Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

30 Octubre 2024 - 9:41AM

Edgar (US Regulatory)

|

Filed Pursuant to Rule 433

Registration No. 333-272447

Free Writing Prospectus dated October 30, 2024 to

Preliminary Pricing Supplement dated October 30,

2024 |

Buffered PLUS Based on the Value of the EURO STOXX 50®

Index due June 3, 2027

Buffered Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

This

document provides a summary of the terms of the Buffered PLUS. Investors must carefully review the accompanying preliminary pricing supplement

referenced below, underlying supplement and prospectus, and the “Risk Considerations” on the following page, prior to making

an investment decision.

| SUMMARY TERMS |

| Issuer: |

Canadian Imperial Bank of Commerce |

| Underlying Index: |

The EURO STOXX 50® Index ((Bloomberg symbol: SX5E) |

| Stated Principal Amount: |

$1,000.00 per Buffered PLUS |

| Issue Price: |

$1,000.00 per Buffered PLUS |

| Pricing Date |

November 15, 2024 |

| Original Issue Date: |

November 20, 2024 (3 Business Days after the Pricing Date) |

| Valuation Date: |

May 31, 2027, subject to postponement for non-Trading Days and certain Market Disruption Events |

| Maturity Date: |

June 3, 2027 |

| Payment at Maturity per Buffered PLUS: |

· If the Final Index Value is greater than the Initial Index Value:

$1,000 + Leveraged Upside Payment

In no event will the Payment at Maturity

exceed the Maximum Payment at Maturity.

· If the Final Index Value is less than or equal to the Initial Index Value but has decreased from the Initial Index Value by an amount

less than or equal to the Buffer Amount of 15%: $1,000

· If the Final Index Value is less than the Initial Index Value and has decreased from the Initial Index Value by an amount greater than

the Buffer Amount of 15%:

($1,000 × Index Performance Factor) +

$150.00

Under these circumstances, the Payment at

Maturity will be less than the Stated Principal Amount of $1,000.

However, under no circumstances will the Buffered PLUS pay less

than $150.00 per Buffered PLUS at maturity. |

| Leveraged Upside Payment: |

$1,000.00 × Leverage Factor × Index Percent Increase |

| Leverage Factor: |

200% |

| Maximum Payment at Maturity: |

At least $1,367.00 per Buffered PLUS (at least 136.70% of the Stated Principal Amount, to be determined on the Pricing Date) |

| Minimum Payment at Maturity: |

$150.00 per Buffered PLUS (15% of the Stated Principal Amount) |

| Index Percent Increase: |

(Final Index Value – Initial Index Value) / Initial Index Value |

| Index Performance Factor: |

Final Index Value / Initial Index Value |

| Buffer Amount: |

15%. As a result of the Buffer Amount of 15%, the value at or above which the Underlying Index must close on the Valuation Date so that investors do not suffer a loss on their initial investment in the Buffered PLUS is 85% of the Initial Index Value. |

| Initial Index Value: |

The Closing Level of the Underlying Index on the Pricing Date |

| Final Index Value: |

The Closing Level of the Underlying Index on the Valuation Date |

| CUSIP/ISIN: |

13607XU54 / US13607XU544 |

| Initial Estimated Value: |

Between $933.70 and $953.70 per Buffered PLUS, which is expected to be less than the price to public |

| Preliminary Terms: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465924112469/tm2425297d53_424b2.htm |

Percentage Change in Underlying

Index |

Return on Buffered PLUS |

| 50.00% |

36.70% |

| 40.00% |

36.70% |

| 30.00% |

36.70% |

| 20.00% |

36.70% |

| 18.35% |

36.70% |

| 10.00% |

20.00% |

| 5.00% |

10.00% |

| 0.00% |

0.00% |

| -5.00% |

0.00% |

| -10.00% |

0.00% |

| -15.00% |

0.00% |

| -16.00% |

-1.00% |

| -30.00% |

-15.00% |

| -40.00% |

-25.00% |

| -50.00% |

-35.00% |

| -100.00% |

-85.00% |

We have filed

a registration statement (including an underlying supplement, a prospectus supplement and a prospectus) with the SEC for the offering

to which this document relates. Before you invest, you should read these documents and other documents that we have filed with the SEC

for more complete information about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC website

at www.sec.gov. Alternatively, we, any agent or any dealer participating in this offering will arrange to send you these documents if

you so request by calling toll-free at 1-833-931-0275.

Underlying Index

For more information about the Underlying Index,

including historical performance information, see the accompanying preliminary pricing supplement.

Risk Considerations

The risks set forth below are discussed

in more detail in the “Risk Factors” section in the accompanying preliminary pricing supplement. Please review those risk

factors carefully prior to making an investment decision.

Risks Relating to the Structure of the Buffered

PLUS

| · | The Buffered PLUS do not pay

interest and provide a Minimum Payment at Maturity of only 10% of your principal. |

| · | The appreciation potential of

the Buffered PLUS is limited by the Maximum Payment at Maturity. |

| · | The amount payable on the Buffered

PLUS is not linked to the Closing Level of the Underlying Index at any time other than the Valuation Date. |

Risks Relating

to the Underlying Index

| · | An Investment in the Buffered

PLUS is subject to risks associated with foreign securities markets. |

| · | Governmental regulatory actions,

such as sanctions, could adversely affect your investment in the Buffered PLUS. |

| · | Adjustments to the Underlying

Index could adversely affect the value of the Buffered PLUS. |

Conflicts of Interest

| · | Certain business, trading and

hedging activities of us and our affiliates may create conflicts with your interests and could potentially adversely affect the value

of the Buffered PLUS. |

| · | There are potential conflicts

of interest between you and the calculation agent. |

General Risks

| · | Payments on the Buffered PLUS

are subject to our credit risk, and actual or perceived changes in our creditworthiness are expected to affect the value of the Buffered

PLUS. |

| · | The Bank’s initial estimated

value of the Buffered PLUS will be lower than the initial issue price (price to public) of the Buffered PLUS. |

| · | The Bank’s initial estimated

value does not represent future values of the Buffered PLUS and may differ from others’ estimates. |

| · | The Bank’s initial estimated

value of the Buffered PLUS will not be determined by reference to credit spreads for our conventional fixed-rate debt. |

| · | If CIBCWM were to repurchase

your Buffered PLUS after the Original Issue Date, the price may be higher than the then-current estimated value of the Buffered PLUS for

a limited time period. |

| · | Economic and market factors

may adversely affect the terms and market price of the Buffered PLUS prior to maturity. |

| · | The Buffered PLUS will not be

listed on any securities exchange and we do not expect a trading market for the Buffered PLUS to develop. |

Tax Considerations

You should review carefully the discussion in

“Additional Information About the Buffered PLUS — United States Federal Income Tax Considerations” and “—

Certain Canadian Federal Income Tax Considerations” in the accompanying pricing supplement, “Material U.S. Federal Income

Tax Consequences” in the underlying supplement and “Material Income Tax Consequences—Canadian Taxation” in the

prospectus concerning the U.S. and the Canadian federal income tax consequences of an investment in the Buffered PLUS, and you should

consult your tax adviser.

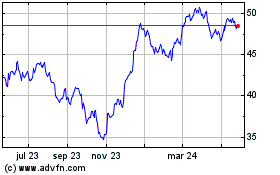

Canadian Imperial Bank o... (NYSE:CM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

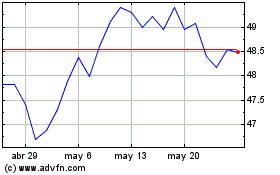

Canadian Imperial Bank o... (NYSE:CM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024