false

0001039280

0001039280

2024-05-20

2024-05-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 20, 2024

Commission

file number: 0-22773

NETSOL

TECHNOLOGIES, INC.

(Exact

name of small business issuer as specified in its charter)

| nevada |

|

95-4627685 |

| (State

or other Jurisdiction of |

|

(I.R.S.

Employer NO.) |

| Incorporation

or Organization) |

|

|

16000

Ventura Blvd. Suite 770

Encino,

CA 91436

(Address

of principal executive offices) (Zip Code)

(818)

222-9195 / (818) 222-9197

(Issuer’s

telephone/facsimile numbers, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $.01 par value

per share |

|

NTWK |

|

NASDAQ |

Item

2.02 Results of Operations and Financial Condition.

On

May 20, 2024, NetSol Technologies, Inc. issued a press release announcing results of operations and financial conditions for the quarter

ended March 31, 2024. The press release is furnished as Exhibit 99.1 to this Form 8-K.

The

information in this report shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated

by reference into any registration statement or other document field under the Securities Act of 1933, as amended, or the Exchange Act,

except as shall be expressly set forth by specific reference in such filing.

Exhibits

SIGNATURES

In

accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

|

NETSOL

TECHNOLOGIES, INC. |

| |

|

|

|

| Date: |

May

20, 2024 |

|

/s/

Najeeb Ghauri |

| |

|

|

NAJEEB

GHAURI |

| |

|

|

Chief

Executive Officer |

| Date: |

May

20, 2024 |

|

/s/

Roger Almond |

| |

|

|

ROGER

ALMOND |

| |

|

|

Chief

Financial Officer |

Exhibit

99.1

NETSOL

Technologies Reports 14% Revenue Growth and EPS of $0.03 in Fiscal Third Quarter 2024

| |

● |

14% increase in Total Revenues to $15.5 million in

3Q ‘24 |

| |

● |

60% increase in 3Q ‘24 Services Revenues to $7.8

million compared to 3Q ‘23 |

| |

● |

3Q ‘24 Gross Margins of 48% increased from 35%

in 3Q ‘23 |

| |

● |

Third consecutive quarter of profitability |

| |

● |

On pace to meet target revenue range of $60 - $61 million

for FY ‘24 |

| |

● |

Targeting FY ‘24 Subscription and Support Revenue

of $28 million |

| |

● |

Establish AI integration as major company wide initiative

|

Encino,

Calif., May 20, 2024 – NETSOL Technologies, Inc. (Nasdaq: NTWK), a global business services and asset finance

solutions provider, reported results for the third quarter and nine months of fiscal 2024 ended March 31, 2024.

Najeeb

Ghauri, Co-Founder and Chief Executive Officer of NETSOL Technologies, commented, “The third quarter of 2024 was another very strong

quarter for our business highlighted by revenue growth and our third straight quarter of profitability. We demonstrated NETSOL’s

ability to deliver profitable results without the recognition of significant license fees, showcasing the enhanced strength and reliability

of our model as we continue to win new customers on a global scale.”

Fiscal

Third Quarter 2024 Financial Results

Total

net revenues for the third quarter of fiscal 2024 increased 14% to $15.5 million, compared with $13.5 million in the prior year period.

On a constant currency basis, total net revenues were $15.6 million.

| |

● |

License

fees were $558,000 compared with $2.0 million in the prior year period. License fees on a constant currency basis were $577,000. |

| |

● |

Total

subscription (SaaS and Cloud) and support revenues were $7.1 million compared with $6.7 million in the prior year period. Total subscription

and support revenues on a constant currency basis were $7.2 million. |

| |

● |

Total

services revenues were $7.8 million, compared with $4.9 million in the prior year period. Total services revenues on a constant currency

basis were $7.8 million. |

Gross

profit for the third quarter of fiscal 2024 was $7.5 million or 48% of net revenues, compared to $4.7 million or 35% of net revenues

in the third quarter of fiscal 2023. On a constant currency basis, gross profit for the third quarter of fiscal 2024 was $7.2 million

or 46% of net revenues as measured on a constant currency basis.

Operating

expenses for the third quarter of fiscal 2024 were $6.2 million or 40% of sales compared to $5.6 million or 42% of sales for the third

quarter of fiscal 2023. On a constant currency basis, operating expenses for the third quarter of fiscal 2024 increased to $6.3 million

or 41% of sales on a constant currency basis.

GAAP

net income attributable to NETSOL for the third quarter of fiscal 2024 totaled $328,000 or $0.03 per diluted share, compared with a GAAP

net income of $2.5 million or $0.23 per diluted share in the third quarter of fiscal 2023. Included in GAAP net income attributable to

NETSOL was a loss of $(964,000) on foreign currency exchange transactions in the third quarter of fiscal 2024, compared to a gain of

$5.4 million in the prior year period. As most contracts are either in U.S. dollars or Euros, currency fluctuations will yield foreign

currency exchange gains or losses depending on the value of other currencies compared to the U.S. dollar and the Euro. On a constant

currency basis, GAAP net loss attributable to NETSOL for the third quarter of fiscal 2024 totaled $(35,000) or $(0.003) per diluted share.

Non-GAAP

adjusted EBITDA for the third quarter of fiscal 2024 was $810,000 or $0.07 per diluted share, compared with non-GAAP adjusted EBITDA

of $3.3 million or $0.29 per diluted share in the third quarter of fiscal 2023 (see note regarding “Use of Non-GAAP Financial Measures,”

below for further discussion of this non-GAAP measure).

Nine

Months Ended March 31, 2024 Financial Results

Total

net revenues for the nine months ended March 31, 2024, were $44.9 million, compared to $38.6 million in the prior year period. On a constant

currency basis, total net revenues were $45.2 million.

| |

● |

License

fees were $4.8 million compared with $2.2 million in the prior year period. License fees on a constant currency basis were $4.9 million. |

| |

● |

Total

subscription (SaaS and Cloud) and support revenues for the nine months ended March 31, 2024, were $20.5 million compared with $19.2

million in the prior year period. Total subscription and support revenues on a constant currency basis were $20.5 million. |

| |

● |

Total

services revenues were $19.6 million compared with $17.2 million in the prior year period. Total services revenues on a constant

currency basis were $19.8 million. |

Gross

profit for the nine months ended March 31, 2024, was $20.8 million or 46% of net revenues, compared with $12.1 million or 31% of net

revenues in the prior year period. On a constant currency basis, gross profit for the nine months ended March 31, 2024, was $17.8 million

or 39% of net revenues as measured on a constant currency basis.

Operating

expenses for the nine months ended March 31, 2024, were $18.1 million or 40% of sales compared with $18.0 million or 47% of sales in

the prior year period. On a constant currency basis, operating expenses for the nine months ended March 31, 2024, were $19.5 million

or 43% of sales on a constant currency basis.

GAAP

net income attributable to NETSOL for the nine months ended March 31, 2024, totaled $767,000 or $0.07 per diluted share, compared with

a GAAP net loss of $(169,000) or $(0.01) per diluted share in the prior year period. Included in GAAP net income attributable to NETSOL

was a loss of $(1.1 million) on foreign currency exchange transactions for the nine months ended March 31, 2024, compared to a gain of

$7.4 million in the prior year period. On a constant currency basis, GAAP net loss attributable to NETSOL for the first nine months of

fiscal 2024 totaled $(2.4 million) or $(0.21) per diluted share.

Non-GAAP

adjusted EBITDA for the nine months ended March 31, 2024, was $2.0 million or $0.18 per diluted share, compared with non-GAAP adjusted

EBITDA of $1.9 million or $0.17 per diluted share in the prior year period (see note regarding “Use of Non-GAAP Financial Measures,”

below for further discussion of this non-GAAP measure).

At

March 31, 2024, cash and cash equivalents were $12.3 million. Total NETSOL stockholders’ equity at March 31, 2024, was $35.3 million,

or $3.10 per share.

Management

Commentary

“These

past several quarters have showcased our hybrid license and SaaS model at work,” Mr. Ghauri stated. “We recognized substantial

license fees in the first half of fiscal 2024, and these contracts are now generating services revenues for our business with services

revenues in the third quarter of fiscal 2024 increasing approximately 60% compared to the third quarter of fiscal 2023. We have a strong

sales pipeline of licensing and SaaS opportunities in our established markets and are working diligently to expand our pipeline in the

United States. As we continue to win new contracts, we expect to realize both license fees and services revenues on a more consistent

basis which, based on our recent performance, we believe will drive enhanced profitability for our business.

“We

continue to make progress advancing our initiatives in the U.S. market,” Mr. Ghauri continued. “We’re expanding our

pipeline of opportunities in this region and remain committed to hiring the best talent available. We’re intently focused on the

continuous innovation and improvement of our offerings to meet the diverse demands of our customers, and we’re integrating leading

technology including deep learning AI algorithms.

“To

that end, we have launched a company wide AI initiative to reduce internal costs and enhance external quality improvements. We have nearly

three decades of internal program management data, which we intend to use to train our AI use cases. We are also in the process of creating

industry leading AI use cases for our clients to help improve their business metrics with an anticipated launch of several new AI-based

offerings in the calendar year.

“We’re

very pleased with our performance in both the third quarter and the fiscal year to date and are beginning to realize the strength of

our business model as we drive revenue growth and consistent profitability. Looking ahead, we’re encouraged by our pipeline of

license and SaaS deals in our established markets, and we’re committed to allocating capital to our many growth opportunities,

specifically the United States. Given our results, we remain confident in our expectation of double-digit organic revenue growth and

improved margins and are on pace to reach our target revenue range of between $60 million and $61 million for the full year of 2024,”

Mr. Ghauri concluded.

Conference

Call

NETSOL

Technologies management will hold a conference call today (May 20, 2024) at 9:00 a.m. Eastern Time (6:00 a.m. Pacific Time) to discuss

these financial results. A question-and-answer session will follow management’s presentation.

U.S.

dial-in: 800-343-4849

International

dial-in: 203-518-9848

Please

call the conference telephone number 5-10 minutes prior to the start time and provide the operator with the conference ID: NETSOL. The

operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Investor

Relations at 818-222-9195.

The

conference call will also be broadcast live and available for replay here, along with additional replay access being provided

through the company information section of NETSOL’s website.

A

telephone replay of the conference call will be available approximately three hours after the call concludes through Monday, June 3,

2024.

Toll-free

replay number: 844-512-2921

International

replay number: 412-317-6671

Replay

ID: 11155702

About

NETSOL Technologies

NETSOL

Technologies, Inc. (Nasdaq: NTWK) is a worldwide provider of IT and enterprise software solutions primarily serving the global leasing

and finance industry. The Company’s suite of applications is backed by 40 years of domain expertise and supported by a committed

team of professionals placed in ten strategically located support and delivery centers throughout the world. NETSOL’s products

help companies transform their finance and leasing operations, providing a fully automated asset-based finance solution covering the

complete leasing and finance lifecycle.

Forward-Looking

Statements

This

press release may contain forward-looking statements relating to the development of the Company’s products and services and future

operation results, including statements regarding the Company that are subject to certain risks and uncertainties that could cause actual

results to differ materially from those projected. The words “expects,” “anticipates,” variations of such words,

and similar expressions, identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995,

but their absence does not mean that the statement is not forward-looking. These statements are not guarantees of future performance

and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Factors that could affect the Company’s

actual results include the progress and costs of the development of products and services and the timing of the market acceptance. The

subject Companies expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein

to reflect any change in the company’s expectations with regard thereto or any change in events, conditions or circumstances upon

which any statement is based.

Use

of Non-GAAP Financial Measures

The

reconciliation of Adjusted EBITDA to net income, the most comparable financial measure based upon GAAP, as well as a further explanation

of adjusted EBITDA, is included in the financial tables in Schedule 4 of this press release.

Investor

Relations Contact:

IMS

Investor Relations

netsol@imsinvestorrelations.com

+1

203-972-9200

NETSOL

Technologies, Inc. and Subsidiaries

Schedule

1: Consolidated Balance Sheets

| | |

As of | | |

As of | |

| |

March 31, 2024 | | |

June 30, 2023 | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 12,338,642 | | |

$ | 15,533,254 | |

| Accounts receivable, net of allowance of $414,745 and $420,354 | |

| 15,826,210 | | |

| 11,714,422 | |

| Revenues in excess of billings, net of allowance of $116,023 and $1,380,141 | |

| 15,659,806 | | |

| 12,377,677 | |

| Other current assets | |

| 2,398,403 | | |

| 1,978,514 | |

| Total current assets | |

| 46,223,061 | | |

| 41,603,867 | |

| Revenues in excess of billings, net - long term | |

| 752,582 | | |

| - | |

| Property and equipment, net | |

| 5,505,609 | | |

| 6,161,186 | |

| Right of use assets - operating leases | |

| 1,490,669 | | |

| 1,151,575 | |

| Other assets | |

| 32,341 | | |

| 32,327 | |

| Intangible assets, net | |

| - | | |

| 127,931 | |

| Goodwill | |

| 9,302,524 | | |

| 9,302,524 | |

| Total assets | |

$ | 63,306,786 | | |

$ | 58,379,410 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 6,707,937 | | |

$ | 6,552,181 | |

| Current portion of loans and obligations under finance leases | |

| 6,047,511 | | |

| 5,779,510 | |

| Current portion of operating lease obligations | |

| 635,168 | | |

| 505,237 | |

| Unearned revenue | |

| 9,503,548 | | |

| 7,932,306 | |

| Total current liabilities | |

| 22,894,164 | | |

| 20,769,234 | |

| Loans and obligations under finance leases; less current maturities | |

| 130,381 | | |

| 176,229 | |

| Operating lease obligations; less current maturities | |

| 837,756 | | |

| 652,194 | |

| Total liabilities | |

| 23,862,301 | | |

| 21,597,657 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $.01 par value; 500,000 shares authorized; | |

| - | | |

| - | |

| Common stock, $.01 par value; 14,500,000 shares authorized; 12,344,271 shares issued and 11,405,240 outstanding as of March 31,

2024 , 12,284,887 shares issued and 11,345,856 outstanding as of June 30, 2023 | |

| 123,445 | | |

| 122,850 | |

| Additional paid-in-capital | |

| 128,736,328 | | |

| 128,476,048 | |

| Treasury stock (at cost, 939,031 shares as of March 31, 2024 and June 30, 2023) | |

| (3,920,856 | ) | |

| (3,920,856 | ) |

| Accumulated deficit | |

| (44,129,431 | ) | |

| (44,896,186 | ) |

| Other comprehensive loss | |

| (45,505,920 | ) | |

| (45,975,156 | ) |

| Total NetSol stockholders’ equity | |

| 35,303,566 | | |

| 33,806,700 | |

| Non-controlling interest | |

| 4,140,919 | | |

| 2,975,053 | |

| Total stockholders’ equity | |

| 39,444,485 | | |

| 36,781,753 | |

| Total liabilities and stockholders’ equity | |

$ | 63,306,786 | | |

$ | 58,379,410 | |

NETSOL

Technologies, Inc. and Subsidiaries

Schedule

2: Consolidated Statement of Operations

| | |

For

the Three Months | | |

For

the Nine Months | |

| | |

Ended

March 31, | | |

Ended

March 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net

Revenues: | |

| | | |

| | | |

| | | |

| | |

| License

fees | |

$ | 558,340 | | |

$ | 1,982,985 | | |

$ | 4,829,242 | | |

$ | 2,248,829 | |

| Subscription

and support | |

| 7,140,358 | | |

| 6,656,082 | | |

| 20,480,382 | | |

| 19,175,585 | |

| Services | |

| 7,765,818 | | |

| 4,867,322 | | |

| 19,635,014 | | |

| 17,178,452 | |

| Total

net revenues | |

| 15,464,516 | | |

| 13,506,389 | | |

| 44,944,638 | | |

| 38,602,866 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost

of revenues | |

| 7,989,696 | | |

| 8,801,360 | | |

| 24,132,064 | | |

| 26,503,377 | |

| Gross

profit | |

| 7,474,820 | | |

| 4,705,029 | | |

| 20,812,574 | | |

| 12,099,489 | |

| Operating

expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling,

general and administrative | |

| 5,811,335 | | |

| 5,333,202 | | |

| 17,051,798 | | |

| 16,727,836 | |

| Research

and development cost | |

| 345,582 | | |

| 302,262 | | |

| 1,065,412 | | |

| 1,244,793 | |

| Total

operating expenses | |

| 6,156,917 | | |

| 5,635,464 | | |

| 18,117,210 | | |

| 17,972,629 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income

(loss) from operations | |

| 1,317,903 | | |

| (930,435 | ) | |

| 2,695,364 | | |

| (5,873,140 | ) |

| Other

income and (expenses) | |

| | | |

| | | |

| | | |

| | |

| Interest

expense | |

| (289,677 | ) | |

| (188,137 | ) | |

| (856,016 | ) | |

| (512,110 | ) |

| Interest

income | |

| 376,466 | | |

| 263,794 | | |

| 1,259,464 | | |

| 1,005,557 | |

| Gain

(loss) on foreign currency exchange transactions | |

| (963,887 | ) | |

| 5,385,591 | | |

| (1,112,757 | ) | |

| 7,358,519 | |

| Share

of net loss from equity investment | |

| - | | |

| 2,377 | | |

| - | | |

| 7,510 | |

| Other

income (expense) | |

| 21,634 | | |

| (62,941 | ) | |

| 22,210 | | |

| 57,383 | |

| Total

other income (expenses) | |

| (855,464 | ) | |

| 5,400,684 | | |

| (687,099 | ) | |

| 7,916,859 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net

income before income taxes | |

| 462,439 | | |

| 4,470,249 | | |

| 2,008,265 | | |

| 2,043,719 | |

| Income

tax provision | |

| (146,569 | ) | |

| (227,718 | ) | |

| (418,517 | ) | |

| (641,122 | ) |

| Net

income | |

| 315,870 | | |

| 4,242,531 | | |

| 1,589,748 | | |

| 1,402,597 | |

| Non-controlling

interest | |

| 11,679 | | |

| (1,697,908 | ) | |

| (822,993 | ) | |

| (1,571,629 | ) |

| Net

income (loss) attributable to NetSol | |

$ | 327,549 | | |

$ | 2,544,623 | | |

$ | 766,755 | | |

$ | (169,032 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

income (loss) per share: | |

| | | |

| | | |

| | | |

| | |

| Net

income (loss) per common share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.03 | | |

$ | 0.23 | | |

$ | 0.07 | | |

$ | (0.01 | ) |

| Diluted | |

$ | 0.03 | | |

$ | 0.23 | | |

$ | 0.07 | | |

$ | (0.01 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted

average number of shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 11,390,888 | | |

| 11,283,954 | | |

| 11,369,778 | | |

| 11,270,466 | |

| Diluted | |

| 11,430,493 | | |

| 11,283,954 | | |

| 11,409,383 | | |

| 11,270,466 | |

NETSOL

Technologies, Inc. and Subsidiaries

Schedule

3: Consolidated Statement of Cash Flows

| | |

For the Nine Months | |

| | |

Ended March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 1,589,748 | | |

$ | 1,402,597 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,351,239 | | |

| 2,519,469 | |

| Provision for bad debts | |

| 9,739 | | |

| 7,648 | |

| Share of net (gain) loss from investment under equity method | |

| - | | |

| (7,510 | ) |

| (Gain) loss on sale of assets | |

| (1,154 | ) | |

| 56,494 | |

| Stock based compensation | |

| 260,875 | | |

| 198,559 | |

| Changes in

operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (3,922,773 | ) | |

| (1,855,899 | ) |

| Revenues in excess of billing | |

| (3,904,609 | ) | |

| 240,324 | |

| Other current assets | |

| (1,525 | ) | |

| (621,731 | ) |

| Accounts payable and accrued expenses | |

| 77,541 | | |

| 1,321,289 | |

| Unearned revenue | |

| 938,242 | | |

| (696,621 | ) |

| Net cash provided

by (used in) operating activities | |

| (3,602,677 | ) | |

| 2,564,619 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (948,337 | ) | |

| (1,575,059 | ) |

| Sales of property and equipment | |

| 125,886 | | |

| 153,402 | |

| Net cash used in

investing activities | |

| (822,451 | ) | |

| (1,421,657 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from bank loans | |

| 340,847 | | |

| 270,292 | |

| Payments on finance lease obligations and loans - net | |

| (307,235 | ) | |

| (787,641 | ) |

| Net cash provided by (used

in) financing activities | |

| 33,612 | | |

| (517,349 | ) |

| Effect of exchange rate changes | |

| 1,196,904 | | |

| (9,329,913 | ) |

| Net decrease in cash and cash equivalents | |

| (3,194,612 | ) | |

| (8,704,300 | ) |

| Cash and cash equivalents at beginning of the period | |

| 15,533,254 | | |

| 23,963,797 | |

| Cash and cash equivalents at end of period | |

$ | 12,338,642 | | |

$ | 15,259,497 | |

NETSOL

Technologies, Inc. and Subsidiaries

Schedule

4: Reconciliation to GAAP

| | |

For the Three Months | | |

For the Nine Months | |

| | |

Ended March 31, | | |

Ended March 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net Income (loss) attributable to NetSol | |

$ | 327,549 | | |

$ | 2,544,623 | | |

$ | 766,755 | | |

$ | (169,032 | ) |

| Non-controlling interest | |

| (11,679 | ) | |

| 1,697,908 | | |

| 822,993 | | |

| 1,571,629 | |

| Income taxes | |

| 146,569 | | |

| 227,718 | | |

| 418,517 | | |

| 641,122 | |

| Depreciation and amortization | |

| 391,290 | | |

| 782,966 | | |

| 1,351,239 | | |

| 2,519,469 | |

| Interest expense | |

| 289,677 | | |

| 188,137 | | |

| 856,016 | | |

| 512,110 | |

| Interest (income) | |

| (376,466 | ) | |

| (263,794 | ) | |

| (1,259,464 | ) | |

| (1,005,557 | ) |

| EBITDA | |

$ | 766,940 | | |

$ | 5,177,558 | | |

$ | 2,956,056 | | |

$ | 4,069,741 | |

| Add back: | |

| | | |

| | | |

| | | |

| | |

| Non-cash stock-based compensation | |

| 149,088 | | |

| 52,392 | | |

| 260,875 | | |

| 198,559 | |

| Adjusted EBITDA, gross | |

$ | 916,028 | | |

$ | 5,229,950 | | |

$ | 3,216,931 | | |

$ | 4,268,300 | |

| Less non-controlling interest (a) | |

| (106,463 | ) | |

| (1,971,602 | ) | |

| (1,216,040 | ) | |

| (2,363,774 | ) |

| Adjusted EBITDA, net | |

$ | 809,565 | | |

$ | 3,258,348 | | |

$ | 2,000,891 | | |

$ | 1,904,526 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average number of shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 11,390,888 | | |

| 11,283,954 | | |

| 11,369,778 | | |

| 11,270,466 | |

| Diluted | |

| 11,430,493 | | |

| 11,283,954 | | |

| 11,409,383 | | |

| 11,270,466 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic adjusted EBITDA | |

$ | 0.07 | | |

$ | 0.29 | | |

$ | 0.18 | | |

$ | 0.17 | |

| Diluted adjusted EBITDA | |

$ | 0.07 | | |

$ | 0.29 | | |

$ | 0.18 | | |

$ | 0.17 | |

| | |

| | | |

| | | |

| | | |

| | |

| (a)The reconciliation of adjusted EBITDA of non-controlling interest to net income attributable to non-controlling interest is as follows | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (loss) attributable to non-controlling interest | |

$ | (11,679 | ) | |

$ | 1,697,908 | | |

$ | 822,993 | | |

$ | 1,571,629 | |

| Income Taxes | |

| 43,852 | | |

| 70,033 | | |

| 155,636 | | |

| 198,349 | |

| Depreciation and amortization | |

| 97,010 | | |

| 219,759 | | |

| 348,092 | | |

| 713,676 | |

| Interest expense | |

| 89,738 | | |

| 57,797 | | |

| 266,922 | | |

| 157,929 | |

| Interest (income) | |

| (115,021 | ) | |

| (77,988 | ) | |

| (387,690 | ) | |

| (303,489 | ) |

| EBITDA | |

$ | 103,900 | | |

$ | 1,967,509 | | |

$ | 1,205,953 | | |

$ | 2,338,094 | |

| Add back: | |

| | | |

| | | |

| | | |

| | |

| Non-cash stock-based compensation | |

| 2,563 | | |

| 4,093 | | |

| 10,087 | | |

| 25,680 | |

| Adjusted EBITDA of non-controlling interest | |

$ | 106,463 | | |

$ | 1,971,602 | | |

$ | 1,216,040 | | |

$ | 2,363,774 | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

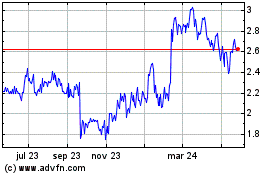

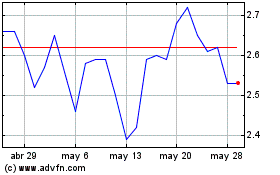

NetSol Technologies (NASDAQ:NTWK)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

NetSol Technologies (NASDAQ:NTWK)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024