Form 8-K - Current report

26 Febrero 2024 - 5:08AM

Edgar (US Regulatory)

false

0000051143

Capital stock, par value $.20 per share

IBM

CHX

0000051143

2024-02-26

2024-02-26

0000051143

us-gaap:CommonStockMember

exch:XCHI

2024-02-26

2024-02-26

0000051143

us-gaap:CommonStockMember

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes1.125PercentDue2024Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes2.875PercentDue2025Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes0.950PercentDue2025Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes0.875PercentDue2025Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes0.300PercentDue2026Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes1.250PercentDue2027Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes3.375PercentDue2027Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes0.300PercentDue2028Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes1.750PercentDue2028Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes1.500PercentDue2029Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes0.875PercentDue2030Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes1.750PercentDue2031Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes3.625PercentDue2031Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

exch:XNYS

ibm:Notes0.650PercentDue2032Member

2024-02-26

2024-02-26

0000051143

exch:XNYS

ibm:Notes1.250PercentDue2034Member

2024-02-26

2024-02-26

0000051143

ibm:Notes3.750PercentDue2035Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Notes4.875PercentDue2038Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

exch:XNYS

ibm:Notes1.200PercentDie2040Member

2024-02-26

2024-02-26

0000051143

ibm:Notes4.000PercentDue2043Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Debentures7.00PercentDue2025Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Debentures6.22PercentDue2027Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Debentures6.50PercentDue2028Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Debentures5.875PercentDue2032Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Debentures7.00PercentDue2045Member

exch:XNYS

2024-02-26

2024-02-26

0000051143

ibm:Debentures7.125PercentDue2096Member

exch:XNYS

2024-02-26

2024-02-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

| Title of each class |

Capital stock, par value $.20 per share |

| Trading

symbol |

IBM |

| Common Stock |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: February 26, 2024

(Date of earliest

event reported)

INTERNATIONAL

BUSINESS MACHINES CORPORATION

(Exact name of registrant

as specified in its charter)

| New York |

|

1-2360 |

|

13-0871985 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(IRS employer Identification No.) |

One New Orchard Road

|

|

|

| Armonk,

New York |

|

10504 |

| (Address of principal executive offices) |

|

(Zip Code) |

914-499-1900

(Registrant’s telephone number)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange

on which registered |

| Capital stock, par value $.20 per share |

|

IBM |

|

New York Stock Exchange |

| |

|

|

|

NYSE Chicago |

| 1.125% Notes due 2024 |

|

IBM 24A |

|

New York Stock Exchange |

| 2.875% Notes due 2025 |

|

IBM 25A |

|

New York Stock Exchange |

| 0.950% Notes due 2025 |

|

IBM 25B |

|

New York Stock Exchange |

| 0.875% Notes due 2025 |

|

IBM 25C |

|

New York Stock Exchange |

| 0.300% Notes due 2026 |

|

IBM 26B |

|

New York Stock Exchange |

| 1.250% Notes due 2027 |

|

IBM 27B |

|

New York Stock Exchange |

| 3.375% Notes due 2027 |

|

IBM 27F |

|

New York Stock Exchange |

| 0.300% Notes due 2028 |

|

IBM 28B |

|

New York Stock Exchange |

| 1.750% Notes due 2028 |

|

IBM 28A |

|

New York Stock Exchange |

| 1.500% Notes due 2029 |

|

IBM 29 |

|

New York Stock Exchange |

| 0.875% Notes due 2030 |

|

IBM 30A |

|

New York Stock Exchange |

| 1.750% Notes due 2031 |

|

IBM 31 |

|

New York Stock Exchange |

| 3.625% Notes due 2031 |

|

IBM 31B |

|

New York Stock Exchange |

| 0.650% Notes due 2032 |

|

IBM 32A |

|

New York Stock Exchange |

| 1.250% Notes due 2034 |

|

IBM 34 |

|

New York Stock Exchange |

| 3.750% Notes due 2035 |

|

IBM 35 |

|

New York Stock Exchange |

| 4.875% Notes due 2038 |

|

IBM 38 |

|

New York Stock Exchange |

| 1.200% Notes due 2040 |

|

IBM 40 |

|

New York Stock Exchange |

| 4.000% Notes due 2043 |

|

IBM 43 |

|

New York Stock Exchange |

| 7.00% Debentures due 2025 |

|

IBM 25 |

|

New York Stock Exchange |

| 6.22% Debentures due 2027 |

|

IBM 27 |

|

New York Stock Exchange |

| 6.50% Debentures due 2028 |

|

IBM 28 |

|

New York Stock Exchange |

| 5.875% Debentures due 2032 |

|

IBM 32D |

|

New York Stock Exchange |

| 7.00% Debentures due 2045 |

|

IBM 45 |

|

New York Stock Exchange |

| 7.125% Debentures due 2096 |

|

IBM 96 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On February 26, 2024, IBM announced that it is updating its

reporting segments in the first quarter of 2024. Exhibit 99.1 of this Form 8-K contains additional information that the Company

posted on its Investor Relations website (www.ibm.com/investor/) about these updates.

The information in this Item 7.01, including Exhibit 99.1, is being

furnished with the Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is being furnished as part of this report:

IBM’s web site (www.ibm.com) contains a significant amount of

information about IBM, including financial and other information for investors (www.ibm.com/investor/). IBM encourages investors to visit

its various web sites from time to time, as information is updated and new information is posted.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: February 26, 2024 |

|

| |

|

|

| |

By: |

/s/ Nicolás Fehring |

| |

|

Nicolás Fehring |

| |

|

Vice President and Controller |

Exhibit 99.1

IBM Provides Update

to Management System and Reporting Segments

February 26, 2024

As we enter 2024, we continue to advance

our hybrid cloud and AI strategy, with the completion of the Weather Company divestiture and updates to our management system. We are

making changes to our reportable segments, to reflect the way the company manages operations and allocates resources. These actions better

align our portfolio to our core strategy and to the underlying business models. These changes also provide more relevant information to

investors. The following updates do not impact IBM’s consolidated results.

| · | The Weather Company divested assets moving from Software segment to Other – divested businesses |

In August 2023 we announced the divestiture

of The Weather Company assets, and the transaction closed on January 31, 2024. In the first quarter of 2024, we realigned our management

structure to have these assets managed outside the Software segment, within Other – divested businesses (Other). The movement of

historical financials to Other is consistent with the treatment of other divested software and services content, and results in a Software

segment more closely aligned to its go-forward business.

| · | Security Services moving from Software to Consulting |

To better capture the growing security

services market opportunity through our consulting engagements, management responsibility for Security Services has moved to Consulting.

Security Services will have greater access to Consulting clients globally and will be able to capitalize on the scale of Consulting’s

operating model and discipline. As a result, Security Services, previously reported within the Software segment will move to the Consulting

segment.

| · | Improved transparency of segment profitability |

IBM’s reportable segments have

historically included stock-based compensation and net interest expense allocations. As those decisions are made at the corporate level,

these expenses have been removed from the business unit management system and will no longer be included in the reportable segments. This

provides improved transparency of segment profitability and better comparability to industry peers.

IBM’s

reported results will reflect these changes beginning in the first quarter of 2024. We expect to provide recast segment

financials for 2022 and 2023 by the end of March to allow investors to update their models ahead of our first quarter earnings report.

The 2024 expectations provided in our

January earnings call incorporated the divestiture of The Weather Company assets in the first quarter. Additionally, the commentary on

segment expectations applies to the recast segments.

| Reportable Segment Change | |

Resulting Segment Implications

|

| The Weather Company asset divestiture | |

- Software Segment

+ Other – divested businesses |

| Security Services realignment | |

- Software Segment

+ Consulting Segment |

| Removal of stock-based compensation and net interest expense allocations from segment profitability | |

- Software Segment, Consulting Segment, Infrastructure Segment, Financing Segment*

+ Other |

*Presentation of interest for the Financing segment will

not change

v3.24.0.1

Cover

|

Feb. 26, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 26, 2024

|

| Entity File Number |

1-2360

|

| Entity Registrant Name |

INTERNATIONAL

BUSINESS MACHINES CORPORATION

|

| Entity Central Index Key |

0000051143

|

| Entity Tax Identification Number |

13-0871985

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity Address, Address Line One |

One New Orchard Road

|

| Entity Address, City or Town |

Armonk

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10504

|

| City Area Code |

914

|

| Local Phone Number |

499-1900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock | NYSE CHICAGO, INC. [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Capital stock, par value $.20 per share

|

| Trading Symbol |

IBM

|

| Security Exchange Name |

CHX

|

| Common Stock | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Capital stock, par value $.20 per share

|

| Trading Symbol |

IBM

|

| Security Exchange Name |

NYSE

|

| Notes 1. 125 Percent Due 2024 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.125% Notes due 2024

|

| Trading Symbol |

IBM 24A

|

| Security Exchange Name |

NYSE

|

| Notes 2. 875 Percent Due 2025 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

2.875% Notes due 2025

|

| Trading Symbol |

IBM 25A

|

| Security Exchange Name |

NYSE

|

| Notes 0. 950 Percent Due 2025 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.950% Notes due 2025

|

| Trading Symbol |

IBM 25B

|

| Security Exchange Name |

NYSE

|

| Notes 0. 875 Percent Due 2025 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Notes due 2025

|

| Trading Symbol |

IBM 25C

|

| Security Exchange Name |

NYSE

|

| Notes 0. 300 Percent Due 2026 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.300% Notes due 2026

|

| Trading Symbol |

IBM 26B

|

| Security Exchange Name |

NYSE

|

| Notes 1. 250 Percent Due 2027 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.250% Notes due 2027

|

| Trading Symbol |

IBM 27B

|

| Security Exchange Name |

NYSE

|

| Notes 3. 375 Percent Due 2027 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.375% Notes due 2027

|

| Trading Symbol |

IBM 27F

|

| Security Exchange Name |

NYSE

|

| Notes 0. 300 Percent Due 2028 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.300% Notes due 2028

|

| Trading Symbol |

IBM 28B

|

| Security Exchange Name |

NYSE

|

| Notes 1. 750 Percent Due 2028 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.750% Notes due 2028

|

| Trading Symbol |

IBM 28A

|

| Security Exchange Name |

NYSE

|

| Notes 1. 500 Percent Due 2029 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.500% Notes due 2029

|

| Trading Symbol |

IBM 29

|

| Security Exchange Name |

NYSE

|

| Notes 0. 875 Percent Due 2030 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Notes due 2030

|

| Trading Symbol |

IBM 30A

|

| Security Exchange Name |

NYSE

|

| Notes 1. 750 Percent Due 2031 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.750% Notes due 2031

|

| Trading Symbol |

IBM 31

|

| Security Exchange Name |

NYSE

|

| Notes 3. 625 Percent Due 2031 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.625% Notes due 2031

|

| Trading Symbol |

IBM 31B

|

| Security Exchange Name |

NYSE

|

| Notes 0. 650 Percent Due 2032 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.650% Notes due 2032

|

| Trading Symbol |

IBM 32A

|

| Security Exchange Name |

NYSE

|

| Notes 1. 250 Percent Due 2034 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.250% Notes due 2034

|

| Trading Symbol |

IBM 34

|

| Security Exchange Name |

NYSE

|

| Notes 3. 750 Percent Due 2035 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.750% Notes due 2035

|

| Trading Symbol |

IBM 35

|

| Security Exchange Name |

NYSE

|

| Notes 4. 875 Percent Due 2038 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.875% Notes due 2038

|

| Trading Symbol |

IBM 38

|

| Security Exchange Name |

NYSE

|

| Notes 1. 200 Percent Die 2040 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.200% Notes due 2040

|

| Trading Symbol |

IBM 40

|

| Security Exchange Name |

NYSE

|

| Notes 4. 000 Percent Due 2043 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.000% Notes due 2043

|

| Trading Symbol |

IBM 43

|

| Security Exchange Name |

NYSE

|

| Debentures 7. 00 Percent Due 2025 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Debentures due 2025

|

| Trading Symbol |

IBM 25

|

| Security Exchange Name |

NYSE

|

| Debentures 6. 22 Percent Due 2027 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.22% Debentures due 2027

|

| Trading Symbol |

IBM 27

|

| Security Exchange Name |

NYSE

|

| Debentures 6. 50 Percent Due 2028 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.50% Debentures due 2028

|

| Trading Symbol |

IBM 28

|

| Security Exchange Name |

NYSE

|

| Debentures 5. 875 Percent Due 2032 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.875% Debentures due 2032

|

| Trading Symbol |

IBM 32D

|

| Security Exchange Name |

NYSE

|

| Debentures 7. 00 Percent Due 2045 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Debentures due 2045

|

| Trading Symbol |

IBM 45

|

| Security Exchange Name |

NYSE

|

| Debentures 7. 125 Percent Due 2096 [Member] | New York Stock Exchange |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.125% Debentures due 2096

|

| Trading Symbol |

IBM 96

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.125PercentDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes2.875PercentDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.950PercentDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.875PercentDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.300PercentDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.250PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes3.375PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.300PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.750PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.500PercentDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.875PercentDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.750PercentDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes3.625PercentDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes0.650PercentDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.250PercentDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes3.750PercentDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes4.875PercentDue2038Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes1.200PercentDie2040Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Notes4.000PercentDue2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures7.00PercentDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures6.22PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures6.50PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures5.875PercentDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures7.00PercentDue2045Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ibm_Debentures7.125PercentDue2096Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

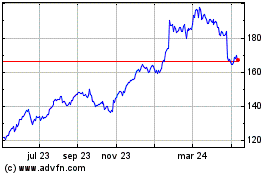

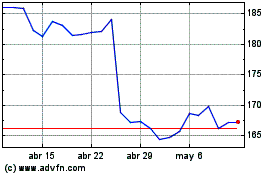

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024