Mercia Asset Management PLC Sale of The Native Antigen Company (4559S)

09 Julio 2020 - 1:00AM

UK Regulatory

TIDMMERC

RNS Number : 4559S

Mercia Asset Management PLC

09 July 2020

RNS 9 July 2020

Mercia Asset Management PLC

("Mercia" the "Company" or the "Group")

Sale of The Native Antigen Company

Mercia Asset Management PLC (AIM:MERC), the proactive,

regionally focused specialist asset manager, is pleased to announce

the profitable sale of The Native Antigen Company Limited ("NAC")

to LGC, a global leader in the life sciences tools sector, for a

total cash consideration of up to GBP18.0million.

Mercia held a 29.4% fully diluted direct holding in NAC at the

date of sale and will receive initial cash proceeds of

GBP4.8million, with up to a further GBP0.4million receivable upon

finalisation of customary closing working capital calculations.

Based upon the total anticipated amount receivable of

GBP5.2million, the total realised return above the GBP2.7million

holding value as at 30 September 2019, will be a further

GBP2.5million. Of this, GBP0.6million will be included as a fair

value increase in the Group's results for the year end ended 31

March 2020, which will be announced on 14 July 2020. The remaining

balance of GBP1.9million will be recognised as a realised gain in

the Group's interim results for the six months to 30 September

2020.

The sale is anticipated to generate an 8.4x return on its

original direct investment cost and a 65% internal rate of return

("IRR").

Mercia first invested in NAC in 2011 through its third-party

managed funds (which as at 31 March 2020 held an additional

combined 20.9% stake) and subsequently, from its own balance sheet

as a direct investment in December 2014.

In addition to the direct investment returns, the sale will

generate a 12.1x return on a blended third-party managed funds

investment cost and a 31% funds IRR. Mercia has proactively

supported NAC since its first day of trading, including

representation from Mercia's Chief Operating Officer Peter Dines,

as a non-executive director on the NAC board through to exit.

Founded in 2010, as a divestiture from a University of

Birmingham spinout company, NAC has become one of the world's

leading suppliers of infectious disease reagents and is widely

acknowledged to be a primary source of reagents for the study of

emerging diseases.

Dr Mark Payton, Mercia Asset Management, CEO, said : "Keeping to

our commitment of realising balance sheet investments within a

three to seven year period from initial investment, NAC is the

fourth full cash exit from our direct investment portfolio. It has

been an excellent investment for Mercia and this sale is a strong

demonstration of the value which our differentiated model can

create; for investors in our managed funds, shareholders in Mercia

and the founders we back. NAC is an example of an innovative

regional business sourced through Mercia's network, supported

initially by our managed fund capital and then scaled using our own

balance sheet capital.

"Mercia plays a critical role in helping the UK's most exciting

regional businesses scale and I am proud of the part we have played

in NAC's journey, not just as the major capital provider but also

as a critical partner in helping the business achieve its

potential. I look forward to watching as they continue to go from

strength to strength with their new owner."

Ends

For further information, please contact:

Mercia Asset Management PLC

Mark Payton, Chief Executive Officer

Martin Glanfield, Chief Financial Officer +44 (0)330 223

www.mercia.co.uk 1430

Canaccord Genuity Limited (NOMAD and Joint +44 (0)20 7523

Broker) 8000

Simon Bridges, Richard Andrews

N+1 Singer (Joint Broker)

+44 (0)20 7496

Harry Gooden, James Moat 3000

+44 (0)20 3727

FTI Consulting 1051

Tom Blackwell, Louisa Feltes, Antonia Powell

mercia@fticonsulting.com

About Mercia Asset Management PLC

Mercia is a proactive, specialist asset manager focused on

supporting regional SMEs to achieve their growth aspirations.

Mercia provides capital across its four asset classes of balance

sheet, venture, private equity and debt capital: the Group's

'Complete Connected Capital'. The Group initially nurtures

businesses via its third-party funds under management, then over

time Mercia can provide further funding to the most promising

companies, by deploying direct investment follow-on capital from

its own balance sheet.

The Group has a strong UK regional footprint through its eight

offices, 19 university partnerships and extensive personal

networks, providing it with access to high-quality deal flow.

Mercia currently has c.GBP800million of assets under management

and, since its IPO in December 2014, has invested over GBP90million

across its direct investment portfolio.

Mercia Asset Management PLC is quoted on AIM with the epic

"MERC".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISQVLFBBDLXBBQ

(END) Dow Jones Newswires

July 09, 2020 02:00 ET (06:00 GMT)

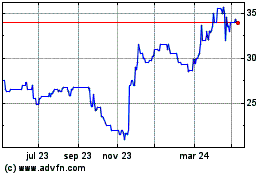

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

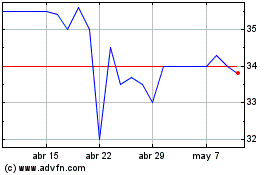

De Mar 2024 a Abr 2024

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024