Mercia Asset Management PLC Investment into OXGENE

06 Mayo 2020 - 1:00AM

RNS Non-Regulatory

TIDMMERC

Mercia Asset Management PLC

06 May 2020

RNS Reach 6 May 2020

Mercia Asset Management PLC

("Mercia", the "Company" or the "Group")

Mercia invests GBP1.0million as part of a GBP3.0million

syndicated investment into OXGENE (TM)

Mercia Asset Management PLC (AIM: MERC), the proactive,

regionally focused specialist asset manager, is pleased to announce

that it has completed a GBP1.0million investment into OXGENE(TM)

("OXGENE(TM)" is the trading name of Oxford Genetics Limited) as

part of a GBP3.0million funding commitment, alongside Canaccord

Genuity Wealth Management.

OXGENE(TM) combines precision engineering, biology, robotics and

bioinformatics to accelerate the design, discovery and manufacture

of new biologics. Working across the fields of gene therapy, gene

editing and antibody therapeutics, OXGENE(TM) has worked with

global partners including Abcam plc for the delivery of over 1,000

CRISPR engineered cell lines, Artios Pharma, who are developing

breakthrough cancer treatments, and The Native Antigen Company

(also a Mercia direct investment) to accelerate the production of

COVID-19 antigens.

In addition, OXGENE(TM) has signed eight separate licence

agreements providing access to its technology and recently

announced a strategic partnership with FUJIFILM Diosynth

Biotechnologies, a world leading cGMP contract development and

manufacturing organisation, to support its partners in the

development and production of biologics, vaccines and gene

therapies.

The synthetic biology market in which OXGENE(TM) operates is

estimated to grow from US$5.3billion in 2019 to US$18.9billion by

2024. (Source: BCC Research)

Jo Bath, Chief Operations Officer of OXGENE (TM) , said:

"Over the course of this financial year, OXGENE(TM) has once

again more than doubled its revenue, with less than a 50% increase

in headcount. This is testament not only to the hard work and

effective management of our team, but also to the strength of our

automation platform, and our focused approach to business and

technology development.

Mercia has continued to support and encourage us through this

year of growth and transition. Their support goes beyond financial,

helping us navigate through challenges as they arise. We're

extremely proud of everything we've accomplished this year, and

look forward to bringing more innovative, game changing

technologies to market in the year ahead."

Mark Payton , Chief Executive Officer of Mercia, commented :

" OXGENE(TM) is now being repeatedly recognised by some of the

world's largest pharmaceutical brands which see the considerable

value of its proprietary technology. The company is rapidly

addressing global healthcare challenges and this latest investment

round demonstrates the confidence that Mercia has in the business

and its management team to deliver medium to long-term value."

Ends

For further information, please contact:

Mercia Asset Management PLC

Mark Payton, Chief Executive Officer

Martin Glanfield, Chief Financial Officer +44 (0)330 223

www.mercia.co.uk 1430

Canaccord Genuity Limited (NOMAD and Joint +44 (0)20 7523

Broker) 8000

Simon Bridges, Richard Andrews

N+1 Singer (Joint Broker)

+44 (0)20 7496

Harry Gooden, James Moat 3000

+44 (0)20 3727

FTI Consulting 1051

Tom Blackwell, Louisa Feltes, Antonia Powell

mercia@fticonsulting.com

About Mercia Asset Management PLC

Mercia is a proactive, specialist asset manager focused on

supporting regional SMEs to achieve their growth aspirations.

Mercia provides capital across its four asset classes of balance

sheet, venture, private equity and debt capital: the Group's

'Complete Connected Capital'. The Group initially nurtures

businesses via its third-party funds under management, then over

time Mercia can provide further funding to the most promising

companies, by deploying direct investment follow-on capital from

its own balance sheet.

The Group has a strong UK regional footprint through its eight

offices, 19 university partnerships and extensive personal

networks, providing it with access to high-quality deal flow.

Mercia currently has c.GBP800million of assets under management

and, since its IPO in December 2014, has invested over GBP90million

across its direct investment portfolio.

Mercia Asset Management PLC is quoted on AIM with the epic

"MERC".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NRAKKPBNFBKDDPK

(END) Dow Jones Newswires

May 06, 2020 02:00 ET (06:00 GMT)

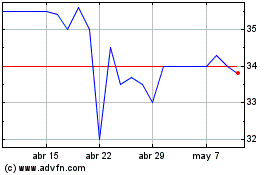

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024