Solid fundraising and transaction activity

supported by resilient fundamentals

Regulatory News:

Tikehau Capital (Paris:TKO):

Solid growth in Asset

Management AuM1

€46.7bn

at 30 September 2024

+13%

YoY growth

Dynamic and selective

deployment

€3.9bn

deployed YTD

Successful realizations

momentum

€1.3bn

realized YTD

Robust level of AM net new

money

€4.8bn

raised YTD

In the first nine months of the year,

Tikehau Capital’s multi-local and diversified platform continued to

demonstrate its resilience and strengths

- Transaction activity remained robust with €3.9bn of capital

deployed by the firm’s closed-end funds and €1.3bn of

realizations year-to-date;

- Capital raising momentum was strong with €4.8bn net new

money raised by the Group’s Asset Management business for the first

nine months of the year, illustrating the Tikehau Capital’s solid

market positioning and its ability to address clients’ evolving

needs;

- Fundraising was driven by Credit strategies over the

first nine months of the year, with an acceleration in Private

Equity during the third quarter;

- The Group has further strengthened its sustainability-themed

and impact platform, which comprised €3.5bn of AuM specifically

allocated to climate and biodiversity at 30 September

2024;

- Tikehau Capital consolidated its strategic partnership with

Nikko Asset Management, which made progress in building a stake

in the Group;

- The Group has advanced its cost optimization program

with a focus on reallocating resources to high-impact and

fast-growing areas and talent, driving global expansion and

innovation.

Tikehau Capital is well-positioned to

capture future growth with a robust fundraising and transaction

pipeline and anticipates an acceleration in net inflows, which

should grow by at least 10% in Q4 20242. The Group thus

confirms that it anticipates an acceleration in revenue and profit

generation for its Asset Management business in the second half of

2024.

AuM for Tikehau Capital’s Asset Management business amounted to

€46.7bn at 30 September 2024, up +9.2% compared to 31

December 2023 and up +12.8% compared to a year ago.

Group AuM at 30 September 2024 reached €47.1bn, up +9.3%

compared to 31 December 2023 and +12.4% compared to a year ago.

FUND DEPLOYMENT DRIVEN BY CREDIT STRATEGIES

Deployment for Tikehau Capital’s closed-end funds reached €1.1bn

in Q3 2024 and €3.9bn for the first nine months of the year.

Discipline remained a core focus in a market which has not yet

stabilized, as evidenced by a selectivity rate3 of 98%, in line

with the historical level.

Fund deployment (€m)

Q3 2024

Q3 2023

9m 2024

9m 2023

Credit

553

1,225

2,750

3,151

Real Assets

335

164

691

593

Private Equity

182

284

459

454

Total Fund deployment

1,069

1,673

3,901

4,197

Tikehau Capital’s Credit strategies deployed €0.6bn,

accounting for 52% of Q3 2024 deployment:

- In the quarter, the firm launched the warehouse of its

European CLO XIII (€200m);

- The firm’s Direct Lending strategies continued to

benefit from an active deal flow, attributed to its pioneering

position in Europe. Asset selection is key for the firm, and

Tikehau Capital remained disciplined in its deployment, carefully

managing leverage levels and maintaining stringent documentation

standards:

- On 1 October 2024, Tikehau Capital arranged a €165m unitranche

facility to support the acquisition by Cinven of Domia

Group, a leading player in the French private tutoring and home

cleaning service. This transaction allows Tikehau Capital to be

fully reimbursed for the existing unitranche, structured in 2018 to

support the acquisition of Domia Group by IK Partners, while

continuing to support the company with a new debt instrument on

favourable terms.

Tikehau Capital’s Real Assets strategies deployed €0.3bn,

accounting for 31% of Q3 2024 deployment. The firm continued to

leverage its robust origination capabilities across geographies to

source compelling off-market investment opportunities, in an

overall muted market:

- The third quarter was marked by the finalization of the

acquisition of 26 commercial real estate assets from Groupe

Casino for over €200m4;

- On 31 July 2024, Tikehau Capital, via its value-add real estate

strategy, acquired a 30,000 sqm office property in

Berlin-Weissensee from a private individual in an off-market

transaction5.

Tikehau Capital’s Private Equity strategies deployed

€0.2bn, accounting for 17% of Q3 2024 deployment. The third quarter

was marked by the finalization of the second investment of the

firm’s second vintage of its Decarbonization strategy, deploying

approximately €130m in CEBAT6, an Italian utility

infrastructure service provider specialized in the installation of

utility networks and maintenance services critical for the

enhancement and upgrade of electricity, water and telecommunication

grids. The deployment of this strategy is progressing well, with

this second investment demonstrating strong momentum, which bodes

well for additional fundraising.

Looking ahead, Tikehau Capital benefits from a promising

pipeline of deployment opportunities across asset classes. At 30

September 2024, Tikehau Capital had €6.6bn of dry powder7

(compared to €6.9bn at 31 December 2023), supporting the funds

managed by the firm to capture attractive investment

opportunities.

CONTINUED POSITIVE REALIZATIONS MOMENTUM

Realizations within Tikehau Capital funds amounted to €0.5bn in

Q3 2024 and €1.3bn for the first nine months of the year, with a

robust contribution of Credit.

Realizations (€m)

Q3 2024

Q3 2023

9m 2024

9m 2023

Credit

359

356

1,028

858

Real Assets

77

181

268

358

Private Equity

35

190

40

264

Total realizations

472

727

1,336

1,480

Credit strategies accounted for more than

two-thirds of realizations in the quarter and over the nine months.

Realizations were driven by the firm’s Direct Lending, Corporate

Lending and Tactical Strategies, corresponding to financing

repayments. The third quarter was notably marked by the repayment

of a £45m unitranche to CLC Group, a UK-based property

refurbishment and asset maintenance contractor. In June 2023, the

third vintage of the firm’s Special Opportunities strategy provided

this unitranche to support HIG Capital’s acquisition of CLC Group.

In August 2024, CLC Group acquired Axis, creating a leading

national property maintenance specialist and initiating the

refinancing of the existing debt.

Realizations in Real Assets strategies were mainly

driven by asset disposals of mid-sized and granular assets from the

firm’s real estate vehicles, notably from portfolios of residential

assets in Iberia and from individual sales of light industrial

assets in France.

In Private Equity strategies, the third quarter was

marked by the completion of the disposal of Tikehau Capital’s stake

in Preligens, a world leader in artificial intelligence for

aerospace and defense, to Safran. This first exit of Tikehau

Capital’s third vintage of its cybersecurity strategy validates its

approach of investing in fast-growing and emerging category leaders

in the cybersecurity and defense sectors. These companies have the

potential to become investment opportunities for both strategic and

private equity buyers. This transaction generated a gross multiple

of 2.4x (2.1x net multiple) and a gross IRR of 30% (18% net

IRR)8.

In addition, during the third quarter, Tikehau Capital announced

exclusive discussions with STS Metals to acquire Brown

Europe9, specialized in wire drawing of high-performance alloys

for the aerospace industry. This transaction would mark the first

divestment from the first vintage of the Group’s strategy dedicated

to aerospace, affirming its leadership in the aerospace and defense

sector, where Tikehau Capital invests in niche players with market

leading positions to support their growth.

Despite a continued challenging exit environment, the Preligens

disposal and prospective disposal of Brown Europe underscore the

Group’s relevant offering across key thematic verticals and

reinforce its positioning for future fundraising efforts.

NET NEW MONEY MAINTAINED AT A HIGH LEVEL

Tikehau Capital raised €1.4bn in Q3 2024 and €4.8bn for the

first nine months of the year, a strong achievement in the current

context, with a notable acceleration in Private Equity during the

quarter. This performance underscores the firm’s expanding reach

and visibility, as well as its capability to meet the evolving

needs of its clients. Fundraising for the Group’s flagship

strategies continued to progress well, reflecting client confidence

and the Group’s solid market positioning in long-term growth

themes.

Net New Money (€m)

Q3 2024

Q3 2023

9m 2024

9m 2023

Credit

606

1,305

2,864

3,236

Real Assets

202

70

333

768

Capital Markets Strategies

35

45

672

153

Private Equity

563

8

887

557

Total Net New Money

1,406

1,428

4,757

4,715

In the third quarter, Net New Money was driven by the following

developments:

- Additional fundraising for the sixth vintage of Tikehau

Capital’s Direct Lending strategy10, reaching approximately

€2.4bn of AuM at 30 September 2024;

- The launch of the warehouse for the firm’s European CLO XIII

for €200m;

- Continued inflows for the Group’s third vintage of Special

Opportunities strategy, nearing the target of €1bn;

- AuM development in Real Estate driven by the acquisition

of 26 commercial real estate assets from Groupe Casino, which

attracted co-investments alongside the firm’s flagship commingled

fund;

- Continued momentum for the firm’s dated funds within the

Capital Markets Strategies;

- The launch of the second vintage of aerospace strategy with

re-ups from the firm’s corporate partners Airbus, Safran, Thales

and Dassault Aviation, alongside Tikehau Capital. The fund’s AuM

reached approximately €380m at 30 September 2024;

- Additional third-party inflows for the firm’s second vintage of

Private Equity Decarbonization and fourth vintage of

Cybersecurity strategies.

The Group has further strengthened its sustainability-themed and

impact platform, which comprised €3.5bn of AuM specifically

allocated to climate and biodiversity at 30 September 2024,

representing a 39% year-over-year growth. This puts Tikehau

Capital on track to reach its target of exceeding €5bn by 2025.

AN INVESTMENT PORTFOLIO SERVING FUTURE GROWTH

- Tikehau Capital’s investment portfolio amounted to €4.0bn at

30 September 2024, a stable level compared 31 December 2023.

Over the first nine months of the year, the main variations in the

portfolio were the following:

- €543m of capital calls and investments, mainly into the

Group’s own Asset Management strategies (in particular CLOs,

Private Equity and Real Assets strategies) and co-investments

alongside its strategies;

- €324m of exits, including returns of capital driven by

the firm’s Special Opportunities, Credit Secondaries and CLOs

strategies;

- (€60)m of fair value changes mainly resulting from

market effects linked to the firm’s listed REITs.

- Tikehau Capital’s investment portfolio at 30 September 2024

was comprised of:

- €3.1bn of investments in the Asset Management strategies

developed and managed by the Group (78% of total portfolio11),

generating a substantial alignment of interests with its

investor-clients;

- €0.9bn (22% of total portfolio) invested in ecosystem

and direct investments, notably direct private equity investments,

co-investments or investments in third-party funds, most of which

aim at serving Tikehau Capital’s Asset Management franchise

globally.

SHARE BUY-BACK

- Tikehau Capital announces that it has extended until 20

February 2025 (included), the date of the Group’s 2024 annual

results announcement, the share buy-back mandate, which was signed

and announced on 19 March 2020 and extended until today.

- As of 22 October 2024, 5,888,004 shares were repurchased under

the share buy-back mandate. The description of the share buy-back

program (published in paragraph 8.3.4 of the Tikehau Capital

Universal Registration Document filed with the French Financial

Markets Authority on 21 March 2024 under number D. 24-0146) is

available on the company’s website in the Regulated Information

section

(https://www.tikehaucapital.com/en/shareholders/regulated-information).

ADDITIONAL DEVELOPMENTS

Partnership with Nikko Asset

Management

- Following the finalization of its strategic partnership with

Nikko Asset Management12, Tikehau Capital announces that Nikko

Asset Management has made progress in building a position in the

Group.

- This strategic partnership encompasses three key components

designed to enhance both groups’ global investment capabilities and

presence through a distribution agreement, a co-GP dedicated to

Asian private market strategies, and Nikko Asset Management taking

an equity stake in Tikehau Capital.

Disciplined cost

optimization

- As outlined during its full-year 2023 results announcement,

Tikehau Capital has advanced its cost optimization program,

prioritizing high-impact and value-enhancing initiatives.

- The Group has taken measures to streamline overhead costs and

central functions, while strategically reallocating resources to

strengthen its core operations and support international expansion,

with a focus on markets and asset classes that offer significant

growth potential.

- In addition, the firm has maintained a disciplined approach to

hiring, onboarding talent selectively to drive efficiency and

foster innovation.

- The dual focus on efficiency and strategic reallocation is

designed to create a stronger, more resilient business and improve

operating leverage going forward.

OUTLOOK

- Tikehau Capital is confident in its ability to navigate the

current environment and remains focused on delivering its

mid-term growth objectives, supported by improving

fundraising conditions and a recovery in transaction activity, in

line with the current evolution of market fundamentals.

- The firm continues to benefit from a robust fundraising

pipeline resulting from its solid positioning across key long-term

growth themes. Tikehau Capital thus confirms that it anticipates a

step up in net inflows in Q4 2024, and consequently an

acceleration in revenue and profit generation for its Asset

Management business in the second half of 2024.

CALENDAR

20 February 2025

FY 2024 results (before market open)

24 April 2025

Q1 2025 announcement (after market

close)

30 April 2025

Annual General Meeting

30 July 2025

2025 half-year results (after market

close)

23 October 2025

Q3 2025 announcement (after market

close)

ABOUT TIKEHAU CAPITAL

Tikehau Capital is a global alternative asset management Group

with €47.1 billion of assets under management (at 30 September

2024).

Tikehau Capital has developed a wide range of expertise across

four asset classes (credit, real assets, private equity and capital

markets strategies) as well as multi-asset and special

opportunities strategies.

Tikehau Capital is a founder-led team with a differentiated

business model, a strong balance sheet, proprietary global deal

flow and a track record of backing high quality companies and

executives.

Deeply rooted in the real economy, Tikehau Capital provides

bespoke and innovative alternative financing solutions to companies

it invests in and seeks to create long-term value for its

investors, while generating positive impacts on society. Leveraging

its strong equity base (€3.1 billion of shareholders’ equity at 30

June 2024), the Group invests its own capital alongside its

investor-clients within each of its strategies.

Controlled by its managers alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA, shared by its 767 employees (at 30 September 2024)

across its 17 offices in Europe, the Middle East, Asia and North

America.

Tikehau Capital is listed in compartment A of the regulated

Euronext Paris market (ISIN code: FR0013230612; Ticker: TKO.FP).

For more information, please visit: www.tikehaucapital.com.

DISCLAIMER

This document does not constitute an offer of securities for

sale or investment advisory services. It contains general

information only and is not intended to provide general or specific

investment advice. Past performance is not a reliable indicator of

future earnings and profit, and targets are not guaranteed.

Certain statements and forecasted data are based on current

forecasts, prevailing market and economic conditions, estimates,

projections and opinions of Tikehau Capital and/or its affiliates.

Due to various risks and uncertainties, actual results may differ

materially from those reflected or expected in such forward-looking

statements or in any of the case studies or forecasts. All

references to Tikehau Capital’s advisory activities in the US or

with respect to US persons relate to Tikehau Capital North

America.

APPENDIX

AuM at 30-09-2024

YoY change

QoQ change

In €m

Amount (€m)

Weight (%)

In %

In €m

In %

In €m

Credit

21,665

46%

+17%

+3,210

+1%

+223

Real Assets

13,388

28%

(4%)

(537)

+1%

+195

Capital Markets Strategies

5,570

12%

+26%

+1,141

+3%

+146

Private Equity

6,120

13%

+32%

+1,490

+10%

+550

Asset Management

46,744

99%

+13%

+5,305

+2%

+1,115

Investment activity

405

1%

(22%)

(114)

(15%)

(70)

Total AuM

47,149

100%

+12%

+5,191

+2%

+1,045

Q3 evolution In €m

AuM at 30-06-2024

Net new money

Distributions

Market effects

Change in scope

AuM at 30-09-2024

Credit

21,442

+606

(309)

(73)

-

21,665

Real Assets

13,193

+202

(74)

+68

-

13,388

Capital Markets Strategies

5,424

+35

-

+111

-

5,570

Private Equity

5,570

+563

(33)

+20

-

6,120

Total Asset Management

45,629

+1,406

(417)

+126

-

46,744

YTD evolution In €m

AuM at 31-12-2023

Net new money

Distributions

Market effects

Change in scope

AuM at 30-09-2024

Credit

19,549

+2,864

(861)

+164

(51)

21,665

Real Assets

13,464

+333

(451)

+42

-

13,388

Capital Markets Strategies

4,649

+672

(1)

+250

-

5,570

Private Equity

5,152

+887

(139)

+179

+41

6,120

Total Asset Management

42,814

+4,757

(1,452)

+635

(10)

46,744

LTM evolution In €m

AuM at 30-09-2023

Net new money

Distributions

Market effects

Change in scope

AuM at 30-09-2024

Credit

18,455

+4,113

(932)

+81

(51)

21,665

Real Assets

13,925

+288

(592)

(232)

-

13,388

Capital Markets Strategies

4,429

+743

(2)

+400

-

5,570

Private Equity

4,630

+1,397

(338)

+391

+41

6,120

Total Asset Management

41,439

+6,540

(1,865)

+640

(10)

46,744

1Figures have been rounded for presentation purposes, which in

some cases may result in rounding differences.

2 Compared to Q4 2023.

3 Selectivity rate presented as total declined deals / total

screened deals.

4 Please refer to press release dated 27 September 2024.

5 Please refer to press release dated 2 October 2024.

6 Please refer to press release dated 9 July 2024.

7 Amounts available for investment at the level of the funds

managed by the Group.

8 Please refer to press release dated 2 September 2024.

9 Please refer to press release dated 25 July 2024.

10 Including the flagship vehicle, bespoke mandates and side

vehicles.

11 Includes investments in funds managed by Tikehau Capital and

co-investments alongside Tikehau Capital Asset Management

strategies.

12 Please refer to press release dated 25 June 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022117417/en/

PRESS: Tikehau Capital: Valérie Sueur – +33 1 40 06 39 30

UK – Prosek Partners: Philip Walters – +44 (0) 7773 331 589 USA –

Prosek Partners: Trevor Gibbons – +1 646 818 9238

press@tikehaucapital.com

SHAREHOLDER AND INVESTOR: Louis Igonet – +33 1 40 06 11

11 Théodora Xu – +33 1 40 06 18 56

shareholders@tikehaucapital.com

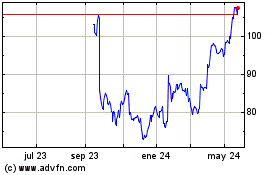

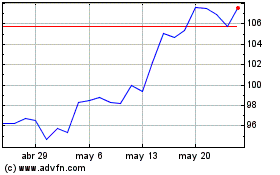

Tko (NYSE:TKO)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Tko (NYSE:TKO)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024