Polar Capital Holdings PLC AuM Update (2863J)

09 Abril 2020 - 1:00AM

UK Regulatory

TIDMPOLR

RNS Number : 2863J

Polar Capital Holdings PLC

09 April 2020

9 April 2020

Polar Capital Holdings plc

AuM Update

Polar Capital Holdings plc ("Polar Capital" or the "Group"), the

specialist asset management group, today provides its regular

quarterly update of its unaudited statement of its assets under

management ("AuM") for the financial year to 31 March 2020.

Group AUM (unaudited)

Polar Capital reports that as at 31 March 2020 its AuM were

GBP12.2bn compared to GBP13.8bn at the end of March 2019, a

decrease of 12% over the year. In the three months ended 31 March

2020 AuM decreased by GBP1.9bn mainly due to the combined impact of

COVID-19 and a sharp fall in oil price causing severe global equity

market declines at the end of the quarter.

AuM movement in three Long-only Alternative Total

months to 31 March 2020 funds funds

AuM at GBP12,794m GBP1,427m GBP14,221m

1 January 2020

------------ ------------ ------------

Net redemptions GBP(5)m GBP(135)m GBP(140)m

------------ ------------ ------------

Market movement GBP(1,711)m GBP(209)m GBP(1,920)m

and performance

------------ ------------ ------------

Total AuM at GBP11,078m GBP1,083m GBP12,161m

31 March 2020

------------ ------------ ------------

During the 12-month period, AuM decreased by GBP1.7bn which

comprised net outflows of GBP1.2bn and a decrease of GBP0.5bn

mainly related to market movement, but mitigated by fund

performance.

AuM movement in twelve Long-only Alternative Total

months to 31 March 2020 funds funds

AuM at GBP12,529m GBP1,306m GBP13,835m

1 April 2019

------------ ------------ ------------

Net redemptions GBP(1,137)m GBP(74)m GBP(1,211)m

------------ ------------ ------------

Market movement GBP(314)m GBP(149)m GBP(463)m

and performance

------------ ------------ ------------

Total AuM at GBP11,078m GBP1,083m GBP12,161m

31 March 2020

------------ ------------ ------------

Gavin Rochussen, Chief Executive, commented:

"The coronavirus pandemic and oil price collapse brought an

abrupt end to the longest bull market in history with the

S&P500 declining 34% over a four-week period to its low point

on 22 March. A strong rally to 31 March followed unprecedented

fiscal and monetary stimulus to ensure economies and markets

continued to function. Polar Capital was not immune to this equity

market volatility with our AuM decreasing by GBP1.9bn in the March

quarter alone because of market declines.

"Leading up to and throughout the period of lock-down as we

invoked our business continuity plan and transitioned to entirely

remote working it has been pleasing to witness the operational

resilience of Polar Capital and its ability to continue servicing

clients in a seamless manner. I am particularly pleased with the

commitment of all our people, whose health and wellbeing are

vitally important, as we have worked tirelessly to meet our

investors' needs.

"The support of our fund investors, clients and other

stakeholders has been comforting and we have been pleasantly

surprised by the initial limited quantum of redemptions when

investors were raising cash to reduce risk in their portfolios.

"Net outflows in the March quarter were GBP140m, of which

GBP135m were from our alternative funds. Net flows were positive

for the first two months of the quarter.

"While AuM has decreased by 12% over the year and the equity

bear market means we enter our new financial year with lower

average AuM than the previous year, Polar Capital continues to be

cash generative and is able to utilise its significant balance

sheet to meet our operational and strategic objectives.

"Despite market volatility in March and a rapid equity sell-off

that exceeded that of the financial crisis, 55% of our AuM

out-performed benchmarks in the March quarter.

"We are comforted by the evidence of our operational resilience

in these testing times and, together with our diverse and

complementary range of fund strategies with proven track records,

we remain well positioned to deliver compelling returns for our

clients and shareholders."

Polar Capital aims to announce its results for the financial

year to 31 March 2020 on 22 June 2020.

For further information please contact:

Polar Capital

Gavin Rochussen (Chief Executive)

John Mansell (Executive Director)

Samir Ayub (Finance Director) +44 (0)20 7227 2700

Numis Securities Limited - Nomad and

Joint Broker

Charles Farquhar

Stephen Westgate

Kevin Cruickshank (QE) +44 (0)20 7260 1000

Peel Hunt LLP - Joint Broker

Guy Wiehahn

Andrew Buchanan +44 (0)20 7418 8893

Camarco

Ed Gascoigne-Pees

Monique Perks +44 (0)20 3757 4984

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDIPMPTMTAMBFM

(END) Dow Jones Newswires

April 09, 2020 02:00 ET (06:00 GMT)

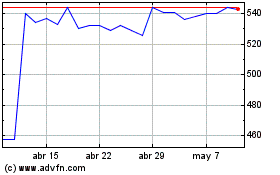

Polar Capital (LSE:POLR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

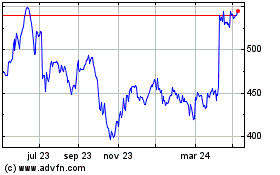

Polar Capital (LSE:POLR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024