic and geopolitical concerns. It

does not believe the Company's going concern status is affected. It

is the Directors' opinion that the Company has adequate resources

to continue in operational existence for the foreseeable future.

The Company's assets, the majority of which are investments in

quoted securities which are readily realisable, exceed its

liabilities significantly. All borrowings require the prior

approval of the Board. The Board approves borrowing and gearing

limits and reviews regularly the amounts of any borrowing and the

level of gearing as well as compliance with borrowing covenants.

The Company has continued to comply with the investment trust

status requirements of section 1158 of the Corporation Tax Act 2010

and the Investment Trust (Approved Company) (Tax) regulations 2011.

In accordance with the Company's Articles of Association,

shareholders have the right to vote on the continuation of the

Company every five years, the next vote being in 2026. Accordingly,

the Directors consider it appropriate to adopt the going concern

basis of accounting in preparing these Financial Statements and

confirm that they are not aware of any material uncertainties which

may affect the Company's ability to continue to do so over a period

of at least twelve months from the date of approval of these

Financial Statements.

2. The financial information contained within this Interim

Financial Report does not constitute statutory accounts as defined

in sections 434 to 436 of the Companies Act 2006. The financial

information for the year ended 31 July 2022 has been extracted from

the statutory accounts which have been filed with the Registrar of

Companies. The Auditor's Report on those accounts was not

qualified, did not include a reference to any matters to which the

Auditor drew attention by way of emphasis without qualifying its

report, and did not contain statements under sections 498(2) or (3)

of the Companies Act 2006.

3. Baillie Gifford & Co Limited, a wholly owned subsidiary

of Baillie Gifford & Co, has been appointed by the Company as

its Alternative Investment Fund Manager and Company Secretary.

Baillie Gifford & Co Limited has delegated the investment

management services to Baillie Gifford & Co. Dealing activity

and transaction reporting have been further sub-delegated to

Baillie Gifford Overseas Limited and Baillie Gifford Asia (Hong

Kong) Limited. The Managers may terminate the Management Agreement

on six months' notice and the Company may terminate on three

months' notice. The annual management fee is 0.75% on the first

GBP50 million of net assets, 0.65% on the next GBP200 million of

net assets and 0.55% on the remaining net assets. Management fees

are calculated and payable on a quarterly basis.

4. Tax

The revenue tax charge includes the overseas withholding tax

suffered in the period. The capital tax charge results from the

Provision for Tax Liability in respect of Indian capital gains tax

as detailed in note 9.

5. Net Return

Year to

Six months Six months

to 31 January to 31 January 31 July

2023 2022 2022

(audited)

GBP'000 GBP'000 GBP'000

============================== ============== ============== ==========

Revenue return after taxation 229 (394) 3,830

Capital return after taxation 458 (30,827) (112,014)

============================== ============== ============== ==========

Total net return 687 (31,221) (108,184)

============================== ============== ============== ==========

Net return per ordinary share

Revenue return after taxation 0.25p (0.44p) 4.21p

Capital return after taxation 0.50p (34.15p) (123.01p)

============================== ============== ============== ==========

Total net return per ordinary

share 0.75p (34.59p) (118.80p)

============================== ============== ============== ==========

Weighted average number of

ordinary shares

in issue 91,439,600 90,271,035 91,063,205

============================== ============== ============== ==========

The net return per ordinary share figures are based on the above

totals of revenue and capital and the weighted average number of

ordinary shares in issue (excluding treasury shares) during each

period.

There are no dilutive or potentially dilutive shares in

issue.

6. Dividends

Year to

Six months Six months

to 31 January to 31 January 31 July

2023 2022 2022

(audited)

GBP'000 GBP'000 GBP'000

==================================== ============== ============== ==========

Amounts recognised as distributions

in the period:

Previous year's final dividend

of 3.00p (31 July 2021 -

nil), paid 29 November 2022 2,745 - -

==================================== ============== ============== ==========

Amounts paid and payable

in respect of the period:

Final dividend (31 July 2022

- 3.00p) - - 2,745

==================================== ============== ============== ==========

No interim dividend has been declared in respect of the current

period.

7. Fair Value Hierarchy

The Company's investments are financial assets held at fair

value through profit or loss. The fair value hierarchy used to

analyse the basis on which the fair values of financial instruments

held at fair value through the profit and loss account are measured

is described below. The levels are determined by the lowest (that

is the least reliable or least independently observable) level of

input that is significant to the fair value measurement for the

individual investment in its entirety.

Level 1 - using unadjusted quoted prices for identical

instruments in an active market;

Level 2 - using inputs, other than quoted prices included within

Level 1, that are directly or indirectly observable (based on

market data); and

Level 3 - using inputs that are unobservable (for which market

data is unavailable).

An analysis of the Company's financial asset investments based

on the fair value hierarchy described above is shown below.

Investments held at fair value through profit or loss

Level Level Level

As at 31 January 1 2 3 Total

2023 GBP'000 GBP'000 GBP'000 GBP'000

====================== ======== ======== ======== ========

Listed equities 566,347 - - 566,347

Unlisted equities - - 2,910 2,910

Unlisted preference

shares * - - 29,686 29,686

====================== ======== ======== ======== ========

Total financial asset

investments 566,347 - 32,596 598,943

====================== ======== ======== ======== ========

Level Level Level

As at 31 July 2022 1 2 3 Total

(audited) GBP'000 GBP'000 GBP'000 GBP'000

====================== ======== ======== ======== ========

Listed equities 570,801 495 - 571,296

Unlisted equities - - 4,051 4,051

Unlisted preference

shares * - - 33,192 33,192

====================== ======== ======== ======== ========

Total financial asset

investments 570,801 495 37,243 608,539

====================== ======== ======== ======== ========

During the period, Brilliance China listed on the Hong Kong

stock exchange having de-listed on 31 March 2021.

* The investments in preference shares are not classified as

equity holdings as they include liquidation preference rights that

determine the repayment (or multiple thereof) of the original

investment in the event of a liquidation event such as a

take-over.

The fair value of listed security investments is bid price or,

in the case of FTSE 100 constituents and holdings on certain

recognised overseas exchanges, last traded price. Listed

Investments are categorised as Level 1 if they are valued using

unadjusted quoted prices for identical instruments in an active

market and as Level 2 if they do not meet all these criteria but

are, nonetheless, valued using market data. Unlisted investments

are valued at fair value by the Directors following a detailed

review and appropriate challenge of the valuations proposed by the

Managers. The Managers' unlisted investment policy applies

methodologies consistent with the International Private Equity and

Venture Capital Valuation guidelines ('IPEV'). These methodologies

can be categorised as follows: (a) market approach (multiples,

industry valuation benchmarks and available market prices); (b)

income approach (discounted cash flows); and (c) replacement cost

approach (net assets). The Company's holdings in unlisted

investments are categorised as Level 3 as unobservable data is a

significant input to their fair value measurements.

8. The Company has a three year multi-currency revolving credit

facility of up to GBP100 million with Royal Bank of Scotland

International Limited which expires on 14 March 2025. At 31 January

2023 there were no outstanding drawings (31 July 2022 - no

outstanding drawings).

9. Provision for Tax Liability

The tax liability provision at 31 January 2023 of GBP1,438,000

(31 July 2022 - GBP3,016,000) relates to a potential liability for

Indian capital gains tax that may arise on the Company's Indian

investments should they be sold in the future, based on the net

unrealised taxable capital gain at the period end and on enacted

Indian tax rates (long term capital gains are taxed at 10% and

short term capital gains are taxed at 15%). The amount of any

future tax amounts payable may differ from this provision,

depending on the value and timing of any future sales of such

investments and future Indian tax rates.

10. Share Capital

As at 31 January As at 31 July

2023 2022 (audited)

Number GBP'000 Number GBP'000

========================= ============ ======= ============ =======

Allotted, called up

and fully paid ordinary

shares of 10p each in

issue 91,199,368 9,120 91,860,961 9,186

Treasury shares of 10p

each 875,593 88 214,000 22

========================= ============ ======= ============ =======

92,074,961 9,208 92,074,961 9,208

========================= ============ ======= ============ =======

The Company has authority to allot shares under section 551 of

the Companies Act 2006. In the six months to 31 January 2023, the

Company issued 25,000 ordinary shares, from treasury (nominal value

GBP2,500, representing 0.03% of the issued share capital as at 31

July 2022) at a premium to net asset value, raising net proceeds of

GBP172,000 (year to 31 July 2022 - 3,645,257 ordinary shares, at a

premium to net asset value, with a nominal value GBP365,000,

representing 4.1% of the issued share capital at 31 July 2021,

raising net proceeds of GBP32,957,000).

In the six months to 31 January 2023, 686,593 shares,

representing 0.7% of the issued share capital as at 31 July 2022,

were bought back at a total cost of GBP3,940,000 and held in

treasury (year to 31 July 2022 - 214,000 shares, representing 0.2%

of the issued share capital at 31 July 2021, were bought back at a

total cost of GBP1,454,000 and held in treasury).

At 31 January 2023 the Company had authority to allot or sell

from treasury 9,139,320 ordinary shares without application of

pre-emption rights and to buy back 13,667,037 ordinary shares on an

ad hoc basis. In accordance with authorities granted at the last

Annual General Meeting in November 2022, buy-backs will only be

made at a discount to net asset value and the Board has authorised

use of the issuance authorities to issue new shares or sell shares

from treasury at a premium to net asset value in order to enhance

the net asset value per share for existing shareholders and improve

the liquidity of the Company's shares.

Over the period from 31 January 2023 to 1 March 2023 the Company

has issued a further 175,000 shares from treasury. No further

shares have been bought back.

11. During the period, transaction costs on purchases amounted

to GBP84,000 (31 January 2022 - GBP67,000; 31 July 2022 -

GBP225,000) and transaction costs on sales amounted to GBP143,480

(31 January 2022 - GBP55,000; 31 July 2022 - GBP308,000).

12. Related Party Transactions

There have been no transactions with related parties during the

first six months of the current financial year that have materially

affected the financial position or the performance of the Company

during that period and there have been no changes in the related

party transactions described in the last Annual Report and

Financial Statements that could have had such an effect on the

Company during that period.

13. Principal risks and uncertainties

The principal risks facing the Company are financial risk,

investment strategy risk, climate and governance risk, discount

risk, regulatory risk, custody and depositary risk, operational

risk, leverage risk, political and associated economic risk, cyber

security risk and emerging risks. An explanation of these risks and

how they are managed is set out on pages 8 and 9 of the Company's

Annual Report and Financial Statements for the year to 31 July 2022

which is available on the Company's website: pacifichorizon.co.uk

.

The principal risks and uncertainties have not changed since the

date of that report.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

The printed version of the Interim Financial Report will be sent

to shareholders and will be available on the Company's page on the

Managers' website pacifichorizon.co.uk ++ on or around 13 March

2023.

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

Third Party Data Provider Disclaimer

No third party data provider ('Provider') makes any warranty,

express or implied, as to the accuracy, completeness or timeliness

of the data contained herewith nor as to the results to be obtained

by recipients of the data. No Provider shall in any way be liable

to any recipient of the data for any inaccuracies, errors or

omissions in the index data included in this document, regardless

of cause, or for any damages (whether direct or indirect) resulting

therefrom.

No Provider has any obligation to update, modify or amend the

data or to otherwise notify a recipient thereof in the event that

any matter stated herein changes or subsequently becomes

inaccurate.

Wit hout limiting the foregoing, no Provider shall have any

liability whatsoever to you, whether in contract (including under

an indemnity), in tort (including negligence), under a warranty,

under statute or otherwise, in respect of any loss or damage

suffered by you as a result of or in connection with any opinions,

recommendations, forecasts, judgements, or any other conclusions,

or any course of action determined, by you or any third party,

whether or not based on the content, information or materials

contained herein.

MSCI Index Data

Source: MSCI. The MSCI information may only be used for your

internal use, may not be reproduced or redisseminated in any form

and may not be used as a basis for or a component of any financial

instruments or products or indices. None of the MSCI information is

intended to constitute investment advice or a recommendation to

make (or refrain from making) any kind of investment decision and

may not be relied on as such. Historical data and analysis should

not be taken as an indication or guarantee of any future

performance analysis, forecast or prediction. The MSCI information

is provided on an 'as is' basis and the user of this information

assumes the entire risk of any use made of this information. MSCI,

each of its affiliates and each other person involved in or related

to compiling, computing or creating any MSCI information

(collectively, the 'MSCI Parties') expressly disclaims all

warranties (including, without limitation, any warranties of

originality, accuracy, completeness, timeliness, non-infringement,

merchantability and fitness for a particular purpose) with respect

to this information. Without limiting any of the foregoing, in no

event shall any MSCI Party have any liability for any direct,

indirect, special, incidental, punitive, consequential (including,

without limitation, lost profits) or any other damages.

(msci.com).

Sustainable Finance Disclosure Regulation ('SFDR')

The EU Sustainable Finance Disclosure Regulation ('SFDR') does

not have a direct impact in the UK due to Brexit, however, it

applies to third-country products marketed in the EU. As Pacific

Horizon Investment Trust PLC is marketed in the EU by the AIFM,

Baillie Gifford & Co Limited, via the National Private

Placement Regime, ('NPPR') the following disclosures have been

provided to comply with the high-level requirements of SFDR.

The AIFM has adopted Baillie Gifford & Co's Governance and

Sustainable Principles and Guidelines as its policy on integration

of sustainability risks in investment decisions. Baillie Gifford

& Co's approach to investment is based on identifying and

holding high quality growth businesses that enjoy sustainable

competitive advantages in their marketplace. To do this it looks

beyond current financial performance, undertaking proprietary

research to build an in-depth knowledge of an individual company

and a view on its long-term prospects. This includes the

consideration of sustainability factors (environmental, social

and/or governance matters) which it believes will positively or

negatively influence the financial returns of an investment. More

detail on the Managers' approach to sustainability can be found in

the Governance and Sustainability Principles and Guidelines

document, available publicly on the Baillie Gifford website

bailliegifford.com.

Taxonomy Regulation

The Taxonomy Regulation establishes an EU-wide framework of

criteria for environmentally sustainable economic activities in

respect of six environmental objectives. It builds on the

disclosure requirements under SFDR by introducing additional

disclosure obligations in respect of alternative investment funds

that invest in an economic activity that contributes to an

environmental objective. The Company does not commit to make

sustainable investments as defined under SFDR. As such, the

underlying investments do not take into account the EU criteria for

environmentally sustainable economic activities.

Glossary of Terms and Alternative Performance Measures

('APM')

Total Assets

This is the Company's definition of Adjusted Total Assets, being

the total value of all assets held less all liabilities (other than

liabilities in the form of borrowings).

Shareholders' Funds and Net Asset Value

Also described as shareholders' funds, Net Asset Value ('NAV')

is the value of all assets held less all liabilities (including

borrowings). The NAV per share is calculated by dividing this

amount by the number of ordinary shares in issue (excluding shares

held in treasury).

Net Liquid Assets

Net liquid assets comprise current assets less current

liabilities (excluding borrowings) and provisions for deferred

liabilities.

Discount/Premium (APM)

As stockmarkets and share prices vary, an investment trust's

share price is rarely the same as its NAV. When the share price is

lower than the NAV per share it is said to be trading at a

discount. The size of the discount is calculated by subtracting the

share price from the NAV per share and is usually expressed as a

percentage of the NAV per share. If the share price is higher than

the NAV per share, this situation is called a premium.

As at As at

31 July

31 January 2022

2023 (audited)

GBP'000 GBP'000

============================= ============= ============ ==========

Net asset value per ordinary

share (a) 663.08p 664.65p

Share price (b) 670.00p 647.00p

============================= ============= ============ ==========

((b) -

(a)) ÷

Premium/(discount) (a) 1.0% (2.7%)

============================= ============= ============ ==========

Total Return (APM)

The total return is the return to shareholders after reinvesting

the net dividend on the date that the share price goes ex-dividend.

In periods where no dividend is paid, the total return equates to

the capital return.

As at

31 January As at

2023 31 July 2022

============================ =========== ================ ================

Share Share

NAV price NAV price

============================ =========== ======= ======= ======= =======

Closing NAV per share/share

price (a) 663.08p 670.00p 664.65p 647.00p

Dividend adjustment

factor * (b) 1.0051 1.0057 1.0000 1.0000

============================ =========== ======= ======= ======= =======

Adjusted closing NAV (c) = (a)

per share/share price x (b) 666.46p 673.82p 664.65p 647.00p

============================ =========== ======= ======= ======= =======

Opening NAV per share/share

price (d) 664.65p 647.00p 777.15p 802.00p

============================ =========== ======= ======= ======= =======

(c) ÷

Total return (d) -1 0.3% 4.1% (14.5%) (19.3%)

============================ =========== ======= ======= ======= =======

* The dividend adjustment factor is calculated on the assumption

that the final dividend of 3.00p (31 July 2021 - nil) paid by the

Company during the period was reinvested into shares of the Company

at the cum income NAV per share/share price, as appropriate, at the

ex-dividend date.

Turnover (APM)

Annual turnover is calculated on a rolling 12 month basis. The

lower of purchases and sales for the 12 months is divided by the

average assets, with average assets being calculated on assets as

at each month's end.

Ongoing Charges (APM)

The total recurring expenses (excluding the Company's cost of

dealing in investments and borrowing costs) incurred by the Company

as a percentage of the daily average net asset value.

Gearing (APM)

At its simplest, gearing is borrowing. Just like any other

public company, an investment trust can borrow money to invest in

additional investments for its portfolio. The effect of the

borrowing on the shareholders' assets is called 'gearing'. If the

Company's assets grow, the shareholders' assets grow

proportionately more because the debt remains the same. But if the

value of the Company's assets falls, the situation is reversed.

Gearing can therefore enhance performance in rising markets but can

adversely impact performance in falling markets.

Invested gearing is borrowings at par less cash and brokers'

balances expressed as a percentage of shareholders' funds.

As at As at

31 January 31 July

2023 2022

(audited)

GBP'000 GBP'000

================================ ==== ============ ==========

Borrowings (at book value) - -

Less: cash and cash equivalents (3,383) (5,399)

Less: sales for subsequent

settlement (4,267) (402)

Add: purchases for subsequent

settlement - 446

====================================== ============ ==========

Adjusted borrowings (a) (7,650) (5,355)

================================ ==== ============ ==========

Shareholders' funds (b) 604,724 610,550

================================ ==== ============ ==========

Gearing: (a) as a percentage

of (b) (1.3%) (0.9%)

====================================== ============ ==========

Potential gearing is the Company's borrowings expressed as a

percentage of shareholders' funds.

As at 31

As at July

31 January 2022

2023 (audited)

GBP'000 GBP'000

=========================== ==== ============ ==========

Borrowings (at book value) (a) - -

Shareholders' funds (b) 604,724 610,550

=========================== ==== ============ ==========

Potential gearing (a) as

a percentage of (b) - -

================================= ============ ==========

Leverage (APM)

For the purposes of the Alternative Investment Fund Managers

Regulations, leverage is any method which increases the Company's

exposure, including the borrowing of cash and the use of

derivatives. It is expressed as a ratio between the Company's

exposure and its net asset value and can be calculated on a gross

and a commitment method. Under the gross method, exposure

represents the sum of the Company's positions after the deduction

of sterling cash balances, without taking into account any hedging

and netting arrangements. Under the commitment method, exposure is

calculated without the deduction of sterling cash balances and

after certain hedging and netting positions are offset against each

other.

Active Share (APM)

Active share, a measure of how actively a portfolio is managed,

is the percentage of the portfolio that differs from its

comparative index. It is calculated by deducting from 100 the

percentage of the portfolio that overlaps with the comparative

index. An active share of 100 indicates no overlap with the index

and an active share of zero indicates a portfolio that tracks the

index.

Compound Annual Return (APM)

The compound annual return converts the return over a period of

longer than one year to a constant annual rate of return applied to

the compound value at the start of each year.

China 'A' Shares

'A' Shares are shares of mainland China-based companies that

trade on the Shanghai Stock Exchange and the Shenzhen Stock

Exchange. Since 2003, select foreign institutions have been able to

purchase them through the Qualified Foreign Institutional Investor

system.

Treasury Shares

The Company has the authority to make market purchases of its

ordinary shares for retention as treasury shares for future

reissue, resale, transfer, or for cancellation. Treasury shares do

not receive distributions and the Company is not entitled to

exercise the voting rights attaching to them.

Private (Unlisted) Company

An unlisted or private company means a company whose shares are

not available to the general public for trading and are not listed

on a stock exchange.

Pacific Horizon Investment Trust PLC (Pacific Horizon) aims to

achieve capital growth through investment in the Asia-Pacific

region (excluding Japan) and in the Indian Sub-continent. At 31

January 2023 the Company had total assets of GBP604.7 million

(before deduction of loans of nil).

Pacific Horizon is managed by Baillie Gifford & Co Limited,

the Edinburgh based fund management group.

Past performance is not a guide to future performance. Pacific

Horizon is a listed UK Company and is not authorised or regulated

by the Financial Conduct Authority. The value of its shares and any

income from those shares can fall as well as rise and you may not

get back the amount invested. Pacific Horizon invests in overseas

securities. Changes in the rates of exchange may also cause the

value of your investment (and any income it may pay) to go down or

up. Pacific Horizon invests in emerging markets (including Chinese

'A' shares) where difficulties in dealing, settlement and custody

could arise, resulting in a negative impact on the value of your

investment. Shareholders in Pacific Horizon have the right to vote

every five years, on whether to continue Pacific Horizon, or wind

it up. If the shareholders decide to wind the Company up, the

assets will be sold and you will receive a cash sum in relation to

your shareholding. The next vote will be held at the Annual General

Meeting in 2026. You can find up to date performance information

about Pacific Horizon on the Pacific Horizon page of the Managers'

website at pacifichorizon.co.uk . Neither the contents of the

Managers' website nor the contents of any website accessible from

hyperlinks on the Managers' website (or any other website) is

incorporated into, or forms part of, this announcement

3 March 2023

For further information please contact:

Anzelm Cydzik, Baillie Gifford & Co

Tel: 0131 275 2000

Jonathan Atkins, Director, Four Communications

Tel: 0203 920 0555 or 07872 495396

- ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKBBPOBKDANK

(END) Dow Jones Newswires

March 03, 2023 02:00 ET (07:00 GMT)

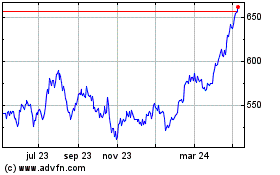

Pacific Horizon Investment (LSE:PHI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

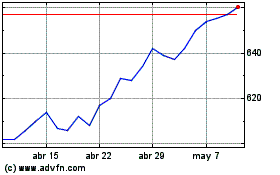

Pacific Horizon Investment (LSE:PHI)

Gráfica de Acción Histórica

De May 2023 a May 2024