0000077360false00000773602024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 30, 2024

Pentair plc

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| | |

| Ireland | 001-11625 | 98-1141328 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File No.) | (I.R.S. Employer

Identification No.) |

Regal House, 70 London Road, Twickenham, London, TW13QS United Kingdom

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 44-74-9421-6154

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary Shares, nominal value $0.01 per share | PNR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2). ☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 Results of Operations and Financial Condition

On January 30, 2024, Pentair plc (the “Company”) issued a press release announcing its earnings for the fourth quarter and full year of 2023 and a conference call in connection therewith. A copy of the release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

This press release refers to certain non-generally accepted accounting principles (“GAAP”) financial measures (core sales, segment income, adjusted return on sales, adjusted net income from continuing operations, adjusted diluted earnings per share from continuing operations and free cash flow) and a reconciliation of those non-GAAP financial measures to the corresponding financial measures contained in the Company’s financial statements prepared in accordance with GAAP.

The 2023 segment income, adjusted return on sales, adjusted net income from continuing operations and adjusted diluted earnings per share from continuing operations (“EPS”) include equity income of unconsolidated subsidiaries and eliminate intangible amortization, costs of certain restructuring, transformation and other activities, certain legal accrual adjustments and settlements, asset impairment and write-offs, pension and other post-retirement mark-to-market loss, other income and certain tax items. The 2022 segment income, adjusted return on sales, adjusted net income from continuing operations and adjusted diluted EPS include equity income of unconsolidated subsidiaries and eliminate intangible amortization, costs of certain restructuring, transformation and other activities, inventory step-up adjustments, deal-related costs and expenses, certain legal accrual adjustments and settlements, asset impairment and write-offs, impact associated with the business exit in Russia, gain on sale of businesses, pension and other post-retirement mark-to-market gain, amortization of bridge financing fees and certain tax items.

We use the term “core sales” to refer to GAAP net sales from continuing operations excluding (1) the impact of currency translation and (2) the impact of net sales from acquired businesses recorded prior to the first anniversary of the acquisition, excluding the excess over prior year net sales of the acquired business, less the amount of net sales attributable to divested product lines not considered discontinued operations (“acquisition sales”). The portion of GAAP net sales attributable to currency translation is calculated as the difference between (a) the period-to-period change in net sales (excluding acquisition sales) and (b) the period-to-period change in net sales (excluding acquisition sales) after applying current period foreign exchange rates to the prior year period. We use the term “core sales growth” to refer to the measure of comparing current period core net sales with the corresponding period of the prior year.

Management utilizes these adjusted financial measures to assess the run-rate of its continuing operations against those of prior periods without the distortion of these factors. The Company believes that these non-GAAP financial measures will be useful to investors as well to assess the continuing strength of the Company’s underlying operations. In addition, adjusted EPS is used as a criterion to measure and pay long-term incentive compensation and segment income is used as a criterion to measure and pay annual incentive compensation. These non-GAAP measures may not be comparable to similarly titled measures reported by other companies.

The Company uses free cash flow to assess its cash flow performance. The Company believes free cash flow is an important measure of liquidity because it provides the Company and its investors a measurement of cash generated from operations that is available to pay dividends, repurchase shares and repay debt. In addition, free cash flow is used as a criterion to measure and pay annual incentive compensation. The Company’s measure of free cash flow may not be comparable to similarly titled measures reported by other companies.

ITEM 9.01 Financial Statements and Exhibits

(a)Financial Statements of Businesses Acquired

Not applicable.

(b)Pro Forma Financial Information

Not applicable.

(c)Shell Company Transactions

Not applicable.

(d)Exhibits

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | Description |

| | Pentair plc press release dated January 30, 2024 announcing earnings for the fourth quarter and full year of 2023 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on January 30, 2024.

| | | | | | | | |

| PENTAIR PLC |

| Registrant |

| | |

| By | /s/ Robert P. Fishman |

| | Robert P. Fishman |

| | Executive Vice President, Chief Financial Officer and Chief Accounting Officer |

Exhibit 99.1

News Release

Pentair Reports Strong Fourth Quarter and Full Year 2023 Results

•Fourth quarter sales of $985 million; full year 2023 sales of $4.1 billion.

•Operating income in the fourth quarter increased 50 percent to $167 million reflecting ROS of 17.0 percent, an increase of 590 basis points when compared to fourth quarter 2022; on an adjusted basis, ROS expanded 190 basis points to 20.1 percent. Full year operating income increased 24 percent to $739 million reflecting ROS of 18.0 percent, an increase of 360 basis points from the prior year; on an adjusted basis, ROS expanded 220 basis points to 20.8 percent.

•Fourth quarter GAAP EPS of $1.25 and adjusted EPS of $0.87; full year 2023 GAAP EPS of $3.75 and adjusted EPS of $3.75.

•Full year net cash provided by operating activities of continuing operations was $621 million, an increase of $257 million compared to the prior year and free cash flow provided by continuing operations for the full year was $550 million, an increase of $267 million compared to full year 2022.

•The Company introduces 2024 GAAP EPS guidance of $3.82 to $3.92 and adjusted EPS guidance of $4.15 to $4.25.

Reconciliations of GAAP to Non-GAAP measures are in the attached financial tables.

LONDON, United Kingdom — January 30, 2024 — Pentair plc (NYSE: PNR) today announced fourth quarter 2023 sales of $985 million. Sales were down 2 percent compared to sales for the same period last year. Excluding currency translation, acquisitions and divestitures, core sales declined 2 percent in the fourth quarter. Fourth quarter 2023 earnings per diluted share from continuing operations (“EPS”) were $1.25 compared to $0.58 in the fourth quarter of 2022. On an adjusted basis, the Company reported EPS of $0.87 compared to $0.82 in the fourth quarter of 2022. Segment income, adjusted net income, free cash flow, and adjusted EPS are described in the attached schedules.

Fourth quarter 2023 operating income was $167 million, up 50 percent compared to operating income for the fourth quarter of 2022, and return on sales (“ROS”) was 17.0 percent, an increase of 590 basis points when compared to the fourth quarter of 2022. On an adjusted basis, the Company reported segment income of $198 million, up 8 percent for the fourth quarter of 2023 compared to segment income for the fourth quarter of 2022, and ROS was 20.1 percent, an increase of 190 basis points when compared to the fourth quarter of 2022.

“Our strong results in 2023 reflected the power of our balanced and resilient water portfolio, our focused growth strategy, and solid execution from our relentless team,” said John L. Stauch, Pentair’s President and Chief Executive Officer. “Each of our three segments drove record margins in 2023. Our Transformation initiatives remain on track and have yielded strong margin expansion to continue to deliver shareholder value. In 2023, we generated significant free cash flow and continued to pay down debt, ending the year with an even stronger balance sheet. And, we raised our dividend for the 48th consecutive year which further solidified our status as a dividend aristocrat.”

Full year 2023 sales were $4.1 billion. Sales were flat compared to sales last year. Excluding currency translation, acquisitions and divestitures, core sales declined 5 percent in 2023. Full year 2023 EPS from continuing operations was $3.75 compared to $2.92 in 2022. On an adjusted basis, the Company reported EPS of $3.75 compared to $3.68 in 2022.

Full year 2023 operating income was $739 million, up 24 percent compared to operating income in 2022, and ROS was 18.0 percent, an increase of 360 basis points when compared to 2022. On an adjusted basis, the Company reported segment income of $855 million, up 11 percent in 2023, compared to segment income in 2022, and ROS was 20.8 percent, an increase of 220 basis points when compared to 2022.

Flow (previously named “Industrial and Flow Technologies”) sales were up 1 percent in the fourth quarter of 2023 compared to sales for the same period last year. Excluding currency translation, acquisitions and divestitures, core sales declined 1 percent in the fourth quarter. Segment income of $65 million was flat compared to the fourth quarter of 2022, and ROS was 17.2 percent, a decrease of 20 basis points when compared to the fourth quarter of 2022.

Flow sales were up 5 percent for the full year of 2023 compared to sales for the same period last year. Excluding currency translation, acquisitions and divestitures, core sales grew 5 percent in 2023. Segment income of $282 million was up 17 percent compared to 2022, and ROS was 17.8 percent, an increase of 170 basis points when compared to 2022.

Water Solutions sales were down 5 percent in the fourth quarter of 2023 compared to sales for the same period last year. Excluding currency translation, acquisitions and divestitures, core sales declined 4 percent in the fourth quarter. Segment income of $52 million was up 15 percent compared to the fourth quarter of 2022, and ROS was 19.1 percent, an increase of 320 basis points when compared to the fourth quarter of 2022.

Water Solutions sales were up 19 percent for the full year of 2023 compared to sales for the same period last year. Excluding currency translation, acquisitions and divestitures, core sales grew 1 percent in 2023. Segment income of $248 million was up 66 percent compared to 2022, and ROS was 21.0 percent, an increase of 590 basis points when compared to 2022.

Pool sales were down 2 percent in the fourth quarter of 2023 compared to sales for the same period last year. Excluding currency translation, acquisitions and divestitures, core sales declined 2 percent in the fourth quarter. Segment income of $105 million was up 5 percent compared to the fourth quarter of 2022, and ROS was 31.3 percent, an increase of 220 basis points when compared to the fourth quarter of 2022.

Pool sales were down 18 percent for the full year of 2023 compared to sales for the same period last year. Excluding currency translation, acquisitions and divestitures, core sales declined 18 percent in 2023. Segment income of $417 million was down 10 percent compared to 2022, and ROS was 31.0 percent, an increase of 270 basis points when compared to 2022.

Full year net cash provided by operating activities of continuing operations was $621 million and free cash flow from continuing operations was $550 million.

Pentair paid a regular cash dividend of $0.22 per share in the fourth quarter of 2023. Pentair previously announced on December 11, 2023 that it will pay a regular quarterly cash dividend of $0.23 per share on February 2, 2024 to shareholders of record at the close of business on January 19, 2024. This dividend reflects a 5 percent increase in the Company’s regular cash dividend rate and marks the 48th consecutive year that Pentair has increased its dividend.

OUTLOOK

Mr. Stauch concluded, “As we look to 2024, we are committed to driving growth, profitability and returns by focusing on our mission to help the world sustainably move, improve, and enjoy water, life’s most essential resource. We are investing in key areas to drive long-term growth and optimizing our sourcing and operational footprint which we expect to continue to drive further margin expansion in 2024 as these Transformation initiatives scale.”

The Company is introducing 2024 GAAP EPS guidance of approximately $3.82 to $3.92 and on an adjusted basis of approximately $4.15 to $4.25, which includes a $0.07 negative impact, primarily driven by changes in global tax standards. This is an increase of 11 percent to 13 percent compared to 2023. The Company anticipates full year 2024 sales to increase 2 percent to 3 percent on a reported basis.

In addition, the Company introduces first quarter 2024 GAAP EPS of approximately $0.81 to $0.84 and on an adjusted EPS basis of approximately $0.88 to $0.91. The Company expects first quarter sales to be down approximately 2 percent to 3 percent on a reported basis compared to first quarter 2023.

EARNINGS CONFERENCE CALL

Pentair President and Chief Executive Officer John L. Stauch and Chief Financial Officer Robert P. Fishman will discuss the Company’s fourth quarter and full year 2023 results on a conference call with investors at 9:00 a.m. Eastern today. A live audio webcast of the call, along with the related presentation, can be accessed in the Investor Relations section of the Company’s website, www.pentair.com, shortly before the call begins.

Reconciliations of non-GAAP financial measures are set forth in the attachments to this release and in the presentations, each of which can be found on Pentair’s website. The webcast and presentations will be archived at the Company’s website following the conclusion of the event.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This release contains statements that we believe to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets,” “plans,” “believes,” “expects,” “intends,” “will,” “likely,” “may,” “anticipates,” “estimates,” “projects,” “should,” “would,” “could,” “positioned,” “strategy,” or “future” or words, phrases, or terms of similar substance or the negative thereof are forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, assumptions and other factors, some of which are beyond our control, which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include the overall global economic and business conditions impacting our business, including the strength of housing and related markets and conditions relating to international hostilities; supply, demand, logistics, competition and pricing pressures related to and in the markets we serve; the ability to achieve the benefits of our restructuring plans, cost reduction initiatives and Transformation Program; the impact of raw material, logistics and labor costs and other inflation; volatility in currency exchange rates and interest rates; failure of markets to accept new product introductions and enhancements; the ability to successfully identify, finance, complete and integrate acquisitions; risks associated with operating foreign businesses; the impact of seasonality of sales and weather conditions; our ability to comply with laws and regulations; the impact of changes in laws, regulations and administrative policy, including those that limit U.S. tax benefits or impact trade agreements and tariffs; the outcome of litigation and governmental proceedings; and the ability to achieve our long-term strategic operating and ESG goals. Additional information concerning these and other factors is contained in our filings with the U.S. Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2022 and our quarterly reports on Form 10-Q. All forward-looking statements, including all financial forecasts, speak only as of the date of this release. Pentair assumes no obligation, and disclaims any obligation, to update the information contained in this release.

ABOUT PENTAIR PLC

At Pentair, we help the world sustainably move, improve, and enjoy water, life’s most essential resource. From our residential and commercial water solutions, to industrial water management and everything in between, Pentair is focused on smart, sustainable water solutions that help our planet and people thrive.

Pentair had revenue in 2023 of approximately $4.1 billion, and trades under the ticker symbol PNR. With approximately 10,500 global employees serving customers in more than 150 countries, we work to help improve lives and the environment around the world. To learn more, visit www.pentair.com.

PENTAIR CONTACTS:

| | | | | |

| Shelly Hubbard | Rebecca Osborn |

| Vice President, Investor Relations | Director, External Communications |

| Direct: 763-656-5575 | Direct: 763-656-5589 |

Email: shelly.hubbard@pentair.com | Email: rebecca.osborn@pentair.com |

| | | | | | | | | | | | | | | | | |

| Pentair plc and Subsidiaries |

| Condensed Consolidated Statements of Operations (Unaudited) |

| | | | | |

| Three months ended | | Twelve months ended |

| In millions, except per-share data | December 31,

2023 | December 31,

2022 | | December 31,

2023 | December 31,

2022 |

| Net sales | $ | 984.6 | | $ | 1,002.9 | | | $ | 4,104.5 | | $ | 4,121.8 | |

| Cost of goods sold | 618.5 | | 678.1 | | | 2,585.3 | | 2,757.2 | |

| Gross profit | 366.1 | | 324.8 | | | 1,519.2 | | 1,364.6 | |

| % of net sales | 37.2 | % | 32.4 | % | | 37.0 | % | 33.1 | % |

| Selling, general and administrative | 175.6 | | 190.1 | | | 680.2 | | 677.1 | |

| % of net sales | 17.8 | % | 19.0 | % | | 16.6 | % | 16.4 | % |

| Research and development | 23.5 | | 23.1 | | | 99.8 | | 92.2 | |

| % of net sales | 2.4 | % | 2.3 | % | | 2.4 | % | 2.2 | % |

| | | | | |

| | | | | |

| Operating income | 167.0 | | 111.6 | | | 739.2 | | 595.3 | |

| % of net sales | 17.0 | % | 11.1 | % | | 18.0 | % | 14.4 | % |

Other expense (income) | | | | | |

| Gain on sale of businesses | — | | — | | | — | | (0.2) | |

| | | | | |

Other expense (income) | 6.4 | | (17.4) | | | 2.0 | | (16.9) | |

| Net interest expense | 26.6 | | 27.6 | | | 118.3 | | 61.8 | |

| % of net sales | 2.7 | % | 2.8 | % | | 2.9 | % | 1.5 | % |

Income from continuing operations before income taxes | 134.0 | | 101.4 | | | 618.9 | | 550.6 | |

(Benefit) provision for income taxes | (74.1) | | 5.1 | | | (4.0) | | 67.4 | |

| Effective tax rate | (55.3) | % | 5.0 | % | | (0.6) | % | 12.2 | % |

Net income from continuing operations | 208.1 | | 96.3 | | | 622.9 | | 483.2 | |

| Loss from discontinued operations, net of tax | (0.1) | | (1.3) | | | (0.2) | | (2.3) | |

| | | | | |

| Net income | $ | 208.0 | | $ | 95.0 | | | $ | 622.7 | | $ | 480.9 | |

| Earnings (loss) per ordinary share | | | | | |

| Basic | | | | | |

| Continuing operations | $ | 1.26 | | $ | 0.59 | | | $ | 3.77 | | $ | 2.93 | |

| Discontinued operations | — | | (0.01) | | | — | | (0.01) | |

| Basic earnings per ordinary share | $ | 1.26 | | $ | 0.58 | | | $ | 3.77 | | $ | 2.92 | |

| Diluted | | | | | |

| Continuing operations | $ | 1.25 | | $ | 0.58 | | | $ | 3.75 | | $ | 2.92 | |

| Discontinued operations | — | | (0.01) | | | — | | (0.02) | |

| Diluted earnings per ordinary share | $ | 1.25 | | $ | 0.57 | | | $ | 3.75 | | $ | 2.90 | |

| Weighted average ordinary shares outstanding | | | | | |

| Basic | 165.3 | | 164.5 | | | 165.1 | | 164.8 | |

| Diluted | 166.7 | | 165.2 | | | 166.3 | | 165.6 | |

| Cash dividends paid per ordinary share | $ | 0.22 | | $ | 0.21 | | | $ | 0.88 | | $ | 0.84 | |

| | | | | |

| | | | | | | | |

| Pentair plc and Subsidiaries |

| Condensed Consolidated Balance Sheets (Unaudited) |

| | |

| | December 31,

2023 | December 31,

2022 |

| In millions |

| Assets |

| Current assets | | |

| Cash and cash equivalents | $ | 170.3 | | $ | 108.9 | |

Accounts receivable, net | 561.7 | | 531.5 | |

| Inventories | 677.7 | | 790.0 | |

| Other current assets | 159.3 | | 128.1 | |

| | |

| Total current assets | 1,569.0 | | 1,558.5 | |

| Property, plant and equipment, net | 362.0 | | 344.5 | |

| Other assets | | |

| Goodwill | 3,274.6 | | 3,252.6 | |

| Intangibles, net | 1,042.4 | | 1,094.6 | |

| Other non-current assets | 315.3 | | 197.3 | |

| | |

| Total other assets | 4,632.3 | | 4,544.5 | |

| Total assets | $ | 6,563.3 | | $ | 6,447.5 | |

| Liabilities and Equity |

| Current liabilities | | |

| | |

| Accounts payable | $ | 278.9 | | $ | 355.0 | |

| Employee compensation and benefits | 125.4 | | 106.0 | |

| Other current liabilities | 545.3 | | 602.1 | |

| | |

| Total current liabilities | 949.6 | | 1,063.1 | |

| Other liabilities | | |

| Long-term debt | 1,988.3 | | 2,317.3 | |

| Pension and other post-retirement compensation and benefits | 73.6 | | 70.8 | |

| Deferred tax liabilities | 40.0 | | 43.3 | |

| Other non-current liabilities | 294.7 | | 244.9 | |

| | |

| Total liabilities | 3,346.2 | | 3,739.4 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Equity | 3,217.1 | | 2,708.1 | |

| Total liabilities and equity | $ | 6,563.3 | | $ | 6,447.5 | |

| | |

| | | | | | | | |

| Pentair plc and Subsidiaries |

Condensed Consolidated Statements of Cash Flows (Unaudited) |

|

| | Years ended December 31 |

| In millions | 2023 | 2022 |

| Operating activities | | |

| Net income | $ | 622.7 | | $ | 480.9 | |

| Loss from discontinued operations, net of tax | 0.2 | | 2.3 | |

| | |

| | |

Adjustments to reconcile net income from continuing operations to net cash provided by operating activities of continuing operations | | |

| Equity income of unconsolidated subsidiaries | (2.8) | | (1.8) | |

| Depreciation | 59.5 | | 54.1 | |

| Amortization | 55.3 | | 52.5 | |

| Gain on sale of businesses | — | | (0.2) | |

| Deferred income taxes | (92.5) | | (44.8) | |

| Share-based compensation | 29.1 | | 24.9 | |

| Asset impairment and write-offs | 7.9 | | 25.6 | |

| | |

| | |

| Amortization of bridge financing debt issuance costs | — | | 9.0 | |

Pension and other post-retirement expense (benefit) | 12.1 | | (12.2) | |

| Pension and other post-retirement contributions | (8.7) | | (8.8) | |

| Gain on sale of assets | (3.4) | | (2.3) | |

| Changes in assets and liabilities, net of effects of business acquisitions | | |

| Accounts receivable | (24.4) | | 30.4 | |

| Inventories | 109.6 | | (187.0) | |

| Other current assets | (29.1) | | (16.5) | |

| Accounts payable | (75.1) | | (56.9) | |

| Employee compensation and benefits | 17.2 | | (35.2) | |

| Other current liabilities | (59.5) | | 46.5 | |

| Other non-current assets and liabilities | 2.7 | | 3.8 | |

| Net cash provided by operating activities of continuing operations | 620.8 | | 364.3 | |

| Net cash used for operating activities of discontinued operations | (1.6) | | (1.0) | |

| Net cash provided by operating activities | 619.2 | | 363.3 | |

| Investing activities | | |

| Capital expenditures | (76.0) | | (85.2) | |

| Proceeds from sale of property and equipment | 5.6 | | 4.1 | |

| | |

| Acquisitions, net of cash acquired | (0.6) | | (1,580.9) | |

(Payments) receipts upon the settlement of net investment hedges | (18.5) | | 78.9 | |

| Other | 4.1 | | 0.3 | |

| | |

| | |

| Net cash used for investing activities | (85.4) | | (1,582.8) | |

| Financing activities | | |

| | |

Net (repayments) borrowings of revolving long-term debt | (320.0) | | 124.5 | |

| Proceeds from long-term debt | — | | 1,391.3 | |

| Repayments of long-term debt | (12.5) | | (88.3) | |

| Debt issuance costs | — | | (15.8) | |

| | |

| | |

| | |

| | |

| Shares issued to employees, net of shares withheld | 9.6 | | (2.7) | |

| Repurchases of ordinary shares | — | | (50.0) | |

| Dividends paid | (145.2) | | (138.6) | |

| Receipts upon the settlement of cross currency swaps | — | | 12.3 | |

| | |

Net cash (used for) provided by financing activities | (468.1) | | 1,232.7 | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | (4.3) | | 1.2 | |

| Change in cash and cash equivalents | 61.4 | | 14.4 | |

| Cash and cash equivalents, beginning of year | 108.9 | | 94.5 | |

| Cash and cash equivalents, end of year | $ | 170.3 | | $ | 108.9 | |

| | |

|

|

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| Pentair plc and Subsidiaries |

Reconciliation of the GAAP Operating Activities Cash Flow to the Non-GAAP Free Cash Flow (Unaudited) |

| | |

| Years ended December 31 |

| In millions | 2023 | 2022 |

| Net cash provided by operating activities of continuing operations | $ | 620.8 | | $ | 364.3 | |

| Capital expenditures | (76.0) | | (85.2) | |

| Proceeds from sale of property and equipment | 5.6 | | 4.1 | |

| Free cash flow from continuing operations | $ | 550.4 | | $ | 283.2 | |

Net cash used for operating activities of discontinued operations | (1.6) | | (1.0) | |

| | |

| | |

| Free cash flow | $ | 548.8 | | $ | 282.2 | |

| | | | | | | | | | | | | | | | | |

| Pentair plc and Subsidiaries |

| Supplemental Financial Information by Reportable Segment (Unaudited) |

| | | | | |

| 2023 |

| In millions | First

Quarter | Second

Quarter | Third

Quarter | Fourth

Quarter | Full

Year |

| Net sales | | | | | |

Flow | $ | 391.8 | | $ | 411.6 | | $ | 400.2 | | $ | 378.5 | | $ | 1,582.1 | |

| Water Solutions | 272.0 | | 336.2 | | 299.4 | | 269.6 | | 1,177.2 | |

| Pool | 364.3 | | 334.3 | | 308.8 | | 336.2 | | 1,343.6 | |

| Other | 0.5 | | 0.4 | | 0.4 | | 0.3 | | 1.6 | |

| Consolidated | $ | 1,028.6 | | $ | 1,082.5 | | $ | 1,008.8 | | $ | 984.6 | | $ | 4,104.5 | |

| Segment income (loss) | | | | | |

Flow | $ | 65.0 | | $ | 74.8 | | $ | 77.5 | | $ | 65.0 | | $ | 282.3 | |

| Water Solutions | 52.4 | | 74.8 | | 68.8 | | 51.6 | | 247.6 | |

| Pool | 116.2 | | 105.1 | | 90.6 | | 105.1 | | 417.0 | |

| Other | (22.6) | | (20.5) | | (24.8) | | (23.9) | | (91.8) | |

| Consolidated | $ | 211.0 | | $ | 234.2 | | $ | 212.1 | | $ | 197.8 | | $ | 855.1 | |

| Return on sales | | | | | |

Flow | 16.6 | % | 18.2 | % | 19.4 | % | 17.2 | % | 17.8 | % |

| Water Solutions | 19.3 | % | 22.2 | % | 23.0 | % | 19.1 | % | 21.0 | % |

| Pool | 31.9 | % | 31.4 | % | 29.3 | % | 31.3 | % | 31.0 | % |

| Consolidated | 20.5 | % | 21.6 | % | 21.0 | % | 20.1 | % | 20.8 | % |

| | | | | | | | | | | | | | | | | |

| Pentair plc and Subsidiaries |

| Supplemental Financial Information by Reportable Segment (Unaudited) |

| | | | | |

| 2022 |

| In millions | First

Quarter | Second

Quarter | Third

Quarter | Fourth

Quarter | Full

Year |

| Net sales | | | | | |

Flow | $ | 358.1 | | $ | 377.4 | | $ | 389.5 | | $ | 375.8 | | $ | 1,500.8 | |

| Water Solutions | 205.8 | | 222.2 | | 275.3 | | 283.5 | | 986.8 | |

| Pool | 435.4 | | 464.0 | | 390.0 | | 343.3 | | 1,632.7 | |

| Other | 0.3 | | 0.6 | | 0.3 | | 0.3 | | 1.5 | |

| Consolidated | $ | 999.6 | | $ | 1,064.2 | | $ | 1,055.1 | | $ | 1,002.9 | | $ | 4,121.8 | |

| Segment income (loss) | | | | | |

| Flow | $ | 52.2 | | $ | 59.1 | | $ | 65.7 | | $ | 65.3 | | $ | 242.3 | |

| Water Solutions | 22.2 | | 32.5 | | 49.3 | | 45.0 | | 149.0 | |

| Pool | 116.3 | | 136.7 | | 109.3 | | 99.8 | | 462.1 | |

| Other | (18.6) | | (22.4) | | (17.4) | | (27.3) | | (85.7) | |

| Consolidated | $ | 172.1 | | $ | 205.9 | | $ | 206.9 | | $ | 182.8 | | $ | 767.7 | |

| Return on sales | | | | | |

| Flow | 14.6 | % | 15.7 | % | 16.9 | % | 17.4 | % | 16.1 | % |

| Water Solutions | 10.8 | % | 14.6 | % | 17.9 | % | 15.9 | % | 15.1 | % |

| Pool | 26.7 | % | 29.5 | % | 28.0 | % | 29.1 | % | 28.3 | % |

| Consolidated | 17.2 | % | 19.3 | % | 19.6 | % | 18.2 | % | 18.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Pentair plc and Subsidiaries | | | | |

| Reconciliation of GAAP to Non-GAAP Financial Measures for the Year Ended December 31, 2023 | | | | |

| Excluding the Effect of Adjustments (Unaudited) | | | | |

| | | | | | | | | |

| In millions, except per-share data | First

Quarter | Second

Quarter | Third

Quarter | Fourth

Quarter | Full

Year | | | |

| Net sales | $ | 1,028.6 | | $ | 1,082.5 | | $ | 1,008.8 | | $ | 984.6 | | $ | 4,104.5 | | | | | |

| Operating income | 183.6 | | 208.5 | | 180.1 | | 167.0 | | 739.2 | | | | | |

| Return on sales | 17.8 | % | 19.3 | % | 17.9 | % | 17.0 | % | 18.0 | % | | | | |

| Adjustments: | | | | | | | | | |

| Restructuring and other | 2.9 | | 0.6 | | 1.6 | | (1.7) | | 3.4 | | | | | |

| Transformation costs | 8.5 | | 6.0 | | 13.5 | | 16.3 | | 44.3 | | | | | |

| Intangible amortization | 13.8 | | 13.9 | | 13.8 | | 13.8 | | 55.3 | | | | | |

| | | | | | | | | |

| Legal accrual adjustments and settlements | (1.9) | | 4.1 | | — | | — | | 2.2 | | | | | |

| Asset impairment and write-offs | 3.9 | | 0.5 | | 1.8 | | 1.7 | | 7.9 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Equity income of unconsolidated subsidiaries | 0.2 | | 0.6 | | 1.3 | | 0.7 | | 2.8 | | | | | |

| Segment income | 211.0 | | 234.2 | | 212.1 | | 197.8 | | 855.1 | | | | | |

| Adjusted return on sales | 20.5 | % | 21.6 | % | 21.0 | % | 20.1 | % | 20.8 | % | | | | |

Net income from continuing operations—as reported | 128.5 | | 154.2 | | 132.1 | | 208.1 | | 622.9 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Pension and other post-retirement mark-to-market loss | — | | — | | — | | 6.1 | | 6.1 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other income | — | | (5.1) | | — | | — | | (5.1) | | | | | |

| Adjustments to operating income | 27.2 | | 25.1 | | 30.7 | | 30.1 | | 113.1 | | | | | |

Income tax adjustments (1) | (4.6) | | (3.1) | | (6.6) | | (98.5) | | (112.8) | | | | | |

Net income from continuing operations—as adjusted | $ | 151.1 | | $ | 171.1 | | $ | 156.2 | | $ | 145.8 | | $ | 624.2 | | | | | |

Continuing earnings per ordinary share—diluted | | | | | | | | | |

| Diluted earnings per ordinary share—as reported | $ | 0.78 | | $ | 0.93 | | $ | 0.79 | | $ | 1.25 | | $ | 3.75 | | | | | |

| Adjustments | 0.13 | | 0.10 | | 0.15 | | (0.38) | | — | | | | | |

| Diluted earnings per ordinary share—as adjusted | $ | 0.91 | | $ | 1.03 | | $ | 0.94 | | $ | 0.87 | | $ | 3.75 | | | | | |

(1) Income tax adjustments in the fourth quarter include $74.3 million resulting from favorable impacts of worthless stock deductions related to exiting certain businesses in our Water Solutions segment and favorable discrete items primarily related to the recognition of deferred tax assets.

| | | | | | | | | | | | | | | | | | | | | |

| Pentair plc and Subsidiaries | | | | |

| Reconciliation of GAAP to Non-GAAP Financial Measures for the Year Ending December 31, 2024 | | | | |

| Excluding the Effect of Adjustments (Unaudited) | | | | |

| | | | | | | | | |

| Forecast | | | | |

| In millions, except per-share data | | First

Quarter | Full

Year | | | |

| Net sales | | approx | Down 2% - 3% | approx | Up 2% - 3% | | | | |

| Operating income | | approx | Up 3% - 7% | approx | Up 17% - 20% | | | | |

| Adjustments: | | | | | | | | | |

| Intangible amortization | | approx | $ | 14 | | approx | $ | 55 | | | | | |

Equity income of unconsolidated subsidiaries | | approx | 1 | | approx | 4 | | | | | |

| Segment income | | approx | Down 3% - flat | approx | Up 8% - 11% | | | | |

| | | | | | | | | |

Net income from continuing operations—as reported | | approx | $135 - $140 | approx | $636 - $653 | | | | |

| Adjustments to operating income | | approx | 14 | | approx | 55 | | | | | |

| Income tax adjustments | | approx | (2) | | approx | — | | | | | |

Net income from continuing operations—as adjusted | | approx | $147 - $152 | approx | $691 - $708 | | | | |

Continuing earnings per ordinary share—diluted | | | | | | | | | |

| Diluted earnings per ordinary share—as reported | | approx | $0.81 - $0.84 | approx | $3.82 - $3.92 | | | | |

| Adjustments | | approx | 0.07 | approx | 0.33 | | | | |

| Diluted earnings per ordinary share—as adjusted | | approx | $0.88 - $0.91 | approx | $4.15 - $4.25 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pentair plc and Subsidiaries |

| Reconciliation of Net Sales Growth to Core Net Sales Growth by Segment |

| For the Quarter and Year Ended December 31, 2023 (Unaudited) |

| | | | | |

| Q4 Net Sales Growth | | Full Year Net Sales Growth |

| Core | Currency | Acq. / Div. | Total | | Core | Currency | Acq. / Div. | Total |

| Total Pentair | (2.3) | % | 0.7 | % | (0.2) | % | (1.8) | % | | (4.9) | % | 0.1 | % | 4.4 | % | (0.4) | % |

Flow | (0.9) | % | 1.6 | % | — | % | 0.7 | % | | 5.1 | % | 0.3 | % | — | % | 5.4 | % |

| Water Solutions | (4.5) | % | 0.4 | % | (0.8) | % | (4.9) | % | | 1.1 | % | (0.3) | % | 18.5 | % | 19.3 | % |

| Pool | (2.1) | % | — | % | — | % | (2.1) | % | | (17.6) | % | (0.1) | % | — | % | (17.7) | % |

| | | | | | | | | | | | | | | | | |

| Pentair plc and Subsidiaries |

| Reconciliation of GAAP to Non-GAAP Financial Measures for the Year Ended December 31, 2022 |

| Excluding the Effect of Adjustments (Unaudited) |

| | | | | |

| In millions, except per-share data | First

Quarter | Second

Quarter | Third

Quarter | Fourth

Quarter | Full

Year |

| Net sales | $ | 999.6 | | $ | 1,064.2 | | $ | 1,055.1 | | $ | 1,002.9 | | $ | 4,121.8 | |

| Operating income | 145.8 | | 190.8 | | 147.1 | | 111.6 | | 595.3 | |

| Return on sales | 14.6 | % | 17.9 | % | 13.9 | % | 11.1 | % | 14.4 | % |

| Adjustments: | | | | | |

| Restructuring and other | 2.1 | | 1.1 | | 12.5 | | 16.7 | | 32.4 | |

| Transformation costs | 5.5 | | 5.2 | | 10.1 | | 6.4 | | 27.2 | |

| Intangible amortization | 6.6 | | 6.3 | | 18.5 | | 21.1 | | 52.5 | |

| | | | | |

| Legal accrual adjustments and settlements | (0.7) | | 0.5 | | — | | 0.4 | | 0.2 | |

| Asset impairment and write-offs | — | | — | | — | | 25.6 | | 25.6 | |

| Inventory step-up | — | | — | | 5.8 | | — | | 5.8 | |

| Deal-related costs and expenses | 6.4 | | 1.6 | | 13.4 | | 0.8 | | 22.2 | |

| Russia business exit impact | 5.9 | | — | | (0.8) | | (0.4) | | 4.7 | |

| Equity income of unconsolidated subsidiaries | 0.5 | | 0.4 | | 0.3 | | 0.6 | | 1.8 | |

| Segment income | 172.1 | | 205.9 | | 206.9 | | 182.8 | | 767.7 | |

| Adjusted return on sales | 17.2 | % | 19.3 | % | 19.6 | % | 18.2 | % | 18.6 | % |

Net income from continuing operations—as reported | 118.5 | | 153.0 | | 115.4 | | 96.3 | | 483.2 | |

| Gain on sale of businesses | — | | — | | (0.2) | | — | | (0.2) | |

| | | | | |

| | | | | |

| Pension and other post-retirement mark-to-market gain | — | | — | | — | | (17.5) | | (17.5) | |

| Amortization of bridge financing fees | 2.6 | | 5.1 | | 1.3 | | — | | 9.0 | |

| Adjustments to operating income | 25.8 | | 14.7 | | 59.5 | | 70.6 | | 170.6 | |

| Income tax adjustments | (5.4) | | (3.8) | | (12.3) | | (14.4) | | (35.9) | |

Net income from continuing operations—as adjusted | $ | 141.5 | | $ | 169.0 | | $ | 163.7 | | $ | 135.0 | | $ | 609.2 | |

Continuing earnings per ordinary share—diluted | | | | | |

| Diluted earnings per ordinary share—as reported | $ | 0.71 | | $ | 0.92 | | $ | 0.70 | | $ | 0.58 | | $ | 2.92 | |

| Adjustments | 0.14 | | 0.10 | | 0.29 | | 0.24 | | 0.76 | |

| Diluted earnings per ordinary share—as adjusted | $ | 0.85 | | $ | 1.02 | | $ | 0.99 | | $ | 0.82 | | $ | 3.68 | |

v3.24.0.1

Cover Page Cover Page

|

Jan. 30, 2024 |

| Cover [Abstract] |

|

| Title of 12(b) Security |

Ordinary Shares, nominal value $0.01 per share

|

| Document Type |

8-K

|

| Entity Registrant Name |

Pentair plc

|

| Document Period End Date |

Jan. 30, 2024

|

| Entity File Number |

001-11625

|

| Entity Central Index Key |

0000077360

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity Tax Identification Number |

98-1141328

|

| Entity Address, Address Line One |

Regal House, 70 London Road

|

| Entity Address, Address Line Two |

Twickenham

|

| Entity Address, City or Town |

London

|

| Entity Address, Postal Zip Code |

TW13QS

|

| Entity Address, Country |

GB

|

| Country Region |

44

|

| City Area Code |

74

|

| Local Phone Number |

9421-6154

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Trading Symbol |

PNR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

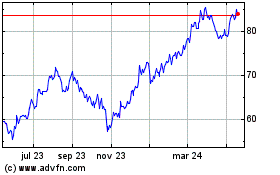

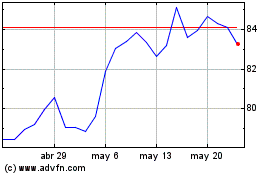

Pentair (NYSE:PNR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pentair (NYSE:PNR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024