TIDMSPEC

RNS Number : 6193L

Inspecs Group PLC

07 September 2023

7 September 2023

INSPECS Group plc

("INSPECS", "the Company" or "the Group")

Interim Results

INSPECS Group plc, a global eyewear and lens design house and

manufacturer, presents its unaudited interim results for the six

months ended 30 June 2023. This is the first set of results in the

Group's new reporting currency of GBP.

Financial highlights:

-- Revenue increased by 6.1% to GBP111.2m (H1 2022: GBP104.8m)

-- On a constant exchange rates basis(1) , revenue increased

by 2.3% to GBP107.2m (H1 2022: GBP104.8m)

-- Operating profit increased by 25.1% to GBP4.6m (H1 2022:

GBP3.6m)

-- Gross profit margin 51.4% (H1 2022: 50.5%)

-- Underlying EBITDA(2) increased by 5.4% to GBP12.1m (H1

2022: GBP11.4m)

-- Adjusted Profit Before Tax (PBT)(2) of GBP6.9m (H1 2022:

GBP7.5m)

-- Adjusted PBT Basic Earnings Per Share (EPS)(2) of GBP0.07

(H1 2022: GBP0.07)

-- Reported Profit Before Tax of GBP3.8m (H1 2022: GBP0.2m

loss(3) )

-- Reported basic EPS of GBP0.02 (H1 2022: GBP(0.03) (3)

), with diluted EPS of GBP0.02 (H1 2022: GBP(0.03) (3)

)

-- Cash generated from operations GBP11.5m (H1 2022: GBP8.7m)

-- Net debt excluding leasing GBP22.7m (31 December 2022:

GBP27.6m)

Operational highlights:

-- 6.9m eyewear frames sold in H1 2023, compared to 6.2m

in H1 2022

-- Strong revenue growth in UK (+20%), North America (+9%)

and LATAM (+277%)

-- Substantial growth of low vision aids revenue in North

America (+19%) to GBP5.9m in H1 2023

-- Construction of the new Vietnam manufacturing facility

commenced in May 2023, with scheduled completion in H1

2024

-- Norville losses reduced substantially compared H1 2022

-- Renewal completed on key licensed brands; Marco Polo and

Ted Baker

-- Orders received for a key licence brand by a global retailer

to be delivered in Q4 2023

-- Successful launch of a women's Titanflex range in Germany

-- Significant growth in commercial activity within Skunkworks,

the Group's research and development division

-- Good progress against objectives outlined in our ESG framework

1 Constant currency exchange rates: figures at constant

currency exchange rates have been calculated using

the average exchange rates in effect for the corresponding

period in the relevant comparative period (H1 2022).

2 Refer to table "Underlying EBITDA and Adjusted PBT".

3 Comparative figures have been restated throughout to

be presented in GBP following a change in presentational

currency. See note 2 for further details. In addition,

the six-month period to 30 June 2022 has been restated

following a retrospective adjustment, see note 11.

Richard Peck, CEO of INSPECS, said:

"The Group has made steady progress during the period, with an

improved trading and cash generation performance. We remain focused

on achieving operational efficiency gains and continue to identify

integration opportunities across our global trading platform.

Construction of our new manufacturing facility in Vietnam

commenced in May 2023, with expected completion in H1 2024. Once

fully operational, this will increase the manufacturing capacity of

the Group to circa 12 million units per year.

Trading in the second half to date has been in line with our

expectations and our order books remain at a good level. Whilst we

remain cautious in relation to global economic and political

events, we remain confident with our full year outlook."

For further information please contact:

INSPECS Group plc via FTI Consulting

Richard Peck (CEO) Tel: +44 (0) 20

Chris Kay (CFO) 3727 1000

Peel Hunt (Nominated Adviser and Broker) Tel: +44 (0) 20

Adrian Trimmings 7418 8900

Andrew Clark

Lalit Bose

FTI Consulting (Financial PR) Tel: +44 (0) 20

Alex Beagley 3727 1000

Harriet Jackson INSPECS@fticonsulting.com

Rafaella de Freitas

About INSPECS Group plc

INSPECS is a leading provider of eyewear solutions to the global

eyewear market. The Group produces a broad range of eyewear frames,

low vision aids and lenses, covering optical, sunglasses and

safety, which are either "Branded" (either under licence or under

the Group's own proprietary brands), or "OEM" (unbranded or private

label on behalf of retail customers).

INSPECS is building a global eyewear business through its

vertically-integrated business model. Its continued growth is

underpinned by six core drivers, including; increasing the

penetration of its own-brand portfolio, increasing distribution in

Asian Pacific markets, growing its travel retail markets,

maximising group synergies, expanding its manufacturing capacity

and scaling the research and development department as it develops

new and innovative eyewear channels.

The Group has operations across the globe: with offices and

subsidiaries in the UK, Germany, Portugal, Scandinavia, the US and

China (including Hong Kong, Macau and Shenzhen), and manufacturing

facilities in Vietnam, China, the UK and Italy.

INSPECS customers are global optical and non-optical retailers,

global distributors and independent opticians, with its

distribution network covering over 80 countries and reaching

approximately 75,000 points of sale.

More information is available at: www.INSPECS.com

CHIEF EXECUTIVE REVIEW

I am pleased to present our results for the six months ended 30

June 2023. The Group has performed well during the period,

achieving record first half revenue of GBP111.2m (H1 2022:

GBP104.8m) a 6.1% increase. The Group sold 6.9m eyewear units in

the period, up 11.3% compared to 6.2m eyewear units sold in H1

2022.

The Group made an Underlying EBITDA of GBP12.1m compared to

GBP11.4m for the same period in 2022.

On a constant exchange basis, Group revenues increased 2.3% from

GBP104.8m to GBP107.2m.

The Group's performance at the Underlying EBITDA level in H1

2023 exceeded our previous record performance of H1 2022 by 5.4%.

The Group saw good growth in our UK and North American businesses,

and a significant reduction in the operational losses at Norville,

as a result of our cost saving programme. Our European markets

(excluding the UK) remained relatively flat. Our gross profit

margin, despite cost inflationary pressures, increased to 51.4%

from 50.5%. Administrative expenses in the period of GBP49.3m (H1

2022: GBP46.6m) were well controlled, decreasing from 44.4% to

44.3% of revenue.

The Group has made key licence renewals, including Marco Polo

and Ted Baker, as well as receiving a significant order from a

global retailer for a key licence brand which will be delivered in

Q4 2023.

UK

Within the UK market, revenue has increased by 19.5% to

GBP13.6m, driven by increased distribution to major retail

chains.

Europe

Revenue in Europe at GBP52.2m was flat year on year with a

strong performance in our key German market offset by a softer

performance in other European markets. During the period TitanFlex,

a brand designed for comfort, successfully launched a new range for

women.

North America

Revenue within North America has increased by GBP3.0m (8.6%) to

GBP37.4m, with good growth in our frame and low vision operating

entities.

Frames and Optics

Our Frames and Optics distribution business increased its

external revenue from GBP93.2m in H1 2022 to GBP100.2m in H1 2023,

an increase of 7.6%. This was driven mainly by a good performance

in the UK and North American markets.

Wholesale

In line with our expectations for the first six months, external

revenue from the Wholesale business for H1 2023 was GBP9.0m,

compared to GBP9.9m in H1 2022. We expect to see increased activity

in the second half.

Lenses

Our lens manufacturing business has reported external revenue

growth of 13.9%, with losses from the division decreasing by

GBP0.9m to GBP1.2m. We continue to make steady progress, with

increased revenue and operational activity, and a drive towards

profitability in the future.

Manufacturing

Construction of our new manufacturing facility in Vietnam

commenced in May 2023, with expected completion in H1 2024. Once

fully operational, this will increase the manufacturing capacity of

the Group to circa 12 million units per year.

We continue to evaluate our Portugal manufacturing facility,

which would mainly supply our European markets.

Research and development

The research and development division of the business,

Skunkworks, has continued to work on the development of innovative

eyewear channels, resulting in significant growth in commercial

activity during H1 2023.

ESG

Following the establishment of our ESG Committee in 2022, we

have been progressing against our ESG goals. During the period the

Group donated two water filtration units for local schools in

Vietnam and offset over 4,500 TCO(2) e through renewable energy

projects. We continue to assess ways in which we can further

integrate ESG into our corporate strategy.

Eyewear market

The eyewear market is projected to grow at a rate of 4.4% per

year between 2023 and 2027 (data from Statista.com) providing a

resilient base to support our long-term growth strategy.

Outlook

Trading in the second half to date has been in line with our

expectations and our order books remain at a good level. Whilst we

remain cautious in relation to global economic and political

events, we remain confident with our full year outlook.

I would like to thank all our teams across the globe who have

contributed to this good performance in H1 2023, and their

continuing hard work and dedication in achieving our long-term goal

of developing INSPECS Group into one of the world's leading eyewear

companies.

Richard Peck

7 September 2023

FINANCIAL REVIEW

Revenue

Revenue increased to GBP111.2m from GBP104.8m in H1 2022, an

increase of 6.1%. This was driven by strong growth in our UK and

North American markets. On a constant exchange rate (1) revenues

increased 2.3% from GBP104.8m (H1 2022) to GBP107.2m.

Gross Profit Margin

The Group's gross profit margin increased from 50.5% in H1 2022

to 51.4% in H1 2023. The Group continues to actively manage its

gross profit margin despite cost inflation.

Operating Profit

The Group's operating profit increased 25.1% to GBP4.6m (H1

2022: GBP3.6m).

Underlying EBITDA

The Group's Underlying EBITDA (as calculated in the 'Underlying

EBITDA and Adjusted PBT' table below) increased from GBP11.4m in H1

2022 to GBP12.1m in H1 2023.

Finance Expenses

Our reported net finance costs increased from GBP1.3m in H1 2022

to GBP2.0m reflecting the rise in interest rates around the globe.

Net finance costs include GBP0.1m (H1 2022: GBP0.3m) relating to

the amortisation of capitalised loan arrangement fees.

Depreciation and amortisation

The increase in depreciation is driven by the renewal of key

leases across the Group.

Period ended Period ended

30 June 2023 30 June 2022

GBPm GBPm

-------------- -------------- --------------

Depreciation 3.4 3.0

Amortisation 3.3 3.4

-------------- -------------- --------------

Total 6.7 6.4

-------------- -------------- --------------

Profit/(Loss) Before Tax

Profit before tax for the period was GBP3.8m (H1 2022: GBP0.2m

loss). The increase of GBP4.0m is after an increase in finance

costs of GBP0.7m, an increase in amortisation and depreciation of

GBP0.3m and an improvement in exchange adjustments on borrowings of

GBP2.8m.

Adjusted Profit Before Tax

The Group's Adjusted Profit Before Tax (PBT) decreased from

GBP7.5m in H1 2022 to GBP6.9m in H1 2023 as a result of increased

net interest costs (excluding amortisation of loan arrangement

fees) of GBP0.9m and an increase in depreciation of GBP0.4m.

Cash Generation

Cash management was a key focus in the period and the Group

generated a net cash inflow from operating activities of GBP8.4m in

H1 2023 compared to GBP4.7m in H1 2022.

Cash Position

The Group's cash as of 30 June 2023 was GBP25.9m compared to

GBP22.2m as at 31 December 2022.

Net Debt

The Group has delivered strong cash generation in the first half

and as a result, net debt (excluding leases) decreased by GBP4.9m

to GBP22.7m (31 December 2022: GBP27.6m). During the period, the

Group invested GBP0.9m on construction of our new manufacturing

facility in Vietnam and paid a further GBP2.2m of deferred and

contingent consideration relating to the EGO and BoDe

acquisitions.

Financing

The Group finances its operation through the following

borrowings and facilities.

Drawn at

Drawn at 31 December

30 June 2023 2022

Expires GBPm GBPm

-------------------------- --------------- ------------- ------------

Group revolving credit

facility October 2024 29.5 30.0

Term loans October 2024 9.7 10.5

Revolving credit facility

USA 1-year rolling 6.7 7.2

Invoice discounting 1-year rolling 2.1 1.5

Other 0.5 0.6

-------------------------------------------- ------------- ------------

Total 48.5 49.8

-------------------------------------------- ------------- ------------

Leverage (using debt to equity ratio)

The Group's leverage position is shown below:

30 June

2023

--------------- -------

Actual ratio 1.99

Required ratio 3.00

--------------- -------

The Group's leverage is calculated using a twelve-month rolling

EBITDA. The Group's performance in the second half of 2022 was weak

and resulted in lower reported EBITDA. As a result of the improved

trading performance in the first half and our current expectations

for the full year, it is expected that, subject to market

conditions, the Group's leverage will continue to improve in the

second half of 2023.

Inventory

Our revenue to inventory ratio has improved compared to 30 June

2022 with increased revenue being delivered from a similar

inventory base.

Period ended Period ended

30 June 2023 30 June 2022

GBPm GBPm

---------------------------- -------------- --------------

Revenue 111.2 104.8

Inventory 42.3 42.4

Revenue to inventory ratio 2.6 2.5

---------------------------- -------------- --------------

Current asset ratio

The current ratio is a liquidity ratio that measures a company's

ability to pay short-term obligations, or those due within one

year.

Period ended Period ended

30 June 2023 30 June 2022

GBPm GBPm

--------------------- -------------- --------------

Current Assets 106.7 103.3

Current Liabilities 69.7 66.4

Ratio 1.5 1.6

--------------------- -------------- --------------

Quick ratio

The quick ratio is an indicator of a company's short-term

liquidity position and measures a company's ability to meet its

short-term obligations with its most liquid assets.

Period ended Period ended

30 June 2023 30 June 2022

GBPm GBPm

--------------------- -------------- --------------

Current Assets 106.7 103.3

Less Inventory (42.3) (42.4)

--------------------- -------------- --------------

64.4 60.9

--------------------- -------------- --------------

Current Liabilities 69.7 66.4

Ratio 0.9 0.9

--------------------- -------------- --------------

Earnings per Share

The Group's Basic Adjusted PBT Earnings per Share for the 6

months to 30 June 2023 was GBP0.07 compared to GBP0.07 for the 6

months to 30 June 2022.

Dividend

As previously announced the Group does not intend to pay a

dividend in 2023 and accordingly is not proposing a dividend for

the period ended 30 June 2023.

Underlying EBITDA and Adjusted PBT

The below table shows how Underlying EBITDA and Adjusted PBT are

calculated:

6 months 6 months 12 months

ended 30 ended 30 ended 31

June 2023 June 2022 December

Restated 2022

(1) Restated

(1)

GBP'000 GBP'000 GBP'000

Revenue 111,199 104,809 200,957

----------------- ---------------------- --------------

Gross Profit 57,147 52,893 98,860

Operating expenses (52,592) (49,253) (100,046)

Operating profit/(loss) 4,555 3,640 (1,186)

Add back: Amortisation 3,252 3,445 6,893

Add back: Depreciation 3,361 2,950 6,744

----------------- ---------------------- --------------

EBITDA 11,168 10,035 12,451

Add back: Share based payment

expense 526 638 1,398

Add back: Earn out on acquisition 366 770 1,544

----------------- ---------------------- --------------

Underlying EBITDA 12,060 11,443 15,393

Add back: Purchase Price Allocation

('PPA') release on inventory

through cost of sales - 27 132

----------------- ---------------------- --------------

Adjusted Underlying EBITDA 12,060 11,470 15,525

Less: Depreciation (3,361) (2,950) (6,744)

Less: Net interest (excluding

amortisation of loan arrangement

fees) (1,846) (990) (1,979)

----------------- ---------------------- --------------

Adjusted Profit Before Tax

(PBT) 6,853 7,530 6,802

----------------- ---------------------- --------------

Adjusted PBT earnings per

share

GBP GBP GBP

Basic Adjusted PBT Earnings

per Share for the period attributable

to the equity holders of the

parent 0.07 0.07 0.07

Diluted Adjusted PBT Earnings

per Share for the period attributable

to the equity holders of the

parent 0.06 0.07 0.06

1 Comparative figures have been restated throughout to be presented in

GBP following a change in presentational currency. See note 2 for

further details. In addition, the six-month period to 30 June 2022 has

been restated following a retrospective adjustment, see note 11.

Underlying EBITDA segmental information

Underlying EBITDA by reportable segment (as defined in note 4) for the

six months ended 30 June 2023 is as

follows: Frames Wholesale Lenses Total before Adjustments Total

and

Optics adjustments &

& elimination

eliminations

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 102,876 9,922 2,069 114,867 (3,668) 111,199

Operating

profit/(loss) 7,272 887 (1,248) 6,911 (2,356) 4,555

-------- ---------- -------- ------------- ------------ --------

Add back:

Amortisation 2,809 433 10 3,252 - 3,252

Depreciation 2,663 347 336 3,346 15 3,361

Share based

payments 198 161 - 359 167 526

Earn out on

acquisitions 366 - - 366 - 366

-------- ---------- -------- ------------- ------------ --------

Underlying

EBITDA 13,308 1,828 (902) 14,234 (2,174) 12,060

-------- ---------- -------- ------------- ------------ --------

INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period ended 30 June 2023

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Unaudited

Unaudited 6 months ended

6 months ended 30 June 2022

Notes 30 June 2023 Restated

GBP'000 GBP'000

REVENUE 4 111,199 104,809

Cost of sales (54,052) (51,916)

GROSS PROFIT 57,147 52,893

Distribution costs (3,328) (2,703)

Administrative expenses (49,264) (46,550)

OPERATING PROFIT 4,555 3,640

Non-underlying costs 9 - (911)

Exchange adjustments on

borrowings 1,210 (1,585)

Share of loss of associates (4) (1)

Finance costs (2,103) (1,371)

Finance income 145 39

PROFIT/(LOSS) BEFORE INCOME

TAX 3,803 (189)

Income tax (1,720) (2,685)

PROFIT/(LOSS) FOR THE

PERIOD 2,083 (2,874)

OTHER COMPREHENSIVE INCOME:

Exchange adjustment on

consolidation (3,973) 4,272

TOTAL COMPREHENSIVE (LOSS)/PROFIT

FOR THE PERIOD (1,890) 1,398

============================== =========================

Earnings per share GBP GBP

Basic EPS for the period

attributable

to the equity holders

of the parent 5 0.02 (0.03)

------------------------------ -------------------------

Diluted EPS for the period

attributable

to the equity holders

of the parent 5 0.02 (0.03)

------------------------------ -------------------------

INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2023

Note Unaudited

Unaudited As at As at

As at 30 June 31 December

30 June 2022 2022

2023 Restated Restated

GBP'000 GBP'000 GBP'000

ASSETS

NON-CURRENT

ASSETS

Goodwill 55,578 56,206 55,578

Intangible assets 32,248 38,523 36,170

Property Plant

and equipment 33,840 38,598 37,107

Investment in

associates 105 91 112

Net investment - 675 - -

sublease

Deferred tax 6,337 8,180 7,007

-------------- ------------ --------------

128,783 141,598 135,974

-------------- ------------ --------------

CURRENT ASSETS

Inventories 42,349 42,402 48,158

Trade and other

receivables 6 36,647 34,532 31,144

Net investment - 110 - -

sublease

Tax receivable 1,719 1,233 3,681

Cash and cash

equivalents 25,862 25,179 22,153

------------

106,687 103,346 105,136

-------------- ------------ --------------

Assets held for

sale 832 - 832

-------------- ------------ --------------

TOTAL ASSETS 236,302 244,944 241,942

-------------- ------------ --------------

EQUITY

SHAREHOLDERS'

EQUITY

Called up share

capital 1,017 1,017 1,017

Share premium 89,508 89,508 89,508

Foreign currency

translation

reserve 5,461 7,478 9,434

Share option

reserve 3,153 2,092 2,703

Merger reserve 5,340 5,340 5,340

Retained earnings 1,698 4,057 (461)

-------------- ------------ --------------

TOTAL EQUITY 106,177 109,492 107,541

-------------- ------------ --------------

LIABILITIES

NON-CURRENT

LIABILITIES

Financial liabilities

- borrowings

Interest

bearing loans

and borrowings 51,525 53,109 16,548

Deferred

consideration 652 1,776 1,350

Deferred tax 8,203 14,215 9,548

-------------- ------------ --------------

60,380 69,100 27,446

-------------- ------------ --------------

CURRENT LIABILITIES

Trade and other

payables 7 38,921 40,175 39,153

Right of return

liability 11,862 8,885 10,613

Financial liabilities

- borrowings

Interest

bearing loans

and borrowings 13,140 13,144 51,746

Invoice discounting 2,089 708 1,490

Deferred

consideration 1,333 1,304 2,518

Tax payable 2,400 2,136 1,435

------------

69,745 66,352 106,955

-------------- ------------ --------------

TOTAL LIABILITIES 130,125 135,452 134,401

-------------- ------------ --------------

TOTAL EQUITY AND

LIABILITIES 236,302 244,944 241,942

-------------- ------------ --------------

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the period ended 30 June 2023

Called Share Foreign Share Retained Merger Total

up premium currency option earnings reserve equity

share translation reserve

capital reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

SIX MONTHSED 30

JUNE 2023

Balance at 1

January

2023 1,017 89,508 9,434 2,703 (461) 5,340 107,541

Profit for the

period - - - - 2,083 - 2,083

Other comprehensive

loss - - (3,973) - - - (3,973)

-------------- ----------- --------------- ------------ ---------- --------- -------------

Total comprehensive

loss - - (3,973) - 2,083 - (1,890)

Share-based

payments - - - 526 - - 526

Share options

forfeited - - - (76) 76 - -

Balance at 30 June

2023 (unaudited) 1,017 89,508 5,461 3,153 1,698 5,340 106,177

-------------- ----------- --------------- ------------ ---------- --------- -------------

SIX MONTHSED 30

JUNE 2022

Balance at 1

January

2022 restated 1,017 89,508 3,206 1,454 6,931 5,340 107,456

Loss for the period - - - - (2,874) - (2,874)

Other comprehensive

income - - 4,272 - - - 4,272

-------------- ----------- --------------- ------------ ---------- --------- -------------

Total comprehensive

profit/(loss) - - 4,272 - (2,874) - 1,398

Share-based

payments - - - 638 - - 638

-------------- ----------- --------------- ------------ ---------- --------- -------------

Balance at 30 June

2022

restated

(unaudited) 1,017 89,508 7,478 2,092 4,057 5,340 109,492

-------------- ----------- --------------- ------------ ---------- --------- -------------

INTERIM CONSOLIDATED STATEMENT OF CASH FLOW

For the period ended 30 June 2023

-------------------------------------------------------------------------------------------------------

Unaudited Unaudited

6 months 6 months

ended ended

30 June 30 June

2023 2022

Restated

GBP000 GBP000

Cash flows from operating

activities

Profit/(loss) before income

tax 3,803 (189)

Depreciation charges 3,361 2,950

Amortisation charges 3,252 3,445

Share based payments 526 638

Earn out on acquisitions 366 770

Exchange adjustments on borrowings (1,210) 1,585

Share of loss from associate 4 1

Finance costs 2,103 1,371

Finance income (145) (39)

---------------------

12,060 10,532

Decrease/(increase) in inventories 5,809 (1,203)

Increase in trade and other

receivables (5,503) (3,290)

(Decrease)/increase in trade

and other payables (866) 2,688

---------------------

Cash generated from operations 11,500 8,727

Interest paid (1,831) (1,353)

Tax paid (1,248) (2,646)

-------------------- ---------------------

Net cash flow from operating

activities 8,421 4,728

-------------------- ---------------------

Cash flows used in investing

activities

Purchase of intangible fixed

assets (124) (59)

Purchase of property plant

and equipment (1,361) (1,007)

Interest received 145 39

---------------------

Net cash flows used in investing

activities (1,340) (1,027)

-------------------- ---------------------

Cash flow from financing

activities

Bank loan principal repayments

in period (1,010) (1,112)

New loans in the period - 1,612

Movement in invoice discounting

facility 599 1,092

Loan transaction costs (70) (105)

Principal payments on leases (1,999) (1,548)

Net cash flows used in financing

activities (2,480) (61)

-------------------- ---------------------

Net increase in cash and

cash

equivalents 4,601 3,640

Cash and cash equivalents

at

beginning of the period 22,153 22,024

Net foreign currency movements (892) (485)

-------------------- ---------------------

Cash and cash equivalents

at end of period 25,862 25,179

==================== =====================

NOTES TO THE INTERIM CONSOLIDATED STATEMENTS

For the period ended 30 June 2023

---------------------------------------------

1. GENERAL INFORMATION

INSPECS Group plc is a public company limited by shares and is

incorporated in England and Wales. The address of the Company's

principal place of business is Kelso Place, Upper Bristol Road,

Bath BA1 3AU.

The principal activity of the Group in the period was that of

design, production, sale, marketing and distribution of high

fashion eyewear and OEM products worldwide.

2. ACCOUNTING POLICIES

Going concern

Based on the Group's forecasts, the interim financial statements

have been prepared on the going concern basis as the Directors have

assessed that there is a reasonable expectation that the Group will

be able to continue in operation and meet its commitments as they

fall due over the going concern period to 30 September 2024.

The assessment has considered the Group's current financial

position as follows:

-- The Group improved its cash position during the period with

net debt including leasing dropping from GBP27.6m at 31 December

2022 to GBP22.7m at 30 June 2023.

-- Cash generated from operations in the period amounted to GBP11.5m (2022 H1: GBP8.7m).

-- The Group balance sheet has net assets of GBP106.2m and net current assets of GBP36.9m.

-- The Group's net debt excluding leasing improved by GBP4.9m in

the six months to 30 June 2023.

The assessment has considered the current measures being put in

place by the Group to preserve cash and ensure continuity of

operations through:

-- Ensuring continuation of its supply chain, building on the

benefit of having its own manufacturing sites and by securing

alternative third-party supply lines.

-- Maintaining geographical sales diversification, focusing

sales to online customers and seeking new revenue streams around

the globe.

-- Ability to service both the major global retail chains and

significant distribution to the independent eyewear market

following the acquisitions completed over recent periods.

-- Retaining cash for investment into the Group by not paying a dividend to shareholders.

Basis of preparation

The interim consolidated financial statements for the six months

ended 30 June 2023 have been prepared in accordance with IAS 34

Interim Financial Reporting and with accounting policies that are

consistent with the Group's Annual Report and Financial Statements

for the period ended 31 December 2022.

Effective from 1 January 2023, the reporting currency of the

Group was changed to GBP from USD to allow for greater transparency

for investors and other stakeholders. Accordingly, comparative

information is therefore also restated in GBP.

The comparative financial information for the period ended 30

June 2022 in this interim report does not constitute statutory

accounts for that period under 434 of the Companies Act 2006 and is

unaudited.

Accounting policies are included in detail within the latest

Annual Report.

3. CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION UNCERTAINTY

The preparation of the Group's historical information requires

management to make judgements, estimates and assumptions that

affect the reported amounts of revenues, expenses, assets and

liabilities, and their accompanying disclosures, and the disclosure

of contingent liabilities. Uncertainty about these assumptions and

estimates could result in outcomes that could require a material

adjustment to the carrying amounts of the assets or liabilities in

the future.

Estimation uncertainty

In addition to the going concern section of note 2, the key

assumptions concerning the future and other key sources of

estimation uncertainty at the end of the reporting period, that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial period, are described below.

Right of return liability

Management applies assumptions in determining the right of

return liability and the associated right of return asset. These

assumptions are based on analysis of historical data trends, but

require estimation of appropriate time periods and expected return

rates. The right of return liability at the period end is

GBP11,862,000 (31 December 2022: GBP10,613,000) in line with the

accounting methodology used as at 31 December 2022.

4. SEGMENT INFORMATION

The Group operates in three operating segments, which upon

application of the aggregation criteria set out in IFRS 8 Operating

Segments results in three reporting segments:

-- Frames and Optics product distribution.

-- Wholesale - being OEM and manufacturing distribution.

-- Lenses - being manufacturing and distribution of lenses.

The criteria applied to identify the operating segments are

consistent with the way the Group is managed. In particular, the

disclosures are consistent with the information regularly reviewed

by the CEO and the CFO in their role as Chief Operating Decision

Makers, to make decisions about resources to be allocated to the

segments and to assess their performance.

The reportable segments subject to disclosure are consistent

with the organisation model adopted by the Group during the six

months ended 30 June 2023 are as below:

Frames Wholesale Lenses Total before Adjustments Total

and

Optics adjustments &

& elimination

eliminations

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External 100,220 9,016 1,963 111,199 - 111,199

Internal 2,656 906 106 3,668 (3,668) -

------------- --------------------- ---------- ------------- ------------ ----------

102,876 9,922 2,069 114,867 (3,668) 111,199

Cost of sales (51,174) (5,731) (1,240) (58,145) 4,093 (54,052)

------------- --------------------- ---------- ------------- ------------ ----------

Gross profit 51,702 4,191 829 56,722 425 57,147

Expenses (44,430) (3,304) (2,077) (49,811) (2,781) (52,592)

---------- ------------- ------------ ----------

Operating

profit/(loss) 7,272 887 (1,248) 6,911 (2,356) 4,555

---------- ------------- ------------

Exchange

adjustment

on borrowings 1,210

Finance costs (2,103)

Finance income 145

Share of loss

of associates (4)

Taxation (1,720)

----------

Profit for the

period 2,083

----------

Reported segments relating to the balance sheet as at 30 June

2023 are as follows:

Frames Wholesale Lenses Total Adjustments Total

and before

Optics adjustments & elimination

&

eliminations

GBP'000 GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

Total assets 325,541 62,385 9,955 397,881 (167,916) 229,965

Total

liabilities (177,949) (6,040) (13,836) (197,825) 145,057 (52,768)

--------------------- ---------------------- ----------- ------------------------ ------------------------ -----------

147,592 56,345 (3,881) 200,056 (22,859) 177,197

--------------------- ---------------------- ----------- ------------------------ ------------------------

Deferred tax

asset 6,337

Deferred tax

liability (8,203)

Current tax

liability (2,400)

Borrowings (66,754)

------------

Group net

assets 106,177

------------

Total assets are the Group's gross assets excluding deferred tax

asset. Total liabilities are the Group's gross liabilities

excluding loans and borrowings, and deferred tax liability.

The reportable segments subject to disclosure are consistent

with the organisation model adopted by the Group during the six

months ended 30 June 2022 (restated) are as below:

Frames Wholesale Lenses Total before Adjustments Total

and

Optics adjustments &

& elimination

eliminations

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External 93,166 9,919 1,724 104,809 - 104,809

Internal 2,892 2,352 113 5,357 (5,357) -

------------- --------------------- ---------- ------------- ------------ ----------

96,058 12,271 1,837 110,166 (5,357) 104,809

Cost of sales (48,166) (6,712) (1,491) (56,369) 4,453 (51,916)

------------- --------------------- ---------- ------------- ------------ ----------

Gross profit 47,892 5,559 346 53,797 (904) 52,893

Expenses (42,133) (3,275) (2,500) (47,908) (1,345) (49,253)

---------- ------------- ------------ ----------

Operating

profit/(loss) 5,759 2,284 (2,154) 5,889 (2,249) 3,640

---------- ------------- ------------

Exchange

adjustment

on borrowings (1,585)

Non-underlying

costs (911)

Finance costs (1,371)

Finance income 39

Share of loss

of associates (1)

Taxation (2,685)

----------

Loss for the

period (2,874)

----------

Reported segments relating to the balance sheet as at 31

December 2022 (restated) are as follows:

Frames Wholesale Lenses Total Adjustments Total

and before

Optics adjustments & elimination

&

eliminations

GBP'000 GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

Total assets 327,596 70,197 10,470 408,263 (173,328) 234,935

Total

liabilities (179,578) (12,523) (12,887) (204,988) 151,354 (53,634)

--------------------- ---------------------- ----------- ------------------------ ------------------------ -----------

148,018 57,674 (2,417) 203,275 (21,974) 181,301

--------------------- ---------------------- ----------- ------------------------ ------------------------

Deferred tax

asset 7,007

Deferred tax

liability (9,548)

Current tax

liability (1,435)

Borrowings (69,784)

------------

Group net

assets 107,541

------------

Total assets are the Group's gross assets excluding deferred tax

asset. Total liabilities are the Group's gross liabilities

excluding loans and borrowings, and deferred tax liability.

Acquisition costs, finance costs and income, and taxation are

not allocated to individual segments as the underlying instruments

are managed on a Group basis.

Deferred tax and borrowings are not allocated to individual

segments as they are managed on a Group basis.

Adjusted items relate to elimination of all intra-Group items

including any profit adjustments on intra-Group revenues that are

eliminated on consolidation, along with the profit and loss items

of the parent company.

Adjusted items in relation to segmental assets and liabilities

relate to the elimination of all intra-Group balances and

investments in subsidiaries, and assets and liabilities of the

parent company.

The revenue of the Group is attributable to the one principal

activity of the Group.

Geographical analysis

The Group's revenue by destination is split in the following

geographic areas:

Unaudited Unaudited

6 months ended 6 months ended

30 June 2023 30 June 2022

Restated

GBP'000 GBP'000

United Kingdom 13,621 11,396

Europe (excluding

UK) 52,161 52,278

North America 37,428 34,457

South America 1,315 349

Asia 2,993 3,228

Australia 3,515 3,033

Other 166 68

-----------------

111,199 104,809

================= =================

5. EARNINGS PER SHARE

Basic Earnings per Share ("EPS") is calculated by dividing the

profit for the period attributable to ordinary equity holders of

the parent by the weighted average number of ordinary shares

outstanding during the period.

Diluted EPS is calculated by dividing the profit attributable to

ordinary equity holders of the parent by the weighted average

number of ordinary shares outstanding during the period plus the

weighted average number of ordinary shares that would be issued on

conversion of all the dilutive potential ordinary shares into

ordinary shares, to the extent that the inclusion of such shares is

not anti-dilutive. During the period to 30 June 2022 the Group made

a loss; therefore, diluted EPS is not applicable as the impact of

potential ordinary shares is anti-dilutive.

Basic earnings per share is GBP0.02 (30 June 2022: GBP(0.03)),

with diluted earnings per share of GBP0.02 (30 June 2022:

GBP(0.03)). The following table reflects the income and share data

used in the basic and diluted EPS calculations:

Basic weighted

average number Total

6 months ended 30 June of Ordinary earnings Earnings per

2023 Shares ('000) (GBP'000) share (GBP)

-------------------------------- ------------------ ----------- -------------

Basic EPS 101,672 2,083 0.02

Diluted EPS 107,492 2,083 0.02

Adjusted PBT basic EPS 101,672 6,878 0.07

Adjusted PBT diluted EPS 107,492 6,878 0.06

-------------------------------- ------------------ ----------- -------------

Basic weighted

average number Total

6 months ended 30 June of Ordinary earnings Earnings per

2022 (restated) Shares ('000) (GBP'000) share (GBP)

--------------------------- --------------- ---------- ------------

Basic EPS 101,672 (2,874) (0.03)

Diluted EPS 107,028 (2,874) (0.03)

Adjusted PBT basic EPS 101,672 7,530 0.07

Adjusted PBT diluted EPS 107,028 7,530 0.07

--------------------------- --------------- ---------- ------------

Within INSPECS Group plc, each Ordinary share carries the right to

participate in distributions, as respects dividends and as respects

capital on winding up.

6. TRADE AND OTHER RECEIVABLES

Unaudited Unaudited As at

As at As at 31 December

30 June 2023 30 June 2022 2022

Restated Restated

GBP'000 GBP'000 GBP'000

Trade receivables 26,298 25,038 22,670

Prepayments 3,381 3,237 2,267

Other receivables 6,968 6,257 6,207

-------------------

36,647 34,532 31,144

-------------------- ------------------- --------------------

7. TRADE AND OTHER PAYABLES

Unaudited Unaudited As at

31 December

2022

Restated

As at As at

30 June 30 June

2023 2022

Restated

GBP'000 GBP'000 GBP'000

Trade payables 23,530 22,460 22,140

Amounts owed to related

parties 185 185 198

Other payables 798 483 464

Social security and

other taxes 4,723 4,593 4,232

Royalties & provisions 3,216 5,656 4,073

Accruals 6,469 6,798 8,046

38,921 40,175 39,153

----------- ---------- ---------------

8. NET DEBT

Unaudited Unaudited As at

31 December

2022

As at As at

30 June 30 June

2023 2022

GBP'000 GBP'000 GBP'000

Restated Restated

Cash and cash equivalents 25,862 25,179 22,153

Interest bearing borrowings

excl. leasing (46,449) (46,081) (48,300)

Invoice discounting (2,089) ( 708) (1,490)

----------- --------------------- ---------------

Net debt excluding

leasing (22,676) (21,610) (27,637)

----------- --------------------- ---------------

Lease liability (18,216) (20,172) (19,994)

Net debt including

leasing (40,892) (41,782) (47,631)

==================== ========== ===============

9. NON-UNDERLYING COSTS

Non-underlying costs during the six months to 30 June 2022

related to accounting alignment of acquisitions which occurred in

2021 as well as work on ongoing acquisitions and restructuring.

10. SHARE-BASED PAYMENTS

Certain employees of the Group are granted options over the

shares in INSPECS Group. The options are granted with a fixed

exercise price and have vesting dates of between one and three

years after date of grant.

The Group recognises a share-based payment expense based on the

fair value of the awards granted, and an equivalent credit directly

in equity to share option reserve. On exercise of the shares by the

employees, the Group is charged the intrinsic value of the shares

by INSPECS Group plc and this amount is treated as a reduction of

the capital contribution, and it is recognised directly in

equity.

Share options outstanding at the end of the period have the

following expiry date and exercise prices:

Grant date Expected life Exercise Number of

of price per share options

options option GBP

11 October 2019 3-5 years 1.01 412,102

27 February

2020 3-5 years 1.95 1,923,110

22 December

2020 3-5 years 2.10 1,290,000

26 February

2021 3-5 years 3.25 641,036

21 June 2021 3-5 years 3.51 90,000

31 August 2021 3-5 years 3.70 275,000

23 December

2021 3-5 years 3.70 414,999

28 February

2022 3-5 years 3.75 641,036

11. RESTATED PROFIT/(LOSS) BEFORE TAX

The 2022 Annual Report and Accounts included restated primary

statements for the year to 31 December 2021 relating to a prior

year adjustment concerning the treatment of contingent

consideration payable on business combinations. The 30 June 2022

comparative primary statements have therefore also been restated

within these interims, with the impact on profit before tax for the

six months to 30 June 2022 being as follows:

GBP'000

Profit before tax 30 June 2022 (converted

to GBP) 581

Adjustments relating to earn-out on contingent

consideration (770)

----------------------------

Restated loss before tax 30 June 2022 (189)

----------------------------

12. POST BALANCE SHEET EVENTS

Since the end of the interim period on 30 June 2023 there were

no material events that the directors consider material to the

users of these interim statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSDFMMEDSESU

(END) Dow Jones Newswires

September 07, 2023 02:00 ET (06:00 GMT)

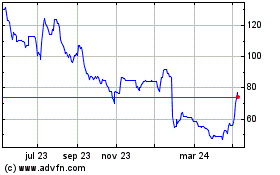

Inspecs (LSE:SPEC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

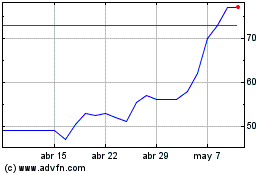

Inspecs (LSE:SPEC)

Gráfica de Acción Histórica

De May 2023 a May 2024