As

filed with the Securities and Exchange Commission on June 14, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

NuZee,

Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

5900 |

|

38-3849791 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Primary

Standard Industrial

Classification

Code No.) |

|

(I.R.S.

Employer

Identification

No.) |

2865

Scott St. Suite 107

Vista,

California 92081

(760)

295-2408

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jianshuang

Wang

Randell

Weaver

Co-Chief

Executive Officer

NuZee,

Inc.

2865

Scott St. Suite 107

Vista,

California 92081

(760)

295-2408

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

With

copies to:

Alan

A. Lanis, Jr.

Baker

& Hostetler LLP

1900

Avenue of the Stars, Suite 2700

Los

Angeles, California 90067

(310)

820-8800

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

|

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

|

☒ |

| |

|

|

Emerging

growth company |

|

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, and it

is not soliciting an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated June 14, 2024

Prospectus

NuZee,

Inc.

Up

to 1,310,167

Shares

of

Common

Stock

by

Selling

Stockholders

This

prospectus relates to the resale from time to time by the selling stockholders named in this prospectus (the “Selling Stockholders”)

of up to 1,310,167 shares of our common stock, par value $0.00001 per share (“Common Stock”), which includes: (i)

1,089,020 shares of Common Stock held directly or indirectly by certain Selling Stockholders; and (ii) up to 221,147 shares of

Common Stock issuable upon the exercise of warrants held directly or indirectly by certain Selling Stockholders. We will not receive

any proceeds from the sale of such shares of Common Stock by the Selling Stockholders.

We

will bear all of the registration expenses incurred in connection with the registration of these shares of Common Stock. The Selling

Stockholders will pay discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any,

incurred for the sale of these shares of Common Stock.

The

Selling Stockholders identified in this prospectus may offer the shares from time to time on terms to be determined at the time of sale

through ordinary brokerage transactions or through any other means described in this prospectus under the caption “Plan of Distribution.”

The shares may be sold at fixed prices, at prevailing market prices, at prices related to prevailing market prices or at negotiated prices.

For more information on the Selling Stockholders, see the section entitled “Selling Stockholders.”

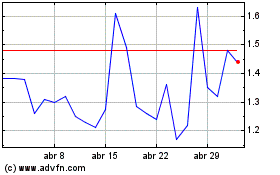

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire

prospectus and any amendments or supplements carefully before you make your investment decision. Our Common Stock is listed on the Nasdaq

Capital Market (“Nasdaq”) under the symbol “NUZE”. On June 13, 2024, the last reported sales price of

our Common Stock was $1.60 per share.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page

5 of this prospectus, as well as the other information contained in or incorporated by reference in this prospectus or in any accompanying

prospectus supplement before making a decision to invest in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is ,

2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”)

using the “shelf” registration process. Under this shelf registration process, the Selling Stockholders (or their pledgees,

donees, transferees or other successors-in-interest) may, from time to time, sell or otherwise dispose of the securities described in

this prospectus in one or more offerings. We will not receive any proceeds from the sale by such Selling Stockholders of the securities

offered by them described in this prospectus.

This

prospectus provides you with a general description of the shares of Common Stock that the Selling Stockholders may sell or otherwise

dispose of. You should rely only on the information provided in this prospectus, as well as the information incorporated by reference

into this prospectus and any applicable prospectus supplement. If there is any inconsistency between the information in this prospectus

and any prospectus supplement, you should rely on the information provided in the prospectus supplement. Neither we nor the Selling Stockholders

have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus

or any applicable prospectus supplement. Neither we nor the Selling Stockholders take responsibility for, and can provide no assurance

as to the reliability of, any other information that others may give you. You should not assume that the information in this prospectus

or any applicable prospectus supplement is accurate as of any date other than the date of the applicable document. Since the date of

this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations

and prospects may have changed. Neither we nor the Selling Stockholders will make an offer to sell these securities in any jurisdiction

where the offer or sale is not permitted.

We

may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or

change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective

amendment to the registration statement together with the information incorporated by reference herein or therein. For information about

the distribution of securities offered, please see “Plan of Distribution” below. You should carefully read both this

prospectus and any prospectus supplement, together with the additional information described in “Where You Can Find More Information”

and “Incorporation of Certain Information by Reference” before you make any investment decisions regarding the securities.

You may obtain the information incorporated by reference into this prospectus without charge by following the instructions under the

headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

This

prospectus summarizes certain documents and other information, and we refer you to them for a more complete understanding of what we

discuss in this prospectus. All of the summaries are qualified in their entirety by the actual documents. In making an investment decision,

you must rely on your own examination of the Company and the terms of the offering and the securities, including the merits and risks

involved.

We

are not making any representation to any purchasers of the securities regarding the legality of an investment in the securities by such

purchasers. You should not consider any information in this prospectus to be legal, business or tax advice. You should consult your own

attorney, business advisor or tax advisor for legal, business and tax advice regarding an investment in the securities.

Unless

the context indicates otherwise, references in this prospectus to the “Company,” “NuZee” “we,” “us,”

“our” and similar terms refer to NuZee, Inc.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, any prospectus supplement and any related free writing prospectus, including the information incorporated by reference herein

and therein, contain or may contain forward-looking statements, which reflect our current views with respect to, among other things,

future events and financial performance, our operations, strategies and expectations. The words “believe,” “may,”

“will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,”

“plan” and similar expressions are intended to identify these forward-looking statements. Any forward-looking statements

contained in this prospectus are based upon our historical performance and on our current plans, estimates and expectations. The inclusion

of this or any forward-looking information should not be regarded as a representation by us or any other person that the future plans,

estimates or expectations contemplated by us will be achieved. Such forward-looking statements are subject to various risks, uncertainties

and assumptions, including but not limited to global and domestic market and business conditions, our successful execution of business

and growth strategies and regulatory factors relevant to our business, as well as assumptions relating to our operations, financial results,

financial condition, business prospects, growth strategy and liquidity. Accordingly, there are or will be important factors that could

cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include, but

are not limited to, those described or incorporated by reference under “Risk Factors”. These factors should not be

construed as exhaustive and should be read in conjunction with the other cautionary statements that are included or incorporated by reference

in this prospectus or any applicable prospectus supplement. We operate in a very competitive and rapidly changing environment. New risks

emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in any forward-looking statements we may make. We undertake no obligation to publicly update or review any forward-looking statement,

whether as a result of new information or future developments, except as otherwise required by law.

SUMMARY

This

summary highlights selected information appearing elsewhere in or incorporated by reference into this prospectus. Because it is a summary,

it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire

prospectus and the documents incorporated by reference herein carefully, including the information referenced under the heading “Risk

Factors” and in our financial statements, together with any accompanying prospectus supplement. Unless otherwise indicated or the

context otherwise requires, all references in this prospectus to “we, ““us,” “our,” the “Company,”

“NuZee”and similar terms refer to NuZee, Inc. and its subsidiaries.

Overview

We

are a specialty coffee and technologies company and, we believe, a leading co-packer of single-serve pour over coffee in the United States,

as well as a preeminent co-packer of coffee brew bags, which is also referred to as tea-bag style coffee. In addition to our single-serve

pour over and coffee brew bag coffee products, we have expanded our product portfolio to offer a third type of single-serve coffee format,

DRIPKIT pour over products, as a result of our acquisition of substantially all of the assets of Dripkit, Inc. (“Dripkit”).

Our DRIPKIT pour over format features a large-size single-serve pour over pack that sits on top of the cup and delivers in our view a

barista-quality coffee experience to customers in the United States, Canada, and Mexico. Our mission is to leverage our position as a

co-packer at the forefront of the North American single-serve coffee market to revolutionize the way single-serve coffee is enjoyed in

the United States. Recently, we further expanded our product offerings to include bagged coffees for existing single-serve customers

as well as a new licensing relationship with Stone Brewing which will include both bagged and single-serve format coffee products. We

believe this expansion will allow us to increase manufacturing efficiency and better serve our customers and the market.

We

believe we are the only commercial-scale producer within the North American market that has the dual capacity to pack single-serve pour

over and brew bag coffee. We intend to leverage our position to become the commercial coffee producer of choice and aim to become the

preeminent leader for coffee companies seeking to enter into and grow within the single-serve coffee market in North America. With our

single-serve pour over and brew bag coffee we are paid per-package based on the number of single-serve coffee products produced by us.

With our bagged coffee products, we will be paid based on the number of completed bags delivered. Accordingly, we consider a portion

of our business model to be a form of tolling arrangement, as we receive a fee for almost every single-serve coffee product our co-packing

customers sell in the North American markets. Under the single-serve model, our risk related to owning and managing inventory is limited.

With our bagged coffees and the Stone Brewing licensing relationship, we expect to manage the production and related inventory which

will involve increased risk levels.

We

may also consider co-packaging other products that are complementary to our current product offerings and provide us with deeper access

to our customers. In addition, we are continually exploring potential strategic partnerships, co-ventures, and mergers, acquisitions,

or other transactions with existing and future business partners to generate additional business, drive growth, reduce manufacturing

costs, expand our product portfolio, enter into new markets, and further penetrate the markets in which we currently operate. Our goal

is to continue to expand our product portfolio to raise our visibility, consumer awareness and brand profile.

On

June 7, 2024, we entered into a share purchase agreement (“Share Purchase Agreement”) with Masateru Higashida, our former

chief executive officer and director. Pursuant to the terms of the Share Purchase Agreement, we are selling all the issued and outstanding

shares of our wholly-owned subsidiaries, NuZee KOREA Ltd. and NuZee Investment Co., Ltd. to Mr. Higashida for a purchase price of $10,000.

The closing of the sale of the shares is set to take place on or before June 30, 2024.

Corporate

Information

We

were incorporated in 2011 in Nevada as Havana Furnishings, Inc. NuZee Co. Ltd. was incorporated in 2011. NuZee Co. Ltd. merged into Havana

Furnishings, Inc. in 2013, at which time we changed our name to NuZee, Inc. Our principal executive and administrative offices are located

at 2865 Scott St. Suite 107, Vista, California 92081, and our telephone number is (760) 295-2408. Our website is www.mynuzee.com.

Information contained on or accessible through our website is not incorporated by reference into this prospectus and should not be considered

a part of this prospectus.

THE

OFFERING

| Common

stock offered by the selling stockholders |

|

1,310,167

shares. |

| |

|

|

| Common

stock outstanding |

|

2,387,434

shares (as of June 12, 2024 and including 222,972 shares issued upon the conversion of certain promissory notes on June 12, 2024). |

| |

|

|

| Use

of proceeds |

|

The

selling stockholders will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. We

will not receive proceeds from the sale of the shares by the selling stockholders. See “Use of Proceeds.” |

| |

|

|

| Risk

factors |

|

See

“Risk factors” on page S-5 of this prospectus and under similar headings in the documents incorporated by reference

into this prospectus supplement and the accompanying prospectus for a discussion of the factors you should carefully consider before

deciding to invest in our common stock. |

| |

|

|

| The

Nasdaq Capital Market symbol |

|

NUZE |

On

April 27, 2024, we entered into

a convertible note and warrant purchase agreement (the “Note and Warrant Purchase Agreement”) with certain investors (the

“April Investors”), providing for the private placement of convertible promissory notes in the aggregate principal amount

of $320,000 (the “Notes”) and warrants (the “Warrants”) to purchase up to an aggregate of 221,147 shares of Common

Stock. The Notes bear interest at an annual rate of 7% and have a maturity date of one-year following the issuance date. The Notes are

convertible any time prior to maturity by the holder into a number of shares of Common Stock equal to (i) the outstanding principal amount

of the Note plus any accrued but unpaid interest, divided by (ii) $1.447, which was the “Minimum Price” required under Nasdaq

Listing Rule 5635(d). Such price was calculated by taking the sum of (i) the average Nasdaq Official Closing Price (“NOCP”)

for the five trading days immediately preceding the signing of the Note and Warrant Purchase Agreement, and (ii) $0.125, the conversion

premium. If any such conversion of the Notes would result in the issuance of a fraction of a share, such number of shares to be issued

will be rounded up to the nearest whole share. If an event of default occurs, the then-outstanding principal amount of the Notes plus

any unpaid accrued interest will accelerate and, at the holder’s option, become immediately payable in cash.

Each

Warrant has an exercise price of $1.322 per share, which represents the average NOCP for the five trading days immediately preceding

the signing of the Note and Warrant Purchase Agreement in accordance with the “Minimum Price” requirements under Nasdaq Listing

Rule 5635(d). The Warrants are immediately exercisable and have a two-year term. The Warrants may not be exercised if the aggregate number

of shares of Common Stock beneficially owned by such holder would exceed 19.99% immediately after exercise thereof.

Concurrently

with entering into the Note and Warrant Purchase Agreement, we also entered into a registration rights agreement with April Investors,

in which we agreed to file one or more registration statements, including the registration statement of which this prospectus is a part,

as permissible and necessary to register under the Securities Act of 1933, as amended (the “Securities Act”), the resale

of (i) the shares of Common Stock issuable upon the conversion of the Notes and (ii) the shares of Common Stock issuable upon the exercise

of the Warrants.

On

June 12, 2024, the April Investors exercised their option to convert the outstanding principal and accrued interest of their respective

Notes into shares of Common Stock. As a result of such conversions of the Notes, we issued an aggregate of 222,972 shares of Common Stock

to the April Investors.

On

June 4, 2024, we entered into a securities purchase agreement (the “Securities Purchase Agreement”) with certain investors

(the “June Investors”), providing for the sale and issuance of 866,048 shares (the “Shares”) of Common Stock

for an aggregate purchase price of $1,500,000. In connection with the Securities Purchase Agreement, we entered into a registration rights

agreement with the June Investors, in which we agreed to file one or more registration statements including the registration statement

of which this prospectus is a part, as permissible and necessary to register under the Securities Act, the resale of the Shares.

RISK

FACTORS

Investing

in our securities involves risks. You should carefully consider the risks, uncertainties and other factors described in our most recent

Annual Report on Form 10-K, as supplemented and updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K

that we have filed or will file with the SEC, and in other documents which are incorporated by reference into this prospectus, including

all future filings we make with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), as well as the risk factors and other information contained in or incorporated by reference into any

accompanying prospectus supplement before investing in any of our securities. Our financial condition, results of operations or cash

flows could be materially adversely affected by any of these risks. The risks and uncertainties described in the documents incorporated

by reference herein are not the only risks and uncertainties that you may face. For more information about our SEC filings, please see

“Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

Sales

of a substantial number of our securities in the public market by our existing securityholders could cause the price of our shares of

Common Stock to fall.

Sales

of a substantial number of our shares of Common Stock on the public market by our existing securityholders, or the perception that those

sales might occur, could depress the market price of our shares of Common Stock and could impair our ability to raise capital through

the sale of additional equity securities. We are unable to predict the effect that such sales may have on the prevailing market price

of our shares of Common Stock.

USE

OF PROCEEDS

All

shares of Common Stock offered by this prospectus are being registered for resale by the Selling Stockholders. We will not receive any

of the proceeds from the sale of these securities. The Selling Stockholders will bear all commissions and discounts, if any, attributable

to the resale of the shares of Common Stock.

SELLING

STOCKHOLDERS

The

Selling Stockholders may from time to time offer and sell any or all of the shares of Common Stock set forth below pursuant to this prospectus.

When we refer to the “Selling Stockholders” in this prospectus, we mean the holders listed in the table below, and its respective

pledgees, donees, permitted transferees, assignees, successors and others who later come to hold any of such Selling Stockholder’s

interests in shares of Common Stock other than through a public sale.

The

following table sets forth, as of the date of this prospectus, the name of the Selling Stockholders for whom we are registering shares

for sale to the public, the number of shares of Common Stock beneficially owned by such Selling Stockholders prior to this offering,

the total number of shares of Common Stock that each Selling Stockholder may offer pursuant to this prospectus and the number of shares

of Common Stock that each Selling Stockholder will beneficially own after this offering. Except as noted below, the Selling Stockholders

do not have, or within the past three years has not had, any material relationship with us or any of our predecessors or affiliates and

the selling stockholder is not or was not affiliated with registered broker-dealers.

Based

on the information provided to us by the Selling Stockholders, assuming that each Selling Stockholder sells all of the shares of Common

Stock beneficially owned by it that have been registered by us and does not acquire any additional shares during the offering, such Selling

Stockholder will not own any shares other than those appearing in the column entitled “Beneficial Ownership After This Offering.”

We cannot advise you as to whether the Selling Stockholders will in fact sell any or all of such shares of Common Stock. In addition,

the Selling Stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time

and from time to time, the shares of our Common Stock in transactions exempt from the registration requirements of the Securities Act

after the date on which it provided the information set forth in the table below.

The

percentage of shares owned prior to completion of the offering is based on 2,387,434 shares of Common Stock outstanding as of June 12,

2024 (including the issuance of 222,972 shares of Common Stock upon the conversion of convertible promissory notes held by the April

Investors on June 12, 2024) unless otherwise indicated.

| | |

Shares

of

Common Stock

beneficially owned before

this offering | | |

Shares

of

Common Stock

offered pursuant

to this prospectus | | |

Shares

of

Common Stock

beneficially owned

after this offering | |

| Name of Selling Stockholder | |

Number

of

shares | | |

Percentage

of shares | | |

Number

of

shares | | |

Number

of

shares | | |

Percentage

of shares | |

| DYT INFO PTE.

LTD. (1) | |

| 288,683 | | |

| 12.1 | % | |

| 288,683 | | |

| - | | |

| * | |

| Metaverse Intelligence Tech

Ltd. (2) | |

| 115,473 | | |

| 4.8 | % | |

| 115,473 | | |

| - | | |

| * | |

| Min Li (3) | |

| 115,473 | | |

| 4.8 | % | |

| 115,473 | | |

| - | | |

| * | |

| YY Tech Inc. (4) | |

| 115,473 | | |

| 4.8 | % | |

| 115,473 | | |

| - | | |

| * | |

| JOYER TECH AND INFORMATION

OPC (5) | |

| 115,473 | | |

| 4.8 | % | |

| 115,473 | | |

| - | | |

| * | |

| Xiangrong Dai (6) | |

| 115,473 | | |

| 4.8 | % | |

| 115,473 | | |

| - | | |

| * | |

| Future Science and Technology

Co. Ltd. (7) | |

| 166,545 | | |

| 6.7 | % | |

| 166,545 | | |

| - | | |

| * | |

| Xiang Zhang (8) | |

| 277,574 | | |

| 11.0 | % | |

| 277,574 | | |

| - | | |

| * | |

| * |

Less

than one percent (1%) |

| (1) |

The

address of the principal office of this Selling Stockholder is 112 ROBINSON ROAD #03-01 ROBINSON 112 Singapore 068902. |

| (2) |

The

address of the principal office of this Selling Stockholder is Coastal Building, Wickham’s Cay II, P. O. Box 2221, Road Town,

Tortola, VG1110, British Virgin Islands. |

| (3) |

The

address of the principal office of this Selling Stockholder is 37−111 YIANMEN NO.1, NANAN, CHAOYANG DIST, BEIJING 100124 CHINA. |

| (4) |

The

address of the principal office of this Selling Stockholder is Sertus Incorporations (Cayman) Limited, P.O. Box 2547, Sertus Chambers,

Governors Square, Suite #5-204, 23 Lime Tree Bay Avenue, Grand Cayman, KY1-1104 Cayman Islands. |

| (5) |

The

address of the principal office of this Selling Stockholder is UNIT 2111 CITYLAND HERRERA TOWER VA RUFINO STREET MAKATI CITY 1227. |

| (6) |

The

address of the principal office of this Selling Stockholder is No. 4-104, Jingjilufu, Changping Dist, Beijing China. |

| (7) |

The

aggregate amount of shares set forth above includes: (i) 83,615 shares of Common Stock issued to Future Science and Technology Co.

Ltd. on June 12, 2024 as a result of the conversion of a convertible promissory note; and (ii) up to 82,930 shares of Common Stock

issuable upon exercise of warrants to purchase Common Stock held by Future Science and Technology Co. Ltd. The address of the principal

office of this Selling Stockholder is CHAOYANG District, YI AN MEN 37-111, 100000, Beijing, China. |

(8) |

The

aggregate amount of shares set forth above includes: (i) 139,357 shares of Common Stock issued to Xiang Zhang on June 12, 2024 as

a result of the conversion of a convertible promissory note; and (ii) up to 138,217 shares of Common Stock issuable upon exercise

of warrants to purchase Common Stock held by Xiang Zhang. The address of the principal office of this Selling Stockholder is Room

507-1, Building 2, No. 3, Liansheng Road, Wuchang Street, Yuhang District, Hangzhou City, Zhejiang Province, China. |

PLAN

OF DISTRIBUTION

The

Common Stock offered by this prospectus is being offered by the Selling Stockholders. The Common Stock may be sold or distributed from

time to time by the Selling Stockholders directly to one or more purchasers or through brokers, dealers, or underwriters who may act

solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices,

or at fixed prices, which may be changed. The sale of the common stock offered by this prospectus may be effected in one or more of the

following methods:

| |

● |

ordinary brokers’ transactions; |

| |

● |

transactions involving cross

or block trades; |

| |

● |

through brokers, dealers,

or underwriters who may act solely as agents; |

| |

● |

“at the market”

into an existing market for the common stock; |

| |

● |

in other ways not involving

market makers or established business markets, including direct sales to purchasers or sales effected through agents; |

| |

● |

in privately negotiated transactions;

or |

| |

● |

any combination of the foregoing. |

In

addition, any securities that qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus.

To

the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. In

connection with distributions of the securities or otherwise, the Selling Stockholders may enter into hedging transactions with broker-dealers

or other financial institutions. In connection with such transactions, broker-dealers or other financial institutions may engage in short

sales of our securities in the course of hedging the positions they assume with the Selling Stockholders. The Selling Stockholders may

also sell our securities short and redeliver the shares to close out such short positions. The Selling Stockholders may also enter into

option or other transactions with broker-dealers or other financial institutions which require the delivery to such broker-dealer or

other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The Selling Stockholders may also pledge

securities to a broker-dealer or other financial institution, and, upon a default, such broker-dealer or other financial institution,

may effect sales of the pledged securities pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

Selling Stockholders may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to

third parties in privately negotiated transactions. If an applicable prospectus supplement indicates, in connection with those derivatives,

the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions.

If so, the third party may use securities pledged by the Selling Stockholders or borrowed from the Selling Stockholders or others to

settle those sales or to close out any related open borrowings of securities, and may use securities received from the Selling Stockholders

in settlement of those derivatives to close out any related open borrowings of securities. If applicable through securities laws, the

third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective

amendment). In addition, the Selling Stockholders may otherwise loan or pledge securities to a financial institution or other third party

that in turn may sell the securities short using this prospectus. Such financial institution or other third party may transfer its economic

short position to investors in our securities or in connection with a concurrent offering of other securities.

In

effecting sales, broker-dealers or agents engaged by the Selling Stockholders may arrange for other broker-dealers to participate. Broker-dealers

or agents may receive commissions, discounts or concessions from the Selling Stockholders in amounts to be negotiated immediately prior

to the sale.

In

offering the securities covered by this prospectus, the Selling Stockholders and any broker-dealers who execute sales for the Selling

Stockholders may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. Any

profits realized by the Selling Stockholders and the compensation of any broker-dealer may be deemed to be underwriting discounts and

commissions.

In

order to comply with the securities laws of certain states, if applicable, the securities must be sold in such jurisdictions only through

registered or licensed brokers or dealers. In addition, in certain states the securities may not be sold unless they have been registered

or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is

complied with.

We

have advised the Selling Stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of securities

in the market and to the activities of the Selling Stockholders and their affiliates. In addition, we will make copies of this prospectus

available to the Selling Stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling

Stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the securities against certain liabilities,

including liabilities arising under the Securities Act.

At

the time a particular offer of securities is made, if required, a prospectus supplement will be distributed that will set forth the number

of securities being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price

paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession allowed

or reallowed or paid to any dealer, and the proposed selling price to the public.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Baker & Hostetler LLP, Los Angeles,

California.

EXPERTS

The

consolidated financial statements of NuZee, Inc. as of September 30, 2023 and 2022 and for each of the two years in the period ended

September 30, 2023 incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended September 30, 2023

have been so incorporated in reliance on the report (which includes an explanatory paragraph relating to NuZee’s ability to continue

as a going concern as described in Note 2 to the financial statements) of MaloneBailey, LLP, an independent registered public accounting

firm, given on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available over the

Internet at the SEC’s website at www.sec.gov. The SEC maintains a website that contains reports, proxy and information statements

and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Our

website address is www.mynuzee.com. The information contained on, or that can be accessed through, our website is not a part of this

prospectus or incorporated by reference into this prospectus or any prospectus supplement, and you should not consider information on

our website to be part of this prospectus. We have included our website address as an inactive textual reference only.

This

prospectus is part of a registration statement that we filed with the SEC and does not contain all of the information in the registration

statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms of the documents establishing

the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements in this prospectus or any

prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document

to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may obtain

the registration statement and exhibits to the registration statement from the SEC’s website, as provided above.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to

be part of this prospectus.

We

incorporate by reference into this prospectus and the registration statement of which this prospectus forms a part the information or

documents listed below that we have filed with the SEC, and any future filings we will make with the SEC under Sections 13(a), 13(c),

14, or 15(d) of the Exchange Act after the date of the initial filing of the registration statement of which this prospectus is a part

and prior to effectiveness of such registration statement, and until the termination of the offering of the shares covered by this prospectus

(other than information furnished under Item 2.02 or Item 7.01 of Form 8-K):

| ● | Our

Annual Report on Form

10-K for the fiscal year ended September 30, 2023, filed on January 16, 2024, as amended

by our Form 10-K/A filed on June 14, 2024; |

| ● | Our

Quarterly Reports on Form 10-Q for the fiscal quarters ended December 31, 2023, filed on

May

6, 2024, and March 31, 2024, filed May

24, 2024; |

| ● | Our

Current Reports on Form 8-K filed on October 20, 2023, November 15, 2023, December 12, 2023,

January 26, 2024, February 28, 2024, April 11, 2024, April 29, 2024, May 2, 2024, June 7, 2024 and June 10, 2024; and |

| ● | The

description of our common stock contained in the Registration Statement on Form 8-A filed

with the SEC on June 17, 2020, including any amendments or reports filed for the purpose

of updating such description. |

Any

statement made in this prospectus or contained in a document all or a portion of which is incorporated by reference herein will be deemed

to be modified or superseded to the extent that a statement contained herein or in any subsequent prospectus supplement to this prospectus

or, if appropriate, post-effective amendment to the registration statement that includes this prospectus, modifies or supersedes such

statement. Any statement so modified will not be deemed to constitute a part hereof, except as so modified, and any statement so superseded

will not be deemed to constitute a part hereof.

You

may read and copy any materials we file with the SEC at the SEC’s website mentioned under the heading “Where You Can Find

More Information.” The information on the SEC’s website is not incorporated by reference in this prospectus.

A

copy of any document incorporated by reference in this prospectus may be obtained at no cost by writing or telephoning us at the following

address and telephone number:

NuZee,

Inc.

2865

Scott St. Suite 107

Vista,

California 92081

(760)

295-2408

We

maintain a website at www.mynuzee.com. Information about us, including our reports filed with the SEC, is available through that site.

Such reports are accessible at no charge through our website and are made available as soon as reasonably practicable after such material

is filed with or furnished to the SEC. Our website and the information contained on that website, or connected to that website, are not

incorporated by reference in this prospectus.

NuZee,

Inc.

Up

to 1,310,167

Shares

of

Common

Stock

by

Selling

Stockholders

PROSPECTUS

,

2024

PART

II

INFORMATION

NOT REQUIRED IN THE PROSPECTUS

| Item 13. |

Other

Expenses of Issuance and Distribution. |

The

following is an estimate of the expenses (all of which are to be paid by us) that we may incur in connection with the securities being

registered hereby.

| |

|

Amount |

|

| SEC

registration fee |

|

$ |

310 |

|

| Legal

fees and expenses |

|

|

* |

|

| Accounting

fees and expenses |

|

|

* |

|

| Miscellaneous |

|

|

* |

|

| Total |

|

$ |

* |

|

| * |

Estimated

expenses are not presently known. To the extent required, any applicable prospectus supplement will set forth the estimated aggregate

amount of expenses payable in respect of any offering of securities. |

| Item 14. |

Indemnification

of Directors and Officers. |

The

Company’s articles of incorporation, as amended, and third amended and restated bylaws provide that, to the fullest extent permitted

by the laws of the State of Nevada, any person who was or is a party or is threatened to be made a party to any proceeding, whether civil,

criminal, administrative or investigative, by reason of the fact that he or she is or was a director, trustee, officer, employee or agent

of the Company or is or was serving at the request of the Company as a director, trustee, officer, employee or agent of another corporation,

partnership, joint venture, trust or other enterprise. For the avoidance of doubt, the foregoing indemnification obligation includes,

without limitation, claims for monetary damages against an indemnitee to the fullest extent permitted under Chapter 78 of the Nevada

Revised Statutes as in existence on the date hereof.

The

indemnification provided shall be from and against expenses (including attorneys’ fees), judgment, fines and amounts paid in settlement

actually and reasonably incurred by such indemnified person in connection with such action, suit or proceeding if such indemnified person

acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Company, and

with respect to any criminal action or proceeding, had no reasonable cause to believe such indemnified person’s conduct was unlawful.

In

the case of any threatened, pending or completed action or suit by or in the right of the Company to procure a judgment in its favor

by reason of the fact that such indemnified person is or was a director, trustee, officer, employee or agent of the Company, or is or

was serving at the request of the Company as a director, trustee, officer, employee or agent of another corporation, partnership, joint

venture, trust or other enterprise, no indemnification shall be made in respect of any claim, issue or matter as to which the indemnified

person shall have been adjudged to be liable for gross negligence or willful misconduct in the performance of such indemnified person’s

duty to the Company unless, and only to the extent that, the court in which such action or suit was brought shall determine upon application

that, despite circumstances of the case, such indemnified person is fairly and reasonably entitled to indemnity for such expenses as

such court shall deem proper.

The

termination of any action or suit by judgment or settlement shall not, of itself, create a presumption that the person did not act in

good faith and in a manner which such person reasonably believed to be in or not opposed to the best interests of the Company.

To

the extent that indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling

the Company pursuant to the foregoing provisions, the Company has been informed that, in the opinion of the SEC, such indemnification

is against public policy as expressed in the Securities Act and is therefore unenforceable. If a claim for indemnification against such

liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company

in the successful defense of any action, suit or proceeding) is asserted by any of the Company’s directors, officers or controlling

persons in connection with the securities being registered, the Company will, unless in the opinion of counsel the matter has been settled

by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by the Company is against

public policy as expressed in the Securities Act and will be governed by the final adjudication of that issue.

| Item 15. |

Recent

Sales of Unregistered Securities. |

Set

forth below is information regarding securities issued by us since June 1, 2021 that were not registered under the Securities

Act of 1933, as amended (the Securities Act). Also included is the consideration, if any, received by us for such securities and

information relating to the section of the Securities Act, or rule of the Securities and Exchange Commission, under which exemption from

registration was claimed.

| ● | In

April 2022, the Company sold to certain accredited investors 884,778 units, at a price of

$2.00 per unit, with each unit consisting of (i) one share of Common Stock and (ii) one warrant

to purchase one whole share of Common Stock with an initial exercise price of $2.00 per share,

for an aggregate purchase price of approximately $1.77 million. |

| ● | In

November 2023, the Company issued and sold to certain accredited investors 46,800 shares

of Common Stock, together with warrants to purchase a total of 5,200 shares of Common Stock

at an exercise price of $2.77 per share, for an aggregate purchase price of $129,636. |

| ● | In

May 2024, the Company sold to certain non-U.S. investors convertible promissory notes

in the aggregate principal amount of $320,000 and warrants to purchase up to an aggregate

of 221,147 shares of Common Stock at an exercise price of $1.322 per share, for an aggregate

purchase price of $320,000. |

| ● | In

June 2024, the Company sold to a certain non-U.S. investor convertible promissory

notes in the aggregate principal amount of $320,000 and warrants to purchase up to an aggregate

of 169,762 shares of Common Stock at an exercise price of $1.885 per share, for an aggregate

purchase price of $320,000. |

| ● | In

June 2024, the Company sold to certain non-U.S. investors 866,048 shares of Common

Stock for an aggregate purchase price of $1.5 million. |

The

securities described above were issued in reliance upon an exemption from the registration requirements of the Securities Act, pursuant

to Section 4(a)(2) thereof as a transaction not involving any public offering.

| 1.1 |

|

Underwriting

Agreement (incorporated by reference to Exhibit 1.1 to the Company’s Current Report on Form 8-K filed on October 20, 2023,

SEC File Number 001-39338). |

| 3.1 |

|

Articles

of Incorporation of the Company, dated July 15, 2011 (incorporated by reference to Exhibit 3.1 to the Company’s Annual Report

on Form 10-K filed on December 23, 2022, SEC File Number 001-39338). |

| 3.2 |

|

Certificate

of Amendment to Articles of Incorporation of the Company, dated May 6, 2013 (incorporated by reference to Exhibit 3.01(b) to the

Company’s Current Report on Form 8-K filed on April 25, 2013, SEC File Number 333-176684). |

| 3.3 |

|

Certificate

of Amendment to Articles of Incorporation of the Company, dated October 28, 2019 (incorporated by reference to Exhibit 3.1 to the

Company’s Current Report on Form 8-K filed on October 28, 2019, SEC File Number 000-55157). |

| 3.4 |

|

Third

Amended and Restated Bylaws of the Company, effective March 17, 2022 (incorporated by reference to Exhibit 3.1 to the Company’s

Current Report on Form 8-K filed on March 23, 2022, SEC File Number 001-39338). |

| 4.1 |

|

Description

of Securities (incorporated by reference to Exhibit 4.1 to the Company’s Annual Report on Form 10-K filed on December 23, 2022,

SEC File Number 001-39338). |

| 4.3 |

|

Series

A Warrant Agent Agreement (including the terms of the Series A Warrant) (incorporated by reference to Exhibit 4.1 to the Company’s

Current Report on Form 8-K filed on March 23, 2021, SEC File Number 001-39338). |

| 4.4 |

|

Series

B Warrant Agent Agreement (including the terms of the Series B Warrant) (incorporated by reference to Exhibit 4.2 to the Company’s

Current Report on Form 8-K filed on March 23, 2021, SEC File Number 001-39338). |

| 4.5 |

|

Form

of Common Stock Purchase Warrant (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed

on April 15, 2022, SEC File Number 001-39338). |

| 4.6 |

|

Common

Stock Purchase Warrant (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on November

15, 2023, SEC File Number 001-39338). |

| 4.7 |

|

Form

of Common Stock Purchase Warrant (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed

on May 2, 2024, SEC File Number 001-39338) |

| 5.1* |

|

Opinion

of Baker & Hostetler LLP |

| 10.3† |

|

NuZee,

Inc. 2013 Stock Incentive Plan (incorporated by reference to Exhibit 10.4 to the Company’s Registration Statement on Form S-1

filed on November 12, 2019, SEC File Number 333-234643). |

| 10.4† |

|

NuZee,

Inc. 2019 Stock Incentive Plan (incorporated by reference to Exhibit 10.5 to the Company’s

Registration Statement on Form S-1 filed on November 12, 2019, SEC File Number 333-234643). |

| 10.5 |

|

Multi-Tenant

Industrial Triple Net Lease, dated May 9, 2019 by and between Nuzee, Inc. and Icon Owner Pool I Texas LLC (incorporated by reference

to Exhibit 10.6 to the Company’s Registration Statement on Form S-1/A filed on March 10, 2020, SEC File Number 333-234643). |

| 10.7† |

|

Form

of Stock Option Agreement (2013 Stock Incentive Plan) (incorporated by reference to Exhibit 10.10 to the Company’s Annual Report

on Form 10-K filed on December 28, 2020, SEC File Number 001-39338). |

| 10.8† |

|

Form

of Stock Option Agreement (2019 Stock Incentive Plan) (incorporated by reference to Exhibit 10.11 to the Company’s Annual Report

on Form 10-K filed on December 28, 2020, SEC File Number 001-39338). |

| 10.9† |

|

Form

of Restricted Stock Award Agreement under the NuZee, Inc. 2019 Stock Incentive Plan (incorporated by reference to Exhibit 10.1 to

the Company’s Current Report on Form 8-K filed on January 15, 2021, SEC File Number 001-39338). |

| 10.12† |

|

Form

of Stock Option Agreement under the NuZee, Inc. 2019 Stock Incentive Plan (Performance-Based) (incorporated by reference to Exhibit

10.3 to the Company’s Current Report on Form 8-K filed on July 7, 2021, SEC File Number 001-39338). |

| 10.14† |

|

Form

of Stock Option Agreement under NuZee, Inc. 2013 Stock Incentive Plan (Time-Based) (incorporated by reference to Exhibit 10.2 to

the Company’s Quarterly Report on Form 10-Q filed on February 11, 2022, SEC File Number 001-39338). |

| 10.15† |

|

Form

of Stock Option Agreement under NuZee, Inc. 2013 Stock Incentive Plan (Performance-Based) (incorporated by reference to Exhibit 10.3

to the Company’s Quarterly Report on Form 10-Q filed on February 11, 2022, SEC File Number 001-39338). |

| 10.16† |

|

Form of Restricted Stock Award Agreement under the NuZee, Inc. 2013 Stock Incentive Plan (incorporated by reference to Exhibit 10.4 to the Company’s Quarterly Report on Form 10-Q filed on February 11, 2022, SEC File Number 001-39338). |

| 10.17† |

|

Description of Registrant’s Non-Employee Director Compensation Policy (incorporated by reference to Exhibit 10.1 to the Company’s Annual Report on Form 10-Q filed on May 12, 2022, SEC File Number 001-39338). |

| 10.19† |

|

Second Amended and Restated Employment Agreement, dated as of November 4, 2022, by and between NuZee, Inc. and Shana Bowman (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on November 4, 2022, SEC File Number 001-39338). |

| 10.20 |

|

Convertible Note and Purchase Agreement, dated April 27, 2024, between the Company and the Investors party thereto (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on May 2, 2024, SEC File Number 001-39338) |

| 10.21 |

|

Form

of Registration Rights Agreement, dated April 27, 2024, between the Company and the Investors party thereto (incorporated by reference

to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed on May 2, 2024, SEC File Number 001-39338) |

| 10.22 |

|

Form

of Convertible Promissory Note (incorporated by reference to Exhibit 10.3 to the Company’s Current Report on Form 8-K filed

on May 2, 2024, SEC File Number 001-39338) |

| 10.23 |

|

Share

Purchase Agreement by and between the Company and Masa Higashida dated as of June 7, 2024 (incorporated by reference to Exhibit 10.1

to the Company’s Current Report on Form 8-K filed on June 7, 2024, SEC File Number 001-39338) |

| 10.24 |

|

Second

Amended and Restated Employment Agreement by and between the Company and Randell Weaver dated as of June 7, 2024 (incorporated by

reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed on June 7, 2024, SEC File Number 001-39338) |

| 10.25 |

|

Termination

and Release Agreement by and between the Company and Masa Higashida dated as of June 7, 2024 (incorporated by reference to Exhibit

10.3 to the Company’s Current Report on Form 8-K filed on June 7, 2024, SEC File Number 001-39338) |

| 10.26 |

|

Securities

Purchase Agreement, dated June 4, 2024, between the Company and the Investors party thereto (incorporated by reference to Exhibit

10.1 to the Company’s Current Report on Form 8-K filed on June 10, 2024, SEC File Number 001-39338) |

| 10.27 |

|

Registration

Rights Agreement, dated June 4, 2024, between the Company and the Investors party thereto (incorporated by reference to Exhibit 10.2

to the Company’s Current Report on Form 8-K filed on June 10, 2024, SEC File Number 001-39338) |

| 21.1 |

|

Subsidiaries of NuZee, Inc. (incorporated by reference to Exhibit 21.1 to the Company’s Annual Report on Form 10-K filed on December 23, 2022, SEC File Number 001-39338). |

| 23.1* |

|

Consent of MaloneBailey, LLP, independent registered public accounting firm. |

| 23.2* |

|

Consent of Baker & Hostetler LLP (included in Exhibit 5.1). |

| 24.1* |

|

Power of Attorney (included on signature page) |

| 101.INS |

|

Inline

XBRL Instance Document – the instance document does not appear in the Interactive Data File because its XBRL tags are embedded

within the inline XBRL document. |

| 101.SCH |

|

Inline

XBRL Taxonomy Extension Schema Document |

| 101.CAL |

|

Inline

XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF |

|

Inline

XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB |

|

Inline

XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE |

|

Inline

XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 |

|

Cover

Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101) |

| 107* |

|

Exhibit Fee Table |

*

Filed or furnished herewith.

†

Indicates management contract or compensatory plan.

+

Certain schedules to this agreement have been omitted pursuant to Item 601 of Regulation S-K. A copy of any omitted schedule will be

furnished supplementally to the Securities and Exchange Commission upon request.

| (a) |

The

undersigned registrant hereby undertakes: |

| (1) |

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) |

to

include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) |

to

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end

of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price

set forth in the “Calculation of Registration Fee Tables” or “Calculation of Registration Fee” table, as

applicable, in the effective registration statement; and |

| (iii) |

to

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

provided,

however, that: Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included

in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934, as amended, that are incorporated by reference in the registration

statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) |

That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof. |

| (3) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| (4) |

That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (i) |

Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and |

| (ii) |

Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule

430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required

by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the

earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities

in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is

at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities

in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement

or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into

the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract

of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus

that was part of the registration statement or made in any such document immediately prior to such effective date. |

| (5) |

That,

for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller

to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| (i) |

Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424; |

| (ii) |

Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant; |

| (iii) |

The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) |

Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (6) |

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion

of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933

and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment

by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense

of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act of 1933 and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf

by the undersigned, thereunto duly authorized, in the City of Beijing, China and the City of Vista, State of California, on June 14,

2024.

| |

NUZEE,

INC. |

| |

|

| |

By:

|

/s/

Jianshuang Wang |

| |

Name: |

Jianshuang Wang |

| |

Title: |

Co-Chief Executive

Officer |

| |

|

|

| |

By:

|

/s/

Randell Weaver |

| |

Name: |

Randell Weaver |

| |

Title: |

Co-Chief Executive

Officer |

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Jianshuang

Wang and Randell Weaver, and each of them, his or her true and lawful attorneys-in-fact and agents, each with full power of substitution

and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments,

including post-effective amendments, to this Registration Statement, and to file the same, with exhibits thereto and other documents

in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them,

full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully for all intents

and purposes as he or she might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents,

or his or her substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities

indicated on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Jianshuang Wang |

|

Co-Chief

Executive Officer and Director |

|

June

14, 2024 |

| Jianshuang

Wang |

|

(Co-Principal Executive

Officer) |

|

|

| |

|

|

|

|

| /s/

Randell Weaver |

|

Co-Chief

Executive Officer and Chief Financial Officer |

|

June

14, 2024 |

| Randell

Weaver |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Yanli Hou |

|

Director |

|

June

14, 2024 |

| Yanli

Hou |

|

|

|

|

| |

|

|

|

|

| /s/

J. Chris Jones |

|

Director |

|

June

14, 2024 |

| J.

Chris Jones |

|

|

|

|

| |

|

|

|

|

| /s/

Changzheng Ye |

|

Director |

|

June

14, 2024 |

| Changzheng

Ye |

|

|

|

|

| |

|

|

|

|

| /s/

David G. Robson |

|

Director |

|

June

14, 2024 |

| David

G. Robson |

|

|

|

|

Exhibit

5.1

June

14, 2024

NuZee,

Inc.

2865

Scott St., Suite 107

Vista,

CA 92081

Ladies

and Gentlemen:

We

have acted as counsel to NuZee, Inc., a Nevada corporation (the “Company”), in connection with the filing of a Registration

Statement on Form S-1 (the “Registration Statement”) by the Company with the Securities and Exchange Commission (the “Commission”)

under the Securities Act of 1933, as amended (the “Act”), covering the resale by the selling stockholders named therein (the

“Selling Stockholders”) of up to 1,310,167 shares of the Company’s common stock, par value $0.0001 per share

(the “Common Stock”), consisting of (i) 1,089,020 outstanding shares of Common Stock (the “Issued Shares”), and

(ii) up to 221,147 shares of Common

Stock issuable upon the exercise of outstanding warrants to purchase shares of Common Stock (the “Issuable Shares”) (the Issuable Shares, together with the Issued Shares, the “Shares”).

In

connection with this opinion, we have examined and relied upon the Registration Statement and related prospectus, the Company’s

Articles of Incorporation, as amended, and Amended and Restated Bylaws, each as currently in effect, and such other documents, records,

certificates, memoranda and other instruments as in our judgment are necessary or appropriate to enable us to render the opinion expressed

below. In such examination, we have assumed: (i) the authenticity of original documents and the genuineness of all signatures; (ii) the

conformity to the originals of all documents submitted to us as copies; (iii) the truth, accuracy and completeness of the information,

representations and warranties contained in the instruments, documents, certificates and records we have reviewed; (iv) that the Registration

Statement, and any amendments thereto (including post-effective amendments), will have become effective under the Act and comply with

all applicable laws and no stop order suspending the Registration Statement’s effectiveness will have been issued and remain in

effect, in each case, at the time the Shares are offered and sold as contemplated by the Registration Statement; (v) that the Shares

will be sold in compliance with applicable U.S. federal and state securities laws and in the manner stated in the Registration Statement;

(vi) at the time of the issuance of any Issuable Shares, the Company will be a validly existing corporation under the law of its jurisdiction

of incorporation; (vii) after the issuance of the Issuable Shares, the total number of issued and outstanding shares of the Common Stock,

together with the total number of shares of the Common Stock reserved for issuance upon the exercise, exchange or conversion, as the

case may be, of any exercisable, exchangeable or convertible security, as the case may be, then outstanding, will not exceed the total

number of authorized shares of Common Stock under the Company’s articles of incorporation, as amended and then in effect; and (viii)

the legal capacity of all natural persons. As to any facts material to the opinions expressed herein that were not independently established

or verified, we have relied upon oral or written statements and representations of officers and other representatives of the Company.

On

the basis of the foregoing, and in reliance thereon, we are of the opinion that (i) the Issued Shares have been validly issued and are

fully paid and nonassessable; and (ii) the Issuable Shares have been duly authorized by the Company and, when issued upon exercise in accordance with the terms of the warrants, will be validly

issued, fully paid and non-assessable.

We

express no opinion as to the laws of any jurisdiction, other than Chapter 78 of the Nevada Revised Statutes, as amended (but not including

any laws, statutes, ordinances, administrative decisions, rules or regulations of any political subdivision below the state level). We

do not express any opinion as to the effect on the matters covered by this letter of the laws of any other jurisdiction. The opinion

expressed above is as of the date hereof only, and we express no opinion as to, and assume no responsibility for, the effect of any fact

or circumstance occurring, or of which we learn, subsequent to the date of this opinion letter, including, without limitation, legislative

and other changes in the law or changes in circumstances affecting any party. We assume no responsibility to update this opinion letter

for, or to advise you of, any such facts or circumstances of which we become aware, regardless of whether or not they affect the opinion

expressed in this opinion letter.

We

hereby consent to the reference to our firm under the caption “Legal Matters” in the prospectus included in the Registration

Statement and to the filing of this opinion as Exhibit 5.1 to the Registration Statement. In giving such consent, we do not hereby admit

that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission.

| |

Very

truly yours, |

| |

|

| |

/s/

Baker & Hostetler LLP |

Exhibit

23.1

CONSENT