Filed Pursuant to Rule 424(b)(2)

Registration No. 333-272447

The information in this preliminary Pricing Supplement

is not complete and may be changed. This preliminary Pricing Supplement and the accompanying Prospectus Supplement and Prospectus are

not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer

or sale is not permitted.

|

Subject to Completion, Dated October 30, 2024

PRICING SUPPLEMENT dated ,

2024

(To ETF Underlying Supplement dated September 5, 2023,

Prospectus Supplement dated September 5, 2023 and

Prospectus dated September 5, 2023)

| |  |

Canadian Imperial Bank

of Commerce

$

Senior Global Medium-Term

Notes

Autocallable

Buffered SPDR® S&P® Metals & Mining ETF-Linked

Notes due |

The notes do not bear interest. The

notes will mature on the stated maturity date (expected to be the second scheduled business day after the determination date) unless

they are automatically called on the call observation date (expected to be between 12 and 14 months after the trade date). Your

notes will be automatically called on the call observation date if the closing price of the SPDR®

S&P® Metals & Mining ETF (the “underlier”) on such date is greater than or equal

to 80% of the initial underlier price (set on the trade date and will be an intra-day price or the closing price of the

underlier on the trade date), resulting in a payment on the call payment date equal to the principal amount of your notes times

between 106.96% and 108.16%.

The

return on your notes is linked to the performance of the underlier, and not to that of the underlying index on which the underlier is

based.

If your notes are not automatically called,

the amount that you will be paid on your notes on the stated maturity date is based on the performance of the underlier as measured from

the trade date to and including the determination date (expected to be approximately 24 months after the trade date).

At maturity, if the final underlier price on

the determination date is greater than or equal to 80% of the initial underlier price, the return on your notes will be positive, and

you will receive the maximum settlement amount (expected to be between $1,139.20 and $1,163.20 for each $1,000 principal amount of your

notes). If the final underlier price declines by more than 20.00% from the initial underlier price, the return on your notes will

be negative. You could lose your entire investment in the notes.

The return on your notes is capped. The maximum payment you could

receive for each $1,000 principal amount of your notes is expected to be between $1,069.60 and $1.081.60 if your notes are automatically

called, and between $1,139.20 and $1,163.20 if your notes are not automatically called.

If your notes are not automatically called on

the call observation date, we will calculate the underlier return to determine your payment at maturity, which is the percentage increase

or decrease in the final underlier price from the initial underlier price. On the stated maturity date, for each $1,000 principal amount

of your notes, you will receive an amount in cash equal to:

| · | if

the underlier return is greater than or equal to -20.00% (i.e. the final underlier

price is greater than or equal to 80% of the initial underlier price), the maximum settlement amount of between $1,139.20 and $1,163.20; or |

| · | if

the underlier return is less than -20.00% (i.e. the final underlier price is less

than 80% of the initial underlier price), the sum of (i) $1,000 plus

(ii) the product of (a) 1.25 times (b) the sum of the

underlier return plus 20.00% times (c) $1,000. This amount will be

less than $1,000 and may be zero. |

The notes have complex features and investing

in the notes involves risks not associated with an investment in conventional debt securities. See “Additional Risk Factors Specific

to Your Notes” beginning on page PRS-9 of this Pricing Supplement and “Risk Factors” beginning on page S-1

of the accompanying Underlying Supplement.

Our estimated value of the notes on the trade date,

based on our internal pricing models, is expected to be between $961.70 and $981.70 per note. The estimated value is expected to be less

than the initial issue price of the notes. See “Additional Information Regarding Estimated Value of the Notes” in this Pricing

Supplement.

| |

Initial

Issue Price |

Price

to Public |

Agent’s

Commission |

Proceeds

to Issuer |

| Per

Note |

$1,000.00 |

100.00% |

Up

to 1.50% |

At

least 98.50% |

| Total |

$ |

$ |

$ |

$ |

The notes are unsecured obligations of Canadian

Imperial Bank of Commerce and all payments on the notes are subject to the credit risk of Canadian Imperial Bank of Commerce. The notes

will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any

other government agency or instrumentality of Canada, the United States or any other jurisdiction. The notes are not bail-inable debt

securities (as defined on page 6 of the Prospectus). The notes will not be listed on any U.S. securities exchange.

Neither the United States Securities and Exchange

Commission (the “SEC”) nor any state or provincial securities commission has approved or disapproved of these securities

or determined if this Pricing Supplement or the accompanying Underlying Supplement, Prospectus Supplement or Prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

The issue price, agent’s commission and net

proceeds listed above relate to the notes we will sell initially. We may decide to sell additional notes after the trade date, at issue

prices and with agent’s commissions and net proceeds that differ from the amounts set forth above. The return (whether positive

or negative) on your investment will depend in part on the issue price you pay for your notes.

The Bank may use this Pricing Supplement in the

initial sale of the notes. Goldman Sachs & Co. LLC (“GS&Co.”) or any of its affiliates or agents may use this

Pricing Supplement in a market-making transaction in a note after its initial sale. Unless we, GS&Co. or any of our or its respective

affiliates or agents informs the purchaser otherwise in the confirmation of sale, this Pricing Supplement is being used in a market-making

transaction.

We will deliver the notes in book-entry form

through the facilities of The Depository Trust Company (“DTC”) on or about , 2024 against payment in immediately available

funds.

Goldman Sachs & Co. LLC

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

ADDITIONAL INFORMATION REGARDING ESTIMATED VALUE

OF THE NOTES

On the cover page of this Pricing Supplement,

the Bank has provided the initial estimated value range for the notes. This range of estimated values was determined by reference to

the Bank’s internal pricing models, which take into consideration certain factors, such as the Bank’s internal funding rate

on the trade date and the Bank’s assumptions about market parameters. For more information about the initial estimated value, see

“Additional Risk Factors Specific to Your Notes” beginning on page PRS-9 herein.

The economic terms of the notes (including the

call premium amount and the maturity date premium amount) are based on the Bank’s internal funding rate, which is the rate the

Bank would pay to borrow funds through the issuance of similar market-linked notes, the underwriting discount and the economic terms

of certain related hedging arrangements. Due to these factors, the initial issue price you pay to purchase the notes will be greater

than the initial estimated value of the notes. The Bank’s internal funding rate is typically lower than the rate the Bank would

pay when it issues conventional fixed rate debt securities, as discussed further under “Additional Risk Factors Specific to Your

Notes — Neither the Bank’s nor GS&Co.’s Estimated Value of the Notes at Any Time Is Determined by Reference to

Credit Spreads or the Borrowing Rate the Bank Would Pay for Its Conventional Fixed-Rate Debt Securities.” The Bank’s use

of its internal funding rate reduces the economic terms of the notes to you.

The value of your notes at any time will reflect

many factors and cannot be predicted; however, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co.

would initially buy or sell notes in the secondary market (if GS&Co. makes a market, which it is not obligated to do) and the value

that GS&Co. will initially use for account statements and otherwise is equal to approximately GS&Co.’s estimate of the

market value of your notes on the trade date, based on its pricing models and taking into account the Bank’s internal funding rate,

plus an additional amount (initially equal to $ per $1,000 principal amount).

Prior to ,

the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes

a market, which it is not obligated to do) will equal approximately the sum of (a) the then-current estimated value of your notes

(as determined by reference to GS&Co.’s pricing models) plus (b) any remaining additional amount (the additional amount

will decline to zero on a straight-line basis from the time of pricing through approximately 3 months). On and after ,

the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes

a market) will equal approximately the then-current estimated value of your notes determined by reference to such pricing models. For

additional information regarding the value of your notes shown in your GS&Co. account statements and the price at which GS&Co.

would buy or sell your notes (if GS&Co. makes a market, which it is not obligated to do), each based on GS&Co.’s pricing

models; see “Additional Risk Factors Specific to Your Notes — The Price at Which GS&Co. Would Buy Or Sell Your Notes

(If GS&Co. Makes a Market, Which It Is Not Obligated To Do) Will Be Based on GS&Co.’s Estimated Value of Your Notes”.

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

ABOUT THIS PRICING SUPPLEMENT

You should read this Pricing Supplement together

with the Prospectus dated September 5, 2023 (the “Prospectus”), the Prospectus Supplement dated September 5, 2023

(the “Prospectus Supplement”) and the ETF Underlying Supplement dated September 5, 2023 (the “Underlying Supplement”),

each relating to our Senior Global Medium-Term Notes, for additional information about the notes. Information in this Pricing Supplement

supersedes information in the accompanying Underlying Supplement, Prospectus Supplement and Prospectus to the extent it is different

from that information. Certain defined terms used but not defined herein have the meanings set forth in the accompanying Underlying Supplement,

Prospectus Supplement or Prospectus.

You should rely only on the information contained

in or incorporated by reference in this Pricing Supplement and the accompanying Underlying Supplement, Prospectus Supplement and Prospectus.

This Pricing Supplement may be used only for the purpose for which it has been prepared. No one is authorized to give information other

than that contained in this Pricing Supplement and the accompanying Underlying Supplement, Prospectus Supplement and Prospectus, and

in the documents referred to in these documents and which are made available to the public. We have not, and GS&Co. has not, authorized

any other person to provide you with different or additional information. If anyone provides you with different or additional information,

you should not rely on it.

We are not, and GS&Co. is not, making an offer

to sell the notes in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained

in or incorporated by reference in this Pricing Supplement or the accompanying Underlying Supplement, Prospectus Supplement or Prospectus

is accurate as of any date other than the date of the applicable document. Our business, financial condition, results of operations and

prospects may have changed since that date. Neither this Pricing Supplement nor the accompanying Underlying Supplement, Prospectus Supplement

or Prospectus constitutes an offer, or an invitation on our behalf or on behalf of GS&Co., to subscribe for and purchase any of the

notes and may not be used for or in connection with an offer or solicitation by anyone in any jurisdiction in which such an offer or

solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

References to “CIBC,” “the Issuer,”

“the Bank,” “we,” “us” and “our” in this Pricing Supplement are references to Canadian

Imperial Bank of Commerce and not to any of our subsidiaries, unless we state otherwise or the context otherwise requires.

You may access the accompanying Underlying Supplement,

Prospectus Supplement and Prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filing

for the relevant date on the SEC website):

| · | Underlying

Supplement dated September 5, 2023: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465923098171/tm2322483d88_424b5.htm

| · | Prospectus

Supplement dated September 5, 2023: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465923098166/tm2322483d94_424b5.htm

| · | Prospectus

dated September 5, 2023: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465923098163/tm2325339d10_424b3.htm

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

SUMMARY INFORMATION

| We

refer to the notes we are offering by this Pricing Supplement as the “offered notes” or the “notes”. Each

of the offered notes has the terms described below. Terms used but not defined in this Pricing Supplement have the meanings set forth

in the accompanying Underlying Supplement, Prospectus Supplement or Prospectus. This section is meant as a summary and should be

read in conjunction with the accompanying Prospectus, Prospectus Supplement and Underlying Supplement. This Pricing Supplement supersedes

any conflicting provisions of the documents listed above. |

Key Terms

Issuer:

Canadian Imperial Bank of Commerce

Underlier:

The SPDR® S&P® Metals & Mining ETF (Bloomberg symbol, “XME UP Equity”)

Underlying index:

the index tracked by the underlier

Specified currency:

U.S. dollars (“$”)

Principal amount:

Each note will have a principal amount of $1,000; $ in

the aggregate for all the offered notes; the aggregate principal amount of the offered notes may be increased if the Issuer, at its sole

option, decides to sell an additional amount of the offered notes on a date subsequent to the trade date.

Minimum investment:

$1,000 (one note)

Denominations:

$1,000 and integral multiples of $1,000 in excess thereof

Purchase at amount

other than the principal amount: The amount we will pay you on the call payment date or the stated maturity date, as the case

may be, for your notes will not be adjusted based on the issue price you pay for your notes, so if you acquire notes at a premium (or

a discount) to the principal amount and hold them to the call payment date or the stated maturity date, it could affect your investment

in a number of ways. The return on your investment in such notes will be lower (or higher) than it would have been had you purchased

the notes at principal amount. Also, the stated buffer price would not offer the same measure of protection to your investment as would

be the case if you had purchased the notes at principal amount. See “Additional Risk Factors Specific to Your Notes — If

You Purchase Your Notes at a Premium to the Principal Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased

at the Principal Amount and the Impact of Certain Key Terms of the Notes Will Be Negatively Affected” in this Pricing Supplement.

Cash settlement

amount (on the call payment date): If your notes are automatically called on the call observation date because the closing

price of the underlier on such day is greater than or equal to the call price, for each $1,000 principal amount of your notes, we will

pay you an amount in cash equal to the sum of (i) $1,000 plus (ii) the product of $1,000 times the call premium amount

Cash settlement

amount (on the stated maturity date): If your notes are not automatically called, for each $1,000 principal amount of your

notes, we will pay you on the stated maturity date an amount in cash equal to:

| · | if

the final underlier price is greater than or equal to the buffer price, the

sum of (i) $1,000 plus (ii) the product of (a) $1,000 times

(b) the maturity date premium amount; or |

| · | if

the final underlier price is less than the buffer price, the sum of (i) $1,000

plus (ii) the product of (a) the buffer rate times (b) the

sum of the underlier return plus the buffer amount times (c) $1,000.

In this case, the cash settlement amount will be less than the principal amount of the

notes, and you will lose some or all of the principal amount. |

Call

premium amount (set on the trade date): Expected to be between 6.96% and 8.16%

Maturity date

premium amount (set on the trade date): Expected to be between 13.92% and 16.32%

Call price: 80.00%

of the initial underlier price

Buffer price:

80.00% of the initial underlier price

Buffer amount:

20.00%

Buffer rate:

The quotient of the initial underlier price divided by the buffer price, which equals 125.00%

Initial underlier

price (set on the trade date and will be an intra-day price or the closing price of the underlier on that date): subject

to adjustments as described under “Certain Terms of the Notes — Anti-Dilution Adjustments” beginning on page S-65

of the accompanying Underlying Supplement

Final underlier

price: The closing price of the underlier on the determination date

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

Underlier return:

The quotient of (1) the final underlier price minus the initial underlier price divided by (2) the

initial underlier price, expressed as a positive or negative percentage

Call observation

date (set on the trade date): expected to be between 12 and 14 months after the trade date, subject to adjustment as described

under “Certain Terms of the Notes—Valuation Dates” in the accompanying Underlying Supplement.

Call payment

date (set on the trade date): expected to be the second scheduled business day after the call observation date, subject to

adjustment as described under “Certain Terms of the Notes—Interest Payment Dates, Coupon Payment Dates, Call Payment Dates

and Maturity Date” in the accompanying Underlying Supplement.

Trade date: ,

2024

Original issue

date (settlement date) (set on the trade date): Expected to be the fifth scheduled business day following the trade date

Determination

date (set on the trade date): A specified date that is expected to be approximately 24 months following the trade date, subject

to adjustment as described under “Certain Terms of the Notes—Valuation Dates” in the accompanying Underlying Supplement.

Stated maturity

date (set on the trade date): A specified date that is expected to be the second scheduled business day following the determination

date, subject to adjustment as described under “Certain Terms of the Notes—Interest Payment Dates, Coupon Payment Dates,

Call Payment Dates and Maturity Date” in the accompanying Underlying Supplement.

Closing price:

As described under “Certain Terms of the Notes –– Certain Definitions –– Closing Price”

in the accompanying Underlying Supplement

No listing:

The offered notes will not be listed on any securities exchange

Calculation agent:

Canadian Imperial Bank of Commerce. We may appoint a different calculation agent without your consent and without notifying

you

CUSIP / ISIN:

13607XU39 / US13607XU395

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

SUPPLEMENTAL TERMS OF THE NOTES

For purposes of the notes offered by this Pricing

Supplement, all references to each of the following terms used in the accompanying Underlying Supplement will be deemed to refer to the

corresponding term used in this Pricing Supplement, as set forth in the table below:

| Underlying

Supplement Term |

Pricing

Supplement Term |

| Final Valuation Date |

determination date |

| maturity date |

stated maturity date |

| Reference Asset |

underlier |

| Reference Sponsor |

underlier sponsor |

| Initial Price |

initial underlier price |

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

HYPOTHETICAL EXAMPLES

The following table and examples are provided

for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and merely are

intended to illustrate the impact that the various hypothetical underlier prices on the call observation date and on the determination

date could have on the cash settlement amount on the call payment date or on the stated maturity date, as the case may be, assuming all

other variables remain constant.

The examples below are based on a range of underlier

prices that are entirely hypothetical; the underlier price on any day throughout the life of the notes, including the underlier price

on the call observation date or on the determination date, cannot be predicted. The underlier has been highly volatile in the past —

meaning that the underlier price has changed considerably in relatively short periods — and its performance cannot be predicted

for any future period.

The information in the following examples reflects

hypothetical rates of return on the offered notes assuming that they are purchased on the original issue date at the principal amount

and held to the call payment date or the stated maturity date as the case may be. If you sell your notes in a secondary market prior

to the call payment date or the stated maturity date as the case may be, your return will depend upon the market value of your notes

at the time of sale, which may be affected by a number of factors that are not reflected in the table or the examples below, such as

interest rates, the volatility of the underlier and the creditworthiness of CIBC. In addition, the estimated value of your notes at the

time the terms of your notes are set on the trade date (as determined by reference to pricing models used by CIBC) will be less than

the initial issue price of your notes. For more information on the estimated value of your notes, see “Additional Risk Factors

Specific to Your Notes — The Bank’s Initial Estimated Value of the Notes at the Time of Pricing (When the Terms of Your Notes

Are Set on the Trade Date) Will Be Lower Than the Initial Issue Price of the Notes” in this Pricing Supplement and “Additional

Information Regarding Estimated Value of the Notes” in this Pricing Supplement. The information in the following hypothetical examples

also reflects the key terms and assumptions in the box below.

| Key

Terms and Assumptions |

| Principal

amount |

$1,000 |

| Call

price |

80.00%

of the initial underlier price |

| Hypothetical

call premium amount |

6.96% |

| Hypothetical

maturity date premium amount |

13.92% |

| Buffer

price |

80.00%

of the initial underlier price |

| Buffer

rate |

125.00% |

| Buffer

amount |

20.00% |

Neither a market disruption event nor a non-trading day occurs

on the originally scheduled call observation date or determination date

No change in or affecting the underlier,

any of the underlier stocks or the policies of the underlier’s investment advisor or the method by which the sponsor of the

underlier’s underlying index calculates its underlying index

Notes purchased on original issue date

at the principal amount and held to the call payment date or the stated maturity date, as the case may be |

Moreover, we have not yet set the initial underlier

price that will serve as the baseline for determining the underlier return and the cash settlement amount that we will pay on your notes,

if any, on the call payment date or at maturity. We will not do so until the trade date. As a result, the actual initial underlier price

may differ substantially from the underlier price prior to the trade date and may be higher or lower than the actual closing price of

the underlier on that date.

For these reasons, the actual performance of the

underlier over the life of your notes, as well as the cash settlement amount payable on the call payment date or at maturity, if any,

may bear little relation to the hypothetical examples shown below or to the historical underlier prices shown elsewhere in this Pricing

Supplement. For information about the historical prices of the underlier during recent periods, see “The Underlier — Historical

Closing Prices of the Underlier” below. Before investing in the offered notes, you should consult publicly available information

to determine the prices of the underlier between the date of this Pricing Supplement and the date of your purchase of the offered notes.

Also, the hypothetical examples shown below do

not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your notes, tax liabilities could

affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax return on the underlier stocks.

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

Hypothetical Payment on the Call Payment Date

If your notes are automatically called

on the call observation date (i.e., the closing price of the underlier on the call observation date is greater than or equal

to the call price), the cash settlement amount that we would deliver for each $1,000 principal amount of your notes on the call payment

date would be the sum of $1,000 plus the product of the call premium amount times $1,000. If, for example,

the closing price of the underlier on the call observation date were determined to be 130% of the initial underlier price, your notes

would be automatically called and the cash settlement amount that we would deliver on your notes on the call payment date would be 106.96%

of the principal amount of your notes or $1,069.60 for each $1,000 of the principal amount of your notes.

Hypothetical Payment at Maturity

If the notes

are not automatically called on the call observation date (i.e., the closing price of the underlier on the call observation

date is less than the call price), the cash settlement amount we would deliver for each $1,000 principal amount of your notes on the

stated maturity date will depend on the performance of the underlier on the determination date, as shown in the table below. The table

below assumes that the notes have not been automatically called on the call observation date and reflects hypothetical

cash settlement amounts that you could receive on the stated maturity date. The prices in the left column of the table below represent

hypothetical final underlier prices and are expressed as percentages of the initial underlier price. The amounts in the right column

represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final underlier price, and are expressed

as percentages of the principal amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement

amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding principal amount

of the offered notes on the stated maturity date would equal 100.000% of the principal amount of a note, based on the corresponding hypothetical

final underlier price and the assumptions noted above.

The Notes Have Not Been Automatically Called

Hypothetical Final Underlier Price

(as Percentage of Initial Underlier Price) |

Hypothetical Cash Settlement Amount

at

Maturity

(as Percentage of Principal Amount) |

| 200.00% |

113.92% |

| 175.00% |

113.92% |

| 150.00% |

113.92% |

| 125.00% |

113.92% |

| 116.56% |

113.92% |

| 113.00% |

113.92% |

| 109.00% |

113.92% |

| 104.00% |

113.92% |

| 100.00% |

113.92% |

| 95.00% |

113.92% |

| 90.00% |

113.92% |

| 85.00% |

113.92% |

| 80.00% |

113.92% |

| 75.00% |

93.75% |

| 50.00% |

62.50% |

| 25.00% |

31.25% |

| 0.00% |

0.00% |

If, for example, the notes have not been automatically

called on the call observation date and the final underlier price were determined to be 25.000% of the initial underlier price, the cash

settlement amount that we would deliver on your notes at maturity would be 31.25% of the principal amount of your notes, as shown in

the table above. As a result, if you purchased your notes on the original issue date at the principal amount and held them to the stated

maturity date, you would lose 68.75% of your investment (if you purchased your notes at a premium to principal amount you would lose

a correspondingly higher percentage of your investment). If the final underlier price were determined to be 0.000% of the initial underlier

price, you would lose your entire investment in the notes. In addition, if the notes have not been automatically called on the call observation

date and the final underlier price were determined to be 200.000% of the initial underlier price, the cash settlement amount that we

would deliver on your notes at maturity would be 113.92% of the principal amount of your notes,

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

as shown in the table above. As a result, if you

purchased your notes on the settlement date at the principal amount and held them to maturity, the cash settlement amount will be capped,

and you would not benefit from any increase in the final underlier price over 113.92% of the initial underlier price.

The cash settlement amounts shown above are entirely

hypothetical; they are based on market prices for the underlier stocks that may not be achieved on the determination date and on assumptions

that may prove to be erroneous. The actual market value of your notes prior to the call payment date and the stated maturity date or

at any other time, including any time you may wish to sell your notes, may bear little relation to the hypothetical cash settlement amounts

shown above, and these amounts should not be viewed as an indication of the financial return on an investment in the offered notes. The

hypothetical cash settlement amounts on notes held to the call payment date or the stated maturity date in the examples above assume

you purchased your notes at their principal amount and have not been adjusted to reflect the actual issue price you pay for your notes.

The return on your investment (whether positive or negative) in your notes will be affected by the amount you pay for your notes. If

you purchase your notes for a price other than the principal amount, the return on your investment will differ from, and may be significantly

lower than, the hypothetical returns suggested by the above examples. Please read “Risk Factors—Market Valuation Risks—The

market value of the notes will be affected by various factors that interrelate in complex ways, and their market value may be less than

the principal amount” in the accompanying Underlying Supplement.

Payments on the notes are economically equivalent

to the amounts that would be paid on a combination of other instruments. For example, payments on the notes are economically equivalent

to a combination of an interest-bearing bond bought by the holder and one or more options entered into between the holder and us (with

one or more implicit option premiums paid over time). The discussion in this paragraph does not modify or affect the terms of the notes

or the U.S. federal income tax treatment of the notes, as described elsewhere in this Pricing Supplement.

| We

cannot predict the actual closing price of the underlier or what the market value of your notes will be on any particular trading

day, nor can we predict the relationship between the underlier price and the market value of your notes at any time prior to the

call payment date and the stated maturity date. The actual amount that you will receive, if any, on the call payment date or at maturity

and the rate of return on the offered notes will depend on the actual initial underlier price, call premium amount and maturity date

premium amount, which we will set on the trade date, the actual closing price of the underlier on the call observation date and whether

the notes are called, and the actual final underlier price determined by the calculation agent as described above. Moreover, the

assumptions on which the hypothetical returns are based may turn out to be inaccurate. Consequently, the amount of cash to be paid

in respect of your notes, if any, on the call payment date or the stated maturity date may be very different from the information

reflected in the table and the examples above. |

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

ADDITIONAL RISK FACTORS SPECIFIC TO YOUR NOTES

| An

investment in your notes is subject to the risks described below, as well as the risks and considerations described under “Risk

Factors” in the accompanying Prospectus, Prospectus Supplement and Underlying Supplement. You should carefully review these

risks and considerations as well as the terms of the notes described herein and in the accompanying Prospectus, Prospectus Supplement

and Underlying Supplement. Your notes are a riskier investment than ordinary debt securities. Also, your notes are not equivalent

to investing directly in the underlier or the underlier stocks, i.e., the stocks held by the underlier to which your notes are linked.

You should carefully consider whether the offered notes are suited to your particular circumstances. |

Structure Risks

You May Lose Your Entire Investment in

the Notes

You may lose your entire investment in the notes.

Assuming your notes are not automatically called on the call observation date, the cash payment on your notes, if any, on the stated

maturity date will be based on the performance of the underlier as measured from the initial underlier price set on the trade date (which

could be higher or lower than the actual closing price of the underlier on that date) to the closing price on the determination date.

If the final underlier price is less than the buffer price, you will lose, for each $1,000 of the principal amount of your notes, an

amount equal to the product of (i) the buffer rate times (ii) the sum of the underlier return plus the buffer amount times

(iii) $1,000. Thus, you may lose your entire investment in the notes, which would include any premium to principal amount you paid

when you purchased the notes.

Also, the market price of your notes prior to

the call payment date or the stated maturity date may be significantly lower than the purchase price you pay for your notes. Consequently,

if you sell your notes before the call payment date or the stated maturity date, you may receive significantly less than the amount of

your investment in the notes.

The Cash

Settlement Amount You Will Receive on the Call Payment Date or on the Stated Maturity Date, as the Case May be, Will Be Capped

Regardless of the closing price of the underlier

on the call observation date, the cash settlement amount you may receive on the call payment date, if any, is capped. If the closing

price of the underlier on the call observation date exceeds the call price, causing the notes to be automatically called,

the cash settlement amount on the call payment date will be capped, and you will not benefit from any increases in the closing price

of the underlier above the initial underlier price on the call observation date. If your notes are automatically called on the call observation

date, the maximum payment you will receive for each $1,000 principal amount of your notes will depend on the call premium amount, which

will be set on the trade date. If your notes are not automatically called on the call observation date, the cash settlement amount you

may receive on the stated maturity date is capped due to the maturity date premium amount.

Your Notes Are Subject to Automatic Redemption

We will call and automatically redeem all, but

not part, of your notes on the call payment date, if the closing price of the underlier on the call observation date is greater than

or equal to the call price. Therefore, the term for your notes may be reduced to as short as between 12 and 14 months after the trade

date (to be set on the trade date). You may not be able to reinvest the proceeds from an investment in the notes at a comparable return

for a similar level of risk in the event the notes are called prior to maturity.

The Amount Payable

on Your Notes Is Not Linked to the Price of the Underlier at Any Time Other than the Call Observation Date or the Determination

Date, as the Case May Be

The cash settlement amount you will receive on

the call payment date, if any, will be paid only if the notes are automatically called when the closing price of the underlier on the

call observation date is greater than or equal to the call price. Therefore, the closing price of the underlier on

dates other than the call observation date will have no effect on the determination as to whether the notes are automatically called.

In addition, if your notes are not automatically called on the call observation date, the cash settlement amount you will receive on

the stated maturity date, if any, will be based on the closing price of the underlier on the determination date. Therefore, if the closing

price of the underlier dropped precipitously on the determination date, the cash settlement amount for your notes may be significantly

less than it would have been had the cash settlement amount been linked to the closing price of the underlier prior to such drop in the

price of the underlier. Although the actual price of the underlier on the call payment date, the stated maturity date or at other times

during the life of your notes may be higher than the closing price of the underlier on the call observation date or the determination

date, you will not benefit from the closing prices of the underlier at any time other than on the call observation date or on the determination

date.

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

Your Notes Do Not Bear Interest

You will not receive any interest payments on

your notes. As a result, even if the cash settlement amount payable for your notes on the call payment date or the stated maturity date,

as the case may be, exceeds the principal amount of your notes, the overall return you earn on your notes may be less than you would

have earned by investing in a non-index-linked debt security of comparable maturity that bears interest at a prevailing market rate.

Underlier Risks

The Underlier Is Concentrated in Metals and

Mining Companies and Does Not Provide Diversified Exposure

The underlier is not diversified. The underlier’s

assets will be concentrated in metals and mining companies (including companies assigned to the aluminum, coal & consumable

fuels, copper, diversified metals & mining, gold, precious metals & minerals, silver or steel sub-industries), which

means the underlier is more likely to be adversely affected by any negative performance of metals and mining companies than an ETF that

has more diversified holdings across a number of sectors. Metals and mining companies can be significantly affected by events relating

to international political and economic developments, energy conservation, the success of exploration projects, commodity prices, exchange

rates, import controls, worldwide competition, environmental policies, consumer demand, and tax and other government regulations. Investments

in metals and mining companies may be speculative and may be subject to greater price volatility than investments in other types of companies.

Metals and mining companies are subject to various risks, including changes in international monetary policies or economic and political

conditions that can affect the supply of precious metals and consequently the value of metals and mining company investments. In addition,

the United States or foreign governments may pass laws or regulations limiting metals investments for strategic or other policy reasons,

and increased environmental or labor costs may depress the value of metals and mining investments. At times, worldwide production of

industrial materials has exceeded demand as a result of over-building or economic downturns. Metals and mining companies can also be

affected by liabilities for environmental damage and general civil liabilities, depletion of resources and mandated expenditures for

safety and pollution control.

The Return on Your Notes Will Not Reflect Any

Dividends Paid on the Underlier or the Underlier Stocks

The return on your notes will not reflect the

return you would realize if you actually owned the shares of the underlier and received the distributions paid on the shares of the underlier.

You will not receive any dividends that may be paid on any of the underlier stocks by the underlier stock issuers or the shares of the

underlier. See “—You Have No Shareholder Rights or Rights to Receive Any Shares of the Underlier or Any Underlier Stock”

below for additional information.

You Have No Shareholder Rights or Rights to

Receive Any Shares of the Underlier or Any Underlier Stock

Investing in the notes will not make you a holder

of any shares of the underlier or any underlier stocks. Neither you nor any other holder or owner of the notes will have any rights with

respect to the underlier or the underlier stocks, including any voting rights, any right to receive dividends or other distributions,

any rights to make a claim against the underlier or the underlier stocks or any other rights of a holder of the underlier stocks. Your

notes will be paid in cash and you will have no right to receive delivery of any shares of the underlier or the underlier stocks.

The Policies of the Underlier’s Investment

Advisor and the Sponsor of The Underlying Index Could Affect the Amount Payable on Your Notes and Their Market Value

The underlier’s investment advisor may from

time to time be called upon to make certain policy decisions or judgments with respect to the implementation of policies of the underlier

investment advisor concerning the calculation of the net asset value of the underlier, additions, deletions or substitutions of securities

in the underlier and the manner in which changes affecting the underlying index are reflected in the underlier that could affect the

market price of the shares of the underlier, and therefore, the amount payable on your notes on the stated maturity date. The amount

payable on your notes and their market value could also be affected if the underlier investment advisor changes these policies, for example,

by changing the manner in which it calculates the net asset value of the underlier, or if the underlier investment advisor discontinues

or suspends calculation or publication of the net asset value of the underlier, in which case it may become difficult or inappropriate

to determine the market value of your notes.

If events such as these occur, the calculation

agent — which initially will be CIBC — may determine the closing price of the underlier on the determination date —

and thus the amount payable on the stated maturity date, if any — in a manner, in its sole discretion, it considers appropriate.

We describe the discretion that the calculation agent will have in determining the closing underlier price on the determination date

and the amount payable on your notes more fully under “Certain Terms of the Notes — Discontinuance of or Material Change

to a Fund” in the accompanying Underlying Supplement.

In addition, the underlying index sponsor owns

the underlying index and is responsible for the design and maintenance of the underlying index. The policies of the underlying index

sponsor concerning the calculation of the underlying index,

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

including decisions regarding the addition, deletion

or substitution of the equity securities included in the underlying index, could affect the price of the underlying index and, consequently,

could affect the market prices of shares of the underlier and, therefore, the amount payable on your notes and their market value.

There Is No Assurance That an Active Trading

Market Will Continue for the Underlier or That There Will Be Liquidity in Any Such Trading Market; Further, the Underlier Is Subject

to Management Risks, Securities Lending Risks and Custody Risks

Although the shares of the underlier and a number

of similar products have been listed for trading on securities exchanges for varying periods of time, there is no assurance that an active

trading market will continue for the shares of the underlier or that there will be liquidity in the trading market.

In addition, the underlier is subject to management

risk, which is the risk that the underlier investment advisor’s investment strategy, the implementation of which is subject to

a number of constraints, may not produce the intended results. The underlier is also not actively managed and may be affected by a general

decline in market segments relating to the underlying index. The underlier investment advisor invests in securities included in, or representative

of, the underlying index regardless of their investment merits. The underlier investment advisor does not attempt to take defensive positions

in declining markets. In addition, the underlier’s investment advisor may be permitted to engage in securities lending with respect

to a portion of the underlier’s total assets, which could subject the underlier to the risk that the borrower of such loaned securities

fails to return the securities in a timely manner or at all.

In addition, the underlier is subject to custody

risk, which refers to the risks in the process of clearing and settling trades and to the holding of securities by local banks, agents

and depositories.

Further, the underlier is subject to listing standards

adopted by the securities exchange on which the underlier is listed for trading. There can be no assurance that the underlier will continue

to meet the applicable listing requirements, or that the underlier will not be delisted.

We Cannot Control Actions By Any of the Unaffiliated

Companies Whose Securities Are Included in the Underlier

Actions by any company whose securities are included

in the underlier may have an adverse effect on the price of its security, the closing price of the underlier and the value of the notes.

These companies will not be involved in the offering of the notes and will have no obligations with respect to the notes, including any

obligation to take our or your interests into consideration for any reason. These companies will not receive any of the proceeds of the

offering of the notes and will not be responsible for, and will not have participated in, the determination of the timing of, prices

for, or quantities of, the notes to be issued. These companies will not be involved with the administration, marketing or trading of

the notes and will have no obligations with respect to the cash settlement amount to be paid to you on the notes.

We and Our Respective Affiliates Have No Affiliation

with the Underlier Sponsor and Have Not Independently Verified Its Public Disclosure of Information

We and our respective affiliates are not affiliated

in any way with the underlier sponsor and have no ability to control or predict its actions, including any errors in or discontinuation

of disclosure regarding the methods or policies relating to the calculation of the underlier. We have derived the information about the

underlier sponsor and the underlier contained herein from publicly available information, without independent verification. You, as an

investor in the notes, should make your own investigation into the underlier and the underlier sponsor. The underlier sponsor is not

involved in the offering of the notes made hereby in any way and has no obligation to consider your interest as an owner of notes in

taking any actions that might affect the value of the notes.

The Performance of the Underlier May Not

Correlate With the Performance of Its Underlying Index as Well as the Net Asset Value Per Share of the Underlier, Especially During Periods

of Market Volatility.

Although the underlier is designed to track the

performance of its underlying index, the performance of the underlier and that of its underlying index generally will vary due to, for

example, transaction costs, management fees, certain corporate actions, and timing variances. Moreover, it is also possible that the

performance of the underlier may not fully replicate or may, in certain circumstances, diverge significantly from the performance of

its underlying index. This could be due to, for example, the underlier not holding all or substantially all of the underlying assets

included in the underlying index and/or holding assets that are not included in the underlying index, the temporary unavailability of

certain securities in the secondary market, the performance of any derivative instruments held by the underlier, differences in trading

hours between the underlier (or the underlying assets held by the underlier) and the underlying index, or due to other circumstances.

This variation in performance is called the “tracking error,” and, at times, the tracking error may be significant.

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

In addition, because the shares of the underlier

are traded on a securities exchange and are subject to market supply and investor demand, the market price of one share of the underlier

may differ from its net asset value per share; shares of the underlier may trade at, above, or below its net asset value per share.

During periods of market volatility, securities

held by the underlier may be unavailable in the secondary market, market participants may be unable to calculate accurately the net asset

value per share of the underlier and the liquidity of the underlier may be adversely affected. This kind of market volatility may also

disrupt the ability of market participants to create and redeem shares of the underlier. Further, market volatility may adversely affect,

sometimes materially, the prices at which market participants are willing to buy and sell shares of the underlier. As a result, under

these circumstances, the market value of shares of the underlier may vary substantially from the net asset value per share of the underlier.

For the foregoing reasons, the performance of

the underlier may not match the performance of its underlying index over the same period. Because of this variance, the return on the

notes, to the extent dependent on the performance of the underlier, may not be the same as an investment directly in the securities,

commodities, or other assets included in the underlying index or the same as a debt security with a return linked to the performance

of the underlying index.

The Historical Performance of the Underlier

Should Not Be Taken as an Indication of Its Future Performance

The closing price of the underlier on the call

observation date or the determination date will determine the amount to be paid on the notes on the call payment date or at maturity,

as the case may be. The historical performance of the underlier does not necessarily give an indication of its future performance. As

a result, it is impossible to predict whether the price of the underlier will rise or fall during the term of the notes. The price of

the underlier will be influenced by complex and interrelated political, economic, financial and other factors.

Conflicts of Interest

There Are Potential Conflicts of Interest Between

You and the Calculation Agent

The calculation agent will, among other things,

determine the cash settlement amount payable on the notes. We will serve as the calculation agent. We may appoint a different calculation

agent without your consent and without notifying you. The calculation agent will exercise its judgment when performing its functions.

For example, the calculation agent may have to determine whether a market disruption event affecting the underlier has occurred. This

determination may, in turn, depend on the calculation agent’s judgment as to whether the event has materially interfered with our

ability or the ability of one of our affiliates or a similarly situated party to unwind our hedge positions. Since this determination

by the calculation agent will affect the payment on the notes, the calculation agent may have a conflict of interest if it needs to make

a determination of this kind. See “Certain Terms of the Notes — Role of the Calculation Agent” in the accompanying

Underlying Supplement.

Our Economic Interests and Those of GS&Co.

and any Dealer Participating in the Offering of the Notes Will Potentially Be Adverse to Your Interests

You should be aware of the following ways in which

our economic interests and those of GS&Co. and any dealer participating in the distribution of the notes, which we refer to as a

“participating dealer,” will potentially be adverse to your interests as an investor in the notes. In engaging in certain

of the activities described below, our affiliates, GS&Co. or its affiliates or any participating dealer or its affiliates may take

actions that may adversely affect the value of and your return on the notes, and in so doing they will have no obligation to consider

your interests as an investor in the notes. Our affiliates, GS&Co. or its affiliates or any participating dealer or its affiliates

may realize a profit from these activities even if investors do not receive a favorable investment return on the notes.

Research Reports by Our Affiliates, GS&Co.

or Its Affiliates or Any Participating Dealer or Its Affiliates May Be Inconsistent With an Investment in the Notes and May Adversely

Affect the Price of the Underlier

Our affiliates, GS&Co. or its affiliates or

any dealer participating in the offering of the notes or its affiliates may, at present or in the future, publish research reports on

the underlier or any underlier stocks. This research will be modified from time to time without notice and may, at present or in the

future, express opinions or provide recommendations that are inconsistent with purchasing or holding the notes. Any research reports

on the underlier or any underlier stocks could adversely affect the price of the underlier and, therefore, adversely affect the value

of and your return on the notes. You are encouraged to derive information concerning the underlier from multiple sources and should not

rely on the views expressed by us or our affiliates, GS&Co. or its affiliates or any participating dealer or its affiliates. In addition,

any research reports on the underlier or any underlier stocks published on or prior to the trade date could result in an increase in

the price of the underlier on the trade date, which would adversely affect investors in the notes by increasing the price at which the

underlier must close on the determination date in order for investors in the notes to receive a favorable return.

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

Hedging Activities by Our Affiliates, GS&Co.

or Its Affiliates or Any Participating Dealer or Its Affiliates May Adversely Affect the Price of the Underlier

We expect to hedge our obligations under the notes

through one or more hedge counterparties, which may include our affiliates, GS&Co. or its affiliates or any participating dealer

or its affiliates. Pursuant to such hedging activities, our hedge counterparty may acquire the underlier or any underlier stocks and/or

other instruments linked to the underlier or any underlier stocks. Depending on, among other things, future market conditions, the aggregate

amount and the composition of such positions are likely to vary over time. To the extent that our hedge counterparty has a long hedge

position in the underlier or any underlier stocks, or derivative or synthetic instruments related to the underlier or any underlier stocks,

they may liquidate a portion of such holdings at or about the time of the determination date or at or about the time of a change in the

underlier or any underlier stocks. These hedging activities could potentially adversely affect the price of the underlier and, therefore,

adversely affect the value of and your return on the notes.

Trading Activities by Our Affiliates, GS&Co.

or Its Affiliates or Any Participating Dealer or Its Affiliates May Adversely Affect the Price of the Underlier

Our affiliates, GS&Co. or its affiliates or

any participating dealer or its affiliates may engage in trading in the underlier or any underlier stocks and other instruments relating

to the underlier or any underlier stocks on a regular basis as part of their general broker-dealer and other businesses. Any of these

trading activities could potentially adversely affect the price of the underlier and, therefore, adversely affect the value of and your

return on the notes.

A Participating Dealer or Its Affiliates May Realize

Hedging Profits Projected by Its Proprietary Pricing Models in Addition to Any Selling Concession or Any Distribution Expense Fee, Creating

a Further Incentive for the Participating Dealer to Sell the Notes to You

If any participating dealer or any of its affiliates

conducts hedging activities for us in connection with the notes, that participating dealer or its affiliates will expect to realize a

projected profit from such hedging activities, and this projected profit will be in addition to any concession or distribution expense

fee that the participating dealer receives for the sale of the notes to you. This additional projected profit may create a further incentive

for the participating dealer to sell the notes to you.

Tax Risks

The U.S. Federal Tax Consequences of An Investment

in the Notes Are Unclear

There is no direct legal authority regarding the

proper U.S. federal tax treatment of the notes, and we do not plan to request a ruling from the U.S. Internal Revenue Service (the “IRS”).

Consequently, significant aspects of the tax treatment of the notes are uncertain, and the IRS or a court might not agree with the treatment

of the notes as prepaid cash-settled derivative contracts. If the IRS were successful in asserting an alternative treatment of the notes,

the tax consequences of the ownership and disposition of the notes might be materially and adversely affected. The U.S. Treasury Department

and the IRS released a notice requesting comments on various issues regarding the U.S. federal income tax treatment of “prepaid

forward contracts” and similar instruments. See “Material U.S. Federal Income Tax Consequences” in the accompanying

Underlying Supplement. Any Treasury regulations or other guidance promulgated after consideration of these issues could materially and

adversely affect the tax consequences of an investment in the notes, including the character and timing of income or loss and the degree,

if any, to which income realized by non-U.S. persons should be subject to withholding tax, possibly with retroactive effect. Both U.S.

and non-U.S. persons considering an investment in the notes should review carefully the section of the accompanying Underlying Supplement

entitled “Material U.S. Federal Income Tax Consequences” and consult their tax advisers regarding the U.S. federal tax consequences

of an investment in the notes (including possible alternative treatments and the issues presented by the notice), as well as tax consequences

arising under the laws of any state, local or non-U.S. taxing jurisdiction.

There Can Be No Assurance that the Canadian

Federal Income Tax Consequences of an Investment in the Notes Will Not Change in the Future

There can be no assurance that Canadian federal

income tax laws, the judicial interpretation thereof, or the administrative policies and assessing practices of the Canada Revenue Agency

will not be changed in a manner that adversely affects investors. For a discussion of the Canadian federal income tax consequences of

investing in the notes, please read the section of this Pricing Supplement entitled “Certain Canadian Federal Income Tax Considerations”

as well as the section entitled “Material Income Tax Consequences — Canadian Taxation” in the accompanying Prospectus.

You should consult your tax advisor with respect to your own particular situation.

General Risks

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

The Notes Are Subject to the Credit Risk of

the Bank

Although the return on the notes will be based

on the performance of the underlier, the payment of any amount due on the notes is subject to the credit risk of the Bank, as issuer

of the notes. The notes are our unsecured obligations. As further described in the accompanying Prospectus and Prospectus Supplement,

the notes will rank on par with all of the other unsecured and unsubordinated debt obligations of the Bank, except such obligations as

may be preferred by operation of law. Investors are dependent on our ability to pay all amounts due on the notes, and therefore investors

are subject to our credit risk and to changes in the market’s view of our creditworthiness. See “Description of Senior Debt

Securities — Ranking” in the accompanying Prospectus.

The Bank’s Initial Estimated Value of

the Notes at the Time of Pricing (When the Terms of Your Notes Are Set on the Trade Date) Will Be Lower Than the Initial Issue Price

of the Notes

The Bank’s initial estimated value of the

notes is only an estimate. The initial issue price of the notes will exceed the Bank’s initial estimated value. The difference

between the initial issue price of the notes and the Bank’s initial estimated value reflects costs associated with selling and

structuring the notes, as well as hedging its obligations under the notes with a third party.

Neither the Bank’s nor GS&Co.’s

Estimated Value of the Notes at Any Time Is Determined by Reference to Credit Spreads or the Borrowing Rate the Bank Would Pay for Its

Conventional Fixed-Rate Debt Securities

The Bank’s initial estimated value of the

notes and GS&Co.’s estimated value of the notes at any time are determined by reference to the Bank’s internal funding

rate. The internal funding rate used in the determination of the estimated value of the notes generally represents a discount from the

credit spreads for the Bank’s conventional fixed-rate debt securities and the borrowing rate the Bank would pay for its conventional

fixed-rate debt securities. This discount is based on, among other things, the Bank’s view of the funding value of the notes as

well as the higher issuance, operational and ongoing liability management costs of the notes in comparison to those costs for the Bank’s

conventional fixed-rate debt securities. If the interest rate implied by the credit spreads for the Bank’s conventional fixed-rate

debt securities or the borrowing rate the Bank would pay for its conventional fixed-rate debt securities were to be used, the Bank would

expect the economic terms of the notes to be more favorable to you. Consequently, the use of an internal funding rate for the notes increases

the estimated value of the notes at any time and has an adverse effect on the economic terms of the notes.

The Bank’s Initial Estimated Value of

the Notes Does Not Represent Future Values of the Notes and May Differ From Others’ (Including GS&Co.’s) Estimates

The Bank’s initial estimated value of the

notes is determined by reference to its internal pricing models when the terms of the notes are set. These pricing models consider certain

factors, such as the Bank’s internal funding rate on the trade date, the expected term of the notes, market conditions and other

relevant factors existing at that time, and the Bank’s assumptions about market parameters, which can include volatility, dividend

rates, interest rates and other factors. Different pricing models and assumptions (including the pricing models and assumptions used

by GS&Co.) could provide valuations for the notes that are different, and perhaps materially lower, from the Bank’s initial

estimated value. Therefore, the price at which GS&Co. or any other party would buy or sell your notes (if GS&Co. makes a market,

which it is not obligated to do) may be materially lower than the Bank’s initial estimated value. In addition, market conditions

and other relevant factors in the future may change, and any assumptions may prove to be incorrect.

The Price at Which GS&Co. Would Buy Or Sell

Your Notes (If GS&Co. Makes a Market, Which It Is Not Obligated To Do) Will Be Based on GS&Co.’s Estimated Value of Your

Notes

GS&Co.’s estimated value of the notes

is determined by reference to its pricing models and takes into account the Bank’s internal funding rate. The price at which GS&Co.

would initially buy or sell your notes in the secondary market (if GS&Co. makes a market, which it is not obligated to do) exceeds

GS&Co.’s estimated value of your notes at the time of pricing. As agreed by GS&Co. and the distribution participants, this

excess (i.e., the additional amount described under “Additional Information Regarding Estimated Value of the Notes” above)

will decline to zero on a straight line basis over the period from the trade date through the applicable date set forth above under “Additional

Information Regarding Estimated Value of the Notes” above. Thereafter, if GS&Co. buys or sells your notes, it will do so at

prices that reflect the estimated value determined by reference to GS&Co.’s pricing models at that time. The price at which

GS&Co. will buy or sell your notes at any time also will reflect its then current bid and ask spread for similar sized trades of

structured notes. If GS&Co. calculated its estimated value of your notes by reference to the Bank’s credit spreads or the borrowing

rate the Bank would pay for its conventional fixed-rate debt securities (as opposed to the Bank’s internal funding rate), the price

at which GS&Co. would buy or sell your notes (if GS&Co. makes a market, which it is not obligated to do) could be significantly

lower.

GS&Co.’s pricing models consider certain

variables, including principally the Bank’s internal funding rate, interest rates (forecasted, current and historical rates), volatility,

price-sensitivity analysis and the time to maturity of the notes. These

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

pricing models are proprietary and rely in part

on certain assumptions about future events, which may prove to be incorrect. As a result, the actual value you would receive if you sold

your notes in the secondary market, if any, to others may differ, perhaps materially, from the estimated value of your notes determined

by reference to GS&Co.’s models, taking into account the Bank’s internal funding rate, due to, among other things, any

differences in pricing models or assumptions used by others. See “Risk Factors—Market Valuation Risks—The market value

of the notes will be affected by various factors that interrelate in complex ways, and their market value may be less than the principal

amount” in the accompanying Underlying Supplement.

In addition to the factors discussed above, the

value and quoted price of your notes at any time will reflect many factors and cannot be predicted. If GS&Co. makes a market in the

notes, the price quoted by GS&Co. would reflect any changes in market conditions and other relevant factors, including any deterioration

in the Bank’s creditworthiness or perceived creditworthiness. These changes may adversely affect the value of your notes, including

the price you may receive for your notes in any market making transaction. To the extent that GS&Co. makes a market in the notes,

the quoted price will reflect the estimated value determined by reference to GS&Co.’s pricing models at that time, plus or

minus GS&Co.’s then current bid and ask spread for similar sized trades of structured notes (and subject to the declining excess

amount described above).

Furthermore, if you sell your notes, you will

likely be charged a commission for secondary market transactions, or the price will likely reflect a dealer discount. This commission

or discount will further reduce the proceeds you would receive for your notes in a secondary market sale.

There is no assurance that GS&Co. or any other

party will be willing to purchase your notes at any price and, in this regard, GS&Co. is not obligated to make a market in the notes.

See “—The Notes Will Not Be Listed on Any Securities Exchange and Your Notes May Not Have an Active Trading Market”

below.

The Notes Will Not Be Listed on Any Securities

Exchange and We Do Not Expect A Trading Market For the Notes to Develop

The notes will not be listed on any securities

exchange. Although GS&Co. and/or its affiliates may purchase the notes from holders, they are not obligated to do so and are not

required to make a market for the notes. There can be no assurance that a secondary market will develop for the notes. Because we do

not expect that any market makers will participate in a secondary market for the notes, the price at which you may be able to sell your

notes is likely to depend on the price, if any, at which GS&Co. and/or its affiliates are willing to buy your notes.

If a secondary market does exist, it may be limited.

Accordingly, there may be a limited number of buyers if you decide to sell your notes prior to the call payment date or the stated maturity

date. This may affect the price you receive upon such sale. Consequently, you should be willing to hold the notes to the call payment

date or the stated maturity date.

We May Sell an Additional Aggregate Principal

Amount of the Notes at a Different Issue Price

At our sole option, we may decide to sell an additional

aggregate principal amount of the notes subsequent to the trade date. The issue price of the notes in the subsequent sale may differ

substantially (higher or lower) from the initial issue price you paid as provided on the cover of this Pricing Supplement.

If You Purchase Your Notes at a Premium to the

Principal Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at the Principal Amount and the Impact

of Certain Key Terms of the Notes Will Be Negatively Affected

The cash settlement amount will not be adjusted

based on the issue price you pay for the notes. If you purchase notes at a price that differs from the principal amount of the notes,

then the return on your investment in such notes held to the call payment date or the stated maturity date will differ from, and may

be substantially less than, the return on notes purchased at the principal amount. If you purchase your notes at a premium to the principal

amount and hold them to the call payment date or the stated maturity date, the return on your investment in the notes will be lower than

it would have been had you purchased the notes at the principal amount or a discount to the principal amount. In addition, the impact

of the buffer price on the return on your investment will depend upon the price you pay for your notes relative to the principal amount.

For example, if you purchase your notes at a premium to the principal amount and the final underlier price is less than the buffer price,

you will incur a greater percentage decrease in your investment in the notes than would have been the case for notes purchased at the

principal amount or a discount to the principal amount.

Autocallable Buffered SPDR®

S&P® Metals & Mining ETF-Linked Notes due

THE UNDERLIER

The underlier seeks to track the investment

results that, before fees and expenses, correspond generally to the price and yield performance of the S&P Metals &

Mining Select Industry Index (the “underlying index”), which is designed to measure the performance of narrow

GICS® sub-industries. The underlying index comprises stocks in the S&P Total Market Index that are classified in

the GICS Aluminum, Coal & Consumable Fuels, Copper, Diversified Metals & Mining, Gold, Precious Metals &

Mining, Silver and Steel sub-industries. The shares of the underlier are listed and trade on the NYSE Arca under the ticker symbol

“XME.”

Information filed by the underlier with the SEC

pursuant to the Securities Exchange Act of 1934 and the Investment Company Act can be located by reference to the CIK Number of 0001064642

on the SEC’s website at http://www.sec.gov.

In addition, information may be obtained from

other publicly available sources including, but not limited to, the Investment Adviser’s website (including information regarding

(i) fees paid to the Investment Adviser, (ii) returns of the underlier and the underlying index for certain periods, and (iii) the

underlier’s and the underlying index’s top constituents and their respective weightings). We are not incorporating by reference

into this document the website or any material it includes. None of us, GS&Co. or any of our respective affiliates makes any representation

that such publicly available information regarding the underlier is accurate or complete.

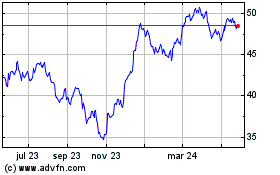

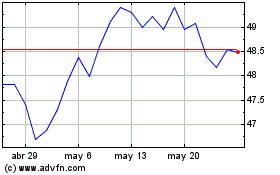

Historical Closing Prices of the Underlier

The closing price of the underlier has fluctuated

in the past and may, in the future, experience significant fluctuations. Any historical upward or downward trend in the closing price

of the underlier during the period shown below is not an indication that the underlier is more or less likely to increase or decrease

at any time during the life of your notes.

You should not

take the historical prices of the underlier as an indication of the future performance of the underlier. We cannot give you

any assurance that the future performance of the underlier or the underlier stocks will result in the automatic call of your notes or

your receiving an amount greater than the outstanding principal amount of your notes on the stated maturity date.

None of us, GS&Co. or any of our respective

affiliates makes any representation to you as to the performance of the underlier. Before investing in the offered notes, you should

consult publicly available information to determine the prices of the underlier between the date of this Pricing Supplement and the date