TIDMPRSR

RNS Number : 9028Z

PRS REIT PLC (The)

17 January 2024

17 January 2024

PRSR.L

The PRS REIT plc

("the PRS REIT" or "the Company")

Second Quarter Update

The PRS REIT, the closed-ended real estate investment trust that

invests in high-quality, new build, family homes in the private

rented sector ("PRS"), is pleased to provide an update on

performance over the second quarter (1 October to 31 December 2023)

of its current financial year ending 30 June 2024.

At At At 31 Dec

31 Dec 30 Sept 2023 2022

2023

---------------------------- ---------------------------- ---------------------------- ----------------------------

Number of completed homes 5,264 5,129 4,913

Estimated rental value GBP60.3m GBP57.6m GBP50.7m

("ERV") per annum

---------------------------- ---------------------------- ---------------------------- ----------------------------

Number of contracted homes 312 395 613

ERV per annum GBP3.1m GBP3.1m GBP6.6m

---------------------------- ---------------------------- ---------------------------- ----------------------------

Completed and contracted

sites 72 71 71

ERV of completed and GBP63.4m GBP60.7m GBP57.3m

contracted sites

---------------------------- ---------------------------- ---------------------------- ----------------------------

Rent collected 99% 98% 98%

---------------------------- ---------------------------- ---------------------------- ----------------------------

Delivery programme

The Company's homes delivery programme is now at a very mature

stage. During the second quarter, which included the Christmas

period, a further 135 rental homes were completed, taking the

number of completed homes in the portfolio at the half-year end on

31 December 2023 to 5,264 and overall delivery to approximately 95%

complete.

The estimated rental value ("ERV") of the 5,264 completed homes

is GBP60.3 million per annum, approximately 19% higher than at the

same point in the prior year (31 December 2022: 4,913 homes, ERV of

GBP50.7 million per annum). The ERV increase reflects both the

increase in completed homes and strong rental growth.

As at 31 December 2023, a further 312 homes, with a combined ERV

of GBP3.1 million, were contracted and under way, at varying stages

of the construction process. Once these homes have been completed,

the ERV of the portfolio is expected to increase to c.GBP63.4

million per annum (30 September 2023: GBP60.7 million per

annum).

Asset performance

Rental demand for the Company's homes remains very high,

reflected in very strong rental growth and occupancy rates.

Occupancy at 31 December 2023 stood at 97% with 5,087 of the 5,264

completed homes occupied. A further 47 homes were reserved for

applicants who had passed referencing and paid rental deposits,

giving an occupancy rate of 98%. Like-for-like rental growth for

the 12 months to 31 December 2023 was 11% (2022: 6%).

Rent collection (defined as rent collected in the period

relative to rent invoiced in the same period) for the quarter ended

31 December 2023 was extremely robust at 99%. Arrears were low at

GBP0.6 million at 31 December 2023 (31 December 2022: GBP0.7

million). This represents c.1% of annualised ERV on completed

units.

Affordability, which is average rent as a proportion of gross

household income, continues to be well within Homes England's upper

guidance limit of 35%. Reflecting the tenant base, where average

household income has increased, the Company's homes have an

affordability ratio of c.22% of gross household income at 31

December 2023 (30 September 2023: 22%).

Dividend

The Company expects to announce the interim quarterly dividend,

relating to the second quarter of the current financial year,

towards the end of January 2024.

For further information, please contact:

The PRS REIT plc Tel: 020 3178 6378

Steve Smith, Non-executive Chairman (c/o KTZ Communications)

Sigma PRS Management Ltd Tel: 0333 999 9926

Graham Barnet, Mike McGill

Singer Capital Markets Tel: 020 7496 3000

James Maxwell, Asha Chotai (Investment

Banking) Alan Geeves, James Waterlow,

Sam Greatrex (Sales)

Jefferies International Limited Tel: 020 7029 8000

Gaudi Le Roux, Tom Yeadon,

Harry Randall, Ollie Nott

G10 Capital Limited (part of IQ-EQ) Tel: 0207 397 5450

Maria Baldwin

KTZ Communications Tel: 020 3178 6378

Katie Tzouliadis, Robert Morton

NOTES TO EDITORS

About The PRS REIT plc www.theprsreit.com

The PRS REIT plc is a closed-ended real estate investment trust

established to invest in the Private Rented Sector ("PRS") and to

provide shareholders with an attractive level of income together

with the potential for capital and income growth. The Company is

investing over GBP1bn in a portfolio of high-quality homes for

private rental across the regions, having raised a total of

GBP0.56bn (gross) through its Initial Public Offering, on 31 May

2017 and subsequent fundraisings in February 2018 and September

2021. The UK Government's Homes England has supported the Company

with direct investments. On 2 March 2021, the Company transferred

its entire issued share capital to the premium listing segment of

the Official List of the FCA and to the London Stock Exchange's

premium segment of the Main Market. With over 5,200 new rental

homes, the Company believes its portfolio is the largest

build-to-rent single-family rental portfolio in the UK.

LEI: 21380037Q91HU97WZX58

About Sigma Capital Group Limited (formerly Sigma Capital Group

plc) www.sigmacapital.co.uk

Sigma Capital Group Limited ("Sigma") is a PRS, residential

development, and urban regeneration specialist, with offices in

Edinburgh, Manchester and London. Sigma's principal focus is on the

delivery of large-scale housing schemes for the private rented

sector. The Company has a well-established track record in

assisting with property-related regeneration projects in the public

sector, acting as a bridge between the public and private

sectors.

Sigma has created an excellent property procurement and

management platform, which sources sites and brings together

construction resource to develop them, enabling Sigma to deliver an

integrated solution to partners. As well as sourcing sites and

managing all stages of the planning and development process, Sigma

manages the rental of completed homes through its award-winning

rental brand 'Simple Life'. The Company's subsidiary, Sigma PRS

Management Ltd, is Investment Adviser to The PRS REIT plc.

About Sigma PRS Management Ltd

Sigma PRS Management Ltd is a wholly-owned subsidiary of Sigma

Capital Group Limited and is Investment Adviser to The PRS REIT

plc. It sources investments and operationally manages the assets of

The PRS REIT plc and advises the Alternative Investment Fund

Manager ("AIFM") and The PRS REIT plc on a day-to-day basis in

accordance with The PRS REIT plc's Investment Policy. The AIFM is

G10 Capital Limited. Sigma PRS Management Ltd is an appointed

representative of G10 Capital Limited, which is authorised and

regulated by the Financial Conduct Authority (FRN:648953).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFZGMMNVGGDZM

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

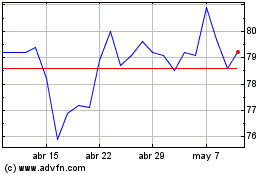

Prs Reit (LSE:PRSR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Prs Reit (LSE:PRSR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024