TIDMPAC

LONDON STOCK EXCHANGE ANNOUNCEMENT

Pacific Assets Trust plc

(the "Company" or the "Trust")

Final Results for the Year Ended 31 January 2020

The Company's annual report will be posted to shareholders on 15 April 2020.

Members of the public may obtain copies by writing to Frostrow Capital LLP, 25

Southampton Buildings, London WC2A 1AL or from the Company's website at

www.pacific-assets.co.uk where up to date information on the Company, including

daily NAV, share prices and fact sheets, can also be found.

The Company's annual report for the year ended 31 January 2020 has been

submitted to the UK Listing Authority, and will shortly be available for

inspection on the National Storage Mechanism (NSM):

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Frostrow Capital LLP, Company Secretary

020 3709 8734

6 April 2020

Company Performance

Performance Summary

As at As at % Change

31 January 31 January

2020 2019

Shareholders' funds GBP345.7m GBP332.7m 3.9%

Market capitalisation GBP324.2m GBP327.3m (0.9)%

Performance One year to One year to

31 January 31 January

2020 2019

Share price total return*^ (0.8)% 8.1%

Net asset value per share total return*^ 4.2% 4.7%

CPI +6%1 7.5% 8.4%

MSCI All Country Asia ex Japan Index total return, 5.0% (7.7)%

sterling adjusted*

Average discount of share price to net asset value per 0.5% 3.1%

share*^

Ongoing charges^ 1.2% 1.2%

Revenue return per share? 3.3p 3.5p

Dividend per share 3.0p 3.0p

*Source: Morningstar

? See Glossary

^ Alternative Performance Measure (see Glossary)

1 The Company's Performance Objective (see Glossary)

Key Information

Pacific Assets Trust plc (the "Company" or the "Trust") aims to achieve

long-term capital growth through investment in selected companies in the Asia

Pacific region and the Indian sub-continent, but excluding Japan, Australia and

New Zealand (the 'Asia Pacific Region'). Up to a maximum of 20% of the

Company's total assets (at the time of investment) may be invested in companies

incorporated and/or listed outside the Asia Pacific Region, (as defined above);

at least 25% of their economic activities (at the time of investment) are

within the Asia Pacific Region with this proportion being expected to grow

significantly over the long term.

Investment Manager

Stewart Investors* have been the Company's Investment Manager since 1 July 2010

and they adopt a sustainable investment strategy in selecting the investments

that make up the Company's portfolio. Stewart Investors is a semi-autonomous

business within First State Investments. It operates through the legal entities

and regulatory licences of First State Investments. First State Investment

Management (UK) Limited is the legal entity that Pacific Assets Trust plc has

appointed as Investment Manager.

Investment Philosophy

Stewart Investors seek to invest in good quality companies with a focus on the

quality of management, franchise and financials. By analysing the sustainable

development performance and positioning of companies they believe they can

better measure less tangible elements of quality and identify less obvious

risks.

Stewart Investors strive to make investment decisions with a minimum five-year

time horizon. They have an absolute return mind-set and define risk as that of

losing client money, rather than deviation from any benchmark index. They focus

as much on the potential downside of investment decisions as on the anticipated

upside. They believe that the identification of long-term sustainable

development risks is an extremely important way of managing risk.

Their willingness to differ substantially from index weightings, both country

and company, means they are not obliged to invest in any company or country if

they have particular sustainability concerns.

What does Stewart Investors mean by Sustainable Development?

The root causes of the sustainable development challenges the world is facing

are numerous and complex. In order to tackle these challenges both developed

and developing countries will have to shift from a resource-intensive,

consumption-driven, debt-dependent model of development and growth to a more

sustainable one.

How does this apply to investment?

Stewart Investors invest in those companies which they believe are particularly

well-positioned to deliver positive long-term returns in the face of the huge

sustainable development challenges facing all countries today. These challenges

include population pressure, land and water scarcity and degradation, resource

constraints, income inequality, ethnic and gender inequalities and extreme

levels of poverty.

Their emphasis is on sustainable development and not 'green', 'clean tech' or

'ethical' investing.

They devote a significant amount of time to engaging with management teams of

the companies in which they invest. They engage on a wide range of issues,

including strategy, governance, alignment of interests and reputation.

Chairman's Statement

Outcomes for the Year to 31 January 2020.

The net asset value per share total return for the year ending 31 January 2020

was 4.2%*. Over the last three years, the annualised return was 7.0%, and over

five years 7.8%.

The one-year figure lies behind the performance objective of UK CPI plus 6%,

which was 7.5%*. Over the longer periods of three and five years, the Trust is

also slightly behind this measure; the annualised return of the performance

objective over three years was 8.4% and it was 7.9% over five years. Taking

account of the peer group of Asia Pacific investment companies, the Trust over

all periods lies behind the average.

These figures are obviously disappointing even when taking the longer-term

perspective of three to five years, which we regard as being the appropriate

time frame to view the performance of an investment manager. Within the long

term, there are many short terms. In the last quarter of the Trust's financial

year, three of the larger holdings, Marico, Vitasoy, and Mahindra & Mahindra

all suffered for different reasons. I mention this because it shows how some

dramatic short-term moves can impact the longer-term numbers. Although only 7%

of the portfolio was held in the Philippines at the start of that quarter, the

exposure there proved to be a detractor. However, to put this into the

longer-term context, Vitasoy (mentioned above) has been one of the Trust's

stand out performers providing a 694 basis point return over three years, and

1,190 basis points over five years.

The stock markets of Asia have not been able to match the returns of developed

markets around the world in the last 12 months with both the United States and

Europe leading performance. Although the Trust's exposure to China has been

minimal, there is no doubt that the escalating rhetoric from the United States

government over Chinese trade practices and perceived technological piracy, has

had some impact on wider sentiment. This cloud is not going to evaporate, and

we face a long period of adjustment in transpacific terms of trade. Within this

wider picture, there were political headwinds with increasingly authoritarian

moves by governments in India and the Philippines, for example, being prepared

to exceed their constitutional authority, while the Hong Kong government

struggled to deal with continuing unrest.

* Alternative Performance Measure (see Glossary).

Coronavirus

The points above shrink into insignificance as the global health crisis has

unfolded, the impact after the closure of the Company's financial year. As we

write, it appears that the centre of the storm has moved away from Asia to

other parts of the world, with consequent impact on asset prices almost

everywhere. The de-rating of markets reflects uncertainty over future profits,

credit defaults, and the timing of the peak of the crisis. It is too early to

assess the economic impact, but all risk assets continue to be fundamentally

re-priced to reflect the uncertainty created from the spread of infection, and

the measures that are being taken to lock down major countries and their

communications. In spite of this being a short period to measure, we note that

the net asset value of the Trust had fallen by 17.4% between 1 February and 2

April 2020, the latest practicable date before the date of this report.

The Sustainability Question

1 July 2020 will mark the tenth anniversary of Stewart Investors' management of

the Trust. Ten years ago, the Investment Manager expressed their strong

preference for owning companies that paid close attention to their impact on

the environment around them. An investment would only qualify for inclusion in

the Trust's portfolio if the management and the board supported exemplary

corporate behaviour, whether in their treatment of employees, or in their

probity in business environments that were often marred by corruption. At the

time and subsequently, there were many who felt that such an approach was

unworkable in an emerging market environment and was out of line with normal

practice. Back handers, ecological destruction and misogyny to take some

examples, were all meant to be part and parcel of the Asian investment

experience. Indeed, in China, the largest market capitalisation, our Investment

Manager has always had difficulty in reconciling the covert or indeed overt

state interference in the business sector, with a viable investment

opportunity. Hence throughout the last ten years there has been virtually no

direct exposure to Chinese listed companies.

Times have changed. Companies, the world over, are aiming their business models

at stakeholders rather than just shareholders. The phrase, 'responsible

capitalism' is widely used. Annual meetings are highly focussed on

environmental impact, or on preventing corporate larceny in one form or

another. Even oil companies are setting targets to become carbon neutral. The

terms of the debate have changed, as has the regulatory environment in which

businesses operate. Economic historians may look back on this period as being a

new version of the industrial revolution in the ways that businesses set their

priorities. Perhaps the identification of stakeholders over shareholders will

be comparable to when limited liability was introduced to joint stock companies

in the nineteenth century. However, we would argue that while the seeds have

been sown, the outcomes are still deficient and there is a long way to travel

before business practice is aligned to the high ideals that are now being

paraded. There is also a lack of leadership from some governments, most notably

in the United States.

We are long term investors. Our portfolio turns over less than 25% a year and

has averaged 20% over the last five years. Many stocks in the Company's

portfolio have been there since the start of our Investment Manager's tenure.

The long term to some people can mean the use of a dividend discount model that

looks far into the future, but whose inputs have limited credibility in today's

easily disrupted business world. Longer term is perhaps better understood by

having confidence that a company has the ingrained culture that it is not going

to diminish the returns of tomorrow, by short term actions that may enhance the

returns of today.

The enthusiasm for ESG (Environmental, Social, Governance) principles across

the investment management industry is heartening because it adds weight to the

current trend of listed companies re-thinking their business models. We applaud

the steps that many professional investors are taking, not least where there is

a younger generation of managers coming forward arguing that they have the

influence, as voting shareholders, with companies to turn the wheel a bit

further. New analytics have been introduced to score adherence to these

principles, although in our view they remain inadequately developed, and can be

frequently misleading.

Pacific Assets Trust and Stewart Investors, our investment manager, will

continue to look at ways of improving interaction with companies that we own,

and then lock in positions for the long term, enabling a continuous

constructive dialogue with the owners and the managers.

Measurement and Investment Management

One of our most important roles as directors of the Company is to scrutinise

the manager on behalf of shareholders. The metrics that we use must be

consistent, and we need to understand why sometimes our returns have fallen

short, as they have in the last 12 months. The Trust's investment decisions are

not undertaken in an opportunistic way. Market timing, momentum, or popular

trends do not feature in decisions that are taken. Our Investment Manager has

emphasised consistency of style, and in our meetings with shareholders, we have

generally found a good recognition of this.

Last year in my Chairman's statement, I discussed the move to a form of

measurement which did not have the misleading qualities of the MSCI All Country

Asia ex?Japan Index to which our investment portfolio maintains minimal

adherence. I do not plan to rehearse this but would like to explain the

measures that we look at to ensure consistency.

The indicators that the Board looks at are additional to the performance

measures relating to the peer group and to CPI plus 6%. Our suite of style

measures includes volatility and turnover, which we would expect to be low. We

look at downside protection during periods of market weakness and would be

surprised if all the upside was to be captured in a momentum driven rising

market. The final measure is 'active share' to see whether there is any drift

towards the index, counter to a style that seeks to invest and build on bottom

up investments. The Board uses these metrics to identify signals of any

deviation from what for ten years has been an entirely consistent approach.

This provides a coherent framework for discussion should one or more of these

measures appear to deviate from its longer-term trend.

The Board formally reviews the Company's investment management arrangements

annually. We looked at the ownership, the organisation and the approach of

Stewart Investors. We considered the stability of the team, their ability to

cover a wide-ranging set of markets, and their investment style. We looked to

see consistency of their stated investment approach with the implementation of

their decisions. In performance terms, we have evaluated them over a five-year

period against the CPI plus 6% objective and against a peer group of Asian

focussed investment companies. The Board also joined members of the Stewart

Investors team in October for three days in Hong Kong visiting companies that

the Company owns or that have the potential to become part of the portfolio.

The Board is satisfied that the interests of shareholders are well served by

Stewart Investors continuing to manage the assets of the Trust.

Costs

We recognise a trend for active management fees to come down. We also note that

the ongoing charges ratio* of the Trust has been higher than most of the peer

group. However, shareholders should also be aware that the Trust's relatively

low turnover, and the absence of any cost of capital associated with gearing,

will mean that the Trust's overall running costs are not necessarily as high as

some other investment vehicles, should these be added into the ongoing cost

ratio.

* Alternative Performance Measure (see Glossary).

With effect from 1 February 2020, the start of the new financial year of the

Trust, the annual management charge payable to Stewart Investors fell from 0.9%

to 0.85% per annum, based on the net asset value of the Trust at the end of

each quarter. This follows a reduction in the fees paid to Frostrow, our

Manager, Company Secretary and Administrator, two years ago and the removal of

the Investment Manager's performance fee three years prior to that.

While we are pleased by this reduction, we also recognise that there is a cost

for the Trust to access some of the smaller, harder to find or to research

companies, and that the Investment Manager should be appropriately equipped to

achieve this.

The Board

Terry Mahony, our longest serving board member retired at the end of the

financial year. Terry has brought his remarkable insight into the Asian sphere

to our boardroom table. His knowledge and experience have enabled the Board to

scrutinise and sometimes challenge the decisions of our managers, and thus keep

everyone on top of their game. He is a fine example of how a non-executive

director can bring additional value to the relationship between an investment

manager and a board. We thank him.

Edward Troughton has joined the Board and will be standing for election at the

AGM. Ed has lived and worked in Asia in the past, and brings with him knowledge

of the Asian region, experience of investment companies, and a deep

understanding of the way fund management companies work. Ed is a partner of

Oldfield Partners LLP, a highly regarded global investment boutique.

We pay close attention to the capacity of individual Directors to carry out

their work on behalf of the Company. In recommending individual Directors to

shareholders for re-election, we considered their other Board positions and

their time commitments and are satisfied that each Director is fully engaged

with the Company's business. In the biographies of Directors, there is a

section on what each one brings to the work of the Board.

Dividend

The Company made a revenue profit of 3.3p per share during the year (2019:

3.5p). The Company usually recommends for shareholders' approval at the AGM

the payment of a final dividend to allow the Company to comply with the

investment trust rules regarding distributable income. However, in light of the

ongoing response to the coronavirus pandemic, this year the Board has decided

to declare an interim dividend of 3.0p per share, to be paid on 2 July 2020 to

shareholders on the register on 29 May 2020. The associated ex-dividend date

will be 28 May 2020.

Declaring an interim dividend means that shareholders will be paid a dividend

irrespective of whether the AGM is able to proceed as planned. Instead of

voting to approve the payment of a dividend, shareholders will instead be able

to vote on the Company's dividend policy at the forthcoming AGM. However, this

will not affect the payment of the dividend itself. It is expected that the

Company will revert to paying a final dividend next year.

Share Issuance

During the year, favourable demand for the Company's shares led to the issue of

a total of 1,085,000 new shares, raising GBP3.2 million. The net proceeds

received from the issue of these new shares were invested in line with the

Company's investment objective. This coincides with our policy of enlarging the

Company's invested capital to the benefit of all shareholders, rather than

seeing the share price rise to a material premium to NAV per share in the

market.

The issuance of new shares takes place only at a premium to the NAV per share,

incorporates any associated costs and is accretive to existing shareholders.

Share issuance can also improve the liquidity of the Company's shares and

contribute to the reduction of the ongoing charges ratio, as operating costs

are spread over a larger capital base.

As at 31 January 2020, the Company had 120,958,386 shares of 12.5p each in

issue (31 January 2019: 119,873,386).

At the last Annual General Meeting ("AGM") in June 2019, shareholders granted

the Board authority to issue up to 10% of the Company's issued share capital

without pre-emption rights. The Board will ask for the same authority again, to

issue up to 10% of issued share capital without pre-emption rights, at the

forthcoming AGM.

Discount and the Share Price

The Company's shares have traded at an average discount to the net asset value

per share of 0.5%* through the year, compared to an average discount of 3.1% in

the previous year. For the year, the share price total return was -0.8%

compared with the net asset value per share total return of 4.2%. However, the

discount has widened since the year end, affected by the volatility of markets

coming to terms with the impact of the new coronavirus.

The Board monitors the share price discount closely and considers ways in which

it may be addressed, including through share buybacks and the Company's

marketing strategy. The Board considers it desirable that the Company's shares

do not trade at a price which, on average, represents a discount that is out of

line with the Company's peer group. The Board will continue to monitor the

discount and, should a material and sustained deviation emerge in the Company's

discount from that of its peer group, it has the authority to buy back shares

in the market.

Shareholder approval to renew the authority to repurchase existing shares in

the market will be sought at the forthcoming AGM.

Annual General Meeting

This year's AGM will be held at 12 noon on Thursday, 25 June 2020, and will be

held at the offices of Frostrow Capital LLP, 25 Southampton Buildings, London

WC2A 1AL. The Board has considered how best to deal with the potential impact

of the coronavirus outbreak on arrangements for the AGM. We are required by

law to hold an AGM, but we are concerned for the safety and wellbeing of our

shareholders and other attendees. Given these unprecedented circumstances, the

Board has decided that we will conduct only the statutory, formal business to

meet the minimum legal requirements. There will be no presentation from our

Investment Manager and no opportunity to interact with the Directors. We will

not be providing any refreshments after the meeting in order to minimise

contact. It may also prove to be necessary to postpone the meeting to a later

date.

The Board strongly encourages all shareholders to exercise their votes in

respect of the meeting in advance and to submit any questions they may have to

the Company Secretary. Voting by proxy will ensure that your votes are

registered in the event that attendance at the AGM is not possible or

restricted, or if the meeting is postponed (your votes will still be valid when

the meeting is eventually held). The Board will continue to monitor the

Government's advice and urges all shareholders to comply with any restrictions

in place at the time of the AGM.

Of course, in the event that the situation has improved and we are able to hold

a meeting with full participation from the Board and the Investment Manager, we

will do so. We will keep shareholders updated via the Company's website,

www.pacific-assets.co.uk, in this regard.

The Outlook

Since the year end there has been a momentous change to the landscape which has

left no market untouched. Stocks in February and March have endured a severe

loss in value, and volatility has risen to levels never previously seen. When

considering the outlook, one must account for the almost deafening noise as

authorities take steps which effectively close their economies. It is hard to

see how even the most stress tested business model can anticipate the

challenges that the global health crisis has introduced. We would suggest that

much of the volatility and the damage to asset prices within such a short time

frame results from market seizure as liquidity evaporates, with many actors

being forced sellers as downward momentum accelerates.

it is too early to comment on the resilience of the Trust's portfolio. However,

owning companies that have the combination of strong and liquid balance sheets

and secure franchises should under most circumstances provide defensive

qualities, if the inevitable recession and loss of confidence were to linger.

Unprecedented monetary and fiscal assistance combined with the benefit to

consumers from a much lower oil price should all help to mitigate some of the

worst effects of the social and economic closure that faces us, but there

remain many unknowns.

Pacific Assets Trust is designed to provide its shareholders with exposure to

quality businesses that not only have inner resilience but are also engaged

with the growth opportunities that Asia's upwardly mobile societies will

continue to provide. As I write there seems to be virtually no comfort to be

taken from the near-term outlook. However, we have faith in the managements of

the companies that we own in the Trust to weather the great turbulence that is

now taking place, and to be positioned to benefit from a return to stability

which will inevitably happen.

James Williams

Chairman

6 April 2020

Investment Portfolio

as at 31 January 2020

% of

Market total

Company Country MSCI sector valuation assets

GBP'000 less

current

liabilities

Tech Mahindra India Information 21,078 6.1

Technology

Unicharm Japan* Consumer Staples 15,843 4.6

Vitasoy International Hong Kong Consumer Staples 14,023 4.1

Holdings

Hoya Japan* Health Care 12,147 3.5

Oversea-Chinese Banking Singapore Financials 12,107 3.4

Corporation

Kotak Mahindra Bank India Financials 11,804 3.4

Mahindra & Mahindra India Consumer 11,388 3.3

Discretionary

Housing Development India Financials 10,944 3.2

Finance

Marico India Consumer Staples 9,683 2.8

Dr. Lal PathLabs India Health Care 9,529 2.8

Ten largest investments 128,546 37.2

Sundaram Finance India Financials 9,217 2.7

Dabur India India Consumer Staples 8,821 2.5

Tube Investments of India India Consumer 8,413 2.4

Discretionary

Chroma ATE Taiwan Information 8,269 2.4

Technology

Delta Electronics Taiwan Information 7,627 2.2

Technology

Koh Young Technology South Korea Information 7,467 2.3

Technology

Bank OCBC NISP Indonesia Financials 7,012 2.0

Tata Consultancy Services India Information 6,653 1.9

Technology

Nippon Paint Japan* Materials 6,086 1.8

Advantech Co Taiwan Information 5,992 1.7

Technology

Twenty largest investments 204,103 59.1

President Chain Store Taiwan Consumer Staples 5,907 1.7

Selamat Sempurna Indonesia Consumer 5,667 1.6

Discretionary

Kasikornbank Thailand Financials 5,532 1.6

Uni-President Enterprise Taiwan Consumer Staples 5,531 1.6

Delta Brac Housing Finance Bangladesh Financials 5,368 1.5

Philippine Seven Philippines Consumer Staples 5,099 1.4

Pigeon Japan* Consumer Staples 5,046 1.5

Dr. Reddy's Laboratories India Health Care 4,938 1.4

E.Sun Financial Taiwan Financials 4,929 1.4

Godrej Consumer Products India Consumer Staples 4,577 1.3

Thirty largest investments 256,697 74.1

Cyient India Information 4,563 1.3

Technology

Elgi Equipments India Industrials 4,223 1.2

Uni-Charm Indonesia Indonesia Consumer Staples 4,022 1.2

Voltronic Power Technology Taiwan Industrials 3,976 1.2

Brac Bank Bangladesh Financials 3,881 1.1

Square Pharmaceuticals Bangladesh Health Care 3,649 1.1

Marico Bangladesh Bangladesh Consumer Staples 3,563 1.0

ViTrox Malaysia Information 3,424 1.0

Technology

Taiwan Semiconductor Taiwan Information 3,375 1.0

Manufacturing Technology

Robinsons Retail Philippines Consumer Staples 3,144 1.0

Forty largest investments 294,517 85.2

Bank Central Asia Indonesia Financials 3,060 0.9

Mahindra Logistics India Industrials 2,783 0.8

Commercial Bank of Ceylon Sri Lanka Financials 2,259 0.7

Kalbe Farma Indonesia Health Care 2,236 0.6

Hemas Holdings Sri Lanka Industrials 2,170 0.6

Concepcion Industrial Philippines Industrials 1,286 0.4

Shanthi Gears India Industrials 1,094 0.3

Humanica Thailand Information 112 0.0

Technology

Total portfolio 309,517 89.5

Net current assets 36,200 10.5

Total assets less curent 345,717 100.0

liabilities

*Economic activity takes place principally in the Asia Pacific Region

Investment Manager's Review

Over the financial year, the Trust's net asset value per share total return was

4.2%. This return lagged both the performance objective of CPI +6% (+7.5%) and

the performance of the MSCI Asia All Country ex-Japan Index (the "Index")

(+5.0%, measured on a total return, sterling-adjusted basis). The Trust's

relative underperformance was more significant towards the end of the calendar

year when Asian markets had one of their strongest quarters outside of a

post-crash recovery - a market that our investment philosophy will tend to lag.

However, in January, the Trust protected capital well, with the NAV rising

0.2%, against the broader market which fell 4.0%.

Comparison with Peers

We find it hard to comment on relative performance but given the

underperformance of the Trust, it is worth touching on a few points.

Firstly, we have not owned the largest companies in the Index which have

fuelled much of the gains over recent years. As we have discussed on a number

of occasions, our philosophy struggles to own the large Chinese internet

companies Alibaba and Tencent. We have doubts over their governance, the

quality and sustainability of their business models and the opaqueness of their

financials.

The Trust does not own the large Korean technology company Samsung Electronics,

again due to concerns around the quality of the people behind the business,

specifically the integrity of the company's founding family where successive

Chairmen have been imprisoned on charges of corruption. Although they have

proven themselves competent technologists, Samsung's businesses are cyclical,

suffer from price deflation and are coming under increasing pressure from

emerging Chinese competition. Taiwan Semiconductor Manufacturing ("TSMC") is

another large position in the Index. We have held this high quality

semiconductor company for close to a decade but more recently we chose to

reduce the Trust's holding due to concerns that the very full valuations we

were being asked to pay failed to reflect the cyclicality of the cash flows.

These four companies, Tencent, Alibaba, TSMC and Samsung account for 23% of the

Index and are currently very popular holdings in many Asian portfolios. Our

decision to have minimal exposure to these names has cost the Trust in a

relative sense.

Secondly, when comparing recent performance with peers, a lack of gearing is a

likely detractor in recent rising markets. We did not use any gearing when

first appointed as Investment Manager in 2010 and the Trust has been unable to

employ gearing since registering as a Small Registered UK AIFM in 2014. However

given our concerns about valuations and our focus on capital preservation, even

if gearing was possible we would still opt to run a net cash balance rather

than gearing the Trust with debt. Whilst such leverage works in the good times,

as has proven recently, it increases the likelihood of a permanent impairment

of capital in the bad times. This is a risk we are uncomfortable taking,

especially in expensive markets such as these.

Thirdly, in strong, liquidity fuelled markets our philosophy will nearly always

underperform. Even with the benefit of hindsight we would change very little.

This is not meant to sound stubborn but is a reflection of faith in our

philosophy to deliver attractive, risk-adjusted returns over the long-term.

Such outcomes require remaining disciplined and not digressing in order to

chase performance whenever our philosophy is relatively unpopular.

Contributors and Detractors

Over the year, the Trust had a number of strong performers that are

successfully taking advantage of long-term structural growth trends. Hoya is a

Japanese-listed manufacturer of health care products (e.g. contact lenses,

lenses for eyeglass and endoscopes) and critical inputs to the semiconductor

and data centre industries. It has a number of attractive qualities that we

look for: a competent, aligned steward with an impressive track record of

capital allocation, a net cash balance sheet, success overseas and world-class

products that generate attractive rates of return. Going forward, both Hoya's

healthcare and IT portfolios are well placed to benefit from sustainable

development. We believe Hoya will be one of the leaders in providing access to

the more than two billion people who have yet to receive corrected vision, most

of which are in Asia. Not only is there significant profit opportunity for Hoya

by providing sight to billions of people, their products have a substantial

impact on the development of the region. Providing glasses to adults with poor

eyesight improves their chance of overcoming illiteracy, getting a job, and

remaining in the work force for longer. Less obvious benefits include better

road safety and a greater participation in the economic benefits that come from

the use of technology.

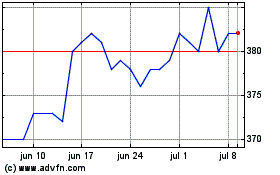

Contribution by investment for the year ended 31 January 2020

Top 10 contributors to and detractors from absolute performance (%)

[Graph shown in Annual Report]

Dr. Lal PathLabs is the leading health diagnostic chain in India. Like

financial services, the diagnostic industry tends to be accident prone, so

values such as quality and conservatism are critical to long-term success. The

powerful combination of a family steward and professional management at Dr

Lal's has been vital in ensuring the company's culture and brand is renowned

for its quality. As we have seen globally, the diagnostics industry's role in

screening, early detection and monitoring plays an important part in reducing

costs elsewhere in the healthcare industry. Historically only spending 4% of

its GDP on healthcare, India has significantly underinvested relative to other

nations.

This level of investment is unsustainable, especially when the country has a

growing prevalence of chronic and lifestyle related disease. We believe Dr Lal

can both improve access to healthcare and support the Indian healthcare system

to develop in a financially sustainable manner. This low base of healthcare

penetration and the fragmented nature of the Indian diagnostic industry

provides the opportunity for Dr Lal to sustain their growth for a long time to

come.

Vitasoy International Holdings, the leading soy milk provider in China,

continues to deliver on its long-term commitment to provide affordable

nutrition to the masses. Their trusted brand and established distribution

network in China puts them in a great position to benefit as China's middle

class looks to consume a healthier diet and become more aware of the need to

tread lighter on the country's fragile natural resources: soy milk's

nutritional value and resource intensity positions it very favourably relative

to other sources of protein. We continue to engage with the company on

improving the recyclability of their packaging and the transparency of its

supply chain. By doing so we hope to improve the quality of Vitasoy's cash

flows by reducing potential regulatory and consumer risks.

Kotak Mahindra Bank also performed well over the year. India's economy

continues to struggle for a number of structural and cyclical reasons. One of

the more pressing cyclical challenges has been the pressure on the country's

financial institutions as they work through the waves caused by the default of

a major lender. It is in times of stress that financial institutions prove

their mettle. As we would have hoped, given their long track record of

conservatism and quality lending, Kotak not only survived but has come out

stronger as depositors increasingly lose trust in lesser quality lenders and

move their hard-earned savings to Kotak. Sound, trusted financial institutions

are critical to the long-term development of an economy. Given India's

relatively low financial penetration level there is significant opportunity for

Kotak to continue its long track record of attractive, risk-aware, growth.

There will always be detractors but this year one of the major disappointments

came from a company listed in the Philippines. Manila Water, frustratingly

became the subject of unexpected political attention. The company is owned and

run by the Ayala Family, a family that for more than two centuries has managed

its businesses with the utmost respect for all its stakeholders. Over the last

few years we had been reducing the Trust's position size in Manila Water, not

over stewardship concerns but due to questions over their ability to grow in a

sustainable manner outside of Manila. In hindsight, we should have been far

more aggressive in selling as over the last twelve months the company became a

target of the Philippines' President, Rodrigo Duterte. The share price came

under intense stress as the President threatened to remove Manila Water's

licence after they successfully won an appeal in an international court over

their right to raise water tariffs. This served as a great tool for Duterte's

populist agenda.

We have since exited the position as we see little opportunity to make our

money back in such an environment. In fact, our concerns were confirmed as the

Ayalas were forced to sell a significant stake in Manila Water to a businessman

with a long track record of questionable integrity. Such transactions sadly

serve as a great example of what is required for success in the Philippines

today and despite our trust in the likes of the Ayalas, we have waning trust in

the independence of the country's institutions. This led us to sell our

Filipino companies with significant regulatory risk: Ayala Corp and Bank of

Philippine Islands. For now, we are comfortable with our remaining holdings as

they serve the retail market and are thus less politically exposed.

Another significant detractor was the Trust's holding in Mahindra and Mahindra.

While we misjudged the Indian auto and tractor cycles, which are now in the

pits of the deepest cycle in decades, we remain confident in the long-term

opportunity. During the depths of the pain, Mahindra and Mahindra has

strengthened its balance sheet, improved its margins and embarked on a major

leadership transition. These factors set the company up well to benefit from a

turn in the cycle and in the longer term, from increased investment in Indian

infrastructure and the development of its vast agricultural industry.

India Exposure

At the end of January, the Trust had 37.2% of the portfolio invested in Indian

listed companies. This is entirely the result of bottom-up stock picking and

not driven by a view on politics or macroeconomics - nevertheless we are often

asked to comment on India by shareholders. Focusing on the Trusts' Indian

exposure purely from a listing perspective misses the diverse cash flows

generated by the underlying holdings. For example, on a weighted average basis,

the Indian companies in the portfolio generate roughly half of their sales from

the domestic market, with the rest being derived overseas.

The Trust's Indian listed Information Technology companies (Tata Consultancy

Services ('TCS'), Tech Mahindra and Cyient) are internationally competitive and

make the majority of their cash flows helping customers in the US and Europe

who trust them to transform their businesses through the use of technology.

These businesses have proven to be resilient in previous economic downturns and

continue to be very well positioned as companies globally become increasingly

dependent on technology and look to partner with the likes of TCS to help in

their evolution. The Trust's healthcare companies (for example Dr Reddy's

Laboratories) are also globally competitive and generate a large portion of

their sales selling affordable medicine outside India. The cash flows of the

consumer companies (Marico, Dabur India, and Godrej Consumer Products) come

from selling, low-priced daily necessities (e.g. toothpaste, shampoo, and

household insecticides) to millions of Indians every day. These companies have

also built formidable businesses throughout Asia. For example, Marico's brands

in Bangladesh and Godrej's in Indonesia account for 10% and 15% of their sales

respectively.

Whilst there are a large number of families in India whom we deliberately avoid

investing alongside, we are able to find a large number of extremely high

quality family owned companies, with long histories of treating stakeholders

fairly, particularly in times of stress. We believe the quality of these

stewards, combined with a diverse set of cash flows, provide the portfolio with

an appropriate level of resilience against the unexpected, while continuing to

offer attractive opportunities for long-term growth.

Outcomes of Our Philosophy

Our philosophy of owning high-quality companies and our focus on capital

preservation has remained unchanged since we took over management of the Trust

almost ten years ago. It will remain unchanged over the next ten.

Despite the volatility and uncertainty that comes with equity markets,

especially in developing countries, we hope shareholders are comfortable with

the relative predictability of how we invest and the outcomes, both short-term

and long-term, of our approach.

Bottom-up approach

Our bottom-up, benchmark agnostic process is reflected in the Trust's active

share consistently sitting above 90%. The active share measure is simply a

short-hand ratio used to calculate how different a fund looks relative to an

index. The higher the number, the less the Trust looks like the Index. With

such a meaningful difference comes performance that is meaningfully different

to the Index and to other funds with a significant overlap with the Index.

Although this can appear frustrating, especially in strong markets where the

Trust has historically lagged, we are grateful to shareholders and to the Board

for allowing us to invest with such an active approach.

Longer-term time horizon

When we look to allocate the Trust's capital we do so with a time horizon of at

least five years. With this time horizon, we avoid much of the meaningless

noise that entraps equity markets and focus on the enduring values of a

company: the quality of the people, quality of the franchise, quality of the

financials, as well as its sustainability positioning. It is these values that

drive long-term earnings and share prices.

The turnover1 of the Trust has averaged 20% over the last five years. It is

worth highlighting that this number includes transactions where we have either

chosen to trim positions because valuations reached excessive levels, or have

added to existing names. It is not the result of constantly chopping and

changing the names in the Trust based on short-term noise. One example is

Vitasoy International Holdings. As discussed in last year's interim report,

Vitasoy's valuation had been inflated to excessive levels by unrealistic

expectations of extreme growth and its inclusion in a worldwide index which led

to indiscriminate buying from passive funds.

These forces pushed the share price up 60%2 in the first six months of the

year, far ahead of the growth in the underlying business. At its peak,

Vitasoy's position in the Trust's portfolio was above 8%. We subsequently more

than halved the position size to a level more in line, despite its quality,

with the extreme rating. Over the rest of the year, as passive buyers

dissipated and expectations of growth became more realistic, Vitasoy's share

price and valuations came back to more acceptable levels. We have since added

to the Trust's position and brought it back to a top three position.

Underlying the turnover number, ten of the 49 holdings in the portfolio at the

time of writing were bought when Stewart Investors took over management of the

Trust. 19 names were held five years ago. Those original ten companies

currently account for 26% of the Trust's portfolio and since their initial

purchase, have returned on average 17% per annum in GBP3. This is arguably a

better reflection of our true portfolio turnover and an outcome of our

conviction in holding quality companies for the long-term.

1 Turnover is calculated by dividing the average total trading by the manager

as a percentage of the portfolio's market value over the period. Source:

Stewart Investors.

2 Source: Bloomberg

3 Source: Bloomberg

Capital preservation

It is very easy for a manager to achieve a high active share. All they need to

do is own companies different to the index. However, what matters is not only

being different but ensuring those companies are of high quality and capable of

protecting capital in down markets. Below are a couple of ways of expressing

how the Trust performs in such markets.

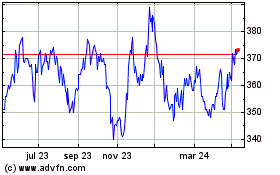

[Graph shown in Annual Report]

The bars on the left and in the centre of this chart measure the proportion of

the Trust's outperformance in down markets. Since Stewart Investors was

appointed, the Trust has outperformed 75% of months where the Index has fallen

and outperformed in 100% of rolling 12-month periods where the Index has

fallen. The bar on the right, Downside Capture, is a way of expressing the

magnitude of the Trust's ability to protect capital. Over the last five years,

the Trust's downside capture ratio is 55%. This means, on average, the Trust

has fallen close to half that of the Index in down months (100% would have

meant that the Trust fell exactly the same amount as the Index).

This ability to preserve capital in such markets has been critical to the

long-term cumulative performance of the Trust.

Long term cumulative performance

[Graph shown in Annual Report]

Risk Management over Return Measurement

By prioritizing risks and ensuring we own quality companies, we believe the

Trust has the ability to protect capital in bear markets (lose less) and

deliver higher returns (greater capital gains over a full market cycle).

As discussed last year, the environment in which the Trust is invested has

become increasingly fragile. Despite growing macro political risk, record

levels of debt, drought, floods, pandemics and stagnating earnings growth,

markets march relentlessly upward. Much of the recent gains has been fuelled by

an expansion in valuations (and the expectation of interest rates staying lower

for longer) rather than growth in the underlying business. There is a long list

of examples across the US and Asia of companies where earnings were flat or

even fell, some significantly, yet share prices were up more than 50%. This

means generating returns is finite given valuations can't continue to expand

indefinitely and, at some point, share prices have to be grounded by a

company's fundamentals.

Strong markets always invoke the fear of missing out or at least being left

behind and as a result, the focus tends to turn away from risk and toward

returns. Today is no different. Many poor quality or extremely valued companies

have been some of the best performers. From an outcome perspective, these

companies haven't seemed risky (they haven't gone down) and in turn, they

remain popular, and owners of these companies have been handsomely rewarded.

However, there is a difference between risk outcomes and risk exposure: the

latter being a risk that hasn't yet materialised but has the potential to cause

permanent loss of capital. It is this exposure that hurts when sentiment

reverses from a short-term focus on return measurement toward the management of

risk. Examples today would include the popularity of severely indebted

companies, companies without earnings or cash flows, cyclical companies that

believe that there will never be a cycle again, management teams publishing

increasingly aggressive accounting practices and companies on valuation

multiples that extrapolate extreme growth. These are all risks to which we are

unwilling to expose the Trust.

Instead we try to actively manage the risk exposure of the Trust with:

* Our focus on stewardship. For example, 70% of the Trust's portfolio is

invested in companies owned and run by high-quality family stewards who are

similarly focused on protecting and growing their wealth over the

long-term. Where there isn't a family, we ensure that the people behind the

business are suitably aligned from both a financial and cultural

perspective.

* 80% of the Trust's portfolio being invested in companies with net cash

balance sheets and thus relatively resilient to external shock and

well-placed to invest counter-cyclically.

* Owning quality franchises with the potential for attractive long-term

earnings growth.

* Our focus on ensuring companies are well positioned to benefit and

contribute from sustainable development and consequently have earnings

streams that are less at risk from consumer, political and environmental

headwinds.

Comments on ESG

It is becoming increasingly popular to use third-party ESG (environmental,

social and governance) scores as a way of excluding companies and demonstrating

the sustainability credentials of a portfolio. We do not use these services. We

believe that our bottom-up analysis incorporates ESG factors naturally.

When investing with a long-term time horizon, sustainability and quality become

critical to wealth preservation and growth. Understanding how a company is

positioned relative to the development challenges facing our planet forms a key

part of how we think about growth and risk. Challenges include population

pressure, resource constraints, income inequality, ethnic and gender

inequalities, and extreme levels of poverty. We are looking for companies which

are well-positioned to deliver positive long term returns in the face of these

challenges.

Companies positioned well for sustainability themes can make poor long term

investments. There are many companies or sectors that, despite being

well-positioned to contribute to sustainable development, have untrustworthy or

incompetent management teams, franchises incapable of generating economic

returns, or balance sheets loaded with debt. Popular examples today would be

manufacturers of electric vehicles, providers of plant-based meat, and solar

panel manufacturers. We believe that quality is critical if businesses, and

shareholders, are to benefit from the long-term tailwinds enjoyed by an

attractive sustainable development position.

Many of the factors used by third party ESG providers represent a very

simplistic, top-down view of what constitutes 'good ESG'. Scores are often

dependent on the ability of companies to provide reporting on various 'ESG

measures' rather than considerations of quality. Many of the Trust's holdings

do not receive a score - often because companies lack the resources to complete

the required reporting or are too small to be covered by ESG providers. In

addition, providers often apply a negative view to all family owned companies.

We do not agree that such a scoring system provides the resiliency to long term

risks and opportunities arising from ESG factors that these providers claim.

Significant Changes During the Year

Rationales for transactions are discussed in the quarterly reports over the

course of the year but we will repeat them here.

Five new companies entered the Trust over the course of the year.

We initiated a position in Voltronic Power Technology (Taiwan). Voltronic is a

manufacturer of uninterruptible power supplies (UPS); products that provide

critical backup systems for their customers e.g. emergency power for factories,

hospital equipment and data centres. We are comfortable investing alongside the

very capable founder and industry veteran, Alex Hsieh, and his aim to build a

franchise renowned for its quality and trustworthiness. The high product mix,

low volume nature of the business means new entrants can't just throw capital

at the problem (a popular strategy of Chinese industrial companies) and success

requires years of effort in building a broad product offering and reputation in

the industry. The high rates of return that Voltronic earns on its capital

reflect their unique model. Although having some cyclical elements to demand,

Voltronic is well placed to benefit from both the structural growth of the

industry and taking market share from less quality peers.

The Trust participated in the IPO of Uni-Charm Indonesia. This listing allows

the Trust to hold a direct stake in a franchise very well positioned to benefit

from the growing use of female sanitary products and baby nappies from what is

currently a low level relative to more developed markets. The Trust has held a

position in the Japanese-listed parent company for a number of years and so we

are very comfortable with the quality of the steward at Uni-Charm Indonesia. We

believe the growth opportunity provided by under-penetration and margins that

are materially below that of the parent company offer the potential for

attractive levels of growth over the long term.

We initiated a position in ViTrox (Malaysia). ViTrox is a Penang-based,

founder-run company focused on the design, development and assembly of vision

inspection equipment. Attractive margins and returns are reflective of how

essential ViTrox is to their customers' ability to ensure defective products do

not leave the factory floor and in reducing costs as they remove the dependence

on the human eye in a repetitive and demanding environment. ViTrox's founders

remain the company's largest shareholders and in our conversations with them,

we have been very impressed with their integrity and technology-focused

culture. Despite being relatively early in their evolution, with sales of less

than US$100m, ViTrox has developed world-class technology and is very well

placed to benefit as vision inspection is utilised in a growing number of

industries.

Bank Central Asia (BCA) is the leading commercial bank in Indonesia and

possesses what we look for in banking franchises: a strong low-cost deposit

base that enables attractive returns despite the bank participating in largely

low-risk parts of the market. One unique feature of Indonesian banking law is

that directors, including independents, are personally liable for the bank's

solvency; unsurprisingly, they, including BCA, tend to be very conservatively

run with little leverage and lots of excess capital. Indonesia's relatively low

level of credit to GDP and an economy that is largely driven by private

consumption provides an appealing environment for a quality bank such as BCA to

continue compounding its earnings at an attractive, risk-aware rate.

Concepcion Industrial is the largest manufacturer and distributor of air

conditioners in the Philippines and has a number of quality attributes. It is

owned and managed by the Concepcion family - a steward we believe to be

long-term, competent and suitably risk-aware. Their leading market share,

strong brands and established distribution network offer an attractive position

from which to benefit as air conditioning penetration in the Philippines

increases.

Over the year we disposed of a number of smaller positions in the Trust as we

lacked the long-term conviction to make them more meaningful weightings. As

mentioned earlier, due to growing political risk and questions over future

growth we exited all of the Ayala owned companies: Manila Water, Ayala Corp and

Bank of the Philippine Islands.

Over the year, we commissioned a couple of pieces of research work on the palm

oil industry that provided valuable insight into the mounting consumption and

supply chain headwinds facing the sector. On the back of this work, we sold our

small position in the Malaysian palm oil company United Plantations. Despite

United Plantations being the industry and sustainability leader, the headwinds

facing the industry are likely to be too great for any player to be able to

offer attractive levels of long-term returns.

We sold our small position in Public Bank. Although we believe it to be the

most conservative bank in Malaysia, the high indebtedness of the Malaysian

household reduces the opportunity for quality growth while increasing the

fragility of the loan book. We believe Bank Central Asia to be a more

attractive place to protect and grow capital over the long-term.

We sold the Trust's position in the Indian generic pharmaceutical company

Cipla. Although being one of the leading suppliers of medicines in India, we

believe the quality of Cipla's franchise to be headed in the wrong direction.

Ambitions of building a meaningful presence in the US requires having to

contend with a consolidated base of powerful intermediaries and the

unpredictability of constantly going head-to head with capable peers to market

new drugs. Both of these factors contribute to a more volatile earnings stream

and increasing pressure on profit margins.

We sold Kansai Paint listed in Japan, having held it in the Trust for less than

a year. We initiated the original position as we believed Kansai to offer an

attractive way of gaining exposure to Asia's growing demand for paint. However,

recent company presentations and their interest in a large US acquisition

suggest Asia is unlikely to be the key driver of growth over the coming years.

We never like to see companies come in and out of the Trust so quickly but

there will be instances, such as these, where selling and admitting a mistake

is preferable to holding on.

Outlook

Last year, many companies favoured by the market delivered high returns driven

by interest rate-fuelled valuation inflation. Going forward, it is hard to see

such an environment repeating itself and returns are likely to be much more a

function of earnings growth, which is usually the case.

The outbreak of coronavirus adds another major variable to the mix. We will

refrain from making any exact predictions on how it will impact both demand and

supply for the global economy and the Trust's holdings - it is too early to

tell. So far the selling has been indiscriminate and dramatic, which is often

the case in the initial stages of a significant correction. We expect to see

more discernment emerging as the world adjusts to the new environment of

reduced economic activity. In the long-term the impacts of COVID-19 will be

wide and unparalleled. We are still at the beginning of the beginning. These

are extraordinary times, but we have been here before. Who would have thought

that 3 million South Koreans would queue up in 1997 to hand over US$2bn worth

of their own gold to the

Government to help pay the national debt. The history of Asian markets is full

of extraordinary times. Fortunately, the resilience of Asian companies, and

particularly their emphasis on net cash balance sheets, should leave good

quality Asian companies well placed to weather this storm, just as they have

done many times before. What we can do is ensure that the companies we own are

as resilient as possible to uncertainty. Corporate memory of historic crisis,

non-discretionary cash flows and strong balance sheets are all valuable assets

in such scenarios.

As discussed earlier, we believe the Trust has significant exposure to such

companies while our cash balance provides the opportunity to add to some

quality companies if they fall foul of discriminate selling. Going forward, we

believe the quality of the companies in the Trust provides an attractive

balance between safety and growth. This positions the Trust well to continue

delivering long-term capital growth through investment in the Asian region.

Stewart Investors

Investment Manager

6 April 2020

Business Review

The Strategic Report contains a review of the Company's business model and

strategy, an analysis of its performance during the financial year and its

future developments and details of the principal risks and challenges it faces.

Its purpose is to inform shareholders and help them to assess how the Directors

have performed their duty to promote the success of the Company.

The Strategic Report contains certain forward-looking statements. These

statements are made by the Directors in good faith based on the information

available to them up to the time of their approval of this report. Such

statements should be treated with caution due to the inherent uncertainties,

including both economic and business risk factors, underlying any such

forward-looking information.

Business Model

The Company is an externally managed investment trust and its shares are listed

on the premium segment of the Official List and traded on the main market of

the London Stock Exchange. The Company is a small registered UK Alternative

Investment Fund Manager under the European Union's Alternative Investment Fund

Managers Directive.

The purpose of the Company is to provide a vehicle for investors to gain

exposure to a portfolio of companies in the Asia Pacific Region, through a

single investment.

The Company's strategy is to create value for shareholders by addressing its

investment objective, which is set out above.

As an externally managed investment trust, all of the Company's day-to-day

management and administrative functions are outsourced to service providers. As

a result, the Company has no executive directors, employees or internal

operations.

The Board has retained responsibility for risk management and has appointed

Stewart Investors to manage its investment portfolio. Company management,

company secretarial and administrative services are outsourced to Frostrow

Capital LLP.

The Board remains responsible for all aspects of the Company's affairs,

including setting the parameters for monitoring the investment strategy and the

review of investment performance and policy. It also has responsibility for all

strategic policy issues, including share issuance and buy backs, share price

and discount/ premium monitoring, corporate governance matters, dividends and

gearing.

Further information on the Board's role and the topics it discusses with the

Investment Manager is provided in the Corporate Governance Report.

Investment Objective

The Company's investment objective along with Stewart Investors' investment

approach is set out at the outset of this report.

Investment Policy

The Company invests in companies which Stewart Investors believe will be able

to generate long-term growth for shareholders.

The Company invests principally in listed equities although it is able to

invest in other securities, including preference shares, debt instruments,

convertible securities and warrants. In addition, the Company may invest in

open and closed-ended investment funds and companies.

The Company is only able to invest in unlisted securities with the Board's

prior approval. It is the current intention that such investments are limited

to those which are expected to be listed on a stock exchange or which cease to

be listed and the Company decides to continue to hold or is required to do so.

Risk is diversified by investing in different countries, sectors and stocks

within the Asia Pacific Region. There are no defined limits on countries or

sectors but no single investment may exceed 7.5% of the Company's total assets

at the time of investment. This limit is reviewed from time to time by the

Board and may be revised as appropriate.

No more than 10% of the Company's total assets may be invested in other listed

closed-ended investment companies unless such investment companies themselves

have published investment policies to invest no more than 15% of their total

assets in other closed-ended investment companies, in which case the limit is

15%.

The Company has the power under its Articles of Association to borrow up to two

times the adjusted total of capital and reserves. However, in accordance with

the Alternative Investment Fund Managers Directive ("AIFMD"), the Company was

registered by the FCA as a Small Registered UK Alternative Investment Fund

Manager ("AIFM") with effect from 30 April 2014. To retain its Small Registered

UK AIFM status, the Company is unable to employ gearing. Notwithstanding this,

the Company's approach is not to gear the portfolio.

The use of derivatives is permitted with prior Board approval and within agreed

limits. However, Stewart Investors are unlikely to use derivatives.

Dividend Policy

It is the Company's policy to pursue capital growth for shareholders with

income being a secondary consideration. This means that the Company's

Investment Manager is frequently drawn to companies whose future growth profile

is more important than the generation of dividend income for shareholders.

The Company complies with the United Kingdom's investment trust rules regarding

distributable income which require investment trusts to retain no more than 15%

of their distributable income each year. The Company's dividend policy is that

the Company will pay a dividend as a minimum to maintain investment trust

status.

The Board

At the date of this report, the Board of the Company comprises James Williams

(Chairman), Charlotta Ginman, Sian Hansen, Robert Talbut and Edward Troughton.

All of these Directors are non-executive, independent Directors.

All of the Directors served throughout the year except Mr Troughton, who was

appointed to the Board on 18 December 2019. Terence Mahony served as a Director

until his retirement on 31 January 2020.

Further information on the Directors can be found in the Governance Report.

Key Performance Indicators

The Board of Directors reviews performance against the following measures

(KPIs). During the year, the Board changed the Company's performance objective

to refer to inflation rather than the MSCI Index. The first KPI reflects this

change, accordingly. The other KPIs are unchanged from the prior year.

* Net asset value total return against the Consumer Price Index +6% (the

"Performance Objective")* ^

* Net asset value total return against the peer group* ^

* Average discount/premium of share price to net asset value per share over

the year^

* Ongoing charges ratio^

* Measured over three to five years

^ Alternative Performance Measure (see Glossary).

Net asset value total return - Performance Objective

The Directors regard the Company's net asset value total return as being the

overall measure of value delivered to shareholders over the long term. Total

return reflects both the net asset value growth of the Company and the

dividends paid to shareholders. During the year, the performance objective of

the Company was amended to refer to inflation (represented by the Consumer

Price Index) plus 6% (a fixed element to represent what the Board considers to

be a reasonable premium on investors' capital which investing in the

faster-growing Asian economies ought to provide over time), measured over three

to five years. This change was designed to reflect that the Investment

Manager's approach does not consider index composition when investing.

During the year under review, the net asset value per share showed a total

return of +4.2% underperforming the Performance Objective by 3.3% (2019: +4.7%,

underperforming the Performance Objective by 3.7%). Over the past three years,

the Company's net asset value has produced an annualised total return of 7.0%,

underperforming the Performance Objective by 1.4%. Over five years, the

annualised NAV total return was 7.8%, underperforming the Performance Objective

by 0.1%.

A full description of performance during the year under review is contained in

the Investment Manager's Review.

Net asset value total return - peer group

The Company exists in a competitive environment and aims to be a leader in its

peer group, defined as being consistently within the top third of that group

measured by net asset value total return. The Company is committed to building

a long-term investment record and will assess itself by reference to its peers

on a rolling three to five-year basis.

Over the three years ended 31 January 2020, the Company ranked sixth in its

peer group of the Company, an exchange traded fund and seven other investment

trusts with a similar investment objective; over five years it was ranked

seventh. The Company's performance is discussed in the Chairman's Statement

beginning on page 6 and the Investment Manager's Review.

Average discount/premium of share price to net asset value per share

The Board believes that an important driver of an investment trust's share

price discount or premium over the long term is investment performance together

with a proactive marketing strategy. However, there can be volatility in the

discount or premium during the year. Therefore, the Board takes powers each

year to buy back and issue shares with a view to limiting the volatility of the

share price discount or premium.

During the year under review 1,085,000 new shares were issued by the Company at

a 1.2% premium to the Company's cum income net asset value per share at the

time of issue. No shares were bought back by the Company. The Company's share

price discount to the net asset value per share was consistently narrower than

the peer group average.

Average discount of share price to net asset value per share*^ during the year

ended

31 January 2020 31 January 2019

0.5% 3.1%

Peer group average Peer group average

discount 5.0% discount 5.9%

* Source: Morningstar

^ Alternative Performance Measure (see Glossary)

Ongoing charges ratio

Ongoing charges represent the costs that shareholders can reasonably expect to

pay from one year to the next, under normal circumstances. The Board continues

to be conscious of expenses and works hard to maintain a sensible balance

between high quality service and costs.

The Board therefore considers the ongoing charges ratio to be a KPI and reviews

the figure both in absolute terms and in relation to the Company's peers.

Ongoing charges ratio^

31 January 2020 31 January 2019

1.2% 1.2%

Peer group average 0.9% Peer group average 1.0%

^ Alternative Performance Measure (see Glossary)

Shareholders should be aware that the Trust's relatively low turnover, and the

absence of any cost of capital associated with gearing, will mean that the

Trust's overall running costs are not necessarily as high as some other

investment vehicles, should these be added into the ongoing cost ratio. It

should also be noted that the Trust does not have a performance fee, which are

not included in published charges for peers.

Risk Management

Principal Risks and Uncertainties Mitigation

Investment Risks

(including financial risks)

Market and Foreign Exchange Risk

By the nature of its activities, To manage this risk the Board have appointed

the Company's portfolio is exposed Stewart Investors to manage the portfolio within

to fluctuations in market prices the remit of the investment objective and policy.

(from both individual security Compliance with the investment objective and

prices and foreign exchange rates) investment policy limits is monitored daily by

in the regions and sectors in which Frostrow and Stewart Investors and reported to

it invests. Emerging markets in the the Board monthly. The investment policy limits

Asia Pacific region, in which the ensure that the portfolio is diversified,

portfolio companies operate, are reducing the risks associated with individual

expected to be more volatile than stocks and markets. Stewart Investors' approach

developed markets. As such, is expected to lead to performance that will

investors should be aware that by deviate from that of comparators, including both

investing in the Company they are market indices and other investments companies

exposing themselves to market risk. investing in the Asia Pacific region. Stewart

Investors report at each Board meeting on the

performance of the Company's portfolio, which

encompasses the rationale for investment

decisions, the make-up of the portfolio, and the

investment strategy.

The Board undertakes, at least annually, a

strategic review of the Company, its investment

objective and policy, and Stewart Investors'

approach to managing the mandate.

As part of its review of the going concern and

viability of the Company, the Board also

considers the sensitivity of the Company to

changes in market prices and foreign exchange

rates (see note 14 to the financial statements),

how the portfolio would perform during a market

crisis, and the ability of the Company to

liquidate its portfolio if the need arose.

Further details are included in the Going Concern

and Viability Statements.

The Board have also considered the impact of

passive funds on market prices in the Asia

Pacific region as an emerging risk. The Board

believe that flows into/out of passive funds are

likely to increase volatility in the shorter term

as they inflate/deflate prices of companies in

the relevant indices. However, the Board believes

that over the longer term, active management and

a focus on the fundamentals of each investment

will prove beneficial.

Counterparty Risk

The Company is exposed to credit Counterparty risk is managed by the Board

risk arising from the use of through:

counterparties. If a counterparty · reviews of the arrangements with, and

were to fail, the Company could be services provided by, the Custodian to ensure

adversely affected through either that the security of the Company's custodial

delay in settlement or loss of assets is being maintained;

assets. The most significant · monitoring of the Custodian, including

counterparty to which the Company reviews of internal control reports and

is exposed is J.P. Morgan Chase sub-custodial arrangements, as appropriate; and

Bank, the Custodian, which is · reviews of Stewart Investors' approved list

responsible for the safekeeping of of counterparties, the process for monitoring and

the Company's assets. adding to the approved counterparty list, and the

Company's use of those counterparties.

Under the terms of the contract with J.P. Morgan

Chase Bank, the Company's investments are

required to be segregated from J.P. Morgan Chase

Bank's own assets.