Amendments and Conversion of Convertible Notes

04 Octubre 2024 - 5:52AM

(“Amaroq” or the “Corporation” or the “Company”)

Amendments and Conversion of Convertible

Notes

TORONTO, ONTARIO – 4 October 2024 - Amaroq

Minerals Ltd. (AIM, TSXV, NASDAQ Iceland: AMRQ), an independent

mine development company with a substantial land package of gold

and strategic mineral assets in Southern Greenland, announces that

the Company has entered into an agreement with the holders of its

US$22.4m convertible notes due 2027 to convert the notes into new

common shares, in order to simplify the Company’s capital

structure, reduce cash interest costs and permit future financial

flexibility.

The Convertible Notes were issued and previously

disclosed on September 1, 2023. The Company has amended the

Convertible Notes to permit the payment of the outstanding interest

and commitment fees in common shares of the Company

(“Common Shares”) at a conversion price equal to

closing price of the Common Shares on the TSX Venture Exchange

(“TSXV”) on the trading day immediately prior to

such conversion. The amendments to the Convertible Notes are

subject to final TSXV approval.

The Company further announces that the holders

of the Convertible Notes have elected to convert all of the

outstanding principal of the Convertible Notes into

33,629,068 Common Shares (the “Principal

Conversion Shares”) at a conversion price of C$0.90

(£0.525) per Principal Conversion Share and all of the outstanding

interest of the Convertible Notes into 1,293,356

Common Shares (the “Interest Conversion Shares”)

at a conversion price of C$1.3 (£0.73) per Interest Conversion

Shares (the “Interest Conversion”).

The Company and the holders of the Convertible

Notes also agreed to make 70% of the total amount of the

outstanding commitment fee immediately payable. The holders of the

Convertible Notes have elected to convert such commitment fee

payable into 3,307,502 Common Shares (the

“Commitment Fee Conversion Shares”) in aggregate,

at a conversion price of C$1.3 (£0.73) per Commitment Fee

Conversion Share (the “Commitment Fee

Conversion”).

Subject to the consent of the TSXV, the Company

expects to issue the Principal Conversion Shares, Interest

Conversion Shares and Commitment Fee Conversion Shares in October

2024.

The Interest Conversion and Commitment Fee

Conversion are treated as a “Shares for Debt” transaction under

Policy 4.3 of the TSXV, and the interest and commitment fees

payable shall be settled in consideration for the Interest

Conversion Shares and Commitment Fee Conversion Shares. Completion

of the Interest Conversion and Commitment Fee Conversion are

subject to the approval of the TSXV.

Related Party Transactions

The “related party transaction” requirements

under Policy 5.9 of the TSXV and Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

("MI 61-101") do not apply as the Interest

Conversion and Commitment Fee Exemption meets the exemption set

forth under Section 5.1(h)(iii) of MI 61-101.

For the purposes of the AIM Rules for Companies,

ECAM LP is a related party of Amaroq. ECAM LP is an affiliate of

GCAM LP, which owns a 49% interest in Gardaq A/S, an Amaroq

subsidiary, and has appointed two directors to the subsidiary

company board.As such, the elements of the Interest Conversion and

Commitment Fee Conversion (US$ 3,118,728) constitute Related Party

Transactions in accordance with AIM Rule 13.

The Directors consider, having consulted with

the Company's Nominated Adviser, that the terms of the transaction

are fair and reasonable insofar as the Company's shareholders are

concerned.

Enquiries:

Amaroq Minerals Ltd. Eldur Olafsson,

Executive Director and CEOeo@amaroqminerals.com

Eddie Wyvill, Corporate Development+44 (0)7713

126727ew@amaroqminerals.com

Stifel Nicolaus Europe Limited (Nominated Adviser and

Joint Broker)Callum StewartVarun TalwarSimon MensleyAshton

Clanfield+44 (0) 20 7710 7600

Panmure Liberum (UK) Limited (Joint

Broker)Scott MathiesonKieron Hodgson+44 (0) 20 7886

2500

Camarco (Financial PR)Billy CleggElfie

KentFergus Young+44 (0) 20 3757 4980

For Company updates:Follow @Amaroq_minerals on

X (Formerly known as Twitter)Follow Amaroq Minerals Inc. on

LinkedIn

Further Information:

About Amaroq Minerals

Amaroq Minerals' principal business

objectives are the identification, acquisition, exploration, and

development of gold and strategic metal properties in South

Greenland. The Company's principal asset is a 100% interest in the

past producing Nalunaq Gold mine which is due to go into production

towards the end of 2024. The Company has a portfolio of gold and

strategic metal assets in Southern Greenland covering the two known

gold belts in the region as well as advanced exploration projects

at Stendalen and the Sava Copper Belt exploring for Strategic

metals such as Copper, Nickel, Rare Earths and other minerals.

Amaroq Minerals is continued under the Business Corporations Act

(Ontario) and wholly owns Nalunaq A/S, incorporated under the

Greenland Public Companies Act.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Inside Information

This announcement contains inside information

for the purposes of Article 7 of the UK version of

Regulation (EU) No. 596/2014 on Market Abuse ("UK MAR"), as it

forms part of UK domestic law by virtue of

the European Union (Withdrawal) Act 2018, and Regulation

(EU) No. 596/2014 on Market Abuse ("EU MAR").

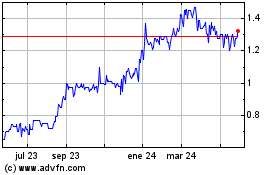

Amaroq Minerals (TSXV:AMRQ)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

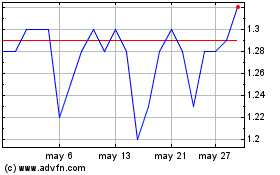

Amaroq Minerals (TSXV:AMRQ)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024