TIDMPRIM

RNS Number : 4369P

Primorus Investments PLC

08 February 2019

Primorus Investments plc

("Primorus" or the "Company")

Quarterly Investor Update

Primorus Investments plc (AIM: PRIM, NEX: PRIM) is pleased to

provide the quarter ending December 31 2018 ("Q4" or the "Quarter")

periodic portfolio update regarding its current holdings and

activities acquired and managed as per its investment mandate.

Executive Director's Quarterly Comment - Alastair Clayton

I probably don't need to point out to shareholders that Q4 was a

pretty wild ride on global markets. Whilst our share price was

probably collateral damage in the lead up to Christmas, I am

pleased that we have, at very least, managed to recover some of our

value. However, we still are frustrated that the Company, in the

Board's opinion, remains so undervalued.

The Quarter was one dominated by realising certain profits on

holdings while ensuring we retain the right mix of investments that

not only seek to create value in the medium-term, as per our

investment mandate, but also increase the visibility of our

publicly tradable investments in order to achieve some concrete

look-through value on our share price.

As outlined below, I believe we have achieved many of the goals

set for the Quarter. We now have a more balanced portfolio of

pre-IPO and private company investments, publicly tradable

shareholdings and also some interest-earning corporate debt with

attached warrants.

I should mention that over the Quarter I have had a lot of

interaction with both existing and potential Primorus shareholders.

Throughout these discussions, which were predominantly positive,

two themes seemed to recur that I would like to briefly

address.

The first one is regarding the possibility of, at the

appropriate time, using excess funds to potentially buy back some

of our outstanding issued capital. Given our share price relative

to the Board's view of value this argument clearly has merit. We

are having a look at the ability and mechanisms to determine if

this is feasible. If the results of this are positive it will

certainly be one tool available to the Company to invest in itself

should the value proposition of its portfolio be as compelling as

we believe it is today.

Secondly a number of shareholders expressed the desire to see a

corporate marketing presence on social media and other such

platforms. Whilst I acknowledge this may be useful, we also see

significant challenges in ensuring a presence on social media

doesn't infringe upon our AIM and directors' duties, not to mention

MiFID and MAR requirements. Thus, we will continue to scope a

presence that is both appropriate and responsible and report back

to shareholders with our solution.

Now, onto some highlights for the period:

Over the Quarter, realised a circa GBP1m unaudited cash profit

on investment by selling most of our holdings in UKOG PLC at an

average weighted price of circa 1.77p.

Built a stake in Greatland Gold (GGP.L) totalling 35m shares or

just under 1.1% of the issued capital in GGP.L at an average price

of 1.71p based on outstanding drill results. Further drilling

released in February confirm exceptional potential of Haiveron

Project.

Former British Olympic Association chief executive Simon Clegg

has been appointed the Non-Executive Chairman of Sport:80. IPO has

been delayed as the company seeks to clean up its share register in

advance of its IPO. Expecting movement on IPO this Quarter.

Engage Technology platform continues outstanding growth rates in

terms of customer contracts with over 110 active corporate clients

(versus 75 end Q3) now using the platform at the end of 2018.

Strongly backed GBP1m (still at GBP22/share) targeted capital raise

secured nearly GBP2.6m in subscriptions. Now is the important

Quarter for scalable product releases.

SOA Energy ("SOA") farm-in with a large regional oil firm

covering both SOA's on-shore and offshore assets. We have been

advised that a lengthy final technical and legal process is now due

to close imminently. SOA management may then allow us to expand on

the farm-in partner and more detail on the deal, subject to any

confidentiality clauses. IPO and drilling programme still on track

for 2019.

StreamTV, in conjunction with Beijing Optical & Electrical

("BOE") release two new products at the CES (Consumer Electronics

Show) in Las Vegas in January. The latest version of the 65" "8K

Lite" 16M pixel panel and the gaming focussed 27" "8K Lite" PC

monitor. Outstanding industry interest

Fresho ticks through the A$1m per day gross order value

demonstrating further excellent platform growth. New payments

platform launched and international growth opportunities present

themselves. We are still eyeing a 2019 liquidity event.

Company finishes the Quarter debt-free and the Board still

foresees no short-term need or intention to raise capital.

Update on Investments

As described above we exited the most of our direct holding in

UKOG for gross proceeds above investment of over GBP1m returned to

treasury. The fact that we have sold most of our holding is not a

reflection on the HHDL-1 project and its potential but is firmly

based upon applying portfolio management principles. As I have

mentioned in previous Investor updates, we should be judged on our

ability to deliver tangible value and this, I am pleased to report,

represents tangible value to all shareholders.

Shareholders will no doubt be aware that in the Quarter we began

to build a share position in Greatland Gold PLC. At the time of

writing we have 35m shares representing just under 1.1% of the

issued capital, purchased at an average price of 1.71p per share.

This investment decision was predicated on the outstanding

exploration results released in December 2018 for the Haiveron Gold

Project near Telfer in Western Australia. We have been looking for

a quality gold-related investment for a while as we believe gold

exposure would be a good balancing influence in our portfolio.

Shareholders may not be aware I researched my thesis on

intrusive-related gold deposits in these relatively obscure regions

of WA and the Northern Territory and studied the nearby Telfer Mine

geology and geochemistry. I am of the belief that Haiveron may

prove to be one of the most significant gold discoveries globally

in recent times and I am pleased that we have been able to build a

meaningful stake. We note that on 5 February Greatland announced a

host of what we consider to be outstanding results for the second

half of the discovery drill programme at Haiveron, comprising holes

HAD006 - HAD009.

These excellent results only further compound our view that

Haiveron has the hallmarks of a globally significant gold-copper

deposit in a world class mining jurisdiction. Furthermore, we

believe the recent drop in the Greatland share price to be

completely unrelated to the quality of the results published. We

will be investigating expanding our stake in Greatland should funds

be available to do so as we believe they will be firmly on the

radar of industry players looking for potential Tier 1

projects.

Elsewhere within our portfolio of oil and gas investments it is

pleasing to note that both Nomad Energy ("Nomad") and SOA Energy

are both moving forwards following the breakthrough of an impasse

in the Ivorian Government and the expected finalisation of a major

farm-in deal respectively.

Clearly we are not privy to, and regardless nor could we

disclose, any commercially sensitive information about the gas

supply negotiations between Nomad, its partner VITOL and the

Ivorian Government. However we have been informed that whilst no

agreement is yet in place, the negotiations are now moving in the

right direction having being stalled for some considerable time.

There is a sense of confidence at Nomad that a deal may be done in

the near term and clearly this would help unlock the value of our

US$300,000 investment we made back in 2017.

We expect to hear from SOA very soon that the final farm-in deal

has reached commercial close. We should then, subject to any

prevailing confidentiality clauses, be able to talk in much more

breadth about the farm-in partner and the exciting drill and test

programme for 2019. SOA has reaffirmed that it will be seeking a

listing on the AIM market in 2019.

Both of these investments highlight a recurring theme that as

the more our investments mature and grow, sometimes the less

Primorus is able to say about them. This is because commercial

confidence and IP demands from our investee companies weigh on our

ability to transmit news.

With this in mind I move on to Fresho where the management team

have rightly requested that some sections of its own Quarterly

Shareholder Report remain confidential. What we can say is that

metric we have been following for some time, Gross Order Volume

(GOV) went through A$1m per day mark during the December Quarter.

Furthermore, several opportunities to potentially launch

internationally on the back of large local customers have presented

themselves. New to Fresho has been the launch of the Fresho Payment

Platform which seeks to monetise more of the GOV by providing an

innovative trade finance offering as part of the general use of the

platform.

We expect the reported solid growth in the Fresho business to

continue through 2019 and despite a cash balance undiminished since

the last Quarter the company is contemplating further external

investment to accelerate international growth opportunities.

Importantly the price at which this is done should allow us to

better benchmark the potential value of our investment to date and

also provide a look-through to when we might exit this investment.

Ideally, we will seek crystallise some gains on this investment in

2019.

Last week we had a very productive meeting with Engage

management at their Paddington HQ to discuss what really is a

critical upcoming quarter or so for the company as a myriad of

long-awaited product releases begin to become available for

customer release. The exciting news is that these are on track and

their effects will hopefully begin to be felt this quarter. As

Engage aims to be a totally viral and self-service product with

unlimited scalability, it potentially represents a very lucrative

financial performance opportunity.

It appears we are not the only ones who feel this way either. A

small GBP1m planned capital raise in December attracted nearly

GBP2.6m in investment, which the Company feels is encouraging given

the global market turmoil experienced at the time. We did not

participate this time as we already have a large holding. This was

the last of the GBP22/share investment level available. We invested

at both GBP15 and GBP22 per share in previous investor rounds, and

have an average buy-in price of GBP20.13 per share.

In terms of a few metrics Engage reported 110 signed corporate

contracts live or onboarding as of Christmas 2018 and have picked

up another 10 or so in 2019 already. This compares to 75 at the end

of Q3. This will take the number of workers paid through Engage to

over 20,000 between now and April. As mentioned above, the quarter

was heavily focussed on re-tooling for scale, including formalising

the Customer Success function - hiring the ex-Bullhorn Customer

Success Director - and releasing the first elements of a new

scalable and automated V3 Payroll.

Engage is load testing successfully to deal with 100,000 paid

workers with multiple transactions per week, and 10,000+ customer

service tickets per week with current product and resources to stay

ahead of demand. In the coming quarters, Engage aims to develop the

automation to lift all limitations.

The key challenge for management as they grow rapidly is to

ensure that large corporate client contracts with high customer

service demands and specific functionality requirements don't pull

product development too out of shape and don't become burdensome on

short-term financial performance as Engage strives to meet

break-even in Q3 2019. We are very pleased that management

highlighted this challenge to us and in our opinion are balancing

the demands of the very large clients with the need for a fully

self-service product to mass market to small and medium enterprises

as this where the true eventual sales volume lies.

We believe all of this means that the 2019 plan to commence IPO

documentation in the summer is still very much on track and I

believe Engage has the potential to be a step-change investment for

Primorus in terms of meeting our stated aim of growing the balance

sheet to at least GBP25m.

Progress is picking up pace at StreamTV, who, in conjunction

with Beijing Optical & Electrical ("BOE") released two new

products at the CES (Consumer Electronics Show) in Las Vegas in

January. The latest version of the 65" "8K Lite" 16M pixel panel

and the gaming focussed 27" "8K Lite" PC monitor. We have received

several reports from the company that the response to the products

from a myriad of household names in the TV, gaming, technology and

content industries was outstanding. With commercially available

products making their way to market in 2019 I very much look

forward to shareholders seeing the products for themselves and

being satisfied that the Company was an early stage investor in

this amazing technology.

We are expecting more significant news soon on industry

participation into StreamTV and perhaps then we can quantify what

that may mean for our potential return on investment then.

Sport:80 was, subject to no unforeseen delays, ready to hit the

road to for its IPO funding round in December. However, an issue

around tightening up the shareholder register prior to the IPO

subsequently delayed the process. In reality however, avoiding the

tumultuous markets of December was probably in everyone's best

interests regardless. The good news is Sport:80 assure me the

matter is moving towards resolution and more importantly the

business continues to add users in the UK and overseas and is

expected to be EBITDA positive for FY 2019. We do see the

appointment of Former British Olympic Association chief executive

Simon Clegg as the Non-Executive Chairman of Sport:80 effective 30

January as a huge positive. As evidenced by his CV, Mr Clegg is a

highly experienced sports businessman who has held numerous board

positions, including his role with the BOA, and Ipswich Town FC,

where he was chief executive between 2009 and 2013. He was also the

Chief Operating Officer of the $1-billion inaugural 2015 European

Games in Baku, Azerbaijan, and holds the same position with Expo

2020 in Dubai. He was awarded an OBE in 2001, upgraded to CBE four

years later. So, whilst the delay to the IPO is a little

frustrating because I am personally keen to demonstrate a full

investment exit, the important point is the quality of the business

and its leadership underpins the eventual value of our reward and

we are prepared to be patient when investing.

TruSpine has been a slow-burn for us and there is no doubt that

the new management team has, largely through events outside their

control, taken longer to put the company on a sustainable funding

path than we had hoped. This impacted their product development

goals for 2018. This is a real shame because the core product

offering remains one that generates a significant amount of

interest from industry. We recently received an update from Simon

Stephens and his team and we walked away very satisfied that whilst

been very frank about the difficulty in securing the funding they

wanted in a more timely fashion and also concluding any joint

ventures being discussed the core proposition has not changed and

they have been able to secure enough funding to avoid any

compromise to existing share structure and value proposition. We

look forward to a more fruitful 2019 for TruSpine as we haven't

changed our view on the company itself, but we have had to adjust

or estimates of timing to exit accordingly.

We have yet to receive our WeShop investor update and will have

to return to this in the near future. We have been told however

that it is in the process of taking its product inventory from 5m

to over 150m products in the UK. There has also been significant

progress on the direct integration platform and WeShop is in

negotiations with a number of global brands and retailers. There is

a marketing plan in place to drive volumes of users in Q2 of 2019.

The company continues to evaluate a potential IPO in 2019.

Summary

We ended 2018 with a successful exit from most of the HHDL

investment that yielded us an unaudited cash profit on investment

of over GBP1m. This compares favourably to our market

capitalisation on percentage-terms. It has been pleasing to be able

to take some money off the table and into treasury where we have

been able to deploy some of it into building a meaningful stake in

Greatland Gold amongst other things. We are debt free and the board

foresees no reason to raise additional capital in the short to

medium-term. With the delay in the Sport:80 IPO we have still not

gone through the full pre-IPO to IPO investment cycle but as our

sale of HHDL has proven there are several ways to achieve the

objective of generating solid returns above investment. We now have

a good balance of private and public investments and we are hopeful

that the implied increase in look-through value can better assist

our share price to reflect underlying portfolio value.

Most importantly our core holdings are preforming well. We hope

for a seminal year ahead for Engage and expect its true potential

to become evident to industry and the broader investment community.

StreamTV products should begin to hit the market and the growth

achieved since investment at Fresho should begin to be quantified

as the company finally raises more capital. Our other oil

investments in SOA and Nomad are, after some time, making real

progress towards commercialisation and WeShop we shall return to

once we receive our final update from them. We also have managed to

begin to accrue some income through the coupon on the Zuuse debt

instrument we purchased and also have the added benefit of some

attaching warrants.

So despite the turmoil that swept global markets at the end of

2018, the Board believes Primorus is very good shape to keep

delivering returns on investment such as the one we delivered this

quarter via HHDL. We look forward to 2019 with considerable

excitement and we thank our shareholders for their patience and

support.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3621 4120

Turner & Pope Investments

Andy Thacker

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDDBGDDGSGBGCR

(END) Dow Jones Newswires

February 08, 2019 02:00 ET (07:00 GMT)

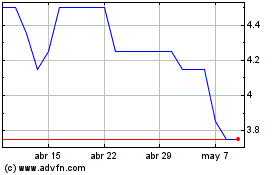

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024