Today's Top Supply Chain and Logistics News From WSJ

24 Abril 2017 - 6:01AM

Noticias Dow Jones

By Brian Baskin

Sign up:With one click, get this newsletter delivered to your

inbox.

The changes e-commerce is forcing on the physical retail world

are accelerating. Brick-and-mortar stores are shuttering at a

record pace this year, and experts say the rash of closings is only

the beginning, the WSJ's Suzanne Kapner reports. Last week, Bebe

Stores Inc. and Rue21 Inc. became the latest mall staples to

announce they would shut down hundreds of locations, pushing the

number of closed stores to nearly 3,000 this year. The growth of

online shopping is the primary force behind the trend, but not the

only one. Also to blame: a decades-long rush by retail chains to

open as many locations as possible, fueled in recent years by

record-low interest rates. Some analysts compare the rise and fall

of mall staples like The Limited and Wet Seal to the housing boom

and bust. Some retailers, including discounter TJX Cos., continue

to expand, though that chain's brands thrive by stealing customers

from ailing department stores. Much of the rest of the industry has

given up waiting for a recovery at the mall, and are hoping

increased online sales can make up for a permanent in-store

slump.

Automakers are setting up electric-vehicle manufacturing plants

in China, betting the rewards of tapping a booming new market will

outweigh the risks that previously led them to steer their supply

chains clear of the country. General Motors Co., Volkswagen AG and

Toyota Motor Corp. said at last week's Auto Shanghai show that they

would produce electric cars in China, the WSJ's Trefor Moss and

Mike Colias write. Intellectual property concerns and uncertain

demand have held back auto manufacturing in the country in the

past, but the Chinese market for electric vehicles has become too

big to ignore, industry insiders say. China drove about half of

global demand for EVs last year, and automakers expect Beijing to

require a growing share of cars sold to have domestically produced

parts. That's forcing automakers to set aside concerns their

technology could be copied by local suppliers, as the alternative -

being shut out of a potentially massive market - is even worse.

Analysts aren't sure future demand will materialize: one forecaster

gave a range of 650,000 to 2 million EVs sold in China in 2020.

Developers can't build warehouses fast enough. Industrial

tenants absorbed 1.7 million square feet in New Jersey in the first

quarter, up about 30% from a year ago, despite an 11.7% increase in

rent, according to real-estate services firm JLL, the WSJ's Keiko

Morris reports. The insatiable demand for space is being driven by

the needs of e-commerce giants like Amazon.com Inc. , which last

week announced plans to open three fulfillment centers in New

Jersey totaling 2.8 million square feet. Some, including No. 1

industrial real-estate landlord Prologis Inc., predict an increase

in speculative construction, where buildings are planned before a

tenant is lined up, will cause the market to cool. But JLL noted

that in the New York area at least, developers can typically find a

tenant well before completing construction on speculative

distribution centers. The firm said soaring rents are a "new

normal" for industrial tenants. With vacancy rates down to 4%, from

5.9% a year ago, landlords remain firmly in control.

ECONOMY & TRADE

France's presidential election is shaping up to be a referendum

on the European Union. Emmanuel Macron and Marine Le Pen won the

first round of voting, and will face off in a second vote next

month. The campaign is viewed by some investors as potentially more

important for global trade and financial markets than even the

U.K.'s Brexit vote or the election of President Donald Trump,

writes the WSJ's Riva Gold. Marine Le Pen has vowed to take France

out of the euro, which would could force the disintegration of the

common currency. Victory for an anti-EU candidate would lead

companies, from insurers to banks to international corporations, to

pull money out of France, analysts say. It would also further

weaken support for the continent-spanning single market, which

eases the flow of goods between countries and allows manufacturers

to easily set up supply chains spanning multiple countries. Many of

Ms. Le Pen's supporters say that's precisely why they are voting

for her, blaming the EU for the loss of French factory jobs to

countries like Poland, where labor costs are lower.

QUOTABLE

IN OTHER NEWS

President Donald Trump will insist on funding for a border wall

as part of any budget deal, an administration official said.

(WSJ)

Existing home sales in the U.S. rebounded in March as the spring

buying season began. (WSJ)

Stores need to make better use of customer data and offer

greater personalization to fend off online competition. (WSJ)

New England businesses are struggling to find workers in a tight

labor market. (WSJ)

Suppliers are fighting back as failing retailers struggle to pay

their bills. (Bloomberg)

Trading of Yang Ming shares was halted in Taiwan so the

container line could reduce its equity capital by half. (Splash

24/7)

Kansas City Southern reported higher first-quarter revenue and

profits. (Progressive Railroading)

Panalpina's profits fell as the forwarder's air-cargo volumes

rose but margins declined. (Air Cargo News)

Navios Maritime Partners will buy 14 container ships from

shipping line Rickers Maritime. (Business TImes)

Rising capacity and wavering demand are threatening car

carriers. (Journal of Commerce)

Quiet Logistics opened a hub in Missouri to fulfill e-commerce

orders. (DC Velocity)

Trucks powered by natural gas are failing to gain traction as

diesel prices remain low. (Transport Topics)

Sears Holdings will close 50 auto centers at 92 Kmart

pharmacies. (Chicago Tribune)

ABOUT US

Brian Baskin is editor of WSJ Logistics Report. Follow him at

@brianjbaskin, and follow the entire WSJ Logistics Report team:

@PaulPage, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Brian Baskin at brian.baskin@wsj.com

(END) Dow Jones Newswires

April 24, 2017 06:46 ET (10:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

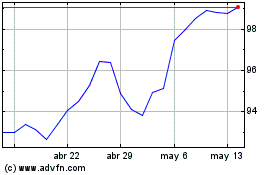

TJX Companies (NYSE:TJX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

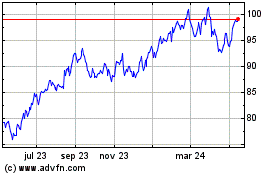

TJX Companies (NYSE:TJX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024