Filed Pursuant to Rule 424(b)(5)

Registration No. 333-264987

PROSPECTUS SUPPLEMENT

To Prospectus dated May 24, 2022

Up to $9,000,000

Common Stock

This prospectus supplement amends and restates our prospectus dated May 24, 2022.

We have previously entered into a sales agreement (the “Sales Agreement”) with Cowen and Company, LLC, TD Cowen, relating to shares of our common stock offered by this prospectus. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $50.0 million from time to time through or to TD Cowen.

Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our common stock registered on the registration statement of which this prospectus supplement forms a part in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million, as measured in accordance with General Instruction I.B.6 of Form S-3. We have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to and including the date of this prospectus. As of October 4, 2023, we have sold 542,500 shares of our common stock for gross proceeds of approximately $4.3 million under the Sales Agreement, all of which shares were sold under General Instruction I.B.1 of Form S-3.

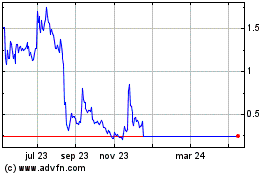

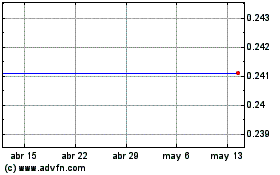

Our common stock is traded on The Nasdaq Global Market under the symbol “IMPL.” The last reported sales price of our common stock on The Nasdaq Global Market on October 4, 2023 was $0.411 per share.

Sales of our common stock, if any, under this prospectus may be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. TD Cowen is not required to sell any specific number or dollar amount of securities, but will act as the sales agent using commercially reasonable efforts consistent with their normal trading and sales practices, on mutually agreed terms between them and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The compensation to TD Cowen for sales of common stock sold pursuant to the sales agreement will be equal to 3% of the aggregate gross proceeds of any shares of common stock sold under the Sales Agreement. In connection with the sale of the common stock on our behalf, TD Cowen will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of TD Cowen will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to TD Cowen with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading “Risk Factors” on page 6 of this prospectus as well as those contained in any accompanying prospectus and any related free writing prospectus or prospectus supplement we prepare or authorize in connection with this offering, and in the other documents that are incorporated by reference into this prospectus or the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is October 5, 2023.

TABLE OF CONTENTS

PAGE

ABOUT THIS PROSPECTUS

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

PROSPECTUS SUMMARY 3

THE OFFERING 7

RISK FACTORS 8

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS 38

USE OF PROCEEDS 39

DIVIDEND POLICY 40

DILUTION 41

DESCRIPTION OF CAPITAL STOCK 43

PLAN OF DISTRIBUTION 47

LEGAL MATTERS 48

EXPERTS 48

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement amends and restates the prospectus filed on May 24, 2022, which prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we may from time to time sell shares of our common stock having an aggregate offering price of up to $200.0 million. Under this prospectus supplement, we may from time to time sell shares of our common stock having an aggregate offering price of up to $9.0 million, at prices and on terms to be determined by market conditions at the time of the offering. The $9.0 million of shares of our common stock that may be sold under this prospectus are included in the $200.0 million of shares of common stock that may be sold under the registration statement. Pursuant to General Instruction I.B.6, of Form S-3 in no event will we sell our common stock registered on the registration statement of which this prospectus supplement forms a part in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million, as measured in accordance with General Instruction I.B.6 of Form S-3.

This prospectus supplement describes the terms of this offering of common stock and also adds to and updates information contained in the documents incorporated by reference into this prospectus supplement. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in any document incorporated by reference into this prospectus supplement that was filed with the SEC before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference into this prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

We have not, and TD Cowen has not, authorized anyone to provide you with any information other than that contained or incorporated by reference in this prospectus supplement or any accompanying prospectus supplement or related free writing prospectus to which we have referred you. Neither we nor TD Cowen take any responsibility for, and can provide no assurance as to the reliability of, any other information others may give you. We are not, and TD Cowen is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this prospectus supplement, the documents incorporated by reference herein and any free writing prospectus that we have authorized for use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement, the documents incorporated by reference herein and therein and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision.

When we refer to “Impel,” “Impel Pharmaceuticals” “we,” “our,” “us,” the “Registrant,” the “Company” and “our company” in this prospectus, we mean Impel Pharmaceuticals Inc., a Delaware corporation, unless otherwise specified.

The mark “Impel Pharmaceuticals Inc.”, the Impel Pharmaceuticals logo and all product candidate names are our common law trademarks. All other service marks, trademarks and tradenames appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

1

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is www.sec.gov.

Our web site address is www.impelpharma.com. The information on our web site, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus is part of a registration statement that we filed with the SEC and does not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements in this prospectus about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above, or at our principal executive offices, 201 Elliott Avenue West, Suite 260, Seattle, WA 98119, during normal business hours.

Incorporation by Reference

The SEC allows us to “incorporate by reference” information that we file with the SEC, which means that we can disclose important information to you by referring you to those other documents. The information incorporated by reference is an important part of this prospectus, and information we file later with the SEC will automatically update and supersede this information. A Current Report (or portion thereof) furnished, but not filed, on Form 8-K shall not be incorporated by reference into this prospectus. We incorporate by reference the documents listed below and any future filings we make with the SEC under Section 13(a), 13(c), 14, or 15(d) of the Exchange Act prior to the termination of any offering of securities made by this prospectus:

•our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023, filed with the SEC on May 12, 2023 and August 18, 2023, respectively;

•the portions of our Definitive Proxy Statement on Schedule 14A (other than information furnished rather than filed) that are incorporated by reference into our Annual Report on Form 10-K, filed with the SEC on April 27, 2023;

•our Current Reports on Form 8-K filed on March 3, 2023, April 12, 2023, April 17, 2023, May 10, 2023, June 16, 2023, August 21, 2023, September 7, 2023 and October 4, 2023; and

•the description of our common stock contained in our registration statement on Form 8-A filed with the SEC on April 19, 2021 under Section 12 of the Exchange Act, including any amendment or report filed for the purpose of updating such description.

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference in this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

We will furnish without charge to you, on written or oral request, a copy of any or all of such documents that has been incorporated herein by reference (other than exhibits to such documents unless such exhibits are specifically incorporated by reference into the documents that this prospectus incorporates). Written or oral requests for copies should be directed to Impel Pharmaceuticals Inc., Attn: Investor Relations, 201 Elliott Avenue West, Suite 260, Seattle, WA 98119, and our telephone number is (206) 568-1466. See the section of

2

this prospectus entitled “Where You Can Find More Information” for information concerning how to obtain copies of materials that we file with the SEC.

Any statement contained in this prospectus, or in a document, all or a portion of which is incorporated by reference, shall be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, any prospectus supplement or any document incorporated by reference modifies or supersedes such statement. Any such statement so modified or superseded shall not, except as so modified or superseded, constitute a part of this prospectus.

3

PROSPECTUS SUMMARY

Our Company

We are a commercial-stage biopharmaceutical company with a mission to develop transformative therapies for people suffering from diseases with high unmet medical needs, with an initial focus on diseases of the central nervous system, or CNS. Our company was founded on the premise that the upper nasal space can be an optimal treatment entry point for CNS and other diseases where rapid vascular absorption can result in superior clinical outcomes. Our strategy is to pair our proprietary Precision Olfactory Delivery, or POD, upper nasal delivery technology with well-established therapeutics or other therapeutics where rapid vascular absorption is preferred to drive therapeutic benefit, improve patient outcomes, reduce drug development risk and expand the commercial opportunity within our target diseases. In September of 2021, Trudhesa was approved by the U.S. Food and Drug Administration, or FDA, for the acute treatment of migraine headaches with or without aura in adult patients.

Recent Developments

Amended Credit Agreement

On September 5, 2023, we entered into the Second Amendment to Credit Agreement and Guaranty and Revenue Interest Financing Agreement, or the Second Amendment, with Oaktree Fund Administration, LLC, or Oaktree, as administrative agent, and the existing and new lenders party thereto, which we collectively refer to as the Secured Parties, which amends our (i) Credit Agreement and Guaranty dated March 17, 2022, as amended on August 21, 2023, and (ii) the Revenue Interest Financing Agreement dated March 17, 2022, as amended on August 21, 2023, or the RIF Agreement. Further, on October 2, 2023, we entered into the Third Amendment to Credit Agreement and Guaranty, which together with the Second Amendment we refer to as the Amended Credit Agreement. We refer to the RIF Agreement and the Credit Agreement and Guaranty as the Original Agreements. The Amended Credit Agreement provides for an aggregate principal loan amount to us by the existing and new lenders of approximately $121.5 million, including up to $20 million in additional cash proceeds to us from the making of additional term loans, the exchange of approximately $96.5 million of outstanding principal under the Original Agreements, and an in-kind forbearance fee of $5.0 million. Affiliates of KKR Iris Investors LLC, a greater than 10% holder of our common stock, are lenders of a portion of the new amount under the Credit Agreement.

Pursuant to the Amended Credit Agreement, as of October 4, 2023, we have drawn $10.0 million of tranche B term loans, including $2.5 million after September 30, 2023, and will have the right to draw up to $10.0 million more in additional tranche B term loans over the course of 2023, subject to our achievement of certain strategic transaction process milestones, satisfaction of minimum net revenue and product units sold covenants and satisfaction of certain other covenants and conditions specified in the Amended Credit Agreement.

Under the Amended Credit Agreement, the first lien tranche A provides for an aggregate original principal loan of $101.5 million, consisting of $51.4 million exchanged for existing tranche A-1 term loans, a $5.0 million forbearance fee, $9.1 million exchanged for existing tranche A-2 term loans, and $36.0 million exchanged for the right to future revenue interest payments under the RIF Agreement. In connection with the execution of the Amended Credit Agreement and the exchange of the future payments due under the RIF Agreement, the RIF Agreement was terminated.

Under the Amended Credit Agreement, the first lien tranche B provides for an aggregate original principal loan of $20.0 million. Further, tranche B investors received warrants to purchase shares of our common stock having an aggregate warrant coverage equal to an aggregate of approximately 19.99% of the outstanding shares and an exercise price of $0.01 per share. The warrants are issued to the tranche B lenders upon each borrowing of tranche B term loans in proportion to the amount of tranche B term loans funded.

Interest will be paid in kind, or PIK, on both the tranche A and tranche B term loans through the end of the forbearance period, which was extended to December 31, 2023 under the Amended Credit Agreement, and accrues at SOFR + 10.75%. The first lien tranche B is entitled to a 2x multiple on invested capital. The tranche A lenders and tranche B lenders will be entitled to be repaid a maximum aggregate amount of approximately $141.5 million (assuming the entire $20.0 million of tranche B loans are funded), plus PIK interest on the tranche A term loan.

The amounts outstanding under the Amended Credit Agreement are secured and collateralized by all of our assets. The Amended Credit Agreement also provides for certain modifications to the existing covenants, including additional reporting obligations, minimum net revenue and product units sold covenants and additional milestones. In addition, the Amended Credit Agreement includes customary events of default, the occurrence of which could result in termination of Oaktree’s commitments or the acceleration of our obligations under the Amended Credit Agreement.

Preliminary Financial and Corporate Information

After giving effect to the $2.5 million in draws under the Amended Credit Agreement after September 30, 2023, as described above, as of September 30, 2023, we had on a pro forma basis approximately $2.7 million in cash and cash equivalents, excluding amounts restricted under the Amended Credit Agreement. However, this estimate is preliminary and subject to the completion of our unaudited financial statements as of and for the three and nine months ended September 30, 2023. The actual amount that we report will be subject to the completion of our financial closing procedures and any final adjustments that may be made prior to the time our financial results for the quarter ended September 30, 2023, are finalized and filed with the SEC. Our independent registered public accounting firm has not audited, reviewed, compiled, or performed any procedures with respect to our cash, cash equivalents and marketable securities and, accordingly, does not express an opinion or any other form of assurance on it. This estimate should not be viewed as a substitute for financial statements prepared in accordance with accounting principles generally accepted in the United States and is not necessarily indicative of the results to be achieved in any future period. Accordingly, you should not draw any conclusions based on the foregoing estimate and should not place undue reliance on this preliminary estimate. We assume no duty to update this preliminary estimate except as required by law. Partially as a result of our ongoing liquidity issues as described herein, including increased attrition from our sales force, we currently expect our revenue for the three months ended September 30, 2023 to be lower than our revenue for the three months ended June 30, 2023.

Liquidity and Going Concern

There is substantial doubt about our ability to continue as a going concern. Due to the fact that we were unable to generate sufficient cash flows from operations, obtain funding to sustain operations, or reduce or stabilize expenses to the point where we could have realized a net positive cash flow, management and our board of directors determined that it was in the best interests of the stockholders to seek strategic alternatives. As part of this process, we plan to consider a wide range of options with a focus on maximizing shareholder value, including a potential sale of assets of the company, a sale of all of the company, a merger or other strategic transactions. We have engaged Moelis & Company LLC to act as our financial advisor in connection with the review.

There can be no assurance that this process will result in us pursuing any particular transaction or other strategic outcome. We currently expect to conduct this process over the remainder of 2023, with a goal of closing any such transactions no later than early 2024. However, if we are unable to complete a transaction, it will be necessary to seek additional financing or other alternatives for restructuring and resolving our liabilities, which may include the initiation of bankruptcy proceedings under Chapter 11 of the U.S. Bankruptcy Code in which case holders of our common stock will likely receive no recovery at all for the securities offered hereby. Even if we do complete a transaction, the proceeds may be insufficient to allow our stockholders to recognize any return on their investment.

Our ongoing liquidity issues also present significant challenges to current operations. We currently expect the financing availability under the Amended Credit Agreement to be sufficient to conduct the strategic review process, but we do not expect it to be sufficient to continue operations beyond this process without substantial additional investment. Our operations are also being impacted by the loss of sales representatives that we do not currently plan to replace, increased pressure from suppliers regarding payments from us that may delay or prevent our ability to obtain sufficient product from suppliers, and concern from prescribers regarding future product availability. Any of these issues can have a material impact on our sales and may further reduce our cash runway, accelerating the potential need to seek alternatives, including bankruptcy proceedings.

Nasdaq Compliance

As previously disclosed, on April 11, 2023, we received two written notifications from the Listing Qualifications Department of The Nasdaq Stock Market LLC, or Nasdaq, stating that we were no longer in compliance with certain minimum market value conditions to maintain continued listing as set forth in Nasdaq Marketplace Rule

5450(b)(2)(C). Under applicable Nasdaq rules, we have until October 9, 2023 to regain compliance by meeting the continued listing requirements, namely that the market value of our publicly held shares closes at $15,000,000 or more for a minimum of 10 consecutive business days and the market value of listed securities closes at $50,000,000 or more for a minimum of 10 consecutive business days. As of the date hereof, we do not expect to meet these criteria by such date, and we expect to receive a delisting determination from Nasdaq at such time. Upon receiving such determination, we intend to request a hearing to remain on the Nasdaq Stock Market, and we expect such request will suspend such delisting determination until a decision is issued by Nasdaq subsequent to the hearing, although we cannot predict whether Nasdaq will suspend a delisting determination or, if we are granted a hearing, what Nasdaq’s ultimate decision in this matter will be.

Additionally, on September 28, 2023, we received written notice from Nasdaq notifying us that we are not in compliance with the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing. Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of $1.00 per share, and Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. Under applicable Nasdaq rules, we have a compliance period of 180 calendar days in which to regain compliance, expiring on March 26, 2024.

Company Information

We were incorporated under the laws of the State of Delaware in July 2008. Our principal executive offices are located at 201 Elliott Avenue West, Suite 260, Seattle, Washington 98119, and our telephone number is (206) 568-1466. Our website address is www.impelpharma.com. The information contained on, or that can be accessed through, our website is not part of, and is not incorporated by reference into, this prospectus. Investors should not rely on any such information in deciding whether to purchase our common stock.

THE OFFERING

|

|

Common stock offered by us |

Shares of our common stock having an aggregate offering price of up to $9.0 million. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our common stock registered on the registration statement of which this prospectus supplement forms a part in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million, as measured in accordance with General Instruction I.B.6 of Form S-3. |

Common stock to be outstanding immediately after this offering |

Up to 45,646,815 shares (as more fully described in the notes following this table), assuming sales of 21,897,810 shares of our common stock in this offering at an offering price of $0.411 per share, which was the last reported sale price of our common shares on The Nasdaq Global Market on October 4, 2023. The actual number of shares issued will vary depending on the sales price under this offering. |

Manner of Offering |

“At the market offering” that may be made from time to time through TD Cowen. See “Plan of Distribution.” |

Use of Proceeds |

We currently intend to use the net proceeds of this offering for general corporate purposes, which may include increasing our working capital, reducing indebtedness, ongoing commercialization activities and market development of Trudhesa, and capital expenditures. See “Use of Proceeds.” |

Risk Factors |

Investing in our common stock involves significant risks. See the disclosure under the heading “Risk Factors” in this prospectus and under similar headings in other documents incorporated by reference into this prospectus. |

The Nasdaq Global Market symbol |

IMPL |

The number of shares of our common stock to be outstanding after this offering is based on 23,749,005 shares of our common stock outstanding as of June 30, 2023, and excludes:

•4,629,027 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2023, with a weighted-average exercise price of $6.82;

•20,000 shares of our common stock issuable upon the exercise of stock options granted after June 30, 2023, with a weighted-average exercise price of $1.31 per share;

•252,500 shares of our common stock issuable upon the vesting and settlement of restricted stock units, or RSUs, outstanding as of June 30, 2023;

•94,688 shares of our common stock issuable upon the exercise of warrants outstanding as of June 30, 2023, with a weighted-average exercise price of $9.51 per share;

•4,749,900 shares of our common stock issuable upon the exercise of warrants issued or issuable to our lenders pursuant to the Amended Credit Agreement after June 30, 2023 with an exercise price of $0.01 per share; and

•2,894,973 shares of common stock reserved for future issuance under our stock-based compensation plans as of June 30, 2023, consisting of (i) 2,150,350 shares of common stock reserved for future issuance under our 2021 Equity Incentive Plan as of June 30, 2023 and (ii) 744,623 shares of common stock reserved for future issuance under our 2021 Employee Stock Purchase Plan.

Except as otherwise indicated, all information in this prospectus does not assume or give effect to any exercise of outstanding options after June 30, 2023.

7

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and the accompanying base prospectus involves risks. You should carefully consider the risk factors described below and in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which are incorporated by reference in this prospectus, any amendment or update thereto reflected in subsequent filings with the SEC, including in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and all other information contained or incorporated by reference in this prospectus, as updated by our subsequent filings under the Exchange Act. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section of this report captioned “Risk Factors.” The following is a summary of the principal risks we face:

•We are substantially restricted in our corporate activities by our existing debt facilities and are considering all strategic alternatives. If we do not maintain access to funding our debt facilities, we may be required to cease operations and seek relief under the U.S. Bankruptcy Code.

•There is substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain further financing.

•If we do not complete a strategic transaction, or do not receive sufficient financing from our debt facilities or from the offering of securities covered by this prospectus, we expect that we will likely file for bankruptcy protection.

•We are not currently in compliance with certain listing requirements of The Nasdaq Global Market. If our common stock is delisted, the market price and liquidity of our common stock and our ability to raise additional capital would be adversely impacted.

•If we fail to retain senior management and key scientific personnel, we may be unable to continue operations, meet sale milestones and complete our strategic review process.

•We are a commercial-stage biopharmaceutical company and have incurred net losses since our inception. We anticipate that we will continue to incur substantial operating losses for the foreseeable future and we may never achieve or sustain profitability.

•Statements in this report concerning our future plans and operations are dependent on our ability to secure adequate funding and the absence of unexpected delays or adverse developments. We may not be able to secure required funding.

•Our future commercial success depends upon attaining significant market acceptance of Trudhesa among physicians, patients, health care payors and others in the medical community necessary for commercial success.

•We rely entirely on third parties for the manufacturing of Trudhesa. If such third parties cease to provide services or require changes to our payment terms, or if we encounter difficulties in negotiating manufacturing and supply agreements with third-party manufacturers and suppliers of our POD device and the active ingredients in Trudhesa, our business and results of operation would be adversely impacted.

•If we are not able to obtain and enforce patent protection for our technologies, development and commercialization of our technology may be adversely affected.

•The market price of our common stock may be volatile, which could result in substantial losses for investors.

Risks Related to the Offering, Our Financial Position and Need for Additional Capital

We are substantially restricted in our corporate activities by our existing our debt facilities and are considering all strategic alternatives. If we do not maintain access to funding our debt facilities, we may be required to cease operations and seek relief under the U.S. Bankruptcy Code.

8

In September 2023 we entered into the Amended Credit Agreement with Oaktree and the Secured Parties. Prior to entry into such agreement, we were in breach of the covenant under our Original Agreements with Oaktree to maintain a minimum of $12.5 million in unrestricted cash and cash equivalents on hand. Pursuant to the Amended Credit Agreement, we have drawn an aggregate of $10.0 million as of the date of this prospectus supplement and will have the right to draw up to $10.0 million more in additional tranche B term loans over the course of 2023, subject to our achievement of certain strategic transaction process milestones, satisfaction of minimum net revenue and product units sold covenants and satisfaction of certain other covenants and conditions specified in the Amended Credit Agreement. We have recently failed to satisfy certain covenants while we have received waivers for such violations to date, if we fail to satisfy these covenants going forward, we may be unable to draw down remaining tranche B term loans. If we are unable to draw additional term loans on the schedule currently anticipated, raise additional capital, whether through this offering or otherwise, or complete a strategic transaction, we will need to cease operations and seek relief under Chapter 11 of the U.S. Bankruptcy Code.

There is substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain further financing.

Our consolidated financial statements are prepared using the generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, as shown in our consolidated financial statements for the year ended December 31, 2022, included in our Annual Report on Form 10-K for the year ended December 31, 2022, and the condensed consolidated financial statements included in our most recent Quarterly Report on Form 10-Q, we have sustained substantial recurring losses from operations. In addition, we have used, rather than provided, cash in our continuing operations. After giving effect to the $2.5 million in draws under the Amended Credit Agreement after September 30, 2023, as described above, as of September 30, 2023, we had on a pro forma basis approximately $2.7 million in cash and cash equivalents, excluding amounts restricted under the Amended Credit Agreement. The above conditions raise substantial doubt about our ability to continue as a going concern within one year after the date that our financial statements are issued. Our consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should we be unable to continue in existence.

Uncertainty concerning our ability to continue as a going concern, among other factors, may hinder our ability to obtain future financing. Continued operations and our ability to continue as a going concern are dependent, among other factors, on our ability to successfully commercialize Trudhesa and our ability to obtain additional required funding in the near term and thereafter. In addition the financing contemplated by this prospectus, we are exploring a wide range of options with a focus on maximizing shareholder value, including a potential sale of assets of the company, a sale of all of the company, a merger or other strategic transaction. Other potential strategic alternatives may include restructuring or refinancing our debt, seeking additional debt or equity capital, reducing or delaying our business activities and strategic, initiatives, mergers and acquisitions, licensing arrangements and partnerships, co-development agreements or a combination of these. We have engaged Moelis & Company LLC to act as our financial advisor in connection with the review of strategic alternatives, however, there can be no assurance that we will be able to complete additional or alternative financings, business development transactions or other strategic alternatives. If we cannot continue as a viable entity, we will likely be required to reduce or cease operations and seek relief under the U.S. Bankruptcy Code, and our stockholders would likely lose most or all of their investment in us.

Our ongoing liquidity issues also present significant challenges to current operations. We currently expect the financing availability under the Amended Credit Agreement to be sufficient to conduct the strategic review process, but we do not expect it to be sufficient to continue operations beyond this process without substantial additional investment. Our operations are also being impacted by the loss of sales representatives that we do not currently plan to replace, increased pressure from suppliers regarding payments from us that may delay or prevent our ability to obtain sufficient product from suppliers, and concern from prescribers regarding future product availability. Any of these issues can have a material impact on our sales and may further reduce our cash runway, accelerating the potential need to seek alternatives, including seeking relieve under the U.S. Bankruptcy Code.

If we do not complete a strategic transaction, or do not receive sufficient financing from our debt facilities or from the offering of securities covered by this prospectus or through any other financing, we expect that we will likely file for bankruptcy protection.

9

If we do not complete a strategic transaction or receive sufficient financing from our existing debt facilities or from the proceeds from the offering of securities covered by this prospectus or any other financing, we expect that we will file for bankruptcy protection. We believe that the present fair market value of our assets are less than the total amount required to pay our probable liabilities on our total existing debts and liabilities (including contingent liabilities) as they become absolute and matured. Subject to certain limitations in the sales agreement and compliance with applicable law, we have the discretion to deliver instruction to TD Cowen to use its commercially reasonable efforts to sell shares of our common stock at any time throughout the term of the sales agreement. The number of shares that are sold through TD Cowen after our instruction will fluctuate based on a number of factors, including the market price of our common stock during the sales period, the limits we set in any instruction to sell shares, and the demand for our common stock during the sales period. Because the price per share of each share sold will fluctuate during this offering, it is not currently possible to predict the gross proceeds to be raised in connection with those sales. In addition, the sales agreement requires that we meet certain conditions at each time of sale, including that our common stock shall remain listed on a national securities exchange. We may not satisfy the conditions in the sales agreement, and therefore we may not receive the potential proceeds from this offering. If we do not receive the proceeds from this offering, whether because we cannot satisfy the conditions in the sales agreement or otherwise, and we are unable to otherwise raise sufficient proceeds in the near term, then we expect that we will likely file for bankruptcy protection, in which case holders of our common stock will likely receive no recovery at all for the securities offered hereby.

We are not currently in compliance with certain listing requirements of The Nasdaq Global Market. If our common stock is delisted, the market price and liquidity of our common stock and our ability to raise additional capital would be adversely impacted.

Our common stock is currently listed on The Nasdaq Global Market (“Nasdaq”). Continued listing of a security on Nasdaq is conditioned upon compliance with various continued listing standards. On April 11, 2023, we received a letter from Nasdaq notifying us that the Company did not meet the $15 million minimum market value of publicly held shares required to maintain continued listing as set forth in Nasdaq Marketplace Rule 5450(b)(2)(C) (the “MVPHS Rule”) for the 30-business day period ended April 5, 2023, and, as a result, we no longer comply with the MVPHS Rule for continued listing on Nasdaq. Additionally, on April 11, 2023, we received a second notice from Nasdaq stating that, for the for the 30-business day period ended April 5, 2023, we had not met the $50 million minimum market value of listed securities required to maintain continued listing as set forth in Nasdaq Marketplace Rule 5450(b)(2)(A) (the “MVLS Rule” and together with the MVPHS Rule, the “Rules”).

As provided in the Nasdaq rules, we have 180 calendar days, or until October 9, 2023, to regain compliance. To regain compliance, the market value of our publicly held shares must be $15 million or more for a minimum of 10 consecutive business days and the market value of our listed securities must close at $50 million or more for a minimum of 10 consecutive business days at any time prior to October 9, 2023.

As of the date hereof, we do not expect to meet these criteria by such date, and we expect to receive a delisting determination from Nasdaq at such time. Upon receiving such determination, we intend to request a hearing to remain on the Nasdaq Stock Market, and we expect such request will suspend such delisting determination until a decision is issued by Nasdaq subsequent to the hearing, though we cannot be certain what decision Nasdaq will ultimately issue or the timing thereof.

Further, on September 28, 2023, we received a notice from Nasdaq notifying us that for 30 consecutive trading days, the bid price of our common stock had closed below the minimum $1.00 per share requirement. In accordance with Nasdaq’s listing rules, we were afforded a grace period of 180 calendar days, or until March 26, 2024, to regain compliance with the bid price requirement. In order to regain compliance, the bid price of our common stock must close at a price of at least $1.00 per share for a minimum of 10 consecutive trading days.

If we fail to regain compliance by March 26, 2024, we may be eligible for a second 180 day compliance period if we elect to transfer to The Nasdaq Capital market, provided that, on such date, we meet the continued listing requirement for market value of publicly held shares and all other applicable Nasdaq listing requirements (other than the minimum closing bid price requirement) and we provide written notice to Nasdaq of our intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. Such extension of the grace period would be subject to Nasdaq’s discretion, and there can be no guarantee that we would be granted an extension. Our failure to regain compliance with the minimum bid price requirement under the Nasdaq listing rules may result in the delisting of our common stock.

10

If we fail to retain senior management and key scientific personnel, we may be unable to continue operations, meet sale milestones and complete our strategic review process.

We are highly dependent on members of our senior management, including Adrian Adams, our Chairman, President and Chief Executive Officer, Michael Kalb, Chief Financial Officer, John Hoekman, Ph.D., Chief Technology and Development Officer and one of our founders, and Leonard S. Paolillo, our Chief Commercial Officer. Although we have entered into employment agreements and retention agreements with our executive officers, each of these persons may terminate their employment with us at any time. We do not maintain “key person” insurance for any of our executives or other employees.

Further, the reduction in employee and non-employee expenses announced in February 2023, and our ongoing liquidity issues makes retention of our current personnel both more important and more challenging. In particular, we are seeing increased loss of sales representatives, limiting our ability to meet our sales goals and revenue targets. We do not intend to fill these vacated positions for the foreseeable future and, as a result, retaining our current sales personnel will be critical to our immediate success. Further, the loss of the services of our executive officers or other key employees could impede the achievement of our research, development and commercialization objectives and seriously harm our ability to successfully implement our business strategy.

We are a commercial-stage biopharmaceutical company and have incurred net losses since our inception. We anticipate that we will continue to incur substantial operating losses for the foreseeable future and we may never achieve or sustain profitability.

We are a commercial-stage biopharmaceutical company formed in 2008. To date, we have financed our operations primarily through the sale and issuance of redeemable convertible preferred stock, convertible notes and warrants, common stock offerings, debt financings and royalty financings. Since 2021, we have also relied on revenues generated from net sales of Trudhesa.

We have incurred significant net losses since our inception. Our net losses were $37.4 million and $106.3 million for the six months ended June 30, 2023 and the year ended December 31, 2022, respectively. As of June 30, 2023, we had an accumulated deficit of $358.5 million. We cannot predict when or whether we will become profitable. Our losses have resulted principally from costs incurred in our product candidate discovery and development activities. We expect to incur net losses for the foreseeable future.

Our financial position will depend, in part, on the rate of our future expenditures and our ability to obtain funding through equity or alternative financings, strategic collaborations, or additional grants. Although we have received approval for Trudhesa, the resulting revenue from its commercialization may not enable us to achieve profitability. Our future revenues will depend upon our ability to achieve sufficient market acceptance, reimbursement from third-party payors and adequate market share for Trudhesa.

Our expenses and net losses may increase as we continue to commercialize Trudhesa as well as hire additional personnel, protect our intellectual property and incur additional costs associated with operating as a public company. Our net losses may fluctuate significantly from quarter to quarter and year to year, depending on our commercialization activities and any expenditures on other research and development activities.

To become and remain profitable, we must expand the market for Trudhesa. We may not succeed in these activities and we may never generate revenue from product sales that are significant enough to achieve profitability. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. We may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business for any reason, including as a result of pandemics or other public health emergencies. The size of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenue. Our prior losses and expected future losses have had and will continue to have an adverse effect on our stockholders’ equity and working capital. Our failure to become or remain profitable would depress our market value and could impair our ability to raise capital, expand our business, discover or develop other product candidates or continue our operations.

Statements in this report concerning our future plans and operations are dependent on our ability to secure adequate funding and the absence of unexpected delays or adverse developments. We may not be able to secure required funding.

11

Any statements contained in this report concerning future events or developments or our future activities, such as concerning commercialization activities or regulatory matters, commercial introduction of any further products that we may develop in the future, anticipated outcome of any legal proceedings in which we are involved, and other statements concerning our future operations and activities, are forward-looking statements that in each instance assume that we have or are able to obtain sufficient funding to support such activities and continue our operations and satisfy our liability and obligations in a timely manner. There can be no assurance that this will be the case. Also, such statements assume that there are no significant unexpected developments or events that delay or prevent such activities from occurring. Failure to timely obtain any required additional funding, or unexpected developments or events, could delay the occurrence of such events or prevent the events described in any such statements from occurring which could adversely affect our business, financial condition and results of operations.

Our ongoing liquidity issues also present significant challenges to current operations. We currently expect the financing availability under the Amended Credit Agreement to be sufficient to conduct the strategic review process, but we do not expect it to be sufficient to continue operations beyond this process without substantial additional investment. Our operations are also being impacted by the loss of sales representatives that we do not currently plan to replace, increased pressure from suppliers regarding payments from us that may delay or prevent our ability to obtain sufficient product from suppliers, and concern from prescribers regarding future product availability. Any of these issues can have a material impact on our sales and may further reduce our cash runway, accelerating the potential need to seek alternatives, including bankruptcy proceedings.

If you purchase shares of our common stock sold in this offering, you may experience immediate and substantial dilution in the net tangible book value of your shares. In addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to you.

The price per share of our common stock being offered may be higher than the net tangible book value per share of our outstanding common stock prior to this offering. Assuming that an aggregate of 21,897,810 shares of our common stock are sold at a price of $0.411 per share, the last reported sale price of our common stock on The Nasdaq Global Market on October 4, 2023, for aggregate gross proceeds of approximately $9.0 million, and after deducting commissions and estimated offering expenses payable by us, new investors in this offering will incur immediate dilution of $1.96 per share. For a more detailed discussion of the foregoing, see the section entitled “Dilution” below. To the extent outstanding stock options or warrants are exercised, there will be further dilution to new investors. We expect our net tangible book value to be negative following this offering, and if we initiate bankruptcy proceedings, holders of our common stock will likely receive no recovery at all for the securities offered hereby.

In addition, to the extent we need to raise additional capital in the future and we issue additional shares of common stock or securities convertible or exchangeable for our common stock, our then existing stockholders may experience dilution and the new securities may have rights senior to those of our common stock offered in this offering.

Our quarterly operating results may fluctuate significantly or may fall below the expectations of investors or securities analysts, each of which may cause our stock price to fluctuate or decline.

We expect our operating results to be subject to quarterly fluctuations. Our net loss and other operating results will be affected by numerous factors, including:

•quarterly fluctuations in product sales of Trudhesa;

•our ability to retain our sales force and the negative impact such attrition will have on our sales of Trudhesa;

•any reductions in supply of Trudhesa due to inability to timely pay our suppliers;

•variation in the level of expense related to the commercialization of Trudhesa;

•any intellectual property infringement lawsuit or opposition, interference or cancellation proceeding in which we may become involved;

•strategic decisions by us or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments or changes in business strategy; and

•changes in general market and macroeconomic conditions.

12

If our quarterly operating results fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially. Furthermore, any quarterly fluctuations in our operating results may, in turn, cause the price of our common stock to fluctuate substantially. We believe that quarterly comparisons of our financial results should not be relied upon as an indication of our future performance.

Our cash and cash equivalents could be adversely affected if the financial institutions in which we hold our cash and cash equivalents fail.

We regularly maintain cash balances at third-party financial institutions, including formerly with Silicon Valley Bank, in excess of the FDIC insurance limit and similar regulatory insurance limits outside the United States. Further, if we enter into a credit, loan or other similar facility with a financial institution, certain covenants included in such facility may require as security that we keep a significant portion of our cash with the institution providing such facility. If a depository institution where we maintain deposits fails or is subject to adverse conditions in the financial or credit markets, we may not be able to recover all, if any, of our deposits, which could adversely impact our operating liquidity and financial performance.

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Our management might not apply our net proceeds in ways that ultimately increase the value of your investment. We currently intend to use the net proceeds from this offering general corporate purposes, which may include increasing our working capital, reducing indebtedness, ongoing commercialization activities and market development of Trudhesa, and capital expenditures. Pursuant to the terms of the Amended Credit Agreement, if we raise proceeds in an equity financing, including this offering, that exceed $5,000,000, we will apply 50% of such excess proceeds to repay the tranche B term loans. The failure by our management to apply these funds effectively could harm our business. Pending their use, we plan to invest the net proceeds from this offering in short-term or long-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

The actual number of shares we will issue under the sales agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the sales agreement and compliance with applicable law, we have the discretion to deliver a placement notice to TD Cowen at any time throughout the term of the sales agreement. The number of shares that are sold by TD Cowen after delivering a placement notice will fluctuate based on the market price of the common shares during the sales period and limits we set with TD Cowen. Because the price per share of each share sold will fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage to predict the number of shares that will be ultimately issued. Further, we are restricted pursuant to General Instruction I.B.6 of Form S-3 to selling securities with a value of no more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million.

The common stock offered hereby will be sold in “at the market offerings”, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices they paid.

Further, if we do not complete a strategic transaction or receive sufficient financing from our existing debt facilities or from the proceeds from the offering of securities covered by this prospectus or any other financing, we expect

13

that we will file for bankruptcy protection, in which case holders of our common stock will likely receive no recovery at all for the securities offered hereby. Even if we do complete a transaction, the proceeds may be insufficient to allow our stockholders to recognize any return on their investment.

The market price of our common stock may be volatile, which could result in substantial losses for investors.

The market price of our common stock has been and may continue to be volatile. The market price for our common stock may be influenced by many factors, including the other risks described in this section and the following:

•our potential insolvency;

•actual or anticipated variations in our financial results or those of companies that are perceived to be similar to us;

•market conditions in the life sciences and pharmaceutical sectors;

•announcements by us or our competitors of significant acquisitions, strategic collaborations, joint ventures or capital commitments;

•developments or disputes concerning patents or other proprietary rights, including patents and litigation matters;

•our ability or inability to raise additional capital and the terms on which we raise it;

•the recruitment or departure of key personnel, particularly our sales personnel;

•introductions and announcements of new product candidates by us, our future commercialization partners, or our competitors, and the timing of these introductions or announcements;

•regulatory or legal developments in the United States and other countries;

•material and adverse impact of pandemics or other public health emergencies on the markets and the broader global economy;

•the success of competitive products or technologies;

•actions taken by regulatory agencies with respect to any clinical trials, manufacturing process or sales and marketing terms;

•changes in the structure of healthcare payment systems;

•actual or anticipated changes in earnings estimates or changes in stock market analyst recommendations regarding our common stock, other comparable companies or our industry generally;

•our failure or the failure of our competitors to meet analysts’ projections or guidance that we or our competitors may give to the market;

•fluctuations in the valuation of companies perceived by investors to be comparable to us;

•announcement and expectation of additional financing efforts;

•speculation in the press or investment community;

•trading volume of our common stock;

•sales of our common stock by us or our stockholders;

•the concentration in ownership of our common stock;

•changes in accounting principles;

•potential litigation or the threat thereof;

•terrorist acts, acts of war or periods of widespread civil unrest;

•natural disasters and other calamities; and

•general economic, industry and market conditions.

In addition, the stock market in general, and the markets for pharmaceutical and medical device stocks in particular, have experienced extreme price and volume fluctuations that have been often unrelated or disproportionate to the operating performance of these companies, including as a result of the COVID-19 pandemic. These broad market and industry factors may seriously harm the market price of our common stock, regardless of our actual operating performance. The realization of any of the above risks or any of a broad range of other risks, including those described in this “Risk Factors” section, could have a dramatic and adverse impact on the market price of our common stock.

Risks Related to Commercialization of Trudhesa

14

Our future commercial success depends upon attaining significant market acceptance of Trudhesa among physicians, patients, health care payors and others in the medical community necessary for commercial success.

Trudhesa may not gain market acceptance among physicians, health care payors, patients and the medical community. There are several approved acute treatments for migraine currently on the market, including triptans, calcitonin gene-related peptides antagonists, or gepants, lasmiditan and alternative formulations of DHE, such as Migranal, which is also administered intranasally. All of these are competitive with Trudhesa and our level of market acceptance of Trudhesa for the acute treatment for migraine may be lower than we expect. Market acceptance of Trudhesa depends on a number of factors, including:

•the efficacy and safety of Trudhesa;

•perceived advantages of Trudhesa over alternative treatments, such as oral, IM and IV formulations;

•the indications for which the product candidates are approved and the labeling approved by regulatory authorities for use with the product candidates, including any warnings, limitations or contraindications contained in a product’s approved labeling;

•acceptance by physicians and patients of Trudhesa as a safe and effective treatment;

•the cost, safety and efficacy of treatment in relation to alternative treatments, including generic versions of the product candidates;

•the extent to which Trudhesa is included on formularies of hospitals and managed care organizations;

•the availability of coverage and adequate reimbursement and pricing by third-party payors and government authorities for Trudhesa;

•relative convenience and ease of administration of Trudhesa;

•the prevalence and severity of adverse side effects;

•the timing of market introduction of competitive products;

•restrictions on the distribution of Trudhesa;

•the effectiveness of our sales and marketing efforts;

•unfavorable publicity relating to Trudhesa; and

•the approval of other new therapies for the same indications.

Market acceptance is critical to our ability to generate significant revenue and become profitable. Trudhesa may be accepted in only limited capacities or not at all. If Trudhesa is not accepted by the market to the extent that we expect, we may not be able to generate significant revenue and our business would suffer.

The market for Trudhesa may not be as large as we expect and, as a result, our product revenues may be lower than expected and our stock price may decline.

Our estimates of the potential market opportunity for Trudhesa include several key assumptions based on our industry knowledge, industry publications, third-party research reports and other surveys, including surveys commissioned by us. These assumptions include the size of our target populations, the prevalence and incidence of addressable migraines, the number of patients receiving current treatment, the percentage of patients unsatisfied with the current treatments, the number of diagnosed but untreated patients, the compliance and adherence of patients in our target populations, the number of treatment centers and prescribing physicians and the percentage of payer acceptance. While we believe that our internal assumptions are reasonable, if any of these assumptions proves to be inaccurate, then the actual market for Trudhesa could be smaller than our estimates of our potential market opportunity. If the actual market for Trudhesa is smaller than we expect, our product revenue may be limited, and it may be more difficult for us to achieve or maintain profitability.

In addition, the FDA has required labeling restrictions for patients and uses of Trudhesa. For example, upper nasal space drug delivery may not be appropriate for use by patients with certain pre-existing conditions, such as chronic rhinitis with or without nasal polyposis or anatomical nasal obstruction.

If we are unable to maintain our commercial distribution capabilities, we will be unable to successfully commercialize Trudhesa.

15

Our ongoing liquidity issues have contributed, in part, to a loss of sales representatives that we do not currently plan to replace and we have also experienced increased pressure from suppliers and other commercial counterparties, including distributors, regarding payments from us. Our inability to retain sales representatives and distributor relationships, or an ability to obtain sufficient product from suppliers may delay or prevent our ability to make and fulfill sales, which would have a material adverse impact on our sales and may further reduce our cash runway, accelerating the potential need to seek alternatives, including bankruptcy proceedings.

Problems related to large-scale commercial manufacturing could cause delays in product launches, an increase in costs or shortages of Trudhesa.

Manufacturing finished drug products, especially in large quantities, is complex. The commercialization of Trudhesa requires several manufacturing steps and involves complex techniques to assure quality and sufficient quantity, especially as the manufacturing scale increases. Trudhesa will need to be made consistently and in compliance with a clearly defined manufacturing process pursuant to FDA regulations. Accordingly, it will be essential to be able to validate and control the manufacturing process to assure that it is reproducible. Slight deviations anywhere in the manufacturing process, including obtaining materials, filling, labeling, packaging, storage, shipping, quality control and testing, may result in lot failures, delay in the release of lots, product recalls or spoilage. Success rates can vary dramatically at different stages of the manufacturing process, which can lower yields and increase costs. We may experience deviations in the manufacturing process that may take significant time and resources to resolve and, if unresolved, may affect manufacturing output and cause us to fail to satisfy contractual commitments, lead to delays in our clinical trials or result in litigation or regulatory action. Such actions would hinder our ability to meet contractual obligations and could cause material adverse consequences for our business. In addition to the complexities of large-scale manufacturing, our ongoing liquidity issues also present significant challenges to current operations, including as a result of increased pressure from suppliers regarding payments from us, which may delay or prevent our ability to obtain sufficient product from suppliers.

Reimbursement for any approved products may be limited or unavailable, which could make it difficult for us to sell Trudhesa profitably.

In both domestic and foreign markets, sales of Trudhesa depend, in part, on the extent to which the costs of any future product candidates will be covered by third-party payors, such as government health care programs, commercial insurance and managed health care organizations. These third-party payors decide which drugs will be covered and establish reimbursement levels for those drugs. The containment of health care costs has become a priority of foreign and domestic governments as well as private third-party payors. The prices of drugs have been a focus in this effort. Governments and private third-party payors have attempted to control costs by limiting coverage and the amount of reimbursement for particular medications, which could affect our ability to sell any approved products profitably. Cost-control initiatives could cause us to decrease the price we might establish for any approved products, which could result in lower than anticipated product revenues.

Reimbursement by a third-party payor may depend upon a number of factors, including the third-party payor’s determination that use of a product is:

•a covered benefit under its health plan;

•safe, effective and medically necessary;

•appropriate for the specific patient;

•cost-effective relative to other alternatives, including generic products; and

•neither experimental nor investigational.

Adverse pricing limitations may hinder our ability to recoup our investment in historical products.

Obtaining coverage and reimbursement approval for a product from a government or other third-party payor is a time-consuming and costly process that could require us to provide supporting scientific, clinical and cost-effectiveness data for the use of any future product candidates to the payor. Further, there is significant uncertainty related to third-party payor coverage and reimbursement of newly approved product candidates. We may not be able to provide data sufficient to gain acceptance with respect to coverage and reimbursement. Also, we cannot be sure that reimbursement amounts will not reduce the demand for, or the price of, Trudhesa. In addition, in the United States, third-party payors are increasingly attempting to contain health care costs by limiting both coverage and the level of reimbursement of new product candidates. As a result, significant uncertainty exists as to whether

16

and how much third-party payors will reimburse patients for their use of newly approved product candidates, which in turn will put pressure on pricing.

Price controls may be imposed in foreign markets, which may adversely affect our future profitability.

In some countries, including member states of the European Union, the pricing of prescription drugs is subject to governmental control. In these countries, pricing negotiations with governmental authorities can take considerable time after receipt of marketing approval for a product. In addition, there can be considerable pressure by governments and other stakeholders on prices and reimbursement levels, including as part of cost containment measures. Political, economic and regulatory developments may further complicate pricing negotiations, and pricing negotiations may continue after reimbursement has been obtained. Reference pricing used by various European Union member states and other countries and parallel distribution, or arbitrage between low-priced and high-priced member states, can further reduce prices. Publication of discounts by third-party payors or authorities may lead to further pressure on the prices or reimbursement levels within the country of publication and other countries.

We face substantial competition, which may result in others discovering, developing or commercializing product candidates before, or more successfully, than we do.

The development and commercialization of new and improved pharmaceutical products is highly competitive. There are many pharmaceutical companies, biotechnology companies, public and private universities, government agencies and research organizations actively engaged in research and development of product candidates which may target the same markets as Trudhesa. Our future success depends on our ability to demonstrate and maintain a competitive advantage with respect to the design, development and commercialization of any of Trudhesa within those markets.

For Trudhesa we are aware of the several competing efforts. Approved acute treatments for migraine include triptans, gepants (such as ZavzpretTM and Nurtec® both commercialized by Pfizer Inc.), lasmiditan and alternative formulations of DHE, such as Migranal, which is administered intranasally. Some of these competitor products have been launched. Some of these competitors are also developing product candidates that utilize alternative routes of administration, including Amneal Pharmaceuticals, Inc., Satsuma Pharmaceuticals, Inc. and Zosano Pharma Corporation, whose product candidates use nasal pumps or other drug delivery technologies.

One or more of our competitors may utilize their expertise in other methods of pharmaceutical drug delivery to develop and obtain approval for upper nasal space delivery products that may compete with Trudhesa. These competitors may include Aegis, Optinose and other smaller pharmaceutical companies. Many of our competitors have significantly greater financial, technical, manufacturing, marketing, sales and supply resources or experience than we have had to date. Our ability to compete effectively will depend, in part, on the timing and scope of regulatory approvals for these product candidates, the availability and cost of manufacturing, marketing and sales capabilities, price, reimbursement coverage and patent position, the safety and effectiveness of any of our future product candidates, the ease with which any of our future product candidates can be administered and the extent to which patients accept relatively new routes of administration. Competing products could present superior treatment alternatives, including by being more effective, safer, less expensive or marketed and sold more effectively than any product candidates we may develop. Competitive products may reduce the demand and price for Trudhesa, making it obsolete or noncompetitive before we recover the expense of developing and commercializing. Our competitors could also recruit our employees, which could negatively impact our level of expertise and our ability to execute our business plan.

We rely entirely on third parties for the manufacturing of Trudhesa. If such third parties cease to provide services or require changes to our payment terms, or if we encounter difficulties in negotiating manufacturing and supply agreements with third-party manufacturers and suppliers of our POD device and the active ingredients in Trudhesa would be impaired.

We do not own any manufacturing facilities and have limited experience in commercial manufacturing. We currently rely, and expect to continue to rely, on a limited number of experienced personnel and contract manufacturing organizations, or CMOs, and suppliers, including in some cases single-source suppliers, who would assist in the production, assembly, test, validation, supply, storage and distribution of Trudhesa, and we do not

17

control their activities. While we have developmental and commercial supply agreements in place with some of our key suppliers, we may not be able to obtain terms that are favorable to us or enter into commercial manufacturing and supply agreements at all with other necessary third parties. If we are unable to enter into such agreements on commercially reasonable terms, our ability to commercialize Trudhesa would be impaired, and our business, financial condition and results of operations would be materially adversely affected.

Further, given our current liquidity issues, we may be delayed in paying these third parties, or these third parties may demand accelerated payment in advance of providing necessary supplies of Trudhesa. Any such change to our payment obligations may decrease the availability of Trudhesa and materially impair our ability to further commercialize Trudhesa.

If product sales for Trudhesa grow, Trudhesa will require production processes to be scaled up. We will be dependent on external manufacturers and suppliers to ensure that their manufacturing processes can be scaled up adequately such that we are able to supply the market. If any of our key suppliers are unable or unwilling to scale up production, our product candidates would be impaired, and our business, financial condition and results of operations would be materially adversely affected.

If third-party manufacturers, wholesalers and distributors fail to perform as expected, our costs may be higher than expected.

Our reliance on third-party manufacturers, wholesalers and distributors exposes us to the following risks, any of which could result in higher costs or deprive us of potential product revenues:

•our CMOs, or other third parties we rely on, may require changes to our payment terms if they consider us unlikely to pay in a timely manner, accelerating our expected cash usage or delaying our access to Trudhesa supply;

•our CMOs, or other third parties we rely on, may encounter difficulties in achieving the volume of production needed to satisfy commercial demand, may experience technical issues that impact quality or compliance with applicable and strictly enforced regulations governing the manufacture of pharmaceutical products, and may experience shortages of qualified personnel to adequately staff production operations;

•our CMOs, wholesalers and distributors may misappropriate our proprietary information; and

•if our CMOs, wholesalers and distributors were to terminate our arrangements or fail to meet their contractual obligations, we may be forced to delay our commercial programs.