TIDMPNN

RNS Number : 3323D

Pennon Group PLC

25 June 2019

PENNON GROUP PLC

PUBLICATION OF ANNUAL REPORT AND ACCOUNTS 2019

AND NOTICE OF ANNUAL GENERAL MEETING

In compliance with Listing Rule 9.6.1 Pennon Group Plc (the

"Company") announces that the following documents have been

submitted to the Financial Conduct Authority electronically via the

National Storage Mechanism and will shortly be available for

inspection at www.morningstar.co.uk/uk/NSM

-- Annual Report and Accounts 2019

-- Notice of Annual General Meeting

-- Form of Proxy

The Annual Report and Accounts 2019 and Notice of Annual General

Meeting may also be viewed on the Company's website at

www.pennon-group.co.uk

The Company will hold its 2019 Annual General Meeting at Sandy

Park Conference Centre, Sandy Park Way, Exeter, Devon, EX2 7NN on

Thursday 25 July at 2.30pm.

The following information in the Appendix to this announcement

is as set out in the Company's Annual Report and Accounts 2019. It

should be read in conjunction with the Company's Full Year Results

announcement released on 30 May 2019 which included a set of

consolidated financial statements, a fair review of the development

and performance of the business and the position of the Company and

its main trading subsidiary companies. Together these documents

constitute the information required by Disclosure and Transparency

Rule 6.3.5.

Simon Pugsley

Group General Counsel & Company Secretary

25 June 2019

APPIX

PRINCIPAL RISKS AND UNCERTAINTIES

The Group's business model exposes it to a variety of external

and internal risks influenced by the

possible impact of macro political, economic and environmental

factors; notably the continued

uncertainly arising from Britain's exit from the European Union

(EU) and the potential renationalisation

of the water industry. While the current Government are

supportive of the existing regulatory model, in

the event of a change of government, it remains the policy of

the opposition to renationalise the water

industry and Labour has provided further detail of their

proposed approach during the year. In the

event of this scenario occurring there could be an impact to the

Group's business model and

consequently this remains a significant risk to the Group.

While the ability of the Group to influence these macro level

risks is limited, they continue to be

regularly monitored and the potential implications are

considered as part of the ongoing risk

assessment process. The Group performs a range of scenario

planning and analysis exercises to

understand the risk exposure of one or a number of these events

occurring. The Group's principal risks

have remained consistent with the 2018 annual report with the

exception of one additional principal

risk: non-delivery of regulatory outcomes and performance

commitments. This risk reflects the significance of the ODI regime

in the regulatory model. South West Water has the opportunity for

reward but it is also exposed to risk if performance commitments

are not achieved.

Britain's exit from the European Union

During the year the Group has continued to evaluate and monitor

the potential risks and opportunities arising from Britain's

decision to exit the EU. Cross functional working groups have been

established and mitigation plans have been implemented focusing on

those activities that are likely to be most impacted in the event

of Britain leaving the EU without a withdrawal agreement. The

Pennon Executive and the Board have received regular updates

throughout the year on the Group's preparations for a

no-deal scenario.

The Group continues to reflect the impact associated with

Britain leaving the EU within the relevant principal risks. While

no single issue is considered to expose the Group to material risk,

it is recognised that the combination of multiple issues or events

concurrently could result in some disruption in the period

immediately after leaving the EU in the event of a no-deal

scenario. Plans have been established which seek to minimise the

potential impact on the Group and its operations.

The following issues have been identified as potentially having

a significant impact on the Group's principal risks:

-- Availability of chemicals (linked to principal risk: Business

interruption or significant operational failures/incidents).

Detailed analysis has been completed on chemicals received from

European-based suppliers and on South West Water and Viridor stock

levels to ensure they continue to be maximised. Additionally,

operational plans have been developed to ensure continued asset

availability and that Government and Local Resilience Forum

requirements are met. South West Water has also been heavily

engaged with Water UK in developing a national response. This has

involved discussions with the UK Government, regulators and other

key stakeholders, developing a 'critical chemicals' action plan

jointly with the Chemicals Industry Association and due diligence

being undertaken on critical chemical suppliers.

-- Exporting of recyclate material (linked to principal risk:

Macro level risks impacting on commodity and power prices). While

we continue to export recyclate to Europe, contingency plans have

been established so that, in the event of a no-deal scenario, the

majority of recyclate can be diverted to non-European markets. We

have engaged extensively with our haulage and shipping partners to

understand their preparations and trialled shipments to EU and

non-EU countries from alternative UK ports. For the limited volume

of recyclate material which will continue to be exported to Europe

in the event of a no-deal scenario, revised documentation

requirements have been reviewed and internal processes amended

where appropriate.

-- Inability to access the same level of funding from the

European Investment Bank (linked to principal risk: Maintaining

sufficient finance and funding): Prior to the financial year end

funding lines have been put in place which has resulted in cash and

committed facilities to fund Viridor's committed growth projects

and South West Water's capital programme into K7 (2020-25).

Furthermore, we have engaged with a variety of UK and European

banks who have reaffirmed their appetite for UK infrastructure

lending.

-- The ability to attract and employ individuals with the

necessary skills and experience (linked to principal risk:

Difficulty in the recruitment, retention and development of

skills): While the current position of the UK Government in the

event of a no-deal scenario is that EU nationals already in the

country will be able to apply for settled status, the Group has

been proactive in reinforcing this to all affected staff.

Furthermore, Viridor has moved 180 employees from agency roles into

permanent employment. The Group has also sought assurances from

temporary employment agencies as to their plans to ensure

sufficient availability of temporary resource in the event of a

no-deal scenario.

The Directors confirm that during 2018/19 they have carried out

a robust assessment of risks facing the Group, including assessing

the impacts on its business model, future performance, solvency and

liquidity.

These principal risks have been considered in preparing the

viability statement on page 69 of the 2019 Annual Report.

Strategic impact - long-term priorities

affected

---------------------------------------------------------------------------

1 2 3

Leadership Leadership Driving sustainable

in UK in cost growth

water and base efficiency

waste

------------ ------------------- ----------------------------------------

Risk level

Green Amber Red

Low Medium High Increasing Stable Decreasing

Law, regulation and finance

Principal risks Strategic impact Mitigation Net Direction Risk appetite

risk

-------------------- ------------------------- -------------------------- ------ ---------- ---------------------

Changes in Long-term priorities (i) While the present Red We recognise

Government affected: Government is supportive that

policy 1,2 of the existing Government

Changes in Government regulatory model, policy

policy the renationalisation evolves. The

may fundamentally of the water industry Group

impact our continues to be seeks to minimise

ability to deliver a central policy potential

the Group's of the Labour Party risk and maximise

strategic priorities, and remains a possibility opportunities

impacting in the event of through regular

shareholder value. a change of Government. engagement,

We continue to communication

engage with all and robust

political parties, scenario planning.

customers and wider

stakeholders, both

directly and via

Water UK, demonstrating

the value received

from our operational

performance and

continued investment

in the network

infrastructure.

South West Water's

2020-25 business

plan also detailed

how we would empower

customers further

and deliver benefits

for our stakeholders

over the next regulatory

period.

(ii) Viridor remains Green

well placed to

leverage the

opportunities

arising from the

key outcomes within

the Government's

Resources and Waste

Strategy, as reflected

by investment in

an

additional plastic

processing facility.

Further clarity

is required, however,

with respect to

key aspects of

the initiatives

within the Resources

and Waste Strategy

as timescales remain

uncertain.

-------------------- ------------------------- -------------------------- ------ ---------- ---------------------

Regulatory Long-term priorities There remains a Amber We accept

reform affected: continued focus that

1,2 from Ofwat on the regulatory

Reform of the regulatory governance of companies reform

framework may result in the water sector; occurs and

in changes to the in particular the seek

Group's introduction of to leverage

priorities and a 'social contract' opportunities

the service we between water companies where possible

provide to our and their stakeholders. and minimise

customers. It may We have been an the

have a significant active voice in negative impact

impact on our the sector during of

performance which the year on this regulatory

can impact topic. reform by

shareholder value. This concept was targeting

at the heart of changes

South West Water's which are

2020-25 business NPV

plan, entitled neutral over

'New Deal', which the

received fast-track longer term

status from Ofwat. to

The Draft Determination protect customer

was received from affordability

Ofwat in April and

2019. This included shareholder

our commitment value.

to provide customers

with a shareholding

and a greater say

in how South West

Water is run.

Additionally,

as a listed company

we continue to

uphold the highest

standards of corporate

governance and

transparency, including

compliance with

the UK Corporate

Governance Code

and Ofwat's Principles

for Holding Companies.

-------------------- ------------------------- -------------------------- ------ ---------- ---------------------

Compliance Long-term priorities The Group operates Green The Group

with laws and affected: a robust and mature has the

regulations 1,2 regulatory framework highest standards

The Group is required which seeks to of

to comply ensure compliance compliance

with a range of with Ofwat, Environment and has

regulated and Agency and other no appetite

non-regulated relevant requirements. for legal

laws and regulation The Group also or regulatory

across our water continues to provide breaches.

and waste businesses. a rolling programme

Non-compliance of training and

with one or a number guidance to our

of these may result staff, contractors

in financial penalties, and partners. This

a negative impact included data protection

on our ability training following

to operate effectively the implementation

and reputational of the General

damage. Data Protection

. Regulation. During

the year we have

also refreshed

our Code of Conduct

and launched a

specific Supply

Chain Code of Conduct,

further reinforcing

the standards expected

of our staff and

our partners.

The Group's Speak

Up whistleblowing

process allows

any concerns to

be raised confidentially

and robust processes

are in place for

investigating these.

Additionally during

the year Pennon

became a member

of the Slave Free

Alliance, demonstrating

the Group's commitment

to eradicating

modern slavery.

-------------------- ------------------------- -------------------------- ------ ---------- ---------------------

Maintaining Long-term priorities The Group has mature Green The Group

sufficient affected: treasury, funding operates

finance and 1,3 and cash flow a prudent

funding, within Failure to maintain arrangements approach

our debt covenants, funding requirements in place and the to our financing

to meet ongoing could lead to additional impact of political, strategy in

commitments finance costs and economic, order to

put our growth and regulatory ensure our

agenda at risk. risks on the Group's funding

Breach of covenants financing commitments requirements

could result in and cashflow is are

the requirement regularly reviewed fully met.

to repay certain by Pennon Executive

debt. and the Board.

The Group has GBP1.2

billion of cash

and committed facilities.

During the year

the Group has signed

new facilities

of

GBP830 million

of which GBP600

million is linked

to the sustainable

nature of our business.

This provides funding

for Viridor's committed

capital projects

and funds the South

West Water into

K7.

The strength of

our position provides

the Group with

added

resilience in the

event of short-term

volatility of a

potential Brexit

no-deal scenario.

Further detail

is provided above.

-------------------- ------------------------- -------------------------- ------ ---------- ---------------------

Non-compliance Long-term priorities The effective management Amber The Group

or occurrence affected: of health & safety has no

of an avoidable 1,2,3 risks continues appetite for

health & safety A breach of health to be a priority health & safety

incident & safety law could for the Board and related incidents

lead to financial Pennon Executive, and has the

penalties, significant as highest standards

legal costs and demonstrated by of compliance

damage to the Group's the 2025 HomeSafe within the

reputation. strategy. Group, contractors,

partners and

Experienced health third parties.

& safety professionals

are embedded

within the Group

providing advice,

guidance and support

to

operational staff.

During the year

the Group progressed

the full roll out

of HomeSafe for

Viridor and South

West Water which

encompassed both

face-to-face and

e-learning training.

This was supported

by a comprehensive

assurance programme

to ensure the key

requirements of

HomeSafe, legal

compliance and

our standards are

being correctly

followed with outcomes

reported to the

Pennon Health &

Safety Committee.

The benefits of

the HomeSafe programme

are already being

seen with lost

time injury frequency

rates falling 32.2%

during the year.

-------------------- ------------------------- -------------------------- ------ ---------- ---------------------

Tax compliance Long-term priorities The Group have Green The Group

and contribution affected: an experienced ensures

2 and professionally full compliance

Non-compliance qualified in-house with

may result in tax team, supported, HMRC requirements

financial penalties, where necessary, and will not

legal costs and by external specialists. enter

reputational damage. into artificial

Furthermore, the The Pennon tax tax

perception that strategy has been arrangements

Pennon's overall refreshed and published, or

tax contribution following customer take an aggressive

is inadequate could consultation. stance in

have a detrimental the

impact on the reputation During the year interpretation

of the Group. Pennon became the of tax legislation.

first water and

waste management

utility to secure

the Fair Tax Mark;

an independent

accreditation scheme,

which recognises

organisations that

demonstrate they

are paying the

right amount of

corporation tax

at the right time.

Processes and controls

have been reviewed

during the year

to ensure we are

able to continue

to meet HMRC

requirements.

-------------------- ------------------------- -------------------------- ------ ---------- ---------------------

Failure to Long-term priorities The Group has an Amber The Group

pay all pension affected: experienced in-house will

obligations 2 pensions team ensure that

as they fall The Group could who also engage all

due and increased be called upon professional advisors obligations

costs to the to increase funding to manage the pension are met

Group should to reduce the deficit, scheme's investment in full but

the deferred impacting our cost strategy, ensuring seeks to

pension scheme base. the scheme can manage this

deficit increase pay without

its obligations unnecessary

as they fall due. increased

costs

During the past to the Group.

year there has

been a significant

decrease in

bond yields resulting

from uncertainty

over Brexit, which

could result in

an increased deficit

position following

the revaluation

of the defined

benefit pension

scheme.

-------------------- ------------------------- -------------------------- ------ ---------- ---------------------

Market and economic conditions

Principal risks Strategic impact Mitigation Net Direction Risk appetite

risk

----------------- ------------------------

Non-recovery Long-term priorities South West Water Green While seeking

of customer affected: has mature and to minimise

debt 1,2 embedded debt collection non-recoverable

Potential impact strategies in place debt, we recognise

on revenue for the recovery customer affordability

as a result of of domestic customer challenges

reduced customer debt which has and

debt collection, delivered improved the inability

particularly with collection rates to

regard to vulnerable and decreased bad disconnect

customers debt exposure during customers

and affordability. the past three results

years. There has in a residual

been no significant risk

increase in bills of uncollectable

for 2019/20 and debt remaining.

real-term decreases

form part of the

business plan for

2020-25.

The potential economic

impact of Brexit

on our customers

remains a risk.

We work proactively

with our customers

who are struggling

to pay and have

a range of affordability

schemes and social

tariffs to

support them including

Restart, WaterCare

and Freshstart.

Within the non-household

market there has

been continued

focus on the collection

of older debt which

has proved effective.

Due to high proportion

of public sector

contracts, Viridor's

debt

collection risk

is lower, however,

customer debt is

regularly

reviewed and proactively

managed.

----------------- ------------------------- -------------------------- ------ ---------- ------------------------

Macroeconomic Long-term priorities Viridor remains Red The Group

risks arising affected: well positioned seeks

from a downturn 3 across the waste to take well-judged

in the global Challenges such hierarchy and informed

and UK economy as continued with long-term decisions

and commodity local authority contracts supporting while

and power prices austerity, reduced the ERF business. ensuring plans

global demand for are

our recycled commodities While recyclate in place to

and decreases in markets have improved mitigate

power prices have during the year, the potential

a direct impact continuing to meet impact

on our revenues the quality requirements of macroeconomic

generated by our within China risks.

recycling and energy and other markets

businesses. remains a key area

of focus in addition

to

sourcing other

potential markets.

Extensive planning

in the event of

a Brexit no deal

scenario has also

been undertaken

and is detailed

further above.

We continue to

invest in our assets

and we work closely

in

partnership with

our local authority

customers in the

delivery of our

services and maximising

the quality of

the input recyclate

material.

Additionally, a

significant proportion

of our input contracts

have price adjustments

based on price

fluctuations during

the year.

Energy risk management

is undertaken at

a Group level and

acts as a natural

hedge between South

West Water and

Viridor, offsetting

any drop in power

prices. Forward

hedges have been

put in place with

the Group c. 95%

hedged for 2019/20,

c.55% for 2020/21

and c.20% for 2021/22

hedged.

----------------- ------------------------- -------------------------- ------ ---------- ------------------------

Operating performance

Principal risks Strategic impact Mitigation Net Direction Risk appetite

risk

--------------------- ----------------------

Poor operating Long-term priorities The increased frequency Amber The Group

performance affected: and impact of extreme seeks

due to extreme 1 weather to reduce

weather or Failure of our exposes our assets both the impact

climate change assets to cope to risk, while and likelihood

with extreme weather there continues through long-term

conditions may to be a planning and

lead to an inability reduced appetite forecasting

to meet our customers' for reduced performance to ensure

needs, environmental arising from such that sufficient

damage, additional incidents from measures are

costs and the regulator and in place to

reputational damage. our stakeholders. mitigate the

impact of

The Group seeks extreme weather

to mitigate this and climate

risk through investment change on

via a planned capital our operations.

investment programme,

emergency resources

and contingency

planning. As part

of the risk management

process the Group

also performs horizon

scanning on the

longer-term impacts

of climate change

on its operations.

Key lessons learnt

from the freeze-thaw

event in March

2018 were incorporated

into our 2018/19

winter preparedness

planning. Extensive

modelling and

forecasting

is also performed

to evaluate

South West Water's

water resources,

both in actively

managing resources

in periods of dry

weather but also

managing long-term

water resources

as demonstrated

through South West

Water's

25 year Water Resources

Management Plan.

Viridor has in

place regional

adverse weather

management

strategies aimed

at reducing disruption

to site operations

and

transport logistics.

--------------------- ------------------------- ------------------------ ------ ---------- ----------------------

Poor customer Long-term priorities There has been Amber The Group

service/ increased affected: a continued focus continually

competition 1,3 on customer experience seeks to

leading to Poor customer service and the customer increase customer

loss of customer has a direct impact journey across satisfaction

base on South West Water's the Group during and

delivery of the the year. maximise customer

PR14 business plan retention

and the ability Enhanced capability while taking

of both Viridor within our call well informed

and Pennon Water centre, investment risk to develop

Services to retain in training and further markets

and grow market expanded channels and offerings.

share. to interact with

our customers resulted

in South West Water's

best ever SIM customer

service score with

a ranking of second

out of all water

and sewerage

companies in England

and Wales. South

West Water is also

accredited to the

Institute of Customer

Service's ServiceMark

accreditation.

Planning is also

underway to evaluate

South West Water's

performance under

the new C-MeX guidance,

which will replace

SIM from 2020.

Customer service

and experience

has been a continued

focus for Viridor

with a score of

7.1 out of ten

on Trustpilot.

Customer service

within Pennon Water

Services is also

monitored through

Trustpilot where

a score of 8.5

out of ten has

been achieved.

--------------------- ------------------------- ------------------------ ------ ---------- ----------------------

Business interruption Long-term priorities The Group maintains Amber The Group

or significant affected: detailed contingency operates

operational 1,3 plans and incident a low tolerance

failures/ Operational failure management procedures for significant

incidents in our water which are regularly operational

business could reviewed and failure

mean that we are assets are managed and seeks

unable to supply through a programme to mitigate

clean water to of sophisticated these risks

our customers or planned and preventive where possible.

provide safe wastewater maintenance and

processes. This effective

has a direct impact management of stores.

on the successful

delivery of the Extensive Group-wide

PR14 business plan. Brexit no-deal

planning has also

Additionally business been

interruption caused undertaken with

by defects, outage further detail

or fire could impact outlined above.

the availability

and optimisation Continued investment

of our ERF and alongside South

recycling facilities. West Water's pollution

reduction strategy

has resulted in

a reduction of

serious pollution

incidents to two

during the year.

This was among

the lowest number

of such incidents

in the industry.

There has also

been a continued

reduction in minor

pollution incidents

(Category 3).

Careful management

and effective

optimisation

of the ERF fleet

has again resulted

in availability

exceeding 90% across

our operational

portfolio (including

joint ventures).

--------------------- ------------------------- ------------------------ ------ ---------- ----------------------

Difficulty Long-term priorities The Group's HR Amber While turnover

in the recruitment, affected: Strategy continues of staff does

retention and 1,2,3 to be embedded occur we ensure

development Failure to have across the organisation the appropriate

of appropriate a workforce of and a range of skills and

skills required skilled and motivated initiatives have experience

to deliver individuals been delivered is in place

the Group's will detrimentally during the year with succession

strategy impact all of our to attract, retain plans providing

strategic priorities. and develop our adequate resilience.

We need the right employees. Employee

people in the right Voice Forums and

places to share engagement provides

best practice, opportunities for

deliver synergies employees to regularly

and move the Group discuss business

forward. priorities and

challenges with

business leaders.

Mitigating actions

have also been

taken to reduce

the potential impact

of a Brexit no-deal

scenario on our

workforce. Further

detail is included

above.

Succession plans

remain in place

for senior and

other key positions.

In order to ensure

the Group can compete

for the top talent

in the market place

during the year

30 graduates joined

Viridor and 226

apprenticeships

started across

the Group supporting

new starters

and existing employees

in their career

development.

The impact of these

initiatives is

measured through

the results

of the most recent

Great Places to

Work Best

Workplaces(TM)

Survey which showed

an improved Trust

Index score of

62% and Engagement

score of 68%.

--------------------- ------------------------- ------------------------ ------ ---------- ----------------------

Non-delivery Long-term priorities The regulatory Amber The Group

of Regulatory affected: framework has been is committed

Outcomes and 1,2,3 in place since to achieving

performance South West Water's 1 April 2015 all of

commitments Regulatory and South West our performance

Outcomes and performance Water has delivered commitments

commitments cover cumulative net over

key strategic focus ODI the length

areas. rewards of GBP11.3 of each

million. South regulatory

Non-delivery against West Water is forecast period.

these could result to meet Where performance

in financial penalties all its ODI commitments in an individual

being applied as by 2020. year falls

well as reputational below expectation

damage to the Group. This risk reflects we

the significance implement

of the ODI regime action

in the regulatory plans and

model. South West targeted

Water has the interventions

opportunity to

for reward but ensure performance

is also exposed returns to

to risk if performance committed

commitments are levels.

not achieved.

Following the South

West Water 2020-25

business plan being

awarded fast-track

status, we are

already working

on plans to

deliver a step

change in operational

performance as

well as meeting

our 2020 commitments.

--------------------- ------------------------- ------------------------ ------ ---------- ----------------------

Business systems and capital investment

Principal risks Strategic impact Mitigation Net Direction Risk appetite

risk

-------------------- -----------------------

Failure or Long-term priorities All capital projects Red The Group's

increased cost affected: are subject to investment

of capital 1,3 a robust business activities

projects/ exposure Inability to case are taken

to contract successfully process which includes on an

failures deliver on our challenge and risk informed basis

capital programme modelling over with

may result in increased key assumptions. risks weighed

costs and delays Projects are delivered against appropriate

and detrimentally using skilled project returns.

impacts our ability management resource

to provide top complimented by

class customer senior oversight

service and achieve and leadership.

our growth agenda.

As a result of

the financial

challenges

experienced by

large

contractors in

the construction

sector, there is

a reduced

appetite for large

water and waste

construction projects,

resulting in a

general lack of

commercial tension.

Regular

monitoring is performed

on the financial

health of key

contractors and

supply chain partners.

Glasgow, Beddington

and Dunbar ERFs

all began processing

waste during the

year while the

commissioning commenced

on Mayflower water

treatment works.

The construction

of Avonmouth ERF

is progressing

well with completion

on track for 2020/21.

Resulting from

remediation work

at the Glasgow

ERF, Viridor is

contractually entitled

to recover the

gross contractual

receivable

of GBP72 million

from the original

principal contractor

Interserve

Construction Limited.

We will take all

necessary legal

and

procedural steps

to achieve this.

Liquidated damages

associated with

Beddington and

Dunbar ERFs have

been fully offset

against milestone

payments.

The redevelopment

of Heathrow Airport

continues to be

closely

monitored, with

the Lakeside ERF

joint venture located

on the

site of the proposed

third runway. Lakeside

ERF would have

to be removed in

the event this

redevelopment occurs

and we would expect

to be fully compensated

for the rebuild

of the facility

on a like-for-like

basis. An alternative

site has been

identified

with detailed site

studies and

environmental

assessments currently

being undertaken.

-------------------- ------------------------- ------------------------ ------ ---------- -----------------------

Failure of Long-term priorities The Group operates Amber We seek to

information affected: a mature and embedded minimise the

technology 1 governance risk of informational

systems, management Failure of our framework over technology

and protection information technology the 'business as failure and

including cyber systems, due to usual' IT environment cyber security

risks inadequate internal and threats to

processes or external major project the lowest

cyber threats could implementations level without

result in the business aligned to ISO detrimentally

being unable to 27001 impacting

operate effectively standards. Disaster on business

and the recovery plans operations.

corruption or loss are in place for

of data. This would corporate

have a detrimental and operational

impact on our customers technology and

and result in financial these are regularly

penalties and reviewed

reputational and tested.

damage for the

Group. Cyber threats continue

to increase in

volume and

sophistication.

These risks are

mitigated by a

strong information

security framework

aligned to guidance

issued by the National

Cyber Security

Centre (NCSC).

A gap analysis

of South West Water's

drinking water

operational technology

cyber security

controls has been

undertaken against

the requirements

of the Network

and Information

Systems (NIS)

directive utilising

external expertise.

The outcomes of

this

exercise have informed

future actions

where opportunities

for

further improvement

exist.

-------------------- ------------------------- ------------------------ ------ ---------- -----------------------

DIRECTORS' RESPONSIBILITIES STATEMENTS

(This statement is extracted from the governance section of the

Annual Report 2019 and page numbers referred to are those in the

Annual Report 2019.)

The Directors are responsible for preparing the annual report,

the Directors' remuneration report and the financial statements in

accordance with applicable law and regulations. Company law

requires the Directors to prepare financial statements for each

financial year. Under that law the Directors have prepared the

Group and Company financial statements in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union.

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and the Company and of

the profit or loss of the Group for the year.

In preparing these financial statements the Directors are

required to:

-- select suitable accounting policies and then apply them consistently

-- make judgements and accounting estimates which are reasonable and prudent

-- state whether applicable IFRSs as adopted by the European

Union have been followed, subject to any material departures

disclosed and explained in the financial statements.

The Directors confirm that they have complied with the above

requirements in preparing the financial statements.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions, and disclose with reasonable accuracy at any time the

financial position of the Group and the Company; and enable them to

ensure that the financial statements and the Directors'

remuneration report comply with the Companies Act 2006 and, as

regards the Group financial statements, Article 4 of the

International Accounting Standards (IAS) Regulation. They are also

responsible for safeguarding the assets of the Group and the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

Each of the Directors, whose names and functions are listed on

pages 76 and 77, confirms that, to the best of his or her

knowledge:

i) The financialstatements, which have been prepared in accordance with International

Financial Reporting Standars (IFRSs) as adopted by the European

Union, give a true

and fair view of the assets, liabilities, financial position and

profit of the Group and of

the Company.

ii) The strategic report (pages 1to71) and the Directors' report

include a fair review of the

development and performance of the business during the year and

the position of the

Company and the Group at the year end, together witha

description of the principal risks

and uncertaintis they face.

iii) Following receipt of advice from the Audit Committee, that

the annual report, taken as a whole, is fair, balanced and

understandable, and provides the information necessary

for the share holders to assess the Group's performance,

business model and strategy.

The Directors are responsible for the maintenance and integrity

of the Company's website www.pennon-group.co.uk.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

RELATED PARTY TRANSACTIONS

(The following is Note 44 to the Financial Statements set out in

the Annual Report 2019.)

During the year Group companies entered into the following

transactions with joint ventures and associate related parties who

are not members of the Group:

2019 2018

GBPm GBPm

============================================ ===== =====

Sales of goods and services

-------------------------------------------- ----- -----

Viridor Laing (Greater Manchester) Limited - 38.4

-------------------------------------------- ----- -----

INEOS Runcorn (TPS) Limited 16.6 15.9

============================================ ===== =====

Purchase of goods and services

-------------------------------------------- ----- -----

Lakeside Energy from Waste Limited 12.4 12.0

-------------------------------------------- ----- -----

INEOS Runcorn (TPS) Limited 7.1 6.0

-------------------------------------------- ----- -----

Dividends received

-------------------------------------------- ----- -----

Lakeside Energy from Waste Holdings Limited 5.5 6.5

============================================ ===== =====

Year-end balances

2019 2018

GBPm GBPm

===================================================== ===== =====

Receivables due from related parties

----------------------------------------------------- ----- -----

Lakeside Energy from Waste Limited (loan balance) 7.7 8.2

----------------------------------------------------- ----- -----

INEOS Runcorn (TPS) Limited (loan balance) 65.0 32.5

===================================================== ===== =====

72.7 40.7

===================================================== ===== =====

Lakeside Energy from Waste Limited (trading balance) 1.0 1.0

----------------------------------------------------- ----- -----

INEOS Runcorn (TPS) Limited (trading balance) 1.8 2.0

===================================================== ===== =====

2.8 3.0

===================================================== ===== =====

Payables due to related parties

----------------------------------------------------- ----- -----

Lakeside Energy for Waste Limited (trading balance) 0.9 1.2

----------------------------------------------------- ----- -----

INEOS Runcorn (TPS) Limited (trading balance) 3.2 2.5

===================================================== ===== =====

4.1 3.7

===================================================== ===== =====

The GBP72.7 million (2018 GBP40.7 million) receivable relates to

loans to related parties included within receivables and due for

repayment in instalments between 2018 and 2033. Interest is charged

at an average of 13.0% (2018 13.0%).

Company

The following transactions with subsidiary undertakings occurred

in the year:

2019 2018

GBPm GBPm

================================================== ===== =====

Sales of goods and services (management fees) 19.7 12.2

================================================== ===== =====

Purchase of goods and services (support services) 2.0 1.5

================================================== ===== =====

Interest receivable 43.3 39.9

================================================== ===== =====

Interest payable 0.1 0.1

================================================== ===== =====

Dividends received 196.7 202.3

================================================== ===== =====

Sales of goods and services to subsidiary undertakings are at

cost. Purchases of goods and services from subsidiary undertakings

are under normal commercial terms and conditions which would also

be available to unrelated third parties.

Year-end balances

2019 2018

GBPm GBPm

============================================= ======= =====

Receivables due from subsidiary undertakings

--------------------------------------------- ------- -----

Loans 1,044.6 870.8

============================================= ======= =====

Trading balances 19.9 16.2

============================================= ======= =====

Interest on GBP499.8 million (2018 GBP425.3 million) of the

loans has been charged at a fixed rate of 5.0%, and on GBP18.1

million (2018 GBP20.3 million) at a fixed rate of 6.0%. Interest on

GBP499.8 million of the loans is charged at 12 month LIBOR +2.2%

(2018 GBP411.8 million charged at 12 month LIBOR + 1.0% and GBP13.4

million charged at 12 month LIBOR + 3.0%). These loans are due for

repayment in instalments over the period 2020 to 2056. Interest on

GBP13.5 million of the loans has been charged at a fixed rate of

5.0%. Interest on GBP13.4 million of the loans is charged at 12

month LIBOR + 3.0%. These loans are due for repayment in

instalments over a five-year period following receipt of a request

to repay.

No material expected credit loss provision has been recognised

in respect of loans to subsidiaries (2018 GBPnil).

2019 2018

GBPm GBPm

======================================== ===== =====

Payables due to subsidiary undertakings

---------------------------------------- ----- -----

Loans 283.9 283.6

======================================== ===== =====

Trading balances 14.3 14.4

======================================== ===== =====

The loans from subsidiary undertakings are unsecured and

interest-free without any terms for repayment.

25 June 2019

www.pennon-group.co.uk

End transmission

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCVELBLKQFEBBE

(END) Dow Jones Newswires

June 25, 2019 05:25 ET (09:25 GMT)

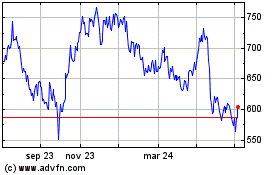

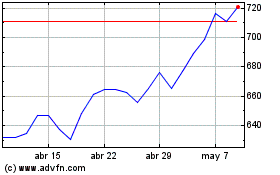

Pennon (LSE:PNN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Pennon (LSE:PNN)

Gráfica de Acción Histórica

De May 2023 a May 2024